UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 21, 2015

NATIONAL RETAIL PROPERTIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

001-11290 |

|

56-1431377 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

| 450 South Orange Avenue

Suite 900 Orlando,

Florida |

|

32801 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (407) 265-7348

Not applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant.

On October 14, 2015, National Retail Properties, Inc. (the “Company”) announced the

pricing of an underwritten public offering of $400 million aggregate principal amount of 4.00% Notes due 2025 (the “Notes”) pursuant to an underwriting agreement, dated October 14, 2015 (the “Underwriting Agreement”), among

the Company and Citigroup Global Markets Inc., Wells Fargo Securities, LLC and RBC Capital Markets, LLC as representatives of the several underwriters named therein. On October 21, 2015, Company entered into a Fourteenth Supplemental Indenture

(the “Supplemental Indenture”) to the Indenture dated as of March 25, 1998, as amended (the “Base Indenture,” and together with the Supplemental Indenture, the “Indenture”), between the Company and U.S. Bank

National Association, as trustee, relating to the offering the Notes pursuant to the Underwriting Agreement.

The Notes are registered

under the Securities Act of 1933, as amended, pursuant to the Registration Statement on Form S-3 (File No. 333-202237), filed by the Company with the Securities and Exchange Commission on February 23, 2015.

The Notes are senior unsecured obligations of the Company, will mature on November 15, 2025 and will rank equally with all of the

Company’s other existing and future senior unsecured indebtedness. The Notes will bear interest at 4.00% per annum. Interest on the Notes is payable semi-annually on May 15 and November 15 of each year, beginning on May 15,

2016. The net proceeds from the offering were approximately $395.5 million. The Company intends to use the net proceeds from the offering to repay outstanding indebtedness under its credit facility, to fund future property acquisitions and for

general corporate purposes.

The foregoing descriptions of the Underwriting Agreement, Notes and the Indenture do not purport to be

complete and are qualified in their entirety by reference to the full text of the Notes and the Indenture. Copies of the Supplemental Indenture and the form of the Notes are attached to this Current Report on Form 8-K as Exhibits 4.1 and 4.2,

respectively, each of which is incorporated herein by reference. Copies of the Underwriting Agreement and Base Indenture were filed with the Securities and Exchange Commission as Exhibit 1.1 to the Company’s Current Report on Form 8-K filed on

October 20, 2015 and as Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on March 20, 1998, respectively.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

| 4.1 |

|

Form of the Fourteenth Supplemental Indenture between National Retail Properties, Inc. and U.S. Bank National Association. |

|

|

| 4.2 |

|

Form of 4.00% Note due 2025. |

|

|

| 5.1 |

|

Opinion of Pillsbury Winthrop Shaw Pittman LLP as to the legality of the securities being issued by the registrant. |

|

|

| 8.1 |

|

Opinion of Pillsbury Winthrop Shaw Pittman LLP regarding certain material tax issues relating to the registrant. |

|

|

| 23.1 |

|

Consent of Pillsbury Winthrop Shaw Pittman LLP to the filing of Exhibit 5.1 herewith (included in its opinion filed as Exhibit 5.1). |

|

|

| 23.2 |

|

Consent of Pillsbury Winthrop Shaw Pittman LLP to the filing of Exhibit 8.1 herewith (included in its opinion filed as Exhibit 8.1). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| NATIONAL RETAIL PROPERTIES, INC. |

|

|

| By: |

|

/s/ Kevin B. Habicht |

| Name: |

|

Kevin B. Habicht |

| Title: |

|

Executive Vice President, |

|

|

Chief Financial Officer, |

|

|

Assistant Secretary and Treasurer |

Dated: October 26, 2015

Exhibit 4.1

NATIONAL RETAIL PROPERTIES, INC.

as Issuer

to

U.S. BANK NATIONAL ASSOCIATION

as

Trustee

Fourteenth Supplemental Indenture

Dated as of October 21, 2015

Supplementing

the Indenture dated as of March 25, 1998

$400,000,000

of

4.00% Notes due 2025

FOURTEENTH SUPPLEMENTAL INDENTURE, dated as of October 21, 2015 (this “Fourteenth

Supplemental Indenture”), between NATIONAL RETAIL PROPERTIES, INC., a corporation duly organized and existing under the laws of the State of Maryland (herein called the “Company”), and U.S. BANK NATIONAL ASSOCIATION (as successor

trustee to Wachovia Bank, National Association (formerly First Union National Bank)), a national banking association duly organized and existing under the laws of the United States of America, as Trustee (herein called the “Trustee”).

RECITALS OF THE COMPANY

The

Company and the Trustee are parties to an Indenture, dated as of March 25, 1998 (the “Original Indenture”), as supplemented by Supplemental Indenture No. 1 dated as of March 25, 1998, Supplemental Indenture No. 2 dated

as of June 21, 1999, Supplemental Indenture No. 3 dated as of September 20, 2000, Supplemental Indenture No. 4 dated as of May 30, 2002, Supplemental Indenture No. 5 dated as of June 18, 2004, Supplemental

Indenture No. 6 dated as of November 17, 2005, the Seventh Supplemental Indenture dated as of September 13, 2006, Supplemental Indenture No. 8 dated as of September 10, 2007, the Ninth Supplemental Indenture dated as of

March 4, 2008, the Tenth Supplemental Indenture dated as of July 6, 2011, the Eleventh Supplemental Indenture dated as of August 14, 2012, the Twelfth Supplemental Indenture dated as of April 15, 2013, and the Thirteenth

Supplemental Indenture dated as of May 14, 2014 (together with the Original Indenture, Supplemental Indenture Nos.1, 2, 3, 4, 5, 6 and 8, the Seventh Supplemental Indenture, the Ninth Supplemental Indenture, the Tenth Supplemental Indenture,

the Eleventh Supplemental Indenture, the Twelfth Supplemental Indenture, the Thirteenth Supplemental Indenture and this Fourteenth Supplemental Indenture, collectively, the “Indenture”), a form of which has been filed with the Securities

and Exchange Commission under the Securities Act of 1933, as amended, as an exhibit to the Company’s Registration Statement on Form S-3 (Registration No. 333-157583), providing for the issuance from time to time of Debt Securities of the

Company (the “Securities”).

The Company has heretofore issued, pursuant to the Indenture, (a) $100,000,000 aggregate

principal amount of 7 1/8% Notes due 2008, (b) $100,000,000 aggregate principal amount of 8.125% Notes due 2004, (c) $20,000,000 aggregate principal amount of 8.50% Notes due 2010, (d) $50,000,000 aggregate principal amount of 7.75%

Notes due 2012, (e) $150,000,000 aggregate principal amount of 6.25% Notes due 2014, (f) $150,000,000 aggregate principal amount of 6.15% Notes due 2015, (g) $172,500,000 aggregate principal amount of 3.95% Convertible Senior Notes

due 2026, (h) $250,000,000 aggregate principal amount of 6.875% Notes due 2017, (i) $234,035,000 aggregate principal amount of 5.125% Convertible Senior Notes due 2028, (j) $300,000,000 aggregate principal amount of 5.500% Notes due

2021, (k) $325,000,000 aggregate principal amount of 3.80% Notes due 2022, (l) $350,000,000 aggregate principal amount of 3.30% Notes due 2023 and (m) $350,000,000 aggregate principal amount of 3.90% Notes due 2024.

