UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

September 16, 2015

Annaly Capital Management, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Maryland

|

1-13447

|

22-3479661

|

|

State or Other Jurisdiction

Of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

1211 Avenue of the Americas

New York, New York

|

|

10036

|

|

(Address of Principal

Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 696-0100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

On September 16, 2015, Annaly Capital Management, Inc. (the "Company") will make a presentation at the 2015 Barclays Global Financial Services Conference in New York, New York. The presentation slides to be used (the “Presentation”) are being furnished as Exhibit 99.1 hereto and are incorporated herein by reference. A copy of the Presentation is also available on the Investor Relations portion of the Company’s website at www.annaly.com.

The Presentation is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The Presentation contains statements that, to the extent they are not recitations of historical fact, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). All such forward-looking statements are intended to be subject to the safe harbor protection provided by the Reform Act. Actual outcomes and results could differ materially from those forecast due to the impact of many factors beyond the control of the Company. All forward looking statements included in the Presentation are made only as of the date of the Presentation and are subject to change without notice. Certain factors that could cause actual results to differ materially from those contained in the forward-looking statements are included in the Company’s periodic reports filed with the SEC. Copies are available on the SEC’s website at www.sec.gov. The Company disclaims any obligation to update its forward looking statements unless required by law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Presentation by Annaly Capital Management, Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANNALY CAPITAL MANAGEMENT, INC. |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

|

|

By:

|

/s/ Glenn A. Votek |

|

| |

|

Name: Glenn A. Votek |

|

| |

|

Title: Chief Financial Officer |

|

| |

|

|

|

Dated: September 16, 2015

Exhibit 99.1

September 2015 Investor Presentation

1 Historically High Relative Yield ü Strongest Balance Sheet ü Highly Scalable Platform ü Outperformed the Market by 346% (4) ü Most Diversified: $2 Trillion Opportunity ü Largest mREIT in the World Annaly Capital Management, Inc. Size Strategy Yield Liquidity Operations Performance Source: Company filings as of Q2 2015. Market data as of September 1, 2015. (1) Economic leverage includes net TBA position. (2) Total stockholders’ equity divided by total assets. (3) Includes cost savings from Annaly externalization and management estimates of operating expense reductions related to other business rationalizations. (4) Market represented by S&P 500. – Dividend Yield: 11.9% – Economic Leverage (1): 5.9x – Capital Ratio (2): 14.2% – Management Fee: 1.05% – Realized Cost Savings (3): ~$135mm – Total Return Since Inception: 533% – Agency – Commercial RE – Market Capitalization: $9.5 Billion – Total Assets: $76 Billion − Non-Agency − Commercial RE − Middle Market Lending Fixed Floating

2 $1.4 $1.5 $3.5 $3.3 $0.2 $1.8 $2.5 $2.6 $1.7 $0.7 $0.6 $2.4 $0.6 $1.3 $2.8 $1.6 $0.6 $0.1 $0.6 $0.4 $3.4 $2.7 $0.7 $0.2 $0.2 $1.6 $6.8 $5.3 $0.4 $0.1 $0.7 $0.3 $0.4 Agency 1 Agency 2 Non-Agency 1 Non-Agency 2 Commercial 1 Commercial 2 Corporates 1 Corporates 2 $26.6 Trillion of Assets Complementary Investment Strategies The current landscape for Annaly’s investment opportunities is broad, diverse and complementary Agency MBS Non-Agency Commercial Debt Corporate Freddie Mac Ginnie Mae Fannie Mae Other UST/Fed Banks Foreign Mutual Funds GSEs Whole Loans Non-Agency MBS Banks & Insurance GSEs REITs Nonfinancial Noncorp Nonfinancial Corp Household Corporate Bonds Financial Institution Bonds ABS C&I Loans Banks Foreign Insurance Asset Managers/ Pension/ Other CMBS Insurance Banks Other Total: ~$5.7 trillion Total: ~$4.2 trillion ($ in trillions) Total Residential Mortgage: ~$9.9 trillion Source: Federal Reserve Flow of Funds, Fed H.8 Report, Inside Mortgage Finance, GSE Filings, SIFMA. Note: As of FY 2014. Represents Assets / Holders. REITs Mutual Funds Foreign Total CRE: ~$3.4 trillion Total Corporate: ~$13.3 trillion Other

