Nike Revenue and Profit Climb -- Update

March 22 2016 - 7:24PM

Dow Jones News

By Sara Germano and Tess Stynes

Nike Inc. posted a 20% jump in quarterly profit in a difficult

retail environment, but its sales growth was slower than expected

and executives cautioned that Wall Street's forecasts may be too

optimistic.

The world's largest sportswear maker said its revenue rose 7.7%

to $8.03 billion for the period ended Feb. 29, slightly below

analyst expectations of $8.2 billion, according to FactSet.

Excluding currency fluctuations, Nike said revenue rose 14%.

Nike has outperformed most apparel makers as it has expanded its

e-commerce offerings and logged strong sales gains in China. On an

earnings call Tuesday, Andy Campion, Nike's chief financial

officer, said "not every dimension of our portfolio will have the

same level of momentum each and every period."

Shares of the company fell 6% in after-hours trading to $60.91.

The stock had risen about 30% in the past 12 months.

The Beaverton, Ore.-based maker of athletic goods last week

unveiled its latest pipeline of technological advancements,

including electronic running shoes that lace at the push of a

button. It also showed a new app that combines Nike's training

software with what it describes as a personalized e-commerce store

that will give members exclusive access to products.

For the quarter ended Feb. 29, Nike reported a profit of $950

million, or 55 cents a share, up from $791 million, or 45 cents a

share, a year earlier. Analysts expected a per-share profit of 48

cents.

Nike said futures orders, which reflect products scheduled for

delivery from March through July, rose 12% on a global basis,

compared with an increase of 2% a year earlier and the 15% growth

from the last quarter. Futures orders are closely watched by

investors as a benchmark for demand for Nike products.

At quarter's end, inventories were $4.6 billion, up 8% from a

year earlier. Nike brand president Trevor Edwards said the

company's high inventories from the holiday period had begun to

"normalize" after Nike worked to clear excess product through its

outlets and third-party retailers.

Nike's quarterly earnings report comes as most of the retail

sportswear industry is facing a crunch, with the bankruptcy filing

of Sports Authority Inc. shaking up the near-term forecast at

Dick's Sporting Goods.

Revenue in North America increased 13%, while sales in its

Greater China segment jumped 23%.

Gross margin was flat at 45.9% as higher average selling prices

and growth in the higher-margin direct-to-consumer business were

offset by negative currency impacts, higher warehousing costs and

efforts to clear inventories in North America.

Nike has used expensive sponsorships to increase its market

share in sports such as soccer and basketball. In the latest

period, Nike increased such spending--called demand creation--by

10% to $804 million.

Write to Sara Germano at sara.germano@wsj.com and Tess Stynes at

tess.stynes@wsj.com

(END) Dow Jones Newswires

March 22, 2016 19:09 ET (23:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

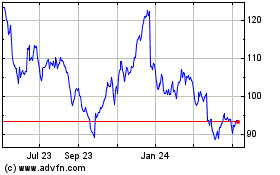

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

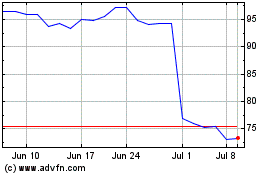

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024