UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

|

| | |

Date of Report (Date of earliest event reported): | June 30, 2015 |

NIKE, Inc. |

(Exact name of registrant as specified in charter) |

| | |

OREGON | 1-10635 | 93-0584541 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

ONE BOWERMAN DRIVE BEAVERTON, OR | 97005-6453 |

(Address of principal executive offices) | (Zip Code) |

| |

Registrant’s telephone number, including area code: | (503) 671-6453 |

| |

NO CHANGE |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

|

r | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

|

r | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

|

r | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

|

r | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d) Election of Directors

Effective June 30, 2015, the Board of Directors of NIKE, Inc. (the "Company") appointed Travis A. Knight to serve as a Director of the Company.

Mr. Knight, 41, is the President and Chief Executive Officer of the animation studio, LAIKA, LLC, which specializes in feature-length films. He has been involved in all principal creative and business decisions at LAIKA since its founding in 2003, serving in successive management positions as Lead Animator, Vice President of Animation, and then as President and CEO in 2009. Mr. Knight has served as Producer and Lead Animator on Academy Award-nominated feature-length films The Boxtrolls (2014), and ParaNorman (2012, for which he won an Annie Award for Outstanding Achievement in Character Animation), and Lead Animator for Coraline (2009). Prior to his work at LAIKA, Mr. Knight held various animation positions at Will Vinton Studios from 1998 to 2002, as a stop-motion animator for television series, commercials, and network promotions. He has been recognized for his work on the Emmy Award-winning stop-motion animated television series The PJs. Mr. Knight serves on the board of directors of LAIKA, LLC. He is the son of NIKE Board Chairman Philip H. Knight.

There was no arrangement or understanding pursuant to which Travis Knight was elected as a director, and there are no related party transactions between the Company and Mr. Knight. Mr. Knight is expected to serve on the Company's Corporate Responsibility and Sustainability Committee and the Executive Committee.

Mr. Knight will participate in the Company's standard director compensation program. The program generally in effect for the Company's current fiscal year ending May 31, 2016 is described in "Corporate Governance - Director Fees and Arrangements" in the Company's proxy statement for its 2014 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on July 25, 2014.

The Company issued a press release on June 30, 2015 announcing the appointment of Mr. Knight. The press release is attached hereto as Exhibit 99.1.

(e) Compensatory Arrangements of Certain Officers

On June 30, 2015, the Compensation Committee (the “Committee”) of the Board of Directors of NIKE, Inc., an Oregon corporation (the “Company”), approved the grant of restricted stock units under the Company’s Stock Incentive Plan (the “RSUs”), to Mark G. Parker, Chief Executive Officer and President of the Company, in view of the Company’s strong performance under Mr. Parker’s leadership and to provide an incentive for Mr. Parker to stay for at least the next five years. The grant, which has a target value of $30 million, provides Mr. Parker the opportunity to earn up to a maximum of 277,727 shares of NIKE Class B Common Stock based on the closing price of the stock on the date of grant. As described below, 60% of the award’s maximum value is based on the Company’s performance.

60% of the award, or a target number of 166,636 shares, is subject to performance vesting based on cumulative revenue growth and cumulative diluted earnings per share (“EPS”) growth over the five-year performance period of fiscal 2016 through fiscal 2020 (the “Performance-Based RSUs”). The performance goals are equally weighted, and both measures exclude the effect of any acquisitions, divestitures or accounting changes. For Mr. Parker to earn the maximum payout for the Performance-Based RSUs (100% of the target number of shares), the Company must achieve a 9% compound annual growth rate (“CAGR”) from fiscal 2015 for cumulative revenues over the five-year performance period, and a 13% CAGR from fiscal 2015 for cumulative EPS. For Mr. Parker to earn a threshold payout of 50% of the target number of shares, the Company must achieve cumulative revenues corresponding to a 7% CAGR, and for EPS, cumulative EPS corresponding to a 9% CAGR. Payout may occur at 25% of the target number of shares if either the revenue or EPS related percentage achievement is less than threshold. Additional shares will be earned pro rata for performance between the threshold and maximum levels. If performance is not achieved at the threshold level for either target, no shares will be earned for the Performance-Based RSUs. The Performance-Based RSUs are also subject to time vesting and will not be earned unless Mr. Parker remains employed with the Company through June 30, 2020. 40% of the award, or 111,091 shares, is subject only to time vesting and will be earned if Mr. Parker remains employed with the Company through June 30, 2020 (the “Time-Based RSUs”).

