ArcelorMittal to Raise $3 Billion After Hefty Net Loss - Update

February 05 2016 - 3:03AM

Dow Jones News

By Alex MacDonald

LONDON-- ArcelorMittal, the world's largest steelmaker, said

Friday it will issue $3 billion worth of shares to strengthen its

balance sheet as it grapples with a world-wide steel glut which

contributed to a near $7 billion fourth-quarter net loss.

The Mittal family, the steel group's controlling shareholder,

will subscribe to its entitlement of the share issue, or about $1.1

billion. Lakshmi Mittal is ArcelorMittal's chairman and chief

executive. At the end of last year, the family owned 39.4% of the

company's shares.

The company will also sell it 35% stake in Spain's automotive

metals component firm Gestamp for about $1 billion by the end of

June as part of the cash-raising program to pay down debt.

ArcelorMittal said it wants to reduce net debt to less than $12

billion from $15.7 billion at the end of December.

"This capital raise, combined with the sale of our minority

shareholding in Gestamp, will...help ensure that the business is

resilient in any market environment and puts ArcelorMittal in a

position of strength from which to further improve performance,"

said Mr. Mittal.

The urgency of ArcelorMittal's debt-reduction plan was

underscored by the company's latest results, released Friday a week

earlier than scheduled, in which its net loss ballooned to $6.7

billion in the three months to end-December from $955 million the

same quarter a year before.

Fourth-quarter revenue sank 25% to $14 billion on a 7% decline

in steel shipments, as falling prices of iron ore and steel

hammered ArcelorMittal's performance.

ArcelorMittal said impairment charges of $4.8 billion largely

related to its iron-ore operations led to a full-year loss of $7.9

billion.

ArcelorMittal shares have fallen 58% over the past year. Falling

steel prices in its regional markets and excess steel supply from

China, the world's largest steel producer, have exerted intense

pressure on its business. China has exported record amounts of the

metal to Europe and other markets amid shrinking demand at

home.

Tata Steel Ltd. of India, in announcing plans to cut a further

1,050 jobs from its U.K. operations last month, joined the chorus

of steelmakers urging governments to do more to stem the tide of

inexpensive steel from China.

Slack demand and falling prices has led other mining and metals

companies--ArcelorMittal mines iron ore and coal itself--to ask

shareholders for cash to shore up their finances as investors worry

about their ability to finance their borrowings amid the slump in

commodity producers' revenues.

French specialty steelmaker Vallourec SA announced this week

plans to raise EUR1 billion ($1.1 billion) from bonds and shares

amid drastic cutbacks in its business. Glencore PLC, the world's

third largest diversified miner, issued $2.5 billion in shares last

September as part of plan to reduce net debt by more than $10

billion.

Mr. Mittal said the steel group faces continued tough trading

conditions.

"[This year] will be another difficult year for our industries,"

said Mr. Mittal. "It is clear that China has a challenge to

restructure its steel industry...Until this situation is fully

addressed the effective and swift implementation of trade defense

instruments will be critical," he said.

In the fourth quarter, ArcelorMittal said earnings before

interest, taxes, depreciation and amortization fell 39% to $1.1

billion, in line market expectations according to analysts polled

by data provider FactSet.

Looking ahead, ArcelorMittal said it expects to generate more

than $4.5 billion in Ebtida this year following a 28% drop to $5.2

billion last year.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

February 05, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

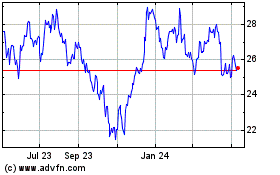

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

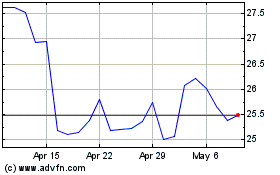

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024