2

The Company has commenced an offering of 4.00% Notes due 2025 (the “4.00% Notes”).

Section 3.1 of the Original Indenture provides for various matters with respect to any series of Securities issued under the Indenture to

be established in an indenture supplemental to the Indenture.

Section 9.1(7) of the Original Indenture provides for the Company and

the Trustee to enter into an indenture supplemental to the Original Indenture to establish the form or terms of Securities of any series as permitted by Sections 2.1 and 3.1 of the Original Indenture.

The Pricing Committee of the Board of Directors of the Company has duly adopted resolutions authorizing the Company to execute and deliver

this Fourteenth Supplemental Indenture.

All the conditions and requirements necessary to make this Fourteenth Supplemental Indenture,

when duly executed and delivered, a valid and legally binding agreement in accordance with its terms and for the purposes herein expressed, have been performed and fulfilled.

NOW, THEREFORE, THIS FOURTEENTH SUPPLEMENTAL INDENTURE WITNESSETH:

For and in consideration of the premises and the purchase of each of the series of Securities provided for herein by the Holders thereof, it

is mutually covenanted and agreed, for the equal and proportionate benefit of all Holders of the Securities, as follows:

ARTICLE ONE

RELATION TO INDENTURE; DEFINITIONS

SECTION 1.1. Relation to Indenture.

This Fourteenth Supplemental Indenture constitutes an integral part of the Indenture.

SECTION 1.2. Definitions.

For

all purposes of this Fourteenth Supplemental Indenture, the following terms shall have the meanings specified except as otherwise expressly provided for or unless the context otherwise requires. Capitalized terms used but not defined herein shall

have the respective meanings assigned to them in the Original Indenture. All references herein to Articles and Sections, unless otherwise specified, refer to the corresponding Articles and Sections of this Fourteenth Supplemental Indenture.

“4.00% Notes” has the meaning given in the Recitals of the Company.

3

“Acquired Indebtedness” means Indebtedness of a Person (i) existing at the time

such Person becomes a Subsidiary or (ii) assumed in connection with the acquisition of assets from such Person, in each case, other than Indebtedness incurred in connection with, or in contemplation of, such Person becoming a Subsidiary or such

acquisition. Acquired Indebtedness shall be deemed to be incurred on the date of the related acquisition of assets from any Person or the date on which the acquired Person becomes a Subsidiary.

“Annual Debt Service Charge” for any period means the aggregate interest expense for such period in respect of, and the amortization

during such period of any original issue discount of, Indebtedness of the Company and its Subsidiaries and the amount of dividends which are payable during such period in respect of any Disqualified Stock.

“Business Day” means any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking

institutions in the City of New York, New York or in the City of St. Paul, Minnesota are authorized or required by law, regulation or executive order to close.

“Capital Stock” means, with respect to any Person, any capital stock (including preferred stock), shares, interests, participations

or other ownership interests (however designated) of such Person and any rights (other than debt securities convertible into or exchangeable for corporate stock), warrants or options to purchase any thereof.

“Consolidated Income Available for Debt Service” for any period means Earnings from Operations of the Company and its Subsidiaries

plus amounts which have been deducted, and minus amounts which have been added, for the following (without duplication): (i) interest on Indebtedness of the Company and its Subsidiaries, (ii) provision for taxes of the Company and its

Subsidiaries based on income, (iii) amortization of debt discount, (iv) provisions for gains and losses on properties and property depreciation and amortization, (v) the effect of any noncash charge resulting from a change in

accounting principles in determining Earnings from Operations for such period and (vi) amortization of deferred charges.

“Corporate Trust Office” means the office of the Trustee at which, at any particular time, its corporate trust business for this

transaction shall be principally administered, which office at the date hereof is located at 225 Water Street, Seventh Floor, Jacksonville, Florida 32202, and for purposes of the Place of Payment provisions of Sections 3.5 and 10.2 of the Original

Indenture, is located at 60 Livingston Avenue, St. Paul, Minnesota 55107.

“Disqualified Stock” means, with respect to any

Person, any Capital Stock of such Person which by the terms of such Capital Stock (or by the terms of any security into which it is convertible or for which it is exchangeable or exercisable), upon the happening of any event or otherwise

(i) matures or is mandatorily redeemable, pursuant to a sinking fund obligation or otherwise (other than Capital Stock which is redeemable solely in exchange for common stock), (ii) is convertible into or exchangeable or exercisable for

Indebtedness or Disqualified Stock or (iii) is redeemable at the option of the holder thereof, in whole or in part (other than Capital Stock which is redeemable solely in exchange for Capital Stock which is not Disqualified Stock

4

or the redemption price of which may, at the option of such Person, be paid in Capital Stock which is not Disqualified Stock), in each case on or prior to the Stated Maturity of the 4.00% Notes.

“Earnings from Operations” for any period means net earnings excluding gains and losses on sales of investments, extraordinary

items and property valuation losses, net as reflected in the financial statements of the Company and its Subsidiaries for such period determined on a consolidated basis in accordance with GAAP.

“Encumbrance” means any mortgage, lien, charge, pledge or security interest of any kind.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder by the

Commission.

“GAAP” means generally accepted accounting principles as used in the United States applied on a consistent basis as

in effect from time to time; provided that solely for purposes of any calculation required by the financial covenants contained herein, “GAAP” shall mean generally accepted accounting principles as used in the United States on the date

hereof, applied on a consistent basis.

“Indebtedness” of the Company or any Subsidiary means any indebtedness of the Company or

any Subsidiary, whether or not contingent, in respect of (i) borrowed money or evidenced by bonds, notes, debentures or similar instruments whether or not such indebtedness is secured by any Encumbrance existing on property owned by the Company

or any Subsidiary, (ii) indebtedness for borrowed money of a Person other than the Company or a Subsidiary which is secured by any Encumbrance existing on property owned by the Company or any Subsidiary, to the extent of the lesser of

(x) the amount of indebtedness so secured and (y) the fair market value (as determined in good faith by the Board of Directors of the Company) of the property subject to such Encumbrance, (iii) the reimbursement obligations,

contingent or otherwise, in connection with any letters of credit actually issued or amounts representing the balance deferred and unpaid of the purchase price of any property or services, except any such balance that constitutes an accrued expense

or trade payable, or all conditional sale obligations or obligations under any title retention agreement, (iv) the principal amount of all obligations of the Company or any Subsidiary with respect to redemption, repayment or other repurchase of

any Disqualified Stock, or (v) any lease of property by the Company or any Subsidiary as lessee which is reflected on the Company’s consolidated balance sheet as a capitalized lease in accordance with GAAP, and also includes, to the extent

not otherwise included, any obligation by the Company or any Subsidiary to be liable for, or to pay, as obligor, guarantor or otherwise (other than for purposes of collection in the ordinary course of business), Indebtedness of another Person (other

than the Company or any Subsidiary) (it being understood that Indebtedness shall be deemed to be incurred by the Company or any Subsidiary whenever the Company or such Subsidiary shall create, assume, guarantee or otherwise become liable in respect

thereof).

