Northrop Grumman Profit Falls 9.3%

January 28 2016 - 7:40AM

Dow Jones News

Northrop Grumman Corp. on Wednesday posted a 9.3% dip in profit

as sales decreased worse-than-expected and the company adopted a

tax method change.

The company also said it expects earnings in 2016 of $9.90 to

$10.20, below analyst estimates for $10.49 a share, according to

Thomson Reuters. The company expects sales between $23.5 billion

and $24 billion, compared with analyst estimates for $24.47

billion.

Northrop has been one of the defense industry's top performers,

with share prices tripling since 2013 when it launched a buyback

effort. During the quarter the company repurchased 1.6 million

shares for $283 million, bringing the 2015 total to 19.3 million

shares for $3.2 billion. As of Dec. 31, $4.3 billion remained on

the company's share repurchase authorization.

For the December quarter the company posted a profit of $459

million down from $506 million a year earlier. Per-share earnings

rose to $2.49 from $2.48. The company said its results in the 2015

quarter were padded 33 cents a share on the passage of the

Protecting Americans from Tax Hikes Act. Adjusted for

pension-related costs, per-share earnings fell to $2.18 from

$2.26.

Revenue slipped 7% to $5.69 billion from $6.12 billion.

Analysts surveyed by Thomson Reuters forecast per-share earnings

of $2.01 on revenue of $5.94 billion.

In October, the Pentagon announced a contract valued at more

than $20 billion was awarded to Northrop Grumman over Boeing Co.

and Lockheed Martin Corp. to build the first 21 jets to replace

aging B-52 and B-1 warplanes.

On Thursday, shares of Northrop Grumman, which have fallen 17%

over the past 12 months, were inactive premarket.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 28, 2016 07:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

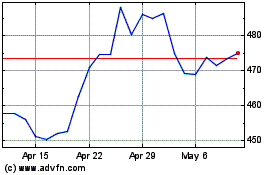

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

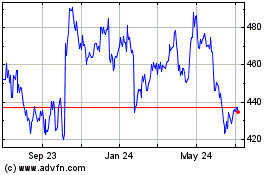

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Apr 2023 to Apr 2024