UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 14, 2015

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in its charter)

|

Bermuda

(State or Other Jurisdiction of

Incorporation or Organization) |

|

001-32657

(Commission File Number) |

|

980363970

(I.R.S. Employer

Identification No.) |

|

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 |

|

|

|

Bermuda

(Address of principal executive offices) |

|

N/A

(Zip Code) |

(441) 292-1510

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On July 14, 2015, Nabors Industries, Inc. (“NII”) and Nabors Drilling Canada Limited, each a wholly owned subsidiary of Nabors Industries Ltd. (the “Company”), and the Company entered into an amendment (“Amendment No. 1”) to the existing credit agreement dated November 29, 2012 (the “Credit Agreement”). Amendment No. 1 increases the available borrowing capacity from US$1,500,000,000 to US$2,200,000,000, extends the maturity date to July 14, 2020 and increases the size of the accordion option from $450,000,000 to $500,000,000. Amendment No. 1 also allows NII to request that the lenders agree to up to two one-year extensions of the maturity date. The current rate under the revised facility has been reduced to LIBOR plus 125 bps with standby fees of 15 bps applying to the undrawn commitment. NII expects to use the extended facility to provide financial flexibility for strategic investment opportunities, debt refinancing and other corporate uses.

Under the terms of the Credit Agreement, as amended, Citigroup Global Markets Inc., Mizuho Bank, Ltd., HSBC Bank USA, N.A. and Wells Fargo Bank Securities, LLC are joint lead arrangers and bookrunners. The lenders participating in the facility are Citibank, N.A., Mizuho Bank, Ltd., HSBC Bank USA, N.A., Wells Fargo Bank, N.A., HSBC Bank Canada, Bank of America, N.A., Bank of Tokyo-Mitsubishi UFJ, Ltd., PNC Bank, National Association, Deutsche Bank AG New York Branch, Morgan Stanley Bank, N.A., Compass Bank, U.S. Bank National Association, Goldman Sachs Bank USA, Sumitomo Mitsui Banking Corporation, Australia and New Zealand Banking Group Limited, Arab Banking Corporation, Grand Cayman Branch, and Riyad Bank, Houston Agency.

A copy of Amendment No. 1, included in this Form 8-K as Exhibit 10.1, is incorporated herein by reference and should be read in its entirety for a complete description of its provisions. The summary in this report is qualified in its entirety by the text of such provisions.

Item 8.01 Other Events.

On July 14, 2015, we issued a press release announcing the amendment to the Credit Agreement. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

10.1 |

|

Amendment No. 1 to the Credit Agreement, dated July 14, 2015. |

|

|

|

|

|

99.1 |

|

Press release. |

1

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Dated: July 15, 2015 |

Nabors Industries Ltd. |

|

|

|

|

|

/s/ Mark D. Andrews |

|

|

Mark D. Andrews |

|

|

Corporate Secretary |

2

EXHIBIT INDEX

|

Exhibit No. |

|

Document Description |

|

|

|

|

|

10.1 |

|

Amendment No. 1 to the Credit Agreement, dated July 14, 2015. |

|

|

|

|

|

99.1 |

|

Press release. |

3

Exhibit 10.1

AMENDMENT NO. 1 TO CREDIT AGREEMENT

dated as of July 14, 2015

among

NABORS INDUSTRIES, INC.,

as US Borrower,

NABORS DRILLING CANADA LIMITED,

as Canadian Borrower,

NABORS INDUSTRIES LTD.,

as Guarantor,

HSBC BANK CANADA,

as Canadian Lender,

THE OTHER LENDERS PARTY HERETO,

MIZUHO BANK, LTD., HSBC BANK USA, N.A., and

WELLS FARGO BANK, N.A.

as Documentation Agents,

HSBC BANK USA, N.A.,

as Syndication Agent,

and

CITIBANK N.A.,

as Administrative Agent for the US Lenders

Arranged By:

CITIGROUP GLOBAL MARKETS INC., MIZUHO BANK, LTD.,

HSBC BANK USA, N.A., and WELLS FARGO SECURITIES, LLC

as Joint Lead Arrangers and Book Runners

AMENDMENT NO. 1 TO CREDIT AGREEMENT

This AMENDMENT NO. 1 TO CREDIT AGREEMENT (this “Amendment No. 1”) is dated as of July 14, 2015, among NABORS INDUSTRIES, INC., a Delaware corporation (“US Borrower”), NABORS DRILLING CANADA LIMITED, an Alberta corporation, as successor in interest to NABORS CANADA, an ordinary partnership formed under the laws of the Province of Alberta (“Canadian Borrower”), NABORS INDUSTRIES LTD., a Bermuda exempted company (“Holdings”), HSBC BANK CANADA, as the Canadian Lender (“Canadian Lender”), the other Lender Parties party hereto “US Lenders”), and CITIBANK, N.A., as Administrative Agent solely for the US Lenders (in such capacity, “Administrative Agent”).

WITNESSETH:

WHEREAS, US Borrower, Canadian Borrower, Holdings, Canadian Lender, the US Lenders and the Administrative Agent are parties to that certain Credit Agreement dated as of November 29, 2012 (as amended or modified prior to the date hereof, the “Credit Agreement”);

WHEREAS, the US Borrower has requested that the Administrative Agent and the US Lenders amend certain terms of the Credit Agreement to, among other things, (a) increase hereby, by amendment to the Credit Agreement (and not by exercise of the election set forth in Section 2.22(a) of the Credit Agreement), the aggregate US Revolving Commitments to US$2,150,000,000, (b) extend the Maturity Date to July 14, 2020 and (c) increase the existing accordion option set forth in Section 2.22(a) of the Credit Agreement by US$50,000,000, so as provide to the US Borrowers the ability to elect in the future to request an increase in US Revolving Commitments by up to US$500,000,000 in the aggregate;

WHEREAS, the US Borrower and the Canadian Borrower have requested that the Administrative Agent, the US Lenders and the Canadian Lenders permit the US Borrower and the Canadian Borrower to request up to two extensions of the Maturity Date;

WHEREAS, in connection with the increase in the US Revolving Commitments, (a) Goldman Sachs Bank USA and Deutsche Bank AG New York Branch will become US Lenders under the Credit Agreement (each, a “New US Lender”) and (b) the US Lenders set forth on Schedule A hereto (each, an “Increasing US Lender”) have agreed to increase their existing US Revolving Commitments by the applicable Increase Amount (as defined below), in each case, on the terms and subject to the conditions herein;

WHEREAS, Nabors Drilling Canada Limited, an Alberta corporation, is successor in interest to Nabors Canada, an ordinary partnership formed under the laws of the Province of Alberta;

WHEREAS, the US Lenders, the Canadian Lender and the Administrative Agent are willing to amend the Credit Agreement to reflect the foregoing requests on the terms and conditions contained herein;

NOW, THEREFORE, the parties hereto agree as follows:

Section 1.01 Defined Terms. Capitalized terms used but not otherwise defined in this Amendment No. 1 shall have the meaning given to such terms in the Credit Agreement. For purposes hereof, “Amendment No. 1 Closing Date” shall mean the first date on which the conditions set forth in Section 1.05 hereof are satisfied or waived in

1

accordance with Section 14.02 of the Credit Agreement, and this Amendment No. 1 becomes effective pursuant to the provisions of Section 1.05 hereof.

