UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: July 30, 2015

NATIONAL RETAIL PROPERTIES, INC.

(exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Maryland | | 001-11290 | | 56-1431377 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employment Identification No.) |

450 South Orange Avenue, Suite 900, Orlando, Florida 32801

(Address of principal executive offices, including zip code)

(407) 265-7348

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02. | Results of Operations and Financial Condition. |

On July 30, 2015 National Retail Properties, Inc. issued a press release announcing its results of operations and financial condition for the quarter and six months ended June 30, 2015. The press release is attached hereto as Exhibit 99.1.

The information in this Form 8-K is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of such section, nor shall such information be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

|

| | | |

| | |

99.1 |

| | Press Release, dated July 30, 2015, of National Retail Properties, Inc. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | National Retail Properties, Inc. |

| | |

Dated: July 30, 2015 | | By: | | /s/ Kevin B. Habicht |

| | | | Kevin B. Habicht |

| | | | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

| | |

Exhibit No. | | Description |

| |

99.1 | | Press Release, dated July 30, 2015, of National Retail Properties, Inc. |

NEWS RELEASE

For information contact:

Kevin B. Habicht

Chief Financial Officer

(407) 265-7348 FOR IMMEDIATE RELEASE

July 30, 2015

SECOND QUARTER 2015 OPERATING RESULTS AND INCREASED 2015 GUIDANCE

ANNOUNCED BY NATIONAL RETAIL PROPERTIES, INC.

Orlando, Florida, July 30, 2015 – National Retail Properties, Inc. (NYSE: NNN), a real estate investment trust, today announced its operating results for the quarter and six months ended June 30, 2015. Highlights include:

Operating Results:

| |

• | Revenues and net earnings, FFO, Recurring FFO and AFFO available to common stockholders and diluted per share amounts: |

|

| | | | | | | | | | | | | | | |

| Quarter Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in thousands, except per share data) |

Revenues | $ | 117,208 |

| | $ | 105,613 |

| | $ | 233,394 |

| | $ | 209,677 |

|

| | | | | | | |

Net earnings available to common stockholders | $ | 37,330 |

| | $ | 36,713 |

| | $ | 82,450 |

| | $ | 71,187 |

|

Net earnings per common share | $ | 0.28 |

| | $ | 0.30 |

| | $ | 0.62 |

| | $ | 0.58 |

|

| | | | | | | |

FFO available to common stockholders | $ | 73,090 |

| | $ | 61,690 |

| | $ | 143,933 |

| | $ | 123,331 |

|

FFO per common share | $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.08 |

| | $ | 1.01 |

|

| | | | | | | |

Recurring FFO available to common stockholders | $ | 73,518 |

| | $ | 61,767 |

| | $ | 144,517 |

| | $ | 123,566 |

|

Recurring FFO per common share | $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.09 |

| | $ | 1.01 |

|

| | | | | | | |

AFFO available to common stockholders | $ | 75,181 |

| | $ | 62,710 |

| | $ | 147,304 |

| | $ | 125,428 |

|

AFFO per common share | $ | 0.56 |

| | $ | 0.51 |

| | $ | 1.11 |

| | $ | 1.02 |

|

Second Quarter 2015 Highlights:

| |

• | FFO per share and Recurring FFO per share increased 10.0% over prior year results |

| |

• | AFFO per share increased 9.8% over prior year results |

| |

• | Portfolio occupancy is 98.8% at June 30, 2015, consistent with March 31, 2015, and 98.6% at December 31, 2014 |

| |

• | Invested $147.8 million in 37 properties with an aggregate 669,000 square feet of gross leasable area at an initial cash yield of 7.1% |

| |

• | Sold three properties for $2.2 million producing $30,000 of gains on sales |

| |

• | Raised $38.7 million in net proceeds from the issuance of 983,317 common shares |

