Sharp, Foxconn Aim to Seal the Deal by Next Week

March 03 2016 - 11:30PM

Dow Jones News

Foxconn Technology Group doesn't plan to adjust its planned ¥

489 billion ($4.30 billion) investment in embattled Japanese

consumer-electronics company Sharp Corp. but terms for creditors

could be revised as negotiations continue, people familiar with the

matter said.

The two companies aim to seal a near $6 billion deal early next

week after one more round of negotiation, the people said. Foxconn

and Sharp are optimistic that the Japanese company's recent

disclosure of an additional ¥ 350 billion in contingent liabilities

or potential financial risk, won't derail the deal, the people

said.

Since Monday, Foxconn and Sharp have deployed hundreds of people

across all of Sharp's locations to study the latest list of

financial risk, the people said. The teams have been meeting around

the clock and late into the night to determine whether the new

risks are acceptable, the people said.

A Sharp spokesman said negotiations are continuing with Foxconn

and declined to comment when asked whether the company's board

would need to meet again to approve revised deal terms.

Foxconn didn't immediately reply to a request for comment.

Battered by price declines in smartphone screens, Osaka-based

Sharp decided last week to accept a takeover offer from Foxconn,

known formally as Hon Hai Precision Industry Ltd. But the Taiwanese

company, which assembles Apple Inc.'s iPhones, paused to seal the

deal, saying it needed more time to review important information

that Sharp disclosed at the last minute of negotiations.

People familiar with the matter said earlier Sharp had disclosed

more than 100 items of contingent liabilities including possible

tax claims by the Japanese government, intellectual-property

lawsuits and potential damages from patent infringement claims

against Sharp.

Sharp faces a March 31 deadline to repay a total of ¥ 510

billion in borrowings. Main lenders need Sharp to reach an

agreement on the takeover deal before renewing the loans, bankers

said.

Under the deal outlined by Sharp last week, it would issue new

shares to Foxconn in exchange for an infusion of ¥ 489 billion.

Sharp said Foxconn would purchase preferred shares held by two

creditors—the core banking units of Mizuho Financial Group Inc. and

Mitsubishi UFJ Financial Group Inc.—for ¥ 100 billion.

Other payments that people familiar with the matter said would

total about ¥ 70 billion would bring the total commitment by

Foxconn to ¥ 659 billion, or $5.80 billion.

It wasn't immediately clear how much Foxconn is willing to pay

creditors for the preferred shares under revised terms.

Foxconn's offer was double what a government-backed Japanese

fund—Innovation Network Corp. of Japan—was offering and included

relief for Sharp's two main banks, which are saddled with the

company's debt.

The deal is being watched closely not just because of its

implications for Japan's reputation for protecting its prized

industrial names from foreign ownership, but because it also could

mark a passing of the technological generations: 103-year-old Sharp

was a pioneer of the modern television set in Japan; Foxconn,

founded more than four decades ago, has grown into a $120 billion

behemoth thanks to its proficiency in assembling smartphones.

Eva Dou in Beijing contributed to this article.

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com and

Wayne Ma at wayne.ma@wsj.com

(END) Dow Jones Newswires

March 03, 2016 23:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

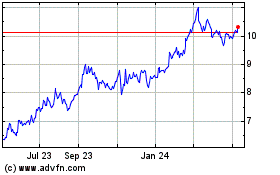

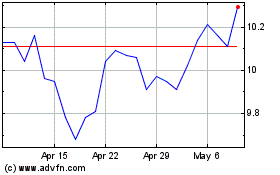

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024