Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. )

|

Filed by the Registrant

[X]

|

|

Filed by a Party other than

the Registrant [ ]

|

|

|

|

Check the appropriate

box:

|

|

|

|

[ ]

|

|

Preliminary Proxy

Statement

|

|

[ ]

|

|

Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

|

Definitive Proxy

Statement

|

|

[ ]

|

|

Definitive Additional

Materials

|

|

[ ]

|

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

ANNALY CAPITAL MANAGEMENT, INC.

|

|

|

|

(Name of Registrant as

Specified In Its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

|

|

|

Payment of Filing Fee (Check

the appropriate box):

|

|

[X]

|

|

No fee required.

|

|

[

]

|

|

Fee computed on

table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of

securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

2)

|

|

Aggregate number of securities to

which transaction applies:

|

|

|

|

|

|

|

|

|

|

3)

|

|

Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11 (set

forth the amount on which the filing fee is calculated and state how it

was determined):

|

|

|

|

|

|

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

[

]

|

|

Fee paid previously

with preliminary materials.

|

|

|

|

|

|

[

]

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for

which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously

Paid:

|

|

|

|

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration

Statement No.:

|

|

|

|

|

|

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

4)

|

|

Date Filed:

|

|

|

|

|

|

|

Table of Contents

Notice of

2016

Annual Meeting of

Stockholders

and Proxy Statement

May 26, 2016, at 9:00

a.m.

The Warwick Hotel

65 West 54th Street

New York, NY

10019

Table of Contents

Dear Fellow

Shareholders,

Amidst a challenging

macroeconomic environment marked by unprecedented volatility across all asset

classes, Annaly delivered strong financial results in 2015, declaring over $1.2

billion in dividends and producing an attractive return on equity while

maintaining a low leverage ratio relative to the industry. In addition to our

dividend program, in August of last year, we authorized a repurchase plan of up

to $1 billion of our common shares through December 31, 2016. As of March 31,

2016, we have cumulatively repurchased $614 million of stock under both our

current program and our previous share repurchase program, which was initiated

in 2012.

|

Annaly delivered strong financial results in

2015, declaring over

$1.2

billion

in

dividends

|

Throughout 2015, we

continued to execute on our strategic plan to diversify our investments in

assets with complementary cash flows. During the year, we expanded our

allocation of capital into lower-levered, largely floating rate credit

businesses from 11% to 23% of our total equity capital. We invested $1.3 billion

in growing our commercial real estate business, launching our own residential

credit platform and nearly tripling the size of our middle market lending

portfolio. On a stand-alone basis of roughly $3 billion of equity capital, these

three businesses would amount to one of the largest hybrid mortgage REITs in the

world and three times the size of the average market capitalization for the 40

other mortgage REITs in the industry.

|

As of March 31,

2016, we have cumulatively repurchased

$614 million

of

stock

|

As we look ahead

through 2016 and beyond, we remain focused both on returning value to our

stockholders and enhancing our corporate governance, compensation and management

structures. The Board of Directors continually evaluates these structures to

further align the interests of our management with those of shareholders. Among

numerous other initiatives, we announced the expansion of our stock ownership

guidelines in the first quarter of 2016. Pursuant to these guidelines, more than

40% of the Annaly team (including our executive officers) will be asked to

purchase predetermined amounts of shares in the open market. These guidelines

reflect our desire to establish an ownership culture throughout the firm, which

is also evidenced by the fact that senior management has purchased nearly 1.9

million common shares with an aggregate purchase price of $22.0 million since

2011.

|

We expanded

our allocation of capital into lower-levered, largely floating

rate credit businesses from 11% to

23%

of our total

equity capital

|

We are proud of our

attention and focus on our shareholders over the years – and our industry best

practices are exemplified by what I believe is one of the most shareholder

friendly management agreements in the asset management industry. Our management

contract is structured without termination or incentive fees, has one of the

lowest fixed management fee percentages in the industry and a two-year term that

provides our Board and shareholders with the opportunity to actively monitor and

assess our performance over reasonable time frames. In addition to the stock

ownership guidelines discussed above, other recent enhancements include the

adoption of a robust clawback policy for the management fee, increased stock

ownership guidelines for our

|

Senior management has

purchased nearly

1.9 million

common shares since

2011

|

|

www.annalyannualmeeting.com

|

|

I

|

Table of Contents

Independent Directors,

a four-year stock holding period requirement, an anti-pledging policy (which is

complementary to our existing anti-hedging policy) and the creation of the role

of Lead Independent Director, which is currently held by Jon

Green.

Also, given the

various changes to the market, our industry and our business, we have dedicated

tremendous focus and resources to enhancing our financial disclosure and risk

management practices. Over the past year, we provided increased transparency

into our amended capital allocation policy and more granular portfolio detail on

our growing credit businesses. This year’s proxy statement, which includes an

updated format and graphics, also reflects our continued focus on accuracy and

transparency. Our paramount responsibility, as long term stewards of capital, is

to ensure that we have appropriate clarity within our financial statements,

strong risk management practices and the comprehensive operational

infrastructure needed to support our evolving businesses. In 2015, significant

achievements were made within our operating strategies including: attracting

numerous key hires into our risk, legal, accounting, human resources and

information technology teams; implementing enhanced asset, portfolio and risk

management systems, including a comprehensive risk rating system across the

various investment businesses; and restructuring our internal management

reporting lines and governance committees to more appropriately monitor and

manage our evolving strategies.

I look forward to

welcoming many of you to our 2016 Annual Meeting of

Stockholders.

Sincerely,

Kevin G.

Keyes

Chief

Executive Officer and President

April 12,

2016

|

Creation of the role of

Lead

Independent Director

|

|

Enhancing

our financial

disclosure and risk

management practices

|

|

Scaling our operating platform to support growth

and

diversification

of

our portfolio

|

|

II

|

|

Annaly Capital

Management, Inc.

►

2016 Proxy

Statement

|

Table of Contents

>

Notice of Annual Meeting of Stockholders

To Be

Held May 26, 2016

at 9:00 a.m. (Eastern Time)

|

|

The

Warwick Hotel, 65 West 54th Street,

New York, NY

10019

|

To the Stockholders of

Annaly Capital Management, Inc.:

We will hold the

annual meeting of the stockholders of Annaly on May 26, 2016, at 9:00 a.m.

(Eastern Time) at the Warwick Hotel, 65 West 54th Street, New York, NY 10019,

to:

We will also transact

any other business as may properly come before our annual meeting or any

adjournment or postponement thereof. Only our common stockholders of record at

the close of business on March 29, 2016, the record date for the annual meeting,

may vote at the annual meeting and any adjournments or postponements

thereof.

Your vote is very

important. Please exercise your right to vote.

To view the Proxy

Statement and other materials about the annual meeting, go to

www.annalyannualmeeting.com.

If you attend the

annual meeting in person, you will need to present proof of your ownership of

our common stock as of the record date, and valid government-issued photo

identification.

