UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [_]

Check the appropriate box:

[_] Preliminary Proxy Statement

[_] Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[_] Definitive Additional Materials

[_] Soliciting Material Pursuant to §240.14a-12

National Retail Properties, Inc.

--------------------------------------------------------------------------------

(Name of Registrant as Specified in Its Charter)

--------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statements, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[_] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

--------------------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

--------------------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

--------------------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

--------------------------------------------------------------------------------

(5) Total fee paid:

--------------------------------------------------------------------------------

[_] Fee paid previously with preliminary materials.

[_] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

--------------------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

--------------------------------------------------------------------------------

(3) Filing Party:

--------------------------------------------------------------------------------

(4) Date Filed:

--------------------------------------------------------------------------------

NATIONAL RETAIL PROPERTIES, INC.

450 South Orange Avenue, Suite 900

Orlando, Florida 32801

Tel: 407-265-7348

March 26, 2015

To Our Stockholders:

You are cordially invited to attend the annual meeting of stockholders of National Retail Properties, Inc. (the “Company”) on May 22, 2015, at 8:30 a.m. local time, at 450 South Orange Avenue, Suite 900, Orlando, Florida 32801. Our directors and officers look forward to greeting you personally. Enclosed for your review are the Proxy Card, Proxy Statement and Notice of Meeting for the Annual Meeting of Stockholders, which describe the business to be conducted at the meeting. The matters proposed for consideration at the meeting are:

1. The election of nine directors;

2. An advisory vote on executive compensation; and

3. The ratification of the selection of our independent registered public accounting firm for 2015.

Whether you own a few or many shares of stock of the Company, it is important that your shares be represented. If you cannot personally attend the meeting, we encourage you to make certain you are represented at the meeting by signing and dating the accompanying proxy card and promptly returning it in the enclosed envelope. You may also vote either by telephone (1-800-690-6903) or on the Internet (http://www.proxyvote.com). Returning your proxy card, voting by telephone or voting on the Internet will not prevent you from voting in person, but will assure that your vote will be counted if you are unable to attend the meeting.

Sincerely,

|

| |

| /s/ Craig Macnab Craig Macnab Chief Executive Officer

|

NATIONAL RETAIL PROPERTIES, INC.

450 South Orange Avenue, Suite 900

Orlando, Florida 32801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 22, 2015

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of NATIONAL RETAIL PROPERTIES, INC. will be held at 8:30 a.m. local time, on May 22, 2015, at 450 South Orange Avenue, Suite 900, Orlando, Florida 32801, for the following purposes:

1. To elect nine directors;

2. To have an advisory vote on executive compensation; and

3. To ratify the selection of the independent registered public accounting firm for 2015.

We will also transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Stockholders of record at the close of business on March 24, 2015, will be entitled to notice of and to vote at the annual meeting or at any adjournment thereof.

Stockholders are cordially invited to attend the meeting in person. PLEASE VOTE, EVEN IF YOU PLAN TO ATTEND THE MEETING, BY COMPLETING, SIGNING AND RETURNING THE ENCLOSED PROXY CARD, BY TELEPHONE (1-800-690-6903) OR ON THE INTERNET (http://www.proxyvote.com) BY FOLLOWING THE INSTRUCTIONS ON YOUR PROXY CARD. If you decide to attend the meeting you may revoke your Proxy and vote your shares in person. It is important that your shares be voted.

By Order of the Board of Directors,

|

| |

| /s/ Christopher P. Tessitore Christopher P. Tessitore Executive Vice President, General Counsel, and Secretary |

March 26, 2015

Orlando, Florida

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING TO BE HELD ON MAY 22, 2015

Our Proxy Statement and our Annual Report to shareholders,

which includes our Annual Report on Form 10-K, are available at

www.nnnreit.com/proxyvote

NATIONAL RETAIL PROPERTIES, INC.

450 South Orange Avenue, Suite 900

Orlando, Florida 32801

Tel: 407-265-7348

General. This Proxy Statement is furnished by the Board of Directors of National Retail Properties, Inc. (the “Company”) in connection with the solicitation by the Board of Directors of proxies to be voted at the annual meeting of stockholders to be held on May 22, 2015, and at any adjournment thereof, for the purposes set forth in the accompanying notice of such meeting. All stockholders of record at the close of business on March 24, 2015 (the “Record Date”), will be entitled to vote. It is anticipated that this Proxy Statement and the enclosed Proxy will be mailed to stockholders on or about March 31, 2015. The Proxy Statement and our Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) will also be available on the Internet at www.nnnreit.com/proxyvote.

When we use the words “we,” “us,” “our” or “Company,” we are referring to National Retail Properties, Inc.

Voting/Revocation of Proxy. If you complete and properly sign and mail the accompanying proxy card, it will be voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy from the institution that holds their shares.

If you are a registered stockholder, you may vote by telephone (1-800-690-6903), or electronically through the Internet (http://www.proxyvote.com), by following the instructions included with your proxy card. If your shares are held in “street name,” please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically.

Any proxy, if received in time, properly signed and not revoked, will be voted at such meeting in accordance with the directions of the stockholder. If no directions are specified, the proxy will be voted FOR each of Proposals I, II, and III contained herein. Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. A proxy may be revoked (1) by delivery of a written statement to the Secretary of the Company stating that the proxy is revoked, (2) by presentation at the annual meeting of a subsequent proxy executed by the person executing the prior proxy, or (3) by attendance at the annual meeting and voting in person.

Vote Required for Approval; Quorum. The nominees for director who receive a majority of the votes cast will be elected. If you indicate “withhold authority to vote” for a particular nominee by entering the number of any nominee (as designated on the proxy card) below the pertinent instruction on the proxy card, your vote will not count either for or against the nominee. As of the Record Date, 133,242,854 shares of the common stock of the Company (the “Common Stock”) were outstanding, of which 132,766,604 shares entitled the holder thereof to one vote on each of the matters to be voted upon at the annual meeting. As of the Record Date, our executive officers and directors had the power to vote approximately 0.88% of the outstanding shares of Common Stock. Our executive officers and directors have advised us that they intend to vote their shares of Common Stock FOR each of Proposals I, II, and III contained herein.

Votes cast in person or by proxy at the annual meeting will be tabulated and a determination will be made as to whether or not a quorum is present. We will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence or absence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders. If a broker submits a proxy indicating that it does not have discretionary authority as to certain shares to vote on a particular matter (broker non-votes), those shares will not be considered as present and entitled to vote with respect to such matter. Broker non-votes with respect to the election of directors will have no effect on the outcome of the vote on that proposal.

YOUR VOTE AT THE ANNUAL MEETING IS VERY IMPORTANT TO US.

Solicitation of Proxies. Solicitation of proxies will be primarily by mail. However, our directors and officers may also solicit proxies by telephone or telegram or in person. All of the expenses of soliciting proxies, including preparing, assembling, printing

and mailing the materials used in the solicitation of proxies, will be paid by us. Arrangements may be made with brokerage houses and other custodians, nominees and fiduciaries to forward soliciting materials, at our expense, to the beneficial owners of shares held of record by such persons.

TABLE OF CONTENTS

PROPOSAL I

ELECTION OF DIRECTORS

Nominees

The persons named below have been nominated by the Board of Directors of the Company (the “Board of Directors” or the “Board”) for election as directors to serve until the next annual meeting of stockholders or until their successors shall have been elected and qualified.

