Report of Foreign Issuer (6-k)

January 22 2015 - 6:27AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of

1934

For the month of January 2015

Commission File No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1, Marunouchi 2-chome, Chiyoda-ku

Tokyo 100-8330, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in

paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 22, 2015

|

|

|

| Mitsubishi UFJ Financial Group, Inc. |

|

|

| By: |

|

/s/ Akira Takeda |

| Name: |

|

Akira Takeda |

| Title: |

|

Chief Manager, General Affairs |

|

|

Corporate Administration Division |

Interim Consolidated Summary Report

<under US GAAP>

For the Fiscal Year Ending March 31, 2015

|

|

|

| Date: |

|

January 22, 2015 |

| Company name (code number): |

|

Mitsubishi UFJ Financial Group, Inc. (8306) |

|

|

(URL http://www.mufg.jp/) |

| Stock exchange listings: |

|

Tokyo, Nagoya, New York |

| Representative: |

|

Nobuyuki Hirano, President & CEO |

| For inquiry: |

|

Hiroshi Fukunaga, General Manager-Financial Planning Division, Financial Accounting Office |

|

|

(Phone) +81-3-3240-3110 |

Consolidated financial data for the six months ended September 30, 2014

(1) Operating results

|

|

|

|

|

|

|

(in millions of yen, except per share data) |

|

|

|

|

|

| |

|

For the six months ended September 30, |

| |

|

2014 |

|

2013 |

| Total revenue |

|

2,865,991 |

|

1,929,399 |

| Income before income tax expense |

|

1,273,959 |

|

530,411 |

| Net income attributable to Mitsubishi UFJ Financial Group |

|

838,296 |

|

383,314 |

| Basic earnings per common share—Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group (in

yen) |

|

58.55 |

|

26.21 |

| Diluted earnings per common share—Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group (in

yen) |

|

58.35 |

|

26.10 |

Comprehensive income attributable to Mitsubishi UFJ Financial Group for the six months ended

September 30, 2014 and 2013 were ¥1,287,757 million and ¥820,313 million, respectively.

Notes:

1. Average number of shares outstanding

(in thousands of shares)

|

|

|

|

|

|

|

| |

|

For the six months ended September 30, |

| |

|

2014 |

|

2013 |

| Common stock |

|

14,163,257 |

|

14,157,332 |

2. “Basic earnings per common share” and “Diluted earnings per common share” are based on

“Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group.”

(2) Financial condition

(in millions of yen)

|

|

|

|

|

|

|

|

| |

|

As of September 30,

2014 |

|

As of March 31,

2014 |

| Total assets |

|

260,014,355 |

|

253,661,077 |

| Total Mitsubishi UFJ Financial Group shareholders’ equity |

|

12,967,812 |

|

12,205,040 |

(3) Cash flows

(in millions of yen)

|

|

|

|

|

|

|

| |

|

For the six months ended September 30, |

| |

|

2014 |

|

2013 |

| Net cash provided by operating activities |

|

869,579 |

|

1,821,992 |

| Net cash used in investing activities |

|

(2,054,938) |

|

(6,124,115) |

| Net cash provided by financing activities |

|

915,968 |

|

4,113,395 |

| Cash and cash equivalents at end of period |

|

3,412,708 |

|

3,483,533 |

-1-

This report is an excerpt of certain highlights from our semiannual condensed consolidated financial information under U.S. GAAP that is included in a report on Form 6-K (the “Semiannual U.S. GAAP

Report”) to be submitted to the U.S. Securities and Exchange Commission. This excerpt report does not contain all of the information that may be important to you. In addition to the items highlighted in this report, the Semiannual U.S. GAAP

Report includes material disclosure about Mitsubishi UFJ Financial Group, Inc., including its business and other detailed U.S. GAAP financial information. You should read the entire Semiannual U.S. GAAP Report carefully to obtain a comprehensive

understanding of the company’s business and U.S. GAAP financial data and related issues.

This report contains

forward-looking statements regarding estimates, forecasts, targets and plans in relation to the results of operations, financial condition and other general management of the company and/or the group as a whole (the “forward-looking

statements”). The forward-looking statements are made based upon, among other things, the company’s current expectations, perceptions, evaluations and opinions. In addition, in order for the company to adopt such estimates, forecasts,

targets and plans regarding future events, certain assumptions have been made, which assumptions are inherently subjective and uncertain. The forward-looking statements should not be viewed as guarantees of future performance as actual results may

be significantly different. For instance, the disclosures regarding provision for credit losses, valuation of financial assets and realizability of the deferred tax assets are based on assumptions and other estimates, such as economic factors, our

business plans and performance, and other factors. There exist a number of factors that may lead to uncertainties and risks, including, but not limited to, the deterioration of the Japanese and global economies, fluctuations in interest rates,

foreign currency exchange rates and stock prices, legal proceedings and changes in the regulatory environment. For the key factors that should be considered, please see the financial highlight, the Annual Securities Report, Disclosure Book, Annual

Report, Form 20-F, reports on Form 6-K and other current disclosures that the company has publicly released.

-2-

(US GAAP)

Mitsubishi UFJ Financial Group, Inc. and Subsidiaries

Condensed Consolidated Balance

Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

| (in millions of yen) |

|

As of

September 30,

2014 |

|

|

As of

March 31,

2014 |

|

| Assets: |

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

3,412,708 |

|

|

|

3,689,228 |

|

| Interest-earning deposits in other banks |

|

|

28,534,929 |

|

|

|

20,500,676 |

|

| Call loans, funds sold, and receivables under resale agreements |

|

|

6,918,062 |

|

|

|

8,219,169 |

|

| Receivables under securities borrowing transactions |

|

|

4,335,157 |

|

|

|

4,210,057 |

|

| Trading account assets |

|

|

39,141,337 |

|

|

|

40,646,275 |

|

| Investment securities: |

|

|

|

|

|

|

|

|

| Available-for-sale securities—carried at fair value |

|

|

51,169,368 |

|

|

|

51,885,652 |

|

| Held-to-maturity securities—carried at amortized cost |

|

|

3,456,827 |

|

|

|

2,706,982 |

|

| Other investment securities |

|

|

747,649 |

|

|

|

737,617 |

|

|

|

|

|

|

|

|

|

|

| Total investment securities |

|

|

55,373,844 |

|

|

|

55,330,251 |

|

|

|

|

|

|

|

|

|

|

| Loans, net of unearned income, unamortized premiums and deferred loan fees |

|

|

111,194,207 |

|

|

|

110,276,411 |

|

| Allowance for credit losses |

|

|

(940,888 |

) |

|

|

(1,094,420 |

) |

|

|

|

|

|

|

|

|

|

| Net loans |

|

|

110,253,319 |

|

|

|

109,181,991 |

|

|

|

|

|

|

|

|

|

|

| Premises and equipment—net |

|

|

1,204,349 |

|

|

|

1,236,648 |

|

| Accrued interest |

|

|

285,226 |

|

|

|

277,222 |

|

| Customers’ acceptance liability |

|

|

220,035 |

|

|

|

126,838 |

|

| Intangible assets—net |

|

|

1,122,826 |

|

|

|

1,133,354 |

|

| Goodwill |

|

|

709,260 |

|

|

|

728,515 |

|

| Deferred tax assets |

|

|

73,126 |

|

|

|

362,267 |

|

| Other assets |

|

|

8,430,177 |

|

|

|

8,018,586 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

260,014,355 |

|

|

|

253,661,077 |

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

| Domestic offices: |

|

|

|

|

|

|

|

|

| Non-interest-bearing |

|

|

16,527,631 |

|

|

|

16,644,469 |

|

| Interest-bearing |

|

|

105,624,258 |

|

|

|

104,860,603 |

|

| Overseas offices, principally interest-bearing |

|

|

41,490,758 |

|

|

|

41,012,714 |

|

|

|

|

|

|

|

|

|

|

| Total deposits |

|

|

163,642,647 |

|

|

|

162,517,786 |

|

|

|

|

|

|

|

|

|

|

| Call money, funds purchased, and payables under repurchase agreements |

|

|

22,102,591 |

|

|

|

24,685,527 |

|

| Payables under securities lending transactions |

|

|

7,053,971 |

|

|

|

5,520,718 |

|

| Due to trust account and other short-term borrowings |

|

|

11,864,008 |

|

|

|

11,856,281 |

|

| Trading account liabilities |

|

|

14,191,216 |

|

|

|

11,981,978 |

|

| Obligations to return securities received as collateral |

|

|

3,505,355 |

|

|

|

3,971,454 |

|

| Bank acceptances outstanding |

|

|

220,035 |

|

|

|

126,838 |

|

| Accrued interest |

|

|

128,270 |

|

|

|

143,362 |

|

| Long-term debt |

|

|

17,945,900 |

|

|

|

14,498,678 |

|

| Other liabilities |

|

|

5,849,851 |

|

|

|

5,607,011 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

246,503,844 |

|

|

|

240,909,633 |

|

|

|

|

|

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

| Mitsubishi UFJ Financial Group shareholders’ equity: |

|

|

|

|

|

|

|

|

| Capital stock |

|

|

2,090,206 |

|

|

|

2,089,245 |

|

| Capital surplus |

|

|

5,973,866 |

|

|

|

6,363,413 |

|

| Retained earnings: |

|

|

|

|

|

|

|

|

| Appropriated for legal reserve |

|

|

239,571 |

|

|

|

239,571 |

|

| Unappropriated retained earnings |

|

|

2,859,520 |

|

|

|

2,157,639 |

|

| Accumulated other comprehensive income, net of taxes |

|

|

1,807,143 |

|

|

|

1,357,682 |

|

| Treasury stock, at cost |

|

|

(2,494 |

) |

|

|

(2,510 |

) |

|

|

|

|

|

|

|

|

|

| Total Mitsubishi UFJ Financial Group shareholders’ equity |

|

|

12,967,812 |

|

|

|

12,205,040 |

|

| Noncontrolling interests |

|

|

542,699 |

|

|

|

546,404 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

13,510,511 |

|

|

|

12,751,444 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

260,014,355 |

|

|

|

253,661,077 |

|

|

|

|

|

|

|

|

|

|

-3-

(US GAAP)

Mitsubishi UFJ Financial Group, Inc. and Subsidiaries

Condensed Consolidated Statements

of Income (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

For the six months ended

September 30, |

|

| (in millions of yen) |

|

2014 |

|

|

2013 |

|

| Interest income: |

|

|

|

|

|

|

|

|

| Loans, including fees |

|

|

973,824 |

|

|

|

817,510 |

|

| Deposits in other banks |

|

|

29,934 |

|

|

|

20,386 |

|

| Investment securities |

|

|

188,482 |

|

|

|

179,037 |

|

| Trading account assets |

|

|

206,135 |

|

|

|

187,493 |

|

| Call loans, funds sold, and receivables under resale agreements and securities borrowing transactions |

|

|

34,834 |

|

|

|

31,511 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,433,209 |

|

|

|

1,235,937 |

|

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

| Deposits |

|

|

151,105 |

|

|

|

107,618 |

|

| Call money, funds purchased, and payables under repurchase agreements and securities lending transactions |

|

|

27,284 |

|

|

|

21,946 |

|

| Due to trust account, other short-term borrowings, and trading account liabilities |

|

|

31,569 |

|

|

|

27,787 |

|

| Long-term debt |

|

|

121,866 |

|

|

|

112,164 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

331,824 |

|

|

|

269,515 |

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

1,101,385 |

|

|

|

966,422 |

|

| Credit for credit losses |

|

|

68,138 |

|

|

|

60,229 |

|

|

|

|

|

|

|

|

|

|

| Net interest income after credit for credit losses |

|

|

1,169,523 |

|

|

|

1,026,651 |

|

|

|

|

|

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

| Fees and commissions income |

|

|

672,050 |

|

|

|

639,422 |

|

| Foreign exchange losses—net |

|

|

(42,982 |

) |

|

|

(35,659 |

) |

| Trading account profits (losses)—net |

|

|

562,518 |

|

|

|

(192,113 |

) |

| Investment securities gains—net |

|

|

63,232 |

|

|

|

129,961 |

|

| Equity in earnings of equity method investees—net |

|

|

121,538 |

|

|

|

87,151 |

|

| Other non-interest income |

|

|

56,426 |

|

|

|

64,700 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,432,782 |

|

|

|

693,462 |

|

|

|

|

|

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

|

534,889 |

|

|

|

496,784 |

|

| Occupancy expenses—net |

|

|

82,643 |

|

|

|

78,619 |

|

| Fees and commission expenses |

|

|

118,546 |

|

|

|

111,437 |

|

| Outsourcing expenses, including data processing |

|

|

121,568 |

|

|

|

105,052 |

|

| Depreciation of premises and equipment |

|

|

54,525 |

|

|

|

49,358 |

|

| Amortization of intangible assets |

|

|

107,308 |

|

|

|

99,550 |

|

| Impairment of intangible assets |

|

|

108 |

|

|

|

133 |

|

| Insurance premiums, including deposit insurance |

|

|

57,200 |

|

|

|

50,445 |

|

| Communications |

|

|

26,721 |

|

|

|

24,924 |

|

| Taxes and public charges |

|

|

47,560 |

|

|

|

34,523 |

|

| Other non-interest expenses |

|

|

177,278 |

|

|

|

138,877 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,328,346 |

|

|

|

1,189,702 |

|

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

|

|

1,273,959 |

|

|

|

530,411 |

|

| Income tax expense |

|

|

409,999 |

|

|

|

99,411 |

|

|

|

|

|

|

|

|

|

|

| Net income before attribution of noncontrolling interests |

|

|

863,960 |

|

|

|

431,000 |

|

| Net income attributable to noncontrolling interests |

|

|

25,664 |

|

|

|

47,686 |

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Mitsubishi UFJ Financial Group |

|

|

838,296 |

|

|

|

383,314 |

|

|

|

|

|

|

|

|

|

|

| Income allocated to preferred shareholders: |

|

|

|

|

|

|

|

|

| Cash dividends paid |

|

|

8,970 |

|

|

|

8,970 |

|

| Changes in a foreign affiliated company’s interests in its subsidiary |

|

|

— |

|

|

|

3,301 |

|

|

|

|

|

|

|

|

|

|

| Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group |

|

|

829,326 |

|

|

|

371,043 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in yen) |

|

|

|

|

|

|

| Earnings per common share applicable to common shareholders of Mitsubishi UFJ Financial Group: |

|

|

|

|

|

|

|

|

| Basic earnings per common share—Earnings applicable to common shareholders of Mitsubishi UFJ Financial Group |

|

|

58.55 |

|

|

|

26.21 |

|

| Diluted earnings per common share—Earnings applicable to common shareholders of Mitsubishi UFJ Financial

Group |

|

|

58.35 |

|

|

|

26.10 |

|

-4-

(US GAAP)

Mitsubishi UFJ Financial Group, Inc. and Subsidiaries

Condensed Consolidated Statements

of Comprehensive Income (Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

For the six months ended

September 30, |

|

| (in millions of yen) |

|

2014 |

|

|

2013 |

|

| Net income before attribution of noncontrolling interests |

|

|

863,960 |

|

|

|

431,000 |

|

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

| Net unrealized gains on investment securities |

|

|

442,705 |

|

|

|

133,548 |

|

| Net unrealized gains (losses) on derivatives qualifying for cash flow hedges |

|

|

1,538 |

|

|

|

(12 |

) |

| Defined benefit plans |

|

|

15,146 |

|

|

|

17,677 |

|

| Foreign currency translation adjustments |

|

|

2,942 |

|

|

|

284,255 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

462,331 |

|

|

|

435,468 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income |

|

|

1,326,291 |

|

|

|

866,468 |

|

|

|

|

|

|

|

|

|

|

| Net income attributable to noncontrolling interests |

|

|

25,664 |

|

|

|

47,686 |

|

| Other comprehensive income (loss) attributable to noncontrolling interests |

|

|

12,870 |

|

|

|

(1,531 |

) |

|

|

|

|

|

|

|

|

|

| Comprehensive income attributable to Mitsubishi UFJ Financial Group |

|

|

1,287,757 |

|

|

|

820,313 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans (Unaudited) |

|

|

|

|

|

|

|

|

| (in millions of yen) |

|

As of

September 30,

2014 |

|

|

As of

March 31,

2014 |

|

| Impaired loans |

|

|

1,696,920 |

|

|

|

1,861,027 |

|

| Other than impaired loans |

|

|

109,497,287 |

|

|

|

108,415,384 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

111,194,207 |

|

|

|

110,276,411 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses (Unaudited) |

|

|

|

|

|

|

|

|

| (in millions of yen) |

|

As of

September 30,

2014 |

|

|

As of

March 31,

2014 |

|

| Related to impaired loans |

|

|

605,866 |

|

|

|

750,321 |

|

| Related to other than impaired loans |

|

|

335,022 |

|

|

|

344,099 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

940,888 |

|

|

|

1,094,420 |

|

|

|

|

|

|

|

|

|

|

-5-

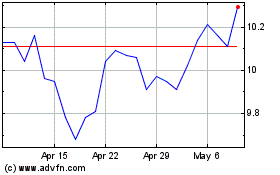

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

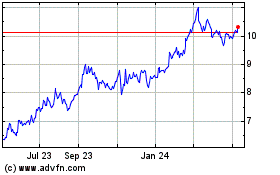

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024