UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of May 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Akira Takeda |

| Name: |

|

Akira Takeda |

| Title: |

|

Chief Manager, General Affairs |

|

|

Corporate Administration Division |

Mitsubishi UFJ Financial Group, Inc.

MUFG announces director and executive officer candidates and

MUFG Corporate Governance Policies

Tokyo May 15, 2015—Mitsubishi UFJ Financial Group, Inc. (MUFG) has decided, subject to approval by its General Meeting of Shareholders in

June 2015, to change from being a company with a board of corporate auditors to a company with three committees, as previously announced on February 26, 2015 ( ‘MUFG to adopt new governance structure’). Following this change to a

company with three committees, director and executive officer candidates have been decided and MUFG Corporate Governance Policies has been formulated, as follows:

1. Director candidates

The number of outside directors

is planned to be increased by two, resulting in a Board of Directors comprising seventeen directors, seven of whom will be either outside directors or non-executive directors with a high degree of independence. Furthermore, nine of the total

seventeen directors will be non-executive directors.

Officers of Mitsubishi UFJ Financial Group as of June 25

(planned)

|

|

|

| Name |

|

Remark |

|

|

| Kiyoshi Sono |

|

Mitsubishi UFJ Financial Group, Chairman |

|

|

| Tatsuo Wakabayashi |

|

Mitsubishi UFJ Financial Group, Deputy Chairman |

|

|

| Takashi Nagaoka |

|

Mitsubishi UFJ Financial Group, Deputy Chairman |

|

|

| Nobuyuki Hirano |

|

Mitsubishi UFJ Financial Group, President & Group CEO |

|

|

| Takashi Oyamada (New) |

|

Mitsubishi UFJ Financial Group, Deputy President & Group COO |

|

|

| Tadashi Kuroda |

|

Mitsubishi UFJ Financial Group, Senior Managing Executive Officer Group CSO |

|

|

| Muneaki Tokunari (New) |

|

Mitsubishi UFJ Financial Group, Managing Executive Officer Group CFO |

|

|

| Masamichi Yasuda (New) |

|

Mitsubishi UFJ Financial Group, Managing Executive Officer Group CRO |

|

|

| Takashi Mikumo (New) *1 |

|

|

|

|

| Takehiko Shimamoto (New) *1 |

|

|

|

|

| Yuko Kawamoto*1*2 |

|

Waseda University Graduate School of Finance, Accounting and Law, Professor |

|

|

| Haruka Matsuyama*1*3 |

|

Hibiya Park Law Offices, Lawyer |

|

|

| Kunie Okamoto*1*3 |

|

Nippon Life Insurance Company, Chairman |

|

|

| Tsutomu Okuda*1*3 |

|

J. Front Retailing, Senior Advisor |

|

|

| Hiroshi Kawakami (New) *1*3 |

|

Central Japan International Airport, President & CEO; Scheduled to be appointed Advisor (from June, 2015) |

|

|

| Yukihiro Sato (New) *1*3 |

|

Mitsubishi Electric Corporation, Advisor |

|

|

| Akira Yamate (New) *1*3 |

|

Certified Public Accountant |

| *1 |

Non-executive director. |

| *2 |

As Ms. Yuko Kawamoto previously worked for the Bank of Tokyo (currently the Bank of Tokyo-Mitsubishi UFJ), she does not fulfill the requirements of outside director under Japan’s Companies Act. However, during

the more than 25 years that have passed since her employment at Bank of Tokyo she has gained a wealth of experience and discernment as a business consultant and university professor, and we therefore believe that her independence from MUFG is

equivalent to that of an outside director. Moreover, as a result of revisions to Japan’s Companies Act, following the conclusion of the June 2016 General Meeting of Shareholders Ms. Kawamoto will meet the requirements of outside director.

|

1

2. Formulation of MUFG Corporate Governance Policies

To set out the policy and framework of the corporate governance of MUFG and to serve as a guide for the actions of directors and management, MUFG Corporate

Governance Policies has been formulated.

MUFG governance structure

| * |

Which is a “nominating committee” as provided for in the Companies Act. |

2

3. Establishment of Committees

MUFG aims to significantly strengthen its corporate governance framework and in addition to the establishment of the statutory Nominating and Governance

Committee, Compensation Committee and Audit Committee, an optional Risk Committee shall also be established.

Outline of each committee

Nominating and Governance Committee

| |

• |

|

Decide the content of proposals that are submitted to general meetings of shareholders regarding the election and removal of directors |

| |

• |

|

Discuss and make recommendations to the Board of Directors on personnel matters regarding key management positions such as Chairman, Deputy Chairman and President & Group CEO of MUFG and Chairmen, Deputy

Chairmen and Presidents of major subsidiaries |

| |

• |

|

Discuss and make recommendations to the Board of Directors on matters pertaining to the policy and framework for corporate governance |

Compensation Committee

| |

• |

|

Establish a policy regarding decisions on compensation for directors and executive officers, and shall decide the details of individual compensation based on this policy. |

| |

• |

|

Discuss and make recommendations to the Board of Directors on the establishment, revision and abolition of systems pertaining to compensation for officers, etc. of MUFG and its key subsidiaries |

