EARNINGS PREVIEW: US Home Builders Have Hopes For Spring

April 22 2010 - 3:54PM

Dow Jones News

TAKING THE PULSE: U.S. home builders, who have battled a

multiyear slump, are convinced they've turned a corner.

They're cash-rich, thanks to hoarding money and generous tax

refunds. That's letting them reload on land, enter new markets,

restart stalled communities and, in some cases, hire staffers,

something that hasn't been done since the crash.

As several large builders report in coming weeks, analysts and

investors are particularly interested in the key spring selling

season. The federal tax credit, offering buyers up to $8,000, is

set to expire later this month. So far, it doesn't seem to have

created a surge in deals.

"The spring selling season is not coming up all roses," Susan

Berliner, J.P. Morgan's fixed-income analyst, wrote in a client

note. "Our expectations are now a bit more muted for 1H10 as many

noted that the buyer credit did not have a material impact on their

sales."

Meanwhile, the usual headwinds continue. Unemployment remains a

stubborn issue, worrying would-be buyers, while the foreclosure

crisis drags on.

Several builders have provided a glimpse of what to expect:

Hovnanian Enterprises Inc. (HOV) saw an earnings improvement helped

by lower land-related charges. Standard Pacific Corp. (SPF) this

week said it narrowed its loss substantially.

COMPANIES TO WATCH

Meritage Homes Corp. (MTH)--reports April 28

Wall Street Expectations: Analysts polled by Thomson Reuters

expect a loss of 14 cents a share on revenue of $198 million. A

year ago, Meritage reported a loss of 60 cents a share and revenue

of $231 million.

Key Issues: Meritage earlier this month preannounced earnings

results, saying the federal tax credit didn't impact sales as much

as hoped. The builder expects to report about $201 million of

closing revenue on 808 homes with an average price of about

$248,000.

DR Horton (DHI) - April 30

Wall Street Expectations: Analysts project a loss of a penny a

share and revenue of $862 million. Horton's year-earlier loss was

34 cents a share on revenue of $775 million.

Key Issues: Horton has been quiet lately, focused on selling

homes and, eventually, rising from the No. 2 builder spot. Horton

is known to build speculative homes, or ones without a buyer in

mind. As with all builders, that could prove a problem should the

homes not sell.

"We remain concerned the tax credit has driven overbuilding and

will eventually result in discounting to sell excess inventory.

Although most of the builders have limited new construction and are

now more focused on rebuilding margins...it would only take a few

bad apples to spoil the bunch, thereby limiting home price

appreciation," UBS analyst David Goldberg wrote in a recent client

note.

PulteGroup Inc. (PHM) - May 5

Wall Street Expectations: Analysts anticipate a loss of 23 cents

a share on revenue of $1.2 billion compared with Pulte Homes'

prior-year loss of $2.02 a share on revenue of $587 million.

Key Issues: PulteGroup, which just changed its name from Pulte

Homes, is now the nation's largest builder, following its

acquisition of rival Centex Corp. last year. Analysts continue

watching the deal play out, wondering whether Pulte's acquisition

signaled the bottom of the housing slump and whether Pulte will pay

dearly for the mega deal.

They also wonder whether its attempts at branding will transform

it into a household name in an industry where most of the inventory

looks the same.

(The Thomson Reuters estimate and year-ago net may not be

comparable due to one-time items and other adjustments.)

-By Dawn Wotapka, Dow Jones Newswires; 212-416-2193;

dawn.wotapka@dowjones.com

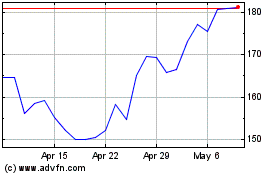

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

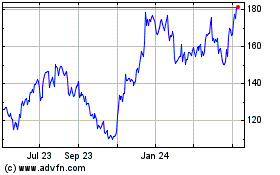

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Apr 2023 to Apr 2024