UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of February 2016

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by

check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form

40-F

Indicate by check mark if

the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3

(NO. 333-209455) OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED

WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: February 12, 2016

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Yasuo Matsumoto |

| Name: |

|

Yasuo Matsumoto |

| Title: |

|

Chief Manager

Documentation & Corporate Secretary Department

Corporate Administration Division |

English Translation of Excerpts from Quarterly Securities Report Filed in Japan

This document is an English translation of selected information included in the Quarterly Securities Report for the quarter ended

December 31, 2015 filed by Mitsubishi UFJ Financial Group, Inc. (“MUFG” or “we”) with the Kanto Local Financial Bureau, the Ministry of Finance of Japan, on February 12, 2016 (the “Quarterly Securities

Report”). An English translation of certain information included in the Quarterly Securities Report was previously submitted in a report on Form 6-K dated February 1, 2016. Accordingly, this document should be read together with the

previously submitted report.

The Quarterly Securities Report has been prepared and filed in Japan in accordance with applicable Japanese

disclosure requirements as well as generally accepted accounting principles in Japan (“J-GAAP”). There are significant differences between J-GAAP and generally accepted accounting principles in the

United States (“U.S. GAAP”). In addition, the Quarterly Securities Report is intended to update prior disclosures filed by MUFG in Japan and discusses selected recent developments in the context of those prior disclosures. Accordingly, the

Quarterly Securities Report may not contain all of the information that is important to you. For a more complete discussion of the background to information provided in the Quarterly Securities Report disclosure, please see our annual report on Form

20-F for the fiscal year ended March 31, 2015 and the other reports filed with or submitted to the U.S. Securities and Exchange Commission by MUFG.

Risks Relating to Our Business

We describe below some major developments and changes to update our risk factor disclosure previously included in our annual securities report

for the fiscal year ended March 31, 2015 filed in Japan on June 25, 2015. The updates below are not a complete update of the prior disclosure, but instead intended to explain only the significant developments and changes that we believe

may have a material impact on the risks to our business and other risks. The discussion below contains forward-looking statements, which, unless specifically described otherwise, reflect our understanding as of the date of filing of the Quarterly

Securities Report.

The numbering of the subheading of the risk disclosure below corresponds to the numbering of the subheading of the

same risk disclosure in “Risks Relating to Our Business” in our most recent annual securities report filed in Japan.

| 5. |

Risks relating to our financial markets operations |

We undertake extensive financial

market operations involving a variety of financial instruments, including derivatives, and hold large volumes of such financial instruments. As a result, our financial condition and results of operations are subject to the risks relating to these

operations and holdings. The primary risks are fluctuations in interest rates in and outside of Japan, foreign currency exchange rates and securities prices. For example, an increase in interest rates in and outside of Japan may adversely affect the

value of our fixed income securities portfolio. Specifically, interest rates may increase in the event that Japanese government bonds decline in value due to such factors as a heightened market expectation for tapering or cessation of the

quantitative and qualitative easing program in response to further progress in the anti-deflation measures in Japan and a decline in confidence in Japan’s fiscal health and sovereign creditworthiness, or in the event that interest rates on U.S.

Treasury securities rise due to such factors as changes in the economic or monetary policy in the United States. If interest rates in and outside of Japan rise for these or other reasons, we may incur significant losses on sales of, and valuation

losses on, our government bond portfolio. In addition, an appreciation of the Japanese yen will cause the value of our foreign currency-denominated investments on our financial statements to decline and may cause us to recognize losses on sales or

valuation losses. We manage market risk, which is the risk of incurring losses due to various market changes including interest rates in and outside of Japan, foreign currency exchange rates and securities prices, by separating market risk into

“general market risk” and “specific risk”. General market risk is the risk of incurring losses due to changes in overall markets, while specific risk is the risk of incurring losses due to changes in the prices of individual

financial instruments, including stocks and bonds, which fluctuate separately from changes in the overall direction of the market. To measure these risks, we use a method that statistically estimates how much the market value of our portfolio may

decline over a fixed period of time in the future based on past market changes, and we consider the sum of our general market risk and specific risk calculated by this method as our market risk exposure. However, because of its inherent nature, our

market risk exposure calculated in this manner cannot always reflect the actual risk that we face, and we may realize actual losses that are greater than our estimated market risk exposure.

In addition, we may voluntarily modify, or may be required by changes in accounting rules or

otherwise to modify, the valuation method and other accounting treatment we apply to the financial instruments we hold in connection with our markets operations. In such case, our results of operations may be adversely affected.

| 18. |

Risks relating to competitive pressures |

Competition in the Japanese financial services

industry may intensify as regional financial institutions further integrate and reorganize their operations and Japan Post Holdings Co., Ltd. and its two financial subsidiaries listed their respective shares on the Tokyo Stock Exchange in November

2015. Competition in financial markets outside of Japan are also expected to increase as U.S. and European financial institutions regain their competitive strength, while local financial institutions in Asia grow their business. In addition, recent

advances in information and communication technology have allowed non-financial institutions to enter the financial services industry, and such new entrants could become substantial competition to us. The ongoing global financial regulatory reforms

may also lead to changes in the competitive environment for financial institutions. If we are unable to compete effectively in the increasingly competitive business environment, our business, financial condition and results of operations may be

adversely affected.

| 20. |

Risks relating to regulatory developments or changes in laws or rules, including accounting rules, governmental policies and economic controls |