First Half 2015 Highlights:

| |

• | FFO per share increased 6.9% over prior year results |

| |

• | Recurring FFO per share increased 7.9% over prior year results |

| |

• | AFFO per share increased 8.8% over prior year results |

| |

• | Invested $303.0 million in 93 properties with an aggregate 1,451,000 square feet of gross leasable area at an initial cash yield of 7.2% |

| |

• | Sold nine properties for $25.5 million producing $7.2 million of gains on sales, net of income tax and noncontrolling interest |

| |

• | Raised $87.4 million in net proceeds from the issuance of 2,207,144 common shares |

National Retail Properties announced an increase in 2015 FFO guidance from a range of $2.14 to $2.17 to a range of $2.16 to $2.19 per share before any impairment expense. The 2015 AFFO is estimated to be $2.21 to $2.24 per share. The FFO guidance equates to net earnings before any gains or losses from the sale of real estate of $1.23 to $1.26 per share, plus $0.98 per share of expected real estate depreciation, amortization and impairments. The guidance is based on current plans and assumptions and subject to risks and uncertainties more fully described in this press release and the company's reports filed with the Securities and Exchange Commission.

Craig Macnab, Chief Executive Officer, commented: "With our recently announced dividend increase, 2015 will be the 26th consecutive year of annual dividend increases which is a long-term record that all of us at NNN are working to perpetuate. Our team continues to source attractive retail properties for acquisition at excellent initial cash yields that will help us accomplish our objective."

National Retail Properties invests primarily in high-quality retail properties subject generally to long-term, net leases. As of June 30, 2015, the company owned 2,138 properties in 47 states with a gross leasable area of approximately 23.7 million square feet and with a weighted average remaining lease term of 11.4 years. For more information on the company, visit www.nnnreit.com.

Management will hold a conference call on July 30, 2015, at 10:00 a.m. ET to review these results. The call can be accessed on the National Retail Properties web site live at http://www.nnnreit.com. For those unable to listen to the live broadcast, a replay will be available on the company’s web site. In addition, a summary of any earnings guidance given on the call will be posted to the company’s web site.

Statements in this press release that are not strictly historical are “forward-looking” statements. Forward-looking statements involve known and unknown risks, which may cause the company’s actual future results to differ materially from expected results. These risks include, among others, general economic conditions, local real estate conditions, changes in interest rates, increases in operating costs, the preferences and financial condition of the company's tenants, the availability of capital, risks related to the company's status as a REIT and the profitability of the company’s taxable subsidiary. Additional information concerning these and other factors that could cause actual results to differ materially from these forward-looking statements is contained from time to time in the company’s Securities and Exchange Commission (“SEC”) filings, including, but not limited to, the company’s Annual Report on Form 10-K. Copies of each filing may be obtained from the company or the SEC. Such forward-looking statements should be regarded solely as reflections of the company’s current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. National Retail Properties, Inc. undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

The reported results are preliminary and not final and there can be no assurance that the results will not vary from the final information filed on Form 10-Q with the SEC for the quarter and six months ended June 30, 2015. In the opinion of management, all adjustments considered necessary for a fair presentation of these reported results have been made.

Funds From Operations, commonly referred to as FFO, is a relative non-GAAP financial measure of operating performance of an equity REIT in order to recognize that income-producing real estate historically has not depreciated on the basis determined under GAAP. FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) and is used by the company as follows: net earnings (computed in accordance with GAAP) plus depreciation and amortization of assets unique to the real estate industry, excluding gains (or including losses), any applicable taxes and noncontrolling interests on the disposition of certain assets, the company’s share of these items from the company’s unconsolidated partnerships and any impairment charges on a depreciable real estate asset.

FFO is generally considered by industry analysts to be the most appropriate measure of performance of real estate companies. FFO does not necessarily represent cash provided by operating activities in accordance with GAAP and should not be considered an alternative to net earnings as an indication of the company’s performance or to cash flow as a measure of liquidity or ability to make distributions. Management considers FFO an appropriate measure of performance of an equity REIT because it primarily excludes the assumption that the value of the real estate assets diminishes predictably over time, and because industry analysts have accepted it as a performance measure.

The company’s computation of FFO may differ from the methodology for calculating FFO used by other equity REITs, and therefore, may not be comparable to such other REITs. A reconciliation of net earnings (computed in accordance with GAAP) to FFO, as defined by NAREIT, is included in the financial information accompanying this release.

