UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————————

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

—————————

Dated May 7, 2015

Commission File Number: 001-35788

ARCELORMITTAL

(Translation of registrant’s name into

English)

24-26, Boulevard d’Avranches

L-1160 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No

☒

If “Yes” marked, indicate below

the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-________

On May 7, 2015, ArcelorMittal

issued the press releases attached hereto as Exhibit 99.1 and Exhibit 99.2 hereby incorporated by reference into this report on

Form 6-K.

Exhibit List

| Exhibit No. |

Description |

|

Exhibit 99.1

|

Press release dated May 7, 2015 reporting ArcelorMittal’s

results for first quarter 2015.

|

|

Exhibit 99.2

|

Press release dated May 7, 2015 reporting that ArcelorMittal Europe has recorded an operating profit of €281 million for first quarter 2015. |

| |

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: May 7, 2015

By: /s/

Henk Scheffer

Exhibit Index

| Exhibit No. |

Description |

|

Exhibit 99.1

|

Press release dated May 7, 2015 reporting ArcelorMittal’s

results for first quarter 2015.

|

|

Exhibit 99.2

|

Press release dated May 7, 2015 reporting that ArcelorMittal Europe has recorded an operating profit of €281 million for first quarter 2015. |

ArcelorMittal results for the first quarter 2015

Luxembourg, May 7, 2015 - ArcelorMittal (referred to as “ArcelorMittal”

or the “Company”) (MT (New York, Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading integrated

steel and mining company, today announced results1 for the three month period ended March 31, 2015.

Highlights:

| § | Health and safety: LTIF rate of 0.88x

in 1Q 2015 as compared to 0.89x in 4Q 2014 |

| § | EBITDA of $1.4 billion in 1Q 2015 (including $0.1

billion onerous contract provision)2, versus $1.8 billion in 1Q 2014 |

| § | Despite significant forex headwinds, 1Q 2015 underlying

steel-only EBITDA stable versus 1Q 20143 |

| § | Net loss of $0.7 billion in 1Q 2015 (primarily forex

driven) as compared to a net loss of $0.2 billion in 1Q 2014 |

| § | Steel shipments of 21.6Mt, an increase of 3% as compared

to 21Mt in 1Q 2014 |

| § | 15.6 Mt own iron ore production, an increase of 5%

as compared to 14.8 Mt in 1Q 2014; 9.4 Mt shipped and reported at market prices as compared to 9.3 Mt in 1Q 2014 |

| § | Iron ore unit cash costs down 13% YoY; FY 2015 cost

reduction target increased to 15% (from 10% previously) |

| § | Net debt of $16.6 billion as of March 31, 2015 as

compared to $18.5 billion at March 31, 2014 |

Outlook

and guidance:

| § | Whilst steel markets have evolved largely as per

expectations, the subsequent deterioration of iron ore prices as well as a weaker U.S. market results in a headwind to guidance.

Although the Company expects to benefit from further improvement in costs, both in mining and steel segments (including lower raw

material costs), the Company now expects 2015 EBITDA within the range of $6.0 - $7.0 billion |

| § | Due to the benefits of foreign exchange as well as

the postponement of some investment projects the Company has further reduced the FY 2015 capital expenditure budget to approximately

$3.0 billion |

| § | The Company continues to expect positive free cash

flow in 2015 and to achieve progress towards the medium term net debt target of $15 billion |

| § | The Company expects net interest expense of approximately

$1.4 billion in 2015 |

Financial highlights (on the basis of IFRS1):

| (USDm) unless otherwise shown |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Sales |

17,118 |

18,723 |

20,067 |

20,704 |

19,788 |

| EBITDA |

1,378 |

1,815 |

1,905 |

1,763 |

1,754 |

| Operating income |

571 |

569 |

959 |

832 |

674 |

| Net (loss) / income attributable to equity holders of the parent |

(728) |

(955) |

22 |

52 |

(205) |

| Basic (loss) /earnings per share (USD) |

(0.41) |

(0.53) |

0.01 |

0.03 |

(0.12) |

| |

|

|

|

|

|

| Own iron ore production (Mt) |

15.6 |

16.7 |

15.8 |

16.6 |

14.8 |

| Iron ore shipped at market price (Mt) |

9.4 |

9.9 |

10.0 |

10.5 |

9.3 |

| Crude steel production (Mt) |

23.7 |

23.2 |

23.9 |

23.1 |

23.0 |

| Steel shipments (Mt) |

21.6 |

21.2 |

21.5 |

21.5 |

21.0 |

| EBITDA/tonne (US$/t) |

64 |

86 |

89 |

82 |

84 |

| Steel-only EBITDA/tonne (US$/t) |

59 |

75 |

76 |

64 |

63 |

Commenting, Mr. Lakshmi N. Mittal, ArcelorMittal Chairman

and CEO, said:

“We faced a number of headwinds in the first quarter, including a declining

iron-ore price, a stronger dollar and surge of imports in the United States. As a result of which EBITDA declined to US$1.4

billion, although the underlying performance of our steel business remained similar to the first quarter of 2014. The performance

in Europe was of particular note, with EBITDA improving 15% year-on-year. Off-setting the impact of these headwinds is a

priority and we are focused on achieving a 15% reduction in mining costs and improving the competitive position of our US operations.

Importantly, we still expect to remain free cash flow positive and further reduce net debt over the course of the year.”

First quarter 2015 earnings analyst conference

call

ArcelorMittal management will host a conference call

for members of the investment community to discuss the first quarter period ended March 31, 2015 on:

| Date |

US Eastern time |

London |

CET |

| Thursday May 7, 2015 |

9.30am |

2.30pm |

3.30pm |

| |

|

|

|

| The dial in numbers: |

|

|

| Location |

Toll free dial in numbers |

Local dial in numbers |

Participant |

| UK local: |

0800 051 5931 |

+44 (0)203 364 5807 |

46266261# |

| USA local: |

186 6719 2729 |

+1 24 06450345 |

46266261# |

| France: |

0800 9174780 |

+33 17071 2916 |

46266261# |

| Germany: |

0800 965 6288 |

+49 692 7134 0801 |

46266261# |

| Spain: |

90 099 4930 |

+34 911 143436 |

46266261# |

| Luxembourg: |

800 26908 |

+352 27 86 05 07 |

46266261# |

| |

|

|

|

| A replay of the conference call will be available for one week by dialing: |

| Number |

Language |

Access code |

|

| +49 (0) 1805 2043 089 |

English |

446929# |

|

The conference call will include a brief question and answer session with

senior management. The presentation will be available via a live video webcast on www.arcelormittal.com.

Forward-Looking Statements

This document may contain forward-looking information and statements about

ArcelorMittal and its subsidiaries. These statements include financial projections and estimates and their underlying assumptions,

statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements

regarding future performance. Forward-looking statements may be identified by the words “believe,” “expect,”

“anticipate,” “target” or similar expressions. Although ArcelorMittal’s management believes that

the expectations reflected in such forward-looking statements are reasonable, investors and holders of ArcelorMittal’s securities

are cautioned that forward-looking information and statements are subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of ArcelorMittal, that could cause actual results and developments to differ

materially and adversely from those expressed in, or implied or projected by, the forward-looking information and statements. These

risks and uncertainties include those discussed or identified in the filings with the Luxembourg Stock Market Authority for the

Financial Markets (Commission de Surveillance du Secteur Financier) and the United States Securities and Exchange Commission

(the “SEC”) made or to be made by ArcelorMittal, including ArcelorMittal’s Annual Report on Form 20-F for the

year ended December 31, 2014 filed with the SEC. ArcelorMittal undertakes no obligation to publicly update its forward-looking

statements, whether as a result of new information, future events, or otherwise.

Corporate responsibility and safety performance

Health and safety - Own personnel and contractors

lost time injury frequency rate

Health and safety performance, based on own personnel figures and contractors

lost time injury frequency (LTIF) rate, remained stable at 0.88x in the first quarter of 2015 (“1Q 2015”) as compared

to 0.89x for the fourth quarter of 2014 (“4Q 2014”) and deteriorated as compared to 0.85x for the first quarter of

2014 (“1Q 2014”). During 1Q 2015, significant improvements in the Mining, NAFTA and Brazil segment performance relative

to 4Q 2014, were partially offset by deterioration in the Europe and ACIS segment.

The Company’s

effort to improve the Group’s Health and Safety record continues and remains focused on both further reducing the rate of

severe injuries and preventing fatalities.

Own personnel and contractors - Frequency rate

| Lost time injury frequency rate |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Mining |

0.60 |

0.75 |

0.29 |

0.84 |

0.26 |

| |

|

|

|

|

|

| NAFTA |

1.13 |

1.42 |

1.03 |

0.88 |

1.00 |

| Brazil |

0.71 |

1.14 |

0.98 |

0.47 |

0.98 |

| Europe |

1.15 |

0.90 |

1.00 |

1.25 |

1.19 |

| ACIS |

0.56 |

0.47 |

0.52 |

0.51 |

0.54 |

| Total Steel |

0.93 |

0.92 |

0.87 |

0.87 |

0.96 |

| |

|

|

|

|

|

| Total (Steel and Mining) |

0.88 |

0.89 |

0.78 |

0.87 |

0.85 |

Key corporate responsibility highlights for 1Q 2015:

| · | ArcelorMittal 2014 sustainability report, “Steel:

the sustainability challenge” was released on April 20, 2015. With the release of the sustainability report the Company

launched a new framework focusing on 10 sustainable development outcomes it will work to achieve. |

| · | ArcelorMittal named a finalist for the Corporate Social Responsibility Award from

Platts Global Metals, with the winner to be announced in May 2015. |

| · | Launch of our #ilovesteel #ilovescience Twitter campaign to motivate young people’s

interest in science, technology, engineering and math and attract top talent to continue cutting edge innovation for steel and

mining. |

Analysis of results for 1Q 2015 versus 4Q 2014

and 1Q 2014

Total steel shipments for 1Q 2015 were 2% higher at 21.6 million metric tonnes

as compared with 21.2 million metric tonnes for 4Q 2014, and 3% higher as compared to 21.0 million metric tonnes for 1Q 2014.

Sales for 1Q 2015 were $17.1 billion as compared to $18.7 billion for 4Q 2014

and $19.8 billion for 1Q 2014. Sales in 1Q 2015, were 8.6% lower as compared to 4Q 2014 primarily due to lower average steel selling

prices (-9.2%), seasonally lower market priced iron ore shipments (-5.7%) and lower iron ore reference prices (-16%), partially

offset by higher steel shipments (+2.0%).

Depreciation was lower at $807 million for 1Q 2015 as compared to $982 million

in 4Q 2014 primarily on account of foreign exchange impact due to depreciation of all major currencies (Brazilian real, Euro and

Canadian dollar) against the US dollar. Depreciation in 1Q 2015 was significantly lower than $1,080 million for 1Q 2014 on account

of these impacts discussed above, as well as increases in the useful lives of plant and equipment. Assuming a similar foreign exchange

translation impact for the remainder of 2015, full year depreciation is expected to be approximately $3.5 billion.

Impairment charges for 1Q 2015 and 1Q 2014 were nil. Impairment charges for

4Q 2014 of $264 million included $114 million primarily related to the idling of the steel shop and rolling facilities of Indiana

Harbor Long carbon operations in the US (NAFTA); $63 million related to write-down of the Volcan iron ore mine in Mexico (Mining);

and $57 million related to the closure of mill C in Rodange, Luxembourg (Europe).

Operating income for 1Q 2015 was $571 million, as compared to $569 million

in 4Q 2014 and $674 million in 1Q 2014. Operating results for 1Q 2015 were negatively impacted by a $69 million provision primarily

related to onerous hot rolled and cold rolled contracts in the US (NAFTA). Operating results for 4Q 2014 were negatively impacted

by a $76 million provision related to onerous annual tin plate contracts at Weirton in the US (NAFTA), offset by the positive impact

from the $79 million gain on disposal of Kuzbass coal mines in Russia (Mining).

Loss from investments in associates, joint ventures and other investments

in 1Q 2015 was $2 million as compared to loss in 4Q 2014 of $380 million and income of $36 million in 1Q 2014. Loss from investments

in associates, joint ventures and other investments in 1Q 2015 was negatively impacted by foreign exchange effects on various investees,

partially offset by improved performance by Spanish and German investees.

Loss from investments in associates, joint ventures and other investments

in 4Q 2014 was negatively impacted by a $621 million impairment loss on China Oriental following a revision of business assumptions,

partially offset by a $193 million gain on sale of Gallatin as well as improved performance of European investees and the share

of profits of Calvert operations. Income in 1Q 2014 was primarily the result of improved performance of Spanish investees.

Net interest expense (including interest expense and interest income) in 1Q

2015 was stable at $323 million as compared to 4Q 2014. Increased interest expense due to the issuance of €750 million of

bonds in January 2015 and “step up” clauses in most of the Company’s outstanding bonds, triggered by the S&P

downgrade in February 2015 was offset by savings following the repayments of bonds in 4Q 2014 ($500 million and $750 million repaid

early in October 2014 and €360 million repaid in November 2014). The decrease in 1Q 2015 relative to $426 million in 1Q 2014

is attributable to both lower gross debt outstanding and lower average cost, following the repayments of convertible bonds in 2Q

2014 (€1.25 billion and $800 million) and the repayments of bonds in 4Q 2014. The Company continues to expect full year 2015

net interest expense of approximately $1.4 billion.

Foreign exchange and other net financing costs were $756 million for 1Q 2015

as compared to $549 million for 4Q 2014 and $380 million for 1Q 2014. Foreign exchange and other net financing costs for 1Q 2015

include foreign exchange losses of $538 million as compared to a loss of $316 million for 4Q 2014 mainly on account of USD appreciation

of 11.4% against the Euro (versus 3.5% in 4Q 2014) and 17.2% against BRL (versus 7.7% in 4Q 2014). This foreign exchange loss is

largely non-cash and primarily relates to the impact of the USD appreciation on Euro denominated deferred tax assets partially

offset by foreign exchange gain on euro debt.

ArcelorMittal recorded income tax expense of $210 million for 1Q 2015, as

compared to an income tax expense of $258 million for 4Q 2014 and income tax expense of $61 million for 1Q 2014.

Non-controlling interests for 1Q 2015 and 4Q 2014 represent a charge primarily

related to minority shareholders’ share of net income recorded in ArcelorMittal Mines Canada and Belgo Bekaert Arames in

Brazil. Non-controlling interests for 1Q 2014 represent a charge primarily related to minority shareholders’ share of net

income recorded in ArcelorMittal Mines Canada and South Africa.

ArcelorMittal recorded a net loss for 1Q 2015 of $728 million, or $0.41 loss

per share, as compared to net loss of $955 million, or $0.53 loss per share for 4Q 2014, and a net loss of $205 million, or $0.12

loss per share for 1Q 2014.

Capital expenditure projects

The following tables summarize the Company’s principal growth and optimization

projects involving significant capital expenditures.

Completed projects in most recent quarters

| Region |

Site |

Project |

Capacity / particulars |

Actual completion |

| China |

Hunan Province |

VAMA auto steel JV |

Capacity of 1.5mt pickling line, 0.9mt continuous annealing line and 0.5mt of hot dipped galvanizing auto steel |

1Q 2015 |

| USA |

AM/NS Calvert |

Continuous coating line upgrade to Aluminize line#4 |

Increased production of Usibor by 0.1mt / year |

1Q 2015 |

| Brazil |

Juiz de Fora (Brazil) |

Rebar and meltshop expansion |

Increase in rebar capacity by 0.4mt / year;

|

1Q 2015

|

Ongoing projects

| Segment |

Site |

Project |

Capacity / particulars |

Forecast completion |

| Mining |

Liberia |

Phase 2 expansion project |

Increase production capacity to 15mt/ year (high grade sinter feed) |

Initial forecast of 2015 / Currently delayed (a) |

| NAFTA |

ArcelorMittal Dofasco (Canada) |

Construction of a heavy gauge galvanizing line#6 to optimize galvanizing operations |

Optimize cost and increase shipment of galvanized products by 0.3mt / year |

2Q 2015 |

| Brazil |

ArcelorMittal Vega Do Sul (Brazil) |

Expansion project |

Increase hot dipped galvanizing (HDG) capacity by 0.6mt / year and cold rolling (CR) capacity by 0.7mt / year |

On hold |

| Brazil |

Monlevade (Brazil) |

Wire rod production expansion |

Increase in capacity of finished products by 1.1mt / year |

2015 |

| |

Juiz de Fora (Brazil) |

Rebar and meltshop expansion |

Increase in meltshop capacity by 0.2mt / year |

2016

|

| Brazil |

Monlevade (Brazil) |

Sinter plant, blast furnace and meltshop |

Increase in liquid steel capacity by 1.2mt / year;

Sinter feed capacity of 2.3mt / year |

On hold |

| Brazil |

Acindar (Argentina) |

New rolling mill |

Increase in rolling capacity by 0.4mt / year for bars for civil construction |

2016 |

Joint venture projects

| Region |

Site |

Project |

Capacity / particulars |

Forecast completion |

| Canada |

Baffinland |

Early revenue phase |

Production capacity 3.5mt/ year (iron ore) |

2H 2015 |

| USA |

AM/NS Calvert |

Slab yard expansion |

Increase coil production level up to 5.3mt/year coils. |

2H 2016 |

| a) | The Liberia phase 2 project to invest $1.7 billion to construct 15 million tonnes

of concentrate capacity and associated infrastructure has been delayed. This follows the contractor’s declaration of force

majeure on August 8, 2014 due to the Ebola virus outbreak in West Africa. Given the project delays and ensuing rapid deterioration

of iron ore prices, the Company is assessing its options to progress with this project. ArcelorMittal remains fully committed to

Liberia. Phase 1 operations are continuing as normal at this time and to date have not been affected by the Ebola situation in

Liberia. |

Analysis of segment operations

NAFTA

| (USDm) unless otherwise shown |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Sales |

4,777 |

5,166 |

5,645 |

5,423 |

4,928 |

| EBITDA |

53 |

341 |

429 |

177 |

259 |

| Depreciation |

156 |

178 |

169 |

170 |

189 |

| Impairments |

- |

114 |

- |

- |

- |

| Restructuring charges |

- |

- |

- |

- |

- |

| Operating (loss) / income |

(103) |

49 |

260 |

7 |

70 |

| |

|

|

|

|

|

| Crude steel production (kt) |

5,908 |

6,142 |

6,485 |

6,153 |

6,256 |

| Steel shipments (kt) |

5,463 |

5,805 |

5,866 |

5,790 |

5,613 |

| Average steel selling price (US$/t) |

796 |

824 |

853 |

856 |

840 |

NAFTA segment crude steel production decreased by 3.8% to 5.9 million tonnes

in 1Q 2015 as compared to 4Q 2014 to align with weaker demand.

Steel shipments in 1Q 2015 decreased by 5.9% to 5.5 million tonnes as compared

to 4Q 2014, primarily driven by a 7.9% decline in flat product steel shipment volumes due to weaker demand resulting in particular

from a strong inventory destock.

Sales in 1Q 2015 decreased by 7.5% to $4.8 billion as compared to 4Q 2014,

due to lower steel shipments as discussed above, and lower average steel selling prices (-3.5%) primarily due to lower domestic

prices impacted by weak demand and import pressures. Average steel selling price for flat products and long products declined -3.1%

and -8.0%, respectively.

EBITDA in 1Q 2015 decreased to $53 million as compared to $341 million in

4Q 2014. EBITDA for 1Q 2015 was negatively impacted by a $69 million provision primarily related to onerous hot rolled and cold

rolled contracts in the US. EBITDA for 4Q 2014 was negatively impacted by a $76 million provision related to onerous annual tin

plate contract at Weirton, in the US. EBITDA in 1Q 2015 was lower as compared to 4Q 2014 due to lower average steel selling prices

and steel shipment volumes as discussed above.

On an underlying basis, EBITDA in 1Q 2015 was 52.9% lower as compared to 1Q

2014 primarily due to lower steel shipments (-2.7%) and lower average steel selling prices (5.3%).

Operating income for 4Q 2014 was also impacted by impairment

charges of $114 million primarily related to the idling of the steel shop and rolling facilities of Indiana Harbor Long carbon

operations in the US.

Brazil

| (USDm) unless otherwise shown |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Sales |

2,119 |

2,543 |

2,707 |

2,431 |

2,356 |

| EBITDA |

377 |

546 |

460 |

414 |

425 |

| Depreciation |

86 |

99 |

111 |

109 |

138 |

| Impairments |

- |

- |

- |

- |

- |

| Restructuring charges |

- |

- |

- |

- |

- |

| Operating income |

291 |

447 |

349 |

305 |

287 |

| |

|

|

|

|

|

| Crude steel production (kt) |

2,875 |

2,758 |

2,971 |

2,382 |

2,413 |

| Steel shipments (kt) |

2,707 |

2,895 |

2,844 |

2,312 |

2,325 |

| Average steel selling price (US$/t) |

713 |

792 |

866 |

934 |

895 |

Brazil segment crude steel production increased by 4.3% to 2.9 million tonnes

in 1Q 2015 as compared to 4Q 2014.

Steel shipments in 1Q 2015 decreased by 6.5% to 2.7 million tonnes as compared

to 4Q 2014, driven by a 7.8% decline in flat product steel shipment volumes (primarily due to decreased slab exports from Brazil),

and 4.8% decline in long product steel shipment volumes primarily due to weak domestic demand in Brazil and Argentina.

Sales in 1Q 2015 decreased by 16.6% to $2.1 billion as compared to 4Q 2014,

due to lower steel shipments as discussed above, and lower average steel selling prices (-10%). Average steel selling prices for

flat and long products decreased by 11.2% and 5.2%, respectively, negatively impacted by a weaker Brazilian real and a decline

in international slab prices.

EBITDA in 1Q 2015 decreased by 30.9% to $377 million as compared to $546 million

in 4Q 2014 primarily on account of lower steel shipment volumes and average steel selling prices, as well as lower profitability

in our tubular operations.

EBITDA in 1Q 2015 was lower as compared to 1Q 2014 by 11.1% due to lower average

steel selling prices offset in part by higher steel shipments (following the restart of Tubarao furnace in July 2014).

Europe

| (USDm) unless otherwise shown |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Sales |

8,600 |

9,023 |

9,689 |

10,518 |

10,322 |

| EBITDA |

616 |

557 |

523 |

689 |

535 |

| Depreciation |

299 |

343 |

357 |

355 |

455 |

| Impairments |

- |

57 |

- |

- |

- |

| Restructuring charges |

- |

- |

- |

- |

- |

| Operating income |

317 |

157 |

166 |

334 |

80 |

| |

|

|

|

|

|

| Crude steel production (kt) |

11,341 |

10,742 |

10,837 |

10,941 |

10,899 |

| Steel shipments (kt) |

10,662 |

9,610 |

9,829 |

10,191 |

10,009 |

| Average steel selling price (US$/t) |

633 |

721 |

760 |

799 |

808 |

Europe segment crude steel production increased by 5.6% to 11.3 million tonnes

in 1Q 2015, as compared to 4Q 2014.

Steel shipments in 1Q 2015 increased by 10.9% to 10.7 million tonnes as compared

to 4Q 2014. Flat product shipment volumes increased by 12.9% and long product shipment volumes increased by 6.4%, both benefiting

from seasonality and improved demand.

Sales in 1Q 2015 decreased by 4.7% to $8.6 billion as

compared to 4Q 2014, primarily due to lower average steel selling prices (-12.2%), partially offset by higher steel shipments as

discussed above. Average steel selling prices for flat and long products decreased by 11.8% and 13.0%, respectively, largely due

to exchange rate effects. Local average steel prices declined marginally, partially reflecting lower raw material costs.

EBITDA in 1Q 2015 increased by 10.6% to $616 million as compared to $557 million

in 4Q 2014, reflecting improved market conditions offset in part by negative translation impacts.

EBITDA in 1Q 2015 was 15% higher than 1Q 2014, reflecting improved market

conditions as well as the benefits of cost optimization efforts.

Operating performance for 4Q 2014 was impacted by impairment charges of $57

million, related to the closure of mill C in Rodange, Luxembourg.

ACIS4

| (USDm) unless otherwise shown |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Sales |

1,721 |

1,967 |

1,994 |

2,300 |

2,007 |

| EBITDA |

133 |

147 |

208 |

156 |

109 |

| Depreciation |

108 |

135 |

130 |

131 |

129 |

| Impairments |

- |

- |

- |

- |

- |

| Restructuring charges |

- |

- |

- |

- |

- |

| Operating income / (loss) |

25 |

12 |

78 |

25 |

(20) |

| |

|

|

|

|

|

| Crude steel production (kt) |

3,603 |

3,519 |

3,616 |

3,600 |

3,413 |

| Steel shipments (kt) |

3,006 |

3,111 |

3,229 |

3,306 |

3,187 |

| Average steel selling price (US$/t) |

507 |

550 |

594 |

592 |

567 |

ACIS segment crude steel production in 1Q 2015 increased by 2.4% to 3.6 million

tonnes as compared to 4Q 2014. This reflects increased production in South Africa following the ramp up at Newcastle blast furnace

post the completion in December of the reline works.

Steel shipments in 1Q 2015 decreased by 3.4% to 3.0 million metric tonnes

as compared to 4Q 2014, primarily due to seasonally lower shipments in our CIS operations offset in part by higher volumes in South

Africa.

Sales in 1Q 2015 decreased by 12.5% to $1.7 billion as compared to 4Q 2014.

This decline was primarily due to lower steel shipment volumes and average steel selling prices (-7.8%). Average steel selling

prices were lower in Ukraine (-13.7%) and Kazakhstan (-10%) impacted by weaker CIS prices, as well as lower prices in South Africa

following a 4.5% depreciation of the South African Rand.

EBITDA in 1Q 2015 decreased to $133 million as compared to $147 million in

4Q 2014, due to lower average steel selling prices partially offset by lower costs in Ukraine (due to currency devaluation) and

South Africa.

EBITDA in 1Q 2015 was 21.7% higher as compared to 1Q 2014 due to lower costs,

offset by lower steel shipments (-5.7%) and lower average steel selling prices (-10.6%).

Mining

| |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Sales |

758 |

1,059 |

1,272 |

1,383 |

1,256 |

| EBITDA |

114 |

232 |

278 |

388 |

433 |

| Depreciation |

150 |

219 |

170 |

155 |

159 |

| Impairments |

- |

63 |

- |

- |

- |

| Restructuring charges |

- |

- |

- |

- |

- |

| Operating income / (loss) |

(36) |

(50) |

108 |

233 |

274 |

| |

|

|

|

|

|

| Own iron ore production (a) (Mt) |

15.6 |

16.7 |

15.8 |

16.6 |

14.8 |

| Iron ore shipped externally and internally at market price (b) (Mt) |

9.4 |

9.9 |

10.0 |

10.5 |

9.3 |

| Iron ore shipment - cost plus basis (Mt) |

4.1 |

6.4 |

7.1 |

6.2 |

4.2 |

| |

|

|

|

|

|

| Own coal production(a) (Mt) |

1.6 |

1.7 |

1.8 |

1.8 |

1.8 |

| Coal shipped externally and internally at market price(b) (Mt) |

0.6 |

0.8 |

1.1 |

1.1 |

1.0 |

| Coal shipment - cost plus basis (Mt) |

0.8 |

0.9 |

0.8 |

0.8 |

0.8 |

(a) Own iron ore and coal production not including strategic long-term

contracts

(b) Iron ore and coal shipments of market-priced based materials include

the Company’s own mines, and share of production at other mines, and exclude supplies under strategic long-term contracts

Own iron ore production (not including supplies under strategic long-term

contracts) in 1Q 2015 decreased by 7.0% to 15.6 million metric tonnes as compared to 4Q 2014. This reflects seasonally weaker performance

in Canada and Brazil offset in part by improved production in Liberia.

Own iron ore production (not including supplies under strategic long-term

contracts) was 5.0% higher than 1Q 2014, primarily due to higher production at Mines Canada due to “efficiency gains”

and improvement at Liberia offset in part by lower production in Ukraine and Brazil.

Market price iron ore shipments in 1Q 2015 decreased by 5.7% to 9.4 million

metric tonnes as compared to 4Q 2014, primarily driven by seasonally lower shipments Mines Canada driven by weather related issues.

Market price iron ore shipments in 1Q 2015 were stable as compared to 1Q 2014

primarily due to lower shipments in Mexico and Ukraine offset by increased shipments in Mines Canada following operational efficiency

gains.

Own coal production (not including supplies under strategic long-term contracts)

in 1Q 2015 decreased 8.0% to 1.6 million metric tonnes as compared to 4Q 2014, primarily due to seasonally lower production at

our US operations impacted by adverse weather.

Own coal production (not including supplies under strategic long-term contracts)

in 1Q 2015 decreased 12.1% as compared to 1Q 2014, primarily due lower production at our US operations and scope change following

the disposal of the Kuzbass coal mines in Russia during the fourth quarter of 2014.

EBITDA in 1Q 2015 decreased to $114 million as compared to $232 million in

4Q 2014. EBITDA for 4Q 2014 was positively impacted by a $79 million gain on the disposal of Kuzbass coal mines. Therefore on an

underlying basis, 1Q 2015 EBITDA decreased by 25.8% primarily due to lower seaborne iron ore market prices (-16%) and lower market

price shipment volumes, offset in part by improved cost performance.

EBITDA in 1Q 2015 was 73.8% lower as compared to 1Q 2014, primarily due to

lower seaborne iron ore market prices (-48%), partially offset by lower unit production costs, the benefits of lower freight, foreign

exchange and restructuring of our coal operations including the sale of Kuzbass.

Operating performance for 4Q 2014 was impacted by a $63 million impairment

charge related to costs associated with the write-down of the Volcan iron ore mine in Mexico.

Liquidity and Capital Resources

For 1Q 2015, net cash used in operating activities was $915 million, as compared

to net cash provided by operating activities of $2,292 million in 4Q 2014. Cash used in operating activities in 1Q 2015 included

a $1,206 million investment of operating working capital as compared to a $994 million release of operating working capital in

4Q 2014. Despite the cash investment in working capital, due to foreign exchange movements, the amount reflected in the balance

sheet remains largely unchanged. Rotation days during 1Q 2015 increased to 54 days as compared to 51 days in 4Q 2014.

Net cash provided by other operating activities in 1Q 2015 was $119 million

(including several items such as, onerous contact provision, unrealised forex, employee benefits and VAT). This compares to net

cash provided by other operating activities in 4Q 2014 of $889 million (including the adjustment of non-cash items related to unrealized

forex losses, income tax accruals, impairment on China Oriental partially offset by adjustments of gains from disposal of Gallatin

and Kuzbass). Net cash used by other operating activities in 1Q 2014 was $393 million (including adjustment of non-cash items such

as income from associates and forex and changes in other payables, such as employee benefits, payment of provisions and VAT).

Net cash used in investing activities during 1Q 2015 was $456 million as compared

to net cash used in investing activities during 4Q 2014 of $492 million. Capital expenditure decreased significantly to $745 million

in 1Q 2015 as compared to $1,067 million in 4Q 2014. Due to the benefits of foreign exchange as well as the postponement of some

investment projects, the Company has reduced the FY 2015 capital expenditure budget to approximately $3.0 billion.

Cash flow from other investing activities in 1Q 2015 of $289 million primarily

included a $108 million inflow from the exercise of the fourth put option on Hunan Valin shares5, cash received from

the Kiswire divestment6 and proceeds from the sale of tangible assets. Cash flow from other investing activities in

4Q 2014 of $575 million primarily included the cash inflow from the divesture of Gallatin for $389 million, a $108 million inflow

from the exercise of the third put option on Hunan Valin shares5 and proceeds from the sale of tangible assets. Other

investing activities in 1Q 2014 of $215 million primarily includes $258 million associated with the AM/NS Calvert acquisition7

offset in part by proceeds from the exercise of the second put option in Hunan Valin.

Net cash provided by financing activities for 1Q 2015 was $313 million as

compared to net cash used in financing activities of $1,926 million for 4Q 2014. Net cash provided by financing activities for

1Q 2015 includes inflow related to issuance of $877 million (€750 million) 3.125% Notes due January 14, 2022, under the Company’s

Euro Medium Term Notes Programme, $339 million of short term financing and proceeds from a 4-year €75 million term loan, offset

in part by a repayment of a $1.0 billion loan.

Net cash used in financing activities for 4Q 2014 primarily included debt

prepayment totalling $1.25 billion - 9.0% Notes due February 15, 2015 ($750 million) and 3.750% Notes due February 25, 2015 ($500

million) prior to their scheduled maturity and €360 million bond repayment.

Net cash provided by financing activities for 1Q 2014 was $557 million and

includes inflow of $1.3 billion relating to the proceeds from the issuance of a €750 million 3.0% Notes due 25 March 2019,

under the Company’s Euro Medium Term Notes Programme and proceeds from new 3-year $300 million financing provided by EDC

(Export Development Canada), offset in part by the early redemption of perpetual securities of $657 million.

During 1Q 2015, the Company paid $53 million in dividends primarily to minority

shareholders in Arcelormittal Mines Canada , as compared to $15 million dividends paid to minority shareholders in 4Q 2014. During

1Q 2014, the Company paid $57 million in dividends to minority shareholders including those in ArcelorMittal Mines Canada and payments

to perpetual securities holders.

At March 31, 2015, the Company’s cash and cash equivalents (including

restricted cash and short-term investments) amounted to $2.8 billion as compared to $4.0 billion at December 31, 2014.

Gross debt of $19.4 billion at March 31, 2015, decreased from $19.9 billion

at December 31, 2014 and $23.6 billion at March 31, 2014. Gross debt was lower at March 31, 2015 following the net repayment of

loans and positive impact of foreign exchange rate effects.

As of March 31, 2015, net debt was $16.6 billion

as compared with $15.8 billion at December 31, 20148,

primarily driven by the investment of operating working capital of $1.2 billion, partially offset by asset disposal proceeds ($0.3

billion)9 and forex effects ($0.6 billion).

The Company had liquidity of $8.8 billion at March 31, 2015, consisting

of cash and cash equivalents (including restricted cash and short-term investments) of $2.8 billion and $6.0 billion of available

credit lines. On March 31, 2015, the average debt maturity was 6.4 years.

Key recent developments

| · | On April 30, 2015, ArcelorMittal signed a US$6 billion Revolving Credit Facility

(incorporating 3 and 5 year tranches) (the "Facility"). The Facility will replace the US$2.4 billion revolving credit

facility agreement dated May 6, 2010 and the US$3.6 billion revolving credit facility agreement dated March 18, 2011 and will be

used for the general corporate purposes of the ArcelorMittal group. The Facility gives ArcelorMittal improved terms over the former

facilities, and extends the average maturity date by approximately two years. ArcelorMittal received indications of interest far

in excess of that which it sought, demonstrating confidence from the debt markets in ArcelorMittal. The $6 billion credit facility

contains a financial covenant of 4.25x Net debt / EBITDA. |

| · | On July 29, 2014, ArcelorMittal entered into agreements with BHPB and Areva to

acquire their respective interests in the Nimba iron ore deposit, subject to the satisfaction of certain conditions precedent,

including dispensation from the Government of Guinea to transport the Nimba ore through the ArcelorMittal infrastructure system

in Liberia. ArcelorMittal took the decision to terminate the transaction, given that this key condition to closing was not

met by the agreed deadline. |

| · | On April 9, 2015, ArcelorMittal announced the issuance of €400 million Floating

Rate Notes due April 9, 2018 and €500 million 3.00 per cent. Notes due April 9, 2021. The Notes were issued under ArcelorMittal’s

Euro Medium Term Notes Programme. The proceeds of the issuance were used for general corporate purposes. |

Outlook and guidance

Based on the current economic outlook, ArcelorMittal expects global apparent

steel consumption (“ASC”) to increase by approximately +0.5% to +1.5% in 2015. ArcelorMittal expects the pick-up in

European manufacturing activity to continue and support ASC growth of approximately +1.5% to +2.5% in 2015 (versus a growth of

3.5% in 2014). Driven by robust underlying steel demand and significant restocking, ASC in the US grew by over 11% in 2014. Whilst

underlying demand continues to expand, due to a destock in the 1H 2015, ASC in the US is expected to decline -2% to -3%. Due to

the weak macro backdrop both in the CIS and Brazil, ASC is expected to decline by -5% to -7% in both regions in 2015. In China,

we see signs of stabilization due to the government’s targeted stimulus, however real estate market remains weak and expect

steel demand growth in the range of +0.5% to +1.5% for 2015. While there remain risks to the global demand picture, given ArcelorMittal’s

specific geographical and end market exposures, the Company expects its steel shipments to increase by between +3% to 5% in 2015

as compared to 2014.

Whilst steel markets have evolved largely as per expectations, the subsequent

deterioration of iron ore prices as well as a weaker U.S. market results in a headwind to guidance. Although the Company expects

to benefit from further improvement in costs, both in mining and steel segments (including lower raw material costs), the Company

now expects 2015 EBITDA within the range of $6.0 - $7.0 billion.

Due to the benefits of foreign exchange as well as the postponement of some

investment projects the Company has further reduced the FY 2015 capital expenditure budget to approximately $3.0 billion.

The Company expects net interest expense of approximately $1.4 billion in

2015.

Importantly, the Company continues to expect positive free cash flow in 2015

and to achieve progress towards the medium term net debt target of $15 billion.

ArcelorMittal Condensed Consolidated Statements

of Financial Position1

| |

|

|

Mar 31, |

Dec 31, |

Mar 31, |

| In millions of U.S. dollars |

|

|

2015 |

2014 |

2014 |

| ASSETS |

|

|

|

|

|

| Cash and cash equivalents including restricted cash |

|

|

2,779 |

4,016 |

5,061 |

| Trade accounts receivable and other |

|

|

4,253 |

3,696 |

5,547 |

| Inventories |

|

|

15,537 |

17,304 |

18,888 |

| Prepaid expenses and other current assets |

|

|

2,492 |

2,627 |

3,406 |

| Assets held for sale10 |

|

|

- |

414 |

621 |

| Total Current Assets |

|

|

25,061 |

28,057 |

33,523 |

| |

|

|

|

|

|

| Goodwill and intangible assets |

|

|

7,104 |

8,104 |

8,716 |

| Property, plant and equipment |

|

|

41,694 |

46,593 |

50,876 |

| Investments in associates and joint ventures |

|

|

5,394 |

5,833 |

6,907 |

| Deferred tax assets |

|

|

6,982 |

7,962 |

9,075 |

| Other assets |

|

|

2,282 |

2,630 |

2,251 |

| Total Assets |

|

|

88,517 |

99,179 |

111,348 |

| |

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

| Short-term debt and current portion of long-term debt |

|

|

2,441 |

2,522 |

5,336 |

| Trade accounts payable and other |

|

|

10,276 |

11,450 |

12,181 |

| Accrued expenses and other current liabilities |

|

|

6,211 |

6,994 |

7,679 |

| Liabilities held for sale10 |

|

|

- |

157 |

194 |

| Total Current Liabilities |

|

|

18,928 |

21,123 |

25,390 |

| |

|

|

|

|

|

| Long-term debt, net of current portion |

|

|

16,986 |

17,275 |

18,226 |

| Deferred tax liabilities |

|

|

2,670 |

3,004 |

3,190 |

| Other long-term liabilities |

|

|

11,634 |

12,617 |

12,478 |

| Total Liabilities |

|

|

50,218 |

54,019 |

59,284 |

| |

|

|

|

|

|

| Equity attributable to the equity holders of the parent |

|

|

35,452 |

42,086 |

48,735 |

| Non–controlling interests |

|

|

2,847 |

3,074 |

3,329 |

| Total Equity |

|

|

38,299 |

45,160 |

52,064 |

| Total Liabilities and Shareholders’ Equity |

|

|

88,517 |

99,179 |

111,348 |

ArcelorMittal Condensed Consolidated

Statement of Operations1

| In millions of U.S. dollars |

Three months ended |

| |

Mar 31,

2015 |

Dec 31,

2014 |

Sept 30,

2014 |

Jun 30,

2014 |

Mar 31,

2014 |

| Sales |

17,118 |

18,723 |

20,067 |

20,704 |

19,788 |

| Depreciation |

(807) |

(982) |

(946) |

(931) |

(1,080) |

| Impairment |

- |

(264) |

- |

- |

- |

| Restructuring charges |

- |

- |

- |

- |

- |

| Operating income |

571 |

569 |

959 |

832 |

674 |

| Operating margin % |

3.3% |

3.0% |

4.8% |

4.0% |

3.4% |

| |

|

|

|

|

|

| Income / (loss) from associates, joint ventures and other investments |

(2) |

(380) |

54 |

118 |

36 |

| Net interest expense |

(323) |

(322) |

(338) |

(383) |

(426) |

| Foreign exchange and other net financing (loss) |

(756) |

(549) |

(657) |

(327) |

(380) |

| Income / (loss) before taxes and non-controlling interests |

(510) |

(682) |

18 |

240 |

(96) |

| Current tax |

(125) |

(155) |

(138) |

(95) |

(156) |

| Deferred tax |

(85) |

(103) |

159 |

(61) |

95 |

| Income tax benefit / (expense) |

(210) |

(258) |

21 |

(156) |

(61) |

| Income / (loss) including non-controlling interests |

(720) |

(940) |

39 |

84 |

(157) |

| Non-controlling interests |

(8) |

(15) |

(17) |

(32) |

(48) |

| Net income / (loss) attributable to equity holders of the parent |

(728) |

(955) |

22 |

52 |

(205) |

| |

|

|

|

|

|

| Basic earnings (loss) per common share ($) |

(0.41) |

(0.53) |

0.01 |

0.03 |

(0.12) |

| Diluted earnings (loss) per common share ($) |

(0.41) |

(0.53) |

0.01 |

0.03 |

(0.12) |

| |

|

|

|

|

|

| Weighted average common shares outstanding (in millions) |

1,793 |

1,793 |

1,792 |

1,791 |

1,790 |

| Adjusted diluted weighted average common shares outstanding (in millions) |

1,793 |

1,795 |

1,795 |

1,793 |

1,792 |

| |

|

|

|

|

|

| EBITDA |

1,378 |

1,815 |

1,905 |

1,763 |

1,754 |

| EBITDA Margin % |

8.0% |

9.7% |

9.5% |

8.5% |

8.9% |

| |

|

|

|

|

|

| OTHER INFORMATION |

|

|

|

|

|

| Own iron ore production (million metric tonnes) |

15.6 |

16.7 |

15.8 |

16.6 |

14.8 |

| Crude steel production (million metric tonnes) |

23.7 |

23.2 |

23.9 |

23.1 |

23.0 |

| Total shipments of steel products (million metric tonnes) |

21.6 |

21.2 |

21.5 |

21.5 |

21.0 |

ArcelorMittal Condensed Consolidated Statements

of Cash flows1

| In millions of U.S. dollars |

Three months ended

|

| |

Mar 31,

2015 |

Dec 31,

2014 |

Sept 30,

2014 |

Jun 30,

2014 |

Mar 31,

2014 |

| Operating activities: |

|

|

|

|

|

| Net income / (loss) attributable to equity holders of the parent |

(728) |

(955) |

22 |

52 |

(205) |

| Adjustments to reconcile net income /(loss) to net cash provided by operations: |

|

|

|

|

|

| Non-controlling interest |

8 |

15 |

17 |

32 |

48 |

| Depreciation and impairment |

807 |

1,246 |

946 |

931 |

1,080 |

| Restructuring charges |

- |

- |

- |

- |

- |

| Deferred income tax |

85 |

103 |

(159) |

61 |

(95) |

| Change in operating working capital |

(1,206) |

994 |

(576) |

856 |

(906) |

| Other operating activities (net) |

119 |

889 |

251 |

(384) |

(393) |

| Net cash (used in) provided by operating activities |

(915) |

2,292 |

501 |

1,548 |

(471) |

| Investing activities: |

|

|

|

|

|

| Purchase of property, plant and equipment and intangibles |

(745) |

(1,067) |

(949) |

(774) |

(875) |

| Other investing activities (net) |

289 |

575 |

61 |

167 |

(215) |

| Net cash used in investing activities |

(456) |

(492) |

(888) |

(607) |

(1,090) |

| Financing activities: |

|

|

|

|

|

| Net (payments) proceeds relating to payable to banks and long-term debt |

386 |

(1,868) |

688 |

(1,659) |

1,286 |

| Dividends paid |

(53) |

(15) |

(381) |

(5) |

(57) |

| Combined capital offering |

- |

- |

- |

- |

- |

| Payments for subordinated perpetual securities |

- |

- |

- |

- |

(