In addition, the Performance-Based RSUs will become earned and vested at target and the Time-Based RSUs will become 100% vested if a “change in control” of the Company occurs and within two years after the change in control, Mr. Parker’s employment is terminated by the Company without “cause” or by him for “good reason.” Upon Mr. Parker’s death or disability, the Performance-Based RSUs will become earned and vested at threshold and the Time-Based RSUs will become 100% vested. The terms “change in control,” “cause” and “good reason” are as defined in the Company’s current form of Restricted Stock Unit Agreement. Mr. Parker’s award is otherwise subject to the other terms of the Company’s current form of Restricted Stock Unit Agreement, as modified by the Committee to expand the Company’s ability to recoup issued RSUs in the event of breach of confidentiality or violation of other specified obligations to the Company, including breach of any covenant not to compete and non-solicitation or non-disclosure agreement, or material breach of any other agreement with the Company.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this Form 8-K:

99.1 Press Release dated June 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

|

| | |

| | |

| NIKE, Inc. (Registrant) |

| | |

Date: June 30, 2015 | By: | /s/ Hilary K. Krane |

| | Hilary K. Krane |

| | Executive Vice President, Chief Administrative |

| | Officer, and General Counsel |

|

| | | | |

Investor Contact: | | | | Media Contact: |

Kelley Hall | | | | Kellie Leonard |

(503) 532-3793 | | | | (503) 671-6171 |

NIKE, INC. and Phil Knight Announce Ownership and Governance Actions

NIKE CEO Mark Parker Recommended as Future Chairman and CEO as Part of Planned Transition

Travis Knight Joins NIKE Board of Directors

BEAVERTON, Ore., June 30, 2015 - NIKE, Inc. (NYSE:NKE) and its Chairman, Phil Knight, today announced actions that will provide long-term stability in the ownership and governance of the company including transfer of ownership of Phil Knight’s shares to a Limited Liability Company.

Concurrent with today’s announcement, Knight and the NIKE Board of Directors also announced the start of a succession planning process that will conclude in the appointment of NIKE’s next Chairman. Knight has informed the NIKE Board of Directors of his recommendation to have Mark Parker, NIKE’s President and Chief Executive Officer since 2006, succeed him as Chairman. Further, the Company also named Travis Knight as the newest member of NIKE’s Board of Directors.

“For me, NIKE has always been more than just a company - it has been my life’s passion,” said Knight. “Over the years, I’ve spent a great deal of time considering how I might someday evolve my ownership and leadership of NIKE in a way that benefits all of our stakeholders. Today, we have taken a number of important steps that will continue to promote NIKE’s long-term growth.”*

Chairman Succession Planning Process Initiated

Knight and the NIKE Board of Directors announced the start of a succession planning process that will conclude in the appointment of NIKE’s next Chairman, which the Board currently expects to occur sometime in 2016. Knight has informed the NIKE Board of Directors of his recommendation to have Mark Parker succeed him as Chairman. Knight will continue to be actively involved with NIKE well beyond the time he steps aside as Chairman.