Audit Committee

| |

• |

|

Audit the execution of duties by executive officers and directors and prepare auditing reports. |

| |

• |

|

Exercise its authority properly to perform investigations, including fieldwork, into the business and finance of MUFG and its subsidiaries |

Risk Committee

| |

• |

|

Discuss and make recommendations to the Board of Directors on various matters regarding risk management in general pertaining to the entire Group |

| |

• |

|

Discuss and make recommendations to the Board of Directors on material matters regarding risk management in general, matters regarding significant compliance cases and any other material matters that require discussion

by the Risk Committee |

Committee structure (planned) (

: Chairperson o: Member)

: Chairperson o: Member)

|

|

|

|

|

|

|

|

|

| |

|

Nominating and

Governance |

|

Compensation |

|

Audit |

|

Risk |

| Yuko Kawamoto |

|

o |

|

o |

|

|

|

|

| Haruka Matsuyama |

|

o |

|

o |

|

o |

|

|

| Kunie Okamoto |

|

o |

|

|

|

|

|

|

| Tsutomu Okuda |

|

|

|

o |

|

|

|

o |

| Hiroshi Kawakami |

|

o |

|

o |

|

|

|

|

| Yukihiro Sato |

|

|

|

|

|

o |

|

|

| Akira Yamate |

|

|

|

|

|

|

|

|

| Nobuyuki Hirano |

|

o |

|

o |

|

|

|

|

| Takashi Mikumo |

|

|

|

|

|

o |

|

|

| Takehiko Shimamoto |

|

|

|

|

|

o |

|

|

| Akira Ariyoshi* |

|

|

|

|

|

|

|

o |

| Kenzo Yamamoto* |

|

|

|

|

|

|

|

o |

| * |

Outside Professional (Akira Ariyoshi: Outside Professional and University Professor. Kenzo Yamamoto: Outside Professional) |

3

4. Election of Executive Officers

The following 17 Executive Officers are expected to be elected, subject to the approval by the board of directors meeting after the General Meeting of

Shareholders in June 2015.

|

|

|

|

|

| Job Title |

|

Responsibility |

|

Name |

| Chairman |

|

|

|

Kiyoshi Sono |

| Deputy Chairman |

|

|

|

Tatsuo Wakabayashi |

| Deputy Chairman |

|

|

|

Takashi Nagaoka |

| President |

|

Group CEO |

|

Nobuyuki Hirano |

| Deputy President |

|

Group COO |

|

Takashi Oyamada |

| Senior Managing Executive Officer |

|

Group Head, Global Business Group |

|

Takashi Morimura |

| Senior Managing Executive Officer |

|

Group CIO |

|

Satoshi Murabayashi |

| Senior Managing Executive Officer |

|

Group Head, Trust Assets Business Group |

|

Junichi Okamoto |

| Senior Managing Executive Officer |

|

Group Head, Corporate Banking Business Group |

|

Hidekazu Fukumoto |

| Senior Managing Executive Officer |

|

Group Head, Global Markets Business Group |

|

Naoto Hirota |

| Senior Managing Executive Officer |

|

Group CSO |

|

Tadashi Kuroda |

| Senior Managing Executive Officer |

|

Group CHRO |

|

Saburo Araki |

| Managing Executive Officer |

|

Group CCO & Group CLO |

|

Akira Hamamoto |

| Managing Executive Officer |

|

Group Head, Retail Banking Business Group |

|

Takahiro Yanai |

| Managing Executive Officer |

|

Group CRO |

|

Masamichi Yasuda |

| Managing Executive Officer |

|

Group CFO |

|

Muneaki Tokunari |

| Executive Officer |

|

Group CAO and General Manager, Internal Audit Division |

|

Yoichi Orikasa |

| Note: |

CEO: Chief Executive Officer; COO: Chief Operating Officer; CIO: Chief Information Officer; CSO: Chief Strategy Officer; CHRO: Chief Human Resources Officer; CCO: Chief Compliance Officer; CLO: Chief Legal Officer; CRO:

Chief Risk Officer; CFO: Chief Financial Officer; CAO: Chief Audit Officer |

4

* * *

Contact:

Mitsubishi UFJ Financial Group, Inc.

Public Relations Division

81-3-3240-7651

5

Biographies of the new director candidates

(New director candidates)

|

|

|

|

|

| Name |

|

Takashi Oyamada |

|

|

| Date of Birth |

|

November 2, 1955 |

|

|

| Education |

|

March 1979 |

|

Graduated Tokyo University, Faculty of Economics |

| Work History |

|

April 1979 |

|

Joined The Mitsubishi Bank, Limited |

|

|

June 2005 |

|

Bank of Tokyo-Mitsubishi: Executive Officer and General Manager, Corporate Planning Office |

|

|

January 2006 |

|

Bank of Tokyo-Mitsubishi UFJ: Executive Officer and General Manager, Corporate Planning Division |