In selecting the candidates to nominate for election as directors, the Board’s principal qualification is whether an individual has the ability to act in the best interests of the Company and its stockholders. In making such determination with respect to each nominee, the Board takes into account certain interpersonal skills, including leadership abilities, work ethic, business judgment, collegiality and communication skills, and believes that each nominee possesses the interpersonal skills necessary to act in the best interests of the Company and its stockholders. The Board also takes into account each person’s experience and management skills, the specifics of which are discussed in the table below. The table sets forth each nominee’s name, age, principal occupation or employment and directorships in other public corporations during at least the last five years, as well as the specific experience, qualifications, attributes and skills each nominee has acquired in such positions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL OF THE

NOMINEES DESCRIBED BELOW FOR ELECTION AS DIRECTORS.

|

| | | | |

Name and Age | Background | | |

| | |

Don DeFosset, 66 | Mr. DeFosset has served as a director of the Company since December 2008. Mr. DeFosset currently serves on the boards of directors for Regions Financial Corporation, ITT Corporation and Terex Corporation and also serves on the board of trustees for the University of Tampa. Mr. DeFosset retired in November 2005 as Chairman, President and Chief Executive Officer of Walter Industries, Inc., a diversified company with principal operating businesses in homebuilding and home financing, water transmission products and energy services. Mr. DeFosset is a graduate of Purdue University, where he earned a Bachelor’s degree in Industrial Engineering. He received his MBA from Harvard Business School in 1974.

The Board believes, that in these positions, Mr. DeFosset has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. DeFosset should serve as a director for the Company.

| |

|

| | | | |

David M. Fick, 57 | Mr. Fick has served as a director of the Company since November 2010. Mr. Fick is a professional faculty member at the Johns Hopkins University Carey Business School where he teaches graduate-level Real Estate Finance, Capital Markets, and Investments. He is President of Nandua Oyster Company, an aquaculture business he founded in 2007. Mr. Fick served as Managing Director at Stifel Nicolaus & Company, a successor to Legg Mason Wood Walker. In that position he headed Real Estate Research and was an analyst covering real estate investment trusts (“REITs”) from 1997 to 2010. During this period he was also a member of the Legg Mason Real Estate Capital Investment Committee. Mr. Fick also served as Equity Vice President, Finance with Alex Brown Kleinwort Benson and LaSalle Partners from 1993 to 1995, and as Chief Financial Officer at Mills Corporation and Western Development Corporation from 1991 to 1994. Prior to that, he was a practicing CPA and consultant with a national accounting firm, specializing in the real estate industry. He is also a member of the International Council of Shopping Centers (“ICSC”), the National Association of Real Estate Investment Trusts (“NAREIT”), and the American Institute of Certified Public Accountants, and is a non-practicing Certified Public Accountant. Mr. Fick is also a member of the Virginia Eastern Shorekeeper board, and the Virginia Coastal Land Management Advisory Council.

The Board believes, that in these positions, Mr. Fick has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, accounting experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Fick should serve as a director for the Company.

| |

Edward J. Fritsch, 56 | Mr. Fritsch has served as a director of the Company since February 2012. Mr. Fritsch is President, Chief Executive Officer and Director of Highwoods Properties, Inc., a REIT publicly traded on the New York Stock Exchange. Joining Highwoods in 1982, Mr. Fritsch was a partner in the predecessor firm which launched its initial public offering in 1994. In 2004, Mr. Fritsch assumed the role of Chief Executive Officer. Mr. Fritsch is also a member of the Board of Governors of NAREIT and serves as 2nd Vice Chair of its executive committee, as well as a member of its audit, governance and investment committees. Mr. Fritsch is also a director and audit committee chair of Capital Associated Industries, Inc., a member of Wells Fargo's central regional advisory board, a member of the University of North Carolina at Chapel Hill Foundation Board, a director of the University of North Carolina at Chapel Hill Real Estate Holdings, a member of the University of North Carolina Kenan-Flagler Business School board of visitors, a member of Urban Land Institute Triangle governance committee, and a member of Catholic Diocese of Raleigh Cathedral steering committee.

The Board believes, that in these positions, Mr. Fritsch has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, accounting experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Fritsch should serve as a director for the Company.

| |

|

| | | | |

Kevin B. Habicht, 56 | Mr. Habicht has served as a director of the Company since June 2000, as Executive Vice President and Chief Financial Officer of the Company since December 1993 and as Treasurer of the Company since January 1998. Mr. Habicht served as Secretary of the Company from January 1998 to May 2003. Mr. Habicht is a Certified Public Accountant and a Chartered Financial Analyst.

The Board believes, that in these positions, Mr. Habicht has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, accounting experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Habicht should serve as a director for the Company.

| |

Richard B. Jennings, 71 | Mr. Jennings has served as a director of the Company since 2000. Mr. Jennings is President of Realty Capital International LLC, a real estate investment banking firm that he founded in 1999, and its predecessor, Realty Capital International Inc., which he founded in 1991. From 1990 to 1991, Mr. Jennings served as Senior Vice President of Landauer Real Estate Counselors, and from 1986 to 1989, Mr. Jennings served as Managing Director, Real Estate Finance at Drexel Burnham Lambert. From 1969 to 1986, Mr. Jennings oversaw REIT investment banking at Goldman, Sachs & Co. During his tenure at Goldman, Sachs & Co., Mr. Jennings also founded and managed the Mortgage Finance Group. Mr. Jennings serves as the lead director of Alexandria Real Estate Equities, Inc. Mr. Jennings is also a director of Terra Income Fund 6, Inc. and is a member of its Audit Committee and Nominating and Corporate Governance Committee, and is chairman of the Valuation Committee. He is a member of ICSC and NAREIT.

The Board believes, that in these positions, Mr. Jennings has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, accounting experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Jennings should serve as a director for the Company.

|

Ted B. Lanier, 80 | Mr. Lanier has served as a director of the Company since 1988 and as Lead Director of the Board of Directors since December 2008. Mr. Lanier retired in 1991 as Chairman and Chief Executive Officer of Triangle Bank and Trust Company, Raleigh, North Carolina, where the chief financial officer and controller regularly reported to him. Since his retirement, Mr. Lanier has managed his personal investments and managed investment accounts for various individuals and trusts.

The Board believes, that in these positions, Mr. Lanier has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, accounting experience, finance and capital markets experience and an understanding of corporate governance regulations, necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Lanier should serve as a director for the Company.

|

|

| | | | |

Robert C. Legler, 71 | Mr. Legler has served as a director of the Company since 2002. From 1973 until 1990, Mr. Legler was the chairman of privately-held First Marketing Corporation, which he founded and was then America’s largest publisher of custom newsletters serving nearly 500 clients in the commercial banking, brokerage, health care, cable television, travel, and retail industries. Upon the sale of the company to Reed (now Reed Elsiever) in 1990, Mr. Legler served as non-executive Chairman of the Board of First Marketing until his retirement in September 2000. Mr. Legler served as a director of Ligonier Ministries of Lake Mary, Florida for more than 20 years.

