Filed pursuant to Rule 424(b)(3)

Registration No. 333-202409

Pricing Supplement

(To prospectus supplement dated March 11,

2016 and prospectus dated February 5, 2016)

Offering of 1,803,359,338 Rights for up to 1,262,351,531 Ordinary Shares

Subscription Price: €2.20 per Ordinary Share

ArcelorMittal granted non-statutory preferential subscription rights (the “

Rights

”) to holders of its existing ordinary

shares to subscribe for an aggregate of up to 1,262,351,531 newly-issued ordinary shares (“

New Shares

”). The exercise of 10 Rights entitled the exercising holder to subscribe for 7 New Shares against payment of a subscription price

of €2.20 per New Share (the “

Subscription Price

”). In addition, each holder that subscribed for at least 7 New Shares under its primary subscription right pursuant to its Rights had the right to submit a request to subscribe at

the Subscription Price for additional New Shares, to the extent any New Shares remained that were not otherwise subscribed for pursuant to the exercise of Rights (the “

Oversubscription Privilege

”).

In the Rights offering, an aggregate of 1,229,905,208 New Shares was subscribed for under the primary subscription rights pursuant to the

Rights against payment of the Subscription Price. In addition, an aggregate of 372,398,986 New Shares was requested pursuant to the Oversubscription Privilege, of which 32,446,323 New Shares will be allocated on a

pro rata

basis to holders

exercising the Oversubscription Privilege in the manner described in the accompanying prospectus supplement.

Pursuant to the underwriting

agreement, the underwriters (as defined in the accompanying prospectus supplement) agreed on a several basis, on the terms and subject to the conditions set forth therein, to underwrite their relevant proportion of any New Shares (other than New

Shares subscribed pursuant to the commitment by two entities held by Mittal Family trusts to fully exercise the Rights allocated to them) that were not subscribed in the Rights offering, including pursuant to the Oversubscription Privilege, and to

market such New Shares to potential investors. Because all New Shares were fully subscribed pursuant to the Rights, including pursuant to the Oversubscription Privilege, the underwriters were not required to underwrite any portion of the New Shares.

Investing in the ordinary shares involves risks. See “Risk Factors” beginning on page S-9 of the accompanying prospectus

supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of

these securities or passed upon the adequacy or accuracy of this pricing supplement, the attached prospectus supplement or the attached prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

Joint Lead Managers and Bookrunners

|

|

|

|

|

|

Goldman Sachs International

|

|

BofA Merrill Lynch

|

|

Crédit Agricole CIB

|

|

|

|

Joint Bookrunners

|

|

|

|

|

|

|

|

Barclays

|

|

BNP PARIBAS

|

|

Citigroup

|

|

J.P. Morgan

|

|

Société Générale

Corporate & Investment

Banking

|

|

|

|

Co-Lead Managers

|

|

|

|

|

|

|

|

|

|

|

|

Banca IMI

|

|

Banco Santander

|

|

BBVA

|

|

COMMERZBANK

|

|

Deutsche Bank

|

|

|

|

|

|

|

|

ING

|

|

Natixis

|

|

RBC Capital Markets

|

|

SMBC Nikko

|

|

UniCredit Bank AG

|

Pricing Supplement dated April 4, 2016.

Underwriters’ Activities

The subscription period for the offering began on March 15, 2016 and ended:

|

|

•

|

|

at 5:00 p.m. (New York City time) on March 29, 2016 for Rights held via book entry in The Depository Trust Company and for Rights held directly in the New York Rights Register (as defined in the accompanying prospectus

supplement) and

|

|

|

•

|

|

at 5:00 p.m. (CET) on March 30, 2016 for Rights held via book entry in the European Clearing Systems (as defined in the accompanying prospectus supplement) except for Rights traded on the Spanish Stock Exchanges (as

defined in the accompanying prospectus supplement), for which the deadline will in each case be 12:00 noon (CET). The rights exercise period for Rights held directly in the European Rights Register (as defined in the accompanying prospectus

supplement) ran from March 15, 2016 to 12:00 noon (CET) on March 30, 2016.

|

During the subscription period:

|

|

•

|

|

no securities were bought by the underwriters in stabilization transactions;

|

|

|

•

|

|

the underwriters purchased 343,398,684 and sold 198,886,931 Rights in the open market and exercised 17,998,504 Rights, yielding approximately 12.60 million New Shares;

|

|

|

•

|

|

in addition, the underwriters purchased 457,629,468 ordinary shares of ArcelorMittal in the open market at prices ranging from €3.02 to €5.10 and U.S.$3.88 to U.S.$4.62; and

|

|

|

•

|

|

the underwriters sold 438,239,086 ordinary shares of ArcelorMittal at prices ranging from €2.36 to €4.96 and U.S.$3.89 to U.S.$4.63.

|

Transactions above include both market-making and proprietary transactions.

2

|

|

|

|

|

Prospectus Supplement

|

|

Filed pursuant to Rule 424(b)(2)

|

|

(To prospectus dated February 5, 2016)

|

|

Registration No. 333-202409

|

Offering of 1,803,359,338 Rights for up to 1,262,351,531 Ordinary Shares

Subscription Price: €2.20 per Ordinary Share

ArcelorMittal is granting non-statutory preferential subscription rights (the “

Rights

”) to holders of its existing ordinary

shares to subscribe for an aggregate of up to 1,262,351,531 newly-issued ordinary shares (“

New Shares

”). One tradable Right will be credited on March 15, 2016 for each existing share held of record on March 14, 2016 at the close of

trading on each applicable European Stock Exchange (as defined below) where the ordinary shares of ArcelorMittal are traded and at 5:00 p.m. (New York City time) in the case of the New York Stock Exchange as further described herein. The exercise of

10 Rights entitles the exercising holder to subscribe for 7 New Shares against payment of a subscription price of €2.20 per New Share (the “

Subscription Price

”). On March 10, 2016, the closing price of ArcelorMittal’s

shares was U.S.$5.10 per share on the New York Stock Exchange and €4.243 per share on Euronext Amsterdam. In addition, each holder that subscribes for at least 7 New Shares pursuant to its primary subscription right pursuant to its Rights will

have the right to submit a request to subscribe at the Subscription Price for additional New Shares, to the extent any New Shares remain that are not otherwise subscribed for pursuant to the exercise of Rights (the “

Oversubscription

Privilege

”). No fractional shares will be issued. Two entities held by Mittal Family trusts (the “

Mittal Family Trust Entities

”), which together own 37.38% of the Company’s share capital, have committed to

ArcelorMittal to fully exercise the Rights allocated to them during the Rights exercise period and accordingly to subscribe, when taken together, for an aggregate amount of 471,816,485 New Shares (the “

Shareholders’

Commitment

”).

The Rights are expected to be admitted for trading on the New York Stock Exchange, where they will begin trading on

a “when issued” basis on March 11, 2016 and will trade through March 23, 2016. The Rights are also expected to be traded on the Luxembourg Stock Exchange, Euronext Amsterdam, Euronext Paris and the Bolsas de Valores of Madrid,

Barcelona, Bilbao and Valencia and included on the “SIBE” Interconnection Electronic System (the “

Spanish Stock Exchanges

”, and together with the Luxembourg Stock Exchange, Euronext Amsterdam and Euronext Paris, the

“

European Stock Exchanges

”) starting on March 15, 2016, and trading is expected to end on the Spanish Stock Exchanges on March 22, 2016 and on the other European Stock Exchanges on March 24, 2016.