Knight said, “I have long felt a great responsibility to provide clarity and certainty for the long-term governance and leadership of NIKE and for my ultimate transition as Chairman. I have worked closely with the NIKE Board in developing this plan and in identifying the most qualified person to serve as my successor in this role. I believe Mark is the best choice to succeed me. He has been an outstanding CEO for the past nine years, and has demonstrated time and again his love for this Company and his clear vision for capturing the tremendous potential NIKE has to innovate, inspire, and drive growth. For myself, I intend to continue to work with NIKE and look forward to contributing to its future well after my chairmanship ends.”*

“Phil founded NIKE to serve athletes,” said Parker. “That vision and inspiration continues to drive our success today around the world. I have been privileged to work with Phil for over 35 years, and NIKE’s exceptional management team and I are committed to building on Phil’s vision to drive the next era of growth for NIKE.”*

Phil Knight’s Transfer of Ownership to Swoosh, LLC

Knight added, “As I announced today, I have created Swoosh to hold the majority of my shares of NIKE Class A Common Stock. Swoosh will itself have a governance structure that is designed to make thoughtful and forward-looking decisions with respect to the ongoing voting and management of those shares. I believe this structure will maintain NIKE’s strong corporate governance, which has focused our management on serving the consumer and pursuing profitable, long-term growth.”

To implement the new ownership structure for Knight’s NIKE Class A Common Stock, the following actions were taken:

| |

• | Knight has formed a Limited Liability Company named Swoosh, LLC, and has contributed 128,500,000 shares of NIKE Class A Common Stock to the entity representing approximately 15% of the combined total outstanding shares of NIKE Class A and Class B Common Stock; |

| |

• | Knight has formed a Board of Directors of Swoosh to serve as its governing body, which will determine how the Class A shares are voted and managed going forward. The Board of Directors will initially have four members, who exercise five votes. |

| |

• | Of the five votes assigned to the Board of Directors of Swoosh, two will initially be held by Knight, and the other three will be held by: |

| |

◦ | Mark Parker, President and CEO of NIKE and a NIKE director since 2006; |

| |

◦ | Alan Graf, Jr., Executive Vice President and CFO of FedEx Corporation and a NIKE director since 2002; and |

| |

◦ | John Donahoe II, President and CEO of eBay Inc. and a NIKE director since 2014. |

| |

• | In the future, Knight may choose to appoint an additional director and assign one or both of his votes to that director. |

A Schedule 13D has been filed by Swoosh with the Securities and Exchange Commission that provides additional details of today’s announcement.

Travis Knight Appointed to Board of Directors

The Company also announced the appointment of Travis Knight to NIKE’s Board of Directors, effective immediately. Knight, 41, is President and CEO of the animation studio, LAIKA, LLC, which specializes in feature films. He has been involved in all principal creative and business decisions at LAIKA since its founding in 2003 and has served as Producer and Lead Animator on Academy Award nominated films The Boxtrolls (2014) and ParaNorman (2012, for which he won an Annie Award, the animation industry’s highest honor, for his character animation work), and Lead Animator on Coraline (2009). Knight was named a “Rising Star of Animation” by Animation Magazine in 2007. Prior to LAIKA, he was recognized for his work on the Emmy Award-winning stop-motion animated television series The PJs and worked on numerous national commercial campaigns during his tenure at Oregon’s renowned Vinton Studios. Knight is currently producing and directing Kubo and the Two Strings, premiering in 2016. He is the son of Phil Knight.

About NIKE, Inc.

NIKE, Inc., based near Beaverton, Oregon, is the world's leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities. Wholly owned NIKE, Inc. subsidiary brands include Converse, which designs, markets and distributes athletic lifestyle footwear, apparel and accessories; and Hurley, which designs, markets and distributes surf and youth lifestyle footwear, apparel and accessories. For more information, NIKE’s earnings releases and other financial information are available at http://investors.nike.com. Individuals can also visit http://news.nike.com/ and follow @Nike.

| |

* | The marked paragraphs contain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties are detailed from time to time in reports filed by NIKE with the S.E.C., including Forms 8-K, 10-Q, and 10-K. |

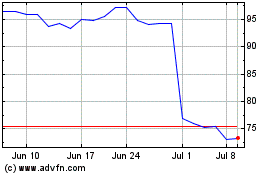

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

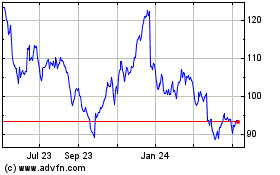

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024