|

|

April 2007 |

|

Executive Officer and General Manager, the Corporate Planning Division |

|

|

January 2009 |

|

Managing Executive Officer in charge of Office of Chairman of Japanese Bankers Association and General Manager, Corporate Planning Division |

|

|

June 2009 |

|

Managing Director in charge of Corporate Administration Division, Corporate Planning Division, Public Relations Division and CSR Promotion Division |

|

|

May 2012 |

|

Managing Executive Officer and Group Head, Corporate Banking Group No. 1 |

|

|

May 2013 |

|

Senior Managing Executive Officer and Group Head, Corporate Banking Group No. 1 |

|

|

May 2014 |

|

Senior Managing Executive Officer in charge of Corporate Services, Corporate Staff, Corporate Risk Management, CPM and main Credit Supervision |

|

|

June 2014 |

|

Deputy President in charge of overall business management (Mainly Corporate Services, Corporate Staff and Corporate Risk Management), CPM and main Credit Supervision (incumbent) |

|

|

(Holding company) |

|

|

|

|

June 2005 |

|

Mitsubishi Tokyo Financial Group: Executive Officer and General Manager, Corporate Policy Division and Financial Policy Division |

|

|

October 2005 |

|

Mitsubishi UFJ Financial Group: Executive Officer and General Manager, Corporate Planning Division |

|

|

November 2005 |

|

Executive Officer and General Manager, Corporate Planning Division and Deputy General Manager, Financial Planning Division |

|

|

April 2007 |

|

Executive Officer and General Manager, Corporate Planning Division |

|

|

June 2009 |

|

Director |

|

|

May 2012 |

|

Retired |

6

|

|

|

|

|

|

|

| Name |

|

Masamichi Yasuda |

| Date of Birth |

|

August 22, 1960 |

| Education |

|

March 1983 |

|

Graduated Hitotsubashi University, Faculty of Law |

| Work History |

|

April 1983 |

|

Joined The Bank of Tokyo, Ltd. |

|

|

June 2009 |

|

Bank of Tokyo-Mitsubishi UFJ: Executive Officer, UnionBanCal Corporation and Union Bank, N.A. |

|

|

May 2011 |

|

Executive Officer and General Manager, Global Planning Division |

|

|

May 2014 |

|

Managing Executive Officer and Deputy Chief Executive, Global Markets Unit |

|

|

August 2014 |

|

Managing Executive Officer and Deputy Chief Executive, Global Markets Unit and Assistant Chief Executive, Global Business Unit (mainly market-related matters and financial regulation compliance) (incumbent) |

|

|

(Holding company) |

|

|

|

|

May 2011 |

|

Mitsubishi UFJ Financial Group: Executive Officer and General Manager, Global Planning Division |

|

|

May 2014 |

|

Executive Officer, in charge of markets business (incumbent) |

|

|

|

| Name |

|

Muneaki Tokunari |

|

|

| Date of Birth |

|

March 6, 1960 |

|

|

| Education |

|

March 1982 |

|

Graduated Keio University, Faculty of Law |

| Work History |

|

April 1982 |

|

Joined The Mitsubishi Trust and Banking Corporation |

|

|

June 2009 |

|

Mitsubishi UFJ Financial Group: Executive Officer and General Manager, Financial Planning Division |

|

|

|

|

Mitsubishi UFJ Trust and Banking: Executive Officer |

|

|

June 2010 |

|

Mitsubishi UFJ Trust and Banking: Executive Officer and General Manager, Corporate Planning Division |

|

|

|

|

Mitsubishi UFJ Financial Group: Executive Officer |

|

|

June 2011 |

|

Mitsubishi UFJ Trust and Banking: Managing Executive Officer and General Manager, Corporate Planning Division |

|

|

|

|

Mitsubishi UFJ Financial Group: Executive Officer |

|

|

April 2012 |

|

Mitsubishi UFJ Trust and Banking: Managing Director and General Manager, Corporate Planning Division |

|

|

|

|

Mitsubishi UFJ Financial Group: Executive Officer |

|

|

June 2012 |

|

Mitsubishi UFJ Trust and Banking: Managing Director; Mitsubishi UFJ Financial Group: Director |

|

|

June 2013 |

|

Mitsubishi UFJ Trust and Banking: Senior Managing Director; Mitsubishi UFJ Financial Group: Director |

|

|

June 2014 |

|

Mitsubishi UFJ Trust and Banking: Senior Managing Director (incumbent) |

|

|

|

|

Mitsubishi UFJ Financial Group: Managing Executive Officer (incumbent) |

7

|

|

|

|

|

| Name |

|

Takashi Mikumo |

|

|

| Date of Birth |

|

September 8, 1957 |

|

|

| Education |

|

March 1980 |

|

Graduated Keio University, Faculty of Economics |

| Work History |

|

April 1980 |

|

Joined The Toyo Trust and Banking Company, Limited |

|

|

June 2007 |

|

Mitsubishi UFJ Trust and Banking: Executive Officer and General Manager, Corporate Agency Division |

