Mitsubishi UFJ Financial Group, Inc. (MUFG - NYSE: MTU), one of

the world's leading financial groups, announced that effective

today it is designating its current U.S. bank holding company, MUFG

Americas Holdings Corporation (MUAH), as its Intermediate Holding

Company (IHC) in accordance with the requirements of the U.S.

Federal Reserve Board’s final rules for Enhanced Prudential

Standards (the EPS Rules). The reorganization also allows all

material U.S. subsidiaries of MUFG to be clearly aligned as one

team.

As the designated IHC, MUAH now directly holds the major U.S.

subsidiaries of MUFG, including MUFG Union Bank, N.A. (MUB); MUFG

Securities Americas Inc. (MUS(USA)), the former U.S. subsidiary of

Mitsubishi UFJ Securities Holdings Co., Ltd; and MUFG Fund Services

(USA) LLC (MFS(USA)), the former U.S. subsidiary of Mitsubishi UFJ

Trust and Banking Corporation (MUTB). In line with the EPS Rules,

all remaining U.S. subsidiaries of MUFG will be transferred under

MUAH by July 2017.

Also effective today, MUS(USA) has changed its legal name to

MUFG Securities Americas Inc. from Mitsubishi UFJ Securities (USA),

Inc., to emphasize a single, cohesive MUFG brand that offers

clients access to a broader suite of products and services under a

single holding company.

“After thousands of hours of collaboration and work by

colleagues from the United States to Japan, MUFG is pleased to have

successfully met this important U.S. regulatory requirement,” said

Kanetsugu “Sugu” Mike, Group Head of Global Business Group,

MUFG; and MUFG and The Bank of Tokyo-Mitsubishi UFJ, Ltd. Regional

Executive for the Americas. “The MUFG team showed unwavering

dedication in achieving this goal without sacrificing service to

our clients and customers – and for that, we are grateful.”

President and CEO of MUAH, Stephen Cummings, who assumes

the role of CEO for the IHC, added: “These changes provide a

stronger governance and risk-management structure in the U.S., in

addition to creating a more streamlined organization. Further, we

are now in a stronger position to go to market with a unified MUFG

brand across our various lines of business."

In another move to comply with the EPS Rules, MUFG has announced

the establishment of the U.S. Risk Committee under the MUFG Board

Risk Committee; the new Committee will oversee all types of risk at

the combined U.S. operations level.

In February 2014, the Federal Reserve Board approved final rules

to strengthen the supervision and regulation of large U.S. bank

holding companies and foreign banking organizations (FBOs) by

establishing the EPS Rules, a series of enhanced prudential

standards to help increase the resiliency of their operations.

These Rules – targeting liquidity, risk management, and capital –

require an FBO with a significant U.S. presence to establish an IHC

to directly hold U.S. subsidiaries it owns or controls to

facilitate consistent supervision and regulation of those U.S.

operations. The EPS Rules were required as part of the Dodd-Frank

Wall Street Reform and Consumer Protection Act.

About MUFG Americas Holdings Corporation

Headquartered in New York, MUFG Americas Holdings Corporation is

a financial holding company and bank holding company with total

assets of $120.9 billion at March 31, 2016. Its principal

subsidiary, MUFG Union Bank, N.A., provides an array of financial

services to individuals, small businesses, middle-market companies,

and major corporations. As of March 31, 2016, MUFG Union Bank, N.A.

operated 370 branches, comprised primarily of retail banking

branches in the West Coast states, along with commercial branches

in Texas, Illinois, New York, and Georgia, as well as two

international offices. MUFG Americas Holdings Corporation as of

July 1, 2016, is owned by The Bank of Tokyo-Mitsubishi UFJ, Ltd.

and Mitsubishi UFJ Financial Group, Inc., one of the world’s

leading financial groups. The Bank of Tokyo-Mitsubishi UFJ, Ltd. is

a wholly-owned subsidiary of Mitsubishi UFJ Financial Group, Inc.

Visit www.unionbank.com or www.mufgamericas.com for more

information.

About MUFG (Mitsubishi UFJ Financial Group, Inc.)

MUFG (Mitsubishi UFJ Financial Group, Inc.) is one of the

world’s leading financial groups, with total assets of

approximately ¥298.3 trillion (JPY) or $2.6 trillion (USD)¹, as of

March 31, 2016. Headquartered in Tokyo and with approximately 350

years of history, MUFG is a global network with over 2,000 offices

in nearly 50 countries. The Group has over 140,000 employees and

about 300 entities, offering services including commercial banking,

trust banking, securities, credit cards, consumer finance, asset

management, and leasing. The Group’s operating companies include

The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and

Banking Corporation (Japan’s leading trust bank), and Mitsubishi

UFJ Securities Holdings Co., Ltd., one of Japan’s largest

securities firms. Through close partnerships among our operating

companies, the Group aims to “be the world’s most trusted financial

group”, flexibly responding to all of the financial needs or our

customers, serving society, and fostering shared and sustainable

growth for a better world. MUFG’s shares trade on the Tokyo,

Nagoya, and New York (NYSE: MTU) stock exchanges. Visit

www.mufg.jp/english/index.html.

1 Exchange rate of 1 USD=¥112.68 (JPY) as of March 31, 2016

Cautionary Statement Concerning Forward-Looking

Information

This document includes forward-looking statements such as those

relating to the strength in the market of our unified MUFG brand.

Forward-looking statements involve risks and uncertainties and can

be identified by the fact that they do not relate strictly to

historical or current facts. Often, they include the words

“believe,” “continue,” “expect,” “target,” “anticipate,” “intend,”

“plan,” “estimate,” “potential,” “project,” or words of similar

meaning, or future or conditional verbs such as “will,” “would,”

“should,” “could,” or “may.” There are numerous risks and

uncertainties that could and will cause actual results to differ

materially from those discussed in MUAH’s forward-looking

statements. Many of these factors are beyond MUAH’s ability to

control or predict and could have a material adverse effect on

MUAH’s financial condition, results of operations and/or prospects.

Such risks and uncertainties include, but are not limited to, risks

and uncertainties discussed in MUAH’s public filings with the SEC.

All forward-looking statements included in this document are based

on information available at the time of such document, and MUAH

assumes no obligation to update any forward-looking statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160701005103/en/

Mitsubishi UFJ Financial Group, Inc.Press

contact:Rich Silverman, 1-212-782-5953orInvestor Relations

contact:Doug Lambert, 1-212-782-5911

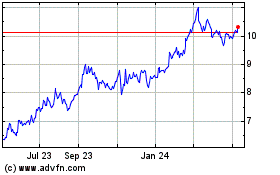

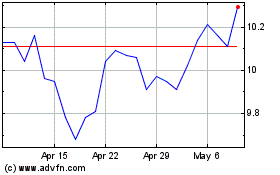

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024