EARNINGS PREVIEW: Weak Selling Season Weighed On Builders' 2Q

July 18 2011 - 1:59PM

Dow Jones News

TAKING THE PULSE: U.S. home builders' hopes for a strong spring

selling season were dashed again in the second quarter, as the

multiyear housing slump continued depressing sales.

Home buyer traffic remains at anemic levels, with buyers still

stuck on the sidelines. Bargain-priced foreclosures remain stiff

competition for builders, while would-be buyers are getting stung

by strict lending standards.

In recent months, builders have also faced tough year-over-year

comparisons because of last year's federal home-buyer tax credit.

The offer of up to $8,000 pulled many sales forward, severely

depressing this year's counts.

Indeed, Los Angeles-based KB Home (KBH) last month reported that

its second-quarter revenues and the number of homes delivered both

fell by nearly 30%.

The tax offer expired last summer, so comparisons should return

to more normal levels in coming months.

There's also nascent optimism that, as the inventory of

foreclosed homes dips, more new homes will sell. Plus, the group

has dramatically curbed construction in recent years, resulting in

a low inventory that some industry watchers warn could lead to a

shortage should consumer interest heat up.

"Housing should continue to stabilize and slowly recover over at

least the next 24 months, and the builders are well positioned to

take advantage of an upturn," wrote Michael Rehaut, a J.P. Morgan

home builder analyst who is quite bullish on the sector, in a

recent client note.

Monday, the National Association of Home Builders trade group

said its closely-watched housing market index climbed two points to

15 in July, one point more than expected. For now, at least, "the

market continues to bounce along the bottom," David Crowe, NAHB's

chief economist, said in the index release.

For how long, of course, remains to be seen.

COMPANIES TO WATCH

NVR Inc. (NVR) - Expected to report Thursday

Wall Street Expectations: Analysts polled by Thomson Reuters

expect earnings of $6.22 a share on revenue of $683 million. A year

ago, NVR reported net income of $11.13 a share and revenue of $947

million.

Key Issues: That's right, NVR could earn money. But NVR, the

largest builder by market capitalization, isn't your traditional

operator. It has a risk-averse culture that avoids land ownership

and the industry's fastest home-construction turnaround time. It

has also generally shied from the boom-to-bust markets of southern

California, Nevada and Arizona, making it a standout in the

troubled sector. Still, the projected year-over-year revenue

decline shows the builder has not escaped the turmoil

unscathed.

D.R. Horton Inc. (DHI) - Reports July 28

Wall Street Expectations: Analysts project a fiscal

third-quarter gain of $0.06 cents a share and revenue of $987

million. A year earlier, DR Horton made $0.16 a share on revenue of

$1.4 billion.

Key Issues: D.R. Horton, one of the sector's largest builders,

sells to many first-time buyers, a crowd that was largely tapped by

the tax credit. That could weigh on results. On a bright note,

Horton is experimenting with "micro homes"--two-bedrooms that

measure just 687 square feet--where buyers can live a car-free

lifestyle. With gas prices around $4 a gallon, these homes priced

from in the $100,000s will undoubtedly attract consumers looking

for something different.

Meritage (MTH) - Reports July 29

Wall Street Expectations: Analysts anticipate a loss of $0.04 a

share on revenue of $204 million. That's down from last year's

profit of $0.13 on revenue of $291 million.

Key Issues: Meritage is betting big on green: Its homes are

among the sector's most ecologically friendly. The company is

betting that penny-pinching buyers will be enticed by electric

bills cut by features including solar power, tighter insulation and

energy-efficient windows. Studies have shown that the green homes

generally outsell competitors two-to-one. "It gives us an advantage

over homes that don't have those features," says Brent Anderson,

vice president of investor relations.

(The Thomson Reuters estimate and year-ago net may not be

comparable due to one-time items and other adjustments.)

-By Dawn Wotapka, Dow Jones Newswires; 212-416-2193;

dawn.wotapka@dowjones.com

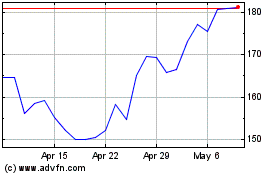

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

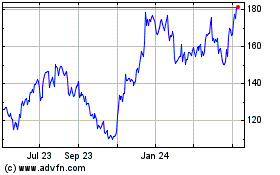

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2023 to Apr 2024