The Board believes, that in these positions, Mr. Legler has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Legler should serve as a director for the Company.

|

Craig Macnab, 59 | Mr. Macnab has served as Chief Executive Officer of the Company since 2004 and as Chairman of the Board of Directors of the Company since February 2008. Mr. Macnab has served as a director of DDR Corp. since 2003, and served as a director of Eclipsys Corporation from 2008 to 2010, and Per Se Technologies, Inc. from 2002 to 2007. Mr. Macnab has been an independent director of Cadillac Fairview Corporation, a Canadian corporation, since 2011, and an independent director of American Tower Corporation since December 2014. Mr. Macnab is also a member of the Board of Governors of NAREIT.

The Board believes, that in these positions, Mr. Macnab has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Macnab should serve as a director for the Company.

|

Robert Martinez, 80 | Mr. Martinez has served as a director of the Company since 2002. From 1987 until 1991, Mr. Martinez served as the fortieth governor of the state of Florida, and from 1991 to 1993, served as the Director of the Office of National Drug Control reporting to the President of the United States. From 1999 to 2007, he served as managing director for Carlton Fields Government Consulting. In 2007, he assumed the position of Senior Policy Advisor at Holland and Knight LLP.

The Board believes, that in these positions, Mr. Martinez has acquired the experience, qualifications, attributes and skills, including business and management experience, real estate experience, accounting experience, finance and capital markets experience and an understanding of corporate governance regulations necessary to act in the best interests of the Company and its stockholders, and based on these skills, together with the interpersonal skills mentioned above, the Board has concluded that Mr. Martinez should serve as a director for the Company. |

| |

In the event that any nominee(s) should be unable to accept the office of director, which is not anticipated, it is intended that the persons named in the Proxy will vote FOR the election of such other person in the place of such nominee(s) for the office of director as the Board of Directors may recommend.

Corporate Governance

General. We are currently managed by a nine-member Board of Directors that consists of Messrs. DeFosset, Fick, Fritsch, Habicht, Jennings, Lanier, Legler, Macnab, and Martinez, with Mr. Macnab serving as Chairman and Mr. Lanier serving as Lead Director.

The Board of Directors has adopted a set of corporate governance guidelines, which, along with the written charters for the Board committees described below, provide the framework for the Board’s governance of the Company. Our corporate governance guidelines are available on our website at http://www.nnnreit.com.

Independence and Composition. Our corporate governance guidelines and the rules and regulations of the New York Stock Exchange, which we refer to as the NYSE listing standards, each require that a majority of the Board of Directors are “independent” directors, as that term is defined in the NYSE listing standards.

The Board of Directors has determined that Messrs. DeFosset, Fick, Fritsch, Jennings, Lanier, Legler and Martinez, representing a majority of the Board of Directors, qualify as independent directors (the “Independent Directors”) as that term is defined in the NYSE listing standards. The Board of Directors made its determination based on information furnished by all directors regarding their relationships with us and our affiliates and research conducted by management. In addition, the Board of Directors consulted with our external legal counsel to ensure that the Board’s determination would be consistent with all relevant securities laws and regulations as well as the NYSE listing standards.

Leadership Structure. We have chosen Mr. Macnab to serve as both Chairman of the Board and Chief Executive Officer because we believe he will best serve the Company and its stockholders in that dual role. Mr. Macnab is intimately familiar with our business, history, industry and strategic plans and future objectives. We believe it is appropriate to keep Mr. Macnab in this combined role in order to provide consistent and strong leadership and direction. Further, we believe by serving as both our Chairman and Chief Executive Officer, Mr. Macnab will be better able to provide information to the rest of the Board in order to facilitate deliberations and the decision-making process. Our corporate governance guidelines provide that the Chairman may or may not be Chief Executive Officer of the Company, but specify that if the same individual is both the Chairman and Chief Executive Officer, then the Board will annually appoint an independent lead director or, in the absence of such appointment, the chairman of the Governance and Nominating Committee will serve as independent lead director. Mr. Lanier has been appointed the independent lead director of the Board. In such role, Mr. Lanier presides as chairman when the Board meets in executive session and he serves as the interface between the Board and the Chief Executive Officer in communicating matters discussed during the executive session. Mr. Lanier, in his role as lead director, reviews and approves Board meeting schedules, agendas, and information provided to the Board.

Risk Oversight. Our management is responsible for managing the day-to-day risks associated with our business. The Board of Directors, however, is elected to provide effective oversight of our affairs for the benefit of our stockholders, and among its primary responsibilities, in accordance with our corporate governance guidelines, is overseeing management in the competent and ethical operation of the Company, reviewing and approving our business plans and corporate strategies, and adopting and evaluating policies of corporate and ethical conduct and governance. Implicit in these duties is risk oversight, the primary responsibility of which has been delegated to the Board’s Audit Committee. The Audit Committee reviews with management annually, or more frequently as the Audit Committee deems necessary, our significant risks or exposures and discusses guidelines and policies to govern this process and assesses steps that management has taken to minimize such risks to the Company.

While the primary responsibility has been delegated to the Audit Committee, the Governance and Nominating Committee and the Compensation Committee consider risks within their area of responsibility. Further, each director may consult with management at any time and is encouraged to discuss with management any questions such director may have.

With respect to risks related to compensation matters, our management, together with the Compensation Committee, reviewed our compensation policies and practices for our employees in order to determine whether they are reasonably likely to have a material adverse effect on the Company. We believe that our compensation policies and practices do

not promote unreasonable risk-taking behavior and are not reasonably likely to have a material adverse effect based on the following factors:

| |

• | the Compensation Committee consists solely of independent non-employee directors, and the Compensation Committee has engaged an independent, external compensation consultant to assist with creating the executive compensation program; |

| |

• | the Compensation Committee maintains the right, in its sole discretion, to modify the compensation policies and practices at any time; |

| |

• | the Compensation Committee has elected to use awards of restricted stock instead of other equity awards, such as stock options, because, as a REIT, which pays a large portion of its annual earnings to stockholders in the form of dividends, the Compensation Committee believes that restricted stock provides a better incentive and alignment of interest than stock options; |

| |

• | restricted stock grants are intended to provide our named executive officers with a significant interest in the long-term performance of our stock; |

| |

• | restricted stock awards are subject to forfeiture upon certain employment termination events; |

| |

• | performance-contingent restricted stock grants tied to our three-year total shareholder returns relative to a broad REIT peer group further focus our executive officers on long-term shareholder value creation; |

| |

• | bonus awards to our executive officers are reduced if balance sheet leverage exceeds levels previously approved by the Compensation Committee; |

| |

• | we have adopted a stock ownership policy for our executive officers and members of our Board which requires all directors and executive officers to own meaningful levels of Company stock; |

| |

• | we have adopted an insider trading policy which prohibits, among other things, trading of Company securities on a short-term basis, and the hedging of shares by the buying or selling of puts or calls of securities of the Company, and by short sales of the securities of the Company; |

| |

• | we have adopted a pledging limitation policy for our directors and executive officers which restricts directors and executive officers from pledging shares of the Company and holding of shares of the Company in margin accounts. Directors and executive officers of the Company may pledge shares or hold shares in a margin account so long as all of the following policy requirements are met: (i) prior to pledging shares or holding shares in a margin account such director or executive officer shall notify the Chief Financial Officer, (ii) in no event shall such director or executive officer pledge more than 25% of the total vested common stock of the Company owned by such director or executive officer, (iii) in no event shall any pledged shares be counted as shares owned by such director or executive officer for purposes of complying with the Company's minimum stock ownership requirements, and (iv) in no event shall any proposed pledging of shares result in such director or executive officer falling below the minimum stock ownership requirements; |

| |

• | we have adopted a clawback policy for our executive officers which allows the Board to recover certain incentive compensation if the Company has a material restatement of financial results, as a result of such restatement the incentive compensation would not have been earned, and the executive officer engaged in fraud or other intentional misconduct; |

| |

• | none of our employees are paid commission compensation; |

| |

• | bonus and incentive awards to our employees eligible for bonus awards are capped; and |

| |

• | we base executive compensation on several critical success factors. |

Given these factors, we believe we have mitigated potential short-term excessive risk-taking and aligned compensation with increasing long-term shareholder value.