The exercise period for the Rights will begin on March 15, 2016 and will close:

|

•

|

|

at 5:00 p.m. (New York City time) on March 29, 2016 for Rights held via book entry in The Depository Trust Company (“

DTC

”) and for Rights held directly in the New York Rights Register (as defined

herein) and

|

|

•

|

|

at 5:00 p.m. (CET) on March 30, 2016 for Rights held via book entry in the European Clearing Systems (as defined herein) except for Rights traded on the Spanish Stock Exchanges, for which the deadline will in each

case be 12:00 noon (CET). The rights exercise period for Rights held directly in the European Rights Register (as defined herein) will run from March 15, 2016 to 12:00 noon (CET) on March 30, 2016.

|

Rights held via book entry in the DTC system or held directly in the New York Rights Register must be exercised via payment of U.S.$2.63 per New

Share subscribed (the “

Estimated U.S. Dollar Subscription Price

”) as described herein. Such Rights may not be exercised via payment of the Euro-denominated Subscription Price of €2.20 per New Share. Rights not exercised as

described above will expire and become null and void without the payment of any compensation.

ArcelorMittal has entered into an

underwriting agreement pursuant to which the underwriters have agreed on a several basis, on the terms and subject to the conditions set forth therein, to underwrite their relevant proportion of any New Shares (other than New Shares subscribed

pursuant to the Shareholders’ Commitment) that are not subscribed in the Rights offering, including through oversubscription (the “

Underwritten Shares

”), and to market such New Shares to potential investors (the “

Rump

Placement

”).

The New Shares, if any, for which Rights have not been validly exercised during the Rights exercise period, including

through oversubscription (the “

Rump Shares

”) may be sold by way of (i) private placements outside the United States in accordance with applicable securities laws, and (ii) a public offering in the United States registered under the

U.S. Securities Act of 1933, as amended (the “

Securities Act

”). In the European Economic Area, such New Shares will be offered to qualified investors within the meaning of Article 2(1)(e) of the Directive 2003/71/EC, as amended (the

“

Prospectus Directive

”). The Rump Placement, if any, is expected to take place on or about April 5, 2016.

ArcelorMittal’s shares trade on the New York Stock Exchange under the ticker symbol MT, and Rights are expected to trade on the New York

Stock Exchange under the ticker symbol MT WS.

Investing in the Rights or the New Shares involves risks. See “

Risk

Factors

” beginning on page S-9.

Neither the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the attached prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to Public

|

|

|

Discounts & Commissions

(2)

|

|

|

Proceeds to ArcelorMittal

(2)

|

|

|

Per Ordinary Share

|

|

|

€2.20

|

|

|

|

€0.02

|

|

|

|

€2.18

|

|

|

Per Right

|

|

|

(1

|

)

|

|

|

(1

|

)

|

|

|

(1

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

€2,777,173,368

|

|

|

|

€26,232,104

|

|

|

|

€2,750,941,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

ArcelorMittal expects to receive no proceeds from the initial offering and allotment of the Rights.

|

|

(2)

|

Before expenses and taxes in connection with the offering. In addition, the Company may pay a discretionary fee of up to 0.2981% of the aggregate amount of the Subscription Price for all New Shares issued by the Company

in the offering excluding the New Shares subscribed pursuant to the Shareholders’ Commitment.

|

ArcelorMittal expects to

deliver the Rump Shares and the New Shares issued in respect of Rights held via book entry in the European Clearing Systems or held directly in the European Rights Register on or about April 8, 2016. ArcelorMittal expects to deliver the New Shares

to be issued in respect of Rights held via book entry in DTC or held directly in the New York Rights Register on or about April 11, 2016.

Joint Lead Managers and Bookrunners

|

|

|

|

|

|

|

Goldman Sachs International

|

|

BofA Merrill Lynch

|

|

Crédit Agricole CIB

|

Joint Bookrunners

|

|

|

|

|

|

|

|

|

|

|

Barclays

|

|

BNP PARIBAS

|

|

Citigroup

|

|

J.P. Morgan

|

|

Société Générale Corporate & Investment Banking

|

Co-Lead Managers

|

|

|

|

|

|

|

|

|

|

|

Banca IMI

|

|

Banco Santander

|

|

BBVA

|

|

COMMERZBANK

|

|

Deutsche Bank

|

|

|

|

|

|

|

|

|

|

|

|

ING

|

|

Natixis

|

|

RBC Capital Markets

|

|

SMBC Nikko

|

|

UniCredit Bank AG

|

Prospectus Supplement dated March 11, 2016.

TABLE OF CONTENTS

Prospectus Supplement

i

ABOUT THIS PROSPECTUS SUPPLEMENT

ArcelorMittal is not making an offer to sell these securities in any jurisdiction where the offer or sale are not permitted. This document may

only be used where it is legal to sell these securities. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on

the front cover of this prospectus supplement. ArcelorMittal’s business, financial condition, results of operations and prospects may have changed since that date.

Unless indicated otherwise, or the context otherwise requires, references herein to “ArcelorMittal”, “we”,

“us”, “our” and the “Company” or similar terms are to ArcelorMittal, formerly known as Mittal Steel Company N.V. having its registered office at 24-26 boulevard d’Avranches, L-1160 Luxembourg, Grand Duchy of

Luxembourg and its consolidated subsidiaries. References to the “Group” are to ArcelorMittal and its consolidated subsidiaries.

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain forward-looking statements

based on estimates and assumptions. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include, among other things, statements concerning the business, future financial condition, results of operations and prospects of ArcelorMittal, including its subsidiaries. These statements usually contain the

words “believes”, “plans”, “expects”, “anticipates”, “intends”, “estimates” or other similar expressions. For each of these statements, you should be aware that forward-looking statements

involve known and unknown risks and uncertainties. Although it is believed that the expectations reflected in these forward-looking statements are reasonable, there is no assurance that the actual results or developments anticipated will be realized

or, even if realized, that they will have the expected effects on the business, financial condition, results of operations or prospects of ArcelorMittal.

These forward-looking statements speak only as of the date on which the statements were made, and no obligation has been undertaken to

publicly update or revise any forward-looking statements made in this prospectus supplement, the accompanying prospectus or elsewhere as a result of new information, future events or otherwise, except as required by applicable laws and regulations.

A detailed discussion of principal risks and uncertainties which may cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk factors” (Part I, Item 3D of

ArcelorMittal’s Annual Report on Form 20-F for the fiscal year ended December 31, 2015 (the “

2015 20-F

”). The Company undertakes no obligation to update or revise publicly any forward-looking statements whether because of

new information, future events, or otherwise, except as required by securities and other applicable laws.

2

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about ArcelorMittal and the Rights and New Shares being offered. It may not contain all of the

information that may be important to you. Before investing in the Rights or New Shares, you should read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the

accompanying prospectus carefully for a more complete understanding of ArcelorMittal’s business and this offering.