Adjusted Funds From Operations (“AFFO”) is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. AFFO adjusts FFO for certain non-cash items that reduce or increase net income in accordance with GAAP. AFFO should not be considered an alternative to net earnings, as an indication of the company's performance or to cash flow as a measure of liquidity or ability to make distributions. Management considers AFFO a useful supplemental measure of the company’s performance.

The company’s computation of AFFO may differ from the methodology for calculating AFFO used by other equity REITs, and therefore, may not be comparable to such other REITs. A reconciliation of net earnings (computed in accordance with GAAP) to AFFO is included in the financial information accompanying this release.

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Income Statement Summary | | | | | | | | |

| | | | | | | | |

Revenues: | | | | | | | | |

Rental and earned income | | $ | 113,224 |

| | $ | 101,388 |

| | $ | 225,288 |

| | $ | 200,977 |

|

Real estate expense reimbursement from tenants | | 3,324 |

| | 3,228 |

| | 6,838 |

| | 6,460 |

|

Interest and other income from real estate transactions | | 213 |

| | 543 |

| | 376 |

| | 1,334 |

|

Interest income on commercial mortgage residual interests | | 447 |

| | 454 |

| | 892 |

| | 906 |

|

| | 117,208 |

| | 105,613 |

| | 233,394 |

| | 209,677 |

|

| | | | | | | | |

Operating expenses: | | | | | | | | |

General and administrative | | 7,830 |

| | 8,055 |

| | 16,435 |

| | 16,762 |

|

Real estate | | 4,658 |

| | 4,746 |

| | 9,417 |

| | 9,086 |

|

Depreciation and amortization | | 34,202 |

| | 28,007 |

| | 66,343 |

| | 56,019 |

|

Impairment – commercial mortgage residual interests valuation | | 428 |

| | 77 |

| | 428 |

| | 235 |

|

Impairment losses | | 2,686 |

| | 89 |

| | 3,714 |

| | 485 |

|

| | 49,804 |

| | 40,974 |

| | 96,337 |

| | 82,587 |

|

| | | | | | | | |

Other expenses (revenues): | | | | | | | | |

Interest and other income | | (35 | ) | | (94 | ) | | (47 | ) | | (158 | ) |

Interest expense | | 21,678 |

| | 21,761 |

| | 43,464 |

| | 42,040 |

|

Real estate acquisition costs | | 96 |

| | 19 |

| | 695 |

| | 227 |

|

| | 21,739 |

| | 21,686 |

| | 44,112 |

| | 42,109 |

|

| | | | | | | | |

Income tax benefit (expense) | | 495 |

| | (441 | ) | | 54 |

| | (349 | ) |

| | | | | | | | |

Earnings from continuing operations | | 46,160 |

| | 42,512 |

| | 92,999 |

| | 84,632 |

|

| | | | | | | | |

Earnings (loss) from discontinued operations, net of income tax expense | | — |

| | 18 |

| | — |

| | (18 | ) |

Earnings before gain on disposition of real estate, net of income tax expense | | 46,160 |

| | 42,530 |

| | 92,999 |

| | 84,614 |

|

| | | | | | | | |

Gain on disposition of real estate, net of income tax expense | | 30 |

| | 3,054 |

| | 7,230 |

| | 4,810 |

|

| | | | | | | | |

Earnings including noncontrolling interests | | 46,190 |

| | 45,584 |

| | 100,229 |

| | 89,424 |

|

| | | | | | | | |

Earnings attributable to noncontrolling interests: | | | | | | | | |

Continuing operations | | (2 | ) | | (13 | ) | | (62 | ) | | (520 | ) |

| | | | | | | | |

Net earnings attributable to NNN | | 46,188 |

| | 45,571 |

| | 100,167 |

| | 88,904 |

|

Series D preferred stock dividends | | (4,762 | ) | | (4,762 | ) | | (9,523 | ) | | (9,523 | ) |

Series E preferred stock dividends | | (4,096 | ) | | (4,096 | ) | | (8,194 | ) | | (8,194 | ) |