“Make-Whole Amount” means, in connection with any optional redemption or accelerated payment of any 4.00% Note

(except for any optional redemption occurring 90 days

5

or fewer prior to the Stated Maturity thereof in accordance with Section 2.5), the aggregate present value as of the date of such redemption or accelerated payment of the remaining scheduled

payments of principal and interest (exclusive of interest accrued to the date of redemption or accelerated payment) on such 4.00% Notes, assuming such 4.00% Notes matured on the Par Call Date, determined by discounting, on a semi-annual basis, such

principal and interest at the Reinvestment Rate (determined on the third Business Day preceding the date such notice of redemption is given or declaration of acceleration is made).

“Par Call Date” has the meaning specified in Section 2.5 hereof.

“Redemption Price” has the meaning specified in Section 2.5 hereof.

“Reinvestment Rate” means 0.35 percent (0.35%) plus the arithmetic mean of the yields under the respective headings “This

Week” and “Last Week” published in the Statistical Release under the caption “Treasury Constant Maturities” for the maturity (rounded to the nearest month) corresponding to the remaining life to maturity (assuming for this

purpose that such maturity occurred on the Par Call Date), as of the payment date of the principal being redeemed or paid. If no maturity exactly corresponds to such maturity, yields for the two published maturities most closely corresponding to

such maturity shall be calculated pursuant to the immediately preceding sentence, and the Reinvestment Rate shall be interpolated or extrapolated from such yields on a straight-line basis, rounding in each of such relevant periods to the nearest

month. For such purposes of calculating the Reinvestment Rate, the most recent Statistical Release published prior to the date of determination of the Make-Whole Amount shall be used.

“Statistical Release” means the statistical release designated “H.15(519)” or any successor publication which is published

weekly by the Federal Reserve System and which establishes yields on actively traded United States government securities adjusted to constant maturities or, if such statistical release is not published at the time of any determination of the

Make-Whole Amount, then such other reasonably comparable index which shall be designated by the Company.

“Subsidiary” means,

with respect to any Person, any corporation or other entity of which a majority of (i) the voting power of the voting equity securities or (ii) the outstanding equity interests of which are owned, directly or indirectly, by such Person.

For the purposes of this definition, “voting equity securities” means equity securities having voting power for the election of directors, whether at all times or only so long as no senior class of security has such voting power by reason

of any contingency.

“Total Assets” as of any date means the sum of (i) the Undepreciated Real Estate Assets and

(ii) all other assets of the Company and its Subsidiaries determined on a consolidated basis in accordance with GAAP (but excluding accounts receivable and intangibles).

“Total Unencumbered Assets” means the sum of (i) those Undepreciated Real Estate Assets not subject to an Encumbrance for

borrowed money and (ii) all other assets of the Company and its Subsidiaries not subject to an Encumbrance for borrowed money determined on

6

a consolidated basis in accordance with GAAP (but excluding accounts receivable and intangibles); provided, however, that, in determining Total Unencumbered Assets as a percentage of outstanding

Unsecured Indebtedness for purposes of the covenant requiring the Company and its Subsidiaries to maintain Total Unencumbered Assets equal to at least 150% of the aggregate outstanding principal amount of Unsecured Indebtedness on a consolidated

basis, all investments in unconsolidated joint ventures, unconsolidated limited partnerships, unconsolidated limited liability companies and other Persons that are not consolidated for financial reporting purposes in accordance with GAAP shall be

excluded from Total Unencumbered Assets.

“Undepreciated Real Estate Assets” as of any date means the cost (original cost plus

capital improvements) of real estate assets of the Company and its Subsidiaries on such date, before depreciation and amortization, determined on a consolidated basis in accordance with GAAP.

“Unsecured Indebtedness” means Indebtedness which is not secured by any Encumbrance upon any of the properties of the Company or any

Subsidiary.

ARTICLE TWO

THE

SERIES OF NOTES

SECTION 2.1. Title of the Securities.

There shall be a series of Securities designated the “4.00% Notes due 2025.”

SECTION 2.2. Limitation on Aggregate Principal Amount.

(a) The 4.00% Notes shall initially have an aggregate principal amount equal to $400,000,000; provided that the Company may, without the

consent of the Holders of any then Outstanding 4.00% Notes, “reopen” this series of Securities so as to increase the aggregate principal amount of 4.00% Notes Outstanding in compliance with the procedures set forth in the Original

Indenture, as supplemented by this Fourteenth Supplemental Indenture, including Sections 3.1 and 3.3 of the Original Indenture, so long as any such additional notes have the same tenor and terms (including, without limitation, rights to receive

accrued and unpaid interest) as the 4.00% Notes then Outstanding.

(b) Nothing contained in this Section 2.2 or elsewhere in this

Fourteenth Supplemental Indenture, or in the 4.00% Notes, is intended to or shall limit execution by the Company or authentication or delivery by the Trustee of 4.00% Notes under the circumstances contemplated by Sections 3.3, 3.4, 3.5, 3.6, 9.6,

11.7 and 13.5 of the Original Indenture.

7

SECTION 2.3. Interest and Interest Rates; Maturity Date of 4.00% Notes.

(a) The 4.00% Notes will bear interest at a rate of 4.00% per annum, from October 21, 2015 or from the immediately preceding

Interest Payment Date to which interest has been paid or duly provided for, payable semi-annually in arrears on May 15 and November 15 of each year, commencing May 15, 2016 (each, an “Interest Payment Date”), to the Person

in whose name such 4.00% Note is registered in the Security Register at the close of business on May 1 or November 1 (whether or not a Business Day), as the case may be, next preceding such Interest Payment Date (each, a “Regular

Record Date”). Interest on the 4.00% Notes will be computed on the basis of a 360-day year comprised of twelve 30-day months.

(b)

The interest so payable on any 4.00% Note which is not punctually paid or duly provided for on any Interest Payment Date (“Defaulted Interest”) shall forthwith cease to be payable to the Person in whose name such 4.00% Note is registered

on the relevant Regular Record Date, and such Defaulted Interest shall instead be payable either (i) to the Person in whose name such 4.00% Note is registered on the Special Record Date for the payment of such Defaulted Interest to be fixed by

the Trustee, notice of which shall be given to the Holder of such 4.00% Note not less than 10 days prior to such Special Record Date or (ii) at any time in any other lawful manner in accordance with the Indenture.

(c) If any Interest Payment Date or Stated Maturity falls on a day that is not a Business Day, the required payment shall be made on the next

Business Day as if it were made on the date such payment was due and no interest shall accrue on the amount so payable for the period from and after such Interest Payment Date or Stated Maturity, as the case may be.

(d) The 4.00% Notes will mature on November 15, 2025.

SECTION 2.4. Limitations on Incurrence of Indebtedness.