|

|

|

|

Mitsubishi UFJ Financial Group: Executive Officer |

|

|

June 2009 |

|

Mitsubishi UFJ Trust and Banking: Managing Director and Chief |

|

|

June 2012 |

|

Executive, Corporate Agency Business Unit

Senior Managing Director and Chief Executive, Corporate Agency Business Unit |

|

|

June 2013 |

|

Mitsubishi UFJ Financial Group: Corporate Auditor (Full Time) (incumbent) |

|

|

|

| Name |

|

Takehiko Shimamoto |

|

|

| Date of Birth |

|

November 15, 1959 |

|

|

| Education |

|

March 1982 |

|

Graduated Keio University, Faculty of Law |

| Work History |

|

April 1982 |

|

Joined The Mitsubishi Bank, Limited |

|

|

April 2008 |

|

Bank of Tokyo-Mitsubishi UFJ: Executive Officer and General Manager, Customer Security Office and Operations Services Planning Division |

|

|

May 2009 |

|

Executive Officer and General Manager, Human Resources Division |

|

|

May 2012 |

|

Managing Executive Officer in charge of Compliance Division (Chief

Compliance Officer), Corporate Risk Management Division and Credit Policy & Planning Division |

|

|

June 2012 |

|

Managing Director in charge of Compliance Division (Chief Compliance Officer), Corporate Risk Management Division and Credit Policy & Planning Division (incumbent) |

|

|

(Holding company) |

|

|

|

|

April 2008 |

|

Mitsubishi UFJ Financial Group: Executive Officer and General Manager, Operations & Systems Planning Division |

|

|

May 2009 |

|

Retired |

|

|

May 2012 |

|

Managing Executive Officer, Deputy Chief Compliance Officer (incumbent) |

8

|

|

|

|

|

|

|

|

| Name |

|

Hiroshi Kawakami |

|

|

| Date of Birth |

|

May 3, 1949 |

|

|

| Education |

|

March 1971 |

|

Graduated Kyoto University, Faculty of Law |

| Work History |

|

April 1972 |

|

Joined Toyota Motor Corporation |

|

|

January 2002 |

|

Toyota Motor Corporation: General Manager, the Americas Division at the America Operations Center |

|

|

June 2003 |

|

Managing Officer |

|

|

June 2007 |

|

Senior Managing Director |

|

|

June 2008 |

|

Toyota Tsusho Corporation: Vice President |

|

|

June 2009 |

|

Central Japan International Airport Co., Ltd.: President and Chief Executive Officer |

|

|

June 2015 |

|

Central Japan International Airport Co., Ltd.: Senior Adviser (planned) |

|

|

|

| Name |

|

Yukihiro Sato |

|

|

| Date of Birth |

|

March 12, 1947 |

|

|

| Education |

|

March 1969 |

|

Graduated Oita University, Faculty of Economics |

| Work History |

|

April 1969 |

|

Joined Mitsubishi Electric Corporation |

|

|

June 2001 |

|

Mitsubishi Electric Corporation: Director and General Manager, Corporate Accounting Division |

|

|

April 2003 |

|

Mitsubishi Electric Corporation: Managing Director and General Manager, Corporate Accounting Division |

|

|

April 2005 |

|

Mitsubishi Electric Corporation: Director and Senior Vice President |

|

|

April 2007 |

|

Mitsubishi Electric Corporation: Director and Representative Executive Officer and Executive Vice-President |

|

|

April 2009 |

|

Mitsubishi Electric Corporation: Director |

|

|

June 2009 |

|

Mitsubishi Electric Corporation: Senior Corporate Adviser |

|

|

June 2013 |

|

Mitsubishi Electric Corporation: Advisor |

|

|

June 2014 |

|

Mitsubishi UFJ Financial Group, Inc.: Corporate Auditor (incumbent) |

|

|

July 2014 |

|

Mitsubishi Electric Corporation: Advisor (incumbent) |

9

|

|

|

|

|

|

|

|

| Name |

|

Akira Yamate |

|

|

| Date of Birth |

|

November 23, 1952 |

|

|

| Education |

|

March 1976 |

|

Graduated Waseda University, Faculty of Political Science and Economics |

| Work History |

|

November 1977 |

|

Joined Price Waterhouse Japan |

|

|

March 1983 |

|

Registered certified public accountant |

|

|

July 1991 |

|

Aoyama Audit Corporation: Partner Price

Waterhouse: Partner |

|

|

April 2000 |

|

ChuoAoyama Audit Corporation: Partner

PricewaterhouseCoopers: Partner |

|

|

September 2006 |

|

PricewaterhouseCoopers Aarata: Partner |

|

|

June 2013 |

|

Retired |

|

|

June 2013 |

|

Nomura Real Estate Development, Co., Ltd.: Audit & Supervisory Board member (incumbent) |

|

|

|

|

Nomura Real Estate Holdings, Inc.: Audit & Supervisory Board member (incumbent) |

10

Items related to MUFG Corporate Governance Policies

| |

• |

|

MUFG plans to disclose the independence standards described in 5-2. “Election of Directors” of these Policies, in the Convocation Notice for the Annual General Meeting of Shareholders, the Annual Securities