Net earnings available to common stockholders | | $ | 37,330 |

| | $ | 36,713 |

| | $ | 82,450 |

| | $ | 71,187 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | |

Basic | | 133,267 |

| | 122,490 |

| | 132,471 |

| | 122,036 |

|

Diluted | | 133,601 |

| | 122,833 |

| | 132,825 |

| | 122,393 |

|

| | | | | | | | |

Net earnings per share available to common stockholders: | | | | | | | | |

Basic: | | | | | | | | |

Continuing operations | | $ | 0.28 |

| | $ | 0.30 |

| | $ | 0.62 |

| | $ | 0.58 |

|

Net earnings | | $ | 0.28 |

| | $ | 0.30 |

| | $ | 0.62 |

| | $ | 0.58 |

|

| | | | | | | | |

Diluted: | | | | | | | | |

Continuing operations | | $ | 0.28 |

| | $ | 0.30 |

| | $ | 0.62 |

| | $ | 0.58 |

|

Net earnings | | $ | 0.28 |

| | $ | 0.30 |

| | $ | 0.62 |

| | $ | 0.58 |

|

| | | | | | | | |

| | | | | | | | |

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Funds From Operations (FFO) Reconciliation: | | | | | | | | |

Net earnings available to common stockholders | | $ | 37,330 |

| | $ | 36,713 |

| | $ | 82,450 |

| | $ | 71,187 |

|

Real estate depreciation and amortization | | 34,086 |

| | 27,945 |

| | 66,113 |

| | 55,898 |

|

Gain on disposition of real estate, net of income tax and noncontrolling interest | | (30 | ) | | (3,057 | ) | | (7,178 | ) | | (4,302 | ) |

Impairment losses – depreciable real estate, net of income tax | | 1,704 |

| | 89 |

| | 2,548 |

| | 548 |

|

Total FFO adjustments | | 35,760 |

| | 24,977 |

| | 61,483 |

| | 52,144 |

|

FFO available to common stockholders | | $ | 73,090 |

| | $ | 61,690 |

| | $ | 143,933 |

| | $ | 123,331 |

|

| | | | | | | | |

FFO per common share: | | | | | | | | |

Basic | | $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.09 |

| | $ | 1.01 |

|

Diluted | | $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.08 |

| | $ | 1.01 |

|

| | | | | | | | |

Recurring Funds from Operations Reconciliation: | | | | | | | | |

Net earnings available to common stockholders | | $ | 37,330 |

| | $ | 36,713 |

| | $ | 82,450 |

| | $ | 71,187 |

|

Total FFO adjustments | | 35,760 |

| | 24,977 |

| | 61,483 |

| | 52,144 |

|

FFO available to common stockholders | | 73,090 |

| | 61,690 |

| | 143,933 |

| | 123,331 |

|

| | | | | | | | |

Impairment – commercial mortgage residual interests valuation | | 428 |

| | 77 |

| | 428 |

| | 235 |

|

Impairment losses – non-depreciable real estate | | — |

| | — |

| | 156 |

| | — |

|

Total Recurring FFO adjustments | | 428 |

| | 77 |

| | 584 |

| | 235 |

|

Recurring FFO available to common stockholders | | $ | 73,518 |

| | $ | 61,767 |

| | $ | 144,517 |

| | $ | 123,566 |

|

| | | | | | | | |

Recurring FFO per common share: | | | | | | | | |

Basic | | $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.09 |

| | $ | 1.01 |

|

Diluted | | $ | 0.55 |

| | $ | 0.50 |

| | $ | 1.09 |

| | $ | 1.01 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

National Retail Properties, Inc. (in thousands, except per share data) (unaudited)

|

| | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Adjusted Funds From Operations (AFFO) Reconciliation: | | | | | | | | |

