Notice of Exempt Solicitation. Definitive Material. (px14a6g)

May 18 2016 - 12:56PM

Edgar (US Regulatory)

May 17, 2016

Please

WITHHOLD

support from

Directors John Yearwood, John Kotts, James Crane, Howard Wolf, Anthony Petrello, Dag Skattum, and Michael Linn

at the Nabors Industries (NYSE: NBR) Annual Meeting on June 7, 2016.

Dear Nabors Industries shareholder:

We believe there is an urgent need for a robust revitalization of Nabors’ board due to the following deficiencies:

-

The ongoing failure to address shareholder concerns:

Nabors’ long-standing history of

inadequately responding to, or totally disregarding majority shareholder votes has

gained it a special notoriety among investors. This includes persistently re-nominating

directors who have previously been rejected by shareholders and refusing to adopt

majority supported governance reforms. Indeed, over half of the current slate of

nominees failed to receive majority support last year and the board has once again

refused to adopt the proxy access model that has received majority support for four

years running.

-

The pervasive executive compensation problems:

A substantial pay for performance

misalignment remains at Nabors, despite the company receiving majority opposition to

its Executive Compensation Plan five out of the last six years.

-

The extreme insularity of the board:

The board is comprised only of white males, almost

all of whom are based in Houston.

Accordingly, we urge you to join us in withholding support for the re-election of all members of the board at the upcoming Nabors Shareholders’ Meeting. Ultimately, this weak board has proved itself inept at responding appropriately to majority votes; it is more than time for new board members to restore accountability to shareholders. Adding urgency to this are the acute challenges facing the oil and gas drilling sector combined with Nabors’ lower than peer returns on capital over the past three years.

The CtW Investment Group works with union sponsored pension funds to enhance long-term shareholder returns through active ownership. These funds have $250 billion in assets under management and are substantial Nabors Industries shareholders.

The board continues to ignore its shareholders.

Last year, Messrs. Yearwood, Wolf, Crane, and Linn all failed to receive majority support for their re-elections, and yet they remain on the board. In fact, Mr. Yearwood has not received majority support for his re-election since 2012 and Mr. Linn since 2013.

The Nabors Board has ignored majority votes on shareholder proposals to adopt proxy access for years. Last year, a proxy access proposal passed with 67% support and yet Nabors failed to adopt it. In fact, this same proposal – to adopt a bylaw allowing shareholders (either individually or as a group) that own at least 3% of shares for a minimum of 3 years to nominate multiple director candidates using the company’s proxy card -- has been on the ballot and received majority support every year since 2012. The company did adopt a policy allowing proxy access for a single candidate nominated by individual holders of at least 5% of Nabors shares. This is obviously a much weaker version than the model that the majority of shareholders have supported for the past four years. In fact, only three shareholders meet this ownership threshold and only two of them have held the shares for the required three year period. The board’s refusal to add the stronger proxy access provision to its bylaws, further exemplifies its blatant disregard for the wishes of Nabors shareholders.

Nabors suffers from pervasive compensation problems.

Nabors has had long-standing problems with its executive compensation plan. In fact, the majority of votes cast were in opposition to the executive compensation plan every year from 2011 through 2014. Last year, after some modest pay reforms in 2014, including an increase in disclosure and a decrease in CEO pay, the board was finally able to muster a majority in favor of its compensation report. In 2015, however, CEO Petrello’s compensation jumped up to $27.6M, a $13M increase from 2014, despite weak performance.

According to compensation research firm, Equilar, Nabors suffers from an extensive misalignment between pay and performance. Equilar ranks the pay-for-performance failure at Nabors worse than 99 percent of companies in the Russell 3000: while three-year TSR is at the 38

th

percentile of its peer group, the three-year CEO target pay is at the 100th percentile and nearly double the next highest.

The board suffers from insularity and lacks diversity.

The Nabors board is extremely insular for a large, international company, which provides drilling and rigging services in 22 countries around the world. Seven out of eight directors are based in Houston. Furthermore, the board is without any gender or racial diversity. As of 2014, 81% of S&P 1500 had at least one female in the boardroom. Currently, only seven companies in the S&P 500 have no women on the board. Nabors’ board is also an outlier when it comes to racial diversity; ISS calculates that 56% of the S&P 1500 and 79% of S&P 500 companies had at least one non-Caucasian board member at the end of 2015.

We, like many investors, believe that diversity in the boardroom leads to healthier debates, better decision making, and greater adaptability to change. Several studies have found a positive link between company performance and greater board diversity. Most recently, a study by MSCI found greater Return on Equity at companies with significant gender diversity among board members.

1

In addition, research conducted by the Credit Suisse Research Institute, which examined the performance of 2,360 companies globally over a six year period, found that the share price performance at companies with some female participation on their boards outperformed companies that lacked any female representation.

2

Another study conducted jointly by Rutgers and Iowa State Universities found that the percentage of women and minorities on boards of directors is positively associated with financial indicators of firm performance.

3

1

“Women on Boards: Global Trends on Gender Diversity on Corporate Boards,” MSCI. November 2015

2

“Gender Diversity and Corporate Performance,” Credit Suisse Research Institute, August 2012.

3

"Board of Director Diversity and Firm Financial Performance," Corporate Governance: An International Review, Vol. 11, pp. 102-111, Erhardt, Niclas L., Werbel, James D. and Shrader, Charles B., Rutgers School of Management and Labor Relations and Iowa State University Department of Management and Marketing, April 2003

We urge you to oppose the re-elections of all of the members of Nabors’ board.

As shareholders, we must send the board a clear message at this year’s shareholder meeting on June 7

th

that we are exasperated by the board’s insular composition and record of unresponsiveness to significant shareholder votes. Given the gravity of the disregard for majority shareholder votes and the persistent pay problems the board must be reconstituted with a more diverse, independent group of directors. Therefore, we urge you to withhold support for the re-elections of all of the entire Nabors Board.

Please contact my colleague Emma Bayes at

emma.bayes@changetowin.org

with any questions.

Dieter Waizenegger

Executive Director, CtW Investment Group

This is not a solicitation of authority to vote your proxy. Please DO NOT send us your proxy card as it will not be accepted.

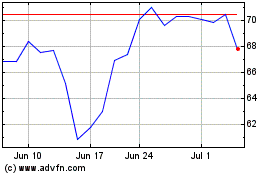

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

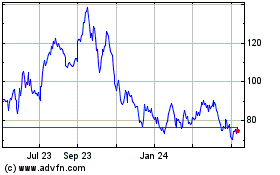

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Apr 2023 to Apr 2024