Japan's Biggest Bank Wants to Get Bigger in the U.S.

September 11 2015 - 11:50AM

Dow Jones News

TOKYO—Mitsubishi UFJ Financial Group Inc. is looking for more

acquisitions to achieve its goal of becoming a top-10 lender in the

U.S., the Japanese bank's chief executive said.

MUFG, Japan's largest lender by assets, last year combined its

New York-based banking operations with wholly owned San

Francisco-based Union Bank. In April, it brought in Steve Cummings,

a former UBS Group executive, as the first non-Japanese head of its

U.S. division.

"We integrated businesses in the East and the West and tapped

Steve Cummings as the new CEO for our U.S. operations," said

Nobuyuki Hirano, MUFG's chief executive in an interview. "Now we

can map out a growth strategy with a sense of unity under the new

management."

Over the past years, MUFG has expanded in the U.S. via

acquisitions of small to midsize regional lenders through Union

Bank, which the Tokyo bank made a wholly owned unit in 2008. In

2012, it acquired a California lender, Pacific Capital Bancorp, for

$1.5 billion.

"We've been saying that our goal is to become a top-10 lender in

the U.S.," said Mr. Hirano, who leads both MUFG and its core

banking unit, Bank of Tokyo Mitsubishi-UFJ. "I think we need a

scale-up of size because our revenue isn't sufficient to cover the

rising cost of complying with legal and regulatory frameworks."

According to SNL Financial data as of December 2013, which MUFG

has cited in a presentation to investors, the Union Bank-BTMU

combined entity ranked 13th in the U.S. with deposits of $115

billion, right behind Atlanta-based BB&T Corp. with deposits of

$127 billion. At No. 10, State Street Corp. had about $182 billion

in deposits.

In contrast to Japan, where MUFG has plenty of deposits but

faces sluggish loan demand, MUFG says it has healthy loan demand in

the U.S. and deposits haven't kept up. In some cases, it is raising

U.S. dollar funds via a currency swap from yen to dollars.

"We'll consider an acquisition to complement our service and

products and shore up deposits in dollars," Mr. Hirano said.

In the year ended March 2015, MUFG became the second Japanese

company after Toyota Motor Corp. to post a net profit of more than

¥ 1 trillion ($8.3 billion), boosted by strong performance in its

overseas operations. About 20% of the profits came from

international businesses including Union Bank and Bank of Ayudhya

in Thailand, which MUFG acquired in 2013.

MUFG also has enjoyed profits from its 20% stake in Morgan

Stanley.

Mr. Hirano, 63, said a possible interest-rate increase by the

Federal Reserve this year could cause market turmoil and generate

unexpected losses from volatility in the short term. "We'll try to

deal with managing risk," he said.

Write to Atsuko Fukase at atsuko.fukase@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 11, 2015 11:35 ET (15:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

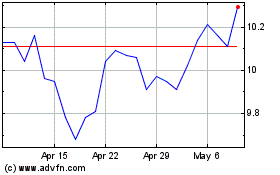

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

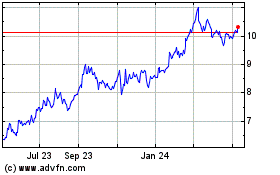

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024