By Order of the Board

of Directors,

R. Nicholas

Singh

Secretary

April 12, 2016

|

Important Notice Regarding the Availability of Proxy

Materials for the Stockholder Meeting to Be Held on May 26, 2016. Our

Proxy Statement and 2015 Annual Report to Stockholders are available at

www.proxyvote.com.

|

|

www.annalyannualmeeting.com

|

|

III

|

Table of Contents

|

IV

|

|

Annaly Capital

Management, Inc.

►

2016 Proxy

Statement

|

Table of Contents

>

Proxy Statement

The Board of Directors

(the “Board”) of Annaly Capital Management, Inc. (“Annaly,” the “Company,” “we,”

“our” or “us”) is soliciting proxies in connection with our 2016 annual meeting

of stockholders (the “Annual Meeting”). We are sending the Notice of Internet

Availability of Proxy Materials, or a printed copy of the proxy materials, as

applicable, commencing on or about April 12, 2016.

>

Proxy Summary

This summary contains

highlights about the Company and the Annual Meeting. This summary does not

contain all of the information that you should consider in advance of the Annual

Meeting, and we encourage you to read the entire proxy statement and our 2015

Annual Report on Form 10-K carefully before voting.

2016 Annual Meeting of

Stockholders

Time

and

Date:

|

|

Thursday, May 26, 2016 at 9:00 a.m. (Eastern

Time)

|

|

Place:

|

|

The

Warwick Hotel, 65 West 54th Street,

|

|

|

|

New York, NY 10019

|

|

Record Date:

|

|

March 29, 2016

|

|

Voting:

|

|

Stockholders are able to vote by

Internet at

www.proxyvote.com

;

telephone at 1-800-690-6903; completing and returning their proxy card; or

in person at the Annual Meeting

|

Voting

Matters

|

|

|

Board Vote

Recommendation

|

|

Page

Number

|

Proposal No. 1:

Election of

Directors

|

|

FOR

each

Director

nominee

|

|

1

|

Proposal No. 2:

Approval, on

an advisory basis, of

our executive

compensation

|

|

FOR

|

|

20

|

Proposal No. 3:

Ratification

of the appointment of

Ernst & Young

LLP

|

|

FOR

|

|

25

|

|

|

|

|

|

|

Time and Date

Thursday, May 26, 2016

at 9:00 a.m. (Eastern

Time)

Place

The Warwick Hotel,

65 West 54th Street,

New York, NY

10019

Record Date

March 29, 2016

Voting

Stockholders are entitled

to vote by

|

|

|

|

|

|

|

|

|

|

|

|

Internet

www.proxyvote.com

|

|

|

|

|

|

|

|

|

|

|

|

Telephone

1-800-690-6903

|

|

|

|

|

|

|

|

|

|

|

|

Mail

completing and returning

their proxy

card

|

|

|

|

|

|

|

|

|

|

|

|

In

Person

at the Annual Meeting

|

|

|

|

|

|

|

|

Information

www.annalyannualmeeting.com

|

|

|

|

|

|

|

www.annalyannualmeeting.com

|

|

V

|

Table of Contents

Annaly at a

Glance

|

►

|

New York Stock Exchange (NYSE):

NLY

|

|

►

|

Founded in 1997

|

|

►

|

Largest mortgage REIT in the

world

|

|

►

|

Diversified investment

strategy

|

|

►

|

16.5% economic return (change in book value plus dividends

paid) from the beginning of 2014 through the end of

2015

|

|

►

|

Share repurchase authorization of up to $1.0 billion of

common shares through the end of

2016

|

|

►

|

605% total return since inception

(including reinvestment of dividends) as of March 31,

2016

|

|

►

|

Paid out $13.7 billion in dividends since

inception

|

|

►

|

Conservative leverage ratios relative to specified

peers

|

|

►

|

Management agreement aligns interests of our manager and our

stockholders

|

|

►

|

Our management team has purchased nearly 1.9 million common

shares since 2011

|

We have been

externally managed by Annaly Management Company, LLC (our “Manager”) since 2013.

Our Manager is responsible for managing our affairs pursuant to a management

agreement. Our Manager pays all of the compensation, including benefits, to our

executive officers (who are employees of our Manager) and our Manager’s other

employees. Although limited personnel (but none of our executive officers) are

employed by our subsidiaries for regulatory or corporate efficiency reasons, all

compensation and benefits paid to such personnel by our subsidiaries reduce, on

a dollar-for-dollar basis, the management fee we pay to our Manager. For ease of

reference, throughout this proxy statement, the employees of our Manager

(including our executive officers) and our subsidiaries are sometimes referred to

as “our” employees.

Key

Accomplishments

Despite challenging

market conditions for mortgage real estate investment trusts ("REITs") during

2015, we performed strongly and achieved a number of significant accomplishments

that are discussed below.

Transitioned

Leadership

Kevin G. Keyes was

appointed Annaly’s Chief Executive Officer effective September 30, 2015. On the

same date, Wellington J. Denahan, our former Chief Executive Officer, transitioned

to the position of Executive Chairman. Ms. Denahan continues to serve as

Chairman of the Board and Jonathan D. Green continues to serve as our Lead

Independent Director.

Diversified Investment

Strategy

Over the last few

years, we have diversified our investment strategy by investing in credit assets

with complementary cash flows to achieve superior risk-adjusted returns over the

long term. During 2015, we invested $1.3 billion by growing our commercial real

estate business, launching our own residential credit platform and nearly

tripling the size of our middle market lending portfolio. On a standalone basis

of roughly $3 billion of equity capital, these three businesses would amount to

one of the largest hybrid mortgage REITs in the world, and three times the size

of the average market capitalization for the 40 other mortgage REITs in the

industry. The majority of our credit assets tend to have shorter-term maturities

and floating interest rates. We expect that combining these credit assets with

our core agency strategy should lead to a smoother earnings profile over various

interest rate cycles. Given the relatively low price correlation between credit

and agency-backed assets, we also expect that our diversified strategy will lead

to lower book value volatility as markets

fluctuate.

|

VI

|

|

Annaly Capital

Management, Inc.

►

2016 Proxy

Statement

|

Table of Contents

Our diversification

strategy is reflected in the following allocation of our capital across four

businesses – agency, commercial real estate, residential credit and middle

market lending – as of December 31, 2015.

Dividends

From our inception in

1997 through December 31, 2015, we have paid over $13 billion in dividends to

our stockholders, as set forth in the table below. In 2015, we declared over

$1.2 billion in dividends.

|

www.annalyannualmeeting.com

|

|

VII

|

Table of Contents

Delivering Significant

Value for Stockholders

In August 2015, the

Board authorized a $1 billion share repurchase program, which gives us another

avenue to return capital to our stockholders alongside our quarterly dividend

program.

|

Returns to Stockholders in 2015

|

|

$114.3

million

Shares

repurchased

|

|

$1.2

billion

Common and

preferred

stock dividends declared

|

|

$1.32

billion

Returns to

stockholders

|

From January 1, 2016

through March 31, 2016, we have repurchased an additional $102.7 million of

common stock and have $783 million remaining authorization under the share

repurchase program.

