UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of May 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Akira Takeda |

| Name: |

|

Akira Takeda |

| Title: |

|

Chief Manager, General Affairs |

|

|

Corporate Administration Division |

Mitsubishi UFJ Financial Group, Inc.

Medium-term Business Plan

Tokyo, May 15, 2015 — Mitsubishi UFJ Financial Group, Inc. (MUFG) announced today that it has formulated its medium-term business plan

for the 3-year period beginning in fiscal 2015.

This year marks the 10th anniversary of the MUFG Group. Over this decade, the Group has

continued to grow steadily by strengthening its comprehensive financial capabilities and expanding its global operations.

The operating

environment for financial institutions has grown increasingly difficult, and it is continuing to go through significant change. With regard to the future of the Group’s operating environment, the domestic market is expected to continue

suffering from low interest rates while the global market is expected to witness intensified competition. More stringent financial regulations and rising geopolitical risks will make our operating environment increasingly opaque. From a medium- to

long-term perspective, we anticipate transformation in the structure of society and the economy, such as changes in consumption patterns stemming from the aging of the Japanese population and Japan’s declining birthrate as well as the mechanism

through which new industries and companies appear and disappear. Furthermore, the evolution of information and communications technology (ICT) brings with it the possibility of changes to the very nature of financial businesses through the

development of more sophisticated financial services or by enabling companies from other fields to participate in the financial industry. It will be crucial to the further progress of the MUFG Group over the next 10 years for us to maintain an

accurate understanding of such changes, and undertake the evolution and reformation of our business model as a preemptive response to these changes.

Based on this recognition, the MUFG Group turned its eye toward the expected operating environment changes over the next decade, and launched the new medium-term business plan, which outlines the

strategies that will be implemented over the first three years of this period. The new plan is designed to guide us as we strive to realize our corporate vision — “Be the world’s most trusted financial group.” By accelerating

initiatives that span across business entities, regions, and business groups, we will work to live up to the expectations of our customers, shareholders, employees, and other stakeholders.

1

The basic

policy of the new medium-term business plan is as follows: We will maintain our focus on the Japanese market while working to incorporate the growth of the global market and evolving and reforming our business model. In addition, we will work to

ensure the financial stability and improve the administration practices that will firmly support business strategies.

In

accordance with this policy, we formulated the Group business strategies and the administrative practices and business foundation strategies that will be employed over the next three years based on three strategic focuses: “Customer

perspective,” “Group-driven approach,” and “Productivity improvements.” “Customer perspective” calls on us to develop businesses based on changing customer needs. “Group-driven approach” inspires us to

bolster inter-Group company unity and consider how to optimize our business on a Group-wide basis. “Productivity improvements” encapsulates our commitment to boosting competitiveness by pursuing higher levels of rationality and efficiency.

“Evolution and reformation to achieve sustainable growth for MUFG”

| |

(1) |

Contribute to the revitalization of the Japanese economy and strengthen the business foundations in Japan to support steady growth |

| |

(2) |

Enhance & expand global businesses as a driving force for growth |

| |

(3) |

Upgrade & reform our business model and explore new business areas and customer segments |

| |

(4) |

Maintain a strong capital base and improve ROE with sophisticated financial and capital management |

| |

(5) |

Build administration practices appropriate for a G-SIFI*1 |

| |

*1 |

Global Systemically Important Financial Institution |

The

MUFG Group aims to achieve stable and sustainable income growth through seeking diversified revenue bases especially in customer segment both domestically and abroad, and capital efficiency by improving productivity. In addition, we will enhance

shareholder value by conducting capital management flexibly taking the balance of (1) enhancement of further shareholder returns, (2) maintenance of a solid capital base and (3) strategic investments for sustainable growth, into

consideration.

2

| 3. |

Group Business Strategies |

In Japan, we will enhance support for wealth accumulation and stimulation of consumption for individuals, contribute to the growth of small and medium-sized enterprises (SMEs), and link contribution to

the revitalization of the Japanese economy with the stable growth of MUFG. Globally, we will enhance and expand businesses by evolving and reforming our Corporate & Investment Banking (CIB)*2 model, sales and trading operations*3, and asset management and investor services operations. We will also

work to further reinforce transaction banking*4 operations

and strengthen commercial banking platforms in Asia and the United States to construct a next-generation business base.

| |

*2 |

A business model that provides customers with end-to-end, comprehensive financial services including both Corporate Banking (e.g. deposits and loans) and Investment

Banking (e.g. capital markets and M&A advisory) services, in order to help customers increase their corporate value |

| |

*3 |

A general term for sales operations involving the provision of financial products and solutions including foreign exchange and derivatives, and trading operations to

buy and sell marketable products through inter-bank trading or trading on exchanges |

| |

*4 |

A general term for deposit business, domestic exchange business, foreign exchange business, and related businesses such as cash management and trade finance

|

| |

(1) |

Support wealth accumulation and stimulation of consumption for individuals |

The needs of individual users are becoming more advanced and diverse in conjunction with the rapid aging of the Japanese population, the accelerating shift from savings to investment, and rise in the

amount of assets transferred via inheritance. Aiming to respond to these needs, the Group will band together to provide customers with assets administration and management support and help ensure the smooth transference of these assets to the next

generation. In this manner, we aim to raise the Group’s balance of assets under management by approximately 25% over the next three years.

