Mitsubishi UFJ Financial's First-Quarter Profit Hit by Negative Rates

August 01 2016 - 5:50AM

Dow Jones News

Japan's largest bank, Mitsubishi UFJ Financial Group Inc., said

its first-quarter net profit tumbled as the country's negative

interest rates ate into the bank's profits from lending.

Net profit declined 32% to ¥ 188.92 billion ($ 1.8 billion) in

the April-June period compared with the same period last year. The

Tokyo lender said first-quarter net interest income from lending

came to ¥ 502 billion, down 8% from a year earlier.

The weak performance highlights the challenges that lenders are

facing now—a painful combination of ultrathin loan spreads, weak

loan demand and lower economic growth.

Last Friday, Mizuho Financial Group Inc., Japan's second-largest

lender by assets, reported a 16% decline in net profit in the

April-June period from a year earlier.

Negative rates are squeezing banks' margins because the banks

have to reduce rates charged to corporate borrowers but have yet to

lower rates on depositors' accounts below zero.

In overseas operations, Mitsubishi UFJ said it also saw a drop

in lending.

MUFG booked a loss of ¥ 6.5 billion from its 20% stake in Morgan

Stanley.

Write to Atsuko Fukase at atsuko.fukase@wsj.com

(END) Dow Jones Newswires

August 01, 2016 05:35 ET (09:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

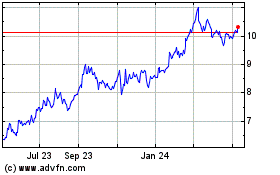

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

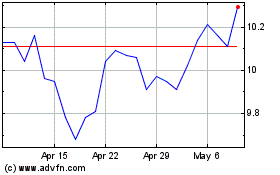

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024