Meetings and Attendance. The Board of Directors met eight times in the fiscal year ended December 31, 2014. Each of the nominees serving on the Board of Directors in 2014 attended 95% or more of the meetings of (i) the Board of Directors and (ii) the committees of the Board of Directors on which he served. Our corporate governance guidelines provide that it is the responsibility of individual directors to make themselves available to attend scheduled and special Board meetings on a consistent basis. All of our directors were in attendance for the 2014 annual meeting of the Company’s stockholders. In addition, non-management members of the Board of Directors met in executive session four times in the fiscal year ended December 31, 2014. These sessions were presided over by Mr. Lanier in his capacity as Lead Director.

Interested Party Communications. The Board of Directors has adopted a process whereby stockholders and other interested parties can send communications to our directors. Anyone wishing to communicate directly with one or more directors may do so in writing addressed to the director or directors, c/o National Retail Properties, Inc., 450 South Orange Avenue, Suite 900, Orlando, Florida 32801, attention: Secretary of the Company. All correspondence will be reviewed by the Secretary of the Company and forwarded directly to the addressee so long as, in the Secretary’s discretion, such correspondence is reasonably related to protecting or promoting legitimate interests of interested parties or the reliability of the financial markets.

Audit Committee

General. The Board of Directors has established an Audit Committee, which is governed by a written charter, a copy of which is available on our website at http://www.nnnreit.com. Among the duties, powers and responsibilities of the Audit Committee as provided in its charter, the Audit Committee:

| |

• | has sole power and authority concerning the engagement and fees of independent registered public accounting firms; |

| |

• | reviews with the independent registered public accounting firm the plans and results of the audit engagement; |

| |

• | pre-approves all audit services and permitted non-audit services provided by the independent registered public accounting firm; |

| |

• | reviews the independence of the independent registered public accounting firm; |

| |

• | reviews the adequacy and effectiveness of our internal control over financial reporting; and |

| |

• | reviews accounting, auditing and financial reporting matters with our independent registered public accounting firm and management. |

Independence and Composition. The composition of the Audit Committee is subject to the independence and other requirements of the Securities Exchange Act of 1934 and the rules and regulations promulgated by the SEC thereunder (the “Exchange Act”), and the NYSE listing standards.

The Board of Directors, upon the unanimous recommendation of the Governance and Nominating Committee, has determined that all current members of the Audit Committee are “independent,” as that term is defined in the NYSE listing standards and as required by the Exchange Act, and meet all audit committee composition requirements of the Exchange Act and the NYSE listing standards, and that each of Messrs. Fick, Jennings and Lanier qualifies as an “audit committee financial expert” as that term is defined in the Exchange Act.

Meetings. The Audit Committee met eight times in the fiscal year ended December 31, 2014. During fiscal year 2014 and as of February 18, 2015, Messrs. Fick, Fritsch, Jennings, Lanier and Martinez were the members of the Audit Committee, with Mr. Jennings serving as Chairman.

Governance and Nominating Committee

General. The Board of Directors has established a Governance and Nominating Committee, which is governed by a written charter, a copy of which is available on our website at http://www.nnnreit.com. As provided in the Governance and Nominating Committee charter, the Governance and Nominating Committee:

| |

• | identifies and recommends to the Board of Directors individuals to stand for election and re-election to the Board of Directors at our annual meeting of stockholders and to fill vacancies that may arise from time to time; |

| |

• | develops and makes recommendations to the Board of Directors for the creation and ongoing review and revision of a set of effective corporate governance principles that promote our competent and ethical operation and a policy governing ethical business conduct of our employees and Directors; and |

| |

• | makes recommendations to the Board of Directors as to the structure and membership of committees of the Board of Directors. |

Selection of Director Nominees. Our corporate governance guidelines provide that the Governance and Nominating Committee will endeavor to identify individuals to serve on the Board of Directors who have expertise that is useful to us and complimentary to the background, skills and experience of other Board members. The Governance and Nominating Committee’s assessment of the composition of the Board of Directors includes (a) skills – business and management experience, real estate experience, accounting experience, finance and capital markets experience, and an understanding of corporate governance regulations and public policy matters, (b) character - ethical and moral standards, leadership abilities, sound business judgment, independence and innovative thought, and (c) composition - diversity, age and public company experience. The Governance and Nominating Committee measures its composition by taking into account the entirety of the Board and the criteria listed above rather than having any representational directors. While we do not have a formal policy on diversity, the Governance and Nominating Committee assesses its effectiveness in accounting for diversity, along with the other factors taken into account to identify director nominees, when it annually evaluates the performance of the Board and each director and periodically reviews the Company’s corporate governance guidelines. The principal qualification for a director is the ability to act in the best interests of the Company and its stockholders. Each of the candidates for director named in this proxy statement have been recommended by the Governance and Nominating Committee and approved by the Board of Directors for inclusion on the attached proxy card.

The Governance and Nominating Committee also considers director nominees recommended by stockholders. See the section of this proxy statement entitled “PROPOSALS FOR NEXT ANNUAL MEETING” for a description of how stockholders desiring to make nominations for directors and/or to bring a proper subject before a meeting should do so. The Governance and Nominating Committee evaluates director candidates recommended by stockholders in the same manner as it evaluates director candidates recommended by our directors, management or employees.

Independence and Composition. The NYSE listing standards require that the Governance and Nominating Committee consist solely of independent directors. The Board of Directors, upon the unanimous recommendation of the Governance and Nominating Committee, has determined that all current members of the Governance and Nominating Committee are “independent” as that term is defined in the NYSE listing standards.

Meetings. The Governance and Nominating Committee met four times in the fiscal year ended December 31, 2014. During fiscal year 2014 and as of February 18, 2015, Messrs. DeFosset, Jennings and Legler were the members of the Governance and Nominating Committee, with Mr. DeFosset serving as Chairman.

Compensation Committee

General. The Board of Directors has established a Compensation Committee, which is governed by a written charter, a copy of which is available on our website at http://www.nnnreit.com.