Report, etc. |

| |

• |

|

MUFG’s Corporate Vision and Principles of Ethics and Conduct described in 9-4. “Appropriate collaboration, etc. with stakeholders other than shareholders” of these Policies are available at the following

locations. |

Corporate Vision

MUFG home page > About MUFG > Corporate Vision, CI

(URL: http://www.mufg.jp/english/profile/philosophy/)

Principles of Ethics and Conduct

MUFG home page > About MUFG > Management Structure > Principles of Ethics and Conduct

(URL: http://www.mufg.jp/english/profile/governance/ethics/)

| |

• |

|

Yoko Kawamoto retired as an employee of one of MUFG’s subsidiaries more than 25 years ago. While she is eligible to be an outside director under the 2014 amendment of Japan’s Companies Act which allows former

employees who left a company more than 10 years previously to be outside directors, in accordance with applicable transitional measures, the amended provisions of the Companies Act regarding eligibility of outside directors will not become effective

at MUFG until after its 2016 Ordinary General Meeting of Shareholders. |

However, because the amended Companies Act is already

in force and we believe that Ms. Kawamoto is substantially independent from MUFG to a degree equivalent to that of an outside director, we will treat her as an independent outside director for the purpose of these Policies.

11

[NOTE: This is a translation of the Japanese original for reference purposes only. In the event of any

discrepancy, the Japanese original shall prevail.]

MUFG Corporate Governance Policies

1. Purpose

1-1. Purpose

The MUFG Corporate Governance Policies (these “Policies”) set out the policy and framework of the corporate governance of Mitsubishi

UFJ Financial Group, Inc. (“MUFG”) and serve as a guide for the actions of directors and management.*

| |

(* |

Those responsible for management of MUFG Group: meaning the executive officers and corporate officers of MUFG and the directors, executive officers and corporate officers of MUFG Group companies.) |

1-2. Revision

These

Policies will be revised as necessary, taking into account changes in MUFG’s business and the business environment.

2. Approach to corporate

governance

2-1. Basic approach

MUFG will aim for sustainable growth and increase of corporate value over the medium- to long-term, in consideration of the perspectives of its

stakeholders including shareholders as well as customers, employees and local communities.

MUFG will aim to realize effective corporate

governance through fair and highly transparent management based on the guidance provided by these Policies.

2-2. Role as a holding

company

As a financial holding company, MUFG will aim to increase the corporate value of the Group as a whole through management of

subsidiaries to ensure the sound and appropriate management of the entire Group.

12

2-3. MUFG’s governance structure

MUFG has chosen the governance structure of a company with three committees (a company prescribed in Article 2, item (xii) of the

Companies Act) from the following perspectives.

| |

• |

|

To enhance the flexibility of management by division of executive and oversight functions, while also creating a structure whereby the Board of Directors oversees management of the entire Group. |

| |

• |

|

To build an efficient and highly effective corporate governance structure through coordination among the Board of Directors, committees required by the Companies Act (a Nominating and Governance Committee,* Compensation

Committee and Audit Committee) and optional committees (a Risk Committee) etc. |

| |

(* |

Which is a “nominating committee” as provided for in the Companies Act.) |

| |

• |

|

To realize a corporate governance structure with even greater accountability to domestic and overseas stakeholders. |

3. Role of the Board of Directors

3-1. Role of the Board of Directors

The Board of Directors decides key management policies and is responsible for management oversight. Decisions on matters of business execution

other than specific matters stipulated by laws and regulations shall in principle be delegated to executive officers; provided, however, that decisions on particularly important matters of business execution shall be made by the Board of Directors.

The matters performed by the Board of Directors are as follows.

| |

• |

|

Decisions on key management policies such as business strategy, risk management policy, capital policy and resource allocation for the entire Group. |

| |

• |

|

Oversight of the execution of duties by directors and executive officers. |

| |

• |

|

Decisions on the MUFG Group’s internal controls system, and oversight of the establishment and operation of such systems. |

| |

• |

|

Election of executive officers. |

| |

• |

|

Oversight of matters such as the development of the corporate governance structure and the establishment of a sound corporate culture. |

4. Duties of Directors

4-1. Duties of

Directors

Directors, as elected by the shareholders and entrusted as managers, owe a duty of loyalty and a duty of care in respect of

the execution of their duties, and shall contribute to MUFG’s sustainable growth and increase of corporate value over the medium- to long-term.

Directors shall make timely and appropriate decisions on investment and other management matters based on the reasonable collection of

information.

13

Directors shall thoroughly review reports and proposals from management and request explanations

or express opinions as necessary for discussion.

4-2. Expectations for independent outside directors

In addition to the above duties of all directors, independent outside directors are expected to oversee the execution of duties by executive

officers from an independent and objective standpoint, oversee conflicts of interest between MUFG and management or controlling shareholders, and advise and provide support to management based on their own experience and professional knowledge.

5. Composition and other matters regarding the Board of Directors

5-1. Composition

The

Board of Directors shall be composed of 20 directors or less in order to ensure its effectiveness.

