MUFG Americas Holdings Corporation (the Company), parent company

of San Francisco-based MUFG Union Bank, N.A. (the Bank), today

reported net income for the quarter of $137 million, compared with

$153 million for the prior quarter and $172 million for the

year-ago quarter.

Highlights:

- Net income for the first quarter was

$137 million, down $16 million from the fourth quarter of 2014 due

to decreases in pre-tax, pre-provision income, partially offset by

lower income tax expense.

- Continued disciplined underwriting

standards produced strong credit quality with low levels of

nonperforming assets and charge-offs, which were 0.34% of total

assets and $3 million, respectively, for the quarter.

- In a historic move, Mitsubishi UFJ

Financial Group, Inc. (MUFG), announced on April 9, 2015 that the

Bank has created a new leadership position - a CEO for the U.S. -

and that Stephen E. Cummings will join the Bank as its President

and Chief Executive Officer. The appointment of Mr. Cummings

represents an evolution from MUFG’s tradition of appointing

executives from the parent company to serve as CEO in the U.S.

market. Mr. Cummings will have authority over all of The Bank of

Tokyo-Mitsubishi UFJ’s, Ltd. (BTMU) U.S. businesses, including its

New York branch and other U.S.-domiciled branch offices. He will

serve as a member of the Bank's Board of Directors and will be

based in New York. Mr. Cummings most recently served as Chairman of

Investment Banking for the Americas for UBS Investment Bank and

Head of Corporate Client Solutions for the Americas at UBS Group

AG.

The following table presents financial highlights for the

periods ended March 31, 2015, December 31, 2014 and March 31,

2014:

As of and for the Three Months Ended

Percent Change toMarch 31, 2015

from

(Dollars in millions)

March 31,2015

December 31,2014

(1)

March 31,2014 (1)

December 31,2014

March 31,2014

Results of operations: Net interest income $ 683 $

709 $ 683

(4

)%

— % Noninterest income 335 352 181 (5 ) 85

Total revenue 1,018 1,061 864 (4 ) 18 Noninterest expense 849

797 627 7 35 Pre-tax, pre-provision income (2)

169 264 237 (36 ) (29 ) (Reversal of) provision for credit losses 3

(1 ) — 400 nm Income before income taxes and

including noncontrolling interests 166 265 237 (37 ) (30 ) Income

tax expense 34 117 70 (71 ) (51 ) Net income

including noncontrolling interests 132 148 167 (11 ) (21 ) Deduct:

Net loss from noncontrolling interests 5 5 5 —

— Net income attributable to MUFG Americas Holdings Corporation

(MUAH) $ 137 $ 153 $ 172 (10 ) (20 )

Balance sheet (end of period): Total assets $ 113,698 $

113,662 $ 107,231 — 6 Total securities 22,463 22,015 23,192 2 (3 )

Total loans held for investment 76,808 76,804 69,933 — 10 Core

deposits (2) 74,190 76,666 70,665 (3 ) 5 Total deposits 82,741

86,004 81,179 (4 ) 2 Long-term debt 8,856 6,972 6,545 27 35 MUAH

stockholder's equity 15,200 14,922 14,403 2 6

Balance

sheet (period average): Total assets $ 113,134 $ 112,589 $

106,491 — 6 Total securities 22,172 22,171 22,611 — (2 ) Total

loans held for investment 77,305 75,795 69,293 2 12 Earning assets

102,645 101,430 96,100 1 7 Total deposits 84,088 84,036 80,433 — 5

MUAH stockholder's equity 15,069 15,202 14,390 (1 ) 5 Net interest

margin (2) 2.70 % 2.81 % 2.87 %

____________________________________

(1)Prior period amounts have been revised to reflect the January

1, 2015 adoption of Accounting Standards Update 2014-01 related to

investments in qualified affordable housing projects.

(2) For additional information, please see the footnote

explanations in our financial supplement at www.unionbank.com

Business Integration

Initiative

Effective July 1, 2014, the U.S. branch banking operations of

BTMU were integrated under the Bank's operations. This integration

did not involve a legal entity combination, but rather an

integration of personnel and certain business and support

activities. The Bank and BTMU entered into a master services

agreement, which provides for employees of the Bank to perform and

make available various business, banking, financial, and

administrative and support services (the Services) and facilities

to BTMU in connection with the operation and administration of

BTMU's businesses in the U.S. (including BTMU's U.S. branches). In

consideration for the Services, BTMU pays to the Bank fee income,

which reflects market-based pricing. Costs related to the Services

performed by the transferred employees are primarily reflected as

salaries and employee benefits expense.

For the quarter ending March 31, 2015, the Company recorded $166

million in fee income from this initiative, including $121 million

related to support services provided by the Company to BTMU.

Noninterest expense related to the Services was $112 million for

the quarter ending March 31, 2015, primarily comprised of salaries

and employee benefits. The remaining fee income was recognized

through revenue sharing agreements with BTMU, which was primarily

offset by associated costs recorded in noninterest expense.

Summary of First Quarter

Results

First Quarter Total

Revenue

For the first quarter of 2015, total revenue (net interest

income plus noninterest income) was $1.0 billion, down $43 million

compared with the fourth quarter of 2014.

Net interest income for the first quarter of 2015 was $683

million, down 4% compared with the fourth quarter of 2014. The

decrease in net interest income was largely due to an 11 basis

point decline in the net interest margin to 2.70%, which was

substantially due to lower yields on loans held for investment and

investment securities reflecting the low interest rate environment,

partially offset by modest growth in commercial and industrial

loans. Average total deposits of $84.1 billion were consistent with

fourth quarter 2014 levels.

For the first quarter of 2015, noninterest income was $335

million, down $17 million, or 5%, compared with the fourth quarter

of 2014, largely due to higher prior quarter merchant banking

fees.

Compared with the first quarter of 2014, total revenue increased

$154 million, with net interest income remaining flat while

noninterest income increased 85%. The increase in noninterest

income was largely due to fees from affiliates resulting from the

business integration initiative. Average total loans held for

investment increased $8.0 billion, or 12%, compared with the first

quarter 2014. Average total deposits increased $3.7 billion

compared with the first quarter of 2014, driven by a 14% increase

in average noninterest bearing deposits.

First Quarter Noninterest

Expense

Noninterest expense for the first quarter of 2015 was $849

million, up $52 million compared with the fourth quarter of 2014

and up $222 million from the first quarter of 2014. The increase

from the fourth quarter of 2014 was largely due to increased

employee expenses related to seasonal factors and higher pension

expense. The increase from the first quarter of 2014 was largely

due to increased employee costs as a result of the business

integration initiative. The effective tax rate for the first

quarter of 2015 was 20.5%, compared with an effective tax rate of

44.2% for the fourth quarter of 2014, reflecting a year-end

adjustment to align estimated expense with actual full year 2014

results.

Balance Sheet

At March 31, 2015, total assets were $113.7 billion,

consistent with December 31, 2014 levels. Total loans held for

investment increased slightly compared with the fourth quarter of

2014 reflecting growth in the commercial and industrial and

construction loan portfolios, largely offset by a decrease in the

residential mortgage lending portfolio.

Total liabilities were $98.3 billion, down $0.2 billion compared

with December 31, 2014, primarily due to a decrease in total

deposits partially offset by increases in long-term debt and

commercial paper and other short-term borrowings. At March 31,

2015, total deposits were $82.7 billion, down $3.3 billion compared

with December 31, 2014. Core deposits at March 31, 2015

decreased to $74.2 billion compared with $76.7 billion at

December 31, 2014.

Credit Quality

The following table presents credit quality data for the

quarters ended March 31, 2015, December 31, 2014 and March 31,

2014:

As of and for the Three Months Ended

Percent Change to

March 31, 2015 from

(Dollars in millions)

March 31,2015

December 31,2014

March 31,2014

December 31,2014

March 31,2014

Total (reversal of) provision for credit losses $ 3 $ (1 ) $

— 400 % 100 % Net loans charged-off (recovered) 3 (1 ) (6 ) 400 150

Nonperforming assets 390 411 506 (5 ) (23 )

Credit

Ratios: Allowance for loan losses to: Total loans held for

investment 0.69 % 0.70 % 0.80 % Nonaccrual loans 147.21 143.35

119.58 Allowance for credit losses to (1): Total loans held for

investment 0.90 0.90 1.01 Nonaccrual loans 191.20 183.80 151.35

Nonperforming assets to total assets 0.34 0.36 0.47 Nonaccrual

loans to total loans held for investment 0.47 0.49 0.67

________________________________________

(1) For additional information, please see the footnote

explanations in our financial supplement at www.unionbank.com

Credit quality remained strong in the first quarter of 2015

reflected by continued low levels of nonperforming assets and net

charge-offs.

Nonperforming assets as of March 31, 2015 were $390

million, or 0.34% of total assets, compared with $411 million, or

0.36% of total assets, at December 31, 2014, and $506 million,

or 0.47% of total assets at March 31, 2014.

Net loans charged-off were $3 million for the first quarter of

2015 compared with net loans recovered of $1 million for the fourth

quarter of 2014 and $6 million for the first quarter of 2014.

The allowance for credit losses as a percentage of total loans

was 0.90% at March 31, 2015, flat from December 31, 2014

and down from 1.01% at March 31, 2014. The allowance for

credit losses as a percentage of nonaccrual loans was 191% at

March 31, 2015, compared with 184% at December 31, 2014

and 151% at March 31, 2014. In the first quarter of 2015, the

provision for credit losses was $3 million, compared with a

reversal of $1 million for the fourth quarter of 2014 and a net

provision of zero for the first quarter of 2014.

Capital

The following table presents capital ratio data for the quarters

ended March 31, 2015, December 31, 2014 and March 31, 2014:

As of and for the Three Months Ended

March 31,2015

December 31,2014

March 31,2014

Capital ratios (1):

Regulatory: U.S. Basel III U.S. Basel I

U.S. Basel III Common Equity Tier 1 risk-based capital ratio

12.68 % n/a 12.59 % Tier 1 risk-based capital ratio 12.68 12.79 %

12.62 Total risk-based capital ratio 14.46 14.74 14.75 Tier 1

leverage ratio 11.30 11.25 11.26

Other: Tangible

common equity ratio 10.69 % 10.48 % 10.60 % Tier 1 common capital

ratio n/a 12.74 n/a Common Equity Tier 1 risk-based capital ratio

(U.S. Basel III

standardized approach; fully phased

in)

12.61 12.56 11.98

____________________________________

(1) For additional information, please see the footnote

explanations in our financial supplement at www.unionbank.com

The Company’s stockholder’s equity was $15.2 billion at

March 31, 2015 compared with $14.9 billion at

December 31, 2014.

In December 2014, the Federal Reserve Board approved the

Company's request to opt-out of the advanced approaches methodology

under U.S. Basel III regulatory capital rules. Accordingly, the

Company now calculates its regulatory capital ratios under the

standardized approach of the U.S. Basel III rules, with certain

provisions subject to phase-in periods. The Bank continues to be

subject to the advanced approaches rules.

The Company's Common Equity Tier 1, Tier 1 and Total risk-based

capital ratios, calculated in accordance with U.S. Basel III

regulatory capital rules, were 12.68%, 12.68% and 14.46%,

respectively, at March 31, 2015. The Tangible common equity

ratio was 10.69% at March 31, 2015.

The Company’s estimated Common Equity Tier 1 risk-based capital

ratio under U.S. Basel III regulatory capital rules (standardized

approach, fully phased in) was 12.61% at March 31, 2015.

FOR ADDITIONAL INFORMATION PLEASE REFER TO OUR FINANCIAL

SUPPLEMENT ON OUR WEBSITE AT WWW.UNIONBANK.COM

Non-GAAP Financial

Measures

This press release includes additional capital ratios (Tier 1

common capital, tangible common equity and Common Equity Tier 1

capital (calculated under the Basel III standardized approach on a

fully phased-in basis)) to facilitate the understanding of the

Company’s capital structure and for use in assessing and comparing

the quality and composition of the Company's capital structure to

other financial institutions. These presentations should not be

viewed as a substitute for results determined in accordance with

GAAP, nor are they necessarily comparable to non-GAAP financial

measures presented by other companies. Please refer to our separate

reconciliation of non-GAAP financial measures in our financial

supplement.

Headquartered in New York, MUFG Americas Holdings Corporation is

a financial holding company and bank holding company with assets of

$113.7 billion at March 31, 2015. Its principal subsidiary,

MUFG Union Bank, N.A., provides an array of financial services to

individuals, small businesses, middle-market companies, and major

corporations. As of March 31, 2015, MUFG Union Bank, N.A.

operated 393 branches, comprised primarily of retail banking

branches in the West Coast states, along with commercial branches

in Texas, Illinois, New York and Georgia, as well as two

international offices. MUFG Americas Holdings Corporation is a

wholly-owned subsidiary of The Bank of Tokyo-Mitsubishi UFJ, Ltd.

which is a wholly-owned subsidiary of Mitsubishi UFJ Financial

Group, Inc., one of the world’s largest and most diversified

financial groups. Visit www.unionbank.com for more information.

MUFG Americas Holdings CorporationAlan Gulick,

425-423-7317Corporate CommunicationsorDoug

Lambert, 212-782-5911Investor Relations

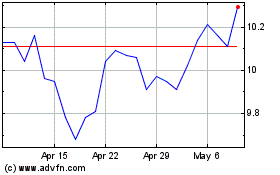

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

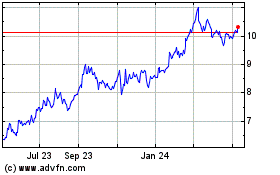

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024