Processes and Procedures for Executive and Director Compensation Determinations

| |

• | Role of Compensation Committee. The Compensation Committee is responsible for discharging the responsibilities of the Board of Directors with respect to approving and evaluating compensation plans, policies and programs for our executive officers and directors and approving all awards to any executive officer, director or associate under our equity incentive plans. The Compensation Committee also serves as the administrator of our 2007 Performance Incentive Plan. |

| |

• | Role of Management in Compensation Determinations. The Compensation Committee considers the recommendations of our Chief Executive Officer when determining the base salary and incentive performance compensation levels of the other executive officers. Similarly, the Compensation Committee also considers the recommendations of our Chief Executive Officer when setting specific Company and individual incentive performance targets. In addition, officers may be invited to attend committee meetings, but are not present for any discussion of their own compensation. Management generally does not have a role in the setting of director compensation. |

| |

• | Role of Compensation Consultants. The Compensation Committee has the authority, in its sole discretion, to engage compensation consultants as needed or desired to assist the Compensation Committee in researching and evaluating executive officer and director compensation programs. In 2012, 2013, and 2014, the Compensation Committee retained Pearl Meyer & Partners, an independent compensation consulting firm (“Pearl Meyer”), to assist the Compensation Committee in reviewing and evaluating the Company’s executive and non-employee director compensation programs. The use of independent third-party consultants provides additional assurance that our executive compensation programs are reasonable, consistent with Company objectives, and competitive with executive compensation for companies in our peer group. Pearl Meyer reports directly to the Compensation Committee, provides no other services to the Company, and regularly participates in committee meetings. The Compensation Committee assessed the independence of Pearl Meyer pursuant to the applicable SEC rules and concluded no conflict of interest exists that would prevent Pearl Meyer from serving as an independent advisor to the Committee. |

| |

• | Delegation of Authority by the Committee. The Committee may delegate its authority to make and administer awards under our equity incentive plans to another committee of the Board of Directors or, except for awards to individuals subject to Section 16 of the Exchange Act, to one or more of our officers. On an annual basis, the Committee typically authorizes a limited number of shares of restricted stock to be awarded by our Chief Executive Officer to such of our non-executive associates as he determines, in consultation with our other executive officers. |

Our executive compensation programs and philosophy are described in greater detail under the section entitled “Compensation Discussion and Analysis.”

Independence and Composition. The NYSE listing standards require that the Compensation Committee consist solely of independent directors. The Board of Directors, upon the unanimous recommendation of the Governance and Nominating Committee, has determined that all current members of the Compensation Committee are “independent” as that term is defined in the NYSE listing standards.

Meetings. The Compensation Committee met four times in the fiscal year ended December 31, 2014. During fiscal year 2014 and as of February 18, 2015, Messrs. DeFosset, Fick, Fritsch, Legler and Martinez were the members of the Compensation Committee, with Mr. Legler serving as Chairman.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is or was previously an officer or employee of the Company, and no executive officer of the Company serves on the board of directors of any company at which any member of the Compensation Committee is employed.

Director Compensation

The following table shows the compensation paid to our non-employee directors during fiscal year 2014.

|

| | | | | | | | | | | | | | |

Name | Fees Earned or Paid in

Cash

($) | | Stock

Awards

($)(1) | Option

Awards

($) | Non-Equity

Incentive Plan

Compensation

($) | Change in Pension

Value and Nonqualified

Deferred Compensation

Earnings | All Other

Compensation

($) | Total

($) |

(a) | (b) | | (c) | (d) | (e) | (f) | (g) | (h) |

Don DeFosset |

| $80,500 |

| |

| $90,000 |

| -- | -- | -- | -- |

| $170,500 |

|

David M. Fick(2) |

| $77,500 |

| |

| $90,000 |

| -- | -- | -- | -- |

| $167,500 |

|

Edward J. Fritsch | - | |

| $167,500 |

| -- | -- | -- | -- |

| $167,500 |

|

Richard B. Jennings |

| $90,000 |

| |

| $90,000 |

| -- | -- | -- | -- |

| $180,000 |

|

Ted B. Lanier |

| $100,000 |

| |

| $90,000 |

| -- | -- | -- | -- |

| $190,000 |

|

Robert C. Legler(2) |

| $23,000 |

| |

| $150,000 |

| -- | -- | -- | -- |

| $173,000 |

|

Robert Martinez |

| $77,500 |

|

|

| $90,000 |

| -- | -- | -- | -- |

| $167,500 |

|

__________

| |

(1) | The awards shown in column (c) represent annual grants made to directors of the Company. The amounts represent the grant date fair value with respect to the fiscal year in accordance with FASB ASC Topic 718. |

| |

(2) | The cash fees and stock awards earned by Mr. Legler, as well as the stock awards earned by Mr. Fick, are deferred into shares of our common stock under our Deferred Fee Plan, which is described in greater detail below. |

The Company only compensates non-employee directors for services provided as directors of the Company. Following a study by Pearl Meyer which found that total compensation levels for our directors were below the median of industry peers (as identified in “Executive Compensation-Compensation Discussion and Analysis-Benchmarking”), effective July 1, 2013, board compensation was set at $150,000 per year, payable in quarterly increments. Non-employee directors may elect to receive up to $60,000 of their annual compensation in the form of cash, with the remainder paid in shares of the Company’s Common Stock. Additionally, the Lead Director, the Chairman of the Audit Committee, the Chairman of the Compensation Committee and the Chairman of the Governance and Nominating Committee receive $30,000, $25,000, $18,000 and $13,000, respectively. Additionally, each non-chair member of the Audit Committee, Compensation Committee and Governance and Nominating Committee receives $10,000, $7,500, and $5,000, respectively.

Pursuant to our corporate governance guidelines, each of our non-employee directors is required to own our Common Stock equivalent to three times the annual board compensation within five years of becoming a board member. The Compensation Committee reviews progress toward meeting these ownership requirements annually, and each of the nominees that have served on the Board of Directors for the requisite number of years exceed the ownership requirements.

A Deferred Fee Plan was established by the Company for the benefit of its directors and their beneficiaries. A director may elect to defer all or part of his or her director’s fees to be earned in any calendar year by filing a deferred fee agreement with the Company no later than December 15 of the previous year. A director has the option to have deferred fees paid in cash, in shares of Common Stock or in a combination of cash and Common Stock. If the director elects to have the deferred fees paid in stock, the number of shares allocated to the director’s stock account is determined based on the market value of the Common Stock on the day the deferred director’s fees were earned. A director is entitled to receive the vested portion of the amounts credited to his or her deferred fee account on the earlier of the occurrence of a change of control or the time specified in such director’s fee agreement. The Deferred Fee Plan was amended by the Compensation Committee on May 30, 2008, for compliance purposes pursuant to Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”).

The following table sets forth fees deferred into shares of Common Stock by directors under the Deferred Fee Plan.

|

| | | |

| Number of Shares Credited to Deferred Fee Account |

Name | 2014 | | Total |

Don DeFosset | 1,137 | | 25,186 |

David M. Fick | 3,183 | | 15,419 |

Richard B. Jennings | 1,726 | | 38,234 |

Robert C. Legler | 8,080 | | 73,101 |

Robert Martinez | 1,890 | | 41,873 |

| | | |

Total | 16,016 | | 193,813 |

Code of Business Conduct and Insider Trading Policy

Our directors, as well as our officers and employees, are also governed by our code of business conduct. Our code of business conduct is available on our website at http://www.nnnreit.com. Amendments to, or waivers from, a provision of the code of business conduct that applies to our directors, executive officers or employees will be posted to our website within four business days following the date of such amendment or waiver.