Net earnings available to common stockholders | | $ | 37,330 |

| | $ | 36,713 |

| | $ | 82,450 |

| | $ | 71,187 |

|

Total FFO adjustments | | 35,760 |

| | 24,977 |

| | 61,483 |

| | 52,144 |

|

Total Recurring FFO adjustments | | 428 |

| | 77 |

| | 584 |

| | 235 |

|

Recurring FFO available to common stockholders | | 73,518 |

| | 61,767 |

| | 144,517 |

| | 123,566 |

|

| | | | | | | | |

Straight line accrued rent | | 187 |

| | (516 | ) | | (18 | ) | | (1,118 | ) |

Net capital lease rent adjustment | | 342 |

| | 338 |

| | 676 |

| | 667 |

|

Below market rent amortization | | (676 | ) | | (633 | ) | | (1,700 | ) | | (1,259 | ) |

Stock based compensation expense | | 2,368 |

| | 2,241 |

| | 4,777 |

| | 4,493 |

|

Capitalized interest expense | | (558 | ) | | (487 | ) | | (948 | ) | | (921 | ) |

Total AFFO adjustments | | 1,663 |

| | 943 |

| | 2,787 |

| | 1,862 |

|

AFFO available to common stockholders | | $ | 75,181 |

| | $ | 62,710 |

| | $ | 147,304 |

| | $ | 125,428 |

|

| | | | | | | | |

AFFO per common share: | | | | | | | | |

Basic | | $ | 0.56 |

| | $ | 0.51 |

| | $ | 1.11 |

| | $ | 1.03 |

|

Diluted | | $ | 0.56 |

| | $ | 0.51 |

| | $ | 1.11 |

| | $ | 1.02 |

|

| | | | | | | | |

Other Information: | | | | | | | | |

Percentage rent | | $ | 112 |

| | $ | 223 |

| | $ | 297 |

| | $ | 312 |

|

Amortization of debt costs | | $ | 714 |

| | $ | 697 |

| | $ | 1,423 |

| | $ | 1,353 |

|

Scheduled debt principal amortization (excluding maturities) | | $ | 410 |

| | $ | 275 |

| | $ | 819 |

| | $ | 554 |

|

Non-real estate depreciation expense | | $ | 122 |

| | $ | 67 |

| | $ | 240 |

| | $ | 132 |

|

National Retail Properties, Inc. (in thousands) (unaudited)

|

| | | | | | | | |

| | June 30, 2015 | | December 31, 2014 |

Balance Sheet Summary | | | | |

| | | | |

Assets: | | | | |

Cash and cash equivalents | | $ | 2,448 |

| | $ | 10,604 |

|

Receivables, net of allowance | | 1,778 |

| | 3,013 |

|

Mortgages, notes and accrued interest receivable, net of allowance | | 10,628 |

| | 11,075 |

|

Real estate portfolio: | | | | |

Accounted for using the operating method, net of accumulated depreciation and amortization | | 4,935,472 |

| | 4,715,906 |

|

Accounted for using the direct financing method | | 15,987 |

| | 16,974 |

|

Real estate held for sale | | 3,753 |

| | 7,169 |

|

Commercial mortgage residual interests | | 10,832 |

| | 11,626 |

|

Accrued rental income, net of allowance | | 25,359 |

| | 25,659 |

|

Debt costs, net of accumulated amortization | | 15,105 |

| | 16,453 |

|

Other assets | | 110,603 |

| | 108,235 |

|

Total assets | | $ | 5,131,965 |

| | $ | 4,926,714 |

|

| | | | |

Liabilities: | | | | |

Line of credit payable | | $ | 127,500 |

| | $ | — |

|

Mortgages payable, including unamortized premium | | 25,109 |

| | 26,339 |

|

Notes payable, net of unamortized discount | | 1,715,354 |

| | 1,714,715 |

|

Accrued interest payable | | 17,448 |

| | 17,396 |

|

Other liabilities | | 100,400 |

| | 85,172 |

|

Total liabilities | | 1,985,811 |

| | 1,843,622 |

|

| | | | |

Stockholders' equity: | | | | |

Preferred stockholders' equity (stated liquidation value) | | 575,000 |

| | 575,000 |

|

Common stockholders' equity | | 2,570,807 |

| | 2,507,515 |

|

Total stockholders' equity of NNN | | 3,145,807 |

| | 3,082,515 |

|

Noncontrolling interests | | 347 |

| | 577 |

|

Total equity | | 3,146,154 |

| | 3,083,092 |

|

| | | | |

Total liabilities and equity | | $ | 5,131,965 |

| | $ | 4,926,714 |

|

| | | | |

Common shares outstanding | | 134,434 |

| | 132,010 |

|

| | | | |

Gross leasable area, Property Portfolio (square feet) | | 23,747 |

| | 22,479 |

|

| | | | |

|

| | | | | | | | | | | | | | | | |

National Retail Properties, Inc. Debt Summary As of June 30, 2015 (in thousands) (unaudited) |

