ArcelorMittal to Idle Sestao Steel Plant Indefinitely

January 25 2016 - 12:28PM

Dow Jones News

By Alex MacDonald

LONDON--ArcelorMittal, the world's largest steelmaker, has

announced plans to idle its steel plant in Sestao, Spain for an

indefinite period of time due to tumbling steel prices caused by a

sudden influx of cheap steel imports from China and high

electricity costs.

"Our operations in Sestao are facing such challenging market

conditions--caused by a significant increase in cheap steel imports

from China and a heavy fall in prices--that keeping the plant open

in the current economic environment is not viable," said an

ArcelorMittal spokeswoman in an emailed statement Monday.

"We deeply regret having to take the difficult decision...and

are making every effort to mitigate the impact it will have on our

employees," she added. "This decision reinforces the need for the

implementation of swifter trade defense measures to protect the

European steel industry from dumping."

Steelmakers in Europe are laying off workers and shutting down

production capacity in response to a wave of cheap steel imports

from China, the world's largest steel producing nation. Shrinking

demand in China has spurred many Chinese steelmakers to sell their

product abroad.

As a result, Chinese steel shipments to the European Union have

more than doubled over the past two years, resulting in a 40% drop

in EU steel prices during the same period. EU steel demand remains

below the high levels last seen prior to the 2008 financial crisis,

data from the International Steel Statistics Bureau show.

The Sestao steel plant, which can produce 1.8 million tons of

steel a year and employs 330 people, will be idled in February and

will remain shut until market conditions improve, the spokeswoman

said. The plant was previously idled between December 2011 and June

2012 and was then idled every December thereafter in response to

challenging market conditions.

The Luxembourg-based steelmaker isn't alone in taking such

drastic measures. Tata Steel Ltd., Europe's second-largest

steelmaker after Arcelor, announced plans last week to axe 1,050

jobs in the U.K., part of a wider cost cutting effort to reduce its

European workforce to 26,000 employees from 30,000. Meanwhile

Sahaviriya Steel Industries PLC of Thailand said in September it

would shut its steel plant in northern England, resulting in 1,700

job losses.

Globally, crude steel production fell 2.8% to 1.62 billion tons

in 2015, according to data released by the World Steel Association

Monday. A combination of lackluster demand and high steel stocks

resulted in global steel output falling for the first time after

five consecutive years of growth.

All regions reported lower steel output except for Oceania, the

association said. Its members account for about 85% of the world's

steel output. In China, which accounts for about half of global

steel output, crude steel production fell 2.3% to 804 million tons

while steel production in the European Union's block of 28 member

states dropped 1.8% to 166 million tons. North America was also

hit, with crude steel production dropping 8.6% to 111 million

tons-and down 11% in the U.S. alone.

This caused the average utilization rate of the world's global

steel production capacity to drop to 69.7% on average last year

compared with 73.4% the year before.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

January 25, 2016 12:13 ET (17:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

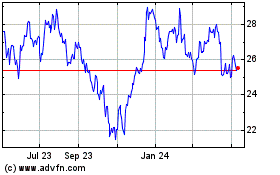

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

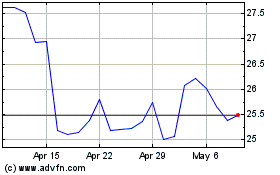

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024