Current Report Filing (8-k)

September 09 2015 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) September 9, 2015

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in its charter)

|

Bermuda |

|

001-32657 |

|

98-0363970 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 Bermuda |

|

N/A |

|

(Address of principal executive offices) |

|

(Zip Code) |

(441) 292-1510

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On September 9, 2015, Mr. William Restrepo, Chief Financial Officer of Nabors Industries Ltd., will make a presentation to certain investors. Attached hereto as Exhibit 99.1 are slides that will be presented at that time.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Investor Presentation |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NABORS INDUSTRIES LTD. |

|

|

|

|

|

|

|

Date: September 9, 2015 |

By: |

/s/ Mark D. Andrews |

|

|

|

Mark D. Andrews |

|

|

|

Corporate Secretary |

|

|

|

|

3

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Investor Presentation |

4

Exhibit 99.1

|

|

Barclays CEO Conference Energy-Power September 2015 Presenter: William Restrepo Chief Financial Officer |

|

|

Forward-Looking Statements We often discuss expectations regarding our markets, demand for our products and services, and our future performance in our annual and quarterly reports, press releases, and other written and oral statements. Such statements, including statements in this document incorporated by reference that relate to matters that are not historical facts are “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the U.S. Securities Exchange Act of 1934. These “forward-looking statements” are based on our analysis of currently available competitive, financial and economic data and our operating plans. They are inherently uncertain, and investors must recognize that events and actual results could turn out to be significantly different from our expectations. Factors to consider when evaluating these forward-looking statements include, but are not limited to: • • • • • • • • fluctuations in worldwide prices and demand for natural gas and oil; fluctuations in levels of natural gas and oil exploration and development activities; fluctuations in the demand for our services; the existence of competitors, technological changes and developments in the oilfield services industry; our ability to complete, and realize the expected benefits of, any strategic transactions; the existence of operating risks inherent in the oilfield services industry; the possibility of changes in tax laws and other laws and regulations; the possibility of political or economic instability, civil disturbance, war or acts of terrorism in any of the countries in which we do business; and general economic conditions including the capital and credit markets. • Our businesses depend, to a large degree, on the level of spending by oil and gas companies for exploration, development and production activities. Therefore, a continued decrease in the price of natural gas or oil, which could have a material impact on exploration and production activities, could also materially affect our financial position, results of operations and cash flows. The above description of risks and uncertainties is by no means all inclusive, but is designed to highlight what we believe are important factors to consider. Statements made in this presentation include non-GAAP financial measures. The required reconciliation to GAAP financial measures are included on our website. 2 |

|

|

Agenda Overview of Nabors Operations I. Actions Taken to Mitigate Downturn II. Market Overview III. Nabors’ Strategy for the Future IV. Nabors: The Global Leader in Drilling V. 3 |

|

|

I Overview of Nabors Operations The Largest Land Drilling Company in the World 16,000+ Employees 94 Nationalities 532 Drilling Rigs 19 Countries As of 6/30/15 * According to proprietary 3rd party survey 4 Customers: “Nabors is the premier international driller”* |

|

|

I Overview of Nabors Operations Nabors Delivers Solutions to Customers Through Three Services Drilling Equipment Drilling Solutions Drilling Ops 5 Nabors is in a unique position in the industry with the combination of a state-of-the-art drilling portfolio, surface and sub-surface intellectual property, and specialized services. The creation of Nabors Drilling Solutions is another step in a long-held strategy to deliver a well more cost-effectively to customers, and, eventually, to fully automate the drilling process. • Top drives • Drawworks • Catwalk • Powerhouse • Iron roughneck • North America • Middle East/North Africa • Latin America • Gulf of Mexico • Russia/CIS/Far East • Directional drilling • Rig performance software • Performance engineering • Additional services |

|

|

I Overview of Nabors Operations Geographic Diversification Mitigates North American Cyclicality Quarterly EBITDA Trend (14.1%) CAGR Lower 48 + Canada 12.5% CAGR International, GOM, & Alaska 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 1Q15 * Includes early termination 6 |

