UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| | |

|

| | |

|

| | |

Date of Report (Date of earliest event reported): | March 19, 2015 |

NIKE, Inc. |

(Exact name of registrant as specified in charter) |

| | |

OREGON | 1-10635 | 93-0584541 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | |

ONE BOWERMAN DRIVE BEAVERTON, OR | 97005-6453 |

(Address of principal executive offices) | (Zip Code) |

| |

Registrant’s telephone number, including area code: | (503) 671-6453 |

| |

NO CHANGE |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

r | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

r | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

r | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

r | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On March 19, 2015, NIKE, Inc. held a public telephone call to discuss its financial results for the fiscal quarter February 28, 2015. The transcript of the conference call is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished with this Form 8-K:

99.1 Transcript of earnings release conference call on March 19, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

|

| | |

|

| | |

|

| | |

| NIKE, Inc. (Registrant) |

| | |

Date: March 24, 2015 | By: | /s/ Donald W. Blair |

| | Donald W. Blair |

| | Chief Financial Officer |

| | |

FY 2015 Q3 Earnings Release Conference Call Transcript

March 19, 2015

This transcript is provided by NIKE, Inc. only for reference purposes. Information presented was current only as of the date of the conference call, and may have subsequently changed materially. NIKE, Inc. does not update or delete outdated information contained in this transcript, and disclaims any obligation to do so.

PRESENTATION

Operator:

Good afternoon, everyone. Welcome to NIKE's Fiscal 2015 Third Quarter Conference Call. For those who need to reference today's press release, you'll find it at investors.nike.com. Leading today's call is Kelley Hall, Vice President, Corporate Finance and Treasurer.

Before I turn the call over to Ms. Hall, let me remind you that participants on this call will make forward-looking statements based on current expectations, and those statements are subject to risks and uncertainties that could cause the actual results to differ materially. These risks and uncertainties are detailed in the reports filed with the SEC, including Forms 8-K, 10-K and 10-Q.

Some forward-looking statements concern future orders that are not necessarily indicative of changes in total revenues for subsequent periods due to mix of futures and at-once orders, exchange rates fluctuations, order cancellations, changes in the timing of shipments, discounts and returns which may vary significantly from quarter-to-quarter. In addition, it is important to remember a significant portion of NIKE, Inc.'s continuing operations, including equipment, NIKE Golf, Converse and Hurley, are not included in these futures numbers.

Finally, participants may discuss non-GAAP financial measures, including references to wholesale equivalent sales. References to total wholesale equivalent sales are only intended to provide context as to the overall current market footprint of the brands owned by NIKE, Inc. and should not be relied upon as a financial measure of actual results.

Participants may also make references to other nonpublic financial and statistical information and non-GAAP financial measures. Discussion of nonpublic financial and statistical information and presentations of comparable GAAP measures and quantitative reconciliations can be found at NIKE's website, investors.nike.com.

Now I would like to turn the call over to Kelley Hall, Vice President, Corporate Finance and Treasurer.

Kelley Hall, Vice President, Treasury and Investor Relations:

Thank you, operator. Hello, everyone, and thank you for joining us today to discuss NIKE's fiscal 2015 third quarter results. As the operator indicated, participants on today's call may discuss non-GAAP financial measures. You will find the appropriate reconciliations in our press release, which was issued about an hour ago, or at our website, investors.nike.com.

Joining us on today's call will be NIKE, Inc. President and CEO, Mark Parker; followed by Trevor Edwards, President of the NIKE Brand; and finally, you will hear from our Chief Financial Officer, Don Blair, who will give you an in-depth review of our financial results. Following their prepared remarks, we will take your questions. [Operator Instructions] Thank you for your cooperation on this.

I'll now turn the call over to NIKE, Inc.'s President and CEO, Mark Parker.

Mark Parker, President & Chief Executive Officer, NIKE, Inc.:

Thank you, Kelley, and hello, everyone. Well, we delivered another strong quarter in Q3. Revenues grew 7% to $7.5 billion; gross margin increased by 140 basis points to 45.9%; and diluted earnings per share increased 19% to $0.89.

We were able to deliver results like these for the quarter by leveraging the power of the NIKE portfolio. Over the last 3 months, the macro environment has become increasingly volatile. Foreign currency headwinds have intensified, product input costs continued to fluctuate and the political landscape is evolving in many countries around the world. This is the environment in which all multinational companies now operate, and NIKE is not immune to it.

The difference for NIKE, however, is that we see this as an opportunity to create further separation in the marketplace. Our globally diverse portfolio of geographies, categories, brands, product types and distribution channels gives us a distinct competitive advantage. By going deep into the business, we are able to see opportunities to serve the consumer and drive growth despite the choppier landscape. This surgical approach to finding new dimensions of growth ensures we capture the full potential of our brands around the world. And that includes driving strong growth in the areas of our business that are already well established such as Western Europe, China, North America in footwear, as well as businesses such as Women's, Young Athletes, Apparel and e-commerce where we are accelerating development. These are just a few examples of the dimensions of our business where we are continuing to identify further opportunities to expand our reach and drive growth.

And we do this while maintaining a disciplined approach to investing in those opportunities with the highest potential for return so we can drive growth and manage risk over the short and the long term. This complete offense is how we can continue to deliver sustainable, profitable growth. As you have seen from NIKE in the past, we know how to operate in a challenging environment better than anyone, and you will continue to see us leverage the breadth and depth of our global portfolio to do just that going forward.

At NIKE, everything we do starts with the consumer. It's our obsession with serving the consumer that sharpens our focus and drives our growth. The expectations of our consumers are evolving rapidly, and we're able to meet and often exceed those expectations because we know the athlete. By working with athletes at all levels, from the elite to the everyday, we have a level of knowledge and insight that is unmatched in our industry. And we are able to use the insights that we gain to create new product and services that drive new levels of performance innovation across all of our categories.

