Current Report Filing (8-k)

April 14 2016 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

April 14, 2016

|

MGIC Investment Corporation

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Wisconsin

|

1-10816

|

39-1486475

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

250 E. Kilbourn Avenue, Milwaukee, Wisconsin

|

|

53202

|

|

________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

414-347-6480

|

Not Applicable

_____________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01

.

Other Events

.

Our executive officers have agreed to change certain long-term equity incentive awards made to them in 2015 and 2016 (the “CR Awards”) to prevent vesting based on performance in any year that is later than the originally scheduled performance year.

In addition, beginning in 2017, grants of certain other long-term equity incentive awards (the “BV Awards”) made to executive officers will include a three-year vesting period with no partial vesting allowed annually.

These changes are made in a continuing effort to be responsive to the feedback the Company receives from its shareholders and their advisors. Recent feedback indicates that the equity award terms being changed are viewed as qualitatively negative features of our executive compensation program.

CR Awards

.

Twenty percent of the long-term equity awards granted in 2015 and 2016 to our Chief Executive Officer and Executive Vice Presidents, and 40% of the awards to our executive officers who were Senior Vice Presidents, vest through continued service during a three-year performance period, if our “Combined Ratio” during the performance year is less than 40%. We refer to these as “CR Awards.” One-third of the CR Awards are scheduled to vest in each of the three years after they are granted. However, if any of the CR Awards that are scheduled to vest in any year do not vest because we fail to meet the Combined Ratio goal, the award will remain eligible for vesting if we meet the Combined Ratio goal in a future year, except that any of the award that has not vested after five years will be forfeited. Our executive officers agreed to waive this right to continued vesting through satisfaction of the Combined Ratio goal in a future year. If the Combined Ratio goal is not met for a particular performance year, the equity that was scheduled to vest will be forfeited.

BV Awards

.

BV Awards represent 80% of the long-term equity awards granted in 2015 and 2016 to the CEO and Executive Vice Presidents and 60% of the awards to executive officers who were Senior Vice Presidents. Vesting for these awards will occur over a three-year period, based on achievement of a three-year cumulative goal for growth in adjusted book value per share (and in the case of the 2015 grant, subject to the Company having a Combined Ratio of less than 40% in the applicable measurement year). Partial vesting may occur annually (up to a maximum of 1/3 for the first year and 2/3 for the first and second years combined) based on progress against the three-year cumulative goal.

Beginning in 2017, grants of BV Awards to executive officers will not allow partial vesting annually; awards would vest based only on performance during the entire three-year performance period against the three-year cumulative goal.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MGIC INVESTMENT CORPORATION

|

|

|

|

|

|

|

|

|

|

Date:

|

April 14, 2016

|

By: s Jeffrey H. Lane

|

|

|

|

|

|

|

|

Jeffrey H. Lane

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

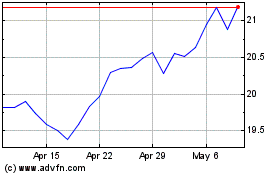

MGIC Investment (NYSE:MTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

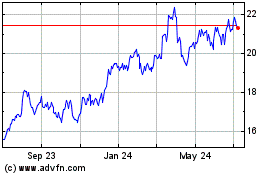

MGIC Investment (NYSE:MTG)

Historical Stock Chart

From Apr 2023 to Apr 2024