ArcelorMittal Loss Worse Than Expected -- Update

November 06 2015 - 2:20AM

Dow Jones News

By Alex MacDonald

LONDON--Steel giant ArcelorMittal on Friday cut its earnings

outlook as it swung to a net loss in the third-quarter due in part

to increased competition from steel imports, particularly from

China, that are taking a toll on steelmakers globally.

The Luxembourg-based steelmaker, the world's largest by

shipments accounting for some 6% of global steel output, reported a

net loss of $711 million in the third quarter compared with $22

million net profit in the same period a year earlier.

The figure missed expectations of a $184 million net loss based

on a FactSet poll of six analysts largely due to $527 million in

impairment charges, including $500 million related to the

write-down of inventories following a sharp drop in international

steel prices, and $27 million related to restructuring costs in

South Africa.

Revenue fell 22% to $15.6 billion due to lower steel and iron

ore shipments as well as lower prices for both products as steel

demand in all major markets, except Europe contracted.

This prompted the company to suspend its dividend and cut its

guidance for full-year earnings before interest, taxes,

depreciation and amortization or Ebitda to between $5.2 billion and

$5.4 billion from a previous range of $6 billion to $7 billion.

The steelmaker said operating conditions have deteriorated

significantly in recent months, both in terms of the international

steel prices, driven by unsustainably low export prices from China,

and order volumes as customers adopt a "wait and see" mind-set in

case steel prices fall further.

Chinese steelmakers are shipping their steel abroad at a record

pace with exports reaching a monthly high in September. The Chinese

steelmakers are exporting their product abroad in larger waves due

to anemic domestic demand at home. The U.S. and Europe Union have

been particularly hard hit by the subsequent influx of cheap steel

imports. The U.S. and EU have responded by launching trade cases to

protect their local steelmakers.

Jefferies estimates that the U.S. has launched steel trade cases

representing 34% of its total steel imports in the year to date,

while the EU has launched steel trade cases for just 15% of its

total steel imports.

"There are...important issues for governments to address,

specifically relating to unfair trade. We are encouraged by various

examples of trade action being initiated in response to dumping,

but the process needs to be faster in order to be fully effective,"

said ArcelorMittal's Chief Executive Lakshmi Mittal.

Looking ahead, Mr. Mittal said: "Whilst we expect market

conditions to remain challenging in 2016, we have a number of

important programs under way across the business which will

structurally improve Ebitda.

The company plans to reduce next year's cash requirements by

about $1 billion from this year by cutting its capital expenditure,

lowering interest and tax expenses and suspending its dividend.

It also expects to lower its net debt to $15.8 billion by the

year end from $16.8 billion at end-September and noted that it

expects to remain free cash-flow positive this year.

Write to Alex MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 06, 2015 02:05 ET (07:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

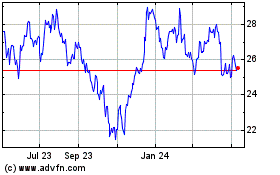

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

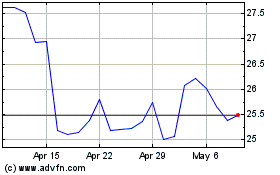

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024