Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 04 2016 - 5:16PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus Dated October 4, 2016

Relating to Preliminary Prospectus Supplement Dated October 4, 2016

to Prospectus dated February 23, 2015

Registration Statement No. 333-202237

NATIONAL RETAIL PROPERTIES, INC.

Depositary Shares Each Representing a 1/100th Interest in a Share of

5.20% Series F Cumulative Redeemable Preferred Stock

(Liquidation Preference Equivalent to $25.00 per Depositary Share)

FINAL PRICING TERMS

|

|

|

|

|

|

|

|

Issuer:

|

|

National Retail Properties, Inc.

|

|

|

|

|

Expected Ratings

1

:

|

|

Baa2 (Moody’s) / BBB- (S&P) / BBB- (Fitch)

|

|

|

|

|

Title of Shares:

|

|

Depositary Shares Each Representing a 1/100th Interest in a Share of 5.20% Series F Cumulative Redeemable Preferred Stock

|

|

|

|

|

Number of Shares:

|

|

12,000,000 depositary shares

|

|

|

|

|

Option to Purchase Additional Shares:

|

|

1,800,000 depositary shares

|

|

|

|

|

Public Offering Price:

|

|

$25.00 per depositary share; $300,000,000 total (not including the option to purchase additional shares)

|

|

|

|

|

Underwriting Discount:

|

|

$0.7875 per depositary share for sales to retail investors and $0.5000 per depositary share for sales to institutional investors; $8,554,265.00 total (not including the option to purchase additional shares)

|

|

|

|

|

No Maturity:

|

|

Perpetual (unless redeemed by the Issuer as set forth under “Optional Redemption” below or under “Special Optional Redemption” below and in the Preliminary Prospectus Supplement)

|

|

|

|

|

Trade Date:

|

|

October 4, 2016

|

|

|

|

|

Settlement Date:

|

|

October 11, 2016 (T+4)

|

|

|

|

|

Dividend Rate:

|

|

5.200% per annum of the $25.00 liquidation preference per depositary share (equivalent to $1.300 per annum per depositary share)

|

|

|

|

|

Dividend Payment Dates:

|

|

On or about March 15, June 15, September 15 and December 15 of each year, commencing December 15, 2016

|

|

|

|

|

Optional Redemption:

|

|

The Issuer may not redeem the Series F Preferred Stock underlying the depositary shares prior to October 11, 2021, except as described below under “Special Optional Redemption” and in limited circumstances relating to its

continuing qualification as a REIT. At any time on and after October 11, 2021, the Issuer may, at its option, redeem the Series F Preferred Stock, in whole or in part, from time to time, by paying $2,500.00 per share (equivalent to $25.00 per

depositary share), plus any accrued and unpaid dividends to, but not including, the date of redemption.

|

|

|

|

|

|

|

|

|

Special Optional Redemption:

|

|

Upon the occurrence of a Change of Control (as defined in the Preliminary Prospectus Supplement), the Issuer may, at its option, redeem the Series F Preferred Stock underlying the depositary shares, in whole or in part within 120

days after the first date on which such Change of Control occurred, by paying $2,500.00 per share (equivalent to $25.00 per depositary share), plus any accrued and unpaid dividends to, but not including, the date of redemption. If, prior to the

Change of Control Conversion Date (as defined in the Preliminary Prospectus Supplement), the Issuer has provided or provides notice of exercise of any of its redemption rights relating to the Series F Preferred Stock (whether its optional redemption

right or its special optional redemption right), the holders of depositary shares representing interests in the Series F Preferred Stock will not have the conversion right described below.