(a) The Company will not, and will not permit any Subsidiary to, incur any Indebtedness if, immediately after giving effect to the incurrence

of such additional Indebtedness and the application of the proceeds thereof, the aggregate principal amount of all outstanding Indebtedness of the Company and its Subsidiaries (determined on a consolidated basis in accordance with GAAP) is greater

than 60% of the sum of (without duplication) (i) the Total Assets of the Company and its Subsidiaries as of the end of the calendar quarter covered in the Company’s Annual Report on Form 10-K or Quarterly Report on Form 10-Q, as the case

may be, most recently filed with the Commission (or, if such filing is not permitted under the Exchange Act, with the Trustee) prior to the incurrence of such additional Indebtedness and (ii) the purchase price of any real estate assets or

mortgages receivable acquired, and the amount of any securities offering proceeds received (to the extent such proceeds were not used to acquire real estate assets or mortgages receivable or used to reduce Indebtedness), by the Company or any

Subsidiary since the end of such calendar quarter, including those proceeds obtained in connection with the incurrence of such additional Indebtedness.

(b) In addition to the limitation set forth in subsection (a) of this Section 2.4, the Company will not, and will not permit any

Subsidiary to, incur any Indebtedness if the ratio

8

of Consolidated Income Available for Debt Service to the Annual Debt Service Charge for the four consecutive fiscal quarters most recently ended prior to the date on which such additional

Indebtedness is to be incurred shall have been less than 1.5:1, on a pro forma basis after giving effect thereto and to the application of the proceeds therefrom, and calculated on the assumption that (i) such Indebtedness and any other

Indebtedness incurred by the Company and its Subsidiaries since the first day of such four-quarter period and the application of the proceeds therefrom, including to refinance other Indebtedness, had occurred at the beginning of such period;

(ii) the repayment or retirement of any other Indebtedness by the Company and its Subsidiaries since the first day of such four-quarter period had been repaid or retired at the beginning of such period (except that, in making such computation,

the amount of Indebtedness under any revolving credit facility shall be computed based upon the average daily balance of such Indebtedness during such period); (iii) in the case of Acquired Indebtedness or Indebtedness incurred in connection

with any acquisition since the first day of such four-quarter period, the related acquisition had occurred as of the first day of such period with the appropriate adjustments with respect to such acquisition being included in such pro forma

calculation; and (iv) in the case of any acquisition or disposition by the Company or its Subsidiaries of any asset or group of assets since the first day of such four-quarter period, whether by merger, stock purchase or sale, or asset purchase

or sale, such acquisition or disposition or any related repayment of Indebtedness had occurred as of the first day of such period with the appropriate adjustments with respect to such acquisition or disposition being included in such pro forma

calculation.

(c) In addition to the limitations set forth in subsections (a) and (b) of this Section 2.4, the Company will

not, and will not permit any Subsidiary to, incur any Indebtedness secured by any Encumbrance upon any of the property of the Company or any Subsidiary if, immediately after giving effect to the incurrence of such additional Indebtedness and the

application of the proceeds thereof, the aggregate principal amount of all outstanding Indebtedness of the Company and its Subsidiaries (determined on a consolidated basis in accordance with GAAP) which is secured by any Encumbrance on property of

the Company or any Subsidiary is greater than 40% of the sum of (without duplication) (i) the Total Assets of the Company and its Subsidiaries as of the end of the calendar quarter covered in the Company’s Annual Report on Form 10-K or

Quarterly Report on Form 10-Q, as the case may be, most recently filed with the Commission (or, if such filing is not permitted under the Exchange Act, with the Trustee) prior to the incurrence of such additional Indebtedness and (ii) the

purchase price of any real estate assets or mortgages receivable acquired, and the amount of any securities offering proceeds received (to the extent that such proceeds were not used to acquire real estate assets or mortgages receivable or used to

reduce Indebtedness), by the Company or any Subsidiary since the end of such calendar quarter, including those proceeds obtained in connection with the incurrence of such additional Indebtedness.

(d) The Company and its Subsidiaries may not at any time own Total Unencumbered Assets equal to less than 150% of the aggregate outstanding

principal amount of the Unsecured Indebtedness of the Company and its Subsidiaries on a consolidated basis.

9

(e) For purposes of this Section 2.4, Indebtedness shall be deemed to be

“incurred” by the Company or a Subsidiary whenever the Company or such Subsidiary shall create, assume, guarantee or otherwise become liable in respect thereof.

SECTION 2.5. Redemption.

The

4.00% Notes may be redeemed prior to August 15, 2025 (three months prior to the Stated Maturity) (the “Par Call Date”), at the option of the Company, at any time in whole or in part from time to time, at a redemption price equal to

the greater of (i) 100% of the principal amount of the 4.00% Notes being redeemed plus accrued and unpaid interest thereon to, but not including, the Redemption Date and (ii) the Make-Whole Amount, if any, with respect to such 4.00% Notes;

provided, however, that if the Company redeems the 4.00% Notes on or after the Par Call Date, the redemption price will equal 100% of the principal amount of the 4.00% Notes to be redeemed plus accrued and unpaid interest thereon to the Redemption

Date (such amount computed under this Section 2.5, the “Redemption Price”). Notice of any optional redemption of all or any portion of the 4.00% Notes then outstanding shall be given to Holders at their addresses, as shown in the

Security Register, not less than 15 days nor more than 60 days prior to the Redemption Date.

SECTION 2.6. Place of Payment.

The Place of Payment where the 4.00% Notes may be presented or surrendered for payment, where the 4.00% Notes may be surrendered for

registration of transfer or exchange and where notices and demands to and upon the Company in respect of the 4.00% Notes and the Indenture may be served shall be in the City of St. Paul, Minnesota, and the office or agency for such purpose shall

initially be located at U.S. Bank National Association, 60 Livingston Avenue, St. Paul, Minnesota 55107.

SECTION 2.7. Method of Payment.

Payment of the principal of and interest on the 4.00% Notes will be made at the office or agency of the Company maintained for that

purpose (which shall initially be an office or agency of the Trustee), in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts; provided, however, that, at the option

of the Company, payments of principal and interest on the Notes (other than payments of principal and interest due at Stated Maturity) may be made (i) by check mailed to the address of the Person entitled thereto as such address shall appear in

the Security Register or (ii) by wire transfer to an account maintained by the Person entitled thereto located within the United States; provided, that such Person owns 4.00% Notes in an aggregate principal amount of at least $1,000,000 and

such Person makes a written request therefor for the appropriate Interest Payment Date.

SECTION 2.8. Currency.

Principal and interest on the 4.00% Notes shall be payable in Dollars.

10

SECTION 2.9. Registered Securities; Global Form.

The 4.00% Notes shall be issuable and transferable in fully registered form as Registered Securities, without coupons. The 4.00% Notes shall

each be issued in the form of one or more permanent Global Securities. The depository for the 4.00% Notes shall initially be The Depository Trust Company (“DTC”). The 4.00% Notes shall not be issuable in definitive form except as provided

in Section 3.5 of the Original Indenture.