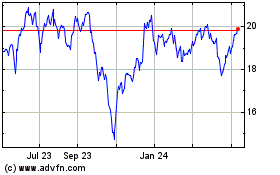

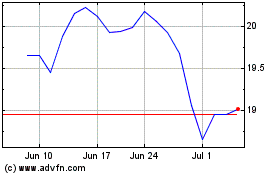

Total Common Stock

Return Performance

Since 2014 (the first

full year we were externally-managed, as more fully described in “

Management

Structure

” below), we have performed well against what we consider to be our

relevant benchmarks. As illustrated by the graph below, shares of our common

stock (including the reinvestment of dividends) have returned significant value

to our stockholders over the long term relative to both our mortgage REIT peers

and other yield-focused investments.

|

Since 2014, Annaly has

generated a total return of 33.1% to our

stockholders

|

Note: Graph reflects

daily market data from December 31, 2013 through March 31, 2016. For the share

performance graph required by the Securities and Exchange Commission (SEC) in

accordance with Item 201(c) of Regulation S-K for the five-year period ended

December 31, 2015, please see page 42 of our Annual Report on Form 10-K for the

year ended December 31, 2015 filed with the SEC on February 26,

2016.

Source:

Bloomberg. mREITs represent the members of the Bloomberg mREIT (“BBREMTG”)

Index; Utilities represent the members of the Russell 3000 Utility Index; MLPs

represent the members of the Alerian MLP Index; Asset Managers represent the

members of the S&P 500 Asset Management and Custody Bank Index; Banks

represent the members of the KBW Bank Index; and S&P represents the members

of the S&P 500 Index.

|

VIII

|

|

Annaly Capital

Management, Inc.

►

2016 Proxy

Statement

|

Table of

Contents

Economic Return

Performance

Since we are organized as a REIT and

therefore must distribute at least 90% of our taxable income to our stockholders

annually, we believe that economic return, comprised of dividends

paid

and

changes in book value measured over a specified period, is an especially

meaningful performance metric for the Company. Concerns over increases in

interest rates led us to maintain this relatively conservative leverage over the

period compared to our Agency mREIT peers. Our Agency mREIT Peers consist of

American Capital Agency Corp. (“AGNC”), Hatteras Financial Corp. (“HTS”), CYS

Investments, Inc. (“CYS”), Capstead Mortgage Corp. (“CMO”), Armour Residential

REIT, Inc. (“ARR”), and Anworth Mortgage Asset Corp. (“ANH”) (collectively, the

“Agency mREIT Peers”), and represent the agency mortgage REITs included in the

BBREMTG Index as of March 31, 2016 with market capitalization above $200

million. From the beginning of 2014 through the end of 2015, we generated an

economic return of 16.5% and operated at 30% less leverage than this peer group.

From the beginning

of 2014 through

the end of

2015,

we generated an

economic return of

16.5% and operated

at 30%

less leverage

then our Agency

mREIT Peers

Stockholder Outreach and

Engagement

Since September 2015, we have had a

renewed focus on developing and maintaining relationships with both our retail

and institutional stockholders. As of March 31, 2016, our outreach has included

six non-deal roadshows with institutional investors, encompassing eight cities

and meetings with 42 different investors. Over the same period, we held an

additional 37 one-on-one meetings with investors to gain and share valuable

insights on a variety of topics, including the Company’s diversified investment

strategy and our corporate governance, compensation and management structures.

In addition, we have enhanced our efforts to personalize our interaction with

retail investors, providing high-touch responses to all

requests for information.

Members of our Board may participate in investor outreach when appropriate.

Stockholders are invited to communicate with the Board as described under

“

Communications with the Board

” as described

below.

Members of

the Board may

participate

in

investor outreach

when appropriate

|

www.annalyannualmeeting.com

|

|

IX

|

Table of

Contents

Our Manager and Our Management Agreement

Highlights of our management

agreement

|

►

|

All of our executive officers are

employees of our Manager

|

|

►

|

Our Manager is responsible for the

compensation of its employees (including our executive officers) who

provide services to the Company. We do not pay any cash or equity

compensation to our executive officers, do not provide pension benefits,

perquisites or other personal benefits, and have no employment agreements

or arrangements to pay any cash severance upon their termination or a

change in control of the Company

|

|

►

|

Our Manager receives a flat

management fee equal to 1.05% of our stockholders’ equity, which is used

to pay the compensation and benefits of its employees (including our

executive officers). However, no specific portion of the management fee is

allocated to the compensation of our executive officers

|

|

►

|

For 2015, the management fee was

approximately $150.3 million

|

Over the past several years, our Manager

has made significant investments in our personnel corresponding to the

diversification of our investment strategy into more people-intensive asset

classes (including residential credit, commercial real estate and middle market

lending assets), as well as to the enhancement of our corporate infrastructure.

These investments include the build out of teams for our agency, residential

credit, commercial real estate and middle market lending businesses, and

significant hires in our risk, legal, accounting, capital markets, middle

office, regulatory, licensing, modeling, project management, forecasting and

information technology departments.

The costs of these personnel expansions

and improvements have been paid by our Manager rather than by us. Unlike a

number of other externally-managed REITs, we do not reimburse our Manager for

any portion or subset of employment costs, all of which are borne by our

Manager. An increase to these costs does not result in any increase to the

management fee, which is a fixed percentage of our stockholders’ equity as

described above.

The independent members of our Board

review the efforts of our Manager to ensure that it continues to invest in our

personnel. The Board has concluded that the efforts of our Manager to

develop

and

enhance

our

personnel

have resulted in the establishment of a robust and high quality

management team having a full complement of human capital to drive our business

performance. We believe our management team compares very favorably in terms of

size, scope and experience with our mortgage REIT peers.

For additional information about our

Manager, our management agreement and executive compensation, see “

Certain

Relationships and Related Party Transactions

,” “

Our Management Structure

” and

“

Compensation Discussion and Analysis.

”

|

X

|

|

Annaly

Capital Management, Inc.

