UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) April 1, 2015

MERITAGE HOMES CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Maryland |

|

1-9977 |

|

86-0611231 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

FileNumber) |

|

(IRS Employer

Identification No.) |

|

|

| 8800 East Raintree Drive, Suite 300, Scottsdale, Arizona |

|

85260 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(480) 515-8100

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 5.02 |

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. |

On April 1, 2015, the employment of Steven Davis, the Company’s Executive Vice President and Chief Operating Officer, ended. The

Company expresses its thanks to Mr. Davis for his service to the Company. Subject to his execution of a customary release, Mr. Davis will be entitled to severance payments and benefits for a no cause termination in accordance with his

existing employment agreement, a copy of which is filed as Exhibit 10.1 to this Form 8-K and incorporated by reference herein. The Company estimates these severance payments will result in a second quarter charge of approximately $3.1 million of

which approximately $0.9 million relates to the acceleration of equity awards. Additionally, another approximate $1.5 million will be expensed over the next three years related to the continued vesting of performance equity awards.

Also on April 1, 2015, the Company appointed Phillippe Lord the Company’s new Executive Vice President and Chief Operating Officer.

Prior to his appointment as Chief Operating Officer, Mr. Lord, 41, was the Company’s Western Region President since 2012. From 2008 to 2012, Mr. Lord was the Company’s Vice President of Strategic Operations. Prior to joining

Meritage, Mr. Lord held various management positions with other homebuilders/land development companies. The Company has not named a replacement Western Region President.

Effective upon his appointment as Chief Operating Officer, Mr. Lord will receive a compensation and benefits package similar in structure

to the Company’s other executive vice presidents. Mr. Lord’s packages includes a base salary of $450,000, an annual cash incentive bonus with target bonus of $1,000,000 (with a maximum bonus of up to 1.5 times target), and an annual

equity award grant with an aggregate award value of $700,000, with 50% of the award value to be comprised of service-based restricted stock units and 50% of the award value to be comprised of three-year performance shares. In addition, Mr. Lord

will receive other benefits, such as an auto allowance and life and disability insurance similar to those offered to the Company’s senior officers. Mr. Lord’s employment arrangement also provides for a severance payment in the event

his employment is terminated without cause. The amount of such payment is equal to the sum of his annual base salary on the date of termination and the higher of (i) his average annual cash incentive bonus paid for the two years prior to his

termination of employment or (ii) the annual cash incentive bonus paid to him for the year preceding his termination; provided, such severance payment (1) shall not exceed $2 million and (2) is subject to Mr. Lord’s

execution and delivery of a customary release.

The above description of Mr. Lord’s compensation arrangement is qualified in its

entirety by the terms and conditions set forth in the letter filed at Exhibit 10.2 to this Form 8-K, which is incorporated by reference herein.

2

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

|

|

|

|

|

| 10.1 |

|

Steven Davis Second Amended and Restated Employment Agreement (incorporated by reference to Exhibit 10.4 of the Registrant’s Form 8-K filed on March 28, 2014) |

|

|

| 10.2 |

|

Phillippe Lord Employment Letter* |

| * |

Confidential information on this exhibit has been omitted and filed separately with the Securities and Exchange Commission pursuant to a Confidential Treatment Request. |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: April 1, 2015

|

|

|

| MERITAGE HOMES CORPORATION |

|

| /s/ LARRY W. SEAY |

| By: |

|

Larry W. Seay |

|

|

Executive Vice President and Chief Financial Officer |

4

Exhibit 10.2

Confidential information in the attachment to this agreement has been omitted and filed separately with the Securities and Exchange Commission pursuant to

a Confidential Treatment Request.

Meritage Letterhead

March 31, 2015

Phillippe Lord

Dear Phillippe:

Meritage Homes Corporation

(the “Company”) is pleased to offer you the position of Executive Vice President effective as of March 31, 2015. We anticipate that you will be appointed Chief Operating Officer in April 2015, following approval of the Board. Upon

appointment as Chief Operating Officer, you will report to the Chief Executive Officer and shall perform such duties as are associated with that position and as directed by the Chief Executive Officer. The Executive Compensation Committee (the

“Committee”) has approved the following terms for your employment:

1. Base Salary: You will be paid a base salary

(“Base Salary”) at the annual rate of $450,000 per year. The Committee may adjust your Base Salary from time to time, provided that the Base Salary (as previously increased, if applicable) may not be reduced without your consent. The Base

Salary will be payable in accordance with the payroll practices of the Company in effect from time to time, but not less frequently than monthly.

2. Incentive Compensation: You are currently entitled to receive a bonus pursuant to the 2015 Annual Bonus Program for your

pre-March 31, 2015 position as Regional Vice President (the “Prior Bonus Program”) as set forth in that letter to you effective January 1, 2015. This letter will modify the Prior Bonus Program. You will for 2015 still be entitled

to a bonus as calculated under the Prior Bonus Program, except that the total bonus you will be entitled to is the bonus as calculated under the Prior Bonus Program multiplied by 25% (to reflect the pro rata portion of that bonus applicable for the

first quarter of the year). In addition, subject to your acceptance of this letter, the Committee has awarded you bonus under the Meritage Homes Corporation Executive Management Incentive Plan (the “Incentive Plan”) for the performance

period beginning January 1, 2015 and ending December 31, 2015 (the “2015 Performance Period”). Your Target Bonus under the Incentive Plan is $1,000,000 for the 2015 Performance Period. The actual bonus payable to you for the 2015

Performance Period, if any, shall be an amount ranging from 0% to 150% of the Target Bonus, contingent on the achievement of the performance goals established by the Committee and set forth in Attachment A. The Threshold Bonus is 25% of a

Target Bonus. For 2015 only, the actual bonus you will be entitled to is the bonus as calculated under the Incentive Plan (based on the Target Bonus described above),

multiplied by 75% (to reflect the pro rata portion of the bonus for the last three quarters of the year). For future annual performance periods during your employment, you will be entitled to a

Target Bonus equal to $1,000,000 under the Incentive Plan, unless you are otherwise notified by the Committee. The actual incentive bonus payable to you in future years shall be an amount ranging from 0% to 150% of the Target Bonus, contingent on

the achievement of the performance goals established by the Committee. Your bonus is subject to the terms and conditions of the Incentive Plan. The Prior Bonus Program will have no applicability after 2015.

3. Restricted Stock Units. In February 2015, you received a grant of 6,000 restricted stock units (the “Prior Stock Award”)

pursuant to the Meritage Homes Corporation Amended and Restated 2006 Stock Incentive Plan (the “Stock Plan”). By signing below, you hereby agree that the Prior Stock Award will be cancelled in its entirety and you will have no further

rights relating to the Prior Stock Award. Alternatively, subject to your acceptance of this letter, as of March 31, 2015, you have been granted restricted stock units under the Stock Plan giving you the right to receive shares of common stock

of the Company (“Shares”) with a fair market value on the date of grant, based on the closing price of the Company’s stock on such date of $350,000. These restricted stock units will become fully vested on March 31, 2018. For

years after 2015, you will also be entitled to a grant of restricted stock units under the Stock Plan giving you the right to receive Shares with a fair market value on the date of grant, based on the closing price of the Company’s stock on

such date of $350,000, subject to the approval of the Committee. The restricted stock units are subject to the terms and conditions of the award agreement and the Stock Plan, including any limits on the maximum number of Shares in any year. The

restricted stock units shall vest on the third anniversary of the date of grant.

4. Performance Share Award. You are also hereby

granted a Performance Share Award pursuant to the Stock Plan for the performance period beginning on January 1, 2015 and ending on December 31, 2017 (the “Initial Performance Period”). Your target number of Shares for the Initial

Performance Period is the number of Performance Shares equal to $350,000 divided by the fair market value of one share of stock as of March 31, 2015 (the “Grant Date”). The actual number of Performance Shares payable, if any, shall be

an amount ranging from 0% to 150% of such target number of Shares, contingent upon the achievement of the performance goals established by the Committee and set forth in Attachment A. For future performance periods, you will be entitled to a

grant of a target number of Shares with a fair market value on the date of grant, based on the closing price of the Company’s stock on such date of $350,000. The actual number of Performance Shares payable, if any, shall be an amount ranging

from 0% to 150% of such target number of Shares, contingent upon the achievement of the performance goals established by the Committee for such performance period. The Performance Share Award is subject to the terms and conditions of the award

agreement and the Stock Plan, including any limits on the maximum number of Shares in any year.

5. Auto Allowance. An annual auto

allowance of $14,400 will be provided to you, payable at the rate of $1,200 per month. This allowance is taxable.

2

6. Life Insurance and Disability Benefits. The Company shall provide you with term life

insurance in the amount of $3,000,000 (or at the Company’s option, reimbursement of premiums paid by you for such policy up to a maximum annual premium reimbursement of $10,000). The Company will also provide you with disability insurance with

monthly benefits of $20,000 in the event of your total disability (or reimburse premiums paid by you for such policy). Taxes related to any payments for life insurance and disability insurance are your responsibility and, accordingly, the Company

will withhold taxes applicable to such payments.

7. Other Benefit Plans. You will be entitled to participate in all of the

retirement, medical, and other benefit programs available to senior executive officers of the Company.

8. Terms of Employment.

Your employment with the Company will be for no specific period of time. Rather, your employment will be at-will, meaning that you or the Company may terminate the employment relationship at any time, with or without Cause (as defined below), and

with or without notice and for any reason or no particular reason. Although your compensation and benefits may change from time to time, the at-will nature of your employment may only be changed by an express written agreement signed by an

authorized officer of the Company.

9. Termination by the Company without Cause. If the Company terminates your employment without

“Cause” then:

(a) the Company shall within 15 days after termination, or such shorter period as may be required by applicable

law, pay your Base Salary through the date of termination and any accrued but unused paid time off amounts; and

(b) the Company will pay

you an amount equal to the sum of:

(1) your annual Base Salary on the date of termination,

(2) the higher of (x) the average annual cash incentive bonus (under the Incentive Plan, and/or as applicable, Prior Bonus Program

for a termination without Cause in 2015 or 2016) paid to you for the two years prior to your termination of employment or (y) the annual cash incentive bonus (under the Incentive Plan, and/or as applicable, the Prior Bonus Program for a

termination without Cause in 2015 or 2016) paid to you for the year preceding the date of termination, and

(3) 150% of the monthly COBRA

premium payable for the coverage in effect on the date of your termination and, if applicable, your dependents under the Company’s group health plan, multiplied by 18.

For the avoidance of doubt, you will be entitled to the payment set forth in the prior sentence if your employment is terminated without Cause following a

Change of Control of the Company. In no event, however, will the amount due pursuant to this paragraph (b) exceed $2 million. The

3

amount due pursuant to this paragraph (b) shall be paid in a lump sum payment within 60 days following your termination of employment, provided you have signed and not revoked the release as

described below. If the 60 day period spans two calendar years, the payment of this amount will be made in the second calendar year.

Notwithstanding anything to the contrary herein, no payments will be made pursuant to paragraph 9(b) unless you execute (and do not revoke) a

customary legal release, in form reasonably acceptable to the Company, in which you release the Company, affiliates, directors, officers, employees, agents and others affiliated with the Company from any and all claims, including claims relating to

your employment with the Company and the termination of your employment. The release shall be provided to you within 5 days following your termination of employment. The release must be executed and returned to the Company within the 21 or 45 day

(as applicable) period described in the release and it must not be revoked by you within the 7-day revocation period described in the release.

For purposes of this Agreement, the term “Cause” will exist if you (a) have engaged in malfeasance, willful or gross

misconduct, or willful dishonesty that materially harms the Company or its stockholders, (b) are convicted of a felony that is materially detrimental to the Company or its stockholders, (c) are convicted of or enters a plea of nolo

contendere to a felony that materially damages the Company’s financial condition or reputation or to a crime involving fraud; (d) are in material violation of and Company policy including, without limitation, the Company’s

ethics/policy code, including breach of duty of loyalty in connection with the Company’s business; (e) willfully fail to perform duties of your position after notice by the Board and an opportunity to cure; (f) impede, interfere or

fail to reasonably cooperate with an investigation authorized by the Board or fail to follow a legal and proper Board directive; and (g) engage in willful misconduct or gross negligence that results in a restatement of financial results

pursuant to the Sarbanes-Oxley Act.

For purposes of this Agreement, the term “Change of Control” shall mean and include the

following transactions or situations: (a) The acquisition of beneficial ownership, directly or indirectly, of securities having 35% or more of the combined voting power of Meritage’s then outstanding securities by any “Unrelated

Person” or “Unrelated Persons” acting in concert with one another. For purposes of this Section, the term “Person” shall mean and include any individual, partnership, joint venture, association, trust, corporation, or other

entity (including a “group” as referred to in Section 13(d)(3) of the Securities Exchange Act of 1934 (the “Act”)). For purposes of this Section, the term “Unrelated Person” shall mean and include any Person other

than the Company, or an employee benefit plan of the Company, or any officer, director, or 10% or more shareholder of the Company as of the date of this Agreement; (b) a sale, transfer, or other disposition through a single transaction or a

series of transactions of all or substantially all of the assets of Meritage to an Unrelated Person or Unrelated Persons acting in concert with one another; (c) any consolidation or merger of Meritage with or into an Unrelated Person, unless

immediately after the consolidation or merger the holders of the common stock of Meritage immediately prior to the consolidation or merger are the Beneficial Owners of

4

securities of the surviving corporation representing at least 50% of the combined voting power of the surviving corporation’s then outstanding securities; and (d) a change during any

period of two consecutive years of a majority of the members of the Board of Directors of Meritage for any reason, unless the election, or the nomination for election by the Company’s shareholders, of each director was approved by the vote of a

majority of the directors then still in office who were directors at the beginning of the period.

10. Restrictive Covenant. In

consideration of the agreements, payments and benefits provided for in this letter, including, but not limited to, the termination benefits set forth in Section 9, you covenant and agree that for a period of two years from the date your

employment terminates, you will not, directly or indirectly, either as an executive, partner, owner, lender, director, advisor or consultant or in any other capacity or through any entity:

(a) Directly or indirectly, hire or solicit for employment for any other business entity (other than the Company) any person who is, or within

the six month period preceding the date of such activity was, an employee of or consultant to the Company (other than as a result of a general solicitation for employment); or

(b) Solicit any customer or supplier of the Company (including lot developers and land bankers) for a production homebuilding business or

otherwise attempt to induce any such customer or supplier to discontinue or materially modify its relationship with the Company.

(c)

Engage in any production homebuilding or home sales within 100 miles of any Company project, provided, that, for purposes of this Section 10(c), you (i) may own stock in the Company and less than 1% of any other publicly traded

homebuilder, and (ii) may engage in custom homebuilding (up to 5 homes annually for third parties and 2 for family members).

Notwithstanding the foregoing, if your employment is terminated without Cause within two years following a Change of Control of the Company,

the restrictive period relating to clause (c) will be one year. The covenants set forth in this Section 10 shall begin as of the date you accept this letter agreement and will survive your termination of employment. You further agree that

the period of time in which this Section 10 is in effect shall be extended for a period equal to the duration of any breach by you of this Section 10.

By signing below you represent to the Company that you is willing and able to engage in businesses that are not competing businesses hereunder

and that enforcement of the restrictions set forth in this Section 10 would not be unduly burdensome to you. You hereby agrees that the period of time provided for in this Section 10 and other provisions and restrictions set forth herein

are reasonable and necessary to protect the Company and its successors and assigns in the use and employment of the goodwill of the business conducted by you. You agrees that, if you in any material respect violates the terms of this Section 10

or Section 11 below, the Company shall not be obliged to pay any remaining payments or benefits specified in Section 9, provided that the Company must first provide you with written notice of such violation and the

5

opportunity to provide within thirty (30) days any information showing that you has not in any material respect breached such letter agreement. During any notice period or any dispute

regarding the violation of the terms of this Section 10 or Section 11, the Company will place such payments in an interest bearing escrow account. You further agrees that damages cannot adequately compensate the Company in the event of a

violation of this Section 10 and that, if such violation should occur, injunctive relief shall be essential for the protection of the Company and its successors and assigns. Accordingly, you hereby covenant and agree that, in the event any of

the provisions of this Section 10 shall be violated or breached, the Company shall be entitled to obtain injunctive relief against the party or parties violating such covenants without bond but upon due notice, in addition to such further or

other relief as may be available at equity or law. An injunction by the Company shall not be considered an election of remedies or a waiver of any right to assert any other remedies which the Company has at law or in equity. No waiver of any breach

or violation hereof shall be implied from forbearance or failure by the Company to take action thereof. The prevailing party in any litigation, arbitration or similar dispute resolution proceeding to enforce this provision will recover any and all

reasonable costs and expenses, including attorneys’ fees.

11. Non-Disclosure of Confidential Information.

(a) It is understood that in the course of your employment with Company, you will become acquainted with Company Confidential Information (as

defined below). By signing below, you acknowledge that you recognize that Company Confidential Information has been developed or acquired at great expense, is proprietary to the Company, and is and shall remain the exclusive property of the Company.

Accordingly, you agree that except as otherwise ordered in a legal or regulatory proceeding, you will not, disclose to others, copy, make any use of, or remove from Company’s premises any Company Confidential Information, except as your duties

may specifically require, without the express written consent of the Company, during your employment with the Company and thereafter until such time as Company Confidential Information becomes generally known, or readily ascertainable by proper or

legal means by persons unrelated to the Company.

(b) Upon any termination of your employment, you shall promptly deliver to the Company

the originals and all copies of any and all materials, documents, notes, manuals, or lists containing or embodying Company Confidential Information, or relating directly or indirectly to the business of the Company, in your possession or control.

(c) You agree that the period of time provided for in this Section 11 and other provisions and restrictions set forth herein are

reasonable and necessary to protect the Company and its successors and assigns in the use and employment of the goodwill of the business conducted by you. You further agree that damages cannot adequately compensate the Company in the event of a

violation of this Section 11 and that, if such violation should occur, injunctive relief shall be essential for the protection of the Company and its successors and assigns. Accordingly you hereby covenant and agree that, in the event any of

the provisions of this

6

Section 11 shall be violated or breached, the Company shall be entitled to obtain injunctive relief against the party or parties violating such covenants, without bond but upon due notice,

in addition to such further or other relief as may be available at equity or law. Obtainment of such an injunction by the Company shall not be considered an election of remedies or a waiver of any right to assert any other remedies which the Company

has at law or in equity. No waiver of any breach or violation hereof shall be implied from forbearance or failure by the Company to take action thereof. The prevailing party in any litigation, arbitration or similar dispute resolution proceeding to

enforce this provision will recover any and all reasonable costs and expenses, including attorneys’ fees.

(d) “Company

Confidential Information” shall mean confidential, proprietary information or trade secrets of Company and its subsidiaries and affiliates including without limitation the following: (1) customer lists and customer information as

compiled by Company; (2) the Company’s internal practices and procedures; (3) the Company’s financial condition and financial results of operation; (4) supply of materials information, including sources and costs, designs,

information on land and lot inventories, and current and prospective projects; (5) strategic planning, manufacturing, engineering, purchasing, finance, marketing, promotion, distribution, and selling activities; (6) all other information

which you have a reasonable basis to consider confidential or which is treated by Company as confidential; and (7) all information having independent economic value to Company that is not generally known to, and not readily ascertainable by

proper or legal means by, persons who can obtain economic value from its disclosure or use. Notwithstanding the foregoing provisions, the following shall not be considered “Company Confidential Information”: (i) your general skills as

an experienced real estate and homebuilding entrepreneur and senior management level employee; (ii) information generally known by senior management executives within the homebuilding and/or land development industry; (iii) persons,

entities, contacts or relationships of yours hat are also generally known in the industry; and (iv) information which becomes available on a non-confidential basis from a source other than you which source is not prohibited from disclosing such

confidential information by legal, contractual or other obligation.

12. Compliance with Code Section 409A. This offer letter

is intended to comply with Section 409A of the Internal Revenue Code (“Section 409A”) or an exemption thereunder and shall be construed and administered in accordance with Section 409A. Notwithstanding any other provision of this

offer letter, payments provided under this offer letter may only be made upon an event and in a manner that complies with Section 409A or an applicable exemption. Any payments under this offer letter that may be excluded from Section 409A

either as separation pay due to an involuntary separation from service or as a short-term deferral shall be excluded from Section 409A to the maximum extent possible. Any payments to be made under this offer letter upon a termination of

employment shall only be made upon a “separation from service” under Section 409A. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under this offer letter comply with

Section 409A and in no event shall the Company be liable for all or any portion of any taxes,

7

penalties, interest or other expenses that may be incurred by you on account of non-compliance with Section 409A.

Notwithstanding any other provision of this offer letter, if any payment or benefit provided to you in connection with termination of

employment is determined to constitute “nonqualified deferred compensation” within the meaning of Section 409A and you are determined to be a “specified employee” as defined in Section 409A(a)(2)(b)(i), then such

payment or benefit shall not be paid until the first payroll date to occur following the six-month anniversary of your termination date (the “Specified Employee Payment Date”) or, if earlier, on the date of your death. The aggregate of any

payments that would otherwise have been paid before the Specified Employee Payment Date shall be paid to you in a lump sum on the Specified Employee Payment Date and thereafter, any remaining payments shall be paid without delay in accordance with

their original schedule.

13. Effect of Restatement of Financial Results. Notwithstanding anything in this offer letter to the

contrary, to the extent any financial results are misstated as a result of your willful misconduct or gross negligence, and as a result such financial results are subsequently restated downward resulting in lower levels of bonuses pursuant to

Sections 2 and 4, offsets shall be made against future bonuses. If such future bonuses are insufficient to offset the full difference between the awarded bonuses and restated bonuses and/or if such restatement occurs at the end of your employment,

bonuses previously earned and delivered may be clawed-back.

14. Directors and Officers Liability Insurance; Indemnification. In

the event your employment is terminated, (1) you shall remain covered under the directors and officers liability insurance maintained by the Company in commercially reasonable amounts (as determined by the Board) to the same extent as

executives of the Company; and (2) you shall remain eligible for indemnification by the Company to the extent provided for in the Company by-laws in effect from time to time, provided that such indemnification shall not be less favorable than

the indemnification provided for in the Company’s by-laws in effect as of March 31, 2015.

15. Acknowledgment. You

acknowledge that (1) the terms of your offer letter are intentionally different from the employment agreements entered into with other named executive officers of the Company and (2) the terms of employment with the other named executive

officers of the Company are not applicable to your employment with the Company. You agree that the terms in this offer letter are the only terms applicable to your employment with the Company. You further acknowledge that you have carefully reviewed

and understand the terms of this offer letter and have consulted with an attorney regarding the terms of this offer letter.

16.

Governing Law. This offer letter shall be governed by the laws of Arizona, without regard to conflict of law principles.

8

We look forward to your continued employment with the Company.

|

| Very truly yours, |

|

| /s/ Steve Hilton |

|

| Steve Hilton |

| Chief Executive Officer |

|

|

|

|

|

|

|

| Above terms accepted and agreed to: |

|

|

|

|

|

|

| /s/ Phillippe Lord |

|

|

|

3-31-15 |

|

|

| Phillippe Lord |

|

|

|

Date |

|

|

9

Attachment A

The performance restricted share award goals are set forth below.

|

|

|

|

|

|

|

|

|

| Relative TSR Goal-40% weighting |

|

Peer Group Rank |

|

|

% of Shares received |

|

| Stretch Target -maximum |

|

|

80 |

% |

|

|

150 |

% |

| High Target |

|

|

65 |

% |

|

|

125 |

% |

| Target |

|

|

50 |

% |

|

|

100 |

% |

| Threshold |

|

|

40 |

% |

|

|

50 |

% |

| Below Threshold |

|

|

<40 |

% |

|

|

0 |

% |

|

|

|

| EPS Goal-30% weighting |

|

Cumulative EPS |

|

|

% of Shares received |

|

| Stretch Target -maximum |

|

$ |

* |

|

|

|

150 |

% |

| High Target |

|

$ |

* |

|

|

|

100 |

% |

| Target |

|

$ |

* |

|

|

|

100 |

% |

| Low Target |

|

$ |

* |

|

|

|

100 |

% |

| Threshold |

|

$ |

* |

|

|

|

50 |

% |

| Below Threshold |

|

<$ |

* |

|

|

|

0 |

% |

|

|

|

| RoA Goal-30% weighting |

|

3 year RoA |

|

|

% of Shares received |

|

| Stretch Target -maximum |

|

|

|

*% |

|

|

150 |

% |

| High Target |

|

|

|

*% |

|

|

100 |

% |

| Target |

|

|

|

*% |

|

|

100 |

% |

| Low Target |

|

|

|

*% |

|

|

100 |

% |

| Threshold |

|

|

|

*% |

|

|

50 |

% |

| Below Threshold |

|

|

< |

*% |

|

|

0 |

% |

Share award amounts will be interpolated between target levels.

The relative TSR goal will be measured using only the homebuilding companies within the Company’s peer group and exclude any building product companies.

The cash bonus compensation goals are set forth below.

|

|

|

|

|

|

|

|

|

| Adj EBITDA Goal-60% weighting |

|

Amount |

|

|

% of Target Bonus |

|

| Stretch Target -maximum |

|

$ |

|

* |

|

|

150 |

% |

| Target |

|

$ |

|

* |

|

|

100 |

% |

| Intermediate |

|

$ |

|

* |

|

|

50 |

% |

| Threshold |

|

$ |

|

* |

|

|

25 |

% |

| Below Threshold |

|

$ |

|

* |

|

|

0 |

% |

| * |

Confidential information on this attachment has been omitted and filed separately with the Securities and Exchange Commission pursuant to a Confidential Treatment Request. |

|

|

|

|

|

|

|

|

|

| Closings Goal-30% weighting |

|

Closings |

|

|

% of Target Bonus |

|

| Stretch target -maximum |

|

|

|

* |

|

|

150 |

% |

| Target |

|

|

|

* |

|

|

100 |

% |

| Intermediate |

|

|

|

* |

|

|

50 |

% |

| Threshold |

|

|

|

* |

|

|

25 |

% |

| Below Threshold |

|

|

|

* |

|

|

0 |

% |

|

|

|

| Cust Satis Goal-10% weighting |

|

Rating |

|

|

% of Target Bonus |

|

| Stretch target -maximum |

|

|

|

*% |

|

|

150 |

% |

| Target |

|

|

|

*% |

|

|

100 |

% |

| Intermediate |

|

|

|

*% |

|

|

50 |

% |

| Threshold |

|

|

|

*% |

|

|

25 |

% |

| Below Threshold |

|

|

< |

*% |

|

|

0 |

% |

Bonus amounts will be interpolated between target levels.

Target Bonus Goal: $1,000,000

For the cumulative EPS growth,

RoA and Adjusted EBITDA goals noted above, computations of such measures will be adjusted to (1) eliminate any impact of South Edge legal outcome or settlements (both positive and negative) and (2) exclude non-routine charges.

| * |

Confidential information on this attachment has been omitted and filed separately with the Securities and Exchange Commission pursuant to a Confidential Treatment Request. |

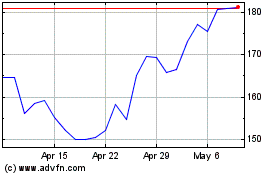

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

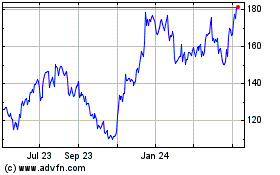

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2023 to Apr 2024