We conduct our business subject to current regulations (including laws, regulations, accounting standards, policies, customary business

practices and interpretations in Japan and other regions where we operate, as well as global financial regulatory standards) and risks associated with changes in such regulations. In light of the ongoing international discussions on various

regulatory standards that could significantly affect banking operations, including the introduction of capital requirements for the interest rate risk for the banking book, revisions to methods of calculating the amount of risk-weighted assets and

the review of the credit valuation adjustment risk framework, future regulatory changes and situations arising as a result of such changes may adversely impact our business, financial condition and results of operations. However, the type, nature

and extent of the impact of any regulatory changes and situations that may arise as a result are difficult to predict and beyond our control.

| 22. |

Risks relating to regulatory capital ratio and other related requirements |

(1) Capital ratio

requirements and adverse factors

Since the fiscal year ended March 31, 2013, we have been subject to capital adequacy requirements

adopted in Japan in accordance with “Basel III: A global regulatory framework for more resilient banks and banking systems” (“Basel III”). Compared to the previous capital adequacy requirements (Basel II), Basel III places

greater importance on the quality of capital, and is designed, among other things, to increase capital levels by raising the level of minimum capital ratio requirements and introduce a framework to promote the conservation of capital where dividends

and other distributions are constrained when capital levels fall within a prescribed buffer range. Basel III capital adequacy requirements are being introduced in Japan in phases starting in the fiscal year ended March 31, 2013. Since we have

international operations, our consolidated capital ratios are subject to the capital requirements applicable to internationally active banks set forth in the capital adequacy guidelines adopted by the Financial Services Agency of Japan for bank

holding companies (the Financial Services Agency of Japan Public Notice No. 20 released in 2006). In addition, since our bank subsidiaries, BTMU and Mitsubishi UFJ Trust and Banking Corporation, have international operations, their consolidated

and non-consolidated capital ratios are subject to the capital requirements applicable to internationally active banks on a consolidated and non-consolidated basis under the capital adequacy guidelines adopted

by the Financial Services Agency of Japan for banks (the Financial Services Agency of Japan Public Notice No. 19 released in 2006).

2

If our or our subsidiary banks’ capital ratios fall below required levels, the Financial

Services Agency of Japan will require us to take a variety of corrective actions, including the suspension of all or a part of our business operations.

In addition, some of our bank subsidiaries are subject to the capital adequacy rules of various foreign countries, including the United

States, and if their capital ratios fall below the required levels, the local regulators will require them to take a variety of corrective actions.

Factors that will affect our capital ratios, including the capital ratios of our bank subsidiaries, include:

| |

• |

|

increases in our and our banking subsidiaries’ credit risk assets and expected losses because of fluctuations in our or our banking subsidiaries’ portfolios due to deterioration in the creditworthiness of

borrowers and the issuers of equity and debt securities, |

| |

• |

|

difficulty in refinancing or issuing instruments upon redemption or at maturity of such instruments to raise capital under terms and conditions similar to prior financings or issuances, |

| |

• |

|

declines in the value of our or our banking subsidiaries’ securities portfolios, |

| |

• |

|

adverse changes in foreign currency exchange rates, |

| |

• |

|

adverse revisions to the capital ratio requirements, |

| |

• |

|

reductions in the value of our or our banking subsidiaries’ deferred tax assets, and |

| |

• |

|

other adverse developments. |

3

(2) Regulatory developments

In November 2014, the Financial Stability Board identified us as one of the globally systemically important banks (“G-SIBs”). The

banks that are included in the list of G-SIBs will be subject to a capital surcharge to varying degrees depending on the bucket to which each bank is allocated, and the capital surcharge requirement is expected to be implemented in phases from 2016.

As the list of G-SIBs will be updated annually, we may be required to meet the capital surcharge requirement.

(3)

Deferred tax assets

Under the capital adequacy guidelines which have been revised in connection with the adoption of Basel III as

discussed above, deferred tax assets can be included as a capital item when calculating capital ratios up to an amount calculable based on Common Equity Tier 1 instrument and reserve items and regulatory adjustment items. If and to the extent the

amount of deferred tax assets exceeds this limit and cannot be included in Common Equity Tier 1 capital, our and our banking subsidiaries’ capital ratios can decrease.

(4) Capital raising

Under the capital adequacy

guidelines which have been revised in connection with the adoption of Basel III as discussed above, there is a transition measure relating to the inclusion as a capital item of capital raising instruments issued in or prior to March 2013 (qualifying

prior capital raising instruments), and such instruments can be included as a capital item when calculating capital ratios to the extent permitted by the transition measure. Such capital raising instruments may require refinancing upon the

expiration of the transition period during which such instruments can be included as a capital item in the calculation of capital ratios. However, in order for newly issued capital raising instruments, other than common stock, to be included as a

capital item in the calculation of capital ratios under the above capital adequacy guidelines, such instruments must have a clause in their terms and conditions that requires them to be written off or converted into common stock upon the occurrence

of certain events, including when the issuing financial institution is deemed non-viable or when the issuing financial institution’s capital ratios decline below prescribed levels. As a result, under certain market conditions, we may be unable

to refinance or issue capital raising instruments under terms and conditions similar to those of qualifying prior capital raising instruments. If such circumstances arise, our and our banking subsidiaries’ capital could be reduced, and our and

our bank subsidiaries’ capital ratio could decrease.