The pace of innovation at NIKE has never been faster, and our pipeline has never been more robust. We're leveraging new tools and processes to unlock significant advancements every day. However, the starting point for innovation remains the same, and that's the athlete. Many of our greatest innovations have come from going deep into an individual sport to solve a unique athletic need. And let me highlight a few examples in our footwear business from Q3.

In Running, the LunarTempo is a shoe that merges speed with cushioning for a great ride over the longer runs; and then the newly redesigned Air Max 2015, our most flexible, comfortable Air Max to date. We're seeing very strong response from consumers, and I'm tremendously excited about the pipeline of products in the Running category.

In Basketball, with his 10th signature shoe, Kobe Bryant returned to a low top and once again pushed the limits of design. In addition to great consumer reaction to the Kobe X, players around the NBA are wearing it for its great traction and cushioning.

And in Football, the Nike Vapor Untouchable cleat was created to provide the game's fastest players with power and precision on the field. We've had tremendous feedback on the performance and the look of the Untouchable from the athletes at both the NFL and the collegiate level.

And in Men's Training, the Nike MetCon 1, a first of its kind high-intensity training shoe that has been incredibly popular in the marketplace, and it's just a hint at what's to come in Men's Training.

These innovations each deliver a new level of performance for the athlete. However, we only truly realize our potential as a company when we continue to leverage those breakthroughs across multiple sports and categories. It's what you've seen from us time and time again. Many of our biggest footwear platforms such as Lunar and Free, Flyknit and Nike Air were initially created to solve a specific athlete need in a specific category. But now they serve as the foundation for our greatest products across multiple categories.

Similarly, in apparel, platforms such as Aeroloft and Dri-FIT, both originally introduced in Running, set the standard for thermoregulation and moisture management in multiple categories and product classifications. And our Nike Pro collection continues to drive energy in all sports, especially our Pro Bra and Tight collections for women.

Individually and collectively, our product innovation is breaking new ground across all of our categories. And as excited as we are about the technical details of these products, what's most important is how well our products are resonating with athletes and consumers, which we clearly saw in the quarter.

Innovation fuels more than product at NIKE. It also drives how we do business and how we connect with the world. In the case of our digital ecosystem, NIKE is growing a connected community of athletes all over the world. This community is seamlessly engaged with the brand not only by accepting the world's best product, but by fueling activity and improving their athletic lives. We know it's not enough to simply to interact. True connections require depth and richness. And in Q3, we strengthened these digital connections and added new dimensions to our digital ecosystem.

So how does NIKE continue to expand our digital innovation? Well, we linked experience to commerce. We released the Nike SNKRS app during the NBA All-Star Game in New York, letting consumers on mobile devices see, share and buy our most coveted footwear products. And we broadened access. We announced several partnerships with the Nike+ Running app to let runners connect to Nike+ experiences to even more of their devices and fitness equipment. And we glow -- we grow our global reach. We added more sharing capabilities to our Nike+ Training Club app. We expanded it to 18 languages. It's work like this that will continue to power our digital experiences for years to come.

At the same time, in Q3, we continued to see tremendous growth in our e-commerce business as NIKE.com was up 42% in the quarter. Traffic and conversion both increased. And for the first time in our history, mobile traffic exceeded desktop traffic, helped in part by the introduction of our SNKRS app. And going forward, we will continue to invest in this area to best serve our consumer.

Additionally, we'll continue to drive growth in our e-commerce business by increasing consumer access to product customization. In Q3, for example, we brought exclusive new Flyknit options to NIKEiD, giving consumers the ability to take customization to yet another level. Overall, we continue to see tremendous potential for growth in our e-commerce business as we leverage our digital platform to continue to deliver premium products, services and experiences for our consumers.

As we head into the final quarter of fiscal 2015 and beyond, I continue to see tremendous opportunity for NIKE around the world. You've heard me say many times that I see more potential for growth going forward than at any time in our history, and I certainly continue to believe that today.

While the current macro environment is challenging, it is not new to us. We have a highly experienced and aligned management team that knows how to continue to deliver profitable growth by turning challenges into opportunities. It's what we've always done in the past, and it's what you can expect from us going forward.

Thanks. And now here's Trevor.

Trevor Edwards, President, NIKE Brand:

Thanks, Mark. Q3 is a great example about how the strength of the NIKE Brand drives growth around the world, even in a more challenging macro environment. As Mark mentioned, the impact of foreign exchange has intensified, and Don will talk more about our work to mitigate those impacts. As I normally do, I'll speak to our results on a constant-currency basis. While we consider the impact of foreign exchange as part of the overall management of our business, currency-neutral results provide a clearer view of the underlying operational performance.

So let's take a look at the numbers. The NIKE Brand revenue grew 11% with strong growth in Western Europe, Greater China and the Emerging Markets, as well as in our Sportswear and Basketball categories. NIKE Brand DTC revenue increased 29%, driven by all concepts in all geographies. And as Mark mentioned, we also saw continued strong growth in NIKE.com. And global futures are up 11%, reflecting the strong growth despite comparisons to the prior year, which included strong World Cup demand. Excluding the impact of the World Cup, we estimate future orders would have grown in the mid-teens.

As Q3 growth -- our Q3 growth is a result of the deep relationships we've built with consumers through the category offense. Our laser focus on individual consumers strengthens our -- those connections, whether they are online, at retail or at live experiences. NIKE's consistent focus on serving the consumer through the lens of their chosen sports helps enable continued profitable growth.

