Northrop Grumman Tops Views, Raises Outlook Again

July 27 2016 - 7:59AM

Dow Jones News

By Anne Steele

Northrop Grumman Corp. again boosted its outlook for the year as

results in the most recent quarter topped expectations on higher

aircraft demand.

The defense contractor now anticipates earnings in the range of

$10.75 to $11 a share, up from its previous forecast for a range of

$10.40 to $10.70 a share. Northrop backed its sales projection of

$23.5 billion to $24 billion.

The Falls Church, Va., contractor late last year won a

hard-fought contest to build new long-range bombers for the U.S.

Air Force, beating out rivals Boeing Co. and Lockheed Martin Corp.

for a roughly $80 billion contract. During the second quarter,

revenue in its aerospace business climbed 4% higher to $2.6 billion

on higher volume for manned aircraft and autonomous systems

programs. The rise in aircraft production was mostly owing to

higher restricted volume and higher F-35 deliveries, partially

offset by fewer F/A-18 deliveries and lower volume on the B-2

program, Northrop said.

Revenue rose 2% in the company's mission systems segment and

fell 2% in the technology services segment.

In all, Northrop reported profit fell to $517 million from $531

million in the quarter a year ago. Per-share earnings rose to $2.85

from $2.74 a year earlier, on a lower share count. Analysts had

projected $2.53 a share, according to Thomson Reuters.

Revenue edged 1.8% higher to $6 billion, just above analysts'

forecast for $5.99 billion.

Shares, inactive premarket, have risen 16% this year to

$218.35.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 27, 2016 07:44 ET (11:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

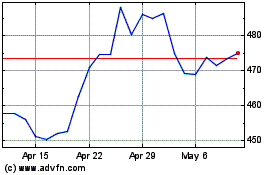

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

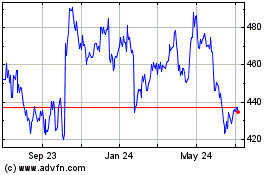

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Apr 2023 to Apr 2024