Nissan Considers Buying a Third of Mitsubishi Motors

May 11 2016 - 9:30PM

Dow Jones News

TOKYO—Nissan Motor Co. is considering buying about a one-third

stake in Mitsubishi Motors Corp. for about 200 billion yen ($1.8

billion) to become the latter company's single largest shareholder,

a person familiar with the matter said Thursday.

The move by Nissan, which is already in a vehicle-development

and manufacturing partnership with Mitsubishi, could lead to a

realignment of the Japanese auto industry, with eight car makers

currently.

It comes as Mitsubishi grapples with declining sales and growing

costs after admitting in April to overstating fuel economy for

certain models sold in Japan.

The current partnership between Nissan, Japan's second-biggest

auto maker based on global vehicle sales volume, and Mitsubishi,

Japan's sixth largest, doesn't involve any capital.

In separate statements Thursday, the two companies said they

would discuss a capital alliance at respective board meetings to be

held later in the day. Nothing has been decided as of now, they

said.

If they reach a decision at the board meetings, the two

companies could hold a news conference to announce the deal later

Thursday, the person familiar with the matter said.

Nissan Chief Executive Officer Carlos Ghosn is set to brief the

media later today on the car maker's earnings results for the

fiscal year that ended in March.

Mitsubishi Motors shares were bid-only, while Nissan shares fell

2.4% in early morning trade.

The deal news was reported earlier Thursday by public

broadcaster NHK and other Japanese media.

Currently, Mitsubishi Motors's biggest single shareholder is

Mitsubishi Heavy Industries Ltd., which holds about a 20% stake in

the auto maker. Mitsubishi Corp. holds a 10% stake, while the Bank

of Tokyo-Mitsubishi UFJ, owned by Mitsubishi UFJ Financial Group

Inc., holds about a 4% stake.

These Mitsubishi group companies rescued Mitsubishi Motors in

2004 by purchasing preferred shares after the car maker's

partnership with DaimlerChrysler fell apart. About two years ago,

the auto maker paid back the group companies, but three of the

group companies retained a combined 34% stake.

Under Japanese law, shareholders with a stake of more than a

third carry veto power of major management decisions.

Nissan's main partner is Renault SA, which owns a 43% voting

interest in the Japanese company. The Japanese auto maker owns a

15% nonvoting right in the French car maker.

Under the Nissan-Mitsubishi partnership, Mitsubishi has

developed and produced several minicars with 0.66 liter engine

displacements for the Japanese market. Those vehicles were sold

under the Mitsubishi and Nissan brands, but sales have been halted

since late April due to the fuel-economy problems with these

cars.

Mitsubishi has a strong foothold in Southeast Asia, while its

presence in the U.S. is relatively thin. One of Nissan's biggest

markets is the U.S. and the company has been trying to expand in

Southeast Asia for years.

Mitsubishi Chairman Osamu Masuko said on Wednesday in a news

conference that his company wants to continue working with Nissan.

He also said the company has enough cash at the moment to manage

costs associated with the fuel-economy problem.

Write to Yoko Kubota at yoko.kubota@wsj.com

(END) Dow Jones Newswires

May 11, 2016 21:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

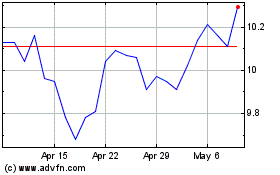

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

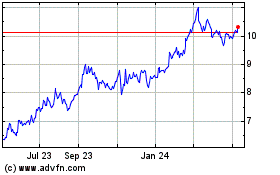

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024