ArcelorMittal

ArcelorMittal is the world’s largest and most global steel producer and a significant producer of iron ore and coal, with production of

92.5 million tonnes of crude steel and, from own mines and strategic contracts, 73.7 million tonnes of iron ore and 6.29 million tonnes of coal in 2015. ArcelorMittal had sales of U.S.$63.6 billion and steel shipments of 84.6 million tonnes for

the year ended December 31, 2015. ArcelorMittal is the largest steel producer in the Americas, Africa and Europe and is the fifth largest steel producer in the CIS region. ArcelorMittal has steel-making operations in 19 countries on four

continents, including 54 integrated and mini-mill steel-making facilities. As of December 31, 2015, ArcelorMittal had approximately 209,000 employees.

ArcelorMittal’s steel-making operations have a high degree of geographic diversification. Approximately 37% of its crude steel is

produced in the Americas, approximately 47% is produced in Europe and approximately 15% is produced in other countries, such as Kazakhstan, South Africa and Ukraine. In addition, ArcelorMittal’s sales of steel products are spread over both

developed and developing markets, which have different consumption characteristics. ArcelorMittal’s mining operations, present in North and South America, Africa, Europe and the CIS region, are integrated with its global steel-making facilities

and are important producers of iron ore and coal in their own right.

ArcelorMittal produces a broad range of high-quality finished and

semi-finished steel products (“semis”). Specifically, ArcelorMittal produces flat steel products, including sheet and plate, and long steel products, including bars, rods and structural shapes. In addition, ArcelorMittal produces pipes and

tubes for various applications. ArcelorMittal sells its steel products primarily in local markets and through its centralized marketing organization to a diverse range of customers in approximately 160 countries including the automotive, appliance,

engineering, construction and machinery industries. The Company also produces various types of mining products including iron ore lump, fines, concentrate and sinter feed, as well as coking, PCI and thermal coal.

As a global steel producer, the Company is able to meet the needs of different markets. Steel consumption and product requirements clearly

differ between developed markets and developing markets. Steel consumption in developed economies is weighted towards flat products and a higher value-added mix, while developing markets utilize a higher proportion of long products and commodity

grades. To meet these diverse needs, the Company maintains a high degree of product diversification and seeks opportunities to increase the proportion of higher value-added products in its product mix.

Corporate and Other Information

ArcelorMittal is a public limited liability company (

société anonyme

) that was incorporated for an unlimited period under

the laws of the Grand Duchy of Luxembourg on June 8, 2001. ArcelorMittal is registered at the Trade and Companies Register (

Registre de Commerce et des Sociétés

) in Luxembourg under number B 82.454. The mailing address and

telephone number of ArcelorMittal’s registered office are: 24-26 boulevard d’Avranches L-1160, Luxembourg, Grand Duchy of Luxembourg, tel: +352 4792-3746. ArcelorMittal’s process agent for U.S. federal securities law purposes is

ArcelorMittal USA Holdings II LLC, 1 South Dearborn Street, 19th Floor, Chicago, Illinois 60603, United States of America, tel: + 1 312 899 3400.

3

Summary of the Offering

The following is a brief summary of the terms of this offering. For a more complete description of the terms of the offering, see “The

Offering” in this prospectus supplement.

|

The Offering

|

ArcelorMittal is granting non-statutory preferential subscription rights to holders of its existing ordinary shares to subscribe for an aggregate of 1,262,351,531 newly-issued ordinary shares of ArcelorMittal. One tradable Right will be credited

on March 15, 2016 for each existing share held of record on March 14, 2016 at the close of trading on each applicable European Stock Exchange where the ordinary shares are traded and at 5:00 p.m. (New York City time) in the case of shares traded on

the New York Stock Exchange as further described herein. No fractional Rights will be issued. The exercise of 10 Rights entitles the exercising holder (each a “

Holder

”) to subscribe for 7 New Shares against payment of a Subscription

Price of €2.20 per New Share. Each Holder that subscribes for at least 7 New Shares under its primary subscription right pursuant to its Rights may also exercise the Oversubscription Privilege as further described below.

|

|

Estimated U.S. Dollar Subscription Price

|

Rights held via book entry in the DTC system or held directly in the local Rights register maintained in New York City (the “

New York Rights Register

”) (“

New York Rights

”

)

must be exercised via payment of

an Estimated U.S. Dollar Subscription Price in the amount of U.S.$2.63 per New Share subscribed, which represents an excess of 10% over the U.S. dollar equivalent of the Euro-denominated Subscription Price of €2.20 per New Share on

March 10, 2016, based on the European Central Bank foreign exchange reference rate of Euros for U.S. dollars (the “

ECB Reference Rate

”) to cover currency fluctuations and the fees applicable to the exercise of New York Rights

(U.S.$0.005 per New Share). If the Estimated U.S. Dollar Subscription Price is insufficient to cover such currency fluctuations and fees, Citibank, N.A. as New York Rights Agent (the “

New York Rights Agent

”) will fund the difference

but will require holders to pay the shortfall prior to receiving their New Shares, and if it exceeds the amount needed to cover such currency fluctuations and fees, the difference will be refunded to holders, in each case as further described under

“

The Offering—Conversion of U.S. Dollars to Euros

”. New York Rights may not be exercised via payment of the Subscription Price in Euros. Rights not exercised as described above will expire and become null and void without the

payment of any compensation. Holders of New York Rights must follow the instructions for exercising New York Rights described under “

The Offering—Exercise of Rights—Exercise Procedure

s

.”

|

|

Oversubscription Privilege

|

Each Holder that subscribes for at least 7 New Shares under its primary subscription right pursuant to its Rights will have an Oversubscription

Privilege to submit, at the time of exercising such Holder’s Rights, a request, on a firm, unconditional and irrevocable basis, to subscribe at the Subscription Price (or at the Estimated U.S. Dollar Subscription Price, in the case of New

York Rights) for

|

4

|

|

additional New Shares, to the extent any New Shares remain at the end of the subscription period that have not otherwise been subscribed for pursuant to the exercise of Rights (any such remaining

New Shares, the “

Surplus Shares

”). A Holder may only make a request for additional New Shares if such Holder has subscribed for at least 7 New Shares under its primary subscription right pursuant to its Rights. Requests for

additional New Shares must be made for a particular amount of additional New Shares and will be deemed to be made on a firm, irrevocable and unconditional basis even though they may not be met in their entirety (or at all) by virtue of the

allocation rules described herein. Holders of New York Rights must follow the instructions for exercising the Oversubscription Privilege described under “

The Offering—Exercise of Rights—Exercise Procedures

”.

|

|

|

There is no limit on the number of additional New Shares a Holder may request pursuant to the Oversubscription Privilege, although such requests will be subject to pro-ration to the extent there are insufficient Surplus

Shares to fulfill all such requests by Holders. The pro-ration of surplus shares is made on the basis of actual Rights exercised.

|

|

Exercise of Rights

|

The exercise of 10 Rights entitles a Holder to subscribe for 7 New Shares. No fractional New Shares will be issued. Accordingly, even if a Holder decides to exercise all of its Rights, it may hold more Rights than can be exercised for an

integral number of New Shares. Such Holder must either sell these excess Rights or purchase enough additional Rights to be able to subscribe for additional full New Shares. Any Rights that are neither exercised nor sold by the applicable deadlines

will expire and become null and void without any payment of compensation.