3 $1,735 $1,692 $1,498 $1,324 $1,167 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 $1,700 $1,800 2015 2016 2017 2018 2019 Portfolio ($bn) $718 $610 $519 $441 $441 $300 $350 $400 $450 $500 $550 $600 $650 $700 $750 2015 2016 2017 2018 2019 Portfolio ($bn) $2 Trillion Opportunity Annaly is positioned to be a permanent capital solution Federal Reserve(2) Fannie / Freddie(1) CRE Maturities & New Originations(3) Source: JPMorgan, Federal Reserve Flow of Funds Report, Trepp, Goldman Sachs and Mortgage Bankers Association. Analytics provided by The YieldBook Software. (1) Retained portfolios include both MBS and unsecuritized loans and represent 15% annual declines from 2015YE target of $718bn (10% below originally agreed upon target in Senior Preferred Stock Purchase Agreement). (2) Fed holdings and runoff are projected assuming reinvestments continue until September 30, 2016. (3) CMBS Data from RSS as of July 13, 2015. (4) Mortgage Bankers Originations from MBA Commercial/Multifamily Real Estate Forecast from February 2015. GSE Run Off(1) $277bn Fed Run Off $568bn $354 $333 $352 $248 $194 $50 $100 $150 $200 $250 $300 $350 $400 $450 2015 2016 2017 2018 2019 Maturities ($bn) CRE Maturities $1.5tn New Originations(4) $1.7tn M drive: nyprodfs01annaly Investor Pres - ACREG PagesGSE Run Off - Fed Run Off - CRE Debt Maturity.xlsx

4 Agency/Residential Commercial Middle Mkt Lending Financing Benefits & Considerations § Highly Liquid Repo Markets § Term Repo Available ▲ Very Scalable ▲ Huge Market ▲ FHLB as Supplemental Funding ▼ Repo Supply Constraints § FHLB § Securitization § Warehouse Lines § 1st Mortgages ▲ Stable EPS & BV Profile ▲ Better Market Valuation ▼ Long Lead Time § CLO § Warehouse Lines ▲ Unique Economic View ▲ Stable Profile ▼ Idiosyncratic Risk Liquidity Very Strong Low to Moderate Moderate Benefits Higher Low to Moderate Low Fluctuates Fairly Stable Fairly Stable Income Stability BV Impact Capital Allocation Profile > 75% of Capital Up to 25% of Capital

5 Average Market Cap ($bn) $9.5 $2.0 $1.4 $1.9 Yield 11.9% 13.7% 14.1% 8.8% Price / Book 0.82x 0.77x 0.85x 1.03x Leverage (Q2'15) 5.9x 8.0x 4.2x 2.1x ADTV ($mm) $106.4 $22.7 $13.8 $20.2 Total Return(1) 19.3% 15.4% 8.1% 10.8% Annaly vs. the mREIT Sector Annaly operates the largest, most liquid mREIT in the industry Source: Bloomberg and Company filings. Market data as of September 1, 2015. Note: Agency peers include AGNC, HTS, CYS, ARR, CMO and ANH. Hybrid peers include TWO, NRZ, CIM, MFA, IVR, PMT, RWT, MTGE, NYMT, WMC, MITT, AMTG, DX and EARN. Commercial peers include STWD, CLNY, BXMT, ARI, NCT and ACRE. Leverage represents reported economic leverage where available. (1) Total Return since January 1, 2014 per Bloomberg. Agency Peers Commercial Peers Hybrid Peers

6 Average Market Cap ($bn) $9.5 $9.3 $4.9 $5.7 $9.6 $50.3 Yield 11.9% 4.3% 4.2% 7.2% 7.1% 2.1% Price / Book 0.82x 1.93x 2.34x 1.76x 3.86x 1.06x Leverage (Q2'15) 5.9x 5.0x 4.1x 2.8x 1.6x 9.7x ADTV ($mm) $106.4 $17.2 $35.5 $5.0 $41.7 $85.4 Total Return(1) 19.3% 6.9% 17.4% (16.2%) (9.4%) 3.7% Annaly vs. Other Yield Investments Annaly pays a superior dividend yield compared to other income-oriented sectors Note: Market data as of September 1, 2015. Annaly leverage represents economic leverage. Source: Bloomberg, Company filings and SNL Financial. Utilities represents the Russell 3000 Utilities Index. Equity REITs represents the FTSE NAREIT Equity REITs Index. MLPs represents the Alerian MLP Index. Asset Managers represents the averages of OAK, CG, BX, OZM, FIG, JNS, LM, KKR, ARES, and APO. Banks represent the KBW Bank Index. (1) Total Return since January 1, 2014 per Bloomberg. Utilities Equity REITs MLPs Asset Managers Banks

