UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of November 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 27, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Yasuo Matsumoto |

| Name: |

|

Yasuo Matsumoto |

| Title: |

|

Chief Manager

Documentation & Corporate Secretary Department Corporate Administration Division |

English Translation of Excerpts from Quarterly Securities Report Filed in Japan

This document is an English translation of selected information included in the Quarterly Securities Report for the

quarter ended September 30, 2015 filed by Mitsubishi UFJ Financial Group, Inc. (“MUFG” or “we”) with the Kanto Local Financial Bureau, the Ministry of Finance of Japan, on November 27, 2015 (the “Quarterly

Securities Report”).

The Quarterly Securities Report has been prepared and filed in Japan in accordance with applicable

Japanese disclosure requirements as well as generally accepted accounting principles in Japan (“J-GAAP”). There are significant differences between J-GAAP and U.S. GAAP. In addition, the Quarterly Securities Report is intended to update

prior disclosures filed by MUFG in Japan and discusses selected recent developments in the context of those prior disclosures. Accordingly, the Quarterly Securities Report may not contain all of the information that is important to you. For a more

complete discussion of the background to information provided in the Quarterly Securities Report disclosure, please see our annual report on Form 20-F for the fiscal year ended March 31, 2015 and the other reports filed with or submitted to the

U.S. Securities and Exchange Commission by MUFG.

Risks Relating to Our Business

We describe below the major developments and changes since the filing on June 25, 2015, in Japan of our annual securities report for

the fiscal year ended March 31, 2015, that we believe may have a material impact on your investment decision with respect to the risks to our business and other risks. The discussion below contains forward-looking statements, which, unless

specifically described otherwise, reflect our understanding as of the date of filing of the Quarterly Securities Report.

The

numbering of the subheading of the risk disclosure below corresponds to the numbering of the subheading of the same risk disclosure in “Risks Relating to Our Business” in our most recent annual securities report filed in Japan.

18. Risks relating to competitive pressures

Competition in the Japanese financial services industry may intensify as regional financial institutions further integrate and reorganize their operations and Japan Post Holdings Co., Ltd. and its two

financial subsidiaries listed their respective shares on the Tokyo Stock Exchange in November 2015. Competition in financial markets outside of Japan are also expected to increase as U.S. and European financial institutions regain their competitive

strength, while local financial institutions in Asia grow their business. In addition, recent advances in information and communication technology have allowed non-financial institutions to enter the financial services industry, and such new

entrants could become substantial competition to us. The ongoing global financial regulatory reforms may also lead to changes in the competitive environment for financial institutions. If we are unable to compete effectively in the increasingly

competitive business environment, our business, financial condition and results of operations may be adversely affected.

Business Segment

Information

1. Summary of Reporting Segment

MUFG’s reporting segments are business units of MUFG for which separate financial information is available and which its executive committee regularly reviews to make decisions regarding allocation

of management resources and evaluate performance.

MUFG engages in a wide range of sophisticated financial businesses through

its group companies that include commercial banks, trust banks, securities companies, credit card companies and consumer finance companies. MUFG operates under an integrated business group system comprising five core business areas — Retail,

Corporate, Global Business, Trust Assets and Global Markets — designed to enhance its operations as an integrated group. Managing its group companies under this system, MUFG provides value-added financial products and services to customers in a

timely manner.

1

MUFG’s group companies are managed using a matrix framework consisting of several

business segments identified based on the integrated business group system as well as through individual group companies. To assist appropriate assessment of MUFG’s future cash flow forecasts, MUFG has identified as its reporting segments the

following core entities (on a consolidated basis), each operating in a different industry and regulatory environment:

The

Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU) — Banking

Mitsubishi UFJ Trust and Banking Corporation (MUTB) — Banking

and trust banking

Mitsubishi UFJ Securities Holdings Co., Ltd. (MUSHD) — Securities

Consumer Finance Subsidiaries (CFS) — Credit card and consumer finance (*)

| |

(*) |

Consumer finance subsidiaries include Mitsubishi UFJ NICOS Co., Ltd. and ACOM CO., LTD. |

Starting this six-month period ended September 30, 2015, a subsidiary engaged in the securities business, which was previously

included in the BTMU segment, is included in the MUSHD segment. This subsidiary of BTMU became a subsidiary of MUSHD on April 1, 2015, and is currently managed as part of MUSHD.

In addition, starting this six-month period ended September 30, 2015, a subsidiary engaged in the asset management business, which

was previously included in the MUSHD segment, is included in the MUTB segment. This subsidiary of MUSHD merged with a subsidiary of MUTB on July 1, 2015, and is currently managed as part of MUTB.

The segment information for the six months ended September 30, 2014 has been restated to reflect the foregoing changes in reporting

segments.

2

2. Information on Ordinary Income (Losses), Net Income (Losses), Total Assets and Other Financial Items for

Each Reporting Segment

Previous Year Interim Financial Reporting Period (from April 1, 2014 to September 30, 2014)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in millions of yen) |

|

| |

|

BTMU |

|

|

MUTB |

|

|

MUSHD |

|

|

CFS |

|

|

Others |

|

|

Total |

|

|

Adjustments |

|

|

Consolidated |

|

| Ordinary Income |

|

|

1,939,875 |

|

|

|

342,071 |

|

|

|

236,936 |

|

|

|

238,313 |

|

|

|

292,291 |

|

|

|

3,049,488 |

|

|

|

(287,947 |

) |

|

|

2,761,541 |

|

| Interest Income |

|

|

1,105,205 |

|

|

|

109,789 |

|

|

|

20,578 |

|

|

|

97,202 |

|

|

|

277,389 |

|

|

|

1,610,165 |

|

|

|

(286,608 |

) |

|

|

1,323,557 |

|

| Profits from Investment in Affiliates (Equity Method) |

|

|

13,549 |

|

|

|

4,851 |

|

|

|

5,650 |

|

|

|

150 |

|

|

|

— |

|

|

|

24,202 |

|

|

|

79,732 |

|

|

|

103,934 |

|

| From Customers |

|

|

1,903,109 |

|

|

|

333,483 |

|

|

|

219,065 |

|

|

|

221,179 |

|

|

|

84,703 |

|

|

|

2,761,541 |

|

|

|

— |

|

|

|

2,761,541 |

|

| From Internal Transactions |

|

|

36,765 |

|

|

|

8,587 |

|

|

|

17,871 |

|

|

|

17,133 |

|

|

|

207,588 |

|

|

|

287,947 |

|

|

|

(287,947 |

) |

|

|

— |

|

| Net Income |

|

|

402,763 |

|

|

|

89,190 |

|

|

|

23,771 |

|

|

|

32,822 |

|

|

|

263,712 |

|

|

|

812,261 |

|

|

|

(233,545 |

) |

|

|

578,716 |

|

| Total Assets |

|

|

203,314,843 |

|

|

|

35,820,380 |

|

|

|

28,806,812 |

|

|

|

4,130,902 |

|

|

|

12,007,925 |

|

|

|

284,080,864 |

|

|

|

(19,622,677 |

) |

|

|

264,458,187 |

|

| Other Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

|

|

105,131 |

|

|

|

15,670 |

|

|

|

7,255 |

|

|

|

11,443 |

|

|

|

801 |

|

|

|

140,301 |

|

|

|

1,745 |

|

|

|

142,046 |

|

| Amortization of Goodwill |

|

|

7,177 |

|

|

|

458 |

|

|

|

479 |

|

|

|

492 |

|

|

|

— |

|

|

|

8,607 |

|

|

|

(1,062 |

) |

|

|

7,544 |

|

| Interest Expenses |

|

|

232,412 |

|

|

|

29,618 |

|

|

|

21,319 |

|

|

|

12,134 |

|

|

|

14,369 |

|

|

|

309,854 |

|

|

|

(22,026 |

) |

|

|

287,828 |

|

| Extraordinary Profits |

|

|

1,111 |

|

|

|

9,177 |

|

|

|

4 |

|

|

|

9 |

|

|

|

0 |

|

|

|

10,302 |

|

|

|

(1 |

) |

|

|

10,300 |

|

| Extraordinary Losses |

|

|

40,474 |

|

|

|

4,711 |

|

|

|

683 |

|

|

|

105 |

|

|

|

5 |

|

|

|

45,979 |

|

|

|

33,291 |

|

|

|

79,271 |

|

| Losses on Impairment of Fixed Assets |

|

|

689 |

|

|

|

2,950 |

|

|

|

148 |

|

|

|

— |

|

|

|

— |

|

|

|

3,789 |

|

|

|

— |

|

|

|

3,789 |

|

| Tax Expenses |

|

|

182,689 |

|

|

|

36,875 |

|

|

|

17,079 |

|

|

|

1,149 |

|

|

|

(467 |

) |

|

|

237,326 |

|

|

|

5,215 |

|

|

|

242,542 |

|

| Unamortized Goodwill |

|

|

255,933 |

|

|

|

16,865 |

|

|

|

17,503 |

|

|

|

7,936 |

|

|

|

— |

|

|

|

298,239 |

|

|

|

(28,496 |

) |

|

|

269,742 |

|

| Total Investment in Equity Method Affiliates |

|

|

260,614 |

|

|

|

120,921 |

|

|

|

241,870 |

|

|

|

4,674 |

|

|

|

823,689 |

|

|

|

1,451,770 |

|

|

|

683,811 |

|

|

|

2,135,582 |

|

| Increase in Tangible and Intangible Fixed Assets |

|

|

133,330 |

|

|

|

15,092 |

|

|

|

11,458 |

|

|

|

16,505 |

|

|

|

2,444 |

|

|

|

178,831 |

|

|

|

— |

|

|

|

178,831 |

|

Notes:

| 1. |

Ordinary income, interest income and interest expenses used in the above table are equivalent to revenues, interest income and interest expenses, respectively,

generally used by Japanese non-financial companies. |

| 2. |

“Others” includes MUFG and other companies. |

| 3. |

Net income for “Others” includes 244,441 million yen of dividends from MUFG’s subsidiaries and affiliates. |

| 4. |

Adjustments on interest income include deduction of dividend income from affiliated companies received by MUFG. |

| 5. |

Adjustments on net income include elimination of inter-segment transactions of 299,063 million yen and 65,518 million yen of net profit representing the

amounts that are not allocated among segments consisting of profits (losses) from investment in affiliates (equity method), amortization of goodwill, tax expenses and profits attributable to non-controlling interests. |

| 6. |

Adjustments on total assets mainly include offsets of inter-segment debt and credit transactions. |

| 7. |

Adjustments on extraordinary losses include losses on change in equity. |

| 8. |

Net income is adjusted from the profits attributable to owners of parent in the consolidated profit and loss statements for the interim financial reporting period ended

September 30, 2014. |

3

Interim Financial Reporting Period (from April 1, 2015 to September 30, 2015)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions of yen) |

|

| |

|

BTMU |

|

|

MUTB |

|

|

MUSHD |

|

|

CFS |

|

|

Others |

|

|

Total |

|

|

Adjustments |

|

|

Consolidated |

|

| Ordinary Income |

|

|

2,074,286 |

|

|

|

369,986 |

|

|

|

266,143 |

|

|

|

249,935 |

|

|

|

364,371 |

|

|

|

3,324,723 |

|

|

|

(332,839 |

) |

|

|

2,991,884 |

|

| Interest Income |

|

|

1,165,362 |

|

|

|

127,551 |

|

|

|

18,677 |

|

|

|

98,718 |

|

|

|

347,584 |

|

|

|

1,757,894 |

|

|

|

(362,926 |

) |

|

|

1,394,968 |

|

| Profits from Investment in Affiliates (Equity Method) |

|

|

16,751 |

|

|

|

5,853 |

|

|

|

8,143 |

|

|

|

110 |

|

|

|

— |

|

|

|

30,859 |

|

|

|

113,821 |

|

|

|

144,680 |

|

| From Customers |

|

|

2,010,489 |

|

|

|

361,903 |

|

|

|

260,776 |

|

|

|

232,289 |

|

|

|

126,425 |

|

|

|

2,991,884 |

|

|

|

— |

|

|

|

2,991,884 |

|

| From Internal Transactions |

|

|

63,796 |

|

|

|

8,083 |

|

|

|

5,367 |

|

|

|

17,645 |

|

|

|

237,946 |

|

|

|

332,839 |

|

|

|

(332,839 |

) |

|

|

— |

|

| Net Income |

|

|

408,599 |

|

|

|

80,930 |

|

|

|

26,191 |

|

|

|

37,323 |

|

|

|

333,825 |

|

|

|

886,870 |

|

|

|

(287,548 |

) |

|

|

599,321 |

|

| Total Assets |

|

|

220,723,906 |

|

|

|

38,044,884 |

|

|

|

32,106,885 |

|

|

|

4,227,493 |

|

|

|

12,169,724 |

|

|

|

307,272,893 |

|

|

|

(18,107,863 |

) |

|

|

289,165,030 |

|

| Other Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

|

|

103,817 |

|

|

|

15,862 |

|

|

|

9,668 |

|

|

|

12,393 |

|

|

|

1,067 |

|

|

|

142,810 |

|

|

|

2,538 |

|

|

|

145,348 |

|

| Amortization of Goodwill |

|

|

8,353 |

|

|

|

531 |

|

|

|

1,038 |

|

|

|

492 |

|

|

|

— |

|

|

|

10,416 |

|

|

|

(1,529 |

) |

|

|

8,886 |

|

| Interest Expenses |

|

|

261,658 |

|

|

|

36,312 |

|

|

|

17,810 |

|

|

|

10,399 |

|

|

|

13,798 |

|

|

|

339,980 |

|

|

|

(21,352 |

) |

|

|

318,627 |

|

| Extraordinary Profits |

|

|

16,941 |

|

|

|

11 |

|

|

|

— |

|

|

|

0 |

|

|

|

— |

|

|

|

16,953 |

|

|

|

(15,716 |

) |

|

|

1,237 |

|

| Extraordinary Losses |

|

|

6,996 |

|

|

|

660 |

|

|

|

2,811 |

|

|

|

164 |

|

|

|

0 |

|

|

|

10,633 |

|

|

|

33,752 |

|

|

|

44,386 |

|

| Losses on Impairment of Fixed Assets |

|

|

1,101 |

|

|

|

508 |

|

|

|

195 |

|

|

|

— |

|

|

|

— |

|

|

|

1,804 |

|

|

|

— |

|

|

|

1,804 |

|

| Tax Expenses |

|

|

203,870 |

|

|

|

30,354 |

|

|

|

21,394 |

|

|

|

2,088 |

|

|

|

(110 |

) |

|

|

257,598 |

|

|

|

1,348 |

|

|

|

258,946 |

|

| Unamortized Goodwill |

|

|

281,641 |

|

|

|

18,574 |

|

|

|

38,359 |

|

|

|

6,951 |

|

|

|

— |

|

|

|

345,527 |

|

|

|

(45,962 |

) |

|

|

299,565 |

|

| Total Investment in Equity Method Affiliates |

|

|

280,264 |

|

|

|

142,615 |

|

|

|

246,782 |

|

|

|

4,920 |

|

|

|

823,689 |

|

|

|

1,498,273 |

|

|

|

1,065,431 |

|

|

|

2,563,704 |

|

| Increase in Tangible and Intangible Fixed Assets |

|

|

98,553 |

|

|

|

35,496 |

|

|

|

26,004 |

|

|

|

10,937 |

|

|

|

1,816 |

|

|

|

172,808 |

|

|

|

— |

|

|

|

172,808 |

|

Notes:

| 1. |

Ordinary income, interest income and interest expenses used in the above table are equivalent to revenues, interest income and interest expenses, respectively,

generally used by Japanese non-financial companies. |

| 2. |

“Others” includes MUFG and other companies. |

| 3. |

Net income for “Others” includes 312,705 million yen of dividends from MUFG’s subsidiaries and affiliates. |

| 4. |

Adjustments on interest income include deduction of dividend income from affiliated companies received by MUFG. |

| 5. |

Adjustments on net income include elimination of inter-segment transactions of 390,382 million yen and 102,834 million yen of net profit representing the

amounts that are not allocated among segments consisting of profits (losses) from investment in affiliates (equity method), amortization of goodwill, tax expenses and profits attributable to non-controlling interests. |

| 6. |

Adjustments on total assets mainly include offsets of inter-segment debt and credit transactions. |

| 7. |

Adjustments on extraordinary losses include losses on change in equity. |

| 8. |

Net income is adjusted from the profits attributable to owners of parent in the consolidated profit and loss statements for the interim financial reporting period ended

September 30, 2015. |

4

Related Information

Previous Year Interim Financial Reporting Period (from April 1, 2014 to September 30, 2014)

1. Information by Type of Service

Omitted because it is similar to the

above-explained reporting segment information.

2. Geographical Information

(1) Ordinary Income (in millions of yen)

|

|

|

|

|

|

|

|

|

|

|

| Japan |

|

United States |

|

Europe/Middle East |

|

Asia/Oceania |

|

Others |

|

Total |

| 1,737,342 |

|

416,374 |

|

171,020 |

|

411,326 |

|

25,477 |

|

2,761,541 |

Notes:

| |

1. |

Ordinary income is equivalent to revenues generally used by Japanese non-financial companies. |

| |

2. |

Ordinary income is categorized by either country or region based on the location of MUFG’s operating offices. |

(2) Tangible Fixed Assets (in millions of yen)

|

|

|

|

|

|

|

| Japan |

|

United States |

|

Others |

|

Total |

| 1,093,009 |

|

368,072 |

|

91,645 |

|

1,552,728 |

3. Information by Major Customer

Not Applicable.

5

Interim Financial Reporting Period (from April 1, 2015 to September 30, 2015)

1. Information by Type of Service

Omitted because it is similar to the above-explained reporting segment information.

2.

Geographical Information

(1) Ordinary Income (in millions of yen)

|

|

|

|

|

|

|

|

|

|

|

| Japan |

|

United States |

|

Europe/Middle East |

|

Asia/Oceania |

|

Others |

|

Total |

| 1,859,700 |

|

507,103 |

|

152,575 |

|

440,708 |

|

31,796 |

|

2,991,884 |

Notes:

| |

1. |

Ordinary income is equivalent to revenues generally used by Japanese non-financial companies. |

| |

2. |

Ordinary income is categorized by either country or region based on the location of MUFG’s operating offices. |

(2) Tangible Fixed Assets (in millions of yen)

|

|

|

|

|

|

|

| Japan |

|

United States |

|

Others |

|

Total |

| 1,114,499 |

|

145,822 |

|

105,012 |

|

1,365,334 |

3. Information by Major Customer

Not Applicable.

6

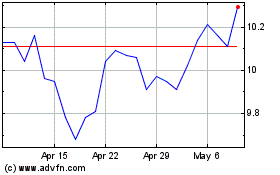

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

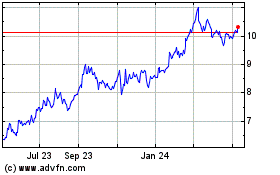

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024