►

2016 Proxy

Statement

|

Table of

Contents

Recent Enhancements to our Corporate

Governance, Compensation and Management Structures

We regularly review and update our

practices related to our corporate governance, compensation and management

structures to align the interests of our management team with those of our

stockholders and to respond to changes in applicable laws, regulations, stock

exchange requirements and best practices and the evolving needs of our

business. Over the last two years, we have made a number of enhancements to

these structures, which include the following:

|

|

|

|

|

|

Year

of

|

|

Action

|

|

|

How It

Works

|

|

Adoption

|

Adopted a

Clawback

Policy for the

Management Fee

|

|

►

|

The Company will seek, and be entitled

to receive, reimbursement from our Manager if the Board determines that a

computation error (regardless of the reason for or amount of such error)

resulted in the overpayment of a management fee to our Manager

|

|

2016

|

Enhanced

Stock

Ownership

Guidelines for Directors

and Employees

to

Support Our Ownership

Culture

|

|

►

|

Expanded application of stock ownership

guidelines to more than 40% of our employees and Manager personnel

(including our executive officers)

|

|

2016

|

|

|

►

|

Increased stock ownership guidelines for our

Chief Executive Officer

|

|

|

|

|

►

|

Increased stock ownership guidelines for our

Independent Directors to five times the annual cash retainer

|

|

|

Four-Year Stock

Holding

Period

Requirement

|

|

►

|

Requires our employees and Manager

Personnel (including our executive officers) to hold for a period of four

years the net after-tax shares of Company stock they receive through stock

option exercises or vesting of equity incentive awards

|

|

2016

|

Adopted an Anti-

Pledging

Policy

|

|

►

|

Prohibits

our employees and Manager Personnel (including our executive officers)

from holding Company securities in a margin account or pledging Company

securities as collateral for a loan

|

|

2016

|

|

|

►

|

We also have in place an anti-hedging

policy with respect to our equity securities, which is discussed on page

23

|

|

|

Updated Governing

Documents

and

Committee Charters

|

|

►

|

Revised and updated the Corporate

Governance Guidelines, Code of Business Conduct and Ethics, and the

charters of our four standing Board committees to reflect best

practices

|

|

2015 – 2016

|

Created the Role of

Lead

Independent

Director

|

|

►

|

Lead Independent Director serves as link

between our management, the Board and our stockholders

|

|

2015

|

|

|

►

|

Robust responsibilities, including the ability

to retain outside consultants who report directly to the

Board

|

|

|

|

www.annalyannualmeeting.com

|

|

XI

|

Table of

Contents

>

Table of Contents

|

XII

|

|

Annaly Capital Management, Inc.

► 2016 Proxy

Statement

|

Table of

Contents

>

Corporate Governance at

Annaly

|

|

Proposal

1

|

|

Election of

Directors

We have three Classes

of Directors. At the Annual Meeting, our stockholders will vote to elect

three Class II Directors, whose terms will expire at our annual meeting of

stockholders in 2019, subject to the election and qualification of their

successors or to their earlier death, resignation or removal. The Class

III and Class I Directors have one year and two years, respectively,

remaining on their terms of office and will not be voted upon at the

Annual Meeting. The

table below provides summary information about each of

our Directors.

OUR BOARD OF DIRECTORS

RECOMMENDS A VOTE FOR KEVIN G. KEYES, KEVIN P. BRADY AND E. WAYNE NORDBERG

AS DIRECTORS TO HOLD OFFICE UNTIL OUR ANNUAL MEETING OF STOCKHOLDERS IN

2019 AND UNTIL THEIR RESPECTIVE SUCCESSORS ARE DULY ELECTED AND QUALIFIED.

THE PERSONS NAMED IN THE ENCLOSED PROXY WILL VOTE YOUR PROXY IN FAVOR OF

THESE NOMINEES UNLESS YOU SPECIFY A CONTRARY CHOICE IN YOUR

PROXY.

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Principal Occupation

|

|

Independent

|

|

|

Committees

|

|

CLASS II DIRECTORS (NOMINATED

TO SERVE FOR THREE-YEAR TERMS EXPIRING IN 2019)

|

|

Kevin

G. Keyes

|

|

48

|

|

Chief Executive

Officer

|

|

No

|

|

|

|

|

|

|

|

|

and

President

|

|

|

|

|

|

|

|

|

|

|

Annaly Capital Management, Inc.

|

|

|

|

|

|

|

Kevin

P. Brady

|

|

60

|

|

Chief Executive

Officer

|

|

Yes

|

|

►

|

Audit (Chair)

|

|

|

|

|

|

ARMtech, LLC

|

|

|

|

►

|

NCG

|

|

|

|

|

|

|

|

|

|

►

|

Risk

|

|

E.

Wayne Nordberg

|

|

77

|

|

Chairman

|

|

Yes

|

|

►

|

NCG (Chair)

|

|

|

|

|

|

Hollow Brook Wealth Management,

|

|

|

|

►

|

Compensation

|

|

|

|

|

|

LLC

|

|

|

|

|

|

|

CLASS III DIRECTORS (TERMS EXPIRE IN

2017)

|

|

Francine J. Bovich

|

|

64

|

|

Former Managing

Director

|

|

Yes

|

|

►

|

Audit

|

|

|

|

|

|

Morgan Stanley Investment

|

|

|

|

►

|

NCG

|

|

|

|

|

|

Management

|

|

|

|

|

|

|

Jonathan D. Green

*

|

|

69

|

|

Former Vice

Chairman

|

|

Yes

|

|

►

|

Risk (Chair)

|

|

|

|

|

|

The

Rockefeller Group

|

|

|

|

►

|

Compensation

|

|

John

H. Schaefer

|

|

64

|

|

Former President and

Chief

|

|

Yes

|

|

►

|

Audit

|

|

|

|

|

|

Operating

Officer

|

|

|

|

►

|

Compensation

|

|

|

|

|

|

Morgan Stanley Global Wealth

|

|

|

|

►

|

Risk

|

|

|

|

|

|

Management

|

|

|

|

|

|

|

CLASS I DIRECTORS (TERMS EXPIRE IN

2018)

|

|

Wellington J. Denahan

|

|

52

|

|

Executive

Chairman

|

|

No

|

|

|

|

|

|

|

|

|

Annaly Capital Management, Inc.

|

|

|

|

|

|

|

Michael Haylon

|

|

58

|

|

Managing

Director

|

|

Yes

|

|

►

|

Audit

|

|

|

|

|

|

Conning Asset Management

|

|

|

|

►

|

Risk

|

|

Donnell A. Segalas

|

|

58

|

|

Chief Executive Officer

and

|

|

Yes

|

|

►

|

Compensation

|

|

|

|

|

|

Managing

Partner

|

|

|

|

|

(Chair)

|

|

|

|

|

|

Pinnacle Asset Management, L.P.

|

|

|

|

►

|

NCG

|

* Lead Independent Director. For more

details, see page

10

.

|

www.annalyannualmeeting.com

|

|

1

|

Table of

Contents

|

Corporate Governance at Annaly

|

Nominees to Serve for a Three-Year Term

Expiring in 2019 (Class II Directors)

|

|

|

|

|

Kevin G. Keyes

Director

since

November

2012

|

|

Mr. Keyes has served as Chief

Executive Officer

of Annaly since September 2015 and as its President

since October 2012. Previously, Mr. Keyes served as Chief Strategy Officer

and Head of Capital Markets of Annaly

from September 2010 until October 2012.