What's more, only NIKE has the global scale to execute this consumer-focused strategy in markets around the world. As we further drive the category offense globally, we continue to prove our ability to connect our brands to consumers and build compelling retail destinations that elevate, segment and differentiate the markets around the globe.

To see the category offense in action, let's first take a look at 2 of our key categories: Basketball and Running. Both NIKE and the Jordan Brand continue to deliver the absolute best in Basketball, with innovative products and groundbreaking experiences. Q3 was the 14th consecutive quarter of double-digit growth for the Basketball category. And as the game expands around the globe, we continue to see amazing opportunity for growth in this important category. Q3 was a great example of the combined power of NIKE Basketball and Brand Jordan to create excitement and energy in the marketplace. I was in New York City for the NBA All-Star weekend, and it was clearly an electric experience for hundreds and thousands of basketball fans who took part. All over the city, NIKE and Brand Jordan executed retail concepts and consumer experiences that showcase basketball's unique culture and passion.

NIKE Basketball invited fans to visit the Zoom City Arena, offering them a chance to play on the first digital LED court in the United States. Brand Jordan transformed the Penn Pavilion into an interactive consumer experience where fans could relive Michael Jordan's iconic game-winning shots. And both brands created elevated retail executions at NIKETOWN at House of Hoops locations with Foot Locker and at pop-up locations around the city. All of this combined to deliver a truly one-of-a-kind experience for our consumers, something only NIKE can do.

In addition to delivering highly engaging consumer experiences, we continued to lead with innovative product. In the quarter, Kyrie Irving, one of the most exciting young players in the game today, became the newest signature athlete for NIKE with the launch of the Kyrie 1. Offering superior traction with the Hyperfuse construction, the Kyrie 1 is an excellent example of how we never stop improving. Also, seeing huge consumer response was the Kobe X, the most coveted shoe yet for the popular Kobe line.

Next, let's talk about Running. As you know, Running is our heritage and our largest performance category. The NIKE Brand continues to resonate with runners, fueled by the Nike+ Run Club and grassroots running events around the world. And the Running category continues to deliver strong results in key geographies, including Europe, China and the Emerging Markets. That said, core footwear within the Running category isn't performing as well as we would like, particularly in North America. As a result, we are highly focused on delivering new innovation into our core product offerings to ensure we continue to serve our consumer with the absolute best.

With our premium performance products, we continue to see strong sell-through for footwear styles like the Air Max 2015, the LunarTempo and the Air Zoom Pegasus 31. In addition, our premium performance apparel continues to drive growth, and we saw strong consumer response to the styles such as the new Epic Lux and the Epic Run Tights.

As part of our Amplify strategy, we leverage the heritage of our Running into Sportswear to deliver great style for consumers who appreciate the aesthetic of running. This is our complete offense in the Running category. And Running-inspired Sportswear performed exceedingly well in the quarter, led by strong consumer response to the Roshe platform and the Roshe Flyknit in particular. The Air Max 1 Collection also had strong performance in the quarter.

Looking ahead, we will continue to build on what's working in Running as we further strengthen our business to accelerate growth. We are excited to have a robust, continuous pipeline of groundbreaking footwear innovations, which we will bring to the market over the next 18 months. And we will also leverage the momentum in platforms such as the Lunar, Flyknit and our Air Max to continue to drive growth. Overall, Running continues to be a tremendous source of innovation and inspiration for NIKE and one of our key long-term growth drivers.

Let's talk about a few of our key geographies. First, North America, which delivered 6% revenue growth in the quarter. Consumer demand continues to be very strong in North America as most key categories grew and futures were up 15%. That said, revenue growth was somewhat lower than expected in the quarter due to challenges related to the port congestion on the West Coast, which escalated late in our fiscal quarter 3. As a result, some shipments originally expected for delivery in Q3 were delayed. Looking ahead, we expect revenue growth in quarter 4 to accelerate as the flow of product through the supply chain begins to normalize. However, we do expect it will take a few quarters to return to fully normalized product flow as there are a significant number of containers to be cleared from the ports on the West Coast.

To be very clear, there continues to be tremendous momentum for the NIKE Brand in North America, thanks to innovative product that continues to resonate with our consumers. And the category offense continues to help us deliver segmented and differentiated retail destinations with our wholesale partners in our stores and online. Executions such as the Fieldhouse with Dick's Sporting Goods and the House of Hoops with Foot Locker performed very well in the quarter, as did our DTC business, which delivered revenue growth of 15% and continued strong growth on NIKE.com. Overall, we continue to see tremendous potential for growth in North America as demand remains strong and our brand continues to resonate with consumers.

In Western Europe, we're seeing broad-based demand with revenue growth of 21% in the quarter. We saw growth across all categories and territories with particular strength in AGS, the U.K. and Southern Europe. A critical part of our successful growth strategy in Western Europe is the work we've done to transform the marketplace along the category offense. We continue to develop more differentiated retail executions with our wholesale partners in our stores and online while continuing to bring innovative products into the marketplace.

The JD Omni-channel store at Trafford and the Pro Direct digital store in London are a great example of powerful avenues we have to differentiate the NIKE Brand. In addition, we continue to see strong performance in our stores, with DTC up 40% and strong growth on NIKE.com. It remains early days yet, but the market growth we're seeing in nearly every territory, coupled with the market share gains, prove the success of our efforts in Western Europe.

Let's turn to the Emerging Markets where revenue grew 12% in the quarter, with 6 of the 9 territories growing double-digits. We also saw strong growth coming from Sportswear, Running and Basketball. While we feel good about the third quarter results in the Emerging Markets, we do anticipate some choppiness going forward. Futures declined 6% for the period, in part the result of tough comparisons to the strong World Cup orders in the prior year. We are also taking proactive steps to reduce the supply to ensure a healthy marketplace in Mexico and Brazil, two of our largest territories in the Emerging Markets.

