Current Report Filing (8-k)

September 24 2015 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8‑K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

Date of Report (Date of earliest event reported): | September 24, 2015 |

|

| | |

NIKE, Inc. |

(Exact name of registrant as specified in charter) |

|

| |

OREGON | 1-10635 | 93-0584541 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | |

ONE BOWERMAN DRIVE BEAVERTON, OR |

97005-6453 |

(Address of principal executive offices) | (Zip Code) |

| |

Registrant’s telephone number, including area code: | (503) 671-6453 |

| |

NO CHANGE |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

Today NIKE, Inc. issued a press release disclosing financial results for the fiscal quarter ended August 31, 2015. The text of the release is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this Form 8-K:

99.1 Press Release dated September 24, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 24, 2015

|

|

NIKE, INC. (Registrant)

By: /s/ Andrew Campion |

Andrew Campion Chief Financial Officer |

|

| | |

Investor Contact: | | Media Contact: |

Kelley Hall | | Kellie Leonard |

(503) 532-3793 | | (503) 671-6171 |

NIKE, INC. REPORTS FISCAL 2016 FIRST QUARTER RESULTS

| |

• | Revenues up 5 percent to $8.4 billion; 14 percent growth excluding currency changes |

| |

• | Diluted earnings per share up 23 percent to $1.34 |

| |

• | Worldwide futures orders up 9 percent; 17 percent growth excluding currency changes |

| |

• | Inventories as of August 31, 2015 up 10 percent |

BEAVERTON, Ore., September 24, 2015 - NIKE, Inc. (NYSE:NKE) today reported financial results for its first quarter ended August 31, 2015. Diluted earnings per share increased 23% due to broad-based revenue growth, gross margin expansion, selling and administrative expense leverage, a lower effective tax rate and a lower average share count.

“Fiscal 2016 is off to a great start,” said Mark Parker, President and CEO of NIKE, Inc. “Our relentless pace of growth is driven by our proven strategy of putting the consumer first, obsessing innovation in everything we do and leveraging our powerful portfolio. We’re well-positioned to continue to deliver long term growth that is both sustainable and profitable.”*

First Quarter Income Statement Review

| |

• | Revenues for NIKE, Inc. increased 5 percent to $8.4 billion, up 14 percent on a currency-neutral basis. |

| |

◦ | Revenues for the NIKE Brand were $7.9 billion, up 15 percent on a currency-neutral basis driven by growth in every geography and nearly every key category. |

| |

◦ | Revenues for Converse were $555 million, up 3 percent on a currency-neutral basis, mainly driven by strong growth in the United States, partially offset by a decline in the United Kingdom. |

| |

• | Gross margin expanded 90 basis points to 47.5 percent. The increase was primarily attributable to higher average selling prices and continued growth in the higher margin Direct to Consumer (DTC) business, partially offset by higher product input and warehousing costs. |

| |

• | Selling and administrative expense increased 4 percent to $2.6 billion. Demand creation expense was $832 million, down 7 percent, reflecting favorable comparisons against higher investment in support of the World Cup in the first quarter of fiscal 2015. Operating overhead expense increased 10 percent to $1.7 billion, reflecting continued growth in the DTC business and targeted investments in infrastructure and consumer-focused digital capabilities. |

| |

• | Other income, net was $31 million, comprised primarily of net foreign currency exchange gains. For the quarter, the Company estimates the year-over-year change in foreign currency-related gains and losses included in other income, net, combined with the impact of changes in exchange rates on the translation of foreign currency-denominated profits, decreased pretax income by approximately $151 million. |

| |

• | The effective tax rate was 18.4 percent, compared to 21.7 percent for the same period last year, primarily due to an increase in the proportion of earnings from operations outside of the United States, which are generally subject to a lower tax rate, as well as certain non-recurring items recognized in the quarter. |

| |

• | Net income increased 23 percent to $1.2 billion while diluted earnings per share increased 23 percent to $1.34, reflecting strong revenue growth, gross margin expansion, selling and administrative expense leverage, a lower tax rate and a decrease in the weighted average diluted common shares outstanding. |

August 31, 2015 Balance Sheet Review

| |

• | Inventories for NIKE, Inc. were $4.4 billion, up 10 percent from August 31, 2014, driven primarily by an 8 percent increase in NIKE Brand wholesale unit inventories. Increases in average product cost per unit, as well as higher inventories associated with growth in DTC, were largely offset by changes in foreign currency rates. |

| |

• | Cash and short-term investments were $5.4 billion, $829 million higher than last year primarily as a result of growth in net income and collateral received from counterparties as a result of hedging activities more than offsetting share repurchases and higher dividends. |

Share Repurchases

During the first quarter, NIKE, Inc. repurchased a total of 5.5 million shares for approximately $588 million as part of the four-year, $8.0 billion program approved by the Board of Directors in September 2012. As of the end of the first quarter, a total of 86.4 million shares had been repurchased under this program for approximately $6.5 billion, at an average cost of $75.70 per share.