Executive Officers

Our executive officers are listed below.

|

| |

Name | Position |

|

|

Craig Macnab | Chief Executive Officer |

Julian E. Whitehurst | President and Chief Operating Officer |

Kevin B. Habicht | Executive Vice President, Chief Financial Officer, Assistant Secretary and Treasurer |

Paul E. Bayer | Executive Vice President and Chief Investment Officer |

Christopher P. Tessitore | Executive Vice President, General Counsel and Secretary |

Stephen A. Horn, Jr. | Executive Vice President and Chief Acquisition Officer |

The backgrounds for Messrs. Whitehurst, Bayer, Tessitore and Horn are set forth below. The backgrounds of Messrs. Macnab and Habicht are described above at “PROPOSAL I - ELECTION OF DIRECTORS - Nominees.”

Julian E. Whitehurst, age 57, has served as President of the Company since May 2006 and as Chief Operating Officer of the Company since June 2004. He also previously served as Executive Vice President of the Company from February 2003 to May 2006, as Secretary of the Company from May 2003 to May 2006 and previously served as General Counsel from 2003 to 2006. Prior to February 2003, Mr. Whitehurst was a shareholder at the law firm of Lowndes, Drosdick, Doster, Kantor & Reed, P.A. He is a member of ICSC and NAREIT, and serves on the board of trustees and on the executive committee of Lake Highland Preparatory School.

Paul E. Bayer, age 53, has served as Executive Vice President of the Company since January 2007 and as Chief Investment Officer since June 2010. He also previously served as Senior Vice President of the Company from September 2005 to December 2006. From September 1999 through September 2005, he served as Vice President of Leasing of the Company. Prior to September 1999, Mr. Bayer was a leasing agent at J. Donegan Company from 1994 through 1999. Mr. Bayer also previously served as a leasing agent for Combined Properties from 1992 until 1993 and as a marketing principal at Trammell Crow Company from 1988 until 1991. He is a member of ICSC.

Christopher P. Tessitore, age 47, has served as Executive Vice President of the Company since January 2007, as General Counsel since February 2006 and as Secretary since May 2006. He also previously served as Senior Vice

President and Assistant General Counsel of the Company from 2005 to 2006. Prior to March 2005, Mr. Tessitore was a shareholder at the law firm of Lowndes, Drosdick, Doster, Kantor & Reed, P.A., where he specialized in real estate acquisition, development and finance, as well as general business law. Mr. Tessitore serves on the board of directors of Elevate Orlando. Mr. Tessitore previously served as the lead director and on the executive committee of BETA Center, Inc., and is a current member of the Advisory Board. He is a member of ICSC, NAREIT, and the Association of Corporate Counsel.

Stephen A. Horn, Jr., age 43, has served as Executive Vice President and Chief Acquisition Officer of the Company since January 2, 2014. He also previously served as Senior Vice President of Acquisitions for the Company from June 2008 to December 2013, and as Vice President of Acquisitions of the Company from 2003 to 2008. Prior to 2003, Mr. Horn worked in the mergers and acquisitions group at A.G. Edwards & Sons in St. Louis, MO. He is a member of ICSC.

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any previous or future filings under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act except to the extent that the Company incorporated it by specific reference.

Management is responsible for the Company’s financial statements, internal controls and financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee is governed by a charter, a copy of which is available on our website at http://www.nnnreit.com. The Audit Committee charter is designed to assist the Audit Committee in complying with applicable provisions of the Exchange Act and the NYSE listing standards, all of which relate to corporate governance and many of which directly or indirectly affect the duties, powers and responsibilities of the Audit Committee.

Review and Discussions with Management and Independent Registered Public Accounting Firm. In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 16, issues regarding accounting and auditing principles and practices, and the adequacy of internal control over financial reporting that could significantly affect the Company’s financial statements.

The Company’s independent registered public accounting firm also provided to the Audit Committee the written disclosures and letter required by applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) regarding the independent accountant’s communications with the Audit Committee concerning independence, and the Audit Committee discussed with the independent registered public accounting firm that firm’s independence. The Audit Committee has reviewed the original proposed scope of the annual audit of the Company’s financial statements and the associated fees and any significant variations in the actual scope of the audit and fees.

Conclusion. Based on the review and discussions referred to above, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC.

AUDIT COMMITTEE

Richard B. Jennings, Chairman

David M. Fick

Edward J. Fritsch

Ted B. Lanier

Robert Martinez

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

We design our executive compensation program in order to maintain our ability to attract and retain talented and experienced executive officers. Our Compensation Committee (for purposes of this discussion, the "Committee") seeks to provide compensation that is not only competitive relative to our peer group, but also structured so as to align our executives’ short-term and long-term interests with the interests of our stockholders. Accordingly, the Committee seeks to incentivize our executive officers and emphasize pay-for-performance by basing a significant portion of compensation on achievement of critical success factors. The primary elements of our total compensation program for our named executive officers ("NEOs") include base salary, annual cash incentives and long-term equity-based incentives. We have designed a compensation program that makes a substantial percentage of executive pay variable, subject to increase and decrease based on performance and corporate target results relative to our peers. In addition, executive officers are subject to market competitive stock ownership guidelines.

Executive Compensation Program. In 2014, the Committee approved annual incentive awards and long-term incentive awards. Annual incentives are tied to the achievement of performance goals based on our funds from operation (“FFO”) per share, excluding any impairments, and are subject to downward adjustment if our leverage ratio exceeds a cap established by the board. For 2014, the Committee approved long-term incentive compensation through grants of the following: (i) service-based restricted stock vesting ratably over four years, and (ii) performance-based restricted stock awards, the vesting of which is tied to the three-year relative total shareholder return of the Company compared to a broad group of REIT companies as of December 31, 2016.

Restricted Stock. Restricted stock grants are intended to provide our NEOs with a significant interest in the long-term performance of our stock. The Committee has elected to use awards of restricted stock instead of other equity awards, such as stock options, because, as a REIT, which pays a large portion of its annual earnings to stockholders in the form of dividends, we believe that restricted stock provides a better incentive and alignment of interest than stock options. The Committee has determined that our desired compensation objectives are better achieved by awarding restricted stock. The Company did not issue any stock options to its executive officers in 2014, and there are no outstanding stock options. Consistent with our pay for performance philosophy, half of the target long-term incentive award opportunity for our NEOs is provided in the form of performance-contingent restricted stock grants.

2014 Business Results. The following are some of the highlights of our business results in 2014:

| |

• | Generated recurring FFO per share of $2.08 per share and Adjusted FFO of $2.12 per share, reflecting an increase of 7.8% and 6.5%, respectively; |

•Dividends increased to $1.65 per share marking the 25th consecutive year of annual dividend increases;

•Invested $618.1 million in 221 properties at a projected 7.5% initial cash return on assets;

•Sold 27 properties for $55.4 million;

•Balance sheet leverage and portfolio property occupancy remained at sector leading levels; and

| |

• | Delivered annualized total return to shareholders of 35.8%, 20.0% and 19.4% for the past one, three and five years ending December 31, 2014. |

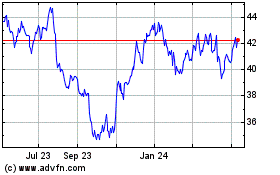

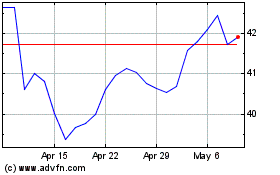

The common stock of the Company currently is traded on the NYSE under the symbol “NNN.” Set forth below is a line graph comparing the cumulative total stockholder return on NNN’s common stock, based on the market price of the common stock and assuming reinvestment of dividends, with the FTSE National Association of Real Estate Investment Trusts Equity Index (“NAREIT”) and the S&P 500 Index (“S&P”) for the five-year period commencing December 31, 2009, and ending December 31, 2014. The graph assumes an investment of $100 on December 31, 2009.