SECTION 2.10. Form of Notes.

The 4.00% Notes shall be substantially in the form attached as Exhibit A hereto.

SECTION 2.11. Registrar and Paying Agent.

The Trustee shall initially serve as Registrar and Paying Agent for the 4.00% Notes.

SECTION 2.12. Defeasance.

The

provisions of Sections 14.2 and 14.3 of the Original Indenture, together with the other provisions of Article XIV of the Original Indenture, shall be applicable to the 4.00% Notes. The provisions of Section 14.3 of the Original Indenture shall

apply to the covenants set forth in Section 2.4 of this Fourteenth Supplemental Indenture and to those covenants specified in Section 14.3 of the Original Indenture.

SECTION 2.13. Waiver of Certain Covenants.

Notwithstanding the provisions of Section 10.11 of the Original Indenture, the Company may omit in any particular instance to comply with

any term, provision or condition set forth in Sections 10.4 to 10.8, inclusive, of the Original Indenture, with Section 2.4 of this Fourteenth Supplemental Indenture and with any other term, provision or condition with respect to the 4.00%

Notes (except any such term, provision or condition which could not be amended without the consent of all Holders of the 4.00% Notes), if before or after the time for such compliance the Holders of at least a majority in principal amount of all

outstanding 4.00% Notes or such series thereof, as applicable, by Act of such Holders, either waive such compliance in such instance or generally waive compliance with such covenant or condition. Except to the extent so expressly waived, and until

such waiver shall become effective, the obligations of the Company and the duties of the Trustee in respect of any such term, provision or condition shall remain in full force and effect.

SECTION 2.14. Acceleration of Maturity; Rescission and Annulment.

If an Event of Default with respect to Securities of any series at the time outstanding occurs and is continuing, then in every such case the

Trustee or the Holders of not less than 25% in principal amount of the Outstanding Securities of that series may declare the

11

Make-Whole Amount with respect to all the Securities of that series to be due and payable immediately, by a notice in writing to the Company (and to the Trustee if given by the Holders), and upon

any such declaration such amount shall become immediately due and payable. If an Event of Default with respect to the Securities of any series set forth in Sections 5.1(1), 5.1(2) and 5.1(6) of the Original Indenture occurs and is continuing, then

in every such case all the Securities of that series shall become immediately due and payable, without notice to the Company, at a price equal to the Make-Whole Amount with respect to the Securities of that series.

SECTION 2.15. Event of Default.

(a) If an Event of Default pursuant to Section 5.1(6) or 5.1(7) of the Original Indenture shall have occurred, the Make-Whole Amount with

respect to all outstanding notes shall become due and payable without any declaration or other act on the part of the Trustee or of the Holders.

(b) For purposes of the 4.00% Notes, Section 5.1(5) of the Original Indenture is hereby deleted in its entirety.

(c) For purposes of the 4.00% Notes, Event of Default shall also include a default under any bond, debenture, note, mortgage, indenture or

instrument under which there may be issued or by which there may be secured or evidenced any Indebtedness for money borrowed by the Company (or by any Subsidiary, the repayment of which the Company has guaranteed or for which the Company is directly

responsible or liable as obligor or guarantor), having an aggregate principal amount outstanding of at least $25,000,000, whether such Indebtedness now exists or shall hereafter be created, which default shall have resulted in such Indebtedness

becoming or being declared due and payable prior to the date on which it would otherwise have become due and payable, without such Indebtedness having been discharged, or such acceleration having been rescinded or annulled, within a period of 10

days after there shall have been given written notice, by registered or certified mail, to the Company by the Trustee or to the Company and the Trustee by the Holders of at least 25% in principal amount of the Outstanding Securities represented by

the 4.00% Notes a written notice specifying such default and requiring the Company to cause such Indebtedness to be discharged or cause such acceleration to be rescinded or annulled and stating that such notice is a “Notice of Default”

hereunder; provided, however, that for purposes of this Section 2.15(c), $25,000,000 shall be replaced by $10,000,000 for so long as any of the Securities issued pursuant to any of Supplemental Indenture Nos. 1, 2, 3, 4, 5, 6 and 8, the

Seventh Supplemental Indenture, the Ninth Supplemental Indenture, the Tenth Supplemental Indenture and the Eleventh Supplemental Indenture to the Original Indenture are Outstanding.

(d) For purposes of the 4.00% Notes, upon cancellation by the Trustee of all Outstanding Securities issued pursuant to each of Supplemental

Indenture Nos. 1, 2, 3, 4, 5, 6 and 8, the Seventh Supplemental Indenture, the Ninth Supplemental Indenture, the Tenth Supplemental Indenture and the Eleventh Supplemental Indenture to the Original Indenture, the provisions of Section 5.1(8) of

the Original Indenture shall cease to exist and shall be of no further effect.

12

ARTICLE THREE

MISCELLANEOUS PROVISIONS

SECTION 3.1. Ratification of Original Indenture.

Except as expressly modified or amended hereby, the Original Indenture continues in full force and effect and is in all respects confirmed and

preserved.

SECTION 3.2. Fiscal Year.

The Company shall notify the Trustee of its fiscal year and any change thereof.

SECTION 3.3. Governing Law.

This Fourteenth Supplemental Indenture and each 4.00% Note shall be governed by and construed in accordance with the laws of the State of New

York. This Fourteenth Supplemental Indenture is subject to the provisions of the Trust Indenture Act of 1939, as amended, and shall, to the extent applicable, be governed by such provisions.

SECTION 3.4. Counterparts.

This Fourteenth Supplemental Indenture may be executed in any number of counterparts, each of which so executed shall be deemed to be an

original, but all such counterparts shall together constitute but one and the same instrument.

[Signature Page Follows]

13

IN WITNESS WHEREOF, the parties hereto have caused this Fourteenth Supplemental Indenture

to be duly executed by their respective officers hereunto duly authorized, all as of the day and year first written above.

|

|

|

| NATIONAL RETAIL PROPERTIES, INC.,

as Issuer |

|

|

| By: |

|

|

|

|

Kevin B. Habicht |

|

|

Executive Vice President, Chief Financial

Officer, Assistant Secretary and Treasurer |

|

| U.S. BANK NATIONAL ASSOCIATION,

as Trustee |

|

|

| By: |

|

|

|

|

Sheryl Lear |

|

|

Vice President |

Signature Page to

Fourteenth Supplemental Indenture

Exhibit 4.2

UNLESS THIS SECURITY IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), 55 WATER STREET,

NEW YORK, NEW YORK, TO THE COMPANY (AS DEFINED BELOW) OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED

REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL

INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

THIS SECURITY IS A GLOBAL SECURITY WITHIN THE MEANING SET FORTH IN

THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF DTC OR A NOMINEE OF DTC. THIS SECURITY IS EXCHANGEABLE FOR SECURITIES REGISTERED IN THE NAME OF A PERSON OTHER THAN DTC OR ITS NOMINEE ONLY IN THE LIMITED CIRCUMSTANCES DESCRIBED

IN THE INDENTURE, AND MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY DTC TO A NOMINEE OF DTC OR ANOTHER NOMINEE OF DTC OR BY DTC OR ITS NOMINEE TO A SUCCESSOR DEPOSITORY OR ITS NOMINEE.

|

|

|

|

|

| Registered No. 001 |

|

|

|

PRINCIPAL AMOUNT |

| CUSIP No.: 637417 AH9 |

|

|

|

$400,000,000.00 (subject to

revision as set forth

below) |

NATIONAL RETAIL PROPERTIES, INC.