Futures Orders

As of the end of the quarter, worldwide futures orders for NIKE Brand athletic footwear and apparel scheduled for delivery from September 2015 through January 2016 were 9 percent higher than orders reported for the same period last year, and 17 percent higher on a currency-neutral basis.*

Conference Call

NIKE, Inc. management will host a conference call beginning at approximately 2:00 p.m. PT on September 24, 2015, to review fiscal first quarter results. The conference call will be broadcast live over the Internet and can be accessed at http://investors.nike.com. For those unable to listen to the live broadcast, an archived version will be available at the same location through 9:00 p.m. PT, October 1, 2015.

About NIKE, Inc.

NIKE, Inc., based near Beaverton, Oregon, is the world's leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities. Wholly-owned NIKE, Inc. subsidiary brands include Converse, which designs, distributes and licenses casual sneakers, apparel and accessories; and Hurley, which designs and distributes a line of action sports and youth lifestyle apparel and accessories. For more information, NIKE, Inc.’s earnings releases and other financial information are available on the Internet at http://investors.nike.com and individuals can follow @Nike.

| |

* | The marked paragraphs contain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties are detailed from time to time in reports filed by NIKE with the Securities and Exchange Commission (SEC), including Forms 8-K, 10-Q, and 10-K. Some forward-looking statements in this release concern changes in futures orders that are not necessarily indicative of changes in total revenues for subsequent periods due to the mix of futures and “at once” orders, exchange rate fluctuations, order cancellations, discounts and returns, which may vary significantly from quarter to quarter, and because a portion of the business does not report futures orders. |

(Tables Follow)

