Report of Foreign Issuer (6-k)

January 24 2017 - 7:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

Report of

Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of January 2017

Commission File

No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1,

Marunouchi

2-chome,

Chiyoda-ku

Tokyo

100-8330,

Japan

(Address of principal executive office)

Indicate by

check mark whether the registrant files or

will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F

X

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 24, 2017

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Yasuo Matsumoto

|

|

Name:

|

|

Yasuo Matsumoto

|

|

Title:

|

|

Chief Manager, Documentation &

Corporate Secretary Department,

Corporate Administration Division

|

Mitsubishi UFJ Financial Group, Inc.

Notice of Share Transfer to Wholly-owned Subsidiary through Simplified Absorption-type Company Split

Tokyo, January

24, 2017 —

Mitsubishi UFJ Financial Group, Inc. (MUFG) has today decided to transfer 285,900 ordinary shares of

Mitsubishi UFJ Investor Services & Banking (Luxembourg) S.A. (MIBL), which MUFG will receive from the Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU) by means of a dividend in kind on May 31, 2017, to

wholly-owned

subsidiary Mitsubishi UFJ Trust and Banking Corporation (MUTB) by means of a company split, effective from May 31, 2017.

Because the inheritor in this absorption-type company split is a wholly-owned subsidiary, some items for disclosure have been omitted.

MUFG, by conducting this absorption-type company split after receiving the

dividend in kind from BTMU, will gather its shareholdings in MIBL at MUTB, which conducts trust banking, with the aim of further strengthening the authority or responsibility of MUTB in its role of managing the business, and of creating an

organizational structure that enables the fastest and most appropriate decision-making.

Signing date of absorption-type company split agreement: February 10, 2017

Effective date: May 31, 2017 (planned)

|

|

Note:

|

As this absorption-type company split falls under a simplified split as defined in Article 784, Paragraph 2 of the Companies Act, MUFG will not convene a General Meeting of Shareholders to approve the absorption-type

company split contract.

|

Company split, with MUFG as the company undergoing a split, and MUTB as the inheritor.

With this absorption-type company split MUTB will issue its new ordinary shares, all

of which will accede to MUFG. The number of shares to be issued will be announced once it has been decided.

|

|

(4)

|

Handling of new share acquisition rights and bonds with new share acquisition rights

|

Not

applicable.

|

|

(5)

|

Increase/decrease in capital

|

There will be no increase or decrease in MUFG’s capital as a

result of this absorption-type company split.

1

|

|

(6)

|

Rights and obligations acceded to inheritor

|

MUTB will inherit 285,900 ordinary shares, which

MUFG will receive from BTMU by means of a dividend in kind on May 31, 2017, in this absorption-type company split.

|

|

(7)

|

Outlook for fulfillment of obligations

|

MUTB will inherit no debt from MUFG in this

absorption-type company split.

|

3.

|

Overview of companies involved

|

(As of March 31, 2016)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company undergoing split

|

|

Inheritor

|

|

Company name

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

Mitsubishi UFJ Trust and Banking Corporation

|

|

Head office

|

|

7-1,

Marunouchi

2-Chome,

Chiyoda-ku, Tokyo

|

|

4-5,

Marunouchi

1-Chome,

Chiyoda-ku,

Tokyo

|

|

Company representatives and positions

|

|

Nobuyuki Hirano, President & CEO

|

|

Mikio Ikegaya, President

|

|

Principal business

|

|

Bank holding company

|

|

Trust banking

|

|

Capital

|

|

JPY 2,141.5 billion

|

|

JPY 324.2 billion

|

|

Date of establishment

|

|

April 2, 2001

|

|

March 10, 1927

|

|

Total outstanding shares

|

|

14,168,853,820 shares

|

|

3,399,187,203 shares

|

|

Fiscal

year-end

|

|

March 31

|

|

March 31

|

|

Major shareholders

(shareholding ratio)

|

|

Japan Trustee Services Bank, Ltd.

(Trust account)

|

|

5.28%

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

100%

|

|

|

The Master Trust Bank of Japan, Ltd.

(Trust account)

|

|

3.81%

|

|

|

|

|

Japan Trustee Services Bank, Ltd.

(Trust account 9)

|

|

1.57%

|

|

|

|

Financial status and business results

|

|

Fiscal year ended March 31, 2016

(Consolidated)

|

|

Fiscal year ended March 31, 2016

(Consolidated)

|

|

|

|

Net assets

|

|

JPY 17,386.7 billion

|

|

JPY 2,470.1 billion

|

|

|

|

Total assets

|

|

JPY 298,302.8 billion

|

|

JPY 45,685.9 billion

|

|

|

|

Net assets per share

|

|

JPY 1,121.06

|

|

JPY 675.66

|

|

|

|

Ordinary income

|

|

JPY 5,714.4 billion

|

|

JPY 717.6 billion

|

|

|

|

Ordinary profits

|

|

JPY 1,539.4 billion

|

|

JPY 238.3 billion

|

|

|

|

Profits attributable to owners of parent

|

|

JPY 951.4 billion

|

|

JPY 159.5 billion

|

|

|

|

Basic earnings per share

|

|

JPY 68.51

|

|

JPY 47.04

|

2

|

|

(1)

|

Details of the split business departments

|

Ordinary shares of MIBL: 285,900 shares

|

|

(2)

|

Business results of the split departments

|

Not applicable.

|

|

(3)

|

Items and amount of the split assets and liabilities

|

|

|

|

|

|

|

|

|

|

Assets

|

|

Liabilities

|

|

Item

|

|

Book value

|

|

Item

|

|

Book value

|

|

Ordinary shares of MIBL

|

|

USD 28.59 million

(JPY 3,689 million)

|

|

—

|

|

—

|

|

5.

|

Status after the split

|

There will be no change in the company name or head office,

company representatives or positions, principal business, capital or fiscal

year-end

of either MUFG or MUTB following the split.

As the inheritor is a wholly-owned subsidiary of the company undergoing

the split, the impact of the split on MUFG’s business results is expected to be negligible. Moreover, the split will be conducted on the premise that the permissions of the relevant authorities required for carrying out this absorption-type

company split have been obtained.

* *

*

Contact:

Mitsubishi UFJ Financial Group

Corporate Communications Division

Media Relations Office

81-3-3240-7651

3

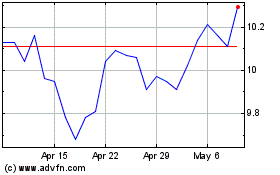

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

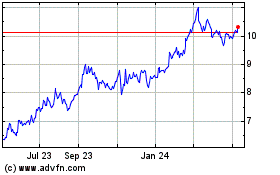

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024