Prior to joining Annaly as a Managing Director in 2009, Mr. Keyes worked

for 20

years in senior Investment Banking and Capital Markets roles. From

2005-2009, Mr. Keyes served in senior management and business origination

roles

in the Global Capital Markets and Banking Group at Bank of America

Merrill Lynch. Prior to that, he

worked at Credit Suisse First Boston

from 1997 until 2005 in various Capital Markets Origination roles and

Morgan Stanley Dean Witter from 1990 until 1997 in the Mergers and

Acquisitions Group and Real Estate Investment Banking Group. Mr. Keyes

holds a B.A. in Economics and a B.S. in Business Administration (ALPA

Program) from the University of Notre Dame.

|

|

|

|

|

|

Director Qualification

Highlights

Mr. Keyes is our Chief Executive

Officer and brings to our Board a deep understanding of issues that are

important to the Company’s growth. Through his role as our Chief Executive

Officer and other senior management positions at the Company, Mr. Keyes

has demonstrated leadership qualities, management capability, business and

industry knowledge and a long-term strategic perspective. In addition, Mr.

Keyes’

qualifications include over 20 years of experience in investment

banking and as an equity capital markets professional.

|

|

|

|

|

|

|

|

Kevin P.

Brady

Director

since

1997

Committees

Audit (Chair), NCG, Risk

|

|

Mr. Brady is the Chief Executive

Officer of ARMtech, LLC, a venture capital firm that invests and incubates

technology start-ups, which he founded in 2007. ARMtech’s current

portfolio includes companies in the financial reporting and data spaces.

Prior to ARMtech, Mr. Brady founded TaxStream, a software company that

specialized in financial reporting, tax and internal controls for

multi-national corporations. Mr. Brady served as Chief Executive Officer

of TaxStream from 2002 to 2008, when the company was sold to

Thomson-Reuters. Mr. Brady previously worked for eight years at

PricewaterhouseCoopers in New York City, where he consulted on M&A

transactions and international tax issues. Mr. Brady holds a B.A. from

McGill University, an M.B.A. from New York University and is a Certified

Public Accountant (inactive). He was awarded a patent from the U.S. Patent

and Trademark Office for the invention of the TaxStream

product.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Mr. Brady’s

qualifications include his expertise in financial and accounting matters

as well as his significant experience managing systems and companies

focusing on the financial accounting market.

|

|

|

|

2

|

|

Annaly

Capital Management, Inc.

►

2016 Proxy

Statement

|

Table of

Contents

|

Corporate Governance at Annaly

|

|

|

|

|

|

E. Wayne Nordberg

Director

since

May 2004

Committees

NCG (Chair), Compensation

|

|

Mr. Nordberg has served as Chairman

of Hollow Brook Wealth Management, LLC, an SEC-registered investment

advisor which manages or advises $1.4 billion of investment assets, since

2008. From January 2003 to November 2008, Mr. Nordberg served as a senior

director of Ingalls & Snyder LLC, a NYSE member and registered

investment advisor. From 1998 to June 2002, Mr. Nordberg served as Vice

Chairman of the board of KBW Asset Management, Inc., an affiliate of

Keefe, Bruyette, & Woods, Inc., a registered investment advisor. From

1988 to 1998, he served in various capacities for Lord Abbett & Co., a

mutual fund company, including partner and director of its family of

funds. Mr. Nordberg received his B.A. from Lafayette College, where he is

a trustee emeritus. He is a member of the Financial Analysts Federation

and The New York Society of Security Analysts and is a Trustee of the

Atlantic Salmon Federation, The American Museum of Fly Fishing and the

National Wildlife Federation Endowment Fund. Mr. Nordberg is also a

director of PetroQuest Energy, Inc. and Reaves Utility Income Fund, both

NYSE-listed companies.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Mr.

Nordberg’s qualifications include his significant experience in serving at

a senior executive level with a SEC-registered investment advisor, his

experience as a director of an asset management company and his service as

a board member of other public companies.

|

|

|

Class III Directors (Terms Expire in

2017)

|

|

|

|

|

Francine J. Bovich

Director

since

May 2014

Committees

Audit, NCG

|

|

Ms. Bovich has over 30 years of

investment management experience lastly serving as a Managing Director of

Morgan Stanley Investment Management from 1993-2010. Since 2011, Ms.

Bovich has been a trustee of The Bradley Trusts. Ms. Bovich has also

served as a board member of The Dreyfus Family of Funds since 2012, and

serves as a board member of a number of registered investment companies

within the fund complex. These funds represent a broad scope of investment

strategies including equities (US, non-US, global, and emerging markets),

taxable fixed income (US, non-US, global and emerging markets), municipal

bonds, and cash management. From 1991 through 2005, Ms. Bovich served as

the U.S. Representative to the United Nations Investment Committee, which

advised a global portfolio of approximately $30 billion. Ms. Bovich is a

member of The Economic Club of New York and an emeritus trustee of

Connecticut College and chair of the Investment Sub-Committee for its

endowment. Ms. Bovich has a B.A. in Economics from Connecticut

College

and an M.B.A. in Finance from New York University.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Ms. Bovich’s

qualifications include her significant investment management experience

and her experience serving as a trustee and board member.

|

|

|

|

www.annalyannualmeeting.com

|

|

3

|

Table of

Contents

|

Corporate

Governance at Annaly

|

|

|

|

|

|

Jonathan D. Green

Director

since

January 1997

Committees

Risk

(Chair), Compensation

Lead

Independent Director

|

|

Mr. Green served as a special

advisor to Rockefeller Group International, Inc., a wholly owned

subsidiary of Mitsubishi Estate Company, Ltd., operating under the brand

of The Rockefeller Group, from January 2011 until December 2014. He joined

The Rockefeller Group in 1980 as Assistant Vice President and Real Estate

Counsel. In 1983, he was appointed Vice President, Secretary and General

Counsel, and in 1990 was elected Chief Corporate Officer. In 1995, he was

named President and Chief Executive Officer of Rockefeller Group

Development Corporation and Rockefeller Center Management Corporation,

both subsidiaries of The Rockefeller Group. In

2002, Mr. Green was named

President and Chief Executive Officer of Rockefeller Group International,

Inc., becoming Vice Chairman in January 2009. He served as Vice Chairman

until December 2010. In his role as Vice Chairman, Mr. Green was active in

formulating the strategic planning for the company and its subsidiaries,

which include Rockefeller Group Development Corporation, Rockefeller Group

Investment Management, Rockefeller Group Technology Solutions, Inc. and

Rockefeller Group Business Centers. Before joining The Rockefeller Group,

Mr. Green was associated with the New York City law firm of Thacher,

Proffitt & Wood. He also serves on the board of trustees of the

Wildlife Conservation Society. Mr. Green graduated from Lafayette College

and the New York University School of Law.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Mr. Green’s

qualifications include his significant experience as a chief executive,

his diverse and significant background in the real estate industry and his

legal expertise.

|

|

|

|

|

|

|

|

John H. Schaefer

Director

since

March 2013

Committees

Audit, Compensation and Risk

|

|

Mr. Schaefer has over 40 years of

financial services experience including serving as a member of the

management committee of Morgan Stanley from 1998 through 2005 and as

President and Chief Operating Officer of the Global Wealth Management

division of Morgan Stanley. Mr. Schaefer retired in February 2006 and from

2008 through 2012 served as a board member and chair of the audit

committee of USI Holdings Corporation. Mr. Schaefer has a B.B.A. in

Accounting from the University of Notre Dame and an M.B.A. from the

Harvard Graduate School of Business.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Mr.