4.00% NOTE DUE 2025

NATIONAL

RETAIL PROPERTIES, INC., a corporation duly organized and existing under the laws of the State of Maryland (herein referred to as the “Company” which term shall include any successor corporation under the Indenture hereinafter referred

to), for value received, hereby promises to pay to CEDE & CO., or registered assigns, upon presentation, the principal sum of FOUR HUNDRED MILLION AND 00/100THS DOLLARS ($400,000,000.00), as may be revised by the Schedule of Increases or

Decreases in Global Security attached hereto, on November 15, 2025 and to pay interest on the outstanding principal amount thereon from October 21, 2015, or from the immediately preceding Interest Payment Date to which interest has been

paid or duly provided for, semi-annually in arrears on May 15 and November 15 in each year, commencing May 15, 2016, at the rate of 4.00% per annum, until the entire principal hereof is paid or made available for payment. The

interest so payable and punctually paid or duly provided for on any Interest Payment Date will, as provided in the Indenture, be paid to the Person in whose name this Security is registered at the close of business on the Regular Record Date for

such interest, which shall be the May 1 or November 1 (whether or not a Business Day), as the case may be, next preceding such Interest Payment Date. Any such interest not so punctually paid or duly provided for shall forthwith cease to be

payable to

- 1 -

the Holder on such Regular Record Date, and may either be paid to the Person in whose name this Security is registered at the close of business on a Special Record Date for the payment of such

Defaulted Interest to be fixed by the Trustee, notice whereof shall be given to Holders of the Securities not more than 15 days and not less than 10 days prior to such Special Record Date, or may be paid at any time in any other lawful manner not

inconsistent with the requirements of any securities exchange on which the Securities may be listed, and upon such notice as may be required by such exchange, all as more fully provided in the Indenture. Payment of the principal of and interest on

this Security will be made at the office or agency maintained for that purpose in the City of St. Paul, Minnesota, or elsewhere as provided in the Indenture, in such coin or currency of the United States of America as at the time of payment is legal

tender for payment of public and private debts; provided, however, that at the option of the Company, payments of principal and interest on the 4.00% Notes (other than payments of principal and interest due at Stated Maturity) may be

made (i) by check mailed to the address of the Person entitled thereto as such address shall appear in the Security Register or (ii) by wire transfer to an account of the Person entitled thereto located within the United States;

provided, that such Person owns 4.00% Notes in an aggregate principal amount of at least $1,000,000 and such Person makes a written request therefor for the appropriate Interest Payment Date.

Securities of this series are one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued

and to be issued in one or more series under an Indenture, dated as of March 25, 1998 (as supplemented, herein called the “Indenture”), between the Company and U.S. Bank National Association, as successor trustee to Wachovia Bank,

National Association (formerly First Union National Bank) (herein called the “Trustee,” which term includes any successor trustee under the Indenture), to which the Indenture and all indentures supplemental thereto, including, the

Fourteenth Supplemental Indenture thereto, dated as of October 21, 2015, between the Company and the Trustee, reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the

Company, the Trustee and the Holders of the Securities and of the terms upon which the Securities are authenticated and delivered. This Security is one of the series designated in the first page thereof, initially having an aggregate principal

amount equal to $400,000,000; provided, that the Company may, without the consent of the Holders of the then Outstanding 4.00% Notes, “reopen” this series of Securities so as to increase the aggregate principal amount of 4.00% Notes

Outstanding in compliance with the procedures set forth in the Indenture, including Sections 3.1 and 3.3 thereof, so long as any such additional notes have the same tenor and terms (including, without limitation, rights to receive accrued and unpaid

interest) as the 4.00% Notes then Outstanding.

Securities of this series may be redeemed prior to August 15, 2025 (which is the date

three months prior to the Stated Maturity), at any time at the option of the Company, in whole or in part from time to time, upon notice of not more than 60 nor less than 15 days prior to the Redemption Date, at a redemption price equal to the

greater of (i) 100% of the principal amount of the Securities being redeemed plus accrued and unpaid interest thereon to, but not including, the Redemption Date and (ii) the Make-Whole Amount, if any, with respect to such Securities;

provided, however, that if the Company redeems the 4.00% Notes on or after August 15, 2025, the redemption price will equal 100% of the principal amount of the Securities to be redeemed plus accrued and unpaid interest thereon to,

but not including, the Redemption Date.

- 2 -

The Indenture contains provisions for defeasance at any time of (i) the entire indebtedness

of the Company on this Security and (ii) certain restrictive covenants and the related defaults and Events of Default applicable to the Company, in each case, upon compliance by the Company with certain conditions set forth in the Indenture,

which provisions apply to this Security.

If an Event of Default with respect to the Securities shall occur and be continuing, the

principal of the Securities may be declared due and payable in the manner and with the effect provided in the Indenture.

As provided in

and subject to the provisions of the Indenture, the Holder of this Security shall not have the right to institute any proceeding with respect to the Indenture or for the appointment of a receiver or trustee or for any other remedy thereunder, unless

(i) such Holder shall have previously given written notice to the Trustee of a continuing Event of Default with respect to the Securities, (ii) the Holders of not less than 25% in principal amount of the Securities of this series at the

time Outstanding shall have made written request to the Trustee to institute proceedings in respect of such Event of Default as Trustee and offered the Trustee reasonable indemnity and (iii) the Trustee shall not have received from the Holders

of a majority in principal amount of Securities of this series at the time Outstanding a direction inconsistent with such request, and shall have failed to institute any such proceeding, for 60 days after receipt of such notice, request and offer of

indemnity. The foregoing shall not apply to any suit instituted by the Holder of this Security for the enforcement of any payment of principal hereof or any interest on or after the respective due dates expressed herein.

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations

of the Company and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company and the Trustee with the consent of the Holders of not less than a majority in principal amount of the

Outstanding Securities of each series of Securities then Outstanding affected thereby. The Indenture also contains provisions permitting the Holders of specified percentages in principal amount of the Securities of each series at the time

Outstanding, on behalf of the Holders of all Securities of such series, to waive compliance by the Company with certain provisions of the Indenture and certain past defaults under the Indenture and their consequences. Any such consent or waiver by

the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not

notation of such consent or waiver is made upon this Security.

No reference herein to the Indenture and no provision of this Security or

of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on (or Make-Whole Amount, if any, with respect to) this Security at the times, place and rate, and in the

coin or currency, herein prescribed.