|

|

II Navigating the Downturn Realigning Our Business and Maintaining FCF Restructured drilling organization > – Reduce direct field costs linearly with decline in utilization •Redeploy most-capable field personnel to working rigs •Upgrade field performance and reserve talent for potential upturn Combine or close field offices, optimize field support costs Reduce annualized 4Q14 G&A spending by ~$80mm, or approximately 20%, by end of year 2015 – – Reiterate forecast for positive free cash flow in 2015 > – – Reduce year-on-year capital spending by ~$1bn Lower costs across supply chain in cooperation with vendors; target of $120mm annually total – Refocus capital investments to International businesses as L48 expansion continues to slow 7 |

|

|

II Navigating the Downturn Improved Liquidity for Flexibility and Prudent Investments Improving financial flexibility has been a top priority –Divestiture of non-core business lines and asset sales now complete with total cash proceeds of ~$1.7 billion > • • • NCPS E&P GOM jackup/barge rigs –Significant improvement in debt structure Revolving credit facility of ~$2.2 billion from ~$1.5 year-end 2014: –Extended maturity to July 2020 Total available liquidity at 6/30: ~$2.4 billion Focus on maintaining our investment-grade credit billion at > > > ratings 8 |

|

|

III Market Overview: Global Global Asset Positioning Supporting Rig Count Vs. Competitors Rig Count Trend Since 3Q14 10% 0% -10% -20% -30% -40% -50% -60% Oct-14 Dec-14 Feb-15 Apr-15 Jun-15 Source: BHI Rig Count, Nabors Internal 9 NBR U.S. L48: -54% Industry U.S. L48: -55% Nabors Global: -36% NBR INTL: -2% |

|

|

III Market Overview: U.S. Drilling and Canada Future Rig Count Highly Dependent on Oil Prices Limited prospects for near-term rig additions; recent volatility has dampened plans to add rigs Spot rig pricing stabilizing well below fleet average dayrates Offshore activity generally down; duration of Big Foot delay unclear Alaska up y-o-y but not immune to sustained downturn > > > > Canada: similar environment to the Lower 48 > NBR Rig Fleet Rig Count TTM EBITDA 20% 0% -20% US/CAN 54% US/CAN 67% -40% -60% Oct-14 Dec-14 Feb-15Apr-15 Jun-15 10 |

|

|

III Market Overview: International Nabors’ Core Markets Relatively Stable Deployments to Saudi, Kazakhstan, and Colombia (6 PACE®-X) on track, partially offsetting expected rig count declines in other regions Pace of resource development in LATAM impacted by oil price decline and country-specific issues Deep gas/unconventional MENA opportunities require high-spec rigs > > > Utilization could be susceptible to sustained oil price weakness > NBR Rig Fleet Rig Count TTM EBITDA 10% 5% INTL 33% INTL 46% 0% -5% -10% Oct-14 Dec-14 Feb-15 Apr-15 Jun-15 11 |

|

|

III Market Overview: MENA Region Remains More Resilient than Rest of World Increasing focus on natural gas drilling Deep gas and unconventional drilling require highest specification land rigs A lack of idle capacity in high-spec gas rigs provides solid utilization and future opportunities > > > Our recent newbuilds have been on time and on budget > Purchased in 1H15 remaining interest in our Saudi Arabia joint venture > 12 |

|

|

III Market Overview: LATAM & Rest of World Future Deployments Help Offset Decline in Certain Regions Six PACE®-X rigs for Colombia expected to commence operations before year end; three to spud in Q3 Mexico remains challenging Argentina holding steady Kazakhstan rigs deploying in 1H16 > > > > Repositioning fleet in markets with critical mass and long-term > growth prospects 13 |

|

|

IV Nabors’ Strategy for the Future Concentrate on Long-Term Sustainable Markets, Critical Mass MENA Offshore Platforms South America GoM & International Lower 48 Alaska 14 |

|

|

IV Nabors’ Strategy for the Future Rigs: The Delivery Platform for Future Services and Technology ® ® 15 For the last four years, we have focused on optimizing drilling performance through: •Innovating surface systems and integrating downhole drilling technology •Leveraging our vertical integration and global footprint •Strengthening our performance drilling culture through newly-formed Nabors Drilling Solutions |