The Board of Directors as a whole shall

have an appropriately balanced composition that provides a deep understanding of MUFG Group’s business and a wealth of knowledge and expertise on finance, financial accounting, risk management and compliance and so forth.

Accordingly, the Board of Directors shall meet the following requirements in particular.

| |

• |

|

The Board of Directors shall have a balanced composition consisting of internal directors who are familiar with the business of MUFG Group and independent outside directors who oversee management and directors from an

independent and objective standpoint. |

| |

• |

|

The percentage of independent outside directors, in principle, shall be at least one third, and the percentage of non-executive directors*, in principle, shall be more than half. |

| |

(* |

Those who do not concurrently serve as an executive officer, corporate officer, employee or executive director of MUFG or an MUFG subsidiary.) |

| |

• |

|

To ensure the effectiveness of oversight of MUFG Group’s management by the Board of Directors, the Presidents of The Bank of Tokyo-Mitsubishi UFJ, Ltd., Mitsubishi UFJ Trust and Banking Corporation, and Mitsubishi

UFJ Securities Holdings Co., Ltd. will, in principle, also serve as directors of MUFG. |

14

5-2. Election of Directors

For election of directors, the Nominating and Governance Committee shall set forth director election standards focused on the following and

nominate persons who meet such standards as director candidates.

Outline of Director Election Standards

| |

• |

|

Directors, as elected by the shareholders and entrusted as managers, shall have the qualities required to be able to appropriately fulfill their duty of loyalty and duty of care in the execution of their duties and to

contribute to the sustainable growth and the increase of corporate value of MUFG over the medium- to long-term. |

| |

• |

|

Independent outside directors shall have a wealth of knowledge and experience in the fields of corporate management, finance, financial accounting and law and the qualities required for oversight of the execution of

duties by management from an independent and objective standpoint, meeting the independence standards of MUFG. |

| |

• |

|

Executive directors shall have extensive knowledge of MUFG Group’s business and the ability to appropriately perform management of MUFG Group. |

5-3. Term of office of directors

The term of office of directors shall be one (1) year. In discussion and decision by the Nominating and Governance Committee on a

candidate for reappointment, the number of years since such candidate assumed the office of a director of MUFG shall be considered.

5-4. Directors with concurrent posts

A director may concurrently serve as a director, corporate auditor, executive officer or corporate officer at a company other than an MUFG

Group company only to the extent such director is able to have enough time required to appropriately fulfill the duties as a director of MUFG, such as understanding the business and other aspects of the MUFG Group, and the director shall report

periodically to the Board of Directors on such concurrent posts.

6. Operation of the Board of Directors

6-1. Resolutions of the Board of Directors

Unless otherwise provided for by law or regulation, resolutions of a meeting of the Board of Directors shall be adopted by an affirmative vote

of a majority of the Directors present who constitute in number a majority of all the Directors of the Company.

15

6-2. Requirements of the Chairman of the Board of Directors

The role of Chairman of the Board of Directors and the role of President and Group Chief Executive Officer shall be separated and a suitable

director shall be appointed as Chairman to ensure that the Board of Directors effectively fulfills its role of management oversight.

In

principle, when MUFG has a director who concurrently serves as Chairman and Executive Officer, such director shall be elected as Chairman of the Board of Directors.

6-3. Role of Chairman of the Board of Directors

Chairman of the Board of Directors shall lead the Board of Directors and shall be obligated to ensure the board’s effectiveness.

Chairman of the Board of Directors shall set the schedule and agenda for board meetings after exchanging opinions with each director on a day

to day basis, so that the Board of Directors is able to make sound decisions based on sufficient information.

6-4. Support framework

A Board of Directors Secretariat shall be established to assist the Chairman of the Board of Directors and to correspond and

coordinate with the company so that sufficient information is provided to directors, including independent outside directors.

6-5.

Provision of information

Management is obligated to provide sufficient information to directors that relates to the execution of

duties of directors.

Management shall distribute the Board of Directors’ meeting agenda and deliberation materials prior to meetings

of the Board of Directors in principle to ensure that directors have the opportunity to understand the content in advance.

Management

shall conduct training and the like, including training about the business activities and management environment of MUFG, particularly for independent outside directors, on an ongoing basis, including at the time of appointment, in order to provide

necessary information in addition to the Board of Directors’ meeting agenda.

6-6. Evaluation of the Board of Directors

In order to maintain and improve the effectiveness of the Board of Directors, evaluation of the Board shall be conducted periodically.

16

6-7. Information exchange among independent outside directors

Independent outside directors may, as necessary, convene meetings comprising only independent outside directors in order to perform their

function from an independent standpoint.

6-8. Appointment of Lead Independent Outside Director

Independent outside directors may appoint a Lead Independent Outside Director from among themselves.

6-9. Advice of outside professionals

Directors may obtain advice from outside professionals at MUFG’s expense if it is necessary for the execution of their duties as a

director.

7. Committees

7-1.

Establishment of committees

In addition to the establishment of a Nominating and Governance Committee, a Compensation Committee and an

Audit Committee as provided under the Companies Act, a Risk Committee shall also be established as an optional board committee.