Section 1.02 Amendments. The Credit Agreement is hereby amended as follows:

(a) The introductory paragraph to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

This CREDIT AGREEMENT (as amended, modified, supplemented or restated from time to time, this “Agreement”) is dated as of November 29, 2012, among NABORS INDUSTRIES, INC., a Delaware corporation (“US Borrower”), NABORS DRILLING CANADA LIMITED, an Alberta Corporation, as successor in interest to NABORS CANADA, an ordinary partnership formed under the laws of the Province of Alberta (“Canadian Borrower”), NABORS INDUSTRIES LTD., a Bermuda exempted company (“Holdings”), HSBC BANK CANADA, as the Canadian Lender (the “Canadian Lender”), the other Lenders party hereto (the “US Lenders”) and CITIBANK N.A., as Administrative Agent solely for the US Lenders and not for the Canadian Lender (in such capacity, “Administrative Agent”).

(b) The first recital to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

“WHEREAS, US Borrower has requested the US Lenders to extend credit to it in the form of US Revolving Loans at any time and from time to time prior to the Maturity Date;”

(c) Section 1.01 of the Credit Agreement is hereby amended to add thereto, in alphabetical order, the following definitions which shall read in full as follows:

“Amendment No. 1” shall means that certain Amendment No. 1 to Credit Agreement dated as of July 14, 2015, among US Borrower, Canadian Borrower, Holdings, Administrative Agent , US Lenders and Canadian Lender.

“Amendment No. 1 Closing Date” shall mean July 14, 2015.

“Anti-Corruption Laws” means all laws, rules, and regulations of any jurisdiction applicable to Holdings or the Borrower or any of their Affiliates from time to time concerning or relating to bribery or corruption, including, without limitation, the FCPA.

“FCPA” means the Foreign Corrupt Practices Act of 1977, as amended.

“OFAC” means the Office of Foreign Asset Control of the Department of Treasury of the United States of America.

“Sanctions” means any economic or financial sanctions or trade embargoes imposed, administered or enforced from time to time by (a) the U.S. government, including those administered by OFAC or the U.S. Department of State, or (b) the United Nations Security Council, the European Union, any European Union member state or Her Majesty’s Treasury of the United Kingdom.

2

“Sanctioned Country” means, at any time, a country or territory which is itself the subject or target of any comprehensive or country-wide Sanctions (as of the Amendment No. 1 Closing Date, the Crimea region of Ukraine, Cuba, Iran, North Korea, Sudan and Syria).

“Sanctioned Person” means, at any time, (a) any person listed in any Sanctions-related list of designated persons maintained by OFAC, the U.S. Department of State, or by the United Nations Security Council, the European Union or any European Union member state, (b) any person operating, organized or resident in a Sanctioned Country or (c) any person owned 50% or more, or otherwise controlled by, any such person or persons described in the foregoing clauses (a) or (b).

(d) Section 1.01 of the Credit Agreement is hereby amended to delete the definitions of “Canadian Managing Partner” and “Prohibited Person” in their entirety.

(e) The definitions of “Arrangers”, “Canadian Officer’s Certificate”, “Canadian US$ Libor Rate”, “Documentation Agent”, “FATCA”, “Federal Funds Effective Rate”, “Loan Documents”, “Maturity Date”, “US Adjusted LIBOR Rate”, and “US LIBOR Rate” contained in Section 1.01 of the Credit Agreement are hereby amended and restated to read in full as follows:

“Arrangers” shall refer to Citigroup Global Markets Inc., Mizuho Bank, Ltd., HSBC Bank USA, N.A. and Wells Fargo Securities, LLC in their capacity as Joint Lead Arrangers and Bookrunners.

“Canadian Officer’s Certificate” shall mean a certificate or notice signed by any one of the president, a vice president, director, treasurer, assistant treasurer, controller, corporate secretary or assistant secretary of the Canadian Borrower.

“Canadian US$ Libor Rate” shall mean, for each Interest Period applicable to a Canadian US$ Libor Loan, the rate of interest per annum (but in any event not less than zero percent (0%)), expressed on the basis of a year of 360 days (as determined by the Canadian Lender) applicable to US Dollars and appearing on the display referred to as the “LIBOR01 Page” (or any display substituted therefor) of Reuters Limited (or any successor thereto or Affiliate thereof) as of 11:00 a.m. (London, England time) on the second Banking Day prior to the first day of such Interest Period; or if such rate does not appear on such Reuters display, or if such display or rate is not available for any reason, the rate per annum at which US Dollars are offered by the principal lending office in London, England of the Canadian Lender (or of its Affiliates if it does not maintain such an office) in the London interbank market at approximately 11:00 a.m. (London, England time) on the second Banking Day prior to the first day of such Interest Period, in each case in an amount similar to such Canadian US$ Libor Loan and for a period comparable to such Interest Period.

“Documentation Agent” shall mean Mizuho Bank, Ltd., HSBC Bank USA, N.A. and Wells Fargo Bank, N.A., each as documentation agent for the Lenders.

“FATCA” shall mean Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code, any intergovernmental agreement entered into in connection with the implementation of such Sections of the Code, and any fiscal or regulatory legislation, rules or practices adopted pursuant to any such intergovernmental agreement.

3

“Federal Funds Effective Rate” shall mean, for any day, the rate per annum equal to the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System of the United States arranged by federal funds brokers on such day, as published on the next succeeding Business Day by the Federal Reserve Bank of New York, or, if such rate is not so published for any day that is a Business Day, the average of the quotations for the day for such transactions received by the Administrative Agent from three federal funds brokers of recognized standing selected by it; provided that if the relevant rate shall be less than zero, such rate shall be deemed to be zero for the purposes of this Agreement.

“Loan Documents” shall mean this Agreement, Amendment No. 1, and the US Notes (if any).

“Maturity Date” shall mean July 14, 2020, as such date may be extended pursuant to Section 2.24.