|

| | | | | | | |

NIKE, Inc. |

CONSOLIDATED STATEMENTS OF INCOME |

|

| THREE MONTHS ENDED | % |

(Dollars in millions, except per share data) | 8/31/2015 | 8/31/2014 | Change |

Revenues | $ | 8,414 |

| $ | 7,982 |

| 5% |

Cost of sales | 4,419 |

| 4,261 |

| 4% |

Gross profit | 3,995 |

| 3,721 |

| 7% |

Gross margin | 47.5 | % | 46.6 | % | |

| | | |

Demand creation expense | 832 |

| 897 |

| -7% |

Operating overhead expense | 1,745 |

| 1,583 |

| 10% |

Total selling and administrative expense | 2,577 |

| 2,480 |

| 4% |

% of revenue | 30.6 | % | 31.1 | % | |

| | | |

Interest expense (income), net | 4 |

| 9 |

| — |

Other (income) expense, net | (31 | ) | 3 |

| — |

Income before income taxes | 1,445 |

| 1,229 |

| 18% |

Income tax expense | 266 |

| 267 |

| 0% |

Effective tax rate | 18.4 | % | 21.7 | % | |

| | | |

NET INCOME | $ | 1,179 |

| $ | 962 |

| 23% |

| | | |

Earnings per common share: | | | |

Basic | $ | 1.38 |

| $ | 1.11 |

| 24% |

Diluted | $ | 1.34 |

| $ | 1.09 |

| 23% |

| | | |

Weighted average common shares outstanding: | | | |

Basic | 854.5 |

| 864.9 |

| |

Diluted | 877.3 |

| 886.2 |

| |

| | | |

Dividends declared per common share | $ | 0.28 |

| $ | 0.24 |

| |

|

| | | | | | | |

NIKE, Inc. |

CONSOLIDATED BALANCE SHEETS |

| | | |

| August 31, | August 31, | % Change |

(Dollars in millions) | 2015 | 2014 |

ASSETS | | | |

Current assets: | | | |

Cash and equivalents | $ | 3,246 |

| $ | 2,303 |

| 41% |

Short-term investments | 2,162 |

| 2,276 |

| -5% |

Accounts receivable, net | 3,288 |

| 3,587 |

| -8% |

Inventories | 4,414 |

| 4,030 |

| 10% |

Deferred income taxes | 377 |

| 348 |

| 8% |

Prepaid expenses and other current assets | 1,751 |

| 996 |

| 76% |

Total current assets | 15,238 |

| 13,540 |

| 13% |

Property, plant and equipment, net | 3,112 |

| 2,895 |

| 7% |

Identifiable intangible assets, net | 281 |

| 282 |

| 0% |

Goodwill | 131 |

| 131 |

| 0% |

Deferred income taxes and other assets | 2,004 |

| 1,673 |

| 20% |

TOTAL ASSETS | $ | 20,766 |

| $ | 18,521 |

| 12% |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

Current liabilities: | | | |

Current portion of long-term debt | $ | 106 |

| $ | 6 |

| 1,667% |

Notes payable | 23 |

| 146 |

| -84% |

Accounts payable | 1,933 |

| 1,970 |

| -2% |

Accrued liabilities | 3,139 |

| 2,441 |

| 29% |

Income taxes payable | 75 |

| 250 |

| -70% |

Total current liabilities | 5,276 |

| 4,813 |

| 10% |

Long-term debt | 1,079 |

| 1,195 |

| -10% |

Deferred income taxes and other liabilities | 1,517 |

| 1,408 |

| 8% |

Redeemable preferred stock | — |

| — |

| — |

Shareholders' equity | 12,894 |

| 11,105 |

| 16% |

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 20,766 |

| $ | 18,521 |

| 12% |

|

|

| | | | | | | | |

NIKE, Inc. |

DIVISIONAL REVENUES |

| | | | % Change Excluding Currency Changes2 |

| THREE MONTHS ENDED | % |

(Dollars in millions) | 8/31/2015 | 8/31/20141 | Change |

North America | | | | |

Footwear | $ | 2,366 |

| $ | 2,183 |

| 8% | 9% |

Apparel | 1,247 |

| 1,104 |

| 13% | 13% |

Equipment | 186 |

| 226 |

| -18% | -17% |

Total | 3,799 |

| 3,513 |

| 8% | 9% |

Western Europe | | | | |

Footwear | 1,128 |

| 1,127 |

| 0% | 19% |

Apparel | 434 |

| 497 |

| -13% | 3% |

Equipment | 79 |

| 89 |

| -11% | 4% |

Total | 1,641 |

| 1,713 |

| -4% | 14% |

Central & Eastern Europe | | | | |

Footwear | 238 |

| 223 |

| 7% | 32% |

Apparel | 133 |

| 135 |

| -1% | 22% |

Equipment | 30 |

| 35 |

| -14% | 7% |

Total | 401 |

| 393 |

| 2% | 26% |

Greater China | | | | |

Footwear | 599 |

| 440 |

| 36% | 36% |

Apparel | 246 |

| 202 |

| 22% | 22% |

Equipment | 41 |

| 37 |

| 11% | 11% |

Total | 886 |

| 679 |

| 30% | 30% |

Japan | | | | |

Footwear | 122 |

| 100 |

| 22% | 47% |

Apparel | 43 |

| 46 |

| -7% | 12% |

Equipment | 14 |

| 14 |

| 0% | 27% |

Total | 179 |

| 160 |

| 12% | 35% |

Emerging Markets | | | | |

Footwear | 670 |

| 628 |

| 7% | 23% |

Apparel | 238 |

| 252 |

| -6% | 9% |

Equipment | 58 |

| 54 |

| 7% | 24% |

Total | 966 |

| 934 |

| 3% | 19% |

Global Brand Divisions3 | 26 |

| 29 |

| -10% | 5% |

Total NIKE Brand | 7,898 |

| 7,421 |

| 6% | 15% |

Converse | 555 |

| 575 |

| -3% | 3% |

Corporate4 | (39 | ) | (14 | ) | — | — |

Total NIKE, Inc. Revenues | $ | 8,414 |

| $ | 7,982 |

| 5% | 14% |

| | | | |

Total NIKE Brand | | | | |

Footwear | $ | 5,123 |

| $ | 4,701 |

| 9% | 18% |

Apparel | 2,341 |

| 2,236 |

| 5% | 12% |

Equipment | 408 |

| 455 |

| -10% | -3% |

Global Brand Divisions3 | 26 |

| 29 |

| -10% | 5% |

1 Certain prior year amounts have been reclassified to conform to fiscal 2016 presentation. These changes had no impact on previously reported results of operations or shareholders' equity. |