7 78% 109% 144% 90% 51% 468% 40% 132% 85% 100% 200% 300% Annaly Agency Peers Utilities MLPs Equity REITs Asset Managers Banks BAML MBS Index 10 Yr Tsy Volatility Range (1) Core EPS Range 10Yr Tsy Yield BAML MBS Index Yield -- 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% Yield Annaly Has Demonstrated Stability in Core Earnings Over Time… Annaly produced core earnings ranging from $0.25 to $0.35 in 10 of the 12 quarters since QE3 – a range that is much less volatile than average for most other yield oriented asset classes Source: Bloomberg. Quarterly data from Q3 2012 to Q2 2015. Note: Utilities represents the Russell 3000 Utilities Index. Equity REITs represents the FTSE NAREIT Equity REITs Index. MLPs represents the Alerian MLP Index. Asset Managers represents the averages of OAK, CG, BX, OZM, FIG, JNS, LM, KKR, ARES, and APO. Banks represent the KBW Bank Index. (1) Volatility measures the range of earnings since the beginning of QE3 in 2012. Annaly and Agency peers represented by core EPS. Utilities, MLPs, Equity REITs, Asset Managers and Banks represented by EBITDA. QE3 Q1 2015 nyprodfs02fidacCapital MarketsCompetitor ComparisonOther Requests2015.05_Earnings BackupIndex Earnings Growth.xlsx nyprodfs02fidacCapital MarketsCompetitor Comparison2015 Q2Q2 2015 CompCo_ vCurrent.xlsx

8 Source: Bloomberg. Data as of September 1, 2015. Note: Utilities represents the Russell 3000 Utilities Index. Equity REITs represents the FTSE NAREIT Equity REITs Index. MLPs represents the Alerian MLP Index. Asset Managers represents the averages of OAK, CG, BX, OZM, FIG, JNS, LM, KKR, ARES, and APO. Banks represent KBW Bank Index. Munis represent BAML US Muni Index. CMBS represents BAML CMBS Index. IG represents BAML US Corporate Index. HY represents BAML High Yield Index. …While Delivering Premium Yield Annaly’s current yield far outstrips income-oriented market alternatives Current Yields nyprodfs02fidacCapital MarketsRequestsAsset ReturnsAsset Class Projected Returns since 2000 vCurrent.xlsx 11.9% 7.6% 7.2% 7.1% 4.3% 4.2% 3.5% 3.3% 2.6% 2.2% 2.2% 2.1% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Current Yield NLY HY MLPs Asset Managers Utilities Equity REITs IG Munis CMBS S&P 500 10yr TSY Banks

9 Industry Performance Analysis: 5-Year Dividends Paid Source: Bloomberg. Dividend data as of quarter ended June 30, 2015. Market Cap as of September 1, 2015. 2014 total return represents full year from December 31, 2013 to December 31, 2014. Note: Top Dividend Paying Public Companies in the S&P 500 Financials, Property REITs and Mortgage REITs. Legend Top Financial Companies in the S&P 500 By Mkt Cap Mortgage REITs Property REITs nyprodfs02fidacCapital MarketsComp AnalysisExecutive CompNew Dividend Summary_vCurrent.xlsx Dividends Paid ($ millions) Total Return Company Name Market Cap LTM 3 Years 5 Years 2014 Wells Fargo $261,750 $8,572 $22,141 $29,190 24% JPMorgan 227,248 7,364 19,481 26,610 10% Bank of America 162,631 4,834 8,158 11,734 16% Annaly Capital Management, Inc. 9,544 1,209 4,507 8,457 21% Goldman Sachs 82,260 1,567 4,153 8,138 11% US Bancorp 70,916 2,005 5,662 7,525 14% Simon Property 54,151 1,713 4,613 6,639 31% MetLife 53,599 1,729 4,609 6,424 3% Average: $96,317 $3,136 $8,079 $11,527 18%