Committees

may appoint outside professionals as outside expert members and have them participate in committee deliberations.

7-2. Nominating and

Governance Committee

i. Role of the Nominating and Governance Committee

| |

• |

|

The Nominating and Governance Committee shall decide the content of proposals that are submitted to general meetings of shareholders regarding the election and removal of directors. |

| |

• |

|

The Nominating and Governance Committee shall discuss and make recommendations to the Board of Directors on personnel matters regarding key management positions such as Chairman, Deputy Chairman and President and Group

Chief Executive Officer of MUFG and Chairmen, Deputy Chairmen and Presidents of major subsidiaries. |

| |

• |

|

The Nominating and Governance Committee shall discuss and make recommendations to the Board of Directors on matters pertaining to the policy and framework for corporate governance. |

ii. Composition and resolutions of the Nominating and Governance Committee

| |

• |

|

The Nominating and Governance Committee shall be composed of three (3) or more members, with the members being independent outside directors and the President and Group Chief Executive Officer. |

| |

• |

|

The chairman of the Nominating and Governance Committee shall be appointed from among the independent outside directors. |

| |

• |

|

Resolutions of the Nominating and Governance Committee shall be adopted by an affirmative vote of a majority of the members present who constitute in number a majority of all the members eligible to vote.

|

17

iii. Nomination policy

| |

• |

|

The Nominating and Governance Committee shall establish Director Election Standards and nominate as director candidates those who meet such standards. |

| |

• |

|

With respect to the nomination of candidates for key management positions such as Chairman, Deputy Chairman and President and Group Chief Executive Officer of MUFG and Chairmen, Deputy Chairmen and Presidents of major

subsidiaries, the appropriateness of the nomination shall be discussed in light of the personnel requirements for each position. |

7-3. Compensation Committee

i. Role of the Compensation Committee

| |

• |

|

The Compensation Committee shall establish a policy regarding decisions on compensation for executive officers and directors, and shall decide the details of individual compensation based on this policy. If an executive

officer or a director concurrently serves as an officer or employee of a subsidiary, the Compensation Committee shall in the same way decide the aggregate amount of compensation for such person inclusive of that to be received as an officer or

employee of the subsidiary. |

| |

• |

|

The Compensation Committee shall discuss and make recommendations to the Board of Directors on the establishment, revision and abolition of systems pertaining to compensation for officers, etc.* of MUFG and its key

subsidiaries. |

| |

(* |

Meaning directors, corporate auditors, executive officers, corporate officers, and so forth) |

ii. Composition and resolutions of the Compensation Committee

| |

• |

|

The Compensation Committee shall be composed of three (3) or more members, with the members being independent outside directors and President and Group Chief Executive Officer. |

| |

• |

|

The chairman of the Compensation Committee shall be appointed from among the independent outside directors. |

| |

• |

|

Resolutions of the Compensation Committee shall be adopted by an affirmative vote of a majority of the members present who constitute in number a majority of all the members eligible to vote. |

iii. Compensation policy

| |

• |

|

In order to achieve sustainable growth and increase of corporate value, policy regarding decisions on the details of compensation shall be determined with the aim of increasing motivation to contribute to medium- to

long-term performance, not just short-term performance. |

| |

• |

|

Levels of compensation shall be decided as appropriate for MUFG and its subsidiaries in light of the state of the economy and society. |

18

7-4. Audit Committee

i. Role of the Audit Committee

| |

• |

|

The Audit Committee shall decide the content of proposals pertaining to the election, removal and non-reappointment of the accounting auditor to be submitted to general meetings of shareholders, as well as auditing the

execution of duties by executive officers and directors and preparing auditing reports. The Audit Committee has the power to consent to decisions on compensation for accounting auditor. |

| |

• |

|

The Audit Committee shall properly exercise its authority to perform investigations, including fieldwork, into the business and finance of MUFG and its subsidiaries, in order to effectively fulfill its role and duties.

|

ii. Composition and resolutions of the Audit Committee

| |

• |

|

The Audit Committee shall be composed of three (3) or more members who are non-executive directors. |

| |

• |

|

A majority of the members of the Audit Committee shall be appointed from among the independent outside directors. |

| |

• |

|

The chairman of the Audit Committee shall be appointed from among the independent outside directors. |

| |

• |

|

In order to ensure the effectiveness of audit, full-time member(s) of the Audit Committee shall be appointed. |

| |

• |

|

Resolutions of the Audit Committee shall be adopted by an affirmative vote of a majority of the members present who constitute in number a majority of all the members eligible to vote. |

iii. Ensuring the effectiveness of audit by the Audit Committee

| |

• |

|

An Audit Committee Secretariat shall be established in order to assist the Audit Committee with its duties. |

| |

• |

|

The Audit Committee may give specific instructions to the Internal Auditing Division as necessary for the effective performance of audit. |

| |

• |

|

The Audit Committee and the Internal Auditing Division shall share information as appropriate to ensure a system of mutual cooperation. |

| |

• |

|

Decisions on the key personnel of the Internal Auditing Division must be approved by the Audit Committee. |

7-5. Risk Committee

i.