|

|

|

The exercise period for the Rights will begin on March 15, 2016 and will close:

|

|

|

•

|

|

at 5:00 p.m. (New York City time) on March 29, 2016 for New York Rights held via book entry in DTC and for Rights held directly in the New York Rights Register; and

|

|

|

•

|

|

at 5:00 p.m. (CET) on March 30, 2016 for Rights held via book entry in the European Clearing Systems (as defined herein) except for Rights traded on the Spanish Stock Exchanges, for which the deadline will be 12:00

noon (CET). The rights exercise period for Rights held directly in the local Rights register maintained in Luxembourg (the “

European Rights Register

”) will run from March 15, 2016 to 12:00 noon (CET) on March 30, 2016.

|

|

Exercises of New York Rights held via book entry in the DTC system

|

Direct participants in DTC must (i) deliver subscription instructions through DTC’s applicable function and (ii) instruct DTC to charge their accounts the applicable Estimated U.S. Dollar Subscription Price for each New Share subscribed

(including any amounts in respect of additional New Shares requested pursuant to the Oversubscription Privilege) prior to 5:00 p.m. (New York City time) on March 29, 2016.

|

5

|

|

New York Rights held via book entry indirectly through a participant in DTC may be exercised only through a Holder’s respective custodian bank or broker, as the case may be. Instructions for exercising New York

Rights and irrevocable payment instructions in connection therewith must be directed to the respective custodian bank or broker, as the case may be, within the time period set by such custodian bank or broker. Holders should follow the instructions

of their custodian bank or broker.

|

|

Exercise of New York Rights held directly in the New York Rights Register

|

Holders of New York Rights directly registered in the New York Rights Register may exercise some or all of their New York Rights by completing their New York Rights subscription form and returning it to the New York Rights Agent. Holders of New

York Rights directly registered in the New York Rights Register must deliver subscription forms along with the Estimated U.S. Dollar Subscription Price in respect of any of the New Shares for which such Holder elects to subscribe (including any

amounts in respect of additional New Shares requested pursuant to the Oversubscription Privilege) as described further under “

The Offering—Conversion of U.S. Dollars to Euros

”.

|

|

New York Rights Agent

|

Citibank, N.A.

|

|

Global Centralization Agent

|

BNP Paribas Security Services.

|

|

Trading of Rights

|

The Rights are expected to be admitted for trading on each of the New York Stock Exchange, the Luxembourg Stock Exchange, Euronext Amsterdam, Euronext Paris and the Spanish Stock Exchanges.

|

|

|

•

|

|

Trading of New York Rights on the New York Stock Exchange is expected to begin on a “when issued” basis on March 11, 2016 and to end on March 23, 2016.

|

|

|

•

|

|

Trading of Rights on the European Stock Exchanges will begin on March 15, 2016. Trading of Rights will end on March 22, 2016 on the Spanish Stock Exchanges, and on March 24, 2016 on the Luxembourg

Stock Exchange, Euronext Amsterdam and Euronext Paris.

|

|

Underwriting Agreement

|

ArcelorMittal has entered into an underwriting agreement dated March 11, 2016 pursuant to which the underwriters have agreed on a several basis, on the terms and subject to the conditions set forth therein, to underwrite their relevant

proportion of any New Shares (other than New Shares subscribed pursuant to the Shareholders’ Commitment) that are not subscribed in the Rights offering, including through oversubscription, and to market such New Shares to potential investors.

The co-lead managers will not underwrite any portion of the offering.

|

|

Rump Placement

|

The New Shares, if any, for which Rights have not been validly exercised during the Rights exercise period, including through oversubscription may be

sold by way of (i) private placements outside

|

6

|

|

the United States in accordance with applicable securities laws, and (ii) a public offering in the United States registered under the Securities Act. In the European Economic Area, such New

Shares will be offered to qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive. The Rump Placement, if any, is expected to take place on or about April 5, 2016.

|

|

Listing

|

New Shares registered in the local shareholders register in the United States maintained by Citibank, N.A. (the “

New York Share Register

”) on behalf of ArcelorMittal are expected to begin “when issued” trading on the

New York Stock Exchange starting on April 11, 2016. The New Shares registered in the local shareholders’ register in Luxembourg (the “

European Share Register

”) are expected to be admitted to listing on the European Stock

Exchanges starting on April 8, 2016.

|

|

Risk Factors

|

See “

Risk Factors

” beginning on page S-9 and the other information included or incorporated by reference in this prospectus supplement.

|

|

Dilution

|

In order to capture the value of the Rights, the Holder must exercise such Rights as described in this prospectus supplement or sell such Rights. If Holders do not exercise all of the Rights allocated in respect of their holding of ordinary

shares, the value of their holding of ArcelorMittal’s ordinary shares will be diluted. See “

The Offering—Dilution

.”

|

|

Joint Lead Managers and Bookrunners

|

Goldman Sachs International, Crédit Agricole Corporate and Investment Bank and Merrill Lynch International.

|

|

Joint Bookrunners

|

Barclays Bank PLC, BNP PARIBAS, Citigroup Global Markets Limited, J.P. Morgan Securities plc and Société Générale.

|

|

Co-Lead Managers

|

Banca IMI S.p.A., Banco Bilbao Vizcaya Argentaria, S.A., Banco Santander, S.A., COMMERZBANK Aktiengesellschaft—London Branch, Deutsche Bank AG, London Branch, ING Belgium SA/NV, Natixis, RBC Europe Limited, SMBC Nikko Capital Markets

Limited and UniCredit Bank AG.

|

|

Use of Proceeds

|

ArcelorMittal intends to use the net proceeds from the exercise of Rights attributed in the offering to reduce its indebtedness and to strengthen its balance sheet.

|

|

Shareholder Commitment and Lock-up

|

The Mittal Family Trust Entities have committed to the Company to fully exercise the Rights allocated to them during the Rights exercise period and accordingly to subscribe, when taken together, for an aggregate amount of 471,816,485 New Shares.