Unsecured Debt | | Principal | | Principal, Net of Discount | | Stated Rate | | Effective Rate | | Maturity Date |

Line of credit payable | | $ | 127,500 |

| | $ | 127,500 |

| | L + 92.5 bps |

| | 1.110% |

| | January 2019 |

| | | | | | | | | | |

Unsecured notes payable: | | | | | | | | | | |

2015 | | 150,000 |

| | 149,976 |

| | 6.150 | % | | 6.185 | % | | December 2015 |

2017 | | 250,000 |

| | 249,744 |

| | 6.875 | % | | 6.924 | % | | October 2017 |

2021 | | 300,000 |

| | 297,142 |

| | 5.500 | % | | 5.689 | % | | July 2021 |

2022 | | 325,000 |

| | 321,226 |

| | 3.800 | % | | 3.985 | % | | October 2022 |

2023 | | 350,000 |

| | 347,907 |

| | 3.300 | % | | 3.388 | % | | April 2023 |

2024 | | 350,000 |

| | 349,359 |

| | 3.900 | % | | 3.924 | % | | June 2024 |

Total | | 1,725,000 |

| | 1,715,354 |

| | | | | | |

| | | | | | | | | | |

Total unsecured debt | | $ | 1,852,500 |

| | $ | 1,842,854 |

| | | | | | |

|

| | | | | | | | | |

Mortgages Payable | | Principal Balance | | Interest Rate | | Maturity Date |

Mortgage(1) | | $ | 14,829 |

| | 5.230 | % | | July 2023 |

Mortgage(1) | | 6,037 |

| | 5.750 | % | | April 2016 |

Mortgage(1) | | 2,863 |

| | 6.400 | % | | February 2017 |

Mortgage | | 1,219 |

| | 6.900 | % | | January 2017 |

Mortgage | | 161 |

| | 8.140 | % | | September 2016 |

| | $ | 25,109 |

| | | | |

(1) Includes unamortized premium |

National Retail Properties, Inc.

Property Portfolio

Top 20 Lines of Trade

|

| | | | | | | | |

| | | | As of June 30, |

| | Line of Trade | | 2015(1) | | 2014(2) |

1. | | Convenience stores | | 17.5 | % | | 19.3 | % |

2. | | Restaurants – full service | | 8.9 | % | | 9.6 | % |

3. | | Automotive service | | 7.1 | % | | 7.5 | % |

4. | | Restaurants – limited service | | 7.1 | % | | 6.8 | % |

5. | | Family entertainment centers | | 5.6 | % | | 2.3 | % |

6. | | Theaters | | 5.1 | % | | 4.5 | % |

7. | | Automotive parts | | 4.5 | % | | 5.1 | % |

8. | | Health and fitness | | 3.8 | % | | 4.2 | % |

9. | | Banks | | 3.6 | % | | 4.1 | % |

10. | | Recreational vehicle dealers, parts and accessories | | 3.6 | % | | 3.2 | % |