(5) Total loss absorbing capacity (TLAC) in resolution

In November 2015, the Financial Stability Board issued the final Total Loss-Absorbing Capacity, or TLAC, standard for global systematically

important banks, or G-SIBs, including us. The standard will require G-SIBs to hold TLAC above a minimum ratio starting in 2019. This standard will be applied in addition to the regulatory capital ratio standard and may have an adverse impact on our

business, financial condition and results of operations.

4

Additional Financial Information for the Nine Months Ended December 31, 2015

| 1. |

“Loans and bills discounted” included the following risk-monitored loans as of the dates indicated: |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

March 31, 2015 |

|

|

December 31, 2015 |

|

| Loans to bankrupt borrowers |

|

¥ |

23,586 |

|

|

¥ |

55,911 |

|

| Non-accrual delinquent loans |

|

|

811,478 |

|

|

|

769,780 |

|

| Loans past due for three months or more |

|

|

51,034 |

|

|

|

50,685 |

|

| Restructured loans |

|

|

653,839 |

|

|

|

559,081 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

¥ |

1,539,939 |

|

|

¥ |

1,435,458 |

|

|

|

|

|

|

|

|

|

|

Note:

Amounts above are stated before the reduction of allowance for credit losses.

| 2. |

The principal amount of money trusts entrusted to a domestic trust banking subsidiary, for which repayment of the principal to the customers was guaranteed, as of the dates indicated were as follows: |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

March 31, 2015 |

|

|

December 31, 2015 |

|

| Money trusts |

|

¥ |

1,738,140 |

|

|

¥ |

2,043,380 |

|

| 3. |

Guarantee obligations for private placement bonds included in “Securities” (provided in accordance with the Article 2-3 of the “Financial Instruments and Exchange Act”) as of the dates indicated were

as follows: |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

March 31, 2015 |

|

|

December 31, 2015 |

|

| Guarantee obligations for private placement bonds |

|

¥ |

694,302 |

|

|

¥ |

615,421 |

|

| 4. |

“Other ordinary income” included the following for the periods indicated: |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Equity in earnings of the equity method investees |

|

¥ |

161,578 |

|

|

¥ |

191,355 |

|

| Gains on sales of equity securities |

|

|

93,234 |

|

|

|

85,663 |

|

| 5. |

“Other ordinary expenses” included the following for the periods indicated: |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Write-offs of loans |

|

¥ |

87,133 |

|

|

¥ |

97,122 |

|

| 6. |

“Settlement package” in Extraordinary losses refers to a payment based on a consent agreement entered into between The Bank of Tokyo-Mitsubishi UFJ, Ltd. and the New York State Department of Financial Service

in relation to the bank’s voluntary investigation, reporting and other compliance procedures regarding settlement transactions for countries under U.S. economic sanctions. |

5

| 7. |

No quarterly consolidated statements of cash flows have been prepared for those periods. Depreciation (including amortization of intangible assets other than goodwill) and amortization of goodwill for the periods

indicated were as follows: |

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Depreciation |

|

¥ |

219,398 |

|

|

¥ |

220,014 |

|

| Amortization of goodwill |

|

|

12,224 |

|

|

|

12,569 |

|

| 8. |

Capital Stock and Dividends Paid |

| |

(1) |

For the nine months ended December 31, 2014 |

Cash dividends approved at the shareholders meeting held on June 27, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total amount

(millions of yen) |

|

|

Per share

amount

(yen) |

|

|

Dividend

record date |

|

Effective date |

|

Source of funds |

| Common stock |

|

¥ |

127,474 |

|

|

¥ |

9 |

|

|

Mar. 31, 2014 |

|

Jun. 27, 2014 |

|

Retained earnings |

| Preferred stock - First series of Class 5 |

|

|

8,970 |

|

|

|

57.5 |

|

|

Mar. 31, 2014 |

|

Jun. 27, 2014 |

|

Retained earnings |

| Preferred stock - Class 11 |

|

|

0 |

|

|

|

2.65 |

|

|

Mar. 31, 2014 |

|

Jun. 27, 2014 |

|

Retained earnings |

| Cash dividends approved at the Board of Directors meeting

held on November 14, 2014 |

| |

|

Total amount

(millions of yen) |

|

|

Per share

amount

(yen) |

|

|

Dividend

record date |

|

Effective date |

|

Source of funds |

| Common stock |

|

¥ |

127,515 |

|

|

¥ |

9 |

|

|

Sep. 30, 2014 |

|

Dec. 5, 2014 |

|

Retained earnings |

| |

(b) |

Dividends the record date for which fell within the nine-month period and the effective date of which was after the end of the nine-month period |

Not applicable.

| |

(c) |

Material changes in capital stock |

In the first quarter ended June 30, 2014, MUFG began to

apply the “Accounting Standard for Retirement Benefits” (ASBJ Statement No. 26 issued on May 17, 2012) and other relevant standards. As a result, retained earnings decreased by ¥37,224 million as of April 1, 2014.

In the first quarter ended June 30, 2014, MUFG began to apply the “Revised Accounting Standard for Business Combinations”

(ASBJ Statement No. 21 issued on September 13, 2013) and other relevant standards. As a result, capital surplus decreased by ¥346,454 million and retained earnings increased by ¥95,134 million as of April 1, 2014.

In addition, MUFG acquired and cancelled the entire first series of class 5 preferred stock on April 1, 2014. As a result, capital

surplus decreased by ¥390,000 million.

6

| |

(2) |

For the nine months ended December 31, 2015 |

Cash dividends approved at the shareholders meeting held on June 25, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total amount

(millions of yen) |

|

|

Per share

amount

(yen) |

|

|

Dividend

record date |

|

|

Effective date |

|

|

Source of funds |

|

| Common stock |

|

¥ |

126,179 |

|

|

¥ |

9 |

|

|

|

Mar. 31, 2015 |

|

|

|

Jun. 25, 2015 |

|

|

|

Retained earnings |

|

Cash dividends approved at the Board of Directors meeting held on November 13, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total amount

(millions of yen) |

|

|

Per share

amount

(yen) |

|

|

Dividend

record date |

|

|

Effective date |

|

|

Source of funds |

|

| Common stock |

|

¥ |

125,212 |

|

|

¥ |

9 |

|

|

|

Sep. 30, 2015 |

|

|

|

Dec. 4, 2015 |

|

|

|

Retained earnings |

|

| |

(b) |

Dividends the record date for which fell within the nine-month period and the effective date of which was after the end of the nine-month period |

Not applicable.

For the nine months ended December 31, 2014

| |

(1) |

Information on Ordinary Income (Losses) and Net Income (Losses) for Each Reporting Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

BTMU |

|

|

MUTB |

|

|

MUSHD |

|

|

CFS |

|

|

Others |

|

|

Total |

|

|

Adjustments |

|

|

Consolidated |

|

| Ordinary Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Customers |

|

¥ |

2,949,341 |

|

|

¥ |

502,842 |

|

|

¥ |

348,178 |

|

|

¥ |

337,106 |

|

|

¥ |

122,860 |

|

|

¥ |

4,260,328 |

|

|

¥ |

— |

|

|

¥ |

4,260,328 |

|

| From Internal Transactions |

|

|

40,356 |

|

|

|

18,164 |

|

|

|

23,816 |

|

|

|

24,732 |

|

|

|

408,355 |

|

|

|

515,425 |

|

|

|

(515,425 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

¥ |

2,989,697 |

|

|

¥ |

521,006 |

|

|

¥ |

371,995 |

|

|

¥ |

361,839 |

|

|

¥ |

531,215 |

|

|

¥ |

4,775,754 |

|

|

¥ |

(515,425 |

) |

|

¥ |

4,260,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

640,859 |

|

|

|

127,097 |

|

|

|

42,514 |

|

|

|

45,595 |

|

|

|

489,499 |

|

|

|

1,345,568 |

|

|

|

(418,597 |

) |

|

|

926,971 |

|

Notes:

| 1. |

Ordinary income used in the above table is equivalent to revenues generally used by Japanese non-financial companies. |

| 2. |

“Others” includes MUFG and other companies. |

| 3. |

Adjustments on net income include elimination of inter-segment transactions of 520,904 million yen and 102,307 million yen of net profit representing the amounts that are not allocated among segments

consisting of profits (losses) from investment in affiliates (equity method), amortization of goodwill, tax expenses and profits attributable to non-controlling interests. |

| 4. |

Net income for “Others” includes 464,313 million yen of dividends from MUFG’s subsidiaries and affiliates. |

| 5. |

Net income is adjusted from the profits attributable to owners of parent in the consolidated profit and loss statements for the quarterly financial reporting period ended December 31, 2014. |

| 6. |

BTMU, MUTB, MUSHD and CFS stand for The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holdings Co., Ltd., and MUFG’s consumer finance subsidiaries*,

respectively, on a consolidated basis. |

| |

* |

Consumer finance subsidiaries include Mitsubishi UFJ NICOS Co., Ltd. and ACOM CO., LTD. |

7

For the nine months ended December 31, 2015

| |

(1) |

Information on Ordinary Income (Losses) and Net Income (Losses) for Each Reporting Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

BTMU |

|

|

MUTB |

|

|

MUSHD |

|

|

CFS |

|

|

Others |

|

|

Total |

|

|

Adjustments |

|

|

Consolidated |

|

| Ordinary Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| From Customers |

|

¥ |

2,886,964 |

|

|

¥ |

526,875 |

|

|

¥ |

362,932 |

|

|

¥ |

350,363 |

|

|

¥ |

163,828 |

|

|

¥ |

4,290,963 |

|

|

¥ |

— |

|

|

¥ |

4,290,963 |

|

| From Internal Transactions |

|

|

93,477 |

|

|

|

10,471 |

|

|

|

9,398 |

|

|

|

26,418 |

|

|

|

351,687 |

|

|

|

491,453 |

|

|

|

(491,453 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

¥ |

2,980,442 |

|

|

¥ |

537,346 |

|

|

¥ |

372,330 |

|

|

¥ |

376,781 |

|

|

¥ |

515,515 |

|

|

¥ |

4,782,416 |

|

|

¥ |

(491,453 |

) |

|

¥ |

4,290,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

584,049 |

|

|

|

113,120 |

|

|

|

33,183 |

|

|

|

41,642 |

|

|

|

470,114 |

|

|

|

1,242,110 |

|

|

|

(389,831 |

) |

|

|

852,279 |

|

Notes:

| 1. |

Ordinary income used in the above table is equivalent to revenues generally used by Japanese non-financial companies. |

| 2. |

“Others” includes MUFG and other companies. |

| 3. |

Adjustments on net income include elimination of inter-segment transactions of 528,683 million yen and 138,852 million yen of net profit representing the amounts that are not allocated among segments

consisting of profits (losses) from investment in affiliates (equity method), amortization of goodwill, tax expenses and profits attributable to non-controlling interests. |

| 4. |

Net income for “Others” includes 451,487 million yen of dividends from MUFG’s subsidiaries and affiliates. |

| 5. |

Net income is adjusted from the profits attributable to owners of parent in the consolidated profit and loss statements for the quarterly financial reporting period ended December 31, 2015. |

| 6. |

BTMU, MUTB, MUSHD and CFS stand for The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holdings Co., Ltd., and MUFG’s consumer finance subsidiaries*,

respectively, on a consolidated basis. |

| |

* |

Consumer finance subsidiaries include Mitsubishi UFJ NICOS Co., Ltd. and ACOM CO., LTD. |

| |

(2) |

Changes in Reporting Segments |

Starting this nine-month period ended December 31, 2015, a subsidiary

engaged in the securities business, which was previously included in the BTMU segment, is included in the MUSHD segment. This subsidiary of BTMU became a subsidiary of MUSHD on April 1, 2015, and is currently managed as part of MUSHD.

In addition, starting this nine-month period ended December 31, 2015, a subsidiary engaged in the asset management business, which was previously

included in the MUSHD segment, is included in the MUTB segment. This subsidiary of MUSHD merged with a subsidiary of MUTB on July 1, 2015, and is currently managed as part of MUTB.

The segment information for the nine months ended December 31, 2014 has been restated to reflect the foregoing changes in reporting segments.

| 10. |

Financial instruments and related disclosures |

There are no material changes to be disclosed as of

December 31, 2015 compared with as of March 31, 2015.

| *1 |

The following shows those securities as of December 31, 2015 which were deemed material in the management of our group company businesses and that showed material changes as compared to those as of March 31,

2015. |

| *2 |

The following tables include negotiable certificates of deposit in “Cash and due from banks” and beneficial interests in trusts in “Monetary claims bought” in addition to “Securities.”

|

8

| (1) |

Available-for-sale securities with fair value |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

March 31, 2015 |

|

| |

|

Acquisition cost |

|

|

Amount on

consolidated

balance sheet |

|

|

Difference |

|

| Domestic equity securities |

|

¥ |

2,791,373 |

|

|

¥ |

5,721,393 |

|

|

¥ |

2,930,019 |

|

| Domestic bonds |

|

|

36,193,843 |

|

|

|

36,520,219 |

|

|

|

326,376 |

|

| Government bonds |

|

|

33,810,955 |

|

|

|

34,084,434 |

|

|

|

273,479 |

|

| Municipal bonds |

|

|

182,942 |

|

|

|

188,316 |

|

|

|

5,374 |

|

| Corporate bonds |

|

|

2,199,945 |

|

|

|

2,247,468 |

|

|

|

47,522 |

|

| Other securities |

|

|

26,217,853 |

|

|

|

27,094,657 |

|

|

|

876,804 |

|

| Foreign equity securities |

|

|

132,934 |

|

|

|

191,401 |

|

|

|

58,466 |

|

| Foreign bonds |

|

|

21,967,649 |

|

|

|

22,564,990 |

|

|

|

597,340 |

|

| Other |

|

|

4,117,268 |

|

|

|

4,338,265 |

|

|

|

220,996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

¥ |

65,203,070 |

|

|

¥ |

69,336,270 |

|

|

¥ |

4,133,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

December 31, 2015 |

|

| |

|

Acquisition cost |

|

|

Amount on

consolidated

balance sheet |

|

|

Difference |

|

| Domestic equity securities |

|

¥ |

2,737,210 |

|

|

¥ |

5,714,260 |

|

|

¥ |

2,977,049 |

|

| Domestic bonds |

|

|

27,789,305 |

|

|

|

28,150,506 |

|

|

|

361,200 |

|

| Government bonds |

|

|

25,134,899 |

|

|

|

25,439,368 |

|

|

|

304,468 |

|

| Municipal bonds |

|

|

333,313 |

|

|

|

339,021 |

|

|

|

5,707 |

|

| Corporate bonds |

|

|

2,321,092 |

|

|

|

2,372,116 |

|

|

|

51,024 |

|

| Other securities |

|

|

26,743,178 |

|

|

|

26,896,166 |

|

|

|

152,987 |

|

| Foreign equity securities |

|

|

130,192 |

|

|

|

132,617 |

|

|

|

2,425 |

|

| Foreign bonds |

|

|

23,017,390 |

|

|

|

23,144,892 |

|

|

|

127,501 |

|

| Other |

|

|

3,595,595 |

|

|

|

3,618,656 |

|

|

|

23,060 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

¥ |

57,269,695 |

|

|

¥ |

60,760,933 |

|

|

¥ |

3,491,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

| 1. |

Available-for-sale securities with fair value (excluding certain securities of which fair value is extremely difficult to determine) are subject to write-downs when their fair value has been impaired considerably and it

is not probable that the value will recover to the acquisition cost as of December 31, 2015 (and March 31, 2015). In such case, the fair value is recorded on the consolidated balance sheet and the difference between fair value and

acquisition cost is recognized as losses for the nine-month period ended December 31, 2015 (and the fiscal year ended March 31, 2015). |

“Considerable decline in fair value” was determined based on the classification of issuers in accordance with the internal standards

for self-assessment of asset quality as follows:

Bankrupt, Substantially bankrupt or Likely to become bankrupt issuers:

Fair value is lower than acquisition cost.

Issuers requiring close monitoring:

Fair value has declined 30% or more from acquisition cost.

Other issuers:

Fair value has

declined 50% or more from acquisition cost.

9

“Bankrupt issuers” mean issuers who have entered into bankruptcy, special liquidation

proceedings or similar legal proceedings or whose notes have been dishonored and suspended from processing through clearing houses. “Substantially bankrupt issuers” mean issuers who are not legally or formally bankrupt but are regarded as

substantially in a similar condition. “Likely to become bankrupt issuers” mean issuers who are not yet legally or formally bankrupt but deemed to have a high possibility of becoming bankrupt. “Issuers requiring close monitoring”

mean issuers who are financially weak and under close monitoring conducted by MUFG’s subsidiaries. “Other issuers” mean issuers who do not correspond to any of the four categories of issuers mentioned above.

| 2. |

“Difference” included gains of ¥53,487 million and ¥64,406 million for the nine-month period ended December 31, 2015 and for the fiscal year ended March 31, 2015, respectively,

which were recognized in profits by applying the fair value hedge accounting. |

The following shows the money held in trust as of December 31, 2015 which was deemed

material in the management of our group company businesses and that showed material changes as compared to those as of March 31, 2015.

There was no

“Money held in trust” classified as held-to-maturity as of March 31, 2015.

“Money held in trust” classified as held-to-maturity

as of December 31, 2015 was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

December 31, 2015 |

|

| |

|

Amount on

consolidated

balance sheet |

|

|

Fair value |

|

|

Difference |

|

| Money held in trust classified as held-to-maturity |

|

¥ |

51,292 |

|

|

¥ |

51,475 |

|

|

¥ |

183 |

|

10

The following shows those derivatives as of December 31, 2015 which were deemed material in

the management of our group company businesses and that showed material changes as compared to March 31, 2015.

| (1) |

Currency-related derivatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

March 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Currency futures |

|

¥ |

286,541 |

|

|

¥ |

365 |

|

|

¥ |

365 |

|

| Over-the-counter (“OTC”) transactions |

|

Currency swaps |

|

|

51,446,610 |

|

|

|

(22,479 |

) |

|

|

(22,479 |

) |

|

|

Forward contracts on foreign exchange |

|

|

108,134,400 |

|

|

|

111,428 |

|

|

|

111,438 |

|

|

|

Currency options |

|

|

18,016,109 |

|

|

|

(133,710 |

) |

|

|

(64,696 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

(44,396 |

) |

|

¥ |

24,627 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value and the related valuation gain (loss) is reported in the consolidated statements of income. Those derivatives

transactions to which the hedge accounting is applied as described in JICPA Industry Audit Committee Report No. 25 “Treatment of Accounting and Auditing concerning Accounting for Foreign Currency Transactions in the Banking Industry”

(July 29, 2002) (“JICPA Industry Audit Committee Report No. 25”) and other relevant standards are excluded from the above table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

December 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Currency futures |

|

¥ |

1,043,786 |

|

|

¥ |

44 |

|

|

¥ |

44 |

|

| OTC transactions |

|

Currency swaps |

|

|

57,428,599 |

|

|

|

(91,333 |

) |

|

|

(91,333 |

) |

|

|

Forward contracts on foreign exchange |

|

|

119,230,008 |

|

|

|

130,611 |

|

|

|

130,611 |

|

|

|

Currency options |

|

|

16,951,682 |

|

|

|

(109,085 |

) |

|

|

(27,397 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

(69,763 |

) |

|

¥ |

11,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value and the related valuation gain (loss) is reported in the consolidated statements of income. Those derivatives

transactions to which the hedge accounting is applied as described in JICPA Industry Audit Committee Report No. 25 and other relevant standards are excluded from the above table.

11

| (2) |

Equity-related derivatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

March 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Stock index futures |

|

¥ |

889,437 |

|

|

¥ |

11,520 |

|

|

¥ |

11,520 |

|

|

|

Stock index options |

|

|

1,510,167 |

|

|

|

(21,877 |

) |

|

|

(43,683 |

) |

| OTC transactions |

|

OTC securities option transactions |

|

|

1,213,477 |

|

|

|

3,811 |

|

|

|

21,570 |

|

|

|

OTC securities index swap transactions |

|

|

125,439 |

|

|

|

7,530 |

|

|

|

7,530 |

|

|

|

Forward transactions in OTC securities indexes |

|

|

21,621 |

|

|

|

1,249 |

|

|

|

1,249 |

|

|

|

Total return swaps |

|

|

6,723 |

|

|

|

(211 |

) |

|

|

(211 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

2,021 |

|

|

¥ |

(2,024 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income. Those derivatives

transactions to which the hedge accounting is applied are excluded from the above table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

December 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Stock index futures |

|

¥ |

896,688 |

|

|

¥ |

20,170 |

|

|

¥ |

20,170 |

|

|

|

Stock index options |

|

|

2,427,292 |

|

|

|

(27,310 |

) |

|

|

(15,576 |

) |

| OTC transactions |

|

OTC securities option transactions |

|

|

1,281,520 |

|

|

|

7,474 |

|

|

|

20,566 |

|

|

|

OTC securities index swap transactions |

|

|

226,888 |

|

|

|

20,432 |

|

|

|

20,432 |

|

|

|

Forward transactions in OTC securities indexes |

|

|

10,443 |

|

|

|

(137 |

) |

|

|

(137 |

) |

|

|

Total return swaps |

|

|

7,298 |

|

|

|

(227 |

) |

|

|

(227 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

20,401 |

|

|

¥ |

45,227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income. Those derivatives

transactions to which the hedge accounting is applied are excluded from the above table.

12

| (3) |

Bond-related derivatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

March 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Bond futures |

|

¥ |

1,294,609 |

|

|

¥ |

1,527 |

|

|

¥ |

1,527 |

|

|

|

Bond futures options |

|

|

2,140,893 |

|

|

|

(28 |

) |

|

|

(1,087 |

) |

| OTC transactions |

|

Bond OTC options |

|

|

411,845 |

|

|

|

(2,946 |

) |

|

|

(1,266 |

) |

|

|

Bond OTC swaps |

|

|

341,269 |

|

|

|

18,316 |

|

|

|

18,316 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

16,868 |

|

|

¥ |

17,489 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income. Those derivatives

transactions to which the hedge accounting is applied are excluded from the above table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

December 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Bond futures |

|

¥ |

1,565,814 |

|

|

¥ |

1,991 |

|

|

¥ |

1,991 |

|

|

|

Bond futures options |

|

|

2,223,413 |

|

|

|

302 |

|

|

|

486 |

|

| OTC transactions |

|

Bond OTC options |

|

|

463,815 |

|

|

|

799 |

|

|

|

1,348 |

|

|

|

Bond OTC swaps |

|

|

474,775 |

|

|

|

19,195 |

|

|

|

19,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

22,289 |

|

|

¥ |

23,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income. Those derivatives

transactions to which the hedge accounting is applied are excluded from the above table.

| (4) |

Commodity-related derivatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

March 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Commodity futures |

|

¥ |

145 |

|

|

¥ |

(9 |

) |

|

¥ |

(9 |

) |

| OTC transactions |

|

Commodity swaps |

|

|

638,937 |

|

|

|

247 |

|

|

|

247 |

|

|

|

Commodity options |

|

|

342,779 |

|

|

|

(111 |

) |

|

|

(93 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

125 |

|

|

¥ |

143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income.

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

December 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| Transactions listed on exchange |

|

Commodity futures |

|

¥ |

225 |

|

|

¥ |

4 |

|

|

¥ |

4 |

|

| OTC transactions |

|

Commodity swaps |

|

|

520,294 |

|

|

|

1,547 |

|

|

|

1,547 |

|

|

|

Commodity options |

|

|

259,773 |

|

|

|

(127 |

) |

|

|

(126 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

1,424 |

|

|

¥ |

1,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income.

(5) Credit-related

derivatives |

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

March 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| OTC transactions |

|

Credit default options |

|

¥ |

6,864,943 |

|

|

¥ |

(370 |

) |

|

¥ |

(370 |

) |

|

|

Total rate of return swaps |

|

|

17,993 |

|

|

|

(3,223 |

) |

|

|

(3,223 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

(3,593 |

) |

|

¥ |

(3,593 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income.

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

December 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| OTC transactions |

|

Credit default options |

|

¥ |

6,231,770 |

|

|

¥ |

6,938 |

|

|

¥ |

6,929 |

|

|

|

Total rate of return swaps |

|

|

11,791 |

|

|

|

22 |

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

6,961 |

|

|

¥ |

6,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income.

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

March 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| OTC transactions |

|

Earthquake derivatives |

|

¥ |

69,647 |

|

|

¥ |

— |

|

|

¥ |

597 |

|

|

|

SVF Wrap Products |

|

|

2,214,874 |

|

|

|

(0 |

) |

|

|

(0 |

) |

|

|

Other |

|

|

5,674 |

|

|

|

408 |

|

|

|

408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

408 |

|

|

¥ |

1,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income. SVF Wrap Products

are derivative instruments that The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU), our consolidated subsidiary, guarantees payment of the principal to the 401(k) investors who invest in Stable Value Fund.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(in millions of yen) |

|

| |

|

|

|

December 31, 2015 |

|

| Classification |

|

Type of transaction |

|

Contract amount |

|

|

Fair value |

|

|

Valuation

gain (loss) |

|

| OTC transactions |

|

Earthquake derivatives |

|

¥ |

70,473 |

|

|

¥ |

707 |

|

|

¥ |

158 |

|

|

|

SVF Wrap Products |

|

|

2,232,194 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

|

Other |

|

|

5,695 |

|

|

|

662 |

|

|

|

662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

— |

|

|

¥ |

1,367 |

|

|

¥ |

818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

The transactions above are stated at fair value, and the related valuation gain (loss) is reported in the consolidated statements of income. SVF Wrap Products

are derivative instruments that BTMU guarantees payment of the principal to the 401(k) investors who invest in Stable Value Fund.

15

| 14. |

Per Share Information |

The following shows the bases for the calculation of basic earnings per share and

diluted earnings per share for the periods indicated:

|

|

|

|

|

|

|

|

|

| |

|

(in yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Basic earnings per share |

|

¥ |

65.49 |

|

|

¥ |

61.23 |

|

| Diluted earnings per share |

|

|

65.19 |

|

|

|

60.94 |

|

|

|

| |

|

(in millions of yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Profits attributable to owners of the parent |

|

¥ |

926,971 |

|

|

¥ |

852,279 |

|

| Profits not attributable to common shareholders |

|

|

— |

|

|

|

— |

|

| Profits attributable to owners of the parent related common shares |

|

|

926,971 |

|

|

|

852,759 |

|

|

|

| |

|

(in thousands) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Average number of common shares during the period |

|

|

14,152,425 |

|

|

|

13,918,899 |

|

|

|

| |

|

(in millions of yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Diluted earnings per share |

|

|

|

|

|

|

|

|

| Adjustment to profits attributable to owners of the parent |

|

¥ |

(3,017 |

) |

|

¥ |

(2,872 |

) |

| Of which, adjustment related to dilutive shares of consolidated subsidiaries and others |

|

|

(3,017 |

) |

|

|

(2,872 |

) |

|

|

| |

|

(in thousands) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

|

2015 |

|

| Increase in common shares |

|

|

19,052 |

|

|

|

17,468 |

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

For the nine months ended December 31, |

|

| |

|

2014 |

|

2015

|

|

| Description of antidilutive securities which were not included in the calculation of diluted earnings per share |

|

Subscription rights to shares of affiliates accounted for under the equity method: |

|

|

|

|

|

|

Morgan Stanley

|

|

|

— |

|

|

|

Stock options and others |

|

|

|

|

|

|

• 15 million units as of September 30, 2014 |

|

|

|

|

16

Capital and Business Alliance with Security Bank Corporation

The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU), our consolidated subsidiary, concluded a Subscription Agreement with Security Bank Corporation (Security Bank),

a leading commercial bank in the Philippines and established a capital and business alliance (Investment and Partnership) with the bank as of January 14, 2016. BTMU will acquire through a private placement newly issued common shares and

preferred shares with voting rights, representing in the aggregate 20.0% of Security Bank’s equity interest on a fully diluted basis, subject to regulatory approvals and conditions precedent, and will appoint 2 directors of Security Bank’s

Board of Directors (BOD). Security Bank will become an equity method affiliate.

| 1. |

Outline of Capital Alliance |

|

|

|

|

|

| (1) |

|

Investment Structure: |

|

BTMU will acquire 20.0% (after dilution) of Security Bank’s common shares and preferred shares with voting rights through a private placement of newly issued shares. BTMU will become the second largest shareholder next to Dy

Group, the largest shareholder group in Security Bank (a shareholders group led by Mr. Frederick Y. Dy, chairman emeritus of Security Bank) with which BTMU signed a Shareholders Agreement at the same time as the Subscription Agreement. Security

Bank will become an equity method affiliate of BTMU. |

|

|

|

| (2) |

|

Investment Amount: |

|

PHP 36,943 million |

|

|

|

| (3) |

|

Acquisition Price: |

|

PHP 245 per common share PHP 0.1 per preferred

share |

|

|

|

| (4) |

|

Implementation Date: |

|

The transaction is expected to close during the first half of 2016, subject to regulatory approval and other conditions precedents. |

|

|

|

| (5) |

|

Board Representation: |

|

BTMU will appoint 2 directors to the Security Bank’s BOD. |

| 2. |

Outline of Business Alliance |

Leveraging both banks’ expertise and customer bases, BTMU will enhance its

services offered to the enlarged customer base in the Philippines through promoting the collaboration in the areas described below:

<Main

collaboration areas>

|

|

|

|

|

| (1) |

|

Work-site business to Japanese corporate employees |

|

|

| (2) |

|

Trade finance |

|

|

| (3) |

|

Project finance |

|

|

| (4) |

|

Reciprocal long-term funding support |

|

|

| (5) |

|

Pursuit of Japan-related business opportunities including large-size projects Japanese corporates are engaged in |

|

|

| (6) |

|

Exchange of knowledge and technological expertise |

|

|

| (7) |

|

Expansion of other collaboration areas between MUFG’s key subsidiaries/affiliates companies, including leasing, securities, and asset management |

17

| 3. |

Overview of Security Bank |

|

|

|

|

|

| (1) |

|

Name: |

|

Security Bank Corporation |

|

|

|

| (2) |

|

Type of business: |

|

Commercial Bank |

|

|

|

| (3) |

|

Year of establishment: |

|

1951 |

|

|

|

| (4) |

|

Headquarters: |

|

Manila City, Republic of the Philippines |

|

|

|

| (5) |

|

Representative: |

|

Mr. Alfonso L. Salcedo, Jr. President and CEO |

|

|

|

| (6) |

|

Capital Stock: |

|

PHP 6,089 million (as of September 30, 2015) |

|

|

|

| (7) |

|

Relationship with MUFG and BTMU: |

|

MUFG and BTMU, on one hand, and Security Bank, on the other, do not have any capital, personal or transactional relationships that are required to be disclosed. |

|

|

|

| (8) |

|

Number of employees: |

|

4,014 (as of December 31, 2014) |

|

|

|

| (9) |

|

Number of branches: |

|

262 (as of January 13, 2016) |

|

|

| (10) |

|

Financial summary for the fiscal year ended December 31, 2014: |

|

|

|

|

|

| |

|

(in millions of PHP) |

|

| Gross profit |

|

|

16,769 |

|

| Operating income |

|

|

8,089 |

|

| Net income attributable to equity holders of the Parent Company |

|

|

7,163 |

|

| Total assets |

|

|

397,198 |

|

| Total equity |

|

|

47,957 |

|

Notes:

| |

1. |

“Operating income” refers to the difference between “Gross profit” and “Operating expenses”. |

| |

2. |

The above figures are sourced from the Form 17-A of Security Bank filed in the Philippines under the Securities Regulation Code of the Philippines. |

18

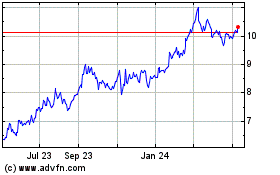

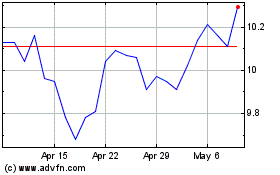

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024