They have also agreed with the underwriters to a lock-up relating to the Company’s ordinary shares until 180 days following the settlement of the Underwritten Shares or if the underwriting agreement terminates prior to such date, the date of

such termination as described in further detail under “

Plan of Distribution—Lock-up Agreements

.”

|

7

|

Company Lock-up

|

The Company has agreed to a lock-up relating to its ordinary shares until 180 days following the settlement of the Underwritten Shares as described in further detail under “

Plan of Distribution—Lock-up Agreements

.”

|

|

Conflict of Interest

|

Because more than 5% of the net proceeds of this offering, not including underwriting compensation, may be received by underwriters or their affiliates or by co-lead managers and their affiliates, to the extent any one underwriter or co-lead

manager, together with its affiliates, receives more than 5% of the net proceeds, such underwriter or co-lead manager would be considered to have a “conflict of interest” with ArcelorMittal in regards to this offering under Financial

Industry Regulatory Authority, Inc. (“

FINRA

”) Rule 5121.

|

|

International Securities Identification Numbers (ISIN)

|

Ordinary shares (New York Share Register): US03938L104

|

|

|

Ordinary shares (European Share Register): LU0323134006

|

|

|

New York Rights: US03938L1127

|

|

CUSIPs

|

Ordinary shares (New York Share Register): 03938L704

|

|

|

New York Rights: 03938L112

|

|

Ticker Symbols for the Rights and Shares

|

NYSE:

|

|

|

•

|

|

Rights (when-issued): MT WS WI

|

|

|

Luxembourg Stock Exchange:

|

8

RISK FACTORS

Investing in the securities offered using this prospectus involves risk. You should consider carefully the risks described below, together

with the risks described in the documents incorporated by reference into this prospectus supplement including those set forth in the 2015 20-F, before you decide to buy the Rights or New Shares. If any of these risks actually occurs, our business,

financial condition and results of operations could suffer, and the trading price and liquidity of the securities offered using this prospectus could decline, in which case you may lose all or part of your investment. The risks described herein

are not the only risks ArcelorMittal faces. Additional risks and uncertainties not presently known to ArcelorMittal or that ArcelorMittal currently believes to be immaterial could also materially affect it.

Risks Relating to ArcelorMittal

You should read “Risk Factors” under “Item 3D—Key Information—Risk Factors” of the 2015 20-F, which is

incorporated by reference in this prospectus supplement, for information on risks relating to ArcelorMittal, including its industry, business and financial structure.

Risks Related to the Offering

The market price of

the shares may fluctuate and may decline below the Subscription Price.

The market price of the shares may fluctuate and may

decline below the Subscription Price. Moreover, given that the market price of the rights depends to a significant degree on the price of the Company’s shares, a decline in the trading price of the shares would also be expected to negatively

affect the trading price of the Rights.

In addition, ArcelorMittal cannot assure holders of Rights that the market price of the

Company’s shares will not decline below the Subscription Price after such holders elect to exercise their Rights. If that occurs, such holders will have committed to buy the New Shares at a price above the prevailing market price, and such

holders will suffer an immediate unrealized loss as a result.

The market price of the shares may fluctuate significantly as a result of

various factors, many of which are beyond ArcelorMittal’s control, including:

|

|

•

|

|

market expectations for ArcelorMittal’s financial performance;

|

|

|

•

|

|

actual or anticipated fluctuations in ArcelorMittal’s business, results of operations and financial condition;

|

|

|

•

|

|

changes in the estimates of ArcelorMittal’s results of operations by securities analysts;

|

|

|

•

|

|

investor perception of the impact of the offering on ArcelorMittal and its shareholders;

|

|

|

•

|

|

potential or actual sales of blocks of shares in the market or short selling of shares;

|

|

|

•

|

|

volatility in the market as a whole or investor perception of ArcelorMittal’s industries and competitors;

|

|

|

•

|

|

announcements by ArcelorMittal or its competitors of significant contracts;

|

|

|

•

|

|

acquisitions, strategic alliances, joint ventures, capital commitments or new products or services;

|

|

|

•

|

|

loss of major customers;

|

|

|

•

|

|

additions or departures of key personnel;

|

|

|

•

|

|

any shortfall in revenue or net income or any increase in losses from levels expected by securities analysts;

|

9

|

|

•

|

|

future issues or sales of shares;

|

|

|

•

|

|

new government regulation;

|

|

|

•

|

|

general, economic, financial and political conditions; and

|

|

|

•

|

|

the risk factors in relation to ArcelorMittal and its industry set out above.

|

The market

price of the shares may be adversely affected by most of the preceding or other factors regardless of ArcelorMittal’s actual results of operations and financial condition. Publicly traded securities from time to time experience significant

price and volume fluctuations that may be unrelated to the performance of the companies that have issued them. ArcelorMittal cannot make any predictions about the market price of its shares. No assurance can be given that the market price of the

shares will not decline below the Subscription Price or their market price at the commencement of the offering.

No assurance can be given that a

trading market will develop for the Rights and, if a market does develop, the Rights may be subject to greater volatility than the shares.

Trading in the Rights is expected to begin on a “when issued” basis on the New York Stock Exchange on March 11, 2016 and to

continue through March 23, 2016. Trading in the Rights on the European Stock Exchanges is expected to begin on March 15, 2016 and will continue until March 22, 2016 on the Spanish Stock Exchanges and March 24, 2016 on the

Luxembourg Stock Exchange, Euronext Amsterdam and Euronext Paris. There will be no application for the Rights to be traded on any other exchange. There is no assurance that an active trading market in the Rights will develop during that period and,

if a market does develop, there is no assurance regarding the nature of such trading market. If an active trading market does not develop or is not substantial, the liquidity and trading price of the Rights could be adversely affected. The trading

price of the Rights depends on a variety of factors, including but not limited to the performance of the price of the shares, but may also be subject to significantly greater price fluctuations than the shares.

Failure by a shareholder to exercise allocated Rights during the applicable Rights exercise period will result in a dilution of such shareholder’s

percentage ownership of the shares.

The offering is designed to enable ArcelorMittal to raise capital in a manner that gives its

eligible shareholders the opportunity to subscribe for the New Shares pro rata to their shareholding at March 14, 2016, subject to applicable securities laws. To the extent that shareholders do not exercise their Rights, their proportionate

ownership and voting interest in ArcelorMittal will be reduced. Even if shareholders elect to sell their Rights, the consideration they receive, if any, may not be sufficient to fully compensate them for the dilution of their percentage ownership of

the Shares that may be caused as a result of the offering.

Termination of the underwriting agreement could have a material adverse effect on the

trading price of the Rights and the Rights would become null and void.

Pursuant to the underwriting agreement, the underwriters

have agreed on a several basis, on the terms and subject to the conditions disclosed therein, to underwrite their relevant proportion of any New Shares (other than New Shares subscribed pursuant to the Shareholders’ Commitment) that are not

subscribed in the Rights offering, including through oversubscription, and to market such New Shares to potential investors. The underwriting agreement entitles the underwriters to terminate the underwriting agreement under certain circumstances, as

more fully described in “

Plan of Distribution—Underwriting Agreement

” below. If the underwriting agreement is terminated prior to the delivery of the New Shares on or about April 8, 2016, the offering will be cancelled and any

funds transferred in respect of the Subscription Price will be returned to the Holders. However, the Rights would thereby become null and void. No prior trading in the Rights will be unwound and no compensation will be paid for the Rights.

10

Any future capital increases by the Company could have a negative impact on the price of the shares.

The Company may in the future increase its share capital against cash or contributions in kind for various reasons including to

finance any future acquisition or other investment or to strengthen its balance sheet. In connection with such transactions, the Company may, subject to certain conditions, limit or cancel the preferential subscription rights of the existing

shareholders otherwise applicable to capital increases through contributions in cash, and no preferential subscription rights apply to capital increases through contributions in kind. Such transactions could therefore dilute the stakes in the

Company’s share capital held by the shareholders at that time and could have a negative impact on the share price, earnings per share and net asset value per share.