- 3 -

As provided in the Indenture and subject to certain limitations therein set forth, the transfer

of this Security is registrable in the Security Register, upon surrender of this Security for registration of transfer at the office or agency of the Company in any Place of Payment where the principal of and interest on (or Make-Whole Amount, if

any, with respect to) this Security are payable, duly endorsed by, or accompanied by a written instrument of transfer in form satisfactory to the Company and the Security Registrar duly executed by the Holder hereof or his attorney duly authorized

in writing, and thereupon one or more new Securities of this series, of authorized denominations and for the same aggregate principal amount, will be issued to the designated transferee or transferees.

The Securities of this series are issuable only in registered form without coupons in denominations of $2,000 and integral multiples of $1,000

thereafter. As provided in the Indenture and subject to certain limitations therein set forth, Securities of this series are exchangeable for a like aggregate principal amount of Securities of this series of a different authorized denomination, as

requested by the Holder surrendering the same.

This 4.00% Note is a Global Security. As provided in and subject to the provisions of the

Indenture, definitive Securities shall be issued to all owners of beneficial interests in a Global Security in exchange for such interests if: (1) the depositary with respect to the 4.00% Notes (which shall initially be DTC) notifies the

Company that it is unwilling or unable to continue as depositary for such Global Security or the depositary ceases to be a clearing agency registered under the Exchange Act, at a time when the depositary is required to be so registered in order to

act as depositary, and in each case a successor depositary is not appointed by the Company within 90 days of such notice; (2) an Event of Default has occurred and is continuing and the Security Registrar has received a request from the

depositary or (3) the Company executes and delivers to the Trustee and Security Registrar an Officers’ Certificate stating that such Global Security shall be so exchangeable. In connection with the exchange of an entire Global Security for

definitive Securities pursuant to this paragraph, such Global Security shall be deemed to be surrendered to the Trustee for cancellation, and the Company shall execute and the Trustee shall authenticate and deliver, to each beneficial owner

identified by the depositary in exchange for its beneficial interest in such Global Security, an equal aggregate principal amount of definitive Securities of authorized denominations.

No service charge shall be made for any such registration of transfer or exchange, but the Company may require payment of a sum sufficient to

cover any tax or other governmental charge payable in connection therewith.

Prior to due presentment of this Security for registration of

transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the

Trustee nor any such agent of the Company or the Trustee shall be affected by notice to the contrary.

No recourse under or upon any

obligation, covenant or agreement contained in the Indenture or in this Security, or because of any indebtedness evidenced hereby or thereby, shall be had against any promoter, as such, or against any past, present or future shareholder, officer or

- 4 -

director, as such, of the Company or of any successor, either directly or through the Company or any successor, under any rule of law, statute or constitutional provision or by the enforcement of

any assessment or by any legal or equitable proceeding or otherwise, all such liability being expressly waived and released by the acceptance of this Security by the Holder thereof and as part of the consideration for the issue of the Securities of

this series.

All capitalized terms used in this Security which are used herein but not defined herein shall have the meanings assigned to

them in the Indenture.

THE INDENTURE AND THE SECURITIES, INCLUDING THIS SECURITY, SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH

THE LAWS OF THE STATE OF NEW YORK.

Pursuant to a recommendation promulgated by the Committee on Uniform Security Identification

Procedures, the Company has caused “CUSIP” numbers to be printed on the Securities of this series as a convenience to the Holders of such Securities. No representation is made as to the correctness or accuracy of such CUSIP numbers as

printed on the Securities, and reliance may be placed only on the other identification numbers printed hereon.

Unless the certificate of

authentication hereon has been executed by or on behalf of the Trustee by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

- 5 -

IN WITNESS WHEREOF, NATIONAL RETAIL PROPERTIES, INC. has caused this instrument to be duly

executed under its corporate seal.

Dated: October 21, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

NATIONAL RETAIL PROPERTIES, INC. |

|

|

|

|

|

|

|

|

By: |

|

|

| [SEAL] |

|

|

|

|

|

Name: |

|

Kevin B. Habicht |

|

|

|

|

|

|

Title: |

|

Executive Vice President, |

|

|

|

|

|

|

|

|

Chief Financial Officer, |

|

|

|

|

|

|

|

|

Assistant Secretary and Treasurer |

Attest:

|

|

|

|

|

| By: |

|

|

|

|

Name: |

|

Christopher P. Tessitore |

|

|

Title: |

|

Secretary |

TRUSTEE’S CERTIFICATE OF AUTHENTICATION:

This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture.

Dated: October 21, 2015

|

|

|

|

|

| U.S. BANK NATIONAL ASSOCIATION, as

Trustee |

|

|

| By: |

|

|

|

|

Name: |

|

Sheryl Lear |

|

|

Title: |

|

Vice President |

- 6 -

ASSIGNMENT FORM

FOR VALUE RECEIVED, the undersigned hereby

Sells, assigns and transfers unto

PLEASE INSERT

SOCIAL

SECURITY OR OTHER IDENTIFYING

NUMBER OF ASSIGNEE

(Please Print or Typewrite Name and

Address including

Zip Code of Assignee)

the within Security of National Retail Properties, Inc. and hereby does irrevocably constitute and appoint

(Attorney) to transfer said Security on the books of the within-named Company with full power of substitution in the premises.

NOTICE: The signature to this assignment must correspond with the name as it appears on the first page of the within Security

in every particular, without alteration or enlargement or any change whatever.

- 7 -

SCHEDULE OF INCREASES OR DECREASES IN GLOBAL SECURITY

The following increases or decreases in this Global Security have been made:

|

|

|

|

|

|

|

|

|

| Date |

|

Amount of

Decrease in

Principal Amount

of this Global

Security |

|

Amount of

Increase in

Principal Amount

of this Global

Security |

|

Principal Amount of

this Global Security

Following Such

Increase or

Decrease |

|

Signature of

Authorized Officer

of Trustee or

Custodian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 8 -

Exhibit 5.1

October 21, 2015

National Retail

Properties, Inc.

450 South Orange Avenue

Orlando, FL 32801

Ladies and Gentlemen:

We are acting as

counsel for National Retail Properties, Inc., a Maryland corporation (the “Company”), in connection with the issuance and sale by the Company (the “Offering”) of $400,000,000 principal amount of its 4.00% Notes due 2025 (the

“Notes”), pursuant to the Underwriting Agreement dated October 14, 2015 between the several underwriters listed on Schedule I thereto (the “Underwriters”) and the Company (the “Agreement”). The Notes are being

issued under the Indenture dated as of March 25, 1998, as supplemented by the Fourteenth Supplemental Indenture dated as of October 21, 2015, between U.S. Bank National Association, as successor trustee (the “Trustee”), and the

Company (as so supplemented, the “Indenture”) pursuant to the Registration Statement on Form S-3 (File No. 333-202237) (the “Registration Statement”) filed by the Company to register the offer and sale of the Notes with the

Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933 (the “Securities Act”), and the related prospectus dated February 23, 2015, as supplemented by the prospectus supplement dated

October 14, 2015 (as so supplemented, the “Prospectus”).