|

|

IV Nabors’ Strategy for the Future Rig Performance Technology Provides Faster, Accurate Results 16 ROCKit® & REVitTM Top Drive Drilling Performance Products ROCKit® is a patented directional steering control system that oscillates drill pipe ROCKit® system significantly increases ROP and reduces directional drilling NPT REVitTM is a proven real-time stick slip torsional oscillation mitigation system The surface-based system extends bit life, reduces failures, and increases ROP Drive Performance and Optimization DrillSmart is a proprietary technology with a best-in-class adaptable auto driller Advanced algorithms mimic intuitive decision-making by experienced drillers ECM – Equipment Condition Monitoring designed to predict, eliminate failures Fuel Tool – Engine management system designed to save fuel, reduce emissions Total Control Drilling – Non Stop Driller (NSD) and MPD Choke (TCD) NSD: Sub-based system enables continuous circulation during pipe connections Designed to improve safety, minimize connection time, reduce NPT, and improve wellbore stability TCD is a proprietary managed pressure drilling choke and metering manifold Designed to control wellbore pressure profiles more precisely than is possible with conventional drilling methods |

|

|

IV Nabors’ Strategy for the Future New AccuSteer MWD Includes EM, Continuous Rotary Inclination, Maximized ROP Azimuthal Gamma, Resistivity AccuSteer Case History - $183k Saved on One Well Nabors 34’ MWD Compares Favorably to the Market Dynamics* * Weight on bit, torque on bit 17 Drilling Efficiency Drilling Efficiency Drilling Efficiency Geosteering Geosteering Geosteering Survey Tool Downhole PWD Stick Slip Azi GR Resistivity Cont. Inclination Gyro Nabors AccuSteer (34’) X X X X Testing X Schlumberger TelePacer (38’) X X X X X Baker Hughes OnTrak (40’) X X X X Halliburton Sperry (60’+) X X X X X WFT SAGR (90’) X X X X Well #1Well #2Benefit Standard MWDAccuSteer($70k/Day Spread Rate) # of Slides Slide Time Max Dogleg Severity Check Shots Survey Slide Footage Torque and Drag 8453Reduced Tortuosity 129 Hours83 Hours46 Hrs. Faster = $134k Saved 9.146.07Smoother Casing Rum 101017 Hrs. Faster = $49k Saved 2,327 feet1,652 feetReduced Torque and Drag Rotate to TDSlide to TDBetter Directional Capability |

|

|

IV Nabors’ Strategy for the Future Acquired Norwegian Rotary Steerable Short, Simple, Cost Effective, Patented Design Company Expands Downhole IP Capable of Building a 15°/30m Dogleg Rev. Development Sponsored by US Major Mud Turbine Power, No External Parts 18 2TD SLB Archer BHI Curve HAL CoPilot WFT Dogleg Severity 15° 15° 15° 10° 10° Power Turbine Turbine Battery Battery Battery Steering Push Push Push Point Point Length 3.5M 5.1M 2.8M 6.1M 3.9M |

|

|

V Nabors: The Global Leader in Drilling Strategic Asset Positioning, Strong Liquidity, Advanced Technology Differentiated, pure-play land driller > – – – Largest land drilling company in the world Geographic diversity dampens North America cyclicality Established infrastructure in best global markets Financial flexibility and discipline – Targeting positive free cash flow in 2015 – Staying power and ability to be opportunistic Nabors is the industry leader in rig technology – PACE®-X continues to outperform; now deploying > > int’l – Advancing technology to integrate surface and downhole – Future improvements in drilling performance will be driven surface automation and downhole integration by 19 |

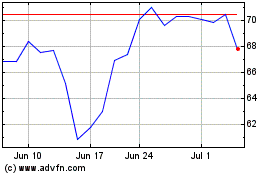

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

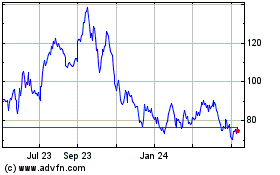

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Apr 2023 to Apr 2024