Pentagon Warns About Defense Deals

September 30 2015 - 5:40PM

Dow Jones News

The Pentagon's chief weapons buyer issued a stark warning about

the potential impact of further consolidation among large defense

companies, which he said could hurt innovation, constrict the

supplier base and inflate costs.

Frank Kendall, the Defense Department's undersecretary for

acquisition, technology and logistics, said Wednesday that recent

mergers and acquisitions have prompted the Pentagon to consider

asking for national security concerns to be among the criteria when

such deals are reviewed by competition officials.

Mr. Kendall said he backed the Justice Department's approval

last week of plans by Lockheed Martin Corp. to buy the Sikorsky

Aircraft unit of United Technologies Corp. for $9 billion, but he

said such deals have given rise to policy concerns.

"With size comes power, and the department's experience with

large defense contractors is that they are not hesitant to use this

power for corporate advantage," Mr. Kendall told reporters. He said

his concerns weren't directed at any particular transactions.

He said the Pentagon planned to engage Congress on the

issue.

"If the trend to smaller and smaller numbers of weapon-system

prime contractors continues, one can foresee a future in which the

department has at most two or three very large suppliers for all

the major weapons systems that we acquire," Mr. Kendall said.

Competition experts said the Pentagon wanted to signal that

approving the Sikorsky deal didn't change Defense Department's

long-standing opposition to deals involving the biggest defense

companies.

"The message is that it's not open season," said Jeff Bialos, a

partner at law firm Sutherland Asbill & Brennan LLP, who has

worked on a number of defense deals.

Lockheed doesn't make helicopters but supplies weapons and

communications systems to Sikorsky and other manufacturers. The

company has said it would continue to supply the government with

equipment for other helicopters,

The proposed deal concentrates even more of the Pentagon's

largest hardware programs with its biggest supplier. The Defense

Department generated almost 60% of Lockheed's revenues last year,

with other U.S. agencies and export sales adding another 20% each.

Lockheed, which makes the F-35 jet fighter, is bidding in

partnership with Boeing Co. for another huge contract, a proposed

new bomber for the Air Force.

Defense stocks were unchanged after Mr. Kendall's statement,

though analysts have long discounted a deal involving any of the

five biggest defense companies: Lockheed, Boeing, Northrop Grumman

Corp. General Dynamics Corp. and Raytheon Co.

Defense Secretary Ash Carter earlier Wednesday repeated his

opposition to mergers between the prime contractors but declined to

comment on Lockheed's planned purchase of Sikorsky.

"It was important to avoid excessive consolidation in the

defense industry to the [extent] that we didn't have multiple

vendors that could compete on programs," he said during a Pentagon

press briefing.

The Pentagon's de facto ban on big deals has been in place since

1998 when antitrust officials blocked Lockheed's plan to buy

Northrop Grumman.

Write to Doug Cameron at doug.cameron@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 30, 2015 17:25 ET (21:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

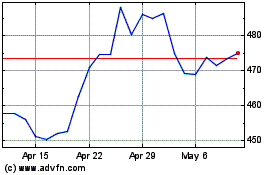

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

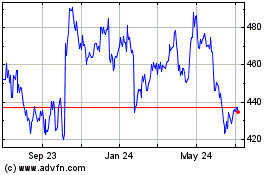

Northrop Grumman (NYSE:NOC)

Historical Stock Chart

From Apr 2023 to Apr 2024