To facilitate these efforts, we will hire 100 additional specialists to enhance our sales system for the financial products intermediation (which entails providing the asset management products of

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. (MUMSS), through the Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU)). At the same time, we plan to develop new products like qualified fund for marriage and child care giving trusts, a product launched

by Mitsubishi UFJ Trust and Banking Corporation in April 2015.

Furthermore, the MUFG Group will contribute to the stimulation

of consumer spending by utilizing state-of-the-art ICT to develop sophisticated payment services and by strengthening consumer finance operations. Through these efforts, we will strive to create financial services that are chosen by every customer

and in which various transactions spread beyond entities and generations to connect with each other.

3

| |

(2) |

Contribute to growth of SMEs |

To support the growth and business development of SME customers, we will fully leverage the functions of Group companies and respond to all the needs and management issues of these customers. Rather than

focusing merely on balance sheet liabilities, for example, we will also consider capital, assets, and net sales, among other factors. As part of this undertaking, we will target an approximately 5% increase in loan balance at BTMU offices and

branches that cater to SME customers over the next three years, which will be accomplished by providing smooth support for customers’ funding needs. In addition, we will develop operations in new business fields through means such as enhancing

our M&A advisory service functions to respond to the rising business transference demand stemming from the aging of business owners and bolstering our ability to provide investment management solutions focused on assets. The Group will also

accelerate efforts to contribute to the growth of customers through means such as offering business matching services to link SME customers with large corporate customers and providing support for expanding businesses overseas.

| |

(3) |

Reform global CIB business model |

The needs of large companies are becoming more advanced, diverse, and global. The MUFG Group responds to the needs of large corporate customers through concerted efforts conducted on a Group-wide and

global basis, and we will establish a unique global CIB model to aid us in this endeavor. As part of this process, we will consolidate the Group’s sector-specific expertise while deepening strategic collaboration with Morgan Stanley.

Outside Japan, we will supplement the loans that have traditionally driven growth by accelerating the provision of a diverse

range of high-value-added products and services, which will then enable us to achieve further sustainable growth. At the same time, we will strive to develop an Origination & Distribution (O & D) business on a Group-wide basis that

pursues capital efficiency by utilizing relationships with institutional investors. The Financial Solutions Unit will be established within MUFG (holding company) to house the strategic planning and monitoring functions for this business.

| |

(4) |

Evolve sales and trading operations |

The operating environment for market-related operations is growing increasingly difficult amidst such changes as the institution of more stringent international financial regulations. We are therefore

leveraging the strengths and specialties of Group companies to boost our competitiveness. As one facet of these efforts, we will manage the sales and trading operations of BTMU, MUMSS and overseas securities subsidiaries in an integrated manner.

With this integrated management system in place, the MUFG Group will push forward with efforts to strengthen its ability to provide products and services that address the diverse needs of various customers, such as corporations and institutional

investors, on a global basis. Through these efforts, we aim to achieve an approximately 10% increase in gross profits from sales and trading operations over the three-year period of the medium-term business plan, while at the same time raising

MUFG’s brand value on the global market and increasing recognition among customers.

4

| |

(5) |

Develop global asset management and investor services operations |

MUFG is committed to establishing a firm position as a global player in the asset management and alternative investment investor services field. As part of this endeavor, we aim to increase foreign

domiciled fund administration balances by approximately 3 times and the amount of assets managed for overseas investors by approximately 2 times over the next three years. These targets will be pursued while implementing both organic and non-organic

strategies in the growing field of alternative investment investor services and asset management operations in the United States, Asia, and other regions.

In Japan, meanwhile, we will merge Group asset management companies, and work to provide more-sophisticated and higher-value-added asset management services in our investment trust operations.

| |

(6) |

Further reinforce transaction banking operations |

Going forward, we aim to further strengthen transaction banking operations. In Japan, efforts in these areas will be directed toward building an unrivaled market position. Specifically, we will leverage

the superiority of branches capable of providing foreign exchange services while improving the convenience of our products. Outside Japan, MUFG will redouble efforts to address the recently expanding cross-border business flows, and target an

increase of approximately 70% in trade finances balances to be accomplished in a three-year period. An approximately 30% increase in deposit balances will also be targeted during this period, and we will bolster product competitiveness and step up

inter-regional collaboration to accomplish this goal. To spearhead these efforts, BTMU will establish the Transaction Banking Group and consolidate related domestic and overseas functions into this organization. In addition, the MUFG Group will

drastically strengthen its systems for advancing transaction banking operations by enhancing overseas sales systems and implementing other measures.

| |

(7) |

Strengthen commercial banking platforms in Asia and the United States |

MUFG is working to strengthen comprehensive commercial banking platforms that give form to its unique capabilities. In Asia, these efforts are centered around Bank of Ayudhya Public Company Limited

(Krungsri), while MUFG Union Bank, N.A. is taking charge in the United States. The Group’s overseas operations have previously focused primarily on large companies, but in strengthening platforms we are branching out to accommodate local

individual and SME customers.