Role of the Risk Committee

| |

• |

|

The Risk Committee shall discuss and make recommendations to the Board of Directors on various matters regarding risk management in general pertaining to the entire Group. |

| |

• |

|

The Risk Committee shall discuss and make recommendations to the Board of Directors on material matters regarding risk management in general, matters regarding significant compliance cases (such as top risk cases) and

any other material matters that require discussion by the Risk Committee. |

ii. Composition of the Risk Committee

| |

• |

|

The Risk Committee shall be composed of independent outside directors and outside professionals. |

| |

• |

|

The chairman of the Risk Committee shall be appointed from among the independent outside directors. |

19

iii. Collaboration with the executive officer in charge of risk management

| |

• |

|

The Risk Committee shall receive reports on material risk management matters from the executive officer in charge of risk management and the risk management department and shall collaborate with them as appropriate.

|

8. Executive officers

8-1. Duties of executive officers

Executive officers shall execute business and make decisions on the execution of business delegated to them by the Board of Directors.

Executive officers owe a duty of loyalty and a duty of care in respect of the execution of their duties, and shall contribute to MUFG’s

sustainable growth and increase of corporate value over the medium- to long-term.

Executive officers shall periodically report to the

Board of Directors regarding the status of the execution of their duties at least once every three (3) months.

Executive officers

shall make explanations on matters as requested by the Board of Directors and the Board committees.

Executive officers are obligated to

provide the Board of Directors with information necessary for directors to fulfill their duties, and to report necessary proposals to the Board of Directors.

Accordingly, any events that may have a particularly material effect on the management of the Group, such as events that may require a change

to the Group’s key management policies or internal control system, shall be reported to the Board of Directors.

9. Relations with shareholders

and other stakeholders

9-1. Ensuring shareholders’ rights and equality

MUFG will take the following actions to secure shareholder rights and ensure that they are exercised effectively. MUFG will give consideration

to the equal treatment of all shareholders, including minority and overseas shareholders.

| |

• |

|

MUFG will take appropriate actions to ensure shareholders’ effective exercise of voting rights at General Meetings of Shareholders. |

| |

• |

|

MUFG will provide information appropriately to contribute to allow shareholders to make appropriate decisions on the exercise of their voting rights. |

| |

• |

|

MUFG will provide adequate explanation about capital policy and the like that would have a significant effect on shareholder interests. |

20

| |

• |

|

In addition to disclosing its policy with respect to cross-shareholdings of listed shares, MUFG will examine the medium- to long-term economic rationale and future outlook of major cross-shareholdings, taking into

consideration the associated risks and returns, and provide appropriate explanations about the purposes and so forth of such shareholdings. MUFG shall also establish and disclose standards that ensure the appropriate exercise of voting rights

pertaining to cross-held shares. |

9-2. Dialogue with shareholders

Through dialogue with shareholders, MUFG will seek their understanding of MUFG’s business strategy and so forth, and will strive to take

appropriate actions based on an understanding of shareholders’ perspectives.

The Board of Directors shall establish and disclose

policies relating to the organizational structures and measures aimed at promoting constructive dialogue with shareholders.

9-3.

Related party transactions

MUFG will establish and disclose appropriate procedures for and monitor transactions with related parties

such as directors and executive officers, so that such transactions do not harm the interests of MUFG or the common interests of its shareholders.

9-4. Appropriate collaboration, etc. with stakeholders other than shareholders

MUFG’s sustainable growth and increase of corporate value over the medium- to long-term are realized through the contributions of

stakeholders such as customers, employees and local communities. In performing its management activities, MUFG will strive to build appropriate collaborative relationships with each of its stakeholders.

MUFG will establish a Corporate Vision in order to indicate its basic stance towards the performance of its management activities and to make

such stance the policy for all of its activities, and will also establish Principles of Ethics and Conduct as a basis for the judgments and actions of all officers and employees.

MUFG will establish an appropriate framework for whistleblowing by employees and so forth, and monitor its enforcement.

21

10. Appropriate disclosure of information

10-1. Approach to disclosure of information

With an aim to ensure that stakeholders evaluate MUFG based on a proper understanding, MUFG will ensure transparency in information disclosure

through appropriate disclosure of its financial information (such as information on its financial condition and operating results) and information regarding business strategy and risk management.

From the perspective of ensuring the fairness and soundness of the securities market, MUFG recognizes the importance of managing the security

of undisclosed material information that would influence investment decisions and will practice strict information security.

10-2.

External accounting audit

MUFG recognizes the responsibility that external accounting auditors owe towards shareholders and investors,

and take appropriate actions to secure the proper performance of audit.

Addendum

These Policies will take effect from June 25, 2015.

22

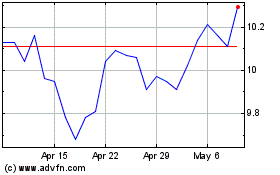

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

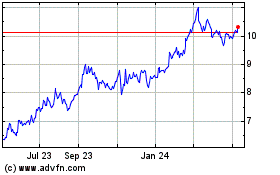

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024