In Mexico, as we have discussed on previous calls, inventory levels in the marketplace were higher than we would like, largely a result of transition issues with our distribution center in early fiscal 2014. We've made significant progress in clearing the excess inventory in Mexico, and we expect to return to more normalized levels by the end of fiscal year '15. To ensure a healthy pull market, we've also worked proactively with our wholesale partners to adjust the flow of product into the marketplace, which contributes to the year-over-year decline in future orders for the Emerging Markets.

In Brazil, Q3 revenue growth was modest as volatile macroeconomic conditions made for a challenging operating environment. The NIKE Brand continues to be incredibly strong in Brazil, and we see great opportunity to reposition this critical market for sustainable, profitable growth. As we successfully did in North America, China and Western Europe, we will leverage the category offense to segment and differentiate our points of distribution. In doing so, we will increase the productivity and profitability of the marketplace. We will accomplish this by elevating the retail experiences for our consumers and presenting our products in more compelling and premium execution. As we start to reset the market in Brazil, we are working proactively with our wholesale partners to pace the flow of product into the market. As with Mexico, this is also contributing to the year-over-year decline in the Emerging Markets futures orders.

We are confident that our actions in Mexico and Brazil will help us to reach our goal of operating a healthy pull market in these important territories. And long term, we remain confident that the Emerging Markets geography will drive significant growth for the NIKE Brand.

Lastly, in Greater China, we continue to see the benefits of our strategy to reset the marketplace. Q3 revenue growth was 17%, and futures are up 23%. This reflects the continued strength of the NIKE Brand in the market along with our efforts to execute a more consumer-focused distribution strategy. Our wholesale partners have continued to see strong comp store growth and expanded profitability in the doors that have been re-profiled. This success aligns with the results we've seen in our own retail doors. Additionally, inventory levels in China continue to be healthy, letting us better serve the consumer and maintain a strong pull market. Given the success we've seen in the marketplace over the last several quarters, we are now focused on evolving from a reset strategy to a new normal of how we do business in China. As we look ahead, we continue to see tremendous opportunity for growth in this key geography.

Ultimately, I feel great about the results we delivered in Q3. And while we will continue to face macroeconomic challenges going forward, we know there's tremendous momentum in the marketplace. And we know the NIKE Brand continues to resonate with consumers all around the world, and we know our relentless focus on serving the consumer will keep us in the lead. We know all of this, and because we do, I personally could not be more excited about what the future holds.

Thanks. Now here's Don.

Don Blair, Executive Vice President & Chief Financial Officer:

Thanks, Trevor. In his opening remarks, Mark spoke about the tremendous macroeconomic volatility we've seen in recent months. In particular, over the last 90 days, the U.S. dollar has appreciated against virtually every other major currency. There's no question that this has and will continue to have an impact on multinational companies, including NIKE. We see these times as opportunities to distinguish ourselves, both in how we deliver for our consumers and how we deliver for our shareholders. The power of our brands and our portfolio, the strength of our balance sheet and the experience of our management team all give us the ability to navigate these conditions in a way few companies can.

We've always run our business to deliver appropriate near-term profitability, invest for long-term growth and manage risk. That approach hasn't changed. That doesn't mean this is business as usual. It does mean we'll use all the levers of our business to deliver profitable growth even in the face of strong macro headwinds. We'll continue to make focused investments to build strong brand connections, deliver innovative products and services and create compelling retail experiences for consumers. We'll leverage our strength with consumers to grow revenues and expand gross margins. We'll apply innovation and operational discipline to increase cost productivity. And we'll continue to deliver increasing profitability and cash returns to shareholders. We've been here before, and we're confident we have the business capabilities and momentum to deliver growth and profitability even under difficult economic circumstances.

With that introduction, I'll now recap our Q3 results. Third quarter reported revenue for NIKE, Inc. increased 7%. On a currency-neutral basis, revenue increased 13%, in line with our expectations, as the NIKE Brand grew 11% and Converse increased 33%. Also on a currency-neutral basis, NIKE Brand futures orders grew 11%, driven by a 6% increase in average selling price and a 5% increase in units. The growth reflects continued strong demand across the NIKE Brand portfolio led by double-digit growth in North America, China and Central and Eastern Europe.

From a category perspective, the growth reflected strong demand across multiple categories, including Sportswear, Basketball and Running. This overall growth is especially noteworthy given last year's robust orders in advance of the 2014 World Cup, which particularly affected futures orders in Europe and the Emerging Markets. As Trevor mentioned earlier, excluding the impact of World Cup, we estimate futures would have increased at a mid-teens rate. On a reported basis, futures grew 2%, reflecting weaker international currencies, particularly the euro, reais, ruble, pound and yen.

Third quarter diluted EPS increased 19% to $0.89, driven by revenue growth, gross margin expansion and a lower share count, partially offset by higher SG&A investments and a higher tax rate. In Q3, the impact of FX was insignificant as the impact of the stronger dollar was largely offset by our currency hedging programs.

Gross margin expanded 140 basis points in the quarter. The increase was driven by a continued shift to higher-margin products, partially offset by higher product input and warehousing costs.

Third quarter demand creation was flat to last year as higher investments in digital and sports marketing were largely offset by lower advertising expenses due to changes in the timing of product launches. Q3 operating overhead increased 15%, reflecting growth in our higher gross margin, higher-cost DTC business, investments in operational infrastructure and continued investments in digital, including consumer engagement.

The Q3 effective tax rate was 24.4%, a 190 basis point increase versus the prior year quarter, primarily due to the impact of tax expense on intercompany transactions, partially offset by the retroactive reinstatement of the U.S. R&D tax credit.

