ArcelorMittal Narrows Losses, Cautions on China -- 2nd Update

May 06 2016 - 7:29AM

Dow Jones News

By Alex MacDonald

LONDON-- ArcelorMittal narrowed its net loss in the first

quarter and forecast improved earnings to come as steel prices

begin to recover, but cautioned that excess steel capacity in China

still remains a concern.

The Luxembourg-based steelmaker, the world's largest by

production accounting for some 6% of global steel output, reported

a net loss of $416 million in the three months ended March 31,

2016, compared with a $728 million net loss in the same period a

year earlier.

The net loss was worse than analysts' expectations of $319

million, but narrower than last year because of a swing to a small

foreign exchange gain compared with a $756 million foreign exchange

and net financing loss in the same quarter a year earlier.

Still, the steelmaker suffered a net loss due to a 33% drop in

earnings before interest, taxes, depreciation and amortization, or

Ebitda, to $927 million after lower steel and iron ore prices and

shipments prompted revenue to fall 22% to $13.4 billion over the

same period.

Net debt also rose to $17.3 billion as of the end of March,

compared with $15.7 billion at the end of December, because of

seasonal working capital adjustments. After taking into account the

rights issue in April and the roughly $1 billion Gestamp asset

sale, net debt would have dropped to $13.3 billion, the company

said.

ArcelorMittal' share were down 4.9% at EUR4.46 ($5.10) a share

in midafternoon European trading. Citigroup said in a note that

while the first quarter results were broadly in line with

expectations investors were likely to react negatively to the

higher-than-expected net debt.

"Our results for the first quarter reflect the very tough

operating conditions in the second half of 2015," said Chief

Executive Lakshmi Mittal. "Since that time we have seen a recovery

in spreads in our core markets to more sustainable levels, which is

expected to result in improved results in the coming quarters," he

said. Mr. Mittal, however, cautioned that the global steel market

remains fragile given excess steel capacity in China. He urged

governments to remain vigilant about unfair trade.

Steelmakers have been hammered globally by an onslaught of cheap

steel exports from China, the world's largest steel producer. China

produced more steel than all the other countries combined last year

even as steel demand slackened at home. The wave of cheap Chinese

steel shipments prompted European Union and U.S. governments to

slap import tariffs to protect their steelmakers, but not quickly

enough in the EU to stem the bleeding.

ArcelorMittal earlier this year raised EUR2.8 billion, or $3.2

billion, through a rights issue to strengthen its balance sheet

given a protracted steel price rout globally. Other steelmakers

such as Sweden's SSAB AB followed suit.

ArcelorMittal's shares rallied after the rights issue was

announced and are up 55% so far this year, buoyed by a pickup in

steel prices in its key U.S. and European markets as well as

China.

ArcelorMittal's Chief Financial Officer Aditya Mittal said the

price rise has been most pronounced in China, where the

government's stimulus package has helped buoy domestic steel

demand. The steelmaker now forecasts Chinese steel demand may

remain flat this year compared with its previous forecast for an up

to 1.5% contraction.

Steel price rises in the U.S. and Europe have also followed

suit, with Europe lagging the U.S. due to slower implementation of

trade barriers against Chinese steel exports, Mr. Mittal said.

Chinese steel exports have fallen quarter-on-quarter but are still

up year-over-year, he noted.

Mr. Mittal cautioned that China may be "kicking the can down the

road" if it fails to remove its structural excess steel production

capacity as a result of the recent government-fueled pickup in

steel demand.

Nevertheless, he expects the impact of rising steel prices to be

fully reflected in the steelmaker's earnings in the second half of

the year, although this year's Ebitda guidance of more than $4.5

billion has been kept unchanged.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

May 06, 2016 07:14 ET (11:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

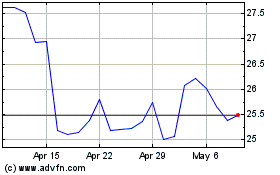

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

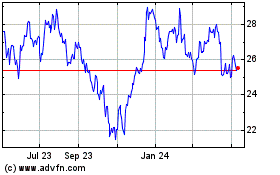

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024