By Suzanne Kapner

Unsold goods are piling up on retailers' shelves, a worrisome

trend that signals weak consumer spending heading into the Black

Friday kick off to the holiday season.

A glut could make it harder for department store chains to hit

their earnings targets in reported results arriving this week. But

it could be a boon for shoppers if higher-than-expected discounts

are needed to clear unsold merchandise.

Nomura and Citi retail analysts on Monday forecast weak

third-quarter results at Macy's Inc. and Kohl's Corp. due to

slower-than-expected sales that had left the pair awash in excess

merchandise at the end of the period. Executives at Michael Kors

Holdings Ltd. and Ralph Lauren Corp., which supply the chains with

goods, earlier said there has been a buildup of inventory at big

department stores.

Chris Peterson, president of global brands at Ralph Lauren, told

analysts last week that inventory at department stores is "a little

bit" elevated, referring to the broader retail industry.

Specialty stores and apparel manufacturers also are experiencing

"a build-up in inventories beyond the natural increase ahead of the

holidays," according to a recent report from analysts at Macquarie

Research. The report named 10 companies where inventory is growing

faster than sales, including Lululemon Athletica, Nike Inc., Under

Armour Inc. and VF Corp.

In an extreme example of the trend, Lululemon said its inventory

jumped 55% in its most recent quarter, compared with a 16% sales

increase, both over the year-earlier period. The company said it

had to restock shelves after having too little inventory a year

ago, and cited West Coast port delays that caused some goods to be

shipped later than planned.

On Tuesday, Cowen and Co. published a report warning "inventory

is above sales growth across retail," and noting that merchandise

levels were bloated at DSW Inc., Dicks Sporting Goods Inc. and

Skechers U.S.A. Inc., among other chains. Under Armour said

accelerated deliveries resulted in its higher inventory levels, but

also aided sales. VF said it stocked up since it plans to open more

retail stores. The other companies weren't available for immediate

comment. On recent calls with investors, some retail executives

cited the easing of congestion at West Coast ports, among other

reasons.

The surplus is building despite a macroeconomic backdrop that is

expected to lay the groundwork for healthy holiday spending. The

unemployment rate is falling and gas prices remain low while

consumer confidence is high. The National Retail Federation

predicts that holiday sales will rise 3.7%, only slightly less than

last year's 4.1% gain.

But as sales have sputtered, some analysts and industry

executives are beginning to question whether those predictions are

too optimistic.

"Sales over the last several months have been softer than many

retailers had anticipated," said Robert Drbul, a Nomura Securities

Co. analyst. "Consumers are not spending a lot of money on apparel

right now. They are buying electronics, cars and items for the

home."

Retailers also are feeling the effects of a downturn in tourism

to the U.S. as a result of the stronger dollar, and unusually warm

weather across much of the country that has curbed shoppers'

appetite for sweaters, coats and other cold-weather goods. Since

most retailers place orders six to nine months in advance, they

have little ability to adjust to short-term changes in demand.

The result is that inventory levels are growing faster than

sales at many chains. The gap isn't as wide as in 2013, when

retailers loaded up on goods they were unable to sell and wound up

discounting heavily to clear their shelves. Still, any buildup is

worrying to analysts, who say it sets retailers up for a difficult

start to the year-end selling season.

"If you've got excess inventory and you have to be promotional

from the outset, that means all the new goods you are bringing in

for the holidays will have to compete with the discounted

merchandise," said Paul Lejuez, a Citi analyst.

Retailers that have done a better job of matching supply and

demand are in a far stronger position. American Eagle Outfitters

Inc., for instance, has made a concerted effort over the past six

months to get lean. Its inventory in the three months ended Aug. 1

increased just 4% despite a 12% gain in sales. As a result,

American Eagle sold more items at full price during its most recent

quarter, according to Adrienne Yih Tennant, an analyst with Wolfe

Research.

Gap Inc., on the other hand, has continued to rely on deep

discounts to clear unsold goods, according to Ms. Tennant. This

past weekend, everything except leather jackets was on sale for 40%

off at its namesake brand. The company said on Monday that it had

made progress clearing out the backlog and that by the end of its

most recent quarter store inventory levels would be even lower than

its previous guidance of "down slightly."

"As expected, October was a very promotional month as we cleared

through Fall collections in anticipation of our new holiday

arrivals and in order to enter the critical season with tight

inventories," a Gap spokeswoman said.

The looming inventory glut is proving a boon for off-price

retailers like Ross Stores Inc. and TJX Cos.'s T.J. Maxx and

Marshalls chains that buy surplus goods that have either been

returned to suppliers or farmed out to jobbers and sold on the gray

market.

"They've been out there with their checkbooks picking off a lot

of very good deals," Nomura's Mr. Drbul said. That will only make

life harder for the full-priced retailers who will now be competing

with the steep bargains offered by the off-price chains.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

November 10, 2015 20:01 ET (01:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

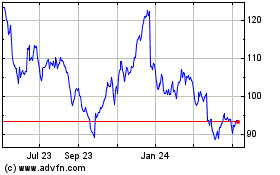

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

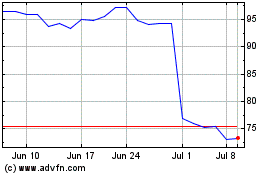

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024