Comparison to Five-Year Cumulative Total Return

Indexed Total Return

(As of December 31, 2014)

Set forth below is a line graph comparing the cumulative total stockholder return on NNN’s common stock, based on the market price of the common stock and assuming reinvestment of dividends, with the FTSE National Association of Real Estate Investment Trusts Equity Index (“NAREIT”) and the S&P 500 Index (“S&P”) for the 15-year period commencing December 31, 1999 and ending December 31, 2014. The graph assumes an investment of $100 on December 31, 1999.

Comparison to Fifteen-Year Cumulative Total Return

Indexed Total Return

(As of December 31, 2014)

2014 Compensation Highlights. The following are some of the highlights related to the 2014 compensation of our executive officers:

| |

• | The Committee approved base salary increases ranging from 2.7% to 5.0% (excluding Mr. Horn who was promoted in 2014) to bring all NEOs' base salaries, other than for Mr. Horn, in line with peer group 50th percentile (or "median") base salaries; |

| |

• | The Committee approved annual cash incentive award opportunities for NEOs, based on position, with potential awards ranging from 50% for “threshold” performance to 225% for “maximum” performance, expressed as a percentage of each executive’s base salary, with any earned awards, subject to downward adjustment of up to 20% of the funded award levels if our leverage exceeded the 57.5% cap established by the board for 2014; |

| |

• | Based on our FFO (excluding impairments) per share results, which exceeded maximum performance goals, the Committee approved payment of annual cash incentive compensation for 2014 at maximum award levels, ranging from 150% to 225% of each executive officer’s base salary; |

| |

• | The Committee approved total long-term incentive award opportunities for NEOs, based on position and performance results, for the three-year period ending December 31, 2016, ranging from 120% to 472.5% of each executive’s base salary, if any; |

| |

• | The Committee engaged Pearl Meyer as an independent third-party compensation consultant in order to assist in the development and evaluation of the executive compensation program. Pearl Meyer was not engaged for any non-compensation related services; and |

| |

• | The Committee concluded that our compensation policies and practices do not promote unreasonable risk-taking behavior and are not reasonably likely to have a material adverse effect on the Company. |

2014 Say on Pay Voting Results

In 2014, we submitted our executive compensation program to an advisory vote of our shareholders (also known as “Say on Pay”). Approximately 96.3% of voting shareholders at the 2014 annual meeting approved our executive compensation program. The Committee considered such strong shareholder support as an endorsement of the Company’s executive compensation program and policies and the Committee intends to continue the pay-for-performance program that is currently in place. The Committee values the opinions of our stockholders and will continue to consider those opinions when making future executive compensation decisions.

Objectives of Compensation Program

We believe our success is largely attributable to the talent and dedication of our employees (whom we refer to as associates) and to the management and leadership efforts of our executive officers. Our goal is to establish a compensation program that will attract and retain talented corporate officers, motivate them to perform to their fullest potential, and align their long-term interests with the interests of our stockholders.

What Our Compensation Program is Designed to Reward and Other Policies

We believe that the most effective compensation program is one that is designed to reward the achievement of specific annual, long-term and strategic goals, and which aligns executives’ interests with those of the stockholders by rewarding performance that meets or exceeds established goals, with the ultimate objective of improving stockholder value. Our Committee evaluates both performance and compensation to ensure that we maintain our ability to attract and retain superior executive officers and that compensation provided to our executive officers is appropriately aligned with performance and remains competitive relative to the compensation paid to similarly situated executives of our peer companies. In making compensation decisions, the Committee considers the compensation practices and financial performance of REIT and other industry participants and from time to time receives assessments and advice regarding compensation practices from third party compensation consultants. In evaluating performance, the Committee considers quantitative and qualitative improvement in factors such as FFO per share based metrics, capital structure, absolute and relative stockholder returns, individual performance, and contribution to corporate goals and objectives. Additionally, the Committee takes into account our general performance, the executive officer’s past performance, the executive officer’s anticipated performance and contribution to our achievement of our long-term goals, and the position, level and scope of the executive officer’s responsibility.

We believe that our compensation program for executive officers, which includes the use of performance-based and service-based restricted stock awards, results in a significant alignment of interest between these individuals and our stockholders. Under our corporate governance guidelines, within five years of becoming a Covered Person, as defined by the Committee, executive officers are required to own our Common Stock (including restricted stock) equal to a minimum of five times the annual base salary for CEO and three times their annual base salary for all other executive officers. The Committee reviews progress toward meeting these guidelines annually and each executive officer exceeds the stock ownership guidelines. In addition, beginning with all restricted stock grants in 2010, and continuing with all subsequent restricted stock grants, the Committee eliminated tax gross ups on all such grants for all executive officers and does not intend to provide tax gross ups on any future restricted stock grants. Additionally, we have adopted a clawback policy for our executive officers which allows the Board to recover certain incentive compensation if the Company has a material restatement of financial results, as a result of such restatement the incentive compensation would not have been earned, and the executive officer engaged in fraud or other intentional misconduct.

Accounting and Tax Considerations

We have selected compensation elements that help us achieve the objectives of our compensation program and not because of preferential financial accounting or tax treatment. However, when awarding compensation, the Committee is mindful of the accounting impact of the compensation expense of each compensation element. In addition, Section 162(m) of the Code provides that public companies cannot deduct for federal income tax purposes non-performance-based compensation paid to certain NEOs in excess of $1.0 million per year. While we have not adopted a policy requiring that all compensation be deductible and expect that we may pay compensation that is not deductible when necessary to achieve our compensation objectives, we consider the consequences of Section 162(m). Under our 2007 Performance Incentive Plan, a portion of our restricted stock awards are intended to be performance-based grants that are exempt from the deduction limits of Section 162(m).

Benchmarking

In 2014, the Committee, with the assistance of Pearl Meyer, determined that our Peer Group included Acadia Realty Trust, BioMed Realty Trust, CBL & Associates Properties, EPR Properties, Equity One, Inc., Federal Realty Investment Trust, Lexington Realty Trust, Omega Healthcare Investors, Realty Income Corporation, Regency Centers Corporation, Tanger Factory Outlet Centers, Taubman Centers, Inc., W.P. Carey, Inc., and Weingarten Realty Investment Trust (collectively, the “Peer Group”).

|

| | | | | | | | | | | | | | | | |

| | Total Assets LFQ ($mm) | Equity Market Cap as of 12/31/2014 ($mm) | Enterprise Value as of 12/31/2014 ($mm) | TSR (%) as of 12/31/2014 |

