Sumitomo Profit Slumps on Emerging-Markets Slowdown

November 13 2015 - 8:10AM

Dow Jones News

Japan's Sumitomo Mitsui Financial Group Inc. said its profit in

the fiscal first half was hit by a slowdown in emerging markets

driven by weak commodity prices.

The country's second-largest lender by market capitalization

reported a 19% drop in net profit to ¥ 388 billion due to increased

credit costs and impairment losses from its investments in

Indonesia.

"Because of instability in emerging markets, we will be more

cautious about credit expansion [in the region]…and will keep an

eye on an economic slowdown in China [and] falling resources

prices," SMFG's president, Koichi Miyata, said at a news

conference. Mr. Miyata said the bank saw a decrease in lending in

Thailand, China and South Korea.

The Tokyo lender booked an impairment loss of ¥ 55 billion from

Indonesian lender PT Bank Tabungan Pensiunan Nasional, in which it

raised its stake to 40% last year.

Meanwhile, Mitsubishi UFJ Financial Group Inc., Japan's largest

lender, reported a slight gain in net profit to ¥ 599.32 billion

from ¥ 578.72 billion a year earlier, boosted by a strong

performance in the U.S. and investment gains from its 20% ownership

stake in Morgan Stanley.

Despite its increase in overall overseas lending, MUFG also saw

a drop in lending in some Asian countries. But MUFG President

Nobuyuki Hirano said his company, which runs Thailand's Bank of

Ayudhya, doesn't see a big impact from the recent market turmoil

and falling resources prices on its business.

"Our customers are Japanese companies operating business in Asia

and non-Japanese companies with high credit ratings so I don't

think we'll be hurt by the recent events," the president said.

Meanwhile, net profit at Mizuho Financial Group Inc. rose 8% to

¥ 384.2 billion thanks to solid growth in its overseas operations

and fee business. Mizuho President Yasuhiro Sato also said the

bank, which has provided financing for global megamergers and

acquisitions, has a proven record in its fee business overseas in

areas such as bond issues.

Despite the economic slowdown in Southeast Asia, the top

executives of the three banks see potential growth in the region

over the long term.

"We won't pay a high price and will consider investment returns

and deals in Asia," Mr. Sato said.

Write to Atsuko Fukase at atsuko.fukase@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 13, 2015 07:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

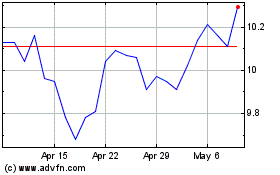

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

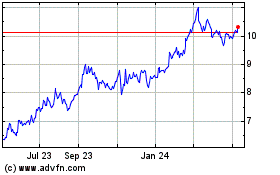

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024