Krungsri aims to become a top tier financial group in Thailand through the enhancement of group

collaboration, the realization of group synergies, and the expansion of its business platform by increasing its sales and service channels through the opening of 100 new branches and the installation of 2,000 new ATMs.

MUFG Union Bank, N.A. has set the goal of becoming one of the United States’ top 10 banks in the future. To accomplish this goal, it

will diversify revenue sources through M&A activities and other means and expand its customer base through online banking and branch-light bank development.

5

| 4. |

Administrative Practices / Business Foundation Strategies |

With maintaining a strong capital base as the first priority, MUFG will streamline Group-wide operations and create administration practices that are appropriate for a G-SIFI. This will enable us continue

to operate a business model that evolves and transforms on a Group-wide and global basis while taking steps to respond to the higher expectations of outside stakeholders.

| |

(1) |

Enhance Group administration practices and integrated risk management |

In conjunction with the evolution and reformation of the MUFG Group as a global financial group, we will strive to

create more-advanced corporate governance systems. To facilitate these efforts, after receiving shareholder approval, MUFG will be converted into a company with three committees, and oversight functions of the Board of Directors will be strengthened

by utilizing outside directors’ perspectives. On the level of Group governance, MUFG’s C-Suite*5 will be responsible for corporate management across the Group for each function. Meanwhile, in terms of globally oriented governance, administration practices will be refined in accordance with the

regulations present in specific countries and regions and will also be tailored to business characteristics.

Furthermore,

recognizing that human resources form part of the foundations necessary for sustainable growth, the Human Resources Division will be established in MUFG (holding company) to conduct human resources-related tasks in manner that exudes a sense of

Group cohesion while managing human resources and their development on a global basis.

To respond to risks, MUFG is developing

more evolved and advanced comprehensive risk management practices that address new regulations and progress in businesses while placing emphasis on managing risks in an integrated and preventative manner.

| |

*5 |

A general term for positions like Chief Financial Officer (CFO) and Chief Risk Officer (CRO) |

| |

(2) |

Strengthen and streamline the Group business platform |

We aim to strengthen and streamline the Group business platform, and this will be done in part through shared usage of systems, back-office functions, and facilities on a Group-wide basis. This

undertaking will in part entail sharing information regarding investment candidates being examined within the Group from the moment they are put on the table, and developing basic system infrastructure in MUFG that can be shared throughout the Group

and is capable of serving the needs of all Group companies.

In addition, the Digital Innovation Division will be established

in MUFG (holding company) to help facilitate efforts to utilize the rapid development and spread of ICT to further the Group’s growth. Accordingly, this division will be responsible for advancing ICT utilizations strategies while sharing ICT

usage know-how and foundations on a Group-wide basis.

6

| |

(3) |

Upgrade Group financial and capital management |

MUFG strives to improve the Group’s return on capital by entrenching frameworks for increasing returns on risks taken, which will be done while placing maintaining a strong capital base as the first

priority. We will also diversify funding methods in consideration of global financial regulations.

| |

(4) |

Promote MUFG global-based corporate communication |

Communication with outside stakeholders and Group employees will be conducted strategically and in a manner that is integrated on a Group-wide and global basis to maximize the benefits of this

communication. We recognize internal communication as a means of fostering a corporate culture that gives form to our corporate vision and creating sense of cohesion within the Group. Meanwhile, communication with outside parties contributes to

improving customer satisfaction and brand value as well as to helping us fulfill our corporate social responsibility.

* *

*

Contact:

Mitsubishi UFJ Financial Group, Inc.

Public Relations Division

81-3-3240-7651

This press release contains

forward-looking statements regarding estimations, forecasts, targets and plans in relation to the results of operations, financial conditions and other overall management of MUFG and/or the Group as a whole (the “forward-looking

statements”). The forward-looking statements are made based upon, among other things, MUFG’s current estimations, perceptions and evaluations. In addition, in order for MUFG to adopt such estimations, forecasts, targets and plans regarding

future events, certain assumptions have been made. Accordingly, due to various risks and uncertainties, the statements and assumptions are inherently not guarantees of future performance, may be considered differently from alternative perspectives

and may result in material differences from the actual results. For the main factors that may affect the current forecasts, please see Consolidated Summary Report, Annual Securities Report, Disclosure Book, Annual Report, and other current

disclosures that MUFG has announced.

7

8

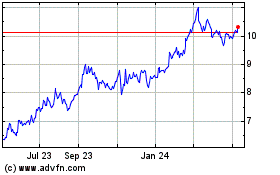

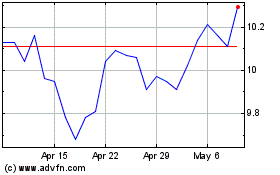

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024