Ahead of the Tape: Nike Can Regain Its Stride After Results -- WSJ

September 27 2016 - 3:02AM

Dow Jones News

By Miriam Gottfried

After weak results on the home court, Nike is playing defense in

North America.

The sportswear giant's revenues in the region decelerated during

its fiscal fourth quarter ended May, coming in flat year over year.

Even after adjusting for a timing shift from last year's West Coast

port delays, that was still a slowdown from the previous

quarter.

Increased competition in the basketball segment from rival Under

Armour was partially responsible. But lower-priced versions of its

LeBron James and Kevin Durant basketball shoes may be helping it

push back.

Accelerating same-store sales reported recently by Foot Locker

and Dick's Sporting Goods bode well for Nike's North American

business. The two retailers purchased 72% and 20% of merchandise,

respectively, from the brand in fiscal 2015. Improvement in North

America and its effect on bolstering Nike's average selling price,

along with conservative guidance for the quarter and a new

partnership aimed at cutting manufacturing costs, could help

investors regain confidence in the company's profit trajectory.

Analysts expect Nike on Tuesday to report fiscal first-quarter

earnings of 56 cents a share on revenue of $8.9 billion. That

compares with per-share earnings of 67 cents on revenue of $8.4

billion in the year-ago quarter. Nike itself said its gross margin

would fall by 1 percentage point in the quarter, driven mostly by

currency effects, and that revenue would climb only mid-single

digits year over year. Many analysts say that guidance sets up an

easily clearable hurdle.

Meanwhile, Nike is working to cut costs. In August it announced

a partnership with private-equity firm Apollo Global Management. As

part of the agreement, a new company was formed to purchase Nike's

existing apparel suppliers in North and Central America. This will

increase manufacturing capabilities in those regions and shorten

lead times.

Granted, Nike's "futures orders," which reflect products

scheduled for delivery, tend to decelerate after the Olympics.

Stronger competition from Under Armour, Adidas and Puma also

remains a risk. But Nike is well aware by now of the need to

develop new products to maintain and grow its share. And its

challenges may already be priced in. At 21.6 times forward

earnings, Nike shares now trades just below their five year average

multiple.

Investors won't have to jump quite so high to score.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

September 27, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

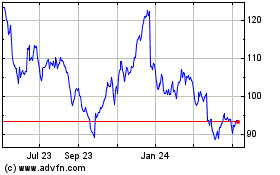

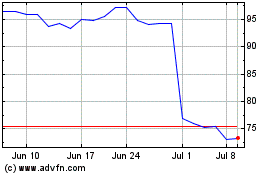

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024