Schaefer’s qualifications include his broad financial services management

experience, including management of strategic planning, capital

management, human resources, internal audit and corporate communications,

as well as his board and audit committee experience.

|

|

|

|

4

|

|

Annaly Capital

Management, Inc.

►

2016 Proxy

Statement

|

Table of

Contents

|

Corporate

Governance at Annaly

|

Class I Directors (Terms Expire in

2018)

|

|

|

|

|

Wellington J. Denahan

Director

since

1997

Chairman of the

Board

|

|

Ms. Denahan has served as Chairman

of the Board since November 2012 and Executive Chairman of Annaly since

September 2015. Previously, Ms. Denahan served as Chief Executive Officer

of Annaly from November 2012 to September 2015 and as Co-Chief Executive

Officer of Annaly from October 2012 to November 2012. Ms. Denahan was

elected in December 1996 to serve as Vice Chairman of the Board. Ms.

Denahan was Annaly’s Chief Operating Officer from January 2006 to October

2012 and Chief Investment Officer from 2000 to November 2012. She was a

co-founder of Annaly. Ms. Denahan has a B.A. in Finance from Florida State

University.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Ms.

Denahan’s qualifications include her significant oversight experience

related to fixed income trading operations through years of serving as our

Chief Operating Officer and Chief Investment Officer, her industry

experience and expertise in the mortgage-backed securities markets, and

her operational expertise, including her service as our former Chief

Executive Officer.

|

|

|

|

|

|

|

|

Michael Haylon

Director

since

June 2008

Committees

Audit, Risk

|

|

Mr. Haylon has served as Managing

Director and Head of Asset Management Sales, Products and Marketing at

Conning, Inc., a global provider of investment management solutions,

services and research to the insurance industry, since December 2014. Mr.

Haylon previously served as Managing Director and Head of Investment

Products at Conning, Inc. from January 2012 until December 2014. From

September 2010 to December 2011, Mr. Haylon served as Head of Investment

Product Management at General Re – New England Asset Management. He was

Chief Financial Officer of the Phoenix Companies, Inc. from 2004 until

2007, and Executive Vice President and Chief Investment Officer of the

Phoenix Companies in 2002 and 2003. From 1995 until 2002, he held the

position of Executive Vice President of Phoenix Investment Partners, Ltd.,

a NYSE-listed company, and President of Phoenix Investment Counsel, where

he was responsible for the management and oversight of $25 billion in

closed-end and open-end mutual funds, corporate pension funds and

insurance company portfolios. From 1990 until 1994, he was Senior Vice

President of Fixed-Income at Phoenix Home Life Insurance Company. From

1986 until 1990, he was Managing Director at Aetna Bond Investors where he

was responsible for management of insurance company and pension fund

portfolios. From 1980 until 1984 he was Senior Financial Analyst at

Travelers Insurance Companies. He began his career in 1979 in the

commercial lending program at Philadelphia National Bank. Mr. Haylon has

previously served on the boards of Aberdeen Asset Management and Phoenix

Investment Partners. He has a B.A. from Bowdoin College and a M.B.A. from

the University of Connecticut.

|

|

|

|

|

|

Director Qualification

Highlights

The Board believes that Mr. Haylon’s

qualifications include his significant leadership and management

experience from his years of management and oversight of large financial

asset portfolios, his prior board experience with other companies and his

expertise in financial matters.

|

|

|

|

www.annalyannualmeeting.com

|

|

5

|

Table of Contents

|

Corporate Governance at Annaly

|

|

|

|

|

|

Donnell A. Segalas

Director since

January

1997

Committees

Compensation (Chair),

NCG

|

|

Mr. Segalas is the Chief Executive

Officer and a Managing Partner of Pinnacle Asset Management L.P., a New

York-based alternative asset management firm. Additionally, Mr. Segalas is

a member of Pinnacle’s Investment Committee and sits on the boards of its

offshore funds. Prior to joining Pinnacle in 2003, Mr. Segalas was

Executive Vice President for Alternative

Investment Products (AIP) at

Phoenix Investment Partners. Mr. Segalas is a member of the Nantucket

Historical Society. He received a B.A. from Denison

University.

|

|

|

|

|

|

Director

Qualification Highlights

The Board believes that Mr.

Segalas’

qualifications include his significant experience from his years of

investing and managing private and public investment vehicles and his

experience serving on investment and executive committees of other

companies.

|

|

|

Independence of Our

Directors

Our Corporate Governance Guidelines and

NYSE rules require that at least a majority of our Board members are Independent

Directors. We have adopted the definition of “independent director” set forth in

Section 303A of the NYSE rules and have affirmatively determined that each

Director (other than Ms. Denahan and Mr. Keyes) has no material relationships

with us (either directly or as partner, stockholder or officer of an

organization that has a relationship with us) and is therefore independent in

accordance with the standards set forth in the NYSE rules and our Corporate

Governance Guidelines.

Director Nomination

Process

The Nominating/Corporate Governance

(“NCG”) Committee is responsible for identifying and screening nominees for

Director and for recommending to the Board candidates for nomination for

election or re-election to the Board and to fill Board vacancies. Nominees may

be suggested by Directors, members of management, stockholders or professional

search firms. In evaluating a Director nomination, the NCG Committee may review

materials provided by the nominator, a professional search firm or other

party.

The NCG Committee seeks to achieve a

balance of knowledge, experience and capability on the Board and considers a

wide range of factors when assessing potential Director nominees, including

a candidate’s background, skills, expertise, diversity, accessibility and

availability to serve effectively on the Board. All candidates should (i)

possess the highest personal and professional ethics, integrity and values,

exercise good business judgment and be committed to representing the long-term

interests of the Company and its stockholders, and (ii) have an inquisitive and

objective perspective, practical wisdom and mature judgment. It is expected that

all Directors will develop an understanding of the Company’s business and be

willing to devote sufficient time and effort to carrying out their duties and

responsibilities effectively.

Although the NCG Committee does not have a

formal diversity policy, it believes that diversity is an important factor in

determining the composition of the Board. Additionally, the Company endeavors to

have a Board representing diverse experiences at policy-making levels in

business, finance, government, education, law and technology, and in other areas

that are relevant to the Company’s business and its status as a public company,

as this contributes to our success and is in the best interests of our

stockholders.

Two new,

highly

qualified

Independent

Directors have

joined the Annaly

Board

over the last

three years

|

|

6

|

|

Annaly Capital Management, Inc.

► 2016 Proxy Statement

|

Table of Contents

|

Corporate Governance at Annaly

|

Stockholder

Recommendation of Director Candidates

Stockholders who wish the NCG Committee to

consider their recommendations for Director candidates should submit their

recommendations in writing to our Secretary at our principal executive offices.

Following verification of the stockholder status of persons proposing

candidates, recommendations are aggregated and considered by our NCG Committee

at a regularly scheduled or special meeting. If any materials are provided by a

stockholder in connection with the nomination of a Director candidate, such

materials are forwarded to our NCG Committee. Properly submitted recommendations

by stockholders will receive the same consideration by the NCG Committee as

other suggested nominees.

The Board’s Role and

Responsibilities

We are committed to maintaining a strong

ethical culture and robust governance practices that benefit the long-term

interests of stockholders. Our corporate governance practices

include:

|

|

|

|

|

|

|

|

|

Board

Structure

►

7 of 9 Directors are Independent

►

Lead Independent Director

►

Regular executive sessions of Independent

Directors

►

Independent Board committees

►

2 women Directors (including the Executive

Chairman)

|

|

Director Qualifications

►

Annual Board and committee self-evaluations

►

Over-boarding policy limits the number of outside boards

on which our Directors can serve

►

2 “audit committee financial experts”

|

|

Stockholder Rights and Engagement

►

Majority vote standard for uncontested

elections

►

Annual stockholder advisory vote on executive

compensation

►

Active stockholder engagement program

|

|

Recent

Governance Enhancements

►

Clawback policy

►

Anti-pledging policy

►

Stock ownership guidelines for our Directors and

employees

►

Four-year stock holding period requirement for

employees

|

|

|

|

|

|

|

|

|

Board Oversight of

Risk

Risk management begins with our Board,

through the review and oversight of the risk management framework, and continues

with executive management, through the ongoing formulation of risk management

practices and related execution in managing risk. The Board exercises its

oversight of risk management primarily through its Risk Committee and Audit

Committee. The Risk Committee is

responsible for

assisting the Board in its oversight of our risk governance structure, our risk

management and risk assessment guidelines and policies, our risk tolerance, and

our capital, liquidity, and funding. The Audit Committee assists the Board in

its oversight of the quality and integrity of our accounting, internal controls

and financial reporting practices, including independent auditor selection,

evaluation and review, and oversight of the internal audit function. At least

annually, the full Board reviews our risk management program, which identifies

and quantifies a broad spectrum of enterprise-wide risks and related action

plans, with management. For additional information on the responsibilities of

the Risk Committee and the Audit Committee, please see the “

Board Committees

”

section of this proxy statement.

The Audit

and

Risk Committees

have primary

Board

oversight

of the Company’s

risk management

framework

|

|

www.annalyannualmeeting.com

|

|

7

|

Table of Contents

|

Corporate Governance at Annaly

|

Risk assessment and risk management are

the responsibility of our management. A series of management committees have

oversight or decision-making responsibilities for risk management activities.

The management committees responsible for our risk management include the

Operating Committee, Enterprise Risk Committee, the Asset and Liability

Committee, the Investment Committee and the Financial Reporting and Disclosure

Committee.

In addition to the risk oversight

processes outlined above, the Board reviews its risk assessment of the Company’s

compensation policies and practices applicable to the Company’s equity incentive

plans with the Compensation Committee. For additional information on this

review, please see the “

Risks Related to Compensation Policies and Practices

”

section of this proxy statement.

Management Succession

Planning

The Board approves and maintains a

succession plan for the Chief Executive Officer and other senior executives. In

carrying out this function, the Board endeavors to ensure that the Company’s

management has the capabilities to cause the Company to operate in an efficient

and business-like fashion in the event of a vacancy in senior management,

whether anticipated or sudden.

Other

Directorships

In order to provide sufficient time for

informed participation in their Board responsibilities:

|

►

|

Directors who also serve as chief executive officers or hold

equivalent positions at other companies should not serve on more than two

other boards of public companies in addition to the Company’s

Board;

|

|

►

|

Other Directors should not serve on more than four other

boards of public companies in addition to the Company’s Board;

and

|

|

►

|

A member of the Audit Committee should not serve on the

audit committee of more than two other public

companies.

|

Directors are required to notify the

Chairman of the Board and the chair of the NCG Committee in advance of accepting

an invitation to serve on another public company board.

Communications with

the Board

Stockholders and other persons interested

in communicating with an individual Director (including the Lead Independent

Director), the Independent Directors as a group, any committee of the Board or

the Board as a whole, may do so by submitting such communication to:

Annaly Capital Management,

Inc.

[Addressee]

1211 Avenue of the Americas

New York, NY

10036

Phone: 1-888-8 ANNALY

Facsimile:

(212) 696-9809

Email:

investor@annaly.com

The Legal Department

reviews communications to

the Directors and forwards those communications related to the duties and

responsibilities of the Board. Certain items such as business solicitation or

advertisements; product-related inquiries; junk mail or mass mailings; resumes

or other job-related inquiries; spam and unduly hostile, threatening,

potentially illegal or similarly unsuitable communications will not be

forwarded.

Stockholders

may

communicate with

any of our Directors,

including the Lead

Indepent

Director

|

|

8

|

|

Annaly Capital Management, Inc.

► 2016 Proxy Statement

|

Table of Contents

|

Corporate Governance at Annaly

|

Certain Relationships

and Related Party Transactions

Approval of Related Party

Transactions

Each of our Directors, Director nominees

and executive officers is required to report all transactions with us in which

they or their immediate family member had or will have a direct or indirect

material interest with respect to us in an annual disclosure questionnaire and

on an on-going basis. We review these annual questionnaires and any interim

reports and, if we determine it to be necessary, discuss any reported

transactions with the entire Board. Other than as discussed in this section,

there were no reported transactions for 2015 and there is no transaction currently

pending for 2016. We do not, however, have a formal written policy for approval

or ratification of such transactions, and all such transactions are evaluated on

a case-by-case basis. If we believe a transaction is significant to us and

raises particular conflict of interest issues, we will discuss it with our legal

counsel, and if necessary, we will form an independent Board committee which has

the right to engage its own legal and financial counsel to evaluate, approve or

ratify the transaction.

Management

Agreement

We have entered into a management

agreement (the “Management Agreement”) with Annaly

Management Company

LLC (our “Manager”). Our management is conducted by our

Manager through the authority delegated to it in the Management Agreement and

pursuant to the policies established by our Board. The Management Agreement was

effective as of July 1, 2013 and was amended in November 2014 and then amended

and restated in April 2016, and may be further amended by agreement between us

and our Manager.

The Management Agreement provides for a

two-year term ending December 31, 2016 with automatic two-year renewals unless

at least two-thirds of our Independent Directors or the holders of a majority of

our outstanding shares of common stock elect to terminate the agreement in their

sole discretion and for any or no reason. At any time during the term or any

renewal term, either party may deliver to the other party prior written notice

of its intention to terminate the Management Agreement no less than one year

prior to its proposed termination date or, but only in the event our Manager is

the terminating party, such earlier date as determined by us in our sole

discretion. There is no termination fee for a termination of the Management

Agreement by either us or our Manager.

The Management Agreement provides that

during its term and, in the event of termination of the Management Agreement by

our Manager without cause, for a period of one year following such termination,

our Manager will not, without our prior written consent, manage any REIT which

engages in the management of mortgage-backed securities in any geographical

region in which we operate.

Pursuant to the terms of the Management

Agreement, we pay our Manager a monthly management fee equal to

1/12

th

of 1.05% of our stockholders’ equity, as defined in the

Management Agreement, for its management services. We incurred approximately

$150.3 million in management fees under the Management Agreement during the year

ended December 31, 2015.

Our

management

fee of 1.05% of

stockholders’ equity

compares

favorably

to the industry

average

|

|

www.annalyannualmeeting.com

|

|

9

|

Table of Contents

>

Board Structure and Processes

Board Leadership

Structure

We carefully considered the leadership

structure of the Board in 2015. While we consider the appropriateness of this

structure regularly, the deliberation is never more critical than in the context

of a leadership transition. Effective September 30, 2015, Ms. Denahan

transitioned from the role of Chief Executive Officer to the newly-created

position of Executive Chairman and Mr. Keyes assumed the role of Chief Executive

Officer. Ms. Denahan continues to serve as Chairman of the Board and Mr. Green

continues to serve as our Lead Independent Director.

We believe that our current leadership

structure, which comprises a separate Chairman of the Board and Chief Executive

Officer, with Mr. Green serving as Lead Independent Director, is effective and

serves the best interests of our stockholders. This structure allows Mr. Keyes

to focus on his duties in managing the day-to-day operations of the Company,

while benefitting from Ms. Denahan’s invaluable knowledge and expertise

regarding the Company’s business. The Lead Independent Director has the

following responsibilities:

Our Lead

Independent

Director

has

significant authority

and

responsibilities

|

|

►

|

Presides at all meetings of the Board in the absence of or

at the request of the Chairman of the Board, including executive sessions

of Independent Directors

|

|

►

|

Facilitates communication between

the Independent Directors and the Chairman of the Board and the Chief

Executive Officer

|

|

►

|

Advises on the selection of

committee chairs

|

|

►

|

Approves the quality, quantity and

timeliness of information sent to the Board

|

|

►

|

Approves Board meeting

agendas

|

|

►

|

Approves Board meeting schedules to

assure there is sufficient time for discussion of all agenda

items

|

|

►

|

Has authority to call meetings of

the Independent Directors

|

|

►

|

Authorizes the retention of outside

advisors and consultants who report directly to the

Board

|

|

►

|

If requested by stockholders,

ensures that he is available, when appropriate, for consultation and

direct communication with major

stockholders

|

We believe that the Board’s independent

oversight function is further enhanced by our policy to hold regular executive

sessions of the Independent Directors without management present and the fact

that our four standing committees are comprised entirely of Independent

Directors.

Executive Sessions of

Independent Directors

Our Corporate Governance Guidelines

require that the Board have at least two regularly scheduled meetings each year

for our Independent Directors. These meetings, which are designed to promote

unfettered discussions among our Independent Directors, are presided over by our

Lead Independent Director. During 2015, our Independent Directors, without the

participation of Board members who are members of management, held five

meetings.

Board and Committee

Evaluations

The Lead Independent

Director

and the NCG Committee are responsible for overseeing an annual

self-evaluation process for the Board. The self-evaluation process seeks to

identify specific areas, if any, that need improvement or strengthening in order

to increase the effectiveness of the Board as a whole

|

10

|

|

Annaly Capital Management, Inc.

► 2016 Proxy Statement

|

Table of Contents

|

Board Structure and Processes

|

and its committees. Each standing

committee of the Board evaluates its performance on an annual basis and reports

to the Board on such evaluation.

Governing

Documents

Code of Business Conduct and

Ethics

We have adopted a Code of Business Conduct

and Ethics, which sets forth the basic principles and guidelines for resolving

various legal and ethical questions that may arise in the workplace and in the

conduct of our business. This code is applicable to our Directors, executive

officers and employees.

Corporate Governance Guidelines

We have adopted Corporate Governance

Guidelines which, in conjunction with the charters of our Board committees,

provide the framework for the governance of our Company.

Where You Can Find Our Governing

Documents

Our Code of Business Conduct and Ethics,

Corporate Governance Guidelines, Compensation Committee Charter, Audit Committee

Charter, NCG Committee Charter and Risk Committee Charter are available on our

website (

www.annaly.com

). We will provide copies of these documents free of

charge to any stockholder who sends a written request to Investor Relations,

Annaly Capital Management, Inc., 1211 Avenue of the Americas, New York,

NY 10036.

Board

Committees

The Board has four standing committees:

the Audit Committee, the Compensation Committee, the NCG Committee, and the Risk

Committee. Each committee is governed by a written charter approved by the Board

and is comprised entirely of Independent Directors, as required under the

existing rules of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) and the NYSE. In addition, each member of the Audit Committee and the

Compensation Committee meets the additional independence criteria applicable to

directors serving on these committees under the NYSE listing rules.

All Board

committees are

composed

entirely

of Independent

Directors

|

The table below shows the current

membership of each Board committee and number of meetings of each committee held

in 2015.

|

Director

|

|

Audit

Committee

|

|

Compensation

Committee

|

|

NCG

Committee

|

|

Risk Committee

|

|

Francine J. Bovich

(1)

|

|

M

|

|

|

|

M

|

|

|

|

Kevin P. Brady

|

|

C

|

|

|

|

M

|

|

M

|

|

Jonathan D. Green

(2)

|

|

|

|

M

|

|

|

|

C

|

|

Michael Haylon

|

|

M

|

|

|

|

|

|

M

|

|

E. Wayne Nordberg

|

|

|

|

M

|

|

C

|

|

|

|

John H. Schaefer

|

|

M

|

|

M

|

|

|

|

M

|

|

Donnell A. Segalas

|

|

|

|

C

|

|

M

|

|

|

|

2015 Meetings:

|

|

5

|

|

4

|

|

2

|

|

4

|

M = Member

C = Chairperson

(1)

Ms. Bovich was appointed to

the NCG Committee in March 2016.

(2)

Mr. Green serves as the

Lead Independent Director. For more details, see page

10

.

|

www.annalyannualmeeting.com

|

|

11

|

Table of Contents

|

Board Structure and Processes

|

|

Committee

|

|

|

Key

Responsibilities

|

|

Audit

|

|

|

►

Recommends to our Board the engagement or termination of

independent registered public accountants

►

Reviews the plan and results of the auditing engagement

with our Chief Financial Officer and our independent registered public

accountants

►

Oversees internal audit activities

►

Oversees the quality and integrity of our financial

statements and financial reporting process

►

Oversees the adequacy and effectiveness of internal

control over financial reporting

|

|

The Board has determined that each

member of the committee is financially literate, and that Messrs. Brady

and Haylon are “audit committee financial experts” under applicable SEC

rules. For more information on the responsibilities and activities of the

committee, see the

“Board Oversight of Risk

” and “

Report of the Audit Committee

” sections of this proxy statement.

|

|

Compensation