10 Filing Date Holder Shares Purchased(1) Purchase Price ($)(1) Purchase Value ($) 8/7/2015 Kevin G. Keyes-President; Director 300,000 $10.08 $3,024,000 8/20/2013 Wellington J. Denahan-Chairman of Board & CEO 181,818 $10.96 $1,993,631 5/8/2015 Wellington J. Denahan-Chairman of Board & CEO 198,216 $10.04 $1,991,203 8/8/2014 R. Nicholas Singh-Chief Legal Officer 122,784 $11.46 $1,407,105 11/15/2012 Kevin G. Keyes-President; Director 100,000 $13.90 $1,390,000 11/12/2013 Kevin G. Keyes-President; Director 100,000 $10.43 $1,043,000 8/21/2015 Wellington J. Denahan-Chairman of Board & CEO 100,000 $10.33 $1,033,000 8/13/2014 Wellington J. Denahan-Chairman of Board & CEO 86,837 $11.52 $1,000,362 11/8/2013 Wellington J. Denahan-Chairman of Board & CEO 93,000 $10.68 $993,240 8/8/2011 Kevin G. Keyes-President; Director 50,000 $17.13 $856,500 3/18/2015 Glenn A. Votek-Chief Financial Officer 25,000 $10.65 $266,250 8/17/2015 Glenn A. Votek-Chief Financial Officer 25,000 $10.36 $259,000 Top Annaly Management Purchases Since 2011 Top Insider Purchases Source: SNL Financial as of August 25, 2015. Current market data from Bloomberg as of August 25, 2015. Note: Includes open market purchases of securities. Not inclusive of purchases tied to options or awards granted. (1) In instances where multiple transactions are disclosed in a single filing, share purchases are combined and weighted average price is shown.

11 (100%) 0% 100% 200% 300% 400% 500% 600% 700% Annaly S&P 500 Bloomberg mREIT Index MSCI US REIT Index S&P Financials Berkshire Hathaway The Annaly Track Record Annaly has paid out $13.0 billion in dividends since inception (1) Source: Bloomberg, weekly, October 10, 1997 through September 1, 2015. MSCI US REIT Index performance data begins June 17, 2005. (1) Source: Company filings and Bloomberg. File: N:Capital MarketsMarketingPresentationsBackup Power of Dividends NEW - Mtg REIT Index_v14- SINCE IPO.xlsx Price Appreciation Annaly (20%) 553% 533% S&P 500 106% 81% 187% Bloomberg mREIT Index (82%) 190% 108% MSCI US REIT Index 26% 68% 93% Berkshire Hathaway 346% 0% 346% S&P Financials 15% 51% 66% Dividends Total Return

12 Annaly Investors Have Been Rewarded Over the Long Term Source: Bloomberg. Market data as of September 1, 2015. Note: Total return begins at trough on December 2, 1998. § The lowest NLY has traded was at 0.66x on December 6 th and 7 th , 1998 § The stock traded below book from June 12, 1998 to April 26, 1999, which was 219 trading days § Since 2000, the lowest NLY has traded was 0.72x on June 29, 2015 § The stock has been trading below book since May 9 th , 2013, which has been 591 trading days to date Average: 1.15x nyprodfs02fidacCapital MarketsHojnackiPrice_to_Book _Dec 2013_v1.xlsx Annaly has generated a total return of over 800% since the last time the stock traded at such a steep discount to Book Value (December 1998) 0% 200% 400% 600% 800% 1000% 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x 1.80x 2.00x Total Return Price to Book Ratio P/B Ratio Average Total Return

14 Source: Bloomberg and Company filings. (1) Market Caps for 1998, 2005 and 2015 are as of December 31, 1998, December 30, 2005 and September 1, 2015, respectively. (2) GSE Credit Risk Sharing debt, Callable debt. 1998 2004 / 2005 2015 Key Takeaways Market Cap(1) $104mm $1.4bn $9.5bn § Largest mREIT globally Asset Classes Agency MBS Agency MBS Agency MBS Resi Credit CRE Debt & Equity Corporate Debt § More durable earnings and book value Agency Portfolio Mix 30% Fixed 30% Floating 40% ARMs 30-40% Fixed / Floating 60-70% ARMs 75% Spec Pools 16% Dollar Roll 4% ARMS 4% CMO/Derivatives 1% Other (2) § Agency strategy has evolved over time to better manage various rate environments Hedge Instruments No explicit hedges used Barbelled portfolio No explicit hedges used Barbelled portfolio Pay Fixed/Receiver Swaps Treasuries EuroDollar Futures § More hedging than ever Leverage 10.0x 9.0 - 9.8x 5.9x § Industry low leverage NIM 0.50 - 1.50% 0.70% - 1.70% 1.25% - 2.25% § Reinvestment spreads remain attractive Annaly Evolution

