EARNINGS PREVIEW: US Home Builders' Pain Dragged On In 1Q

April 18 2011 - 2:05PM

Dow Jones News

TAKING THE PULSE: U.S. home builders struggled to sell homes --

and make money -- in their first quarters as the sector's multiyear

slump drags through the all-important spring selling season.

Homebuyer traffic and sales remain at anemic levels.

Bargain-priced foreclosures continue posing stiff competition for

builders, while would-be buyers are being stung by strict lending

standards. Consumers remain jittery that home values have further

to fall.

Monday, the National Association of Home Builders trade group

said its closely-watched housing market index slipped one point to

16 out of 100 in April.

There's no relief in sight: The "selling season is coming in

below expectations," notes David Goldberg, a UBS home-builder

analyst. "We expect the index to remain constrained over the next

few months."

Builder KB Home (KBH) earlier this month provided a glimpse

about what to expect from its peers in upcoming weeks: Its fiscal

first-quarter loss widened sharply as plunging orders fueled a

steep revenue drop and charges weighed on the bottom line.

The "operational results were shockingly disappointing," wrote

Stephen East, a builder analyst with Ticonderoga Securities, on

April 5. "All the headway made during 2010 appears to have been

tossed and the bar reset back one year."

To be sure, there are reasons for optimism. The glut of unsold

homes that forced six-figure markdowns during the sector's crash

has been reduced, leaving a manageable supply. Builders remain

flush with cash -- some boast cash hoards topping $1 billion.

And to prepare for recovery -- which has been pushed out to next

year -- they are slowly buying new land lots and jump-starting

construction in stalled communities. Meritage Homes Corp. (MTH)

recently announced an entrance into the Raleigh, N.C., area -- its

first new market since 2005 -- while M/I Homes Inc. (MHO) announced

the acquisition of a small Texas builder.

COMPANIES TO WATCH

NVR Inc. (NVR) -- expected Wednesday

Wall Street Expectations: Analysts polled by Thomson Reuters

expect earnings of $4.68 a share on revenue of $530 million. A year

ago, NVR reported net income of $5.01 a share and revenue of $577

million.

Key Issues: You read that right -- NVR could earn money. But

NVR, the largest builder by market cap, isn't your traditional

operator. It has a risk-averse culture that avoids land ownership

and the industry's fastest home-construction turnaround time. It

has also generally shied away from the boom-to-bust markets of

southern California, Nevada and Arizona, making it a standout in

the troubled sector.

PulteGroup (PHM) -- April 28

Wall Street Expectations: Analysts anticipate a loss of $0.13

cents a share on revenue of $813 million, compared with the

prior-year loss of $0.03 cents a share on revenue of $1

billion.

Key Issues: Analysts continue watching the 2009 acquisition of

Centex Corp. play out, becoming more convinced the sector giant

jumped too early and overpaid. At the time, the company touted the

benefit of cutting overhead costs and entering new markets. But the

housing market has taken much longer to heal than expected,

weighing on Pulte's performance.

Standard Pacific Corp. (SPF) -- April 28

Wall Street Expectations: Analysts anticipate a loss of $0.02 a

share on revenue of $137 million. That matches last year's loss of

$0.02 on revenue of $175 million.

Key Issues: StanPac remains the industry's maverick: While other

builders focus on entry level, it builds move-up homes. Competitors

are buying small parcels of land here and there, securing it via

option rather than paying outright. Standard Pacific, meanwhile, is

spending hundreds of millions of dollars on land -- some of it

undeveloped -- betting it will benefit as land and housing values

increase.

D.R. Horton Inc. (DHI) -- April 29

Wall Street Expectations: Analysts project a loss of $0.04 cents

a share and revenue of $756 million. A year earlier, DR Horton made

$0.04 a share on revenue of $914 million.

Key Issues: D.R. Horton, one of the sector's largest builders,

sells to many first-time buyers, a crowd that hasn't been out in

full force lately. That could affect results. On a bright note,

there might be some bragging on the earnings call -- Horton beat

Pulte for the nation's top builder spot by number of completed

annual sales. Last year, Horton closed on 18,983 homes compared

with Pulte's 17,095.

(The Thomson Reuters estimate and year-ago net may not be

comparable due to one-time items and other adjustments.)

--By Dawn Wotapka, Dow Jones Newswires; 212-416-2193;

dawn.wotapka@dowjones.com

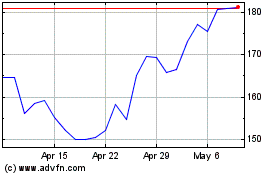

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

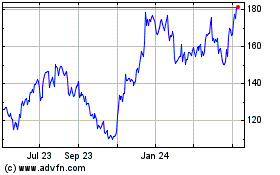

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2023 to Apr 2024