We have reviewed and are familiar with such documents, corporate

proceedings and other matters as we have considered relevant or necessary as a basis for the opinions in this letter. Based on the foregoing, we are of the opinion that the Notes have been duly authorized and, when issued and sold by the Company in

the manner described in the Registration Statement and the Prospectus and in accordance with the resolutions adopted by the Board of Directors of the Company, will constitute valid and legally binding obligations of the Company enforceable against

the Company in accordance with their terms.

The opinion set forth in this letter is limited to the laws of the State of New York and the

State of Maryland, as in effect on the date hereof.

We hereby consent to the filing of this opinion letter as an exhibit to the

Company’s Current Report on Form 8-K filed by the Company with the Commission on October 26, 2015 and the incorporation thereof in the Registration Statement and to the use of our name under the caption “Legal Matters” in the

Prospectus. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Pillsbury Winthrop Shaw Pittman LLP

Exhibit 8.1

Pillsbury Winthrop Shaw Pittman LLP

1200 Seventeenth Street, NW |

Washington, DC 20036-3006 | tel 202.663.8000 | fax 202.663.8007

October 14, 2015

National Retail Properties, Inc.

450 South Orange Avenue

Suite 900

Orlando, FL 32801

Ladies and Gentlemen:

In connection with the

filing on October 14, 2015 by National Retail Properties, Inc. (the “Company”) of a registration statement on Form S-3, including the prospectus, prospectus supplement, and all documents incorporated and deemed to be incorporated by

reference therein (collectively, the “Registration Statement”) with the Securities and Exchange Commission, you have asked us to render an opinion with respect to the qualification of the Company as a real estate investment trust

(“REIT”) under sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”).

We have served

as special counsel for the Company in connection with the filing of the Registration Statement and from time to time in the past have represented the Company on specific matters as requested by the Company. Specifically for the purpose of this

opinion, we have examined and relied upon the following: copies of the Company’s Articles of Incorporation and any amendments thereto; the Registration Statement; copies of executed leases covering real property owned by the Company; the Form

10-K filed on February 20, 2015; and the Company’s Form S-11 Registration Statement as filed with the Securities and Exchange Commission on August 15, 1984.

We have not served as general counsel to the Company and have not been involved in decisions regarding the day-to-day operation of the Company

and its properties. We have, however, discussed the mode of operation of the Company with its officers with a view to learning information relevant to the opinions expressed herein and have received and relied upon a certificate from the Company

with respect to certain matters.

We have discussed with management of the Company arrangements relating to the management of its

properties, the relationships of the Company with tenants of such properties, and certain terms of leases of such properties to tenants, with a view to assuring that (i) at the close of each quarter of the taxable years covered by this opinion,

it met the asset composition requirements set forth in section 856(c)(4), (ii)

National Retail Properties, Inc.

October 14, 2015

Page

2

with respect to years covered by this opinion, it satisfied the 95% and 75% gross income tests set forth in sections 856(c)(2) and (3), respectively, and (iii) with respect to tax years

prior to 1998, it satisfied the 30% gross income test. We have further reviewed with management of the Company the requirements that the beneficial ownership of a REIT be held by 100 or more persons for at least 335/365ths of each taxable year and

that a REIT must satisfy the diversity of ownership requirements of section 856(h) as such requirements existed in the years covered by this opinion, and we have been advised by management that at all times during the years covered by this opinion

(and specifically on each record date for the payment of dividends during 1984 through the date hereof) the Company has maintained the records required by section 1.857-8 of the Treasury Regulations, that no later than January 30 of each year

it sent the demand letters required by section 1.857-8(d) of the Treasury Regulations, and that the actual ownership of the Company shares was such that, to the best knowledge of its management (based upon responses to the aforesaid demands, any

filing of a Schedule 13D or 13G under the Securities Exchange Act of 1934, as amended, or any other sources of information), the Company satisfied the applicable requirements of section 856(h). Further, we have examined various property leases and

lease supplements relating to the properties that the Company owns, and although leases relating to certain properties that the Company owns have not been made available to us, the Company has represented with respect to such leases that they do

conform in all material respects to a form of lease agreement provided to us. On the basis of discussions with management of the Company, we are not aware that the Company’s election to be a REIT has been terminated or challenged by the

Internal Revenue Service or any other party, or that the Company has revoked its election to be a REIT for any such prior year so as to make the Company ineligible to qualify as a REIT for the years covered by this opinion.

In rendering the opinions set forth herein, we are assuming that copies of documents examined by us are true copies of originals thereof and

that the information concerning the Company set forth in the Company’s federal income tax returns, and in the Registration Statement, as well as the information provided to us by the Company’s management are true and correct. We have no

reason to believe that such assumptions are not warranted.

Based upon the foregoing, we are of the opinion that (i) the Company was

a “real estate investment trust” as defined by section 856(a) for its taxable years ended December 31, 1984 through December 31, 2014, (ii) its current and proposed method of operation and ownership will enable it to meet

the requirements for qualification and taxation as a REIT for its taxable year ending December 31, 2015 and for all future taxable years, and (iii) the statements in (x) the prospectus set forth under the

National Retail Properties, Inc.

October 14, 2015

Page

3

caption “Material Federal Income Tax Considerations,” and (y) the prospectus supplement set forth under the caption “Additional Material Federal Income Tax

Considerations,” insofar as they purport to describe or summarize certain provisions of the agreements, statutes or regulations referred to therein, are accurate descriptions or summaries in all material respects, and the discussion thereunder

expresses the opinion of Pillsbury Winthrop Shaw Pittman LLP insofar as it relates to matters of United States federal income tax law and legal conclusions with regard to those matters. With respect to the 2015 year and all future years, however, we

note that the Company’s status as a real estate investment trust at any time is dependent upon, among other things, its meeting the requirements of section 856 throughout the year and for the year as a whole.

This opinion is based upon the existing provisions of the Code (or predecessor provisions, as applicable), rules and regulations (including

proposed regulations) promulgated thereunder, and reported administrative and judicial interpretations thereof, all of which are subject to change, possibly with retroactive effect. This opinion is limited to the specific matters covered hereby and

should not be interpreted to imply that the undersigned has offered its opinion on any other matter.

We hereby consent to the filing of

this opinion as an exhibit to the Registration Statement. We also consent to the reference to Pillsbury Winthrop Shaw Pittman LLP under the caption “Legal Matters” in the Registration Statement. In giving such consent, we do not consider

that we are “experts,” within the meaning of the term used in the Securities Act of 1933, as amended (the “Act”), or the rules and regulations of the Securities and Exchange Commission promulgated thereunder, with respect to any

part of the Registration Statement, including this opinion as an exhibit or otherwise, or within the category of persons whose consent is required by Section 7 of the Act.

/s/ PILLSBURY WINTHROP SHAW PITTMAN LLP

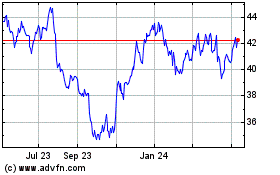

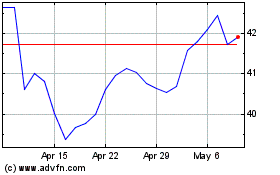

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Apr 2023 to Apr 2024