Global Stocks Rally

January 19 2016 - 5:40AM

Dow Jones News

Global stocks rallied Tuesday even though China recorded the

weakest annual pace of growth in a quarter century, as gains in

crude oil and base metals prices lifted downtrodden energy and

mining shares.

China's 6.9% annual growth rate seemed to offer relief to

investors, some of whom had feared worse, and many expect Beijing

may do more to stimulate its economy.

The Stoxx Europe 600 rose 1.4% in early trade Tuesday after

Asian shares closed higher.

Futures pointed to a 1.4% opening gain for the S&P 500 as it

reopens from a holiday. Changes in futures don't necessarily

reflect market moves after the opening bell.

Fears of a slowdown in China and its impact on commodity prices

have rattled stock markets around the world from the first trading

session of the year. Both European stocks and the S&P 500 are

down 8% in 2016.

Still, some investors are less pessimistic on the outlook for

China, noting that Beijing has room to maneuver if it wants to

boost its slowing economy.

"China still has a dashboard of policy buttons it can press,"

said Neil Williams, group chief economist at Hermes Investment

Management, noting China can continue to devalue its currency,

undertake quantitative easing, or "go on a fiscal splurge" if

needed.

The volatile Shanghai Composite Index was up 3.2% Tuesday,

bringing losses for the year down to 15%.

Adding to the positive sentiment across markets, Brent crude oil

was last up 2.6% at $29.28, as bargain-hunting overshadowed the

sting of slowing Chinese growth. Base metals also gained, with

copper up 1.8%.

The day's reprieve in battered commodity prices sent Europe's

basic resources sector up 4.1%, as the oil and gas sector climbed

2%. Shares in mining Glencore PLC were up 7.7%, as Anglo American

PLC gained 7.9% and steelmaker ArcelorMittal SA rose 5.3%.

In currencies, the euro was down 0.1% against the dollar at

$1.0878 ahead of inflation data for the eurozone as a whole due

later in the European morning.

Data early Tuesday showed German inflation was unchanged in

December from the previous month, well below the European Central

Bank's medium-term inflation target of just around 2%.

Subdued inflation across the eurozone caused the ECB in December

to cut its deposit rate--at which commercial banks park excess

money with the central bank--deeper into negative territory, while

it also extended the duration of its asset purchase program to

March 2017.

The ECB holds a governing council meeting on Thursday, and while

analysts don't expect immediate action, many expect the bank to

roll out additional stimulus measures later this year.

Elsewhere in Asian trade, Japan's Nikkei Stock Average was up

0.6% as the dollar gained 0.4% against the yen to ¥ 117.8790.

Australia's S&P ASX 200 added 0.9%.

Gold was up 0.3% at $1093.90 a troy ounce.

Later Tuesday, the U.S. earnings season continues with reports

from Bank of America Corp., Morgan Stanley, International Business

Machines Corp. and Netflix Inc.

Emese Bartha contributed to this article

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

January 19, 2016 05:25 ET (10:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

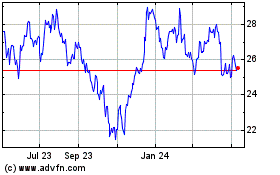

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

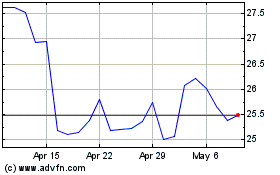

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024