2 Fiscal 2016 results have been restated using fiscal 2015 exchange rates for the comparative period to enhance the visibility of the underlying business trends excluding the impact of translation arising from foreign currency exchange rate fluctuations. |

3 Global Brand Divisions revenues are primarily attributable to NIKE Brand licensing businesses that are not part of a geographic operating segment. |

4 Corporate revenues primarily consist of foreign currency hedge gains and losses related to revenues generated by entities within the NIKE Brand geographic operating segments and Converse but managed through our central foreign exchange risk management program. |

|

| | | | | | | |

NIKE, Inc. |

EARNINGS BEFORE INTEREST AND TAXES1 |

| | |

| THREE MONTHS ENDED | % |

(Dollars in millions) | 8/31/2015 | 8/31/20142 | Change |

North America | $ | 1,042 |

| $ | 970 |

| 7% |

Western Europe | 485 |

| 404 |

| 20% |

Central & Eastern Europe | 98 |

| 69 |

| 42% |

Greater China | 330 |

| 218 |

| 51% |

Japan | 36 |

| 11 |

| 227% |

Emerging Markets | 258 |

| 156 |

| 65% |

Global Brand Divisions3 | (624 | ) | (534 | ) | -17% |

TOTAL NIKE BRAND | 1,625 |

| 1,294 |

| 26% |

Converse | 147 |

| 186 |

| -21% |

Corporate4 | (323 | ) | (242 | ) | -33% |

TOTAL EARNINGS BEFORE INTEREST AND TAXES | $ | 1,449 |

| $ | 1,238 |

| 17% |

1 The Company evaluates performance of individual operating segments based on earnings before interest and taxes (commonly referred to as “EBIT”), which represents net income before interest expense (income), net and income taxes. |

2 Certain prior year amounts have been reclassified to conform to fiscal 2016 presentation. These changes had no impact on previously reported results of operations or shareholders' equity. |

3 Global Brand Divisions primarily represent demand creation, operating overhead and product creation and design expenses that are centrally managed for the NIKE Brand. Revenues for Global Brand Divisions are primarily attributable to NIKE Brand licensing businesses that are not part of a geographic operating segment. |

4 Corporate consists largely of unallocated general and administrative expenses, including expenses associated with centrally managed departments; depreciation and amortization related to the Company’s corporate headquarters; unallocated insurance, benefit and compensation programs, including stock-based compensation; and certain foreign currency gains and losses, including certain hedge gains and losses. |

|

| | |

NIKE, Inc. |

NIKE BRAND REPORTED FUTURES GROWTH BY GEOGRAPHY1 |

As of August 31, 2015 |

| | |

| Reported Futures Orders | Excluding Currency Changes2 |

|

North America | 14% | 15% |

Western Europe | 6% | 22% |

Central & Eastern Europe | -3% | 16% |

Greater China | 22% | 27% |

Japan | 12% | 26% |

Emerging Markets | -11% | 6% |

Total NIKE Brand Reported Futures | 9% | 17% |

1 Futures orders for NIKE Brand footwear and apparel scheduled for delivery from September 2015 through January 2016. The U.S. Dollar futures orders amount is calculated based upon our internal forecast of the currency exchange rates under which our revenues will be translated during this period. |

The reported futures orders growth is not necessarily indicative of our expectation of revenue growth during this period. This is due to year-over-year changes in shipment timing, changes in the mix of orders between futures and at-once orders and because the fulfillment of certain orders may fall outside of the schedule noted above. In addition, exchange rate fluctuations as well as differing levels of order cancellations, discounts and returns can cause differences in the comparisons between futures orders and actual revenues. Moreover, a portion of our revenue is not derived from futures orders, including sales of at-once and closeout NIKE Brand footwear and apparel, sales of NIKE Brand equipment, sales from our DTC operations and sales from Converse, NIKE Golf and Hurley. |

2 Reported futures have been restated using prior year exchange rates for the comparative period to enhance the visibility of the underlying business trends excluding the impact of foreign currency exchange rate fluctuations. |

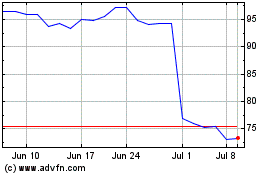

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

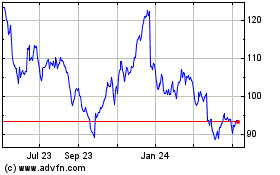

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024