“US Adjusted LIBOR Rate” shall mean, with respect to any US Eurodollar Borrowing for any Interest Period, an interest rate per annum (rounded upward, if necessary, to the nearest 1/100th of 1%, but in any event not less than zero percent (0%)) determined by the Administrative Agent to be equal to (a) the US LIBOR Rate for such US Eurodollar Borrowing in effect for such Interest Period, divided by (b) 1.00 minus the Statutory Reserves (if any) for such US Eurodollar Borrowing for such Interest Period.

“US LIBOR Rate” shall mean, with respect to any US Eurodollar Borrowing for any Interest Period, the rate per annum determined on the basis of the rate for deposits in dollars with a term comparable to such Interest Period that appears on the Reuters Screen LIBOR01 Page (or any applicable successor page) at approximately 11:00 a.m., London, England time, two (2) London Banking Days prior to the first day of the applicable Interest Period; provided, however, that (i) if no comparable term for an Interest Period is available, the US LIBOR Rate shall be determined using the weighted average of the offered rates for the two terms most nearly corresponding to such Interest Period and (ii) if there shall at any time no longer exist a Reuters Screen LIBOR01 Page, “US LIBOR Rate” shall mean, with respect to each day during each Interest Period pertaining to US Eurodollar Borrowings comprising part of the same Borrowing, the rate per annum equal to the rate at which the Administrative Agent is offered deposits in dollars at approximately 11:00 a.m., London, England time, two (2) London Banking Days prior to the first day of the applicable Interest Period, in the London interbank market for delivery on the first day of such Interest Period for the number of days comprised therein and in an amount comparable to its portion of the amount of such US Eurodollar Borrowing to be outstanding during such Interest Period. Notwithstanding the foregoing, for purposes of clause (c) of the definition of US Alternate Base Rate, the rates referred to above shall be the published rates as of 11:00 a.m., London, England time, on the date of determination (rather than the second London Business Day preceding the date of determination).

(f) The reference to “US$1,450,000,000” in the definition of “US Revolving Commitment” in Section 1.01 of the Credit Agreement is hereby replaced with a reference to “US$2,150,000,000”.

(g) The reference to “US$450.0 million” in Section 2.22(a) of the Credit Agreement is hereby replaced with a reference to “US$500.0 million”.

(h) Section 2.18(e)(ii) of the Credit Agreement is hereby amended by:

4

(i) adding the phrase “or IRS Form W-8BEN-E (or applicable successor form), as applicable” after each reference to the phrase “(or applicable successor form)” in clauses (B)(1) and (B)(3) thereof, and

(ii) adding the phrase “an IRS Form W-8BEN-E (or any successor form),” after the phrase “an IRS Form W-8BEN (or any successor form),” in clause (B)(4) thereof.

(i) A new Section 2.24 is hereby added to the Credit Agreement, such new Section 2.24 to read in its entirety as follows:

Section 2.24 Extension of Maturity Date.

(a) Request for Extension. Not less than 30 days nor more than 90 days prior to the Maturity Date (including any extensions thereof pursuant hereto), the Borrowers may, by written notice to the Administrative Agent (which shall promptly, but in any event within three (3) Business Days after receipt of such notice, forward such notice to the US Lenders) and the Canadian Lender, request an extension of the Maturity Date for an additional one-year period; provided that no more than two (2) such one-year extensions shall be permitted hereunder. Prior to sending such notice to the Administrative Agent and the Canadian Lender, the Borrowers shall consult therewith regarding the time period within which each Lender Party would be requested to respond (which shall in no event be less than ten (10) Business Days after the date of delivery of such notice to the Lender Parties), and such notice shall set forth such response deadline. No Lender is committed hereby to agree to any such extension of the Maturity Date.

(b) Lender Party Elections to Extend; Payments to Declining Lender Parties. Each Lender Party that agrees, in its sole discretion, to extend its Revolving Commitment (an “Extending Lender”) shall notify the Administrative Agent within such time period of its agreement to extend its Revolving Commitment. The Revolving Commitment of any Lending Party that declines, or fails to respond to, the Borrowers’ request for an extension of the Maturity Date within such time period (a “Declining Lender”), shall be terminated on the Maturity Date then in effect for such Lending Party (without regard to any extension by other Lending Parties) and on such date the aggregate Revolving Commitments shall be reduced by the total Revolving Commitments of all Declining Lenders expiring on the Maturity Date (without giving effect to the extension request) except to the extent one or more lenders (including other Lending Parties) shall have agreed to assume such Revolving Commitments hereunder. The Administrative Agent shall notify promptly the Borrowers and each Lending Party of the Lending Parties’ responses to each request made hereunder. The US Borrower or the Canadian Borrower, as applicable, shall pay in full the unpaid principal amount of all Revolving Borrowings owing to each Declining Lender, together with all accrued and unpaid interest thereon and all fees accrued and unpaid under this Agreement, and all other amounts due to such Declining Lender under this Agreement, including any breakage fees or costs that are payable pursuant to Section 2.16, on the Maturity Date (without giving effect to the extension request) or on the earlier replacement of such Declining Lender.

(c) Conditions to Extension of Maturity Date. Any extension of the Maturity Date pursuant to this Section 2.24 shall be subject to the satisfaction on or prior to the Extension Effective Date of the following conditions:

(i) The Administrative Agent and the Canadian Lender shall have received documents of the type required to be delivered by the US Loan Parties and

5

Canadian Borrower pursuant to Section 1.05(a)(ii), Section 1.05(a)(iv), and Section 1.05(c) of Amendment No. 1, which, in each case, shall be in form and substance satisfactory to the Administrative Agent and shall relate to the extension of the Maturity Date then being requested; and

(ii) The Borrowers shall have paid to the Administrative Agent, for the account of each Extending Lender, an extension fee (if any) in an amount to be agreed.

(d) Effective Date and Allocations. If the Maturity Date is extended in accordance with this Section 2.24, the Administrative Agent, the Canadian Lender (to the extent the Canadian Lender is not a Declining Lender) and the Borrowers shall determine the effective date of the extension (the “Extension Effective Date”), and upon such effectiveness, (i) the Administrative Agent shall record in the register any replacement lender’s information as provided pursuant to an Administrative Questionnaire that shall be executed and delivered by such replacement lender to the Administrative Agent on or before such Extension Effective Date, (ii) Schedule I attached hereto shall be amended and restated so as to set forth in its entirety all Lending Parties (including any replacement lenders) that will be Lending Parties hereunder after giving effect to such extension and the Administrative Agent shall distribute to each Lender Party (including each replacement lender) a copy of such amended and restated Schedule I which reflects the Commitments of the Lenders, and applicable Maturity Dates (if more than one) after giving effect to the changes effected on the Extension Effective Date, (iii) each replacement lender that complies with the provision of this Section 2.24 shall be a “Lending Party” for all purposes under this Agreement, and (iv) all calculations and payments of interest on the Revolving Borrowings shall take into account the actual Revolving Commitments of each Lender Party and the principal amount outstanding of each Revolving Borrowing made by such Lender Party during the relevant period of time.

