Adidas Extends Winning Streak

April 27 2016 - 5:30AM

Dow Jones News

FRANKFURT—Adidas AG's return to form continued Wednesday as it

raised its guidance for 2016 for the second time in three months on

a leap in earnings.

The world's second-largest sporting-goods company, after Nike

Inc., recorded a 38% rise in net profit to €350 million ($394.9

million), beating analyst expectations. Revenue increased 17% when

adjusted for currency effects.

Adidas said it now expects currency-adjusted sales in 2016 to

grow at a rate of about 15% and net profit at between 15% and

18%.

The company's shares were up 6.4% Wednesday morning, leading the

gainers on the Frankfurt blue-chip index.

The German sportswear maker has been enjoying stellar momentum

recently. In December, departing Chief Executive Herbert Hainer

said he expected 2016 to be a record year for the company.

The recent good news has come at a convenient time for Mr.

Hainer, who is set to leave Adidas in October after 15 years at the

helm.

About a year ago, his situation was quite different.

Due to currency losses in Russia, a general poor performance in

North America and tumbling golf sales, Mr. Hainer had to slash his

ambitious financial targets for 2014 and 2015.

He issued two surprise profit warnings in a year that investors

had expected to be particularly good due to the FIFA World Cup.

Suddenly, activists began raising concerns about his management

skills. Some even demanded his departure.

Mr. Hainer, on the other hand, refused to move. He had learned

from his mistakes, he said at the time. He promised his new game

plan was already under way.

Since then, Mr. Hainer has reshuffled the company's North

American management, boosted its marketing budget, begun developing

local and in-store production facilities, and tried to enhance

brand awareness through collaborations with profiled U.S. athletes

and pop stars.

In the past year, Adidas has been one of the best-performing

companies on the Frankfurt stock exchange. Its profits have risen

every quarter.

Analysts have in recent months pointed to the general growth of

the sporting goods industry when talking about Adidas's numbers,

given that competitors Nike and Under Armour Inc. also have been

delivering strong results.

Bryan Garnier analyst Cé dric Rossi said Wednesday that Adidas's

most recent figures are also a sign of a successful company

strategy.

"Today's numbers suggest that Adidas also has been better at

execution, marketing and launching the right products at the right

time," he said.

Mr. Hainer's efforts even seem to show results in the North

American market, where Adidas had been struggling for decades.

NPD analyst Matt Powell said Adidas's U.S. resurgence is

ongoing. According to NPD figures, the company performed

particularly well in the lifestyle running, classics and casual

footwear segments in March.

"Adidas moves from two years ago are really paying off," Mr.

Powell said.

Write to Ellen Emmerentze Jervell at ellen.jervell@wsj.com

(END) Dow Jones Newswires

April 27, 2016 05:15 ET (09:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

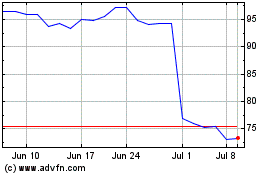

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

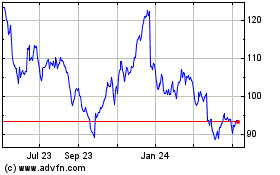

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024