Mining Companies Seen as Winners After Trump Victory

November 09 2016 - 9:21AM

Dow Jones News

By Alex MacDonald

Mining and metals company stocks surged on Wednesday after the

election of Donald Trump, as investors looked to the

president-elect's promises to revive U.S. manufacturing and

rehabilitate the country's aging infrastructure.

Swiss commodities giant Glencore PLC was up 3% while the world's

second largest miner by market value, Rio Tinto PLC gained 2.5%.

ArcelorMittal, the world's largest steelmaker, was up 3.9%.

Overall, in London, the FTSE 350 mining index was up 3.4%

compared with a 0.2% drop in the FTSE 100 index. Among the biggest

winners here was Mexican precious metals producer Fresnillo PLC,

which rose 9%.

"The market is telling you that the mining sector is the biggest

beneficiary of a Trump election, particularly precious metals,"

said Jeremy Wrathall, senior analyst at Investec Securities.

Mr. Trump had made rejuvenating the U.S. coal industry a large

part of his platform, but that wasn't seen as the main factor

driving global mining company stocks higher.

Other reasons include a weakening dollar, making it cheaper to

purchase U.S. dollar denominated commodities. Both copper and

nickel were up 2.7% and 2.9% respectively.

Over the longer term, investors expect Mr. Trump's promise to

spend more on infrastructure, hospitals, highways and railways to

result in extra demand for commodities such as copper, steel and

aluminum. This "volume effect would take at least a year or so" to

hit miners' earnings, said Mr. Wrathall.

Mr. Trump has also called upon Mexico to pay for the

construction of a long wall on the U.S. border and to revisit trade

agreements with key partners to extract a fairer deal. The Mexican

peso fell to its lowest level ever against the U.S. dollar as a

result, following Mr. Trump's election.

Mr. Trump's promises have appealed to many voters in the rust

belt-states that were formerly a bastion of U.S. manufacturing but

which are now suffering from increased competition abroad.

It has also raised the specter of economic uncertainty among

some investors who fear Mr. Trump's talk of protectionist trade

policies and higher fiscal spending could hinder U.S. growth

prospects, according to Liberum Capital analyst Richard

Knights.

Investors responded by piling out of the U.S. dollar to invest

in gold, a safe-haven asset class that investors typically flock to

amid economic uncertainty as a way to preserve capital. Spot gold

was up 2.2% at $1,302 an ounce.

The gold price rise spurred shares in West Africa's Randgold

Resources Ltd. and Russia's Polymetal International PLC to rise

7.9% and 6.5% respectively.

Fresnillo, however, climbed the most out of the U.K.'s FTSE 100

index given that it earns all of its revenue in U.S. dollars

(through the sale of gold and silver) and incurs a significant

chunk of its costs in Mexican pesos. This means its profit margin

should expand in U.S. dollar denominated terms due to gold and

currency movements.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

November 09, 2016 09:06 ET (14:06 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

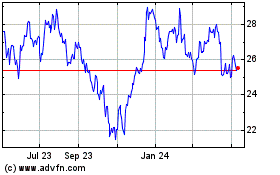

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

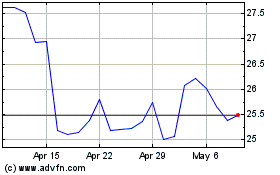

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024