11. | | Sporting goods | | 3.4 | % | | 3.8 | % |

12. | | Wholesale clubs | | 2.8 | % | | 3.1 | % |

13. | | Drug stores | | 2.4 | % | | 2.7 | % |

14. | | Consumer electronics | | 2.3 | % | | 2.6 | % |

15. | | Travel plazas | | 2.2 | % | | 2.0 | % |

16. | | Grocery | | 2.1 | % | | 1.2 | % |

17. | | Medical service providers | | 2.0 | % | | 1.8 | % |

18. | | Home furnishings | | 2.0 | % | | 1.6 | % |

19. | | Home improvement | | 1.9 | % | | 2.4 | % |

20. | | General merchandise | | 1.5 | % | | 1.6 | % |

| | Other | | 10.6 | % | | 10.6 | % |

| | Total | | 100.0 | % | | 100.0 | % |

Top 10 States

|

| | | | | | | | | | | | |

| State | | | % of Total(1) | | | State | | | % of Total(1) |

1. | Texas | | | 20.4 | % | | 6. | Virgina | | | 4.1 | % |

2. | Florida | | | 9.6 | % | | 7. | Indiana | | | 4.0 | % |

3. | North Carolina | | | 5.5 | % | | 8. | Ohio | | | 3.5 | % |

4. | Illinois | | | 4.9 | % | | 9. | Pennsylvania | | | 3.2 | % |

5. | Georgia | | | 4.8 | % | | 10. | Alabama | | | 2.9 | % |

| |

(1) | Based on the annualized base rent for all leases in place as of June 30, 2015. |

| |

(2) | Based on the annualized base rent for all leases in place as of June 30, 2014. |

National Retail Properties, Inc.

Property Portfolio

Top Tenants (> 2.0%)

|

| | | | | | | |

| | | Properties | | % of Total (1) |

| Energy Transfer Partners (Sunoco) | | 125 |

| | 6.3 | % |

| Mister Car Wash | | 87 |

| | 4.4 | % |

| Pantry | | 86 |

| | 3.9 | % |

| 7-Eleven | | 78 |

| | 3.8 | % |

| LA Fitness | | 24 |

| | 3.7 | % |

| Camping World | | 30 |

| | 3.6 | % |

| SunTrust | | 121 |

| | 3.5 | % |

| AMC Theatre | | 16 |

| | 3.2 | % |

| Chuck E. Cheese's | | 53 |

| | 2.9 | % |

| BJ's Wholesale Club | | 7 |

| | 2.8 | % |

| Gander Mountain | | 12 |

| | 2.4 | % |

| Bell American (Taco Bell) | | 78 |

| | 2.3 | % |

| Best Buy | | 19 |

| | 2.3 | % |

Lease Expirations(2)

|

| | | | | | | | | | | | | | | | | | | | |

| | % of

Total(1) | | # of

Properties | | Gross Leasable

Area (3) | | | | % of

Total(1) | | # of

Properties | | Gross Leasable Area (3) |

2015 | | 0.5 | % | | 15 |

| | 157,000 |

| | 2021 | | 4.4 | % | | 105 |

| | 1,072,000 |

|

2016 | | 1.4 | % | | 34 |

| | 502,000 |

| | 2022 | | 6.0 | % | | 96 |

| | 1,158,000 |

|

2017 | | 3.2 | % | | 53 |

| | 1,086,000 |

| | 2023 | | 2.9 | % | | 57 |

| | 952,000 |

|

2018 | | 6.7 | % | | 184 |

| | 1,650,000 |

| | 2024 | | 2.8 | % | | 50 |

| | 771,000 |

|

2019 | | 3.6 | % | | 80 |

| | 1,085,000 |

| | 2025 | | 5.4 | % | | 125 |

| | 954,000 |

|

2020 | | 4.4 | % | | 132 |

| | 1,525,000 |

| | Thereafter | | 58.7 | % | | 1,175 |

| | 12,343,000 |

|

| |

(1) | Based on the annual base rent of $458,586,000, which is the annualized base rent for all leases in place as of June 30, 2015. |

| |

(2) | As of June 30, 2015, the weighted average remaining lease term is 11.4 years. |

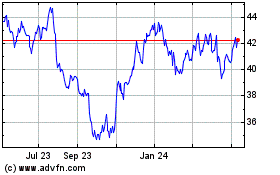

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

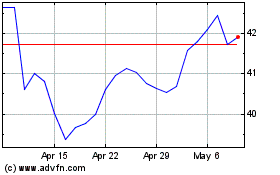

NNN REIT (NYSE:NNN)

Historical Stock Chart

From Apr 2023 to Apr 2024