|

|

|

|

|

Conversion Rights:

|

|

Upon the occurrence of a Change of Control, each holder of depositary shares representing interests in the Series F Preferred Stock will have the right (unless, prior to the Change of Control Conversion Date, the Issuer has provided

or provides notice of its election to redeem the depositary shares or the Series F Preferred Stock) to direct the depositary, on such holder’s behalf, to convert some or all of the Series F Preferred Stock underlying the depositary shares held

by such holder on the Change of Control Conversion Date into a number of shares of the Issuer’s common stock (or equivalent value of alternative conversion consideration) per share of Series F Preferred Stock to be converted equal to the lesser

of:

|

|

|

|

|

|

|

• The quotient obtained by dividing (1) the sum of

the $2,500.00 per share (equivalent to $25.00 per depositary share) liquidation preference plus the amount of any accrued and unpaid dividends to, but not including, the Change of Control Conversion Date (unless the Change of Control Conversion Date

is after a record date for a Series F Preferred Stock dividend payment and prior to the corresponding Series F Preferred Stock dividend payment date, in which case no additional amount for such accrued and unpaid dividends will be included in this

sum) by (2) the Common Stock Price (as defined in the Preliminary Prospectus Supplement); and

|

|

|

|

|

|

|

• 99.62 per share of Series F Preferred Stock

(equivalent to 0.9962 per depositary share) (the “Share Cap”), subject to certain adjustments;

|

|

|

|

|

|

|

subject, in each case, to an aggregate cap on the total number of shares of common stock (or alternative conversion consideration, as applicable) issuable upon exercise of the Change of Control Conversion Right (as defined in the

Preliminary Prospectus Supplement) of 11,954,400 shares of common stock (or equivalent alternative conversion consideration, as applicable) or approximately 13,747,560 shares of common stock (or equivalent alternative conversion consideration, as

applicable) if the underwriters exercise their option to purchase additional shares in full, and subject, in each case, to provisions for the receipt of alternative conversion consideration as described in the Preliminary Prospectus

Supplement.

|

|

|

|

|

Use of Proceeds:

|

|

The Issuer intends to use the net proceeds of this offering to repay all of the outstanding indebtedness under its credit facility. In addition, the Issuer intends to use the remainder of the net proceeds from this offering, if any,

to fund future property acquisitions and for general corporate purposes.

|

|

|

|

|

|

|

|

|

Expected Listing / Trading Symbol:

|

|

NYSE / “NNNPRF”

|

|

|

|

|

CUSIP / ISIN:

|

|

637417 874/ US6374178746

|

|

|

|

|

Joint Book-Running Managers:

|

|

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Morgan Stanley & Co. LLC

Wells Fargo Securities,

LLC

|

|

|

|

|

Senior Co-Managers:

|

|

Citigroup Global Markets Inc.

Raymond James

& Associates, Inc.

RBC Capital Markets, LLC

Stifel,

Nicolaus & Company, Incorporated

|

|

|

|

|

Co-Managers:

|

|

BB&T Capital Markets, a division of BB&T Securities, LLC

Capital One Securities, Inc.

PNC Capital Markets LLC

U.S. Bancorp Investments, Inc.

|

|

1

|

A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time.

|

Capitalized terms used but not defined in this term sheet are defined in the preliminary prospectus supplement dated October 4, 2016 (the

“Preliminary Prospectus Supplement”). The information in this term sheet supplements the Preliminary Prospectus Supplement and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the

information in the Preliminary Prospectus Supplement. The Issuer has filed a registration statement (including a prospectus dated February 23, 2015 and the Preliminary Prospectus Supplement) with the Securities and Exchange Commission

(“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the Preliminary Prospectus Supplement and other documents the Issuer has filed with the SEC for

more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering

will arrange to send you the Preliminary Prospectus Supplement and accompanying prospectus if you request it by contacting Merrill Lynch, Pierce, Fenner & Smith Incorporated, toll-free at 1-800-294-1322 or by email at

dg.prospectus_requests@baml.com

, Morgan Stanley & Co. LLC toll-free at 1-800-584-6837 or by e-mail at

prospectus@morganstanley.com,

and/or Wells Fargo Securities, LLC toll-free at 1-800-645-3751 or by email at

wfscustomerservice@wellsfargo.com

.

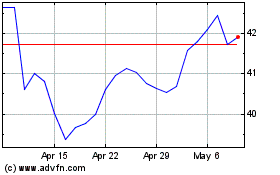

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

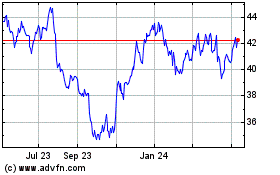

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Apr 2023 to Apr 2024