(j) Section 3.18 to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

Section 3.18 Anti-Terrorism and Anti-Corruption Laws.

The Borrowers have implemented and maintain in effect policies and procedures designed to ensure compliance by the Borrowers, their Subsidiaries and their respective directors, officers, employees and agents with applicable Anti-Terrorism Laws, Anti-Corruption Laws and Sanctions, and the Borrowers, their Subsidiaries and their respective officers and employees and to the knowledge of the Borrowers, their directors and agents, are in compliance with applicable Anti-Terrorism Laws, Anti-Corruption Laws, and Sanctions in all material respects. None of the Borrowers, any of their Subsidiaries or, to the knowledge of the Borrowers, any director, officer, employee, agent, or affiliate of the Borrowers or any of their Subsidiaries is a Sanctioned Person.

(k) Section 4.01 to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

Section 4.01 Existence and Good Standing.

Canadian Borrower: (a) is a corporation validly subsisting under the jurisdiction of its amalgamation, (b) is duly qualified to do business in all other jurisdictions where its ownership, lease or operation of properties and conduct of its business requires such qualification, and, (c) has all necessary corporate power and authority to own its properties and carry on its

6

business as presently carried, except in each case referenced in paragraph (b) and (c) above as would not, individually or in the aggregate, have a Canadian Material Adverse Effect.

(l) Section 4.04 to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

Section 4.04 Non-Conflict.

Neither the execution of this Agreement and the other Loan Documents to which the Canadian Borrower is a party, nor the consummation of the transactions contemplated herein and therein, nor the performance of and compliance with the terms and provisions hereof and thereof by the Canadian Borrower will (a) violate any provision of its Organizational Documents, or (b) to the knowledge of the Canadian Borrower after due inquiry, the provisions of any material indenture, instrument, undertaking, or other agreement to which it is a party or by which it is bound, except as would not, individually, or in the aggregate, have a Canadian Material Adverse Effect.

(m) Section 6.01(a) to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

(a) Canadian Borrower shall have delivered to Canadian Lender current certified Organizational Documents and the resolutions of the Canadian Borrower authorizing the Loan Documents to which it is a party and the transactions thereunder and an officer’s certificate as to the incumbency of the officers of Canadian Borrower signing such Loan Documents;

(n) Section 8.01(a) and Section 8.06 to the Credit Agreement are hereby amended by deleting each reference to “Canadian Managing Partner” contained in such Sections and replacing it with “Canadian Borrower” in each instance.

(o) The following sentence is hereby added to the end of Section 7.05 to the Credit Agreement.

Holdings and Borrowers will maintain in effect and enforce policies and procedures designed to ensure compliance by Holdings, Borrowers, their Subsidiaries and their respective directors, officers, employees and agents with applicable Anti-Terrorism Laws, Anti-Corruption Laws and Sanctions.

(p) Section 9.08 to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

Section 9.08 Compliance with Anti-Terrorism Laws.

The Borrowers will not, directly or indirectly, use the proceeds of the Loans, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person, (i) to fund any activities or business of or with any Sanctioned Person, or in any Sanctioned Country, or (ii) in any other manner that would result in a violation of Anti-Terrorism Laws, Anti-Corruption Laws or Sanctions by any person (including any person participating in the Loans, whether as underwriter, advisor, investor, or otherwise).

(q) Section 12.01(e) to the Credit Agreement is hereby amended and restated in its entirety to read in full as follows:

7

(e) Defaults under Other Agreements. With respect to any Indebtedness of any US Loan Party or any of their Subsidiaries (other than Indebtedness outstanding under the US Loans, any Canadian Loans under US$100.0 million (or the Equivalent Amount in Canadian Dollars) or any Swap Contract with a Swap Termination Value under US$100.0 million) having an outstanding principal amount in excess of US$100.0 million in the aggregate (i) such Loan Party or any such Subsidiary shall (A) default in making any payment when due (after giving effect to any applicable grace period with respect thereto) with respect to such Indebtedness or obligations in respect of Swap Contracts, as applicable, or (B) default (after giving effect to any applicable grace period with respect thereto) in the observance or performance of any other covenant or agreement relating to such Indebtedness or obligations in respect of Swap Contracts, as applicable, or contained in any instrument or agreement evidencing, securing or relating thereto, or any other event shall occur or condition exist, in each case the effect of which default or other event or condition is to cause or permit the holder or the holders of such Indebtedness or such obligations in respect of Swap Contracts, as applicable, (or any trustee or agent on behalf of such holders) to cause (determined without regard to whether any notice or lapse of time is required) such Indebtedness or obligations in respect of Swap Contracts to become due prior to its stated maturity; or (ii) such Indebtedness or obligations in respect of Swap Contracts shall be declared due and payable, or required to be prepaid, redeemed or repurchased other than by a regularly scheduled required prepayment prior to the stated maturity thereof; or (iii) such Indebtedness or obligations in respect of Swap Contracts shall mature and remain unpaid.

(r) Section 14.03(d) of the Credit Agreement is hereby amended by adding the following proviso to the end of the first sentence thereof:

; provided that nothing contained in this Section 14.03(d) or otherwise shall limit any Borrower’s indemnity or reimbursement obligations to the extent otherwise set forth in this Section 14.03

(s) The last sentence of Section 14.05 of the Credit Agreement is hereby amended and restated to read in full as follows:

The provisions of Section 2.13, Section 2.14, Section 2.16, Section 2.17, Section 2.18 and Article XIV (other than Section 14.12) shall survive and remain in full force and effect regardless of the consummation of the transactions contemplated hereby, the repayment of the Loans, the expiration or termination of the Commitments or the termination of this Agreement or any provision hereof.

(t) Annex I of the Credit Agreement is hereby deleted and replaced in its entirety with the Annex I attached to this Amendment No. 1.

(u) (i) Schedule I of the Credit Agreement is hereby deleted and replaced in its entirety with the Schedule I attached to this Amendment No. 1.

(ii) Effective as of the date hereof and subject to the satisfaction of the conditions set forth herein, after giving effect to clause (u)(i) above, the outstanding US Revolving Loans and US Pro Rata Percentages will be reallocated by the Administrative Agent among the US Lenders (including the New US Lenders) in accordance with their revised US Pro Rata Percentages (and the US Lenders (including the New US Lenders) agree to make all payments and adjustments necessary to effect such reallocation and the US Borrower shall pay any and all costs, if any, required pursuant to Section 2.16 of the Credit Agreement in connection

8

with such reallocation as if such reallocation were a repayment to the extent not waived by an affected US Lender).

