Corporate Winners and Losers Emerge After Trump Win

November 09 2016 - 5:40AM

Dow Jones News

LONDON—Amid the global market turbulence following Donald

Trump's surprise presidential election victory, some early

corporate winners and losers were emerging in European stock

markets.

U.S. stock futures plunged overnight on the surprise Trump win,

and most global indexes were also down sharply. The Nikkei stock

index was down 3%, while the FTSE 100 index of British blue chips

was down 0.2%. Still, some investors were taking early cues to pick

possible beneficiaries.

Pharmaceutical stocks shot higher in Europe, after being weighed

down for months by the prospect of a pricing crackdown in the

U.S.—one of the industry's most lucrative markets—threatened by a

Hillary Clinton presidency. Pharmaceutical companies also are

widely regarded as a haven during periods of political turmoil.

GlaxoSmithKline PLC and AstraZeneca PLC were both up about 2% in

early London trading.

Some mining companies also rose early in Europe. Gold prices

were soaring on safe-haven buys. Mr. Trump has been outspoken in

his support of coal miners in the U.S.—a sentiment that might be

reverberating more broadly among shares of the world's more

diversified miners. Mr. Trump has also been broadly skeptical of

energy-industry regulation that has weighed on oil, gas and other

extractive resources companies for years.

Still, most big oil firms, including BP PLC and Royal Dutch

Shell PLC, were down sharply early in London after oil markets took

a big hit amid the wider market upheaval.

BAE Systems PLC, Europe's biggest arms maker, rose early

Wednesday. Mr. Trump had signaled before his election victory that

European members of the North Atlantic Treaty Organization would

have to contribute more to their own defense.

Whether any of these moves end up being knee-jerk reactions, or

early signals of which global sectors may benefit from a Trump

presidency, is far from clear. Many of Mr. Trump's policy

statements so far have been vague and open to interpretation, and

he has been known to swerve on positions radically.

But because the U.S. is the world's biggest economy—and the

biggest market for many of the things the rest of the world

makes—executives and investors were scrambling early Wednesday to

work out who might best be poised to profit from his win, or lose

out.

For many investors and executives, a Clinton victory was

expected to provide more immediate clarity about key

business-related policy initiatives in a new administration. That

is despite the fact that on the campaign trail, she has targeted

big businesses—including pharmaceuticals firms—as ripe for

scrutiny.

Mr. Trump, meanwhile, has been more outspoken on the campaign

trail than Mrs. Clinton about the pitfalls of global trade deals,

and has vowed to roll them back. That has spooked global executives

who have pushed expanded global trade.

Underscoring the new uncertainty surrounding global business,

Germany's industry federation BDI warned early Wednesday of

"massive uncertainties in the economy" after the victory of Donald

Trump in the U.S. presidential election, and the business group

called on the president-elect not to close off the U.S. from the

rest of the world.

"Donald Trump is well advised not to shut off the U.S. economy

from the world or else the uncertainty about the future course will

lead to considerable negative effects on the global economy," BDI

President Ulrich Grillo said. The U.S. is Germany's largest export

market. Some 5,000 German firms have operations in the U.S.,

according to the BDI.

Specific reaction from company executives around the world has

been muted so far. A group of CEOs in the U.S. issued a joint

letter early Wednesday pledging to promote "healing and

reconciliation."

In an open letter to President-elect Donald Trump, CEOs

affiliated with the National Association of Manufacturers, a trade

group in Washington, wrote, "we can be constructive—both when we

agree and when we do not—if we can all approach challenging

situations in good faith, guided by an unwavering commitment to a

greater purpose."

The letter was organized by the National Association of

Manufacturers, a major Washington trade group. The more than 1,100

signers included Dennis A. Muilenburg of Boeing Co., Wes Bush, CEO

of Northrop Grumman Corp., David Taylor, CEO of Procter &

Gamble Co. and Gregory Hayes of United Technologies Corp.

(END) Dow Jones Newswires

November 09, 2016 05:25 ET (10:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

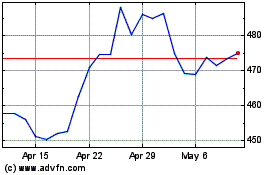

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

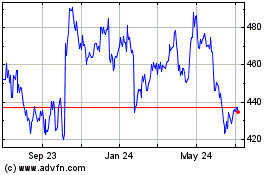

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Apr 2023 to Apr 2024