Company | GICS Industry Description | 1-Yr | 3-Yr | 5-Yr |

Acadia Realty Trust | Retail REITs | $ | 2,455 |

| $ | 2,173 |

| $ | 3,547 |

| 35 | % | 21 | % | 18 | % |

BioMed Realty Trust Inc. | Office REITs | $ | 6,238 |

| $ | 4,165 |

| $ | 7,044 |

| 27 | % | 12 | % | 12 | % |

CBL & Associates Properties Inc. | Retail REITs | $ | 6,633 |

| $ | 3,307 |

| $ | 8,160 |

| 14 | % | 13 | % | 21 | % |

EPR Properties | Specialized REITs | $ | 3,679 |

| $ | 3,294 |

| $ | 4,917 |

| 25 | % | 17 | % | 18 | % |

Equity One Inc. | Retail REITs | $ | 3,320 |

| $ | 3,140 |

| $ | 4,664 |

| 17 | % | 19 | % | 14 | % |

Federal Realty Investment Trust | Retail REITs | $ | 4,479 |

| $ | 9,093 |

| $ | 11,645 |

| 35 | % | 17 | % | 18 | % |

Lexington Realty Trust | Diversified REITs | $ | 3,840 |

| $ | 2,550 |

| $ | 4,716 |

| 15 | % | 21 | % | 19 | % |

Omega Healthcare Investors Inc. | Healthcare REITs | $ | 3,858 |

| $ | 4,979 |

| $ | 7,280 |

| 39 | % | 35 | % | 23 | % |

Realty Income Corporation | Retail REITs | $ | 10,940 |

| $ | 10,624 |

| $ | 16,023 |

| 34 | % | 16 | % | 19 | % |

Regency Centers Corporation | Retail REITs | $ | 4,128 |

| $ | 5,947 |

| $ | 8,221 |

| 43 | % | 24 | % | 17 | % |

Tanger Factory Outlet Centers Inc. | Retail REITs | $ | 2,140 |

| $ | 3,466 |

| $ | 4,939 |

| 19 | % | 11 | % | 17 | % |

Taubman Centers, Inc. | Retail REITs | $ | 3,612 |

| $ | 4,839 |

| $ | 6,864 |

| 31 | % | 12 | % | 21 | % |

W. P. Carey Inc. | Diversified REITs | $ | 8,501 |

| $ | 7,291 |

| $ | 10,745 |

| 21 | % | 26 | % | 27 | % |

Weingarten Realty Investors | Retail REITs | $ | 3,861 |

| $ | 4,270 |

| $ | 6,415 |

| 33 | % | 22 | % | 17 | % |

| | | | | | | |

National Retail Properties, Inc. | Retail REITs | $4,867 | $5,192 | $7,624 | 36% | 20% | 19% |

Percentile | | 71 | 71 | 65 | 86 | 59 | 70 |

Data Source: S&P Capital IQ

In 2013, CBL & Associates Properties and W.P. Carey, Inc. were added, and Corporate Office Properties and Highwood Properties were removed, from the Peer Group in order to better reflect the retail property character of our portfolio. The Peer Group consists of 14 publicly-traded REITs operating across a variety of property sectors, with a primary focus on the retail sector, recognizing that the Company competes with REITs across all property sectors for capital and executive talent. Relative to the Peer Group, the Company’s total assets and equity market capitalization are between the Peer Group 50th and 75th percentiles. In determining 2014 pay opportunities for executive officers, the

Committee considered the compensation of our executive officers as compared to the compensation of executive officers of companies in our Peer Group. Pearl Meyer provided the Committee with a detailed analysis of the compensation of our executive officers as compared to the executive officers of companies in our Peer Group, with the overall strategy of providing total pay opportunities comparable to those provided by industry peers. For the past one, three, five, and ten years ending December 31, 2014, our total return to shareholders was above the median and the average total return of the Peer Group.

We believe that our compensation, benchmarked against our Peer Group, provides an appropriate mix of fixed and variable pay, balances short-term operational performance with long-term shareholder value creation, and encourages executive recruitment and retention. The Committee compared base salary and total compensation for our executive officers against the Peer Group, generally focusing on targeting total pay opportunities between the 50th and 75th percentiles in recognition of the Company’s use of stretch performance goals. Compared with the Peer Group, 2014 base salaries for each of our NEOs were comparable with that of the Peer Group median, excluding Mr. Horn who was promoted in 2014 and who was below the 25th percentile. Cash compensation for each of our NEOs, comprised of base salary and “target” annual cash incentive bonus, was in line with the Peer Group median, excluding Mr. Horn who was promoted in 2014 and who was below the 25th percentile. Total compensation for our NEOs, including base salary, “target” cash bonus and “target” equity incentive awards, ranged between the 50th and 75th percentiles of the Peer Group median, excluding Mr. Horn who was promoted in 2014 and who was at the 25th percentile, and in the aggregate was equal to 104% of the Peer Group median.

2014 Executive Compensation Components and How They Relate to Our Objectives

For the fiscal year ended December 31, 2014, base salary, annual cash incentives, cash bonus, and long-term equity-based incentives were the principal components of compensation for the NEOs. Executives also receive certain benefits and other perquisites. We believe that these compensation components provide an appropriate mix of fixed and variable pay, balances short-term operational performance with long-term shareholder value, and encourages executive recruitment and retention. Total “target” compensation mix for NEOs was 22% base salary, 27% cash incentive bonus and 51% long-term incentive compensation which is comparable with the Peer Group 50th percentile target compensation mix.

The differences in the amounts of compensation awarded to the NEOs are primarily a result of comparing each executive's compensation against corresponding market values for industry peers and giving consideration to differences in position and responsibilities among the Company’s NEOs. The responsibilities for each named executive officer are as follows: (i) Mr. Macnab, our Chairman and Chief Executive Officer, is responsible for developing, defining, implementing and executing the Company’s corporate strategy, policies, mission, philosophy, goals and objectives; (ii) Mr. Whitehurst, our President and Chief Operating Officer, is responsible for overseeing the day-to-day operations of the Company including its acquisitions, dispositions, development, property management, underwriting, structured finance, human resources, and legal departments; (iii) Mr. Habicht, our Executive Vice President, Chief Financial Officer, Treasurer and Assistant Secretary, is responsible for overseeing all capital, financial reporting, tax, information technology and corporate communication matters of the Company and assisting the corporate secretary with his duties;

(iv) Mr. Bayer, our Executive Vice President and Chief Investment Officer, is responsible for overseeing the leasing, asset management, due diligence and underwriting groups of the Company; and (v) Mr. Horn, our Executive Vice President and Chief Acquisition Officer, is responsible for leading our property acquisition department. Our Committee believes that the different levels of compensation provided to the NEOs are commensurate to the responsibilities of each executive.

Base Salary

The Committee sets and adjusts the base salaries of our NEOs based on the qualifications, experience, scope of responsibilities and past performance of each executive, the practices of and salaries awarded by our Peer Group, and other factors deemed appropriate by the Committee. The base salary of each named executive officer has been below the Peer Group median in recent years. Based on these criteria and consistent with the Committee’s plan to make base salaries more comparable to the median base salaries of the Peer Group, the Committee approved 2014 base salary increases for our NEOs ranging from 2.0% to 6.0% (3.2% weighted average), excluding Mr. Horn whose base salary was increased 20.0% to reflect his promotion and bring him more in line with market pay levels. After these increases, 2014 base salaries for NEOs, other than Mr. Horn, were comparable with median levels for the Peer Group, ranging from 94% to 100% of median levels, with aggregate competitiveness for our NEOs, including Mr. Horn, equal to 94% of the Peer Group median.

Annual Incentive Compensation