UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of June 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 25, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Akira Takeda |

| Name: |

|

Akira Takeda |

| Title: |

|

Chief Manager, General Affairs Corporate Administration Division |

Mitsubishi UFJ Financial Group, Inc.

Notice concerning Allotment of Stock Compensation Type Stock Options (Stock Acquisition Rights)

Tokyo, June 25, 2015 — Mitsubishi UFJ Financial Group, Inc. (MUFG) resolved at their respective meeting of the Board of Directors held today

to issue stock compensation type stock options (stock acquisition rights) to the Directors (excluding outside Directors), Corporate Executive Officers, Executive Officers, and Senior Fellow of MUFG and of The Bank of Tokyo-Mitsubishi UFJ, Ltd.

(BTMU), Mitsubishi UFJ Trust and Banking Corporation (MUTB), Mitsubishi UFJ Securities Holdings Co., Ltd. (MUSHD) and Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (MUMSS), subsidiaries of MUFG, in accordance with Articles 238 and 240 of the

Company Law of Japan, as follows.

| 1. |

Reason for Issuance of Stock Acquisition Rights as Stock Options |

The purposes of issuance of stock acquisition

rights as stock options (hereinafter referred to as the “Stock Acquisition Rights”) are with respect to the Directors (excluding outside Directors), Corporate Executive Officers, Executive Officers and Senior Fellow of MUFG, BTMU, MUTB,

MUSHD and MUMSS, further strengthening their motivation to contribute to the improvement of the stock price and the profits of MUFG.

| 2. |

Terms and Conditions of Stock Acquisition Rights |

| (1) |

Name of Stock Acquisition Rights: |

Ninth Series of Stock Acquisition Rights of Mitsubishi UFJ

Financial Group, Inc.

| (2) |

Aggregate Number of Stock Acquisition Rights: 27,628 |

The above aggregate number shall be the

number of Stock Acquisition Rights scheduled to be allotted. If the aggregate number of the Stock Acquisition Rights to be allotted is reduced due to any Stock Acquisition Rights which have not been applied for subscription or for any other reason,

the aggregate number of the Stock Acquisition Rights to be issued shall be the same as the aggregate number of the Stock Acquisition Rights to be allotted.

| (3) |

Class and Number of Shares to be Issued or Transferred upon Exercise of Stock Acquisition Rights: |

The class of shares to be issued or transferred upon exercise of Stock Acquisition Rights shall be the shares of common stock of MUFG, and the

number of shares to be issued or transferred upon exercise of each Stock Acquisition Right (hereinafter referred to as the “Number of Granted Shares”) shall be 100 shares;

Provided, however, that in the event that, on and after the date on which the Stock Acquisition Rights shall be allotted as set forth in

(13) below (hereinafter referred to as the “Allotment Date”), MUFG conducts, with respect to the shares of its common stock, a stock split (including the allotment of shares of common stock of MUFG to shareholders without

consideration; hereinafter the same shall apply, when referred to a stock split) or a consolidation of shares, the Number of Granted Shares shall be adjusted in accordance with the following formula and any fraction less than one (1) share

resulting from the adjustment shall be disregarded:

|

|

|

|

|

|

|

|

|

| Number of Granted Shares after

adjustment |

|

= |

|

Number of Granted Shares before

adjustment |

|

x |

|

Ratio of stock split or stock consolidation |

1

The Number of Granted Shares after adjustment shall become effective, in the case of a stock

split, on and after the day immediately following the record date of the relevant stock split or, in the case of a consolidation of shares, on and after its effective date; provided, however, that, in the event that a stock split is conducted on the

condition that an agendum to increase the capital or reserves by reducing the amount of surpluses is approved at a general meeting of shareholders of MUFG and that the record date for such stock split is prior to the date of closing of such general

meeting of shareholders, the Number of Granted Shares after adjustment shall be applicable on and after the day immediately following the date of closing of the relevant general meeting of shareholders.

In addition, if MUFG conducts mergers, consolidations, company splits or capital reductions, or if any other events occur that require an

adjustment of the Number of Granted Shares in a method similar to such events on and after the Allotment Date, MUFG may appropriately adjust the Number of Granted Shares to a reasonable extent.

When the Number of Granted Shares is adjusted, MUFG shall give notice of necessary matters to each holder of the Stock Acquisition Rights

registered in the register of Stock Acquisition Rights (hereinafter referred to as the “Holder”) or give public notice thereof, no later than the day immediately preceding the date on which the Number of Granted Shares after adjustment

shall become effective; provided, however, that, if MUFG is unable to give such notice or public notice no later than the date immediately preceding such applicable date, MUFG shall thereafter promptly give such notice or public notice.

| (4) |

Amount of Assets to be Contributed upon Exercise of Stock Acquisition Rights: |

The amount of

assets to be contributed upon exercise of each Stock Acquisition Right shall be the amount obtained by multiplying the exercise price per share to be issued or transferred upon exercise of such Stock Acquisition Right (which shall be one

(1) yen), by the Number of Granted Shares.

| (5) |

Period During Which Stock Acquisition Rights May be Exercised: |

From July 14, 2015 to

July 13, 2045

| (6) |

Matters concerning the Capital and Capital Reserve to be Increased due to Issuance of Shares upon Exercise of Stock Acquisition Rights: |

| |

(i) |

The amount of capital to be increased due to the issuance of shares upon exercise of the Stock Acquisition Rights shall be a half of the maximum amount of capital increase, etc. which is calculated in accordance with

Article 17, Paragraph 1 of the Corporation Accounting Regulations, and any fraction less than one (1) yen arising therefrom shall be rounded up to the nearest one (1) yen. |

| |

(ii) |

The amount of capital reserve to be increased due to the issuance of shares upon exercise of the Stock Acquisition Rights shall be the amount determined by deducting the amount of capital to be increased provided for in

(i) above from the maximum amount of capital increase, etc. set forth in (i) above. |

| (7) |

Restrictions on the Acquisition of Stock Acquisition Rights by Way of Transfer: |

The

acquisition of Stock Acquisition Rights by way of transfer shall require an approval by a resolution of the Board of Directors of MUFG.

2

| (8) |

Matters concerning Mandatory Repurchase of Stock Acquisition Rights: |

If any of the agendas set

forth in (i), (ii), (iii), (iv) and (v) below is approved at a general meeting of shareholders of MUFG (or, if a resolution of a general meeting of shareholders is not required, is resolved at the Board of Directors of MUFG or determined

by the Corporate Executive Officer who has been delegated such determination pursuant to the provisions of Article 416, Paragraph 4 of the Company Law), MUFG may acquire the Stock Acquisition Rights without consideration on the date to be separately

determined by the Board of Directors:

| |

(i) |

Agenda for approval of a merger agreement under which MUFG shall become a dissolving company; |

| |

(ii) |

Agenda for approval of split agreement or split plan under which MUFG shall be split; |

| |

(iii) |

Agenda for approval of a stock exchange agreement or stock transfer plan under which MUFG shall become a wholly-owned subsidiary; |

| |

(iv) |

Agenda for approval of an amendment to the Articles of Incorporation in order to establish the provision that an acquisition by way of transfer of all shares to be issued by MUFG shall require the approval of MUFG; and

|

| |

(v) |

Agenda for approval of an amendment to the Articles of Incorporation in order to establish the provision that an acquisition by way of transfer of a class of shares to be issued or transferred upon exercise of the Stock

Acquisition Rights shall require the approval of MUFG or that MUFG may acquire all of such class of shares upon a resolution of a general meeting of shareholders. |

| (9) |

Matters Concerning the Delivery of the Stock Acquisition Rights in accordance with the Acts of Structural Reorganization: |

If MUFG conducts a merger (limited to the case where MUFG ceases to exist due to the merger), an absorption-type or incorporation-type company

split (both, limited to the case where MUFG is split), or a stock exchange or transfer (both, limited to the case where MUFG becomes a wholly-owned subsidiary) (hereinafter collectively referred to as the “Acts of Structural

Reorganization”), MUFG shall, in each of the above cases, deliver the stock acquisition rights of any of the relevant companies listed in “a”. through “e”. of Article 236, Paragraph 1, Item 8 of the Company Law

(hereinafter referred to as the “Reorganized Company”) to the Holders holding the Stock Acquisition Rights remaining at the time immediately preceding the effective date of the relevant Act of Structural Reorganization (hereinafter

referred to as the “Remaining Stock Acquisition Rights”) (the effective date of the relevant Act of Structural Reorganization shall mean, in the case of a merger, the date on which the merger becomes effective; in the case of a

consolidation, the date of establishment of a newly-incorporated company through consolidation; in the case of an absorption-type company split, the date on which such absorption-type company split becomes effective; in the case of an

incorporation-type company split, the date of establishment of a newly-incorporated company through such incorporation-type company split; in the case of a stock exchange, the date on which the stock exchange becomes effective; and in the case of a

stock transfer, the date of establishment of a wholly-owning parent company through the stock transfer; hereinafter the same shall apply). In this case, the Remaining Stock Acquisition Rights shall be extinguished and the Reorganized Company shall

issue new stock acquisition rights; provided, however, that the foregoing shall be on the condition that delivery of such stock acquisition rights by the Reorganized Company in accordance with each of the following items is stipulated in a merger

agreement, a consolidation agreement, an absorption-type company split agreement, an incorporation-type company split plan, a stock exchange agreement or a stock transfer plan.

3

| |

(i) |

Number of Stock Acquisition Rights of the Reorganized Company to be Delivered: |

A number equal

to the number of the Remaining Stock Acquisition Rights held by the Holder shall be delivered to such Holder.

| |

(ii) |

Class of Shares of the Reorganized Company to be Issued or Transferred upon Exercise of the Stock Acquisition Rights: |

Shares of common stock of the Reorganized Company.

| |

(iii) |

Number of Shares of the Reorganized Company to be Issued or Transferred upon Exercise of the Stock Acquisition Rights: |

To be determined in accordance with (3) above, taking into consideration the conditions, etc. of the Act of Structural Reorganization.

| |

(iv) |

Amount of Assets to be Contributed upon Exercise of the Stock Acquisition Rights: |

The amount

of assets to be contributed upon exercise of each stock acquisition right to be delivered shall be the amount obtained by multiplying (x) the exercise price after reorganization set forth below by (y) the number of shares of the

Reorganized Company to be issued or transferred upon exercise of the relevant stock acquisition rights as determined in accordance with (iii) above. The exercise price after reorganization shall be one (1) yen per share of the shares of

the Reorganized Company to be delivered upon exercise of each of its stock acquisition rights.

| |

(v) |

Period During Which Stock Acquisition Rights May be Exercised: |

From and including whichever

is the later of (x) the commencement date of the period during which the Stock Acquisition Rights may be exercised as provided for in (5) above or (y) the effective date of the Act of Structural Reorganization, to and including the

expiry date of the period during which the Stock Acquisition Rights may be exercised as provided for in (5) above.

| |

(vi) |

Matters concerning the Capital and Capital Reserve to be Increased due to the Issuance of Shares upon Exercise of Stock Acquisition Rights: |

To be determined in accordance with (6) above.

| |

(vii) |

Restrictions on Acquisition by Way of Transfer of Stock Acquisition Rights: |

Acquisition by

way of transfer of the stock acquisition rights shall require an approval of the Board of Directors of the Reorganized Company.

| |

(viii) |

Mandatory Repurchase of Stock Acquisition Rights: |

To be determined in accordance with

(8) above.

| (10) |

Handling of Fractions Less Than One (1) Share Resulting from Exercise of Stock Acquisition Rights: |

In the case where the number of shares to be delivered to the Holders who have exercised the Stock Acquisition Rights includes any fraction

less than one (1) share, such fraction shall be disregarded.

| (11) |

Conditions for the Exercise of Stock Acquisition Rights: |

The Holder may exercise the Stock

Acquisition Rights which have been allotted due to his or her status as a Director (excluding outside Directors), a Corporate Executive Officer, an Executive Officer or a Senior Fellow of MUFG, BTMU, MUTB, MUSHD or MUMSS on and after the day

immediately following the date on which such Holder loses the status of being a Director (excluding outside Directors), a Corporate Executive Officer, an Executive Officer and a Senior Fellow of the relevant company.

4

| (12) |

Method of Calculation of the Amount to be Paid upon Allotment of the Stock Acquisition Rights (Issue Price): |

The amount to be paid upon allotment of each Stock Acquisition Right (Issue Price) shall be the amount obtained by multiplying (x) the

option price per share calculated by the Black-Sholes Model using the basic numerical value set forth in (ii) through (vii) below by (y) the Number of Granted Shares (any fraction less than one (1) yen arising therefrom shall be

rounded up to the nearest one (1) yen).

Where

| |

(i) |

Option price per share (C) |

| |

(ii) |

Stock price (S): Closing price of the regular trading of the shares of common stock of MUFG on the Tokyo Stock Exchange on July 13, 2015 (if there is no such closing

price, the base price of the next transaction date) |

| |

(iii) |

Exercise price (X): One (1) yen |

| |

(iv) |

Expected time to maturity (t): Four (4) years |

| |

(v) |

Volatility (s): To be calculated using the closing price of the regular

transaction of the shares of common stock of MUFG on each transaction date during four (4) years (from July 14, 2011 to July 13, 2015) |

| |

(vi) |

Risk-free interest rate (r): Interest rate of the national bonds whose remaining years to maturity correspond to the

expected time to maturity |

| |

(vii) |

Yield (l): Aggregate dividend amount of the most recent fiscal year / Stock price set forth in (ii) above |

| |

(viii) |

Standard normal cumulative distribution function (N(•)) |

The amount obtained as a result of the above calculation shall be the fair value of the Stock Acquisition Rights and the issuance hereunder

shall not fall under the category of an issue of the Stock Acquisition Rights at an unfair value.

The rights, held by the person who

receives the allocation, to claim for remuneration shall be offset by the obligation to pay the amount to be paid upon allocation of the Stock Acquisition Rights.

| (13) |

Date on Which the Stock Acquisition Rights Shall be Allotted: |

July 14, 2015

| (14) |

Date on Which Money Shall be Paid in Exchange for Stock Acquisition Rights: |

The payment date

shall be July 14, 2015.

5

| (15) |

Place where Applications for Exercise of the Stock Acquisition Rights Shall be Made: |

Corporate

Administration Division of MUFG (or any division or office in charge of such business from time to time)

| (16) |

Payment Handling Place for the Money to be Contributed upon Exercise of the Stock Acquisition Rights: |

BTMU, Tokyo Main Office (or any successor bank of such bank or any successor branch of such branch from time to time)

| (17) |

Persons to be Allocated the Stock Acquisition Rights, the Numbers of such Persons, and Number of the Stock Acquisition Rights to be Allocated: |

The persons to be allocated the Stock Acquisition Rights and the number of such persons and the number of the Stock Acquisition Rights to be

allocated are as follows. If the number of the Stock Acquisition Rights applied for by each person to be allocated the Stock Acquisition Rights is less than the number determined at the meeting of the Board of Directors held today, the actual number

of the Stock Acquisition Rights to be allocated to such person shall be reduced to the number of the Stock Acquisition Rights applied for by such person.

|

|

|

|

|

|

|

|

|

| Persons to be allocated the Stock Acquisition Rights |

|

Number

of

persons |

|

|

Number of the Stock

Acquisition Rights to

be allocated |

|

| Directors (excluding outside Directors), Corporate Executive Officers and Executive Officers of MUFG |

|

|

69 |

|

|

|

4,925 |

|

| Directors (excluding outside Directors), Executive Officers and Senior Fellows of BTMU |

|

|

66 |

|

|

|

11,229 |

|

| Directors (excluding outside Directors) and Executive Officers of MUTB |

|

|

51 |

|

|

|

9,120 |

|

| Directors (excluding outside Directors) and Executive Officers of MUSHD |

|

|

19 |

|

|

|

569 |

|

| Directors (excluding outside Directors) and Executive Officers of MUMSS |

|

|

41 |

|

|

|

1,785 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

246 |

|

|

|

27,628 |

|

|

|

|

|

|

|

|

|

|

| (18) |

Treatment in Case Where the Certificates for Stock Acquisition Rights Are to Issued: |

No

certificates shall be issued for the Stock Acquisition Rights

* * *

Contact:

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc. |

|

|

Public Relations Division

81-3-3240-7651 |

6

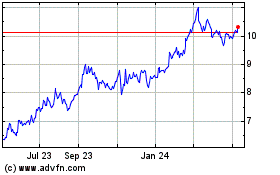

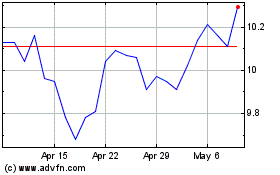

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024