At the end of Q3, NIKE, Inc. inventories were up 12%, primarily driven by unit growth in North America and Europe. As Trevor mentioned earlier, our North America business was affected by congestion at West Coast ports, reducing Q3 revenue growth and increasing Q3 inventories. While we anticipate the flow of product will soon begin to return to normal, we expect we will have somewhat higher inventory levels and lower margins in North America for the next few quarters as we work to rebalance supply and demand in the market.

Now let's take a look at some of the performance highlights by segment. In North America, Q3 revenue increased 6% on both a reported and currency-neutral basis, led by Basketball and Sportswear. Direct-to-Consumer revenues grew 15%, driven by the rapid expansion of NIKE.com, 7% comp store sales growth and the addition of new stores. On a reported basis, Q3 EBIT for North America grew 14%, driven by revenue growth, gross margin expansion and SG&A leverage.

In Western Europe, Q3 revenues increased 21% on a currency-neutral basis. The growth was broad-based as nearly every territory increased at a double-digit rate and every key category grew, led by double-digit growth in Sportswear, Men's Training -- sorry, Women's Training and Running. Despite the weaker euro, reported Q3 revenue for Western Europe increased 10% and EBIT increased 22%, driven by revenue growth, gross margin expansion and SG&A leverage.

In Central and Eastern Europe, Q3 revenue increased 7% on a currency-neutral basis. Most territories delivered double-digit revenue growth, but revenues in Russia, Israel and Turkey declined. Nearly every key category expanded, led by Sportswear, Women's Training and Running. Reported revenue for CEE declined 10% and EBIT fell 35%, reflecting significantly weaker currencies, most significantly in Russia.

In Greater China, Q3 revenues increased 17% on a currency-neutral basis, led by double-digit growth in Sportswear, Basketball and Running. On a reported basis, Q3 revenue for China increased 15% while EBIT increased 7%, driven by strong revenue growth and gross margin expansion, partially offset by investments in demand creation and DTC.

In the Emerging Markets geography, Q3 revenue grew 12% on a currency-neutral basis, driven by strong growth in all territories except Brazil, which grew at a single-digit rate, and Mexico, which declined mid-teens. From a category perspective, the growth was led by Sportswear, Running and Basketball. On a reported basis, Emerging Markets revenue increased 2% and EBIT increased 3%, reflecting significant currency headwinds.

As Trevor discussed, we're seeing the results of our work to clear excess inventory in Mexico. At the same time, we're taking action to realign the Brazil marketplace along the lines of the category offense. We're confident these steps will set us up to continue to deliver sustainable, profitable growth in these territories and to the Emerging Markets geography as a whole.

At Converse, Q3 revenue grew 33% on a currency-neutral basis, boosted by the acceleration of Q4 shipments in advance of a major systems go live. The balance of the growth was driven by continued strength in North America, the conversion of several European markets to direct distribution and strong growth in DTC. On a reported basis, Converse revenue increased 28% and EBIT increased 23%, driven by revenue growth, partially offset by higher investments in infrastructure, DTC and demand creation to enable long-term growth.

We've seen strong momentum in our business year-to-date, and we expect that momentum to continue into Q4 and beyond. That said, FX headwinds have intensified significantly in the last 90 days, especially from the erosion of the value of the euro. While our hedging programs have significantly reduced the impact of FX on profitability, we cannot eliminate all currency risk.

Based on what we know today, we expect the following for Q4 and full year FY '15. We expect constant dollar revenue growth for Q4 in the low-double digits, with reported revenue growth 8 to 9 points lower, reflecting the significantly stronger dollar. For the full year, we expect constant dollar revenue growth in the low-teens, with reported revenue growth 4 to 5 points lower.

We now expect Q4 gross margin to be flat to up about 25 basis points as the impact of higher closeouts, particularly in North America and Europe, largely offset the ongoing benefits of mix shifts to higher-margin products and businesses. For the full year, we now expect gross margin expansion of about 100 basis points.

We expect demand creation to decrease at a high-single digit rate for Q4 as we anniversary investments in World Cup marketing in Q4 of FY '14. For the full year, we now expect demand creation to grow at a mid-single digit rate.

We expect operating overhead to grow at a high-single to low-double digit rate for Q4 and at a mid-teens rate for the full year, reflecting higher DTC expenses, as well as investments in digital innovation and new operating capabilities.

We continue to expect the effective tax rate for FY '15 will be approximately 24.5%.

Looking ahead to FY '16, we haven't yet completed our planning but can provide some initial thoughts. We expect to see continued strong momentum in our business and anticipate currency-neutral revenue growth for FY '16, slightly above our high-single digit target range. When combined with the impact of our ongoing work to expand gross margins and ongoing investments in our growth strategies, we would have expected EPS growth at or above our long-term mid-teens target.

That said, the appreciation of the U.S. dollar against nearly every other major currency will reduce next year's reported revenue, gross margin and profit. Assuming exchange rates remain in about the same range as they are today, we expect FY '16 reported revenue growth in the mid-single digits and EPS growth in the high-single to low-double digit range. Currency markets remain volatile, so we will provide an update on our FY '16 expectations on our Q4 earnings call.

On our last conference call, I spoke about one of our NIKE maxims, and today, I'd like to highlight another. We are on the offense. Always. As Mark said at the outset, we view a challenging operating environment as an opportunity to create further competitive separation. By staying focused on consumers and leveraging our strengths, we're confident we can continue to deliver strong financial performance and create value for our shareholders even in a challenging macroeconomic environment.

We're now ready to take your questions.

QUESTION AND ANSWER SECTION

Operator: Kate McShane, Citigroup Inc.

<Q – Kate McShane >: Don, I just want to say congratulations to you on your announcement.

<A – Don Blair>: Thank you.

<Q – Kate McShane >: I have 2 questions today. One of was there was a very big article this week or late last week from Adidas talking about the NBA sponsorship and walking away from that. How would you view that opportunity? And can you just walk us through just sponsorship in general and how you're thinking about it for the future?

<A – Mark Parker>: Well, with regards to the NBA, there's really nothing further to share at this time. We are, as you would imagine, always talking to the leagues, clubs and federations, but really nothing more to report on any specific conversations with the NBA sponsorship. But as you know, the relationships that we have with leagues, clubs, federations and, of course, the athletes are key. We gain the insights from the athletes that really ultimately drive the innovation that fuels NIKE's Brand strength and our growth as a company. So that's always been the case. I can't imagine that it wouldn't be going forward. We're selective in the choices that we make in terms of where we think we have the greatest opportunities. And we look at those opportunities in a very complete sort of holistic way. Very, very happy with where we are in Basketball and feel like there's tremendous potential going forward. Trevor talked about Jordan and NIKE Basketball, incredible performance in the quarter and really strong outlook going forward. So we expect that our relationships with athletes, and at the collegiate level and the professional level, continue to be really an important part of that.

<Q – Kate McShane >: Okay, great, thank you. And then my second question is on the supply chain. As we see faster speed to market from other apparel companies, can you talk about how you view this opportunity, how quickly the supply chain can be refined to address this?

<A – Kelley Hall>: Kate, are you talking about the congestion at the West Coast ports?

<Q – Kate McShane >: I'm sorry, no, more of a longer-term strategy. I think a couple of retailers have indicated that they're looking for more freshness in the market. As you see a lot more speed to market from other manufacturers, I wondered if that was something that NIKE talked about and if there was any opportunity within the supply chain to address that.

<A – Don Blair>: Well, absolutely, Kate. We have made a number of different investments over time. And we continue to do that both in terms of how we operate our supply chain and more closely tied the timing of production and shipping all the way through to the final consumer, so certainly on that front. We've also, as you know, done a lot of work in the innovation space around how we manufacture product and how we design and develop it. For example, on the NFL, we've had to do some very different approaches to make sure that we're able to respond very quickly to changes in demand, whether it be for specific teams or specific athletes. And that goes all the way to the manufacturing revolution type of investments we've made around technologies like Flyknit. So we are putting a lot of money and a lot of resources against how our supply chain evolves to increase speed and make sure we deliver to consumers as quickly and as innovatively as we can.

Operator: Matthew Boss, JP Morgan

<Q – Matthew Boss>: Great quarter. So there's a lot of talk about Flyknit marquee basketball price points. But can you touch on the mid-tier channel, the segmentation strategy you guys have, particularly any product innovation for us to watch and just kind of how you think about pricing power in that channel?

<A – Trevor Edwards>: Yes, it's -- obviously, we continue to make sure that we continue to focus our pricing strategy, certainly, around ensuring that we give great value to our consumers. So it's always a balance of price to value with the consumer. Our ability to bring new innovation allows us the ability to command certainly a premium price. And certainly, our brand strength does that, too. So obviously, one area that we talked about, which was the -- in the Running business, we talked certainly about the core and our ability to make sure we continue to stay focused on bringing more innovation there. Our Basketball business is very strong at the moment. And we feel it will continue to be strong because we have an incredible pipeline of new innovations that we keep bringing into the marketplace. So obviously, as you saw when we brought the Kyrie Irving -- the KYRIE shoe into the marketplace, we're just seeing tremendous response to those products. So we continue to feel, again, very confident about our ability to keep the excitement in the Basketball category while continuing to serve all the various segments, whether you're coming through the House of Hoops like at Foot Locker or you work in certainly more of a mid-tier account.

<A – Mark Parker>: Yes, I just want to quickly add that our innovation agenda is really about bringing a complete offense, which means across the categories, across the product types and up and down the price point spectrum. So that's really important to us. We have a major focus on elevating the state of innovation in our core product, and I think you'll see that coming through the pipeline here in the quarters ahead; very excited about that part of NIKE. But certainly, innovation is not reserved for the upper price point premium product. It runs up and down the price spectrum, and that's a very, very important part of our growth strategy going forward.

<Q – Matthew Boss>: Great. And then so we've seen a clear top line and bottom line inflection really over the last 12 to 18 months. Mark, I'm curious when you take a step back, what do you think's been the largest enabler in the organization here as we've seen this inflection? And as we think about the category offense, what do you think -- what's the best way to think about the potential next leg of opportunity?

<A – Mark Parker>: In terms of the category offense?

<Q – Matthew Boss>: Yes, I mean, just largely, I'd be curious as you think about what's really changed in the organization to drive both the top and bottom line inflection that we've seen over really the last year to 2 years here.

<A – Mark Parker>: Well, the category offense, just touching on that for a second, is really driving deeper insights into the marketplace, which really, as you know, drive the innovation, which creates the product, which drives growth for us. And it's not just the product innovation. It's also the insights in the consumer and consumer cultures, making sure the brand is resonating, we're relevant, we're connected. I think it's not so much a difference from where we've been. We're refining our ability to be highly creative and innovative but also really disciplined and operating in a much higher level across the various dimensions of the business. We have a management team here that is very much aligned, very experienced. We never take our success for granted. We're always looking for ways that we can improve, which is really important to me and I think NIKE's success to date. But we are probably our own biggest critic. But I think our ability to innovate and our ability to drive operational excellence at the same time is just -- it's never been at the level it is today, and I'm actually quite proud of that.

Operator: Omar Saad, Evercore ISI

<Q – Omar Saad>: I actually wanted to ask my first question about the manufacturing revolution in the context of currency. They have been -- you and the industry largely have been producing in Asia and markets where the currencies are tied to the dollar, and the dollar, as you said, has seeing unprecedented strength against all other major currencies. Is now the time to kind of accelerate the process of maybe pulling manufacturing out of some of these markets and taking manufacturing to the end markets and using some of the automated technologies to allow yourself to produce in markets -- in the end markets where the costs will be aligned, at least from a currency perspective, where the sales are? Just your thoughts around that, if this changes the equation there.

<A – Don Blair>: Well, one of the things that I made a reference to this in the prepared remarks, Omar, is that when we implemented our trading company 4 or 5 years ago, one of the things that we did is we started deconstructing our payments to the factories into a basket of currencies as opposed to 1 currency, which lets us get natural offsets to some of the currency exposures. So we're getting some of the benefit that you're talking about here of matching sourcing currencies and selling currencies even within our existing structure. The second thing is that we've adjusted -- or we do adjust payments to the factories on the basis of how those currencies move. So we are getting some offsetting sourcing benefits right now from the fact that currencies in a lot of our sourcing countries are weakening. So that helps us also net down our foreign exchange exposure. With respect to your overall premise of trying to make sure that our manufacturing is closer both in proximity and time to where the product is sold, that is absolutely part of the strategy from a consumer standpoint. So I think when you look at the financial side of it, we're getting some of the benefits that you're describing through the way we've set up our trading company. And that's not stopping us from keeping the pedal down on driving manufacturing revolution because we think there's a huge consumer benefit to doing that as well.

<A – Mark Parker>: We definitely see the opportunity. The innovation agenda is really helping to create some efficiencies and opportunity to automate the manufacturing process, which ultimately will allow us to source more broadly down the road. And as Don said, that's a big part of our agenda.

<Q – Omar Saad>: That's really helpful. And then a follow-up. Don, as you head into retirement, there's a lot of complex things going on in the global markets and currencies and the trading company that you set up. Mark also, how do you feel about the transition? Can you talk a little bit about the transition? Don's been there a really long time, obviously knows the business extremely well. Can you help us understand why we shouldn't be concerned about the transition going on in the CFO position? Thanks.

<A – Don Blair>: Well, let me take the first cut at that. First of all, rumors of my departure are premature here because I will still be in this role through the end of July. So you're not quite rid of me yet. I am tremendously excited about the next chapter in my life, but I'm also extraordinarily excited about the prospects for NIKE and have tremendous confidence in both the management team as well as my successor, Andy Campion. Certainly, Mark can speak for himself on that. But you're not quite rid of me yet, and I feel real excited about it.

<A – Mark Parker>: Well, since you brought it up, I'll just say that Don's impact here has been absolutely tremendous through the years. I personally have nothing but incredible respect for Don and the impact that he's made at NIKE. I wasn't going to go here. It's a little premature, as Don said. But I will say that I'm also incredibly confident in Don's successor early into Fiscal '16. Andy Campion has -- is really a seasoned NIKE veteran, and he's been under the tutelage of Don and the incredible financial leadership team here at NIKE. And I have tremendous confidence in Andy's ability to take the reins and continue the momentum that Don's helped create for us going forward. More on that as we move forward.

<Q – Omar Saad>: Thanks guys, great quarter. Don, congratulations on your retirement.

<A – Don Blair>: Thanks, Omar.

Operator: Robby Ohmes, Bank of America Merrill Lynch

<Q – Robby Ohmes>: So my 2 questions. First, Trevor, you mentioned in your comments the core footwear in Running in North America not performing quite as well as you guys would like. I was wondering if you might share with us sort of more what is going on there. Is it a fashion shift? Is this a product presentation? Or what are some of the things that we should be looking for that could get that going again? And then the second question is just as you look over the next year or so in Europe, the sort of need and ability to raise prices over there to offset all the FX changes and how you guys are thinking about that?

<A – Trevor Edwards>: Okay. Certainly, Robby. The -- I think the first thing I want to just maybe communicate is that Running -- our brand continues to really resonate with runners in North America. And one of the things I want to do is maybe unpack a little bit about how we view the business. And we always talk about what we say is the amplified offense, which really gives you a greater view of the marketplace. And so when you take a look at it, you have the performance segment, you have the core segment, and you have the Running-inspired segment. And so if you break those down, in the performance segment, we're seeing tremendous success of the new parts that we've been bringing to marketplace. So we -- whether you take the Air Pegasus 31 or the Max 2015 or any of those products, they're doing really, really well. And so we feel obviously very, very confident about that. As I mentioned, in the core footwear, we think there's opportunity for us to do better in that zone. And so as Mark said, we're going to continue to bring more innovation and strengthen that part of the business. The other dimension is the Running-inspired business, which I mentioned, which are things like the Roshe, which really speak to more the aesthetic side or certainly people who like the aesthetic for the style component of Running. And that's doing really well. So all in all, the Running business core performance is where we see some challenges, but the rest of the business really continues to do really well. In addition, the apparel is also doing really, really well in the marketplace. So we feel we're connected with runners in a great way. Lastly, I would say that I'm very confident about the innovations we're going to continue to bring in the marketplace over the next 18 months. We have a robust pipeline. So I'm really excited about doing that and making sure that we continue. Futures are actually up 15%. So we feel confident about the Running business and its impact in the marketplace.

<A – Kelley Hall>: Robby, just to clarify, futures are up 15% for North America. Futures are also strong in both footwear and apparel for the total Running category globally.

<Q – Robby Ohmes>: Great. And then...

<A – Don Blair>: And to your second question -- go ahead, Robby.

<Q – Robby Ohmes>: Yes. Back to Europe. Yes, yes Europe, just pricing increases and how much of that is maybe, Don, in some of the guidance, the preliminary guidance you gave us.

<A – Don Blair>: Yes, just the first piece would be the way we approach these things, which is when we think about managing the business on a long term and how we move all the levers in the business. So just because the euro has gone down dramatically doesn't mean we're going to try to get all of that back with pricing in Europe. And we're going to pull all the levers to deliver against our goals. We do have in our expectations for FY '16 that we will continue to migrate consumers to premium. We're continuing to manage mix. And if you look at the way our business has performed over the last few years, I think we've been very successful in moving average price points higher, and we would expect to do that. What I wouldn't look for is trying to get all of a very big move in currency back in the near term with huge price increases in any one piece of geography. We play for the long term.

Operator: Bob Drbul, Nomura

<Q – Bob Drbul>: Don, congratulations. Best of luck.

<A – Don Blair>: Thank you.

<Q – Bob Drbul>: And maybe I guess the 2 questions that I have, the first one is with the U.S. business like with some of the challenges, I think you called out the Running pieces of it. But would you attribute any of the challenges in the U.S. business this quarter to cannibalization or potential cannibalization given the big increase that you've generated on the Direct-to-Consumer piece?

<A – Trevor Edwards>: No, I wouldn't. I said that we continue to see great momentum in North America. And as I mentioned earlier, the 15% futures growth continues to give us confidence about the business in North America. Obviously, we do have -- our DTC business is growing, but we're also growing very well and we have a great relationship with our wholesale partners. So we feel very confident about the way the business is growing and how the brand continues to resonate with consumer. The demand for the brand is really high in North America and actually around the world.

<Q – Bob Drbul>: Okay. And then a question on the futures with the reported period. Can you just talk about like the first half of the order period versus the second half? And was it stronger in the second half or in the first half? Like how can we think about that?

<A – Don Blair>: Futures are a little stronger in the second half of the window.

<Q – Bob Drbul>: Got it, okay. And then just the last question is what do you guys have the -- at UAB in your brackets?

<A – Mark Parker>: Not going to go there.

Operator: Lindsay Drucker Mann, Goldman Sachs

<Q – Lindsay Drucker Mann>: I wanted to ask about your Women's apparel or just the Women's business in North America. You've had a couple of very high-profile initiatives, some shifts on sponsorship and marketing. And then also, we've seen a number of the Training Club shop-in-shops in Macy's. Can you give us an update on your progress in Women's apparel and maybe some of the specific things you have in the pipeline for the next few quarters?

<A – Trevor Edwards>: Okay, yes. Our Women's business, I'm obviously very excited about the progress in our Women's business. Our Women's business really across not only North America, but really around the world, continues to grow at a really rapid pace. In fact, it's outpacing our Men's business. And our strategy to really focus on the run, train and live component of the business, every dimension is actually growing, both footwear and apparel. As well as some of the things that we've done certainly around the community work with the services that we're providing, they're also doing really well. So it really is a case of every dimension of this is actually working really well. So we're really excited. Some of the things to really point to, whether it's the Epic Lux Tights, the bras that we've just recently launched, some of the great footwear, all of those things are doing really, really well both in our doors, in dotcom as well as with our wholesale partners. So we feel really, really pleased about the progress.

<Q – Lindsay Drucker Mann>: Great. And just a quick maybe housekeeping item. I'm sorry if you answered this already. But beyond the port delays, were there any other factors that drove the disconnect between your North America sales versus what futures orders suggested they might be in the quarter?

<A – Don Blair>: Yes, we also had some weather-related delays in the South. There were some ice storms down there. So we lost some shipping and so on. So there's quite a bit of supply chain noise in Q3, which, as we said in the prepared remarks, we do expect that's going to sort out over the next few quarters. But as Trevor said, demand extraordinarily strong in North America, futures up 15%, so feeling really good about the underlying strength of the business.

Operator: Jim Duffy, Stifel

<Q – Jim Duffy>: First, Don, congratulations on the well-deserved pending retirement.

<A – Don Blair>: Thank you, Jim.

<Q – Jim Duffy>: A couple other questions. E-commerce growth has been a standout. I know it's also been also a big area for investment. As we look into Fiscal '16, is that business at a point where we can lever some of those investments? Or do you expect the investments there to continue to drag on the profitability?

<A – Don Blair>: Well, first thing I would say is the profitability is growing faster than the revenue. So we're continuing to drive both top line and bottom line on e-commerce. So number one is this has been a winner both from a growth and a profitability standpoint. The second thing is we are going to continue to invest in digital. We believe that's where the consumer is and is going. And that's where our brand is and is going, and so we're going to continue to invest there. But from an economic standpoint, it's been a very positive driver for business, both top and bottom line.

<Q – Jim Duffy>: Great to hear. And then next question on China. Sales turning nicely, but the profit growth in the quarter lagged. Is that simply a function of timing of investments? Or is there some broader influence of the repositioning in the market?

<A – Trevor Edwards>: No, I really -- I think from the China perspective, obviously, we're very pleased with the continued growth. No, none of the -- it's probably more just at this point in time, but I would -- it's not something that we would envision over the long term.

<A – Kelley Hall>: Well, thank you, everyone, for joining us, and we'll look forward to talking to you on our Q4 call.

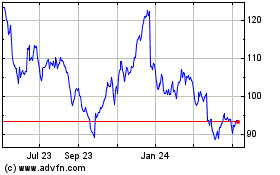

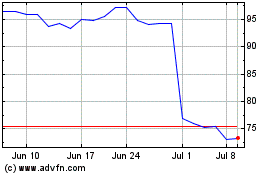

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024