Section 1.03 Increase Amount. Subject to the terms and conditions set forth herein, each Increasing US Lender severally agrees to provide US Revolving Commitments to the US Borrower on the Amendment No. 1 Closing Date in the amount set forth opposite its name on Schedule A hereto (the “Increase Amount”), which amounts are included in, and not in addition to, the US Revolving Commitments set forth on Schedule I hereto.

Section 1.04 New US Lenders. Each New US Lender hereby joins in, becomes a party to, and agrees to comply with and be bound by the terms and conditions of the Credit Agreement as a US Lender thereunder and under each and every other Loan Document to which any US Lender is required to be bound by the Credit Agreement as amended hereby, to the same extent as if such New US Lender were an original signatory thereto. Each New US Lender hereby appoints and authorizes the Administrative Agent to take such action as agent on its behalf and to exercise such powers and discretion under the Credit Agreement as amended hereby as are delegated to the Administrative Agent by the terms thereof, together with such powers and discretion as are reasonably incidental thereto. Each New US Lender represents and warrants that (a) it has full power and authority, and has taken all action necessary, to execute and deliver this Agreement, to consummate the transactions contemplated hereby and to become a party to, and a US Lender under, the Credit Agreement as amended hereby, (b) it has received a copy of the Credit Agreement and copies of the most recent financial statements delivered pursuant to Section 7.01 thereof, and such other documents and information as it has deemed appropriate to make its own credit analysis and decision to enter into this Agreement and to become a US Lender on the basis of which it has made such analysis and decision independently and without reliance on the Administrative Agent or any other US Lender, and (c) from and after the Amendment No. 1 Closing Date, it shall be a party to and be bound by the provisions of the Credit Agreement as amended hereby and the other Loan Documents and have the rights and obligations of a US Lender thereunder. The Administrative Agent hereby grants its consent to each New US Lender becoming a US Lender under the Credit Agreement.

Section 1.05 Conditions Precedent. This Amendment No. 1 shall become effective upon the satisfaction of the following conditions precedent:

(a) Documents. The Administrative Agent and the Canadian Lender shall have received the following:

(i) counterparts of this Amendment No. 1 duly executed by US Borrower, Canadian Borrower, Holdings, the Canadian Lender and all of the US Lenders; and

(ii) a certificate from each US Loan Party and Canadian Borrower dated as of the Amendment No. 1 Closing Date, duly executed by the secretary or assistant secretary of each of the foregoing, stating that, both before and after giving effect to this Amendment No. 1,

(A) the representations and warranties made by each Loan Party in the Credit Agreement are true and correct, except that any representation or warranty which by its terms is made as of a specified date shall be true and correct only as of such specified date,

(B) no Default or Event of Default shall have occurred and be continuing,

9

(C) attached thereto is a true and complete copy of each Organizational Document of such Loan Party certified (to the extent applicable as of a recent date by the Secretary of State (or applicable Governmental Authority) of the jurisdiction of its incorporation or formation),

(D) attached thereto is a true and complete copy of resolutions duly adopted by the Board of Directors of such Loan Party authorizing the execution, delivery and performance of the Loans Documents to which such person is a party and, in the case of US Borrower, the borrowings under the Credit Agreement, and that such resolutions have not been modified, rescinded or amended and are in full force and effect and

(E) as to the incumbency and specimen signature of each officer executing any Loan Document to which it is a party or any other document delivered in connection herewith on behalf of such Loan Party (together with a certificate of another officer as to the incumbency and specimen signature of the secretary of assistance secretary executing the certificate in this clause (5));

(iii) certificates, dated the Amendment No. 1 Closing Date and signed by the chief executive officer and the treasurer or other senior financial officer of the US Borrower and the Canadian Borrower, certifying compliance with the conditions precedent set forth in this Section 1.05;

(iv) a certificate as to the good standing (or equivalent, to the extent applicable) of each Loan Party as of a recent date, from such Secretary of State or other applicable Governmental Authority; and

(v) such other documents as the Administrative Agent may reasonably request.

(b) Payment of Fees. The Borrower and Canadian Borrower shall have paid the fees required to be paid to the Administrative Agent, the Canadian Lender and the US Lenders (including New US Lenders), as applicable, including, to the extent invoiced, reimbursement or payment of all out-of-pocket expenses (including the legal fees and expense of Vinson & Elkins L.L.P., special counsel to the Administrative Agent), required to be reimbursed or paid by the Loan Parties hereunder or under any other Loan Document and upfront fees for the ratable benefit of each Lender in amounts as set forth below.

(i) For Lenders (other than New US Lenders) (A) 12.5 basis points (0.125%) of the amount of such Lender’s Original Commitment (defined below) if it is less than $100.0 million, (B) 13.0 basis points (0.130%) of the amount of such Lender’s Original Commitment if it is greater than or equal to $100.0 million and less than $200.0 million, and (C) 13.5 basis points (0.135%) of the amount of such Lender’s Original Commitment if it is equal to or greater than $200.0 million. As used herein, a Lender’s “Original Commitment” means the sum of the US Revolving Commitment of such Lender plus the Canadian Commitment, if any, of such Lender or any Affiliate thereof prior to giving effect to the increase of the US Revolving Commitments pursuant to Section 1.02(u) hereof;

(ii) For Increasing US Lenders or New US Lenders, (A) 18.0 basis points (0.180%) of the amount of such Increasing US Lender’s Increase Amount or such New US

10

Lender’s US Revolving Commitment if it is less than $100.0 million, (B) 19.0 basis points (0.190%) of the amount of such Increasing US Lender’s Increase Amount or such New US Lender’s US Revolving Commitment if it is equal to or greater than $100.0 million and less than $200.0 million, and (C) 20.0 basis points (0.200%) of the amount of such Increasing US Lender’s Increase Amount or such New US Lender’s US Revolving Commitment if it is equal to or greater than $200.0 million;

(c) Opinions of Counsel. (i) The Administrative Agent, on behalf of itself and the Lenders, shall have received a favorable written opinion of Norton Rose Fulbright US LLP, special counsel to the US Loan Parties, and a favorable written opinion of local Bermuda counsel for Holdings, and (ii) the Canadian Lender shall have received a favorable written opinion of local Canadian counsel for the Canadian Borrower, each opinion to be (A) dated the Amendment No. 1 Closing Date and (B) addressed to the Administrative Agent and the US Lenders or Canadian Lender, as applicable.

(d) USA Patriot Act. The US Lenders and the Administrative Agent shall have received the information required under Section 14.13 of the Credit Agreement to be delivered by each applicable US Loan Party on or prior to the Amendment No. 1 Closing Date and which was identified by the US Lenders and the Administrative Agent to US Borrower.

(e) US Notes. the Administrative Agent shall have received an executed original US Note for each Increasing US Lender and New US Lender requesting a US Note, made by the US Borrower payable to such requesting Increasing US Lenders or New US Lender in the amount of each such Increasing US Lender or New US Lender’s US Revolving Commitment after giving effect to Section 1.02(u) hereof; and

For purposes of determining compliance with the conditions specified in this Section 1.05, each Lender that has signed this Amendment No. 1 shall be deemed to have consented to, approved or accepted or to be satisfied with, each document or other matter required under this Section 1.05 to be consented to or approved by or acceptable to a Lender unless the Administrative Agent shall have received notice from such Lender prior to the Amendment No. 1 Closing Date specifying its objection thereto. All documents executed or submitted pursuant to this Section 1.05 by and on behalf of the Borrowers or any of their Subsidiaries shall be in form and substance satisfactory to the Administrative Agent and its counsel. The Administrative Agent shall notify the Borrowers and the Lenders of the Amendment No. 1 Closing Date, and such notice shall be conclusive and binding. Notwithstanding the foregoing, this Amendment No. 1 shall expire and be without force or effect if the foregoing conditions are not satisfied (or waived in writing) on or prior to July 31, 2015.

Section 1.06 Representation and Warranties. The US Borrower represents and warrants to the Administrative Agent, and the Canadian Borrower represents to the Canadian Lender, that, as of the date hereof (a) all of its representations and warranties set forth in the Loan Documents are true and correct, except that any representation or warranty which by its terms is made as of a specified date shall be true and correct only as of such specified dates, (b) the execution, delivery and performance of this Amendment No. 1 by it are within its corporate power and authority and has been duly authorized by appropriate corporate action, (c) this Amendment No. 1 constitutes the legal, valid and binding obligation of it enforceable in accordance with its terms, except as limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the rights of creditor generally and general principles of equity, and (d) there are no governmental or other third party consents, licenses and approvals required in connection with the execution, delivery, performance validity and enforceability of this Amendment No. 1.

11

Section 1.07 Reaffirmation of Guarantee. Holdings hereby ratifies, confirms, acknowledges and agrees that its obligations under Article XI of the Credit Agreement are and remain in full force and effect and that Holdings continues to guarantee, in accordance with the terms of such Article XI, the prompt payment in full when due (whether at stated maturity, by required prepayment, declaration, demand, by acceleration or otherwise) of the US Guaranteed Obligations and the Canadian Guaranteed Obligations, and its execution and delivery of this Amendment No. 1 does not indicate or establish an approval or consent requirement by Holdings in connection with the execution and delivery of any amendments, consents or modifications of or waivers to, any of the Loan Documents.

Section 1.08 FATCA Treatment. For purposes of determining withholding Taxes imposed under FATCA, from and after the effective date of this Amendment No. 1, the Borrowers and the Administrative Agent shall treat (and the Lender Parties hereby authorize the Administrative Agent to treat) the Credit Agreement and any outstanding Loans as not qualifying as “grandfathered obligations” within the meaning of Treasury Regulation Section 1.1471-2(b)(2)(i).

Section 1.09 Miscellaneous.

(a) This Amendment No. 1 may be executed in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. Headings, subheadings and captions used herein are for the convenience of the parties only and shall not be used to construe the meaning or intent of any provision hereof.

(b) This Amendment No. 1 shall become effective when it shall have been executed by the Administrative Agent and when the Administrative Agent shall have received counterparts hereof which, when taken together, bear the signatures of each of the other parties hereto, and thereafter shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. Delivery of an executed counterpart of a signature page of this Amendment No. 1 by email (in .pdf or similar format) or telecopy shall be effective as delivery of a manually executed counterpart of this Amendment No. 1.

(c) Any provision of this Amendment No. 1 held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

(d) This Amendment No. 1 and the transactions contemplated hereby, and all disputes between the parties under or relating to this Amendment No. 1 or the facts or circumstances leading to its execution, whether in contract, tort or otherwise, shall be construed in accordance with and governed by the laws (including statutes of limitation) of the State of New York, without regard to conflicts of law principles that would require the application of the laws of another jurisdiction. Each party hereto hereby irrevocably and unconditionally submits, for itself and its property, to the non-exclusive jurisdiction of the Supreme Court of the State of New York sitting in New York County and of the United States District Court of the Southern District of New York, and any appellate court from any thereof, in any action or proceeding arising out of or relating to this Amendment No. 1.

(e) EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE REQUIREMENTS OF LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AMENDMENT NO. 1.

12

Section 1.10 Exiting Lender. Mega International Commercial Bank Co., Ltd. (the “Exiting Lender”) hereby (a) consents to this Amendment No. 1 as required under Section 14.02 of the Credit Agreement and (b) acknowledges and agrees to Section 1.02(u) of this Amendment No. 1. Each of the parties hereto hereby agrees and confirms that after giving effect to Section 1.02(u) of this Amendment No. 1, the Exiting Lender’s US Revolving Commitment shall be $0.00, the Exiting Lender’s Commitments to lend and all obligations under the Credit Agreement shall be terminated, and the Exiting Lender shall cease to be a Lender for all purposes under the Loan Documents.

[Signature Pages Follow]

13

IN WITNESS WHEREOF, the parties hereto have caused this Amendment No. 1 to be duly executed by their respective authorized officers as of the day and year first above written.

|

|

NABORS INDUSTRIES, INC. |

|

|

|

|

|

|

|

|

By: |

/s/ William Restrepo |

|

|

Name: |

William Restrepo |

|

|

Title: |

Chief Financial Officer |

|

|

|

|

|

|

|

|

NABORS DRILLING CANADA LIMITED |

|

|

|

|

|

|

|

|

By: |

/s/ Joe Bruce |

|

|

Name: |

Joe Bruce |

|

|

Title: |

President |

|

|

|

|

|

|

|

|

NABORS INDUSTRIES LTD. |

|

|

|

|

|

|

|

|

By: |

/s/ Mark D. Andrews |

|

|

Name: |

Mark D. Andrews |

|

|

Title: |

Corporate Secretary |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

CITIBANK N.A., as Administrative Agent |

|

|

|

|

|

|

|

|

By: |

/s/ Maureen Maroney |

|

|

Name: |

Maureen Maroney |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

HSBC BANK CANADA, as Canadian Lender |

|

|

|

|

|

|

|

|

By: |

/s/ STEPHEN CHUANG |

|

|

Name: |

023487 STEPHEN CHUANG |

|

|

Title: |

Assistant Vice President |

|

|

|

Commercial Banking |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ CAMERON BAILEY |

|

|

Name: |

CAMERON BAILEY |

|

|

Title: |

Assistant Vice President |

|

|

|

Commercial Banking |

|

|

|

|

|

|

|

|

HSBC BANK USA, N.A., as US Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Michael Bustios |

|

|

Name: |

Michael Bustios |

|

|

Title: |

Vice President 20556 |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

MIZUHO BANK, LTD., as US Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Leon Mo |

|

|

Name: |

Leon Mo |

|

|

Title: |

Authorized Signatory |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

MORGAN STANLEY BANK, N.A., as US Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Michael King |

|

|

Name: |

Michael King |

|

|

Title: |

Authorized Signatory |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

PNC BANK, NATIONAL ASSOCIATION,

as US Lender |

|

|

|

|

|

|

|

|

By: |

/s/ Jonathan Luchansky |

|

|

Name: |

Jonathan Luchansky |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

BANK OF AMERICA, N.A., as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ Michael Clayborne |

|

|

Name: |

Michael Clayborne |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

BANK OF TOKYO-MITSUBISHI UFJ, LTD., as US Lender |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Todd Vaubel |

|

|

Name: |

Todd Vaubel |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

WELLS FARGO BANK, N.A., as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ C. David Allman |

|

|

Name: |

C. David Allman |

|

|

Title: |

Managing Director |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

COMPASS BANK, as US Lender |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Susana Campuzano |

|

|

Name: |

Susana Campuzano |

|

|

Title: |

Senior Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

US BANK NATIONAL ASSOCIATION, as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ John Prigge |

|

|

Name: |

John Prigge |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

SUMITOMO MITSUI BANKING CORPORATION, as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ James D. Weinstein |

|

|

Name: |

James D. Weinstein |

|

|

Title: |

Managing Director |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

ARAB BANKING CORPORATION, GRAND CAYMAN BRANCH, as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ Tony Berbari |

|

|

Name: |

Tony Berbari |

|

|

Title: |

General Manager |

|

|

By: |

/s/ Victoria Gale |

|

|

Name: |

Victoria Gale |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED, as US Lender |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Robert Grillo |

|

|

Name: |

Robert Grillo |

|

|

Title: |

Director |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

RIYAD BANK, HOUSTON AGENCY, as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ Michael Meiss |

|

|

Name: |

Michael Meiss |

|

|

Title: |

General Manager |

|

|

By: |

/s/ Paul N. Travis |

|

|

Name: |

Paul N. Travis |

|

|

Title: |

Vice President & Head of Corporate Finance |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

The undersigned is executing this Amendment No. 1 as of the date and year first above written for the sole purpose of Section 1.10 hereof.

|

|

MEGA INTERNATIONAL COMMERCIAL BANK CO., LTD., as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ Luke Hwang |

|

|

Name: |

Luke Hwang |

|

|

Title: |

VP and General Manager |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

NEW US LENDERS: |

|

|

|

|

|

GOLDMAN SACHS BANK USA, as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ Rebecca Kratz |

|

|

Name: |

Rebecca Kratz |

|

|

Title: |

Authorized Signatory |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

|

|

DEUTSCHE BANK AG NEW YORK BRANCH, as US Lender |

|

|

|

|

|

|

|

|

|

By: |

/s/ Virginia Cosenza |

|

|

Name: |

Virginia Cosenza |

|

|

Title: |

Vice President |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Ming K. Chu |

|

|

Name: |

Ming K. Chu |

|

|

Title: |

Vice President |

[SIGNATURE PAGE TO AMENDMENT NO. 1 — NABORS INDUSTRIES, INC.]

Schedule A

to Amendment No. 1

|

NAME OF INCREASING US LENDER |

|

INCREASE AMOUNT |

|

|

Wells Fargo Bank, N.A. |

|

$ |

150,000,000 |

|

|

Sumitomo Mitsui Banking Corporation |

|

$ |

50,000,000 |

|

|

Bank of America, N.A. |

|

$ |

30,000,000 |

|

|

U.S. Bank National Association |

|

$ |

30,000,000 |

|

|

PNC Bank, National Association |

|

$ |

25,000,000 |

|

|

Bank of Tokyo-Mitsubishi UFJ, Ltd. |

|

$ |

25,000,000 |

|

|

TOTAL: |

|

$ |

310,000,000 |

|

Annex I

Applicable Margin

|

Index Debt Rating

(S&P / Moody’s /

Fitch’s) |

|

US ABR

Loans |

|

Canadian

US$-

Denominated

ABR Loans

and

Canadian

Prime Rate

Loans |

|

US

Eurodollar

Loan |

|

Canadian

US$

Libor

Loan |

|

Canadian

BA

Stamping

Rate |

|

Applicable

Fee |

|

|

A3/A- or higher |

|

0.000 |

% |

0.000 |

% |

1.000 |

% |

1.000 |

% |

1.000 |

% |

0.100 |

% |

|

Baa1/BBB+ |

|

0.075 |

% |

0.075 |

% |

1.125 |

% |

1.125 |

% |

1.125 |

% |

0.125 |

% |

|

Baa2/BBB |

|

0.200 |

% |

0.200 |

% |

1.250 |

% |

1.250 |

% |

1.250 |

% |

0.150 |

% |

|

Baa3/BBB- |

|

0.325 |

% |

0.325 |

% |

1.375 |

% |

1.375 |

% |

1.375 |

% |

0.200 |

% |

|

Ba1/BB+ or lower |

|

0.450 |

% |

0.450 |

% |

1.500 |

% |

1.500 |

% |

1.500 |

% |

0.250 |

% |

For purposes of the above, (i) if any of Moody’s or S&P or Fitch’s shall not have in effect a rating for the Index Debt (other than by reason of the circumstances referred to in the last sentence of this definition), then such rating agency shall be deemed to have established the same rating as the rating agency that has in effect the higher rating for the Index Debt; provided that if none of Fitch’s, Moody’s or S&P has in effect a rating for the Index Debt (other than by reason of the circumstances referred to in the last sentence of this definition), then the Level IV rating in the above grid shall be the rating deemed in effect; (ii) if the ratings established or deemed to have been established by Fitch’s, Moody’s and S&P for the Index Debt shall fall within two different Levels, the Applicable Margin shall be based on the higher of the two Levels, but if the three ratings are separated by more than one rating Level, the Applicable Margin shall be the rating Level that is one lower than the highest such rating Level; and (iii) if the ratings established or deemed to have been established by Fitch’s, Moody’s and S&P for the Index Debt shall be changed (other than as a result of a change in the rating system of Moody’s, S&P or Fitch’s), such change shall be effective as of the date on which it is first announced by the applicable rating agency, irrespective of when or whether notice of such change shall have been furnished by any Loan Party to the Administrative Agent and the Lenders. Each change in the Applicable Margin shall apply during the period commencing on the effective date of such change and ending on the date immediately preceding the effective date of the next such change; provided, however that (x) with respect to Canadian US$ Libor Loans, such change shall apply only for those portions of applicable Interest Periods falling within those times during which the changes in Applicable Margin are effective, as provided above, (y) with respect to Canadian Bankers’ Acceptances and Canadian US$ Libor Loans, such change shall be effective upon the earlier of (1) 90 days after any change in the ratings above or when the Index Debt ceases to be rated and (ii) the next rollover or conversion thereof after such change or cessation in rating, as the case may be. If the rating system of Fitch’s, Moody’s or S&P shall change, or if no such rating agency shall then be in the business of rating corporate debt obligations, the Loan Parties and the Lenders shall negotiate in good faith to amend this definition to reflect such changed rating system or the unavailability of ratings from such rating agency and, pending the effectiveness of any such amendment, the Applicable Margin shall be determined by reference to the rating most recently in effect prior to such change or cessation.

Schedule I

US Lender Commitments

|

NAME OF LENDER |

|

APPLICABLE PERCENTAGE |

|

US REVOLVING COMMITMENT |

|

|

Citibank, N.A. |

|

11.62790697674420 |

% |

$ |

250,000,000 |

|

|

Mizuho Bank, Ltd. |

|

11.62790697674420 |

% |

$ |

250,000,000 |

|

|

Wells Fargo Bank, N.A. |

|

11.62790697674420 |

% |

$ |

250,000,000 |

|

|

HSBC Bank USA, N.A. |

|

9.30232558139535 |

% |

$ |

200,000,000 |

|

|

Bank of America, N.A. |

|

7.20930232558140 |

% |

$ |

155,000,000 |

|

|

PNC Bank, National Association |

|

6.97674418604651 |

% |

$ |

150,000,000 |

|

|

Bank of Tokyo-Mitsubishi UFJ, Ltd. |

|

6.97674418604651 |

% |

$ |

150,000,000 |

|

|

Deutsche Bank AG New York Branch |

|

5.11627906976744 |

% |

$ |

110,000,000 |

|

|

Morgan Stanley Bank, N.A. |

|

5.11627906976744 |

% |

$ |

110,000,000 |

|

|

Compass Bank |

|

4.65116279069767 |

% |

$ |

100,000,000 |

|

|

Goldman Sachs Bank USA |

|

4.65116279069767 |

% |

$ |

100,000,000 |

|

|

Sumitomo Mitsui Banking Corporation |

|

4.65116279069767 |

% |

$ |

100,000,000 |

|

|

U.S. Bank National Association |

|

4.65116279069767 |

% |

$ |

100,000,000 |

|

|

Arab Banking Corporation, Grand Cayman Branch |

|

2.32558139534884 |

% |

$ |

50,000,000 |

|

|

Australia and New Zealand Banking Group Limited |

|

2.32558139534884 |

% |

$ |

50,000,000 |

|

|

Riyad Bank, Houston Agency |

|

1.16279069767442 |

% |

$ |

25,000,000 |

|

|

TOTAL: |

|

100.00 |

% |

$ |

2,150,000,000 |

|

Exhibit 99.1

|

|

NEWS RELEASE |

FOR IMMEDIATE RELEASE

July 14, 2015

Nabors Extends Term of Revolving Credit Facility, Increases Borrowing Capacity to $2.2 Billion

Hamilton, Bermuda, July 15, 2015/ PR Newswire — Nabors Industries Ltd. (NYSE: NBR) today announced the execution of an amendment to its existing committed, unsecured revolving credit facility. Under the terms of the amendment, the borrowing capacity under the revolving credit facility has been increased to $2.2 billion. In addition, the term of the revolving credit facility has been extended until July 2020. The current rate under the revised facility has been reduced to LIBOR plus 125 bps with standby fees of 15 bps applying to the undrawn commitment. Nabors expects to use the extended facility to provide financial flexibility for strategic investment opportunities, debt refinancing and other corporate uses.

Under the terms of the revolving credit agreement, as amended, Citigroup Global Markets Inc., Mizuho Bank, Ltd., HSBC Bank USA, N.A. and Wells Fargo Bank Securities, LLC., are joint lead arrangers and bookrunners. The lenders participating in the facility are Citibank, N.A., Mizuho Bank, Ltd., HSBC Bank USA, N.A., Wells Fargo Bank, N.A., HSBC Bank Canada, Bank of America, N.A., Bank of Tokyo-Mitsubishi UFJ, Ltd., PNC Bank, National Association, Deutsche Bank AG New York Branch, Morgan Stanley Bank, N.A., Compass Bank, U.S. Bank National Association, Goldman Sachs Bank USA, Sumitomo Mitsui Banking Corporation, Australia and New Zealand Banking Group Limited, Arab Banking Corporation, Grand Cayman Branch, and Riyad Bank, Houston Agency.

About Nabors Industries

The Nabors companies own and operate approximately 468 land drilling rigs throughout the world. Nabors’ actively marketed offshore fleet consists of six jackups and 36 platform rigs in the United States and multiple international markets. Nabors also manufactures top drives and drilling instrumentation systems. Nabors participates in most of the significant oil and gas markets in the world.

####

The information above includes forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Such forward-looking statements are subject to certain risks and uncertainties, as disclosed by Nabors from time to time in its filings with the Securities and Exchange Commission. As a result of these factors, Nabors’ actual results may differ materially from those indicated or implied by such forward-looking statements. The projections contained in this release reflect management’s estimates as of the date of the release. Nabors does not undertake to update these forward-looking statements.

Media & Investor Contacts:

Dennis A. Smith, Director of Corporate Development & Investor Relations, at +1 281-775-8038.

To request investor materials, contact Nabors’ corporate headquarters in Hamilton, Bermuda at +1 441-292-1510 or via email at mark.andrews@nabors.com.

SOURCE: Nabors Industries Ltd.

1

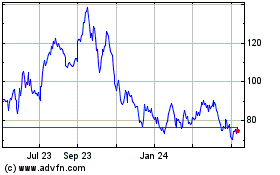

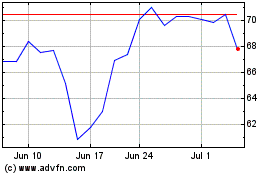

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Apr 2023 to Apr 2024