15 2014 – 2015 Agency Strategic Roadmap § Decision to increase duration (via basis risk – addition of specified pools) based on relative MBS valuations Q1: Add Leverage § Decision to increase duration (through interest rate risk) based on Desk’s rate view Q2’14: Swap Unwinds § Hedge against a continued rally; opportunity to rebalance into Futures for TBA trade Q1’15: Swap Unwind § Monetized Specified Pool Payups and transitioned into TBAs for increased liquidity and beneficial financing Q1-15: Dollar Roll § TBAs continued to outperform specifieds in the selloff as demand for call protection waned § Swap unwind trade performed well as the long-end sold off in Q2/Q3 given the front end remained wellanchored and the tenor of the unwinds Q2’15 Performance Q1’14 Q2’14 Q3’14 Q4’14 Q1’15 Q2’15 § Shift to shorter duration, with an improved convexity profile and focus on sectors less susceptible to low/declining rates Q3/Q4: Repositioning ’14 - YTD’15 Annaly Peer Avg Economic Return 16.4% 11.0% Annaly actively manages the portfolio with a long-term perspective to provide an attractive risk-adjusted, stable return to shareholders Source: Bloomberg and Company filings. Note: Economic Return represents Ending Book Value plus Cumulative Dividends, expressed as a percentage of Beginning Book Value. Peer Average includes AGNC, HTS, CYS, ARR, CMO, and ANH.

16 Portfolio Composition (Holdings)(1) Residential Credit Portfolio Resi Credit Investment Overview Diversification Positive Technicals / Fundamentals Attractive Returns § Low correlation profile to Agency book § Spread attractive relative to alternative credit products § Helps better manage interest rate cycles § Given the combination of floating-rate coupons and discounted securities, low sensitivity to interest rate volatility § Housing has stabilized and demonstrates balanced dynamics: § low inventories § price/income ratios § high home affordability § long term home ownership § Lack of new supply in legacy sector § Since the beginning of July, the resi credit portfolio has grown to $547mm § We have focused on our target sectors (RMBS 2.0, Legacy, CRT and NPL/RPL) within the securitization market § Position the portfolio in high carry assets as cash flows should drive returns going forward § Approximate levered yields in low double digits 48% 26% 8% 11% 3% 2% 2% CRT NPL/RPL RMBS 2.0 Prime Sub-Prime Alt-A Re-REMIC Source: Internal. (1) Data as of September 15, 2015.

17 Comparative Performance Annaly has generated an economic return of 16.4% over the last 6 quarter vs. 11.0% for its Agency peers while operating at 70% of the average peer leverage 0.7% 1.9% (0.1%) 0.8% 0.1% (0.4%) 0.6% 1.0% 0.0% 0.4% 0.2% (0.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Annaly Peer Average BV Weighted Source: Company filings. Note: Peer Average includes AGNC, HTS, CYS, ARR, CMO, and ANH. Economic Return per Unit of Leverage

18 9.4% 29.7% (12.4%) (2.0%) 6.0% 21.2% (12.7%) (2.9%) (20.0%) (10.0%) 10.0% 20.0% 30.0% 2004 2008 1H 2013 Q2 2015 NLY Agency Peers Economic Return in Stressed or Volatile Markets Annaly has consistently outperformed during times of volatility; aggregate returns over the period of 25.7% vs. (15.3%) for the S&P 500 (1) Source: Bloomberg and Company filings. Note: Agency Peers represents the market cap weighted average of AGNC, HTS, CYS, ARR, CMO and ANH. (1) Represents cumulative return for period shown at bottom, specifically 4/1/2004 to 6/30/2005, 4/1/2008 to 6/30/2009, 1/1/2013 to 6/30/2013 and 4/1/2015 to 6/30/2015. Economic Return Fed initiates a hiking cycle in June 2004 while funds rate at 1%; added another 225bps of tightening over those four quarters Q2’04 – Q2’05 2.8% (30.5%) 12.6% (0.2%) Increased market volatility related to market uncertainty of rate hike– 10yr tsys sell off 50bps Q2 2015 The economic and financial crisis in 2008 leads to unprecedented volatility across all equity and fixed income markets Q2’08 – Q2’09 May ‘13 Fed signals they would begin tapering back purchases of QE program; rates sell off and MBS spreads widen 1H 2013 S&P 500

19 1.0% 1.5% 2.0% 2.5% 3.0% UST Yield (6.0%) (4.0%) (2.0%) 2.0% 4.0% 6.0% 8.0% 10.0% Q1 Q2 Q3 Q4 Q1 Q2 2014 2015 Conservative Book Value Forecasting Due to active portfolio management, Annaly has consistently outperformed model projections of book value impact based on realized movements in interest rates and mortgage spreads Source: Bloomberg, public filings and internal data. Rate & Spread Forecast Actual BV % Change 10yr Tsy Yield

20 Commercial

21 Apartment, $2,150 Office $1,768 Retail, $1 14 Health Care, $1,007 Warehouse, $426 Other, $528 Current Net Stock of Private CRE Assets (1) (1) Source: Bureau of Economic Analysis (as of 2014). (2) Source: Real Capital Analytics. Volumes annual except for 2015, which is as of June 30, 2015. (3) Source: Haver Analytics. (4) Source: Commercial Real Estate Finance Council. Volumes annual except for 2015, which is as of June 30, 2015. CRE: Large Investable Market—Room for Growth Continued growth for investing opportunities in the U.S. $50.9 $30.0 $44.4 $80.3 $89.9 2011 2012 2013 2014 2015 $258.2 $234.8 $298.1 $362.5 $430.4 2011 2012 2013 2014 2015 CRE Transaction Volume (2) ($ in billions) CMBS Deal Issuance (4) ($ in billions) REITs, $199 CMBS, $631 LifeCos, $373 Banks, $1,698 GSEs, $247 Gov't, $201 Other, $76 Commercial Mortgage Debt Outstanding (3) ($ in billions) ($ in billions) Total: $6.9 trillion Total: $3.4 trillion 37.6% 29.4% 1H Volume Annual Volume 1H Volume Annual Volume

22 Annaly Commercial Real Estate Group Portfolio Whole Loans 14% Mezzanine Loan Investments 29% Preferred Equity 12% Equity 13% AAA CMBS 13% B-Piece CMBS Securities 19% Source: Company filings and internal. Data as of June 30, 2015. (1) Based on percentage of equity invested in ACREG portfolio as a percentage of stockholders’ equity. Whole Loans 10% Mezzanine Loan Investments 38% Preferred Equity 16% Equity 8% AAA CMBS 3% B-Piece CMBS Securities 25% Total Value: $1.74 billion Unlevered Yield: 7.9% Total Invested: $1.31 billion Levered Yield: 9.9% Total Equity: $12.6 billion § ACREG invests across the capital structure ü Whole Loans ü Mezzanine Loans ü Preferred Equity ü Equity ü Securities (AAA CMBS, B-Pieces) § ACREG uses leverage to enhance returns of whole loans, equity and AAA CMBS Asset Value Equity Invested Annaly Book Equity (1) ACREG 10% Agency, NonAgency, Corporate 90%

23 Annaly Commercial Real Estate Group Strategy Intensive credit focus as long-term investors, not traders § Providing capital for acquisitions and refinancings at higher leverage points in the capital structure on real estate with growth potential § Focus on top tier sponsors, operating in good markets with rational business plans, and loan structures that mitigate risk § Maximize returns through conservative financing strategies utilizing syndication relationships, credit facilities and the securitization market § Enhance the current yield of the overall commercial real estate book by investing in assets with attractive current yields, durable income streams and potential upside from appreciation § Executing strategy by making both direct investments and investments with operating partners primarily in: § Grocery-anchored shopping centers § Multifamily § Net Lease Debt Approach – Broad Based Equity Approach – Strategic and Focused

Annaly Capital Management (NYSE:NLY)

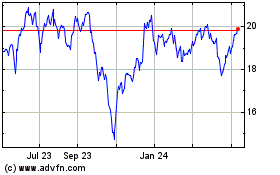

Historical Stock Chart

From Mar 2024 to Apr 2024

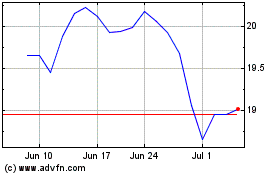

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024