Housing Regulator Closes Loan Loophole Used by REITs

January 12 2016 - 4:47PM

Dow Jones News

By Joe Light

A top federal housing regulator on Tuesday shut the door on

mortgage investors who had been using a loophole to access

low-cost, government-backed financing.

The Federal Housing Finance Agency said so-called captive

insurance companies, which insure the risks of the companies that

own them, no longer will be eligible for membership in

government-backed federal home loan banks.

Real-estate investment trusts that invest in mortgages are

normally ineligible for home-loan-bank membership, but over the

past few years have created captive insurers to gain indirect

access to cheap federal funding.

After the announcement on Tuesday, shares of some mortgage REITs

with captive insurers, such as Annaly Capital Management Inc., Two

Harbors Investment Corp. and Redwood Trust Inc., fell between 0.9%

and 5%.

Mortgage experts said the move is likely to make it even more

difficult for some riskier borrowers who don't fit the parameters

of government-backed agencies to get loans.

"It will make some loans to lower-quality borrowers even slower

to come back," said Laurie Goodman, director of the Housing Finance

Policy Center at the Urban Institute, a think tank.

Mortgage rates also could tick up, since the rules would

effectively cut off some investment in mortgage bonds.

On the other hand, some had feared that allowing captive

insurers to get access could put the FHLB system at risk, as other

types of firms like hedge funds and investment banks considered

using the workaround.

"Congress has had plenty of opportunities to give [mortgage

REITs] access to the system, and they haven't done so," said Joseph

Pigg, senior vice president for mortgage finance for the American

Bankers Association, a banking industry trade group.

The 11 regional federal home loan banks advance low-cost loans

to financial institutions such as credit unions and commercial

banks to promote lower mortgage rates.

In shutting captive insurers out, FHFA Director Melvin Watt said

the agency sought to abide by Congress's intent when it passed the

law governing the home loan bank system.

As of the end of September, 40 captive insurers had become

home-loan bank members and as of mid-November, they had outstanding

borrowings of more than $35 billion.

In a statement, John von Seggern, president of the Council of

FHLBanks, said the FHFA's decision "will mean fewer opportunities

for private capital to expand homeownership opportunities for

Americans."

Mortgage Bankers Association President David Stevens said the

rule "removes a vital component of the FHLBank membership which

provides liquidity for the real estate finance market."

On Tuesday, the FHFA did roll back separate provisions that

would have required home-loan bank members to keep a certain

percentage of their assets in mortgages. That move is expected to

help liquidity.

The FHFA first proposed the changes in September 2014. A

bipartisan group of congressmen in October last year introduced a

bill that would require the FHFA to withdraw the proposal, though

that legislation never left committee.

Mortgage REITs that have already used insurers to get home-loan

bank access will get some relief. Those that entered the system

before the September 2014 proposal can stay members for up to five

years, while those that became members after will have one

year.

Michael Widner, an analyst for Keefe, Bruyette & Woods, said

that because of the uncertainty surrounding membership, mortgage

REITs until now have hesitated to rely on the home-loan banks for a

large portion of their funding. In part for that reason, he said he

didn't expect the FHFA's decision to have a near-term impact on

REIT earnings. Mr. Widner said 19 of 24 publicly traded mortgage

REITs had captive insurers that were home-loan bank members.

Annaly CEO Kevin Keyes said mortgage REIT membership in the FHLB

system "enhances both the stability of the residential financing

market and is supportive of the federal government's broader goal

of returning private capital to the U.S. mortgage market."

Write to Joe Light at joe.light@wsj.com

(END) Dow Jones Newswires

January 12, 2016 16:32 ET (21:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

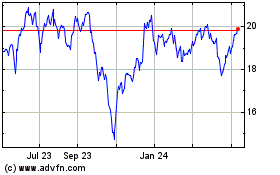

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

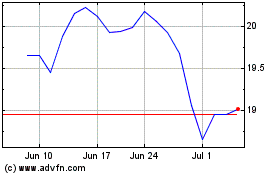

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024