As filed with the Securities and Exchange Commission on June 10, 2015

Registration No. 333 -

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KABUSHIKI KAISHA MITSUBISHI UFJ FINANCIAL GROUP

(Exact name of registrant as specified in its charter)

|

|

|

| Japan |

|

98-0521973 |

| (State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer Identification Number) |

7-1, Marunouchi 2-chome

Chiyoda-ku, Tokyo 100-8330, Japan

(Address of Principal Executive

Offices, Including Zip Code)

MUFG Americas Holdings Corporation Stock Bonus Plan

(formerly, The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan)

(Full title of the plan)

Robert E.

Hand

Deputy General Counsel and Corporate Secretary

MUFG Americas Holdings Corporation

1251 Avenue of the Americas

New York, New York 10020-1104

+1-212-782-4000

(Name, address, and telephone number, including area code, of agent for service)

With

copies to:

Tong Yu, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

Fukoku Seimei

Bldg. 2F

2-2, Uchisaiwaicho 2-chome

Chiyoda-ku, Tokyo 100-0011, Japan

+81-3-3597-8101

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company.) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Securities

to Be Registered |

|

Amount

to Be

Registered(1) |

|

Proposed

Maximum

Offering Price Per Share |

|

Proposed

Maximum

Aggregate

Offering Price |

|

Amount of

Registration Fee |

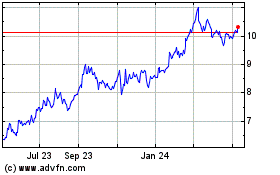

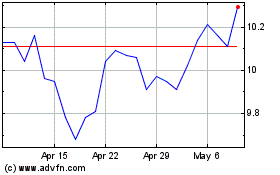

| Common Stock(2) |

|

30,000,000(3) |

|

$7.25(4) |

|

$217,500,000 |

|

$25,273.50 |

| |

| |

| (1) |

Plus such indeterminate number of additional shares as may be offered and issued to prevent dilution resulting from stock splits or similar transactions in accordance

with Rule 416 under the U.S. Securities Act of 1933, as amended (the “Securities Act”). |

| (2) |

American Depositary Shares issuable upon deposit of the shares of common stock registered hereby have been registered under a separate registration statement on Form

F-6 (Registration No. 333-13338). Each American Depositary Share represents one share of common stock. |

| (3) |

Relates to 30,000,000 Restricted Share Units or other Share-based Awards to be awarded under the MUFG Americas Holdings Corporation Stock Bonus Plan (formerly, The Bank

of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan). |

| (4) |

The proposed maximum offering price per share was calculated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act

based on the average of the high and low prices for the registrant’s common stock as reported on the Tokyo Stock Exchange on June 8, 2015 after conversion into U.S. dollars based on the exchange rate released by the Bank of Japan as in effect

on such date. |

EXPLANATORY NOTE

This Registration Statement on Form S-8 is filed by Mitsubishi UFJ Financial Group, Inc. (the “Registrant”) pursuant to General

Instruction E to Form S-8 (“General Instruction E”) under the Securities Act for the purpose of registering an additional 30,000,000 shares of common stock of the Registrant to be issued under the MUFG Americas Holdings Corporation Stock

Bonus Plan (formerly, The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan) (the “Plan”).

The Plan was originally adopted effective as of August 27, 2012, by The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, a branch of a wholly owned subsidiary of the Registrant, and amended and

restated effective June 8, 2015, to reflect the assumption and adoption of the Plan by MUFG Americas Holdings Corporation, a wholly owned subsidiary of the Registrant. The Plan, as amended and restated, is filed as Exhibit 4.5 hereto.

In accordance with General Instruction E, the registration statement on Form S-8 (No. 333-187274), previously filed by the

Registrant with the U.S. Securities and Exchange Commission (the “Commission”) on March 15, 2013 in respect of the Plan, is hereby incorporated by reference except to the extent supplemented, amended or superseded by the information

set forth herein.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

The documents containing the information specified in Part I of Form S-8 will be sent or given to participants in the Plan

as specified by Rule 428(b)(1) under the Securities Act. Under the rules of the Commission, such documents are not required to be, and are not, filed with the Commission but constitute, together with the documents incorporated by reference into this

Registration Statement, a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant

Information and Employee Plan Annual Information.

The Registrant will furnish without charge to each person to whom the

prospectus is delivered, upon the written or oral request of such person, a copy of any and all of the documents incorporated by reference in Item 3 of Part II of this Registration Statement, other than exhibits to such documents (unless such

exhibits are specifically incorporated by reference to the information that is incorporated). Those documents are incorporated by reference in the Section 10(a) prospectus. Requests should be directed to Mitsubishi UFJ Financial Group, Inc.,

7-1 Marunouchi 2-chome, Chiyoda-ku, Tokyo 100-8330, Japan, Attention: Financial Planning Division, Telephone number: +81-3-3240-8111.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, or sections of documents, as applicable, filed by the Registrant with the Commission are incorporated herein by reference and made a part hereof to the extent not superseded by

reports or other information subsequently filed or furnished:

| |

(a) |

The Registrant’s annual report on Form 20-F for the fiscal year ended March 31, 2014 filed by the Registrant with the Commission on July 18, 2014

(Commission File No. 000-54189) (the “Annual Report”); |

| |

(b) |

The Registrant’s report on Form 6-K filed by the Registrant with the Commission on January 22, 2015; and |

| |

(c) |

All other reports filed by the Registrant pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

since March 31, 2014. |

In addition, all documents filed by the Registrant subsequent to

the date of this Registration Statement pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which

deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be

modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 8. Exhibits.

|

|

|

| Exhibit

No. |

|

Document Description |

|

|

| 4.1 |

|

Articles of Incorporation of Mitsubishi UFJ Financial Group, Inc., as amended on June 27, 2013. (English translation)* |

|

|

| 4.2 |

|

Share Handling Regulations of Mitsubishi UFJ Financial Group, Inc., as amended on June 27, 2013. (English Translation)** |

|

|

| 4.3 |

|

Form of American Depositary Receipt.*** |

|

|

| 4.4 |

|

Form of Deposit Agreement, amended and restated as of December 22, 2004, among Mitsubishi Tokyo Financial Group, Inc. (subsequently renamed Mitsubishi UFJ Financial Group, Inc.),

The Bank of New York Mellon and the holders from time to time of American Depositary Receipts issued thereunder.*** |

|

|

| 4.5 |

|

MUFG Americas Holdings Corporation Stock Bonus Plan (formerly, The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan).** |

|

|

| 4.6 |

|

Trust under the MUFG Americas Holdings Corporation Stock Bonus Plan (formerly, Trust under The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus

Plan).** |

|

|

| 4.7 |

|

Form of MUFG Americas Holdings Corporation Stock Bonus Plan Restricted Share Unit Agreement.** |

|

|

| 23.1 |

|

Consent of Deloitte Touche Tohmatsu LLC.** |

|

|

| 24.1 |

|

Power of Attorney (included in this Registration Statement under “Signatures”).** |

| * |

Incorporated by reference to the Registrant’s annual report on Form 20-F (File No. 000-54189) filed on July 22, 2013. |

| *** |

Incorporated by reference to the Registrant’s annual report on Form 20-F (File No. 000-54189) filed on July 23, 2012. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly

caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tokyo, Japan on June 10, 2015.

|

|

|

|

|

| MITSUBISHI UFJ FINANCIAL GROUP, INC. |

|

|

| By: |

|

/s/ Taihei Yuki |

|

|

Name: |

|

Taihei Yuki |

|

|

Title: |

|

Senior Managing Director and Chief Financial Officer |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Taihei Yuki as such person’s true and lawful attorney-in-fact and

agent, with full power of substitution and resubstitution, for such person and in such person’s name, place, and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments, exhibits thereto and other

documents in connection therewith) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto each said attorney-in-fact and agent full power and

authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that each

said attorney-in-fact and agent, or any substitute therefor, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

| Signature |

|

Capacity |

|

Date |

|

|

|

| /s/ Kiyoshi Sono Kiyoshi Sono |

|

Chairman |

|

May 29, 2015 |

|

|

|

| /s/ Tatsuo Wakabayashi

Tatsuo Wakabayashi |

|

Deputy Chairman and Chief Audit Officer |

|

May 29, 2015 |

|

|

|

| /s/ Nobuyuki Hirano

Nobuyuki Hirano |

|

President & Chief Executive Officer |

|

May 29, 2015 |

|

|

|

| /s/ Masaaki Tanaka Masaaki Tanaka |

|

Deputy President |

|

May 29, 2015 |

|

|

|

| /s/ Taihei Yuki Taihei Yuki |

|

Senior Managing Director and Chief Financial Officer |

|

May 29, 2015 |

|

|

|

| /s/ Tadashi Kuroda Tadashi Kuroda |

|

Managing Director and Chief Planning Officer |

|

May 29, 2015 |

|

|

|

| /s/ Takashi Nagaoka

Takashi Nagaoka |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Junichi Okamoto

Junichi Okamoto |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Hiroyuki Noguchi

Hiroyuki Noguchi |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Ryuji Araki Ryuji Araki |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Yuko Kawamoto Yuko Kawamoto |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Tsutomu Okuda Tsutomu Okuda |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Kunie Okamoto Kunie Okamoto |

|

Director |

|

May 29, 2015 |

|

|

|

| /s/ Haruka Matsuyama

Haruka Matsuyama |

|

Director |

|

May 29, 2015 |

SIGNATURE OF AUTHORIZED REPRESENTATIVE OF THE REGISTRANT

Pursuant to the requirements of the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of

Mitsubishi UFJ Financial Group, Inc., has signed this Registration Statement or amendment thereto on June 10, 2015.

|

|

|

|

|

| MUFG AMERICAS HOLDINGS CORPORATION |

|

|

| By: |

|

/s/ Robert E. Hand |

|

|

Name: |

|

Robert E. Hand |

|

|

Title: |

|

Deputy General Counsel and

Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Document Description |

|

|

| 4.1 |

|

Articles of Incorporation of Mitsubishi UFJ Financial Group, Inc., as amended on June 27, 2013. (English translation)* |

|

|

| 4.2 |

|

Share Handling Regulations of Mitsubishi UFJ Financial Group, Inc., as amended on June 27, 2013. (English Translation)** |

|

|

| 4.3 |

|

Form of American Depositary Receipt.*** |

|

|

| 4.4 |

|

Form of Deposit Agreement, amended and restated as of December 22, 2004, among Mitsubishi Tokyo Financial Group, Inc. (subsequently renamed Mitsubishi UFJ Financial Group, Inc.), The Bank of New York Mellon and the holders from time

to time of American Depositary Receipts issued thereunder.*** |

|

|

| 4.5 |

|

MUFG Americas Holdings Corporation Stock Bonus Plan (formerly, The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan).** |

|

|

| 4.6 |

|

Trust under the MUFG Americas Holdings Corporation Stock Bonus Plan (formerly, Trust under The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan).** |

|

|

| 4.7 |

|

Form of MUFG Americas Holdings Corporation Stock Bonus Plan Restricted Share Unit Agreement.** |

|

|

| 23.1 |

|

Consent of Deloitte Touche Tohmatsu LLC.** |

|

|

| 24.1 |

|

Power of Attorney (included in this Registration Statement under “Signatures”).** |

| * |

Incorporated by reference to the Registrant’s annual report on Form 20-F (File No. 000-54189) filed on July 22, 2013. |

| *** |

Incorporated by reference to the Registrant’s annual report on Form 20-F (File No. 000-54189) filed on July 23, 2012. |

Exhibit 4.2

[Translation]

SHARE HANDLING REGULATIONS

MITSUBISHI UFJ FINANCIAL GROUP, INC.

CHAPTER I. GENERAL PROVISIONS

Article 1. (Purpose)

1. The handling with respect to the shares

and stock acquisition rights and the fees therefor provided for in Article 12 of the Articles of Incorporation of the Company shall be governed by the rules prescribed by the Japan Securities Depository Center, Inc., as a depository company

(hereinafter referred to as the “Center”), and account management institutions, such as securities companies and trust banks (hereinafter referred to as the “Securities Companies, Etc.”) as well as these Regulations.

2. The handling of special accounts opened pursuant to the agreement entered into by and between the Company and a trust bank designated by the Company and

the fees therefor shall be governed by the rules prescribed by such trust bank as well as these Regulations.

Article 2. (Share Transfer Agent)

The Company’s share transfer agent and its handling office shall be as follows:

|

|

|

| Share Transfer Agent: |

|

Mitsubishi UFJ Trust and Banking Corporation |

|

|

4-5, Marunouchi 1-chome, Chiyoda-ku, Tokyo |

|

|

| Handling Office: |

|

Mitsubishi UFJ Trust and Banking Corporation |

|

|

Corporate Agency Division |

|

|

4-5, Marunouchi 1-chome, Chiyoda-ku, Tokyo |

Article 3. (Method of Making Requests or Notifications)

1. All requests or notifications to the Company shall be made in the form prescribed by the Company, except in the event where such request or notification is

made through the Securities Companies, Etc. and the Center or through the Securities Companies, Etc., and in the event set forth in Article 36, Paragraph 1 hereof.

2. In case any request or notification as described in the preceding paragraph is made by a proxy or requires consent of a protector (hosanin) or an

assistant (hojonin), a document evidencing the authority of such proxy; or such consent, respectively, shall be submitted.

3. In the event that

the request or the notification set forth in Paragraph 1 is made through the Securities Companies, Etc. and the Center or through the Securities Companies, Etc., such request or notification may be deemed to have been made by a shareholder

himself/herself.

4. The Company may require the person who made the request or the notification set forth in Paragraph 1 to submit materials certifying

that the person is a shareholder or a proxy himself/herself.

1

5. In the event that the Company requires the person to submit the materials provided for in the preceding

paragraph, the Company shall not accept the request or the notification set forth in Paragraph 1 unless such materials are submitted.

CHAPTER II. ENTRIES OR RECORDS, ETC. IN REGISTER OF SHAREHOLDERS

Article 4. (Entries or Records in Register of Shareholders)

1.

The Company shall make entries or records in the register of shareholders in accordance with the notice concerning all shareholders (sokabunushi tsuchi) (which means the notice provided for in Article 151 of the Law Concerning Central

Clearing of Bonds, Shares and Other Securities; hereinafter referred to as the “Clearing Law”) given by the Center.

2. In the event that the

Company receives a notice of a change of address of a person entered or recorded in the register of shareholders (hereinafter referred to as the “Shareholder(s), Etc.”) or a notice of any other change in the matters entered or recorded in

the register of shareholders (other than an individual shareholder notice (kobetsu kabunushi tsuchi) (which means the notice provided for in Article 154, Paragraph 3 of the Clearing Law; the same shall apply hereinafter)) through the

Securities Companies, Etc. and the Center, the Company shall change the entry or the record in the register of shareholders pursuant to such notice.

3.

In addition to the provisions of the preceding two (2) paragraphs, in the case of the issuance of new shares or in any other case prescribed by laws or regulations, the Company shall make entries or records in the register of shareholders.

Article 5. (Characters, Etc. to be Used in Register of Shareholders)

Entries or records in the register of shareholders of the Company shall be made using the characters and/or symbols designated by the Center.

Article 6. (Entries or Records, Etc. in Ledger of Stock Acquisition Rights)

1. A request for entries or records in the ledger of stock acquisition rights, a request for registration, transfer or cancellation of a pledge with respect to

stock acquisition rights, and/or a request for the recordation of shares held in trust or cancellation thereof shall be made to the share transfer agent.

2. In addition to the provisions of the preceding paragraph, the handling of stock acquisition rights may be separately prescribed.

2

CHAPTER III. NOTIFICATIONS

Article 7. (Notification of Address, and Name or Trade Name)

1.

Shareholders, Etc. shall notify the Company of their addresses and names or trade names.

2. The notification set forth in the preceding paragraph or any

change in such notification shall be made through the Securities Companies, Etc. and the Center, except in the case of the issuance of new shares or in any other case prescribed by laws or regulations.

Article 8. (Notification of Nonresident Shareholders, etc.)

1.

Shareholders, Etc. residing in foreign countries shall either appoint their standing proxies in Japan or designate their mailing addresses in Japan for receiving notices and notify the Company thereof.

2. Standing proxies shall be included in the Shareholders, Etc. set forth in Paragraph 1 of the preceding article.

3. The notification set forth in Paragraph 1 or any change in such notification shall be made through the Securities Companies, Etc. and the Center, except in

the case of the issuance of new shares or in any other case prescribed by laws or regulations.

Article 9. (Representative of Corporation)

1. In case a Shareholder, Etc. is a corporation, the title and the name of one (1) representative of such corporation shall be notified.

2. The notification set forth in the preceding paragraph or any change in such notification shall be made through the Securities Companies, Etc. and the

Center, except in the case of the issuance of new shares or in any other case prescribed by laws or regulations.

Article 10. (Representative, Etc. of

Co-owned Shares)

1. Shareholders who co-own shares shall appoint one (1) representative on their behalf, and shall notify the address and the name or

the trade name of such representative.

2. The notification set forth in the preceding paragraph or any change in such notification shall be made through

the Securities Companies, Etc. and the Center, except in the case of the issuance of new shares or in any other case prescribed by laws or regulations.

3. In case a Shareholder, Etc. is an unincorporated association, the provisions of the preceding two (2) paragraphs shall apply.

Article 11. (Statutory Agent)

1. In case a statutory agent,

such as a person in parental authority or a guardian (kokennin) represents a Shareholder, Etc., the address and the name or the trade name of such statutory agent shall be notified.

3

2. The notification set forth in the preceding paragraph, or any change or cancellation thereof, shall be made

through the Securities Companies, Etc. and the Center, except in the case of the issuance of new shares or in any other case prescribed by laws or regulations.

Article 12. (Other Notifications)

1. In addition to the

notifications set forth in Article 7 hereof through the preceding article, unless otherwise designated by the Company, any notification to the Company shall be made through the Securities Companies, Etc. and the Center, or through the Securities

Companies, Etc., except in the case of the issuance of new shares or in any other case prescribed by laws or regulations.

2. Any notification that is

unable to be accepted or handled by the Securities Companies, Etc. shall be made to the share transfer agent.

Article 13. (Matters, Etc. to be Notified

concerning Holders of Stock Acquisition Rights)

The provisions of Article 7 hereof through the preceding article shall apply mutatis

mutandis to the matters to be notified concerning the person who is entered or recorded and the method of notification thereof in the ledger of stock acquisition rights of the Company, except that such notification shall be made to the share

transfer agent, unless otherwise prescribed pursuant to Article 6, Paragraph 2 hereof.

CHAPTER IV. PURCHASE OF FRACTIONAL UNIT SHARES

Article 14. (Request for Purchase of Fractional Unit Shares)

In case a shareholder requests the Company to purchase fractional unit shares, such request shall be made through the Securities Companies,

Etc. and the Center in accordance with the rules prescribed by the Center.

Article 15. (Determination of Purchase Price)

The purchase price of fractional unit shares shall be the amount equivalent to the closing price per share of the shares of the Company as

reported by the Tokyo Stock Exchange on the day when a request pursuant to the preceding article reaches the handling office of the share transfer agent provided for in Article 2 hereof, multiplied by the number of such fractional unit shares;

provided, however, that if there is no trading of the shares of the Company effected on such day or if such day falls on a day when the Tokyo Stock Exchange is closed, such closing price shall be deemed the amount equivalent to the first trading

price per share effected thereafter.

4

Article 16. (Payment of Purchase Proceeds)

1. The Company shall pay to the shareholder who requested for purchase of fractional unit shares the amount equivalent to the purchase price as calculated

pursuant to the preceding article after deducting the handling fees set forth in Article 39 hereof (hereinafter referred to as the “Purchase Proceeds”) on the fourth (4th) business day from the day immediately following the day on

which the purchase price is determined, unless the Company otherwise determines; provided, however, that if the purchase price reflects the right to receive dividends from a surplus or shares arising from a stock split, etc., such purchase price

shall be paid by the record date.

2. Upon request of the shareholder who requested for purchase of fractional unit shares, the Purchase Proceeds may be

paid by transfer to a bank account designated by him/her or by Japan Post Bank cash payment. In such cases, the payment of the Purchase Proceeds is deemed to be completed when the procedures for such transfer or the procedures for Japan Post Bank

cash payment are taken.

Article 17. (Transfer of Shares Purchased)

The fractional unit shares for which a request for purchase is made shall be transferred to the transfer account of the Company on the day on

which the payment of the Purchase Proceeds, as prescribed in the preceding article, has been completed.

CHAPTER V. PURCHASE OF ADDITIONAL

FRACTIONAL UNIT SHARES BY FRACTIONAL UNIT SHAREHOLDERS

Article 18. (Request for Purchase of Additional Fractional Unit Shares by Fractional Unit

Shareholders)

In case a shareholder holding fractional unit shares makes a request for the Company to sell to such fractional unit

shareholder shares held by the Company in the number as will constitute one (1) full unit of shares when added to the fractional unit shares held by such shareholder (hereinafter referred to as the “Request for Additional Purchase”),

such request shall be made through the Securities Companies, Etc. and the Center pursuant to the rules prescribed by the Center.

Article 19. (Restriction

on Request for Additional Purchase)

If an aggregate number of fractional unit shares for which the Requests for Additional Purchase are

made on the same day exceeds the number of shares owned by the Company which shall be transferred, the Company shall not transfer any fractional unit share for any of the Requests for Additional Purchase made on such day.

5

Article 20. (Effective Date of Request for Additional Purchase)

Requests for Additional Purchase shall be deemed to be made on the day when a request as described in Article 18 hereof is accepted at the

handling office of the share transfer agent provided for in Article 2 hereof.

Article 21. (Determination of Additional Purchase Price)

The additional purchase price of fractional unit shares shall be the amount equivalent to the closing price per share of the shares of the

Company as reported by the Tokyo Stock Exchange on the day when the request set forth in Article 18 hereof is accepted at the handling office of the share transfer agent provided for in Article 2 hereof, multiplied by the number of such fractional

unit shares; provided, however, that if there is no trading of the shares of the Company effected on such day or if such day falls on a day when the Tokyo Stock Exchange is closed, such closing price shall be deemed the amount equivalent to the

first trading price per share effected thereafter.

Article 22. (Timing of Transfer of Shares Additionally Purchased)

With respect to the fractional unit shares for which the Request for Additional Purchase is made, the application for the transfer thereof to

the transfer account of the shareholder who made such Request for Additional Purchase shall be made on the day on which it is confirmed that the amount of the additional purchase price calculated pursuant to the preceding article and the fees

provided for in Article 39 hereof (hereinafter referred to as the “Proceeds from Additional Purchase”) have been remitted to the bank account designated by the Company.

Article 23. (Suspension of Acceptance of Request for Additional Purchase)

1. The Company shall suspend the acceptance of Requests for Additional Purchase during the period beginning ten (10) business days prior to any of the

days provided for in the following items up to the day provided for in such item:

| |

(3) |

Any other determination date of shareholders. |

2. In addition to the case provided for in the preceding

paragraph, when the Company or the Center deems necessary, the Company may suspend the acceptance of Requests for Additional Purchase.

6

CHAPTER VI. PREFERRED SHARES

Article 24. (Exceptions for Preferred Shares)

1. With respect

to the provisions concerning the Preferred Shares, notwithstanding any other provisions hereof, the provisions of this Chapter shall prevail and apply.

2. All request or notification procedures, or any other handling, concerning the Preferred Shares shall be made to the share transfer agent, unless otherwise

provided for in this Chapter.

Article 25. (Entries or Records in Register of Holders of Preferred Shares)

1. In case of a request for entries or records in the register of holders of the Preferred Shares (hereinafter referred to as the “Registration of

Transfer”), a written request therefor, with the names and seals of both the holder of the Preferred Shares entered or recorded in the register of shareholders and the person who acquired such Preferred Shares affixed thereto, shall be

submitted together with the materials evidencing the matters regarding the Registration of Transfer.

2. In case a request for the Registration of

Transfer is made with respect to the Preferred Shares acquired due to inheritance, merger or any other event other than assignment, a written request therefor shall be submitted together with a document evidencing the cause for such acquisition.

Article 26. (Notifications of Holders, Etc. of Preferred Shares)

1. Holders of the Preferred Shares and the registered preferred share pledgees, or their statutory agents, in addition to the notification set forth in Article

7 hereof, shall notify the Company of their seal impressions; provided, however, that foreigners may substitute their specimen signatures for seal impressions.

2. In case of a change in the matters notified pursuant to the preceding paragraph, such change shall be notified.

3. All requests, notifications or any other exercises of holders’ rights concerning the Preferred Shares to the Company shall be made in the form

prescribed by the Company, bearing the seal impressions notified pursuant to the provisions of Paragraph 1.

Article 27. (Registration of Transfer in Case

of Special Procedures Required by Laws and Regulations)

If any special procedure is required by laws and regulations in connection with

transfer of the Preferred Shares, a written request therefor shall be submitted together with a document evidencing the completion of such procedure.

7

Article 28. (Registration of Pledges, Transfer or Cancellation Thereof)

In case of a request for the registration of pledges on the Preferred Shares, transfer or cancellation thereof, a written request therefor with

the names and seals of both a pledgor and a pledgee affixed thereto shall be submitted.

Article 29. (Recordation of Shares Held in Trust or Cancellation

Thereof)

In case of a request for the recordation of the Preferred Shares held in trust or cancellation thereof, a written request

therefor shall be submitted either by a trustor or a trustee.

Article 30. (Method for Request for Acquisition of Preferred Shares)

1. In case of a request to the Company for acquisition of Class 6 Preferred Shares (the First to the Fourth Series), Class 7 Preferred Shares (the First to the

Fourth Series)and Class 11 Preferred Shares, in exchange for ordinary shares of the Company (hereinafter referred to as the “Ordinary Shares”) in the number as is calculated by the formula set forth in Article 19 of the Articles of

Incorporation, such request shall be made in the prescribed written form through the Securities Companies, Etc. or otherwise in accordance with the rules prescribed by the Center, and a transfer account (other than a special account) which has been

opened for himself/herself for the purpose of the transfer of such Ordinary Shares shall be designated.

2. The request provided for in the preceding

paragraph may not be cancelled after submitting the written request therefor.

3. The delivery of the Ordinary Shares set forth in Paragraph 1 shall be

made by a notification of new record or an application for the transfer of such Ordinary Shares to the transfer account designated pursuant to the provisions of such paragraph.

Article 31. (Effect of Request for Acquisition of Preferred Shares)

The request set forth in the preceding article shall come into effect when the written request therefor reaches the handling office of the

share transfer agent provided for in Article 2 hereof.

Article 32. (Notice or Public Notice of Change in Acquisition Price and Delivery Ratio of

Preferred Shares)

In case the acquisition price or the delivery ratio included in the terms of the acquisition of Preferred Shares

provided for in Article 19 of the Articles of Incorporation shall be reset or adjusted, details of such reset or adjustment and the number of the Ordinary Shares to be delivered in exchange for acquisition of Preferred Shares shall be notified or

notified publicly to the holders of the Preferred Shares by the day preceding the reset date or the day on which such adjusted acquisition price or delivery ratio shall be applied (hereinafter referred to as the “Reset Date, Etc.”);

provided, however, that in case the Company is not able to give notices or public notices of such change to the holders of the Preferred Shares by the day preceding the Reset Date, Etc., the Company shall give notices or public notices of such

change to the holders of the Preferred Shares promptly after the Reset Date, Etc.

8

Article 33. (Notice or Public Notice of Restriction on Period for Request for Acquisition of Preferred Shares)

In case there is a provision which excludes a certain period within the period in which the holders of the Preferred Shares are entitled

to request acquisition, included in the terms of the acquisition of Preferred Shares provided for in Article 19 of the Articles of Incorporation, the Company shall give notices or public notices of such excluded period to the holders of the

Preferred Shares in advance.

Article 34. (Procedures for Acquisition pursuant to Provisions of Acquisition of Preferred Shares)

1. In case of acquisition of Preferred Shares set forth in Article 18 of the Articles of Incorporation, the Company shall give notices or public notices of the

amount of cash to be delivered to the holders of the Preferred Shares in exchange for the acquisition of one (1) share of such Preferred Shares and any other necessary matters to the holders of the Preferred Shares.

2. In case of mandatory acquisition of Preferred Shares provided for in Article 20 of the Articles of Incorporation, the Company shall give notices or public

notices of (i) the acquisition date, (ii) the occurrence of any acquisition event, (iii) if the Ordinary Shares will be delivered in exchange for the acquisition of such Preferred Shares set forth in the said article, the number of

the Ordinary Shares to be delivered, (iv) if such Preferred Shares will be acquired free of consideration, the fact that such Preferred Shares will be acquired free of consideration, and (v) any other necessary matters, to the holders of

the Preferred Shares.

Article 35. (Delivery of New Shares upon Mandatory Acquisition of Preferred Shares)

1. In case of mandatory acquisition of Preferred Shares provided for in Article 20 of the Articles of Incorporation, a holder of the Preferred Shares shall

give written notice of a transfer account (other than a special account) which has been opened for himself/herself for the purpose of the transfer of such Ordinary Shares.

2. The delivery of the Ordinary Shares set forth in the preceding paragraph shall be made by a notification of new record or an application for the transfer

of such Ordinary Shares to the transfer account notified pursuant to the provisions of the preceding paragraph.

9

CHAPTER VII. METHODS BY WHICH TO EXERCISE

MINORITY SHAREHOLDERS’ RIGHTS, ETC.

Article

36. (Methods by Which to Exercise Minority Shareholders’ Rights, Etc.)

1. In case of direct exercise of the minority shareholders’ rights, etc.

set forth in Article 147, Paragraph 4 of the Clearing Law against the Company, a shareholder shall submit a document on which his/her printed name and seal is affixed, after requesting the individual shareholder notice; provided, however, that a

foreigner may substitute his/her signature for such printed name and seal.

2. Notwithstanding the provisions of the preceding paragraph, in case of

exercise of the minority shareholders’ rights, etc. by the holders of the Preferred Shares, the request for the individual shareholder notice shall not be required.

3. The provisions of Article 3, Paragraphs 2, 4 and 5 hereof shall apply mutatis mutandis to the exercise of the minority shareholders’ rights,

etc. referred to in the preceding two (2) paragraphs.

Article 37. (Agenda that are Proposed by Shareholders in Reference Materials for General

Meeting of Shareholders)

In case of exercise of the shareholders’ proposal rights pursuant to the provisions of Paragraph 1 of the

preceding article, if the description of the following matters that are included in the proposed agenda exceeds 400 characters or is otherwise determined by the Company to be inappropriate to describe all of the matters, such description may be

summarized in the reference materials for a general meeting of shareholders:

| |

(1) |

Reasons for the proposal; or |

| |

(2) |

Matters relating to the appointment of directors, accounting advisors, corporate auditors and accounting auditors. |

CHAPTER VIII. IDENTIFICATION OF SHAREHOLDERS

Article 38. (Identification of Shareholders)

1. In case of

exercises of shareholders’ rights, except as otherwise provided for in laws and regulations or these Regulations, the Company may request the submission of materials certifying that the person who exercises the rights is a shareholder

himself/herself or a proxy thereof.

2. The provisions of Article 3, Paragraphs 2 and 5 hereof shall apply mutatis mutandis to the identifications

of shareholders set forth in the preceding paragraph.

10

CHAPTER IX. HANDLING FEES

Article 39. (Handling Fees)

Fees for handling

of shares of the Company (including consumption tax) shall be as follows:

| |

1. |

In case of purchase of fractional unit shares pursuant to Article 14 hereof or purchase of additional fractional unit shares pursuant to Article 18 hereof: |

The fee shall be the amount obtained by multiplying the purchase price provided for in Article 15 hereof by 0.75%, or the amount obtained by

multiplying the additional purchase price provided for in Article 21 hereof by 0.75%, in each case plus consumption tax. (Fractions less than one (1) yen shall be disregarded.)

| |

2. |

Fees to be paid by the Shareholders, Etc. to the Securities Companies, Etc. or the Center shall be borne by the Shareholders, Etc. |

Supplemental Provisions

Article 1. (Application

for Cancellation by Registrant of Lost Share Certificates)

In case a registrant of lost share certificates applies for cancellation of the

registration of lost share certificates, a written application therefor in the form prescribed by the Company shall be submitted.

Article 2. (Application

for Cancellation by Person Possessing Share Certificates)

In case a person who possesses the share certificates for which registration of

the lost share certificates is made (excluding registrants of lost share certificates) applies for cancellation of such registration of the lost share certificates, the application form therefor in the form prescribed by the Company shall be

submitted together with the share certificates concerned and a document for identification of the applicant.

Article 3. (Application of Notifications

mutatis mutandis)

The provisions of Article 7 to Article 12 hereof shall apply mutatis mutandis to the case of any change in

the entries or records in the register of lost share certificates upon request of a registrant of lost share certificates, and such registrant of lost share certificates shall submit notifications to the handling office of the Company’s share

transfer agent set forth in Article 2 hereof.

Article 4. (Transitional Measure)

The provisions of Article 1 of the Supplemental Provisions to this article shall be deleted on January 6, 2010.

11

Amendment History

|

|

|

| October 1, 2001 |

|

Article 9 amended |

| June 27, 2002 |

|

Articles 1, 9, 10, 11, 23, 33, 34, 35 and 36 amended |

| April 1, 2003 |

|

Articles 4, 5, 24, 25, 26, 27, 29, 30, 33, 40, 41, Article 2 of Supplemental Provision amended |

|

|

Articles after No. 28 were renumbered |

| July 1, 2003 |

|

Articles 1, 2, 32, 33, 35, 36, 37, 38, 39, 40, 41, 42, 45, 46, 47, 48 and 49 amended |

|

|

Articles after No. 43 were renumbered |

| June 29, 2004 |

|

Articles 1, 45, 46, 47 and 48 amended |

| June 29, 2005 |

|

Articles 43, 44, 45, 46, 47 and 48 amended |

| October 1, 2005 |

|

Articles 2, 33, 35, 36, 38, 41, 43, 49 and 50 amended |

|

|

Articles after No. 37 were renumbered |

| May 1, 2006 |

|

Articles 2, 4 through 10, 16 through 18, 20, 21, 23 through 27, 29, 31 through 33, and 35 through 50 amended |

|

|

Articles after No. 37 were renumbered |

|

|

Articles 1 through 3 of Supplemental Provisions amended |

| June 29, 2006 |

|

Articles 1, 9, 23 (newly established), 34, 39, 41, 46, 48, 49, 50, 51, 52 and Article 1 of Supplemental Provisions amended |

|

|

Articles after No. 34 were renumbered |

| September 30, 2007 |

|

Articles 1, 3, 5 through 7, 15 through 17, 26, 29 through 39, 42, 44, 46 through 50 amended |

|

|

Articles after No. 7 were renumbered |

|

|

Article 1 of Supplemental Provisions amended |

|

|

Article 3 of Supplemental Provisions deleted |

| January 5, 2009 |

|

The Regulations were wholly amended |

| May 19, 2009 |

|

Article 36 amended |

|

|

Article 1 of Supplemental Provisions deleted |

|

|

Articles after No. 2 of Supplemental Provisions were renumbered |

| June 26, 2009 |

|

Articles 1, 30, and 32 through 35 amended |

| June 27, 2013 |

|

Articles 17, 22, 34 and 35 amended |

- No further entry -

12

Exhibit 4.5

MUFG AMERICAS HOLDINGS CORPORATION STOCK BONUS PLAN

(formerly The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan)

INTRODUCTION

This MUFG Americas

Holdings Corporation Stock Bonus Plan (as it may be amended from time to time, the “Plan”) was originally adopted by The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch, a branch licensed under the laws of the State of New York

(“HQA”), effective as of August 27, 2012, under the name “The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan.” The Plan has been amended and restated as set forth herein, effective

June 8, 2015, to reflect the assumption and adoption of the Plan by MUFG Americas Holdings Corporation (the “Company”), in connection with the integration of Union Bank, N.A., the Company’s subsidiary, and HQA to form MUFG

Union Bank, N.A. (the “Bank”).

The purpose of the Plan is to promote the long-term success of the Company and its

Affiliates and the creation of stockholder value by (a) encouraging key Employees to focus on critical long-range objectives, (b) encouraging the attraction and retention of key Employees with exceptional qualifications and

(c) linking key Employees directly to stockholder interests through increased stock ownership. The Plan seeks to achieve this purpose by providing for payment of some or a portion of annual bonuses to such key Employees in the form of

Restricted Share Units representing a right to acquire equity of Mitsubishi UFJ Financial Group, Inc., a Japanese corporation (“MUFG”), the parent company of the Company and the Bank.

The Plan, as amended and restated herein, has been assumed and adopted by the Company with the consent of HQA, and it shall be governed by,

and construed in accordance with, the laws of the State of New York.

ARTICLE 1

DEFINITIONS

1.1

“AFFILIATE” means MUFG or any corporation, limited liability company or other entity (other than the Company or MUFG, as the case may be) in an unbroken chain of such entities beginning with the Company or MUFG, as the case may be, if each

such entity other than the last entity in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other entities in such chain. A corporation, limited liability company or other

entity that attains the status of an Affiliate on a date after the adoption of the Plan shall be considered an Affiliate commencing as of such date.

1.2 “BANK” has the meaning set forth in the Introduction to this Plan.

1.3 “BUSINESS COMBINATION” means the consummation of a reorganization, merger or consolidation or sale or other disposition of all

or substantially all of the assets or stock of a designated corporation or other entity or the acquisition by the designated corporation or other entity of the assets or stock of another entity.

1.4 “CHANGE IN CONTROL” shall mean a Business Combination with respect to a designated

corporation or other entity; excluding, however, such a Business Combination pursuant to which (i) a Permitted Holder will beneficially own, directly or indirectly, 30% or more of, respectively, the Company Stock, as the case may be, of the

corporation or other entity resulting from such Business Combination (including, without limitation, a corporation or other entity which as a result of such transaction owns the designated corporation or other entity or all or substantially all of

the designated corporation or other entity’s assets either directly or through one or more subsidiaries), and (ii) no individual, entity or group (within the meaning of section 13(d)(3) or 14(d)(2) of the Exchange Act) has a greater

beneficial interest, directly or indirectly, in the Company Stock than a Permitted Holder.

1.5 “CODE” means the Internal

Revenue Code of 1986, as amended.

1.6 “COMPANY” has the meaning set forth in the Introduction to this Plan.

1.7 “COMPANY STOCK” means, with respect to a designated corporation or other entity, the outstanding shares of common stock, and the

combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors.

1.8

“EMPLOYEE” means a bona fide employee of the Company or an Affiliate.

1.9 “EXCHANGE ACT” means the Securities

Exchange Act of 1934, as amended.

1.10 “HCC” means the Human Capital Committee of the Board of Directors of the Company and the

Bank.

1.11 “HQA” has the meaning set forth in the Introduction to this Plan.

1.12 “MUFG” has the meaning set forth in the Introduction to this Plan.

1.13 “PARTICIPANT” means an individual or estate who holds Restricted Share Units issued under the Plan.

1.14 “PERMITTED HOLDER” means (i) MUFG or any successor thereto, (ii) an employee benefit plan of MUFG or (iii) a

corporation or other entity controlled by MUFG.

1.15 “PLAN” means this MUFG Americas Holdings Corporation Stock Bonus Plan, as

amended from time to time.

1.16 “RESTRICTED SHARE UNIT” means an unfunded and unsecured promise to deliver a Share, cash, other

securities or other property, subject to certain restrictions (including, without limitation, a requirement that the Participant remain continuously employed for a specified period of time) as set forth herein and under the Restricted Share Unit

Agreement, granted under Article 5 of the Plan.

2

1.17 “RESTRICTED SHARE UNIT AGREEMENT” means the agreement between the Company and the

recipient of Restricted Share Units which contains the terms, conditions and restrictions pertaining to such Restricted Share Units.

1.18

“SHARE” means an American Depositary Receipt representing an American Depositary Share, which represents one share of common stock of MUFG.

1.19 “TRUST” means a revocable trust established by the Company with an independent trustee for the purpose of acquiring Shares with

funds contributed by or at the direction of the Company and holding such Shares until transferred to Participants pursuant to Restricted Share Unit Agreements.

ARTICLE 2

ADMINISTRATION

2.1 HCC. The Plan shall be administered by the HCC.

2.2 HCC RESPONSIBILITIES. The HCC shall (a) select the Employees who are to receive Restricted Share Units under the Plan,

(b) determine the number of Shares, vesting requirements and other features and conditions of such Restricted Share Units, (c) interpret the Plan and (d) make all other decisions relating to the operation of the Plan. The HCC may

adopt such rules or guidelines as it deems appropriate to implement the Plan. The HCC’s determinations under the Plan shall be final and binding on all persons.

2.3 DELEGATION. The HCC may delegate to the Bank’s Chief Human Resources Officer for the Americas and the Head of Total Rewards, or to

other Bank committees in its sole discretion, the power and authority to administer the Plan pursuant to such conditions and limitations as the HCC may establish.

ARTICLE 3

SHARES AVAILABLE FOR

GRANTS

3.1 GENERAL. Shares delivered pursuant to Restricted Share Units granted pursuant to the Plan shall be authorized and issued

Shares acquired by the Trust pursuant to a trust agreement with the Company.

ARTICLE 4

ELIGIBILITY

4.1 GENERAL. Only

Employees are eligible to be selected by the HCC as Participants in the Plan.

3

ARTICLE 5

RESTRICTED SHARE UNIT AWARDS

5.1 TIME, AMOUNT AND FORM OF RESTRICTED SHARE UNIT AWARDS. Restricted Share Units may be awarded in such amounts, at such times, and subject

to such vesting or other restrictions as the HCC may determine.

5.2 PAYMENT FOR RESTRICTED SHARE UNITS. No payment shall be required by

Participants for receiving Restricted Share Units or Shares delivered pursuant to Restricted Share Units awarded under the Plan.

5.3

VESTING CONDITIONS. Each award of Restricted Share Units shall become vested, in full or in installments, upon satisfaction of the conditions specified in the Restricted Share Unit Agreement. Subject to the HCC’s determination, a Restricted

Share Unit Agreement may provide for accelerated vesting in the event of the Participant’s death, disability or retirement or other events. The HCC may determine, at the time of making a Restricted Share Unit award or thereafter, that such

Restricted Share Unit award shall become fully vested in the event that a Change in Control occurs with respect to the Company or the relevant Affiliate that employs the Participant upon the occurrence of a Change in Control.

5.4 SETTLEMENT OF RESTRICTED SHARE UNITS. Unless otherwise provided by the HCC in the Restricted Share Unit Agreement, upon expiration of any

vesting conditions with respect to a Restricted Share Unit, one Share (or other securities or other property, as applicable) for each such outstanding Restricted Share Unit shall be delivered to the Participant, or his or her beneficiary, without

charge, from the Trust; provided, however, that unless otherwise provided in the Restricted Share Unit Agreement, the HCC may, in its sole discretion, elect to (i) pay cash, or part cash and part Shares, in lieu of delivering only Shares in

respect of such Restricted Share Unit, or (ii) defer the delivery of Shares (or cash, or part Shares and part cash, as the case may be) beyond the expiration of the lapse of the vesting restrictions, subject to compliance with section 409A of

the Code. Notwithstanding the payment schedule set forth in the Restricted Share Unit Agreement, the HCC may accelerate payment of a Participant’s Restricted Share Unit(s) in accordance with Treasury Regulations Section 1.409A-1(c)(2). If

a cash payment is made in lieu of delivering Shares (or a fraction thereof), the amount of such payment shall be equal to the fair market value of the Shares as of the date on which the Shares (or a fraction thereof) would otherwise have been

delivered, subject to any applicable withholding or other taxes.

5.5 CLAWBACK AND RECOUPMENT. All Restricted Share Units awarded and

Shares delivered to Participant under the Plan pursuant to the Restricted Share Unit Agreement shall be subject to certain clawback and recoupment terms and conditions as may be provided in such agreement.

4

ARTICLE 6

OTHER SHARE-BASED AWARDS

6.1

GENERAL. The HCC may grant other awards to Participants denominated in Shares in such amounts as the HCC shall from time to time in its sole discretion determine. Such awards may include grants of Shares subject to forfeiture to the extent vesting

conditions have not been fulfilled upon termination of employment. Each other Share-based award granted under the Plan shall be evidenced by an award agreement, and shall be subject to such conditions not inconsistent with the Plan as may be

reflected in such award agreement.

ARTICLE 7

CHANGES AFFECTING AWARDS

7.1

GENERAL. In the event of (a) any dividend (other than ordinary cash dividends) or other distribution (whether in the form of cash, Shares, other securities or other property), recapitalization, stock split, reverse stock split, reorganization,

merger, consolidation, split-up, split-off, spin-off, combination, repurchase or exchange of Shares or other securities of MUFG, issuance of warrants or other rights to acquire Shares or other securities of MUFG, or other similar corporate

transaction or event that affects the Shares, or (b) unusual or nonrecurring events (including, without limitation, a Change in Control) affecting the Company or any Affiliate, or the financial statements of the Company or any Affiliate, or

changes in applicable rules, rulings, regulations or other requirements of any governmental body or securities exchange or inter-dealer quotation system, accounting principles or law, such that in either case an adjustment is determined by the HCC

in its sole discretion to be necessary or appropriate, then, subject to section 409A of the Code, the HCC shall make any such adjustments in such manner as it may deem equitable, including without limitation, any or all of the adjustments described

in paragraphs (i) and (ii) below:

(i) adjusting any or all of (1) the number of Shares or other securities

of MUFG (or number and kind of other securities or other property) which may be delivered in respect of the awards or with respect to which awards may be granted under the Plan and (2) the terms of any outstanding award, including, without

limitation, the number of Shares or other securities of MUFG (or number and kind of other securities or other property) subject to outstanding awards or to which outstanding awards relate; or

(ii) cancelling any one or more outstanding awards and causing to be paid to the holders thereof, in cash, Shares, other

securities or other property, or any combination thereof, the value of such awards (whether vested or unvested), if any, as determined by the HCC (which if applicable may be based upon the price per Share received or to be received by other holders

of Shares in such event);

provided, however, that in the case of any “equity restructuring” (within the meaning of the Financial

Accounting Standards Board Accounting Standards Codification Topic 718), the HCC shall make an equitable or proportionate adjustment to outstanding awards to reflect such equity restructuring.

5

ARTICLE 8

LIMITATION ON RIGHTS

8.1

RETENTION RIGHTS. Neither the Plan nor any Restricted Share Units granted under the Plan shall be deemed to give any individual a right to remain an employee of the Company or an Affiliate. The Company and the Affiliates reserve the right to

terminate the service of any employee at any time, with or without cause, with or without notice, subject to applicable laws, the Company’s certificate of incorporation and by-laws and a written employment agreement (if any).

8.2 STOCKHOLDERS’ RIGHTS. A holder of Restricted Share Units shall have no dividend rights, voting rights or other rights as a

stockholder with respect to any Shares covered by his or her Restricted Share Unit award prior to the delivery of Shares, if any. However, unless otherwise provided in the Restricted Share Unit Agreement, if a cash dividend is declared on the

Shares, then on the payment date of the dividend, the Participant will be credited with dividend equivalents payable in cash or Shares equal to the amount of the cash dividend per Share multiplied by the number of Restricted Share Units credited to

the Participant through the record date for the dividend. The dividend equivalents will be subject to the same terms regarding vesting, applicable taxes and forfeiture, and will be distributed at the same time, as the Shares associated with the

Participant’s Restricted Stock Units.

8.3 REGULATORY REQUIREMENTS. Any other provision of the Plan notwithstanding, the obligation

of the Company to deliver Shares under the Plan shall be subject to all applicable laws, rules and regulations and such approval by any regulatory body as may be required. The Company reserves the right to restrict, in whole or in part, the delivery

of Shares pursuant to any award prior to the satisfaction of all legal or regulatory requirements relating to the delivery of such Shares, to their registration, qualification or listing or to an exemption from registration, qualification or

listing.

ARTICLE 9

WITHHOLDING TAXES

9.1 GENERAL.

To the extent required by applicable federal, state, local or foreign law, a Participant or his or her successor shall make arrangements satisfactory to the Company or the Affiliate for the satisfaction of any withholding tax obligations that arise

in connection with the Plan. The Company shall not be required to release any Shares or make any cash payment under the Plan until such withholding tax obligations are satisfied.

6

ARTICLE 10

ASSIGNMENT OR TRANSFER OF RESTRICTED SHARE UNITS

10.1 GENERAL. Restricted Share Units awarded under the Plan shall not be anticipated, assigned, hypothecated, attached, garnished, optioned,

transferred or made subject to any creditor’s process, whether voluntarily, involuntarily or by operation of law, except as approved by the HCC in writing. However, this Article 10 shall not preclude a Participant from designating a

beneficiary who will receive the proceeds upon settlement of any outstanding Restricted Share Units in the event of the Participant’s death, nor shall it preclude a transfer of Restricted Share Units by will or by the laws of descent and

distribution. No other rights given to a Participant under the Plan or the Restricted Share Unit Agreement may be anticipated, assigned, hypothecated, attached, garnished, optioned, transferred or made subject to any creditor’s process, whether

voluntarily, involuntarily or by operation of law, except as approved by the HCC in writing.

ARTICLE 11

FUTURE OF THE PLAN

11.1 TERM OF

THE PLAN. The Plan, as set forth herein, shall remain in effect until it is terminated under Section 11.2.

11.2 AMENDMENT OR

TERMINATION. The HCC may, at any time and for any reason, amend or terminate the Plan. An amendment of the Plan shall be subject to the approval of the Company’s stockholders only to the extent required by applicable laws, regulations or rules.

No Restricted Share Units shall be awarded under the Plan after the termination thereof. The termination of the Plan, or any amendment thereof, shall not affect any Restricted Share Units previously awarded under the Plan, unless required under

applicable law or regulation. In the event of any conflict among the provisions (including defined terms) of the Plan, the Restricted Share Unit Agreement and the Award Notice, the Plan shall prevail.

7

ARTICLE 12

EXECUTION

To record the

Company’s assumption and adoption of the Plan and the amendment and restatement thereof, the Company has caused its duly authorized officers to execute this document.

|

|

|

| MUFG AMERICAS HOLDINGS CORPORATION |

|

|

| By: |

|

|

|

|

Annemieke van der Werff |

|

|

Chief Human Resources Officer |

|

|

MUFG Union Bank, N.A. |

|

|

| Date: |

|

June 8, 2015 |

|

|

| By: |

|

|

|

|

Matthew Insinga |

|

|

Head of Total Rewards |

|

|

MUFG Union Bank, N.A. |

|

|

| Date: |

|

June 8, 2015 |

8

Exhibit 4.6

TRUST UNDER THE MUFG AMERICAS HOLDINGS CORPORATION

STOCK BONUS PLAN

This

AMENDED AND RESTATED AGREEMENT, effective the 8th day of June, 2015, by and between MUFG Americas Holdings Corporation, a Delaware corporation (the “Company”), and RBC Trust Company (Delaware) Limited, a trust company incorporated

under the laws of Delaware (the “Trustee”):

W I T N E S S E T H:

WHEREAS, The Bank of Tokyo-Mitsubishi UFJ, Ltd., Headquarters for the Americas, a branch licensed under the laws of the State of New York

(“HQA”), adopted The Bank of Tokyo-Mitsubishi UFJ, Ltd. Headquarters for the Americas Stock Bonus Plan (the “Plan”), effective as of August 27, 2012, pursuant to which HQA granted equity incentives to certain

key employees of HQA and its affiliates in the form of American Depositary Receipts evidencing American Depositary Shares (“Shares”) representing ordinary shares of its indirect Japanese parent company, Mitsubishi UFJ Financial

Group, Inc. (“MUFG”);

WHEREAS, in connection with the integration of Union Bank, N.A., the Company’s subsidiary,

and HQA to form MUFG Union Bank, N.A., the Plan has been amended and restated, effective June 8, 2015, to reflect the assumption and adoption of the Plan by the Company and pursuant to which the Company will continue to grant equity incentives

to certain key employees of the Company and its affiliates (“Participants”);

WHEREAS, the Company has been advised that

under applicable Japanese law, the Company is not permitted to own the Shares;

WHEREAS, pursuant to an agreement dated November 8,

2012, HQA established and funded this trust (hereinafter called the “Trust”) for the purpose of purchasing the Shares for direct transfer to Participants who have been awarded Shares by HQA pursuant to the terms of the Plan and

individual restricted share awards or restricted share unit awards (collectively “RSUs”) between HQA and the Participants;

WHEREAS, it is the intention of the parties that the Trust, together with the Plan and the RSUs,

shall constitute an unfunded incentive compensation arrangement that does not provide for deferred compensation, and that the Trust shall not affect the status of the Plan and RSUs as unfunded for purposes of Title I of the Employee Retirement

Income Security Act of 1974, as amended (“ERISA”), and the Internal Revenue Code of 1986, as amended (the “Code”); and

WHEREAS, in connection with the assumption and adoption of the Plan by the Company, the parties hereto desire to amend and restate this

Agreement;

NOW, THEREFORE, the parties do hereby establish the Trust and agree that the Trust shall be comprised, held and disposed of as

follows:

SECTION 1. Establishment of the Trust.

(a) The Company hereby has caused to be deposited Ten Dollars ($10) with the Trustee in trust which shall become the initial principal of the

Trust to be held, administered and disposed of by the Trustee as provided in this Trust Agreement, including without limitation for the purpose of purchasing Shares to be transferred to Participants.

(b) The Trust hereby established is revocable by the Company only in accordance with Section 13(b) hereof.

(c) The Trust is intended to be a grantor trust, of which the Company is the grantor, within the meaning of subpart E, part I,

subchapter J, chapter 1, subtitle A of the Code, and shall be construed accordingly.

(d) The principal of the Trust and

any earnings thereon shall be held separate and apart from other funds of the Company and shall be used exclusively for the uses and purposes as herein set forth. Participants (or their beneficiaries) who constitute Nominated Participants (as

hereinafter defined) (or their beneficiaries) shall have no preferred claim on, or any beneficial ownership interest in, any assets of the Trust. Any rights created under the Plan, including the RSUs, shall be mere unsecured contractual rights of

Participants (or their beneficiaries) against the Company. For purposes of this Trust Agreement, a “Nominated Participant” means a Participant listed on a Grant Schedule who holds an RSU which has become vested by its terms, and

which entitles the Participant to immediate payment of Shares (or cash or other property in respect thereof) which obligation has not been satisfied by the Company by other means.

2

(e) The Company, in its sole discretion, may at any time, or from time to time, make or cause to

be made additional deposits of cash or other property in trust with the Trustee to augment the principal to be held, administered and disposed of by the Trustee as provided in this Trust Agreement. Neither the Trustee nor any Participant shall have

any right to compel such additional deposits.

SECTION 2. Grants to Participants.

(a) The Company shall, from time to time, deliver to the Trustee a schedule (the “Grant Schedule”) which indicates the number

of Shares to be transferred in respect of each Participant, the dates on which such Shares are to be transferred and, if applicable, the vesting schedule applicable thereto and the amount of any accrued dividend equivalents (net of applicable

withholding taxes) payable in respect thereof. Except as otherwise provided herein, the Trustee shall transfer the Shares and cash equal to the amount of any accrued dividend equivalents (net of applicable withholding taxes) to a transfer agent,

broker or custodian to hold in a separate account under the Trust for each Participant in accordance with such Grant Schedule. The number of Shares (and the amount of any accrued dividend equivalents) to be transferred pursuant to the Grant Schedule

may reflect a reduction from the gross number of Shares subject to the RSUs (and from the gross amount of accrued dividend equivalents) to account for applicable withholding taxes. The Company shall make provision for the reporting and withholding

of any taxes that may be required to be withheld with respect to the grant, vesting and settlement of RSUs and accrued dividend equivalents pursuant to the terms of the Plan. If the Grant Schedule provides that the Shares so transferred are subject

to vesting restrictions, the Trustee shall direct that the Shares be held in a restricted account pending the vesting of the Shares, and any such Shares forfeited by the Participants shall revert to the Trustee. If the Company notifies the Trustee

that the number of Shares or transfer date for any Shares listed in a Grant Schedule was erroneous, the Trustee and the Company shall cooperate in asserting commercially reasonable attempts to recover such overpayment of Shares from the applicable

Participant(s), provided that the expenses and fees incurred in such collection efforts shall be the responsibility of the Company.

3

(b) The entitlement of a Participant to grants of Shares under the Plan shall be determined by

the Company or such party as it shall designate under the Plan, and any claims with respect to such awards shall be considered and reviewed under the administrative procedures set out in the Plan.

(c) The Company may make other arrangements for the grant of Shares and payment of dividend equivalents to Participants under the terms of the

Plan. The Company shall notify the Trustee of its decision to make grants and deliver the most recent updated Grant Schedule prior to the time Shares and any accrued dividend equivalents are to be transferred to Participants. The Trustee shall

notify the Company if the Trust holds insufficient Shares or the principal and earnings in the Trust are not sufficient for the purchase of the Shares and/or payment of accrued dividend equivalents in respect of Shares covered by the Grant Schedule.

(d) With respect to the security of written directions (including a Grant Schedule), the Trustee will: (i) provide the Company with

the latest SSAE-16 SOC 1 or equivalent control report prepared by the Trustee’s external auditors; (ii) once annually, respond to the Company’s reasonable information security questionnaire; and (iii) once annually, permit the

Company to view on-site the Trustee’s security-related policies and procedures; provided, however, that no documentation may be copied, shared, transmitted or removed from the Trustee’s premises, except as mutually agreed.

SECTION 3. Trustee Responsibility Regarding Payments to Trust Beneficiary When the Company is Insolvent.

(a) The Trustee shall cease the grant of Shares and payment of dividend equivalents to Participants if the Company is Insolvent. The Company

shall be considered “Insolvent” for purposes of this Trust Agreement if (i) the Company is unable to pay its debts as they become due, (ii) the Company is subject to a pending proceeding as a debtor under the United States

Bankruptcy Code, or (iii) the Company is determined to be insolvent by a state or federal regulatory banking authority exercising jurisdiction over the Company.

4

(b) At all times during the continuance of this Trust, except as may be provided in

Section 1(d) hereof, the principal and income of the Trust shall be subject to claims of general creditors of the Company under federal and state law and subject to the following requirements:

(1) The Executive Committee of the Company and the Chief Executive Officer of the Company (the “CEO”) shall

have the duty to inform the Trustee in writing of the Company’s Insolvency. If a person claiming to be a creditor of the Company alleges in writing to the Trustee that the Company has become Insolvent, the Trustee shall provide a copy of such

notice to the CEO within two (2) business days, transmitting or delivering such notice in the same manner provided for a notice in Section 14, shall determine whether the Company is Insolvent and, pending such determination, shall

discontinue grant of Shares and payment of dividend equivalents to Participants.

(2) Unless the Trustee has actual

knowledge of the Company’s Insolvency, or has received notice from the Company or a person claiming to be a creditor alleging that the Company is Insolvent, the Trustee shall have no duty to inquire whether the Company is Insolvent. The Trustee

may in all events rely on such evidence concerning the Company’s solvency as may be furnished to the Trustee and that provides the Trustee with a reasonable basis for making a determination concerning the Company’s solvency.

(3) If at any time the CEO notifies the Trustee, or the Trustee has determined, that the Company is Insolvent, the Trustee

shall discontinue grants and payments to Participants, shall notify the CEO within two (2) business days of making such determination (if applicable), and shall hold the assets of the Trust for benefit of the Company’s general creditors.

Nothing in this Trust Agreement shall in any way diminish any rights of Participants to pursue their rights as general creditors of the Company with respect to benefits due under the Plans or otherwise.

(4) The Trustee shall resume the grant of Shares and payment of dividend equivalents to Participants discontinued in accordance

with this Section 3 only after the Trustee has determined that the Company is not Insolvent (or is no longer Insolvent). The second sentence of Subsection (2) above shall apply to such determination.

5

SECTION 4. Payments to the Company.

Notwithstanding any provision of this Trust Agreement to the contrary, the Company shall have no right or power to direct the Trustee to, and

in no event shall the Trustee, deliver Shares, or cash or other securities or property received in respect of Shares by reason of a dividend or other distribution or a sale or other disposition (“Share Proceeds”), to the Company or

any subsidiary thereof or, subject to Section 13(b), any person other than the Nominated Participants, if any.

SECTION 5. Investment

Authority.

All rights associated with assets of the Trust shall be exercised by the Trustee or the person designated by the Trustee

(who shall not be the Company or any affiliates thereof), subject to the express provisions of this Trust Agreement. Upon the delivery of a Grant Schedule and a cash contribution to the Trustee by the Company pursuant to Section 1, the Trustee

shall purchase on the open market on behalf of the Trust, at such time or times as it shall determine in its discretion and in accordance with applicable law, the number of Shares specified in the Grant Schedule. The Trustee shall make all such