INTERVIEW: Regus Set For Expansion Despite Harsh Conditions

August 27 2010 - 5:59AM

Dow Jones News

Regus PLC (RGU.LN), the world's largest provider of outsourced

office space, is preparing for another period of expansion even

though it continues to make losses amid difficult trading

conditions.

Regus is planning to open one center per day until the end of

the year as it continues to believe that flexibility is key to

future working practices. But while the company continues to sign

new contracts and customers, it has had to reduce its prices and it

took a hit as it regeared some leases negotiated a decade ago.

Chief Executive Mark Dixon played down these concerns in an

interview with Dow Jones Newswires, saying, "The economy is

challenging but we are doing quite well."

"More people will move to flexible working and the economy will

improve," he said, adding that Regus now was "trading at the bottom

point of the cycle."

Regus has some 800,000 customers paying for access to business

centers globally and virtual products to aid working from home. It

has signed new deals with companies such as Yell Group PLC's

(YELL.LN) Yell.com and General Electric Co. (GE).

It is also cooperating with giants such as Microsoft Corp.

(MSFT), Nokia Corp. (NOK) and Google Inc. (GOOG), companies that

believe in flexible working.

But its path hasn't been straightforward. The company Friday

reported its first-half results, booking a net loss of GBP7.8

million compared with net profit of GBP54.4 million in the same

period last year.

"We are being effected by the economy ... that means that people

are willing to pay less for our products, but we are still

producing very good cash and have some good things happening for

us," said Dixon.

Regus reported net cash of GBP224.2 million, largely unchanged

from the GBP229.5 million reported in the same period last

year.

"We had hoped that first-half profit would mark the low, but

this looks now unlikely. Conditions are described as challenging in

the first half, with no published outlook," said KBC Peel Hunt

analyst Andrew Shepherd-Barron.

"Perhaps the strongest indicator of the environment is that

Regus has moved back to being more aggressive on price,

understandably given that no region has mature occupancy in the

first half better than 78%," he added.

Although Dixon said that he has seen some stability on pricing,

he wouldn't say by how much prices have been cut or where.

Regus, which leases space from developers and repackages it to

sell to clients in various forms, signed expensive leases 10 years

ago, which were weighing on the company.

The company revealed Friday that regearing those U.K. leases has

cost it GBP15.8 million, which hit Regus' earnings, but will save

GBP12 million a year.

Dixon doesn't want to disclose where those leases are and how

much they will cost the company from now on, but assured investors

that the new regeared leases have been signed at current market

prices.

He said that the leases had to be regeared because of pricing,

not lower occupancy.

Still, Dixon sees the U.K. as a growth market. He also wants to

move further into emerging markets.

"We also see strong demand in emerging markets ... so we plan to

open many more centers there," he said, adding that at least half

the centers planned for opening will be in countries in Asia, Latin

America, Africa and Eastern Europe.

At 0900 GMT, Regus shares traded down 2 pence, or 2.8%, at 64

pence, making it one of the biggest fallers in the FTSE 250 index,

which traded up 0.2%.

-By Anita Likus, Dow Jones Newswires; +44 20 7842 9407;

anita.likus@dowjones.com

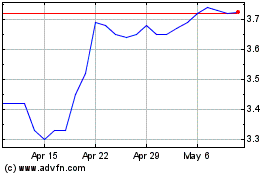

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024