The New Shares could be subject to the European financial transactions tax

Prospective holders of the Company’s shares should be aware that the European Commission has published a proposal for a Directive on a

financial transactions tax (the “

European FTT

”) common to Austria, Belgium, Estonia, France, Germany, Greece, Italy, Portugal, Slovenia, Slovakia and Spain (the “

Participating Member States

”).

The proposed European FTT has a very broad scope and could, if introduced in its current draft form, apply, under certain circumstances, to

certain dealings involving the shares of the Company. It would call for the Participating Member States to impose a tax of generally at least 0.1% on all such transactions, generally determined by reference to the amount of consideration paid. The

European FTT might apply to both residents and non-residents of the Participating Member States.

The European FTT proposal remains

subject, however, to discussion between the Participating Member States. It may therefore be altered prior to any implementation, the timing of which remains unclear. Additional EU Member States may decide to participate and or certain of the

Participating Member States may decide to withdraw.

In December 2015, a joint statement was issued by Participating Member States

(excluding Estonia), indicating an intention to make decisions on the remaining open issues by the end of June 2016.

The European

FTT could increase the transaction costs associated with purchases and sales of the shares of the Company and could reduce the liquidity of the market for the shares of the Company.

Prospective holders of the shares of the Company are advised to consult their usual tax advisor on the potential consequences of the European

FTT.

The Company has no fixed dividend policy and no dividend is being proposed in respect of the 2015 financial year.

The Company’s dividend policy is determined by the Company’s board of directors and may change from time to time in the future. Any

declaration of dividends will be based upon the Company’s earnings, financial condition, capital requirements and other factors considered important by the Company’s board of directors. Luxembourg law and the Company’s articles of

association do not require the Company to declare dividends. The Company’s board of directors has proposed that no dividend be paid in respect of the 2015 financial year. This proposal is subject to shareholder approval at the next annual

general meeting to be held on May 4, 2016.

The exercise of Rights by shareholders in the United States is subject to exchange rate risk.

If the U.S. dollar weakens against the Euro, holders in the United States subscribing for New Shares may be required to pay more

than the Estimated U.S. Dollar Subscription Price. The Estimated U.S. Dollar Subscription

11

Price for Holders of Rights held via book entry in DTC or directly in the New York Rights Register is U.S.$2.63 per New Share, which represents an excess of 10% over the U.S. dollar equivalent of

the Euro-denominated Subscription Price of €2.20 per New Share on March 10, 2016, based on the ECB Reference Rate on that date. This additional amount over and above the March 10, 2016 exchange rate for U.S. dollars into Euro is intended to

increase the likelihood that the New York Rights Agent will have sufficient funds to pay the final U.S. dollar equivalent of the Euro-denominated Subscription Price, which will be determined based on the ECB Reference Rate on April 7, 2016, together

with the fees applicable to the exercise of the Rights. If the Estimated U.S. Dollar Subscription Price is insufficient to cover these amounts, the New York Rights Agent will not deliver the New Shares to subscribing Holders until it has received

payment of the deficiency from such Holders. The New York Rights Agent may sell all or a portion of the New Shares to the extent necessary to pay any shortfall that is not paid within 14 days of notice of the deficiency. The sale of New Shares to

pay any shortfall that is not paid within 14 days of notice of the deficiency is subject to execution fees of up to U.S.$0.0325 per New Share sold.

12

SELECTED FINANCIAL INFORMATION

The following tables present selected consolidated financial information of ArcelorMittal as of and for the years ended December 31, 2015,

2014, 2013, 2012 and 2011, prepared in accordance with International Financial Reporting Standards (“

IFRS

”) as issued by the International Accounting Standards Board. The audited consolidated financial statements of ArcelorMittal

and its consolidated subsidiaries, including the consolidated statements of financial position as of December 31, 2015 and 2014, and the consolidated statements of operations, other comprehensive income, changes in equity and cash flows for

each of the years ended December 31, 2015, 2014 and 2013, which we refer to as the “

ArcelorMittal Consolidated Financial Statements

,” are contained in the 2015 20-F. The ArcelorMittal Consolidated Financial Statements have been

incorporated by reference in this prospectus supplement and the accompanying prospectus. The following selected consolidated financial information should be read in conjunction with the ArcelorMittal Consolidated Financial Statements, including

the notes thereto, incorporated by reference herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Operations

|

|

|

(Amounts in U.S.$ millions except per share data)

|

|

Year ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Sales

(1)

|

|

$

|

63,578

|

|

|

$

|

79,282

|

|

|

$

|

79,440

|

|

|

$

|

84,213

|

|

|

$

|

93,973

|

|

|

Cost of sales

(2)

|

|

|

65,196

|

|

|

|

73,288

|

|

|

|

75,247

|

|

|

|

83,543

|

|

|

|

85,212

|

|

|

Selling, general and administrative expenses

|

|

|

2,543

|

|

|

|

2,960

|

|

|

|

2,996

|

|

|

|

3,315

|

|

|

|

3,557

|

|

|

Operating income/(loss)

|

|

|

(4,161

|

)

|

|

|

3,034

|

|

|

|

1,197

|

|

|

|

(2,645

|

)

|

|

|

5,204

|

|

|

Income (loss) from associates, joint ventures and other investments

|

|

|

(502

|

)

|

|

|

(172

|

)

|

|

|

(442

|

)

|

|

|

185

|

|

|

|

614

|

|

|

Financing costs—net

|

|

|

(2,858

|

)

|

|

|

(3,382

|

)

|

|

|

(3,115

|

)

|

|

|

(2,915

|

)

|

|

|

(2,983

|

)

|

|

Income/(loss) before taxes

|

|

|

(7,521

|

)

|

|

|

(520

|

)

|

|

|

(2,360

|

)

|

|

|

(5,375

|

)

|

|

|

2,835

|

|

|

Net income/(loss) from continuing operations (including non-controlling interest)

|

|

|

(8,423

|

)

|

|

|

(974

|

)

|

|

|

(2,575

|

)

|

|

|

(3,469

|

)

|

|

|

1,956

|

|

|

Net income/(loss) attributable to equity holders of the parent

|

|

|

(7,946

|

)

|

|

|

(1,086

|

)

|

|

|

(2,545

|

)

|

|

|

(3,352

|

)

|

|

|

2,420

|

|

|

Net income/(loss) (including non-controlling interest)

|

|

|

(8,423

|

)

|

|

|

(974

|

)

|

|

|

(2,575

|

)

|

|

|

(3,469

|

)

|

|

|

2,417

|

|

|

Earnings per common share—continuing operations (in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share

(3)

|

|

|

(4.43

|

)

|

|

|

(0.61

|

)

|

|

|

(1.46

|

)

|

|

|

(2.17

|

)

|

|

|

1.26

|

|

|

Diluted earnings per common share

(3)

|

|

|

(4.43

|

)

|

|

|

(0.61

|

)

|

|

|

(1.46

|

)

|

|

|

(2.17

|

)

|

|

|

1.00

|

|

|

Earnings per common share (in U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per common share

(3)

|

|

|

(4.43

|

)

|

|

|

(0.61

|

)

|

|

|

(1.46

|

)

|

|

|

(2.17

|

)

|

|

|

1.56

|

|

|

Diluted earnings per common share

(3)

|

|

|

(4.43

|

)

|

|

|

(0.61

|

)

|

|

|

(1.46

|

)

|

|

|

(2.17

|

)

|

|

|

1.29

|

|

|

Dividends declared per share

|

|

|

—

|

|

|

|

0.20

|

|

|

|

0.20

|

|

|

|

0.75

|

|

|

|

0.75

|

|

Notes:

|

(1)

|

Including U.S.$6,124 million, U.S.$6,606 million, U.S.$4,770 million, U.S.$5,181 million and U.S.$5,875 million of sales to related parties for the years ended December 31, 2015, 2014, 2013, 2012 and 2011,

respectively.

|

|

(2)

|

Including U.S.$1,460 million, U.S.$1,355 million, U.S.$1,310 million, U.S.$1,505 million and U.S.$2,615 million of purchases from related parties for the years ended December 31, 2015, 2014, 2013, 2012 and

2011, respectively.

|

|

(3)

|

Basic earnings per common share are computed by dividing net income attributable to equity holders of ArcelorMittal by the weighted average number of common shares outstanding during the periods

presented. Diluted earnings per common share include assumed shares from stock options, shares from restricted stock units and convertible debt (if dilutive) in the weighted average number of common shares outstanding during the

periods presented.

|

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Financial Position

|

|

|

|

|

(Amounts in U.S.$ millions except share data)

|

|

As of December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Cash and cash equivalents including restricted

cash

(1)

|

|

|

4,102

|

|

|

|

4,016

|

|

|

|

6,232

|

|

|

|

4,540

|

|

|

|

3,908

|

|

|

Property, plant and equipment

|

|

|

35,700

|

|

|

|

46,465

|

|

|

|

51,232

|

|

|

|

53,815

|

|

|

|

54,189

|

|

|

Total assets

|

|

|

76,846

|

|

|

|

99,179

|

|

|

|

112,308

|

|

|

|

113,998

|

|

|

|

121,679

|

|

|

Short-term debt and current portion of long-term debt

|

|

|

2,308

|

|

|

|

2,522

|

|

|

|

4,092

|

|

|

|

4,348

|

|

|

|

2,769

|

|

|

Long-term debt, net of current portion

|

|

|

17,478

|

|

|

|

17,275

|

|

|

|

18,219

|

|

|

|

21,965

|

|

|

|

23,634

|

|

|

Net assets

|

|

|

27,570

|

|

|

|

45,160

|

|

|

|

53,173

|

|

|

|

50,466

|

|

|

|

56,504

|

|

|

Share capital

|

|

|

10,011

|

|

|

|

10,011

|

|

|

|

10,011

|

|

|

|

9,403

|

|

|

|

9,403

|

|

|

Basic weighted average common shares outstanding (millions)

|

|

|

1,795

|

|

|

|

1,791

|

|

|

|

1,780

|

|

|

|

1,549

|

|

|

|

1,549

|

|

|

Diluted weighted average common shares outstanding (millions)

|

|

|

1,795

|

|

|

|

1,791

|

|

|

|

1,780

|

|

|

|

1,549

|

|

|

|

1,611

|

|

Notes:

|

(1)

|

Including restricted cash of U.S.$100 million, U.S.$123 million, U.S.$160 million, U.S.$138 million and U.S.$84 million for the years ended December 31, 2015, 2014, 2013, 2012 and 2011, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Consolidated Other Data

|

|

|

|

|

U.S.$ millions (unless otherwise indicated)

|

|

Year ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Net cash provided by operating activities

|

|

|

2,151

|

|

|

|

3,870

|

|

|

|

4,296

|

|

|

|

5,340

|

|

|

|

1,859

|

|

|

Net cash (used in) investing activities

|

|

|

(2,170

|

)

|

|

|

(3,077

|

)

|

|

|

(2,877

|

)

|

|

|

(3,730

|

)

|

|

|

(3,744

|

)

|

|

Net cash (used in) provided by financing activities

|

|

|

395

|

|

|

|

(2,750

|

)

|

|

|

241

|

|

|

|

(1,019

|

)

|

|

|

(555

|

)

|

|

Total production of crude steel (millions of tonnes)

|

|

|

92.5

|

|

|

|

93.1

|

|

|

|

91.2

|

|

|

|

88.2

|

|

|

|

91.9

|

|

|

Total shipments of steel products (millions of tonnes)

|

|

|

84.6

|

|

|

|

85.1

|

|

|

|

82.6

|

|

|

|

82.2

|

|

|

|

83.5

|

|

14

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Securities and Exchange Commission, or SEC, allows us to “incorporate by reference” the information we file with it, which means

that we may disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus, and certain later information

that we file with the SEC will automatically update and supersede this information. The 2015 20-F of ArcelorMittal and the current reports on Form 6-K (i) filed on March 11, 2016, containing the underwriting agreement dated March 11, 2016 among

ArcelorMittal and the underwriters named therein, and (ii) filed on March 10, 2016, containing the Company’s revised articles of association, are incorporated by reference herein.

We also incorporate by reference into this prospectus supplement and the accompanying prospectus any future filings made with the SEC under

Sections 13(a), 13(c) or 15(d) of the Securities Exchange Act of 1934, as amended (which is referred to as the “

Exchange Act

”), before the termination of the offering, and, to the extent designated therein, reports on Form 6-K that

we furnish to the SEC before the termination of the offering.

As you read the above documents, you may find inconsistencies in

information from one document to another. If you find inconsistencies you should rely on the statements made in the most recent document. Any statement contained in a document incorporated by reference herein shall be deemed to be modified or

superseded for purposes of this prospectus supplement and the accompanying prospectus to the extent that a statement contained in this prospectus supplement and the accompanying prospectus or a later document incorporated by reference herein

modifies or supersedes such first statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement and the accompanying prospectus. All information

appearing in this prospectus supplement and the accompanying prospectus is qualified in its entirety by the information and financial statements, including the notes thereto, contained in the documents that we have incorporated by reference.

Upon request, we will provide to each person, including any beneficial owner of Company shares, to whom the prospectus supplement and the

accompanying prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in the prospectus supplement and the accompanying prospectus but not delivered with the prospectus supplement and the accompanying

prospectus. You may request a copy of these filings, at no cost, by writing or telephoning us at ArcelorMittal USA Inc., 1 South Dearborn Street, 19th Floor, Chicago, IL 60603, Attention: Ms. Lisa M. Fortuna, Manager, Investor Relations,

telephone number: (312) 899-3985.

15

USE OF PROCEEDS

The Company’s share capital is denominated in Euros and its Financial Statements are denominated in U.S. dollars. The gross proceeds

from the offering before expenses, commissions and fees are expected to amount to €2,777 million and to result in an allocation to the share premium reserve of €2,651 million. The gross proceeds of €2,777 million are equivalent to

U.S.$3.015 billion at the ECB Reference Rate on March 10, 2016 (the date of the extraordinary shareholders’ meeting which approved the capital increase). The equivalent amount in U.S. dollars at the settlement date (or any conversion date)

will depend on the applicable exchange rate at such time.

The net proceeds of the offering, after deduction of underwriting discounts and

commissions and expenses of approximately €33 million (excluding any potential discretionary fees of up to €5,184,487), are expected to amount to approximately €2,745 million. ArcelorMittal intends to use the net proceeds from the

exercise of Rights attributed in the offering to reduce its indebtedness and to strengthen its balance sheet.

16

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth the Company’s consolidated capitalization and indebtedness as of December 31, 2015, prepared on the

basis of IFRS:

|

|

•

|

|

on an actual basis; and

|

|

|

•

|

|

as adjusted to give effect to (i) the conversion into ordinary shares of ArcelorMittal’s mandatorily convertible subordinated notes at maturity on January 15, 2016, (ii) the decrease in the par value of the

shares of the Company to €0.10 per share approved by the Extraordinary General Meeting on March 10, 2016, and (iii) the issuance of 1,262,351,531 newly-issued ordinary shares of the Company at the Subscription Price in connection with the

offering, after deducting the estimated underwriting and management commissions of the underwriters (excluding any potential discretionary fees) and offering expenses, as described under “

Use of Proceeds

”.

|

This table should be read together with the 2015 20-F, the financial statements included therein, the notes thereto and the other financial

data appearing elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2015

(amounts in U.S.$ millions)

(

*

)

|

|

|

|

|

Actual

|

|

|

As Adjusted

|

|

|

Short-term borrowings, including current portion of long-term debt

|

|

|

2,308

|

|

|

|

2,308

|

|

|

Secured and Unguaranteed

|

|

|

65

|

|

|

|

65

|

|

|

Guaranteed and Unsecured

|

|

|

90

|

|

|

|

90

|

|

|

Secured and Guaranteed

|

|

|

0

|

|

|

|

0

|

|

|

Unsecured/Unguaranteed

|

|

|

2,153

|

|

|

|

2,153

|

|

|

Long-term borrowings, net of current portion

|

|

|

17,478

|

|

|

|

17,478

|

|

|

Secured and Unguaranteed

|

|

|

560

|

|

|

|

560

|

|

|

Guaranteed and Unsecured

|

|

|

100

|

|

|

|

100

|

|

|

Secured and Guaranteed

|

|

|

0

|

|

|

|

0

|

|

|

Unsecured/Unguaranteed

|

|

|

16,818

|

|

|

|

16,818

|

|

|

Non-controlling interests

|

|

|

2,298

|

|

|

|

2,298

|

|

|

Equity attributable to the equity holders of the parent

|

|

|

25,272

|

|

|

|

28,260

|

|

|

Ordinary shares

(1)

|

|

|

10,011

|

|

|

|

394

|

|

|

Treasury shares

(1)

|

|

|

(377

|

)

|

|

|

(377

|

)

|

|

Additional paid-in capital

(1)

|

|

|

20,294

|

|

|

|

24,323

|

|

|

Retained earnings

|

|

|

13,902

|

|

|

|

13,902

|

|

|

Reserves

(2)

|

|

|

(20,358

|

)

|

|

|

(20,358

|

)

|

|

Non-distributable reserves

(3)

|

|

|

0

|

|

|

|

10,376

|

|

|

Mandatory convertible subordinated

notes

(1)

|

|

|

1,800

|

|

|

|

0

|

|

|

Total shareholders’ equity

|

|

|

27,570

|

|

|

|

30,558

|

|

|

Total capitalization (Total shareholder’s equity

plus

Short-term

borrowings

plus

Long-term borrowings)

|

|

|

47,356

|

|

|

|

50,344

|

|

|

(*)

|

For purposes of the adjustments to this table, the expected gross proceeds of €2,777 million and the expected net proceeds of €2,745 million have been converted into U.S. dollars at an exchange rate of

€1.00 = U.S.$1.09, which corresponds to the U.S. dollar / euro exchange rate in effect at December 31, 2015. The gross proceeds of €2,777 million are equivalent to U.S.$3.015 billion converted at the ECB Reference Rate in effect on

March 10, 2016. The equivalent U.S. dollar amounts at the settlement date (or any conversion date) will depend on the applicable foreign exchange rates at such date.

|

|

(1)

|

ArcelorMittal delivered 2.3 million shares against 1.8 million mandatory convertible subordinated notes converted

at the option of the holders in December 2015 and the remaining 88.2 million notes were converted into shares following the mandatory conversion at maturity that occurred on January 15, 2016.

|

17

|

|

Following this conversion, as of January 15, 2016, ArcelorMittal’s ordinary shares, treasury shares and additional paid-in capital amounted to U.S.$10,633 million, U.S.$(377) million

and U.S.$21,472 million, respectively. On March 10, 2016, the Extraordinary General Meeting approved the reduction in the share capital of the Company from €7,453,441,006.98 to an amount of €180,335,933.80 represented by 1,803,359,338

ordinary shares without nominal value and with a par value of €0.10 per share. Following this approval, ArcelorMittal’s ordinary shares, treasury shares and additional paid-in capital amounted to U.S.$257 million, U.S.$(377) million and

U.S.$21,472 million, respectively, based on the ECB Reference Rate in effect on March 10, 2016.

|

|

(2)

|

Including U.S.$1,001 million allocated to legal reserve.

|

|

(3)

|

Reserve results from the decrease in the par value of the shares of the Company to €0.10 per share as mentioned above.

|

Except as disclosed herein, there have been no material changes in ArcelorMittal’s consolidated capitalization and indebtedness since

December 31, 2015.

As of December 31, 2015, ArcelorMittal had guaranteed approximately U.S.$0.2 billion of debt of its operating

subsidiaries.

The ArcelorMittal group has sufficient working capital (including its unused credit lines) to meet its payment obligations

for at least twelve months from the date of this prospectus supplement.

18

DESCRIPTION OF THE ORDINARY SHARES

The ordinary shares of ArcelorMittal are described in detail in the 2015 Form 20-F, including under “Item 10.A—Additional

Information—Share capital” and Item “10.B—Additional Information—Memorandum and Articles of Association”, which in each case updates the information provided in ArcelorMittal’s Annual Report on Form 20-F for the

fiscal year ended December 31, 2014 and referred to in the accompanying prospectus under “

Description of the Ordinary Shares

”. Changes to the Company’s share capital were approved by the Extraordinary General Meeting (as

defined below) as described under “—

Corporate Decisions

” below.

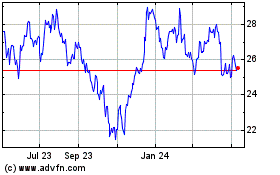

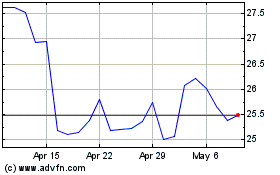

The following table sets forth, for the periods

indicated, the high and low sales prices per share of ArcelorMittal shares as reported on the New York Stock Exchange and the European exchanges on which its shares are listed.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The New York Stock

Exchange

|

|

|

Euronext Amsterdam

|

|

|

Euronext Paris

|

|

|

|

|

ArcelorMittal Shares

|

|

|

ArcelorMittal Shares

|

|

|

ArcelorMittal Shares

|

|

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

|

|

(in U.S. dollars)

|

|

|

(in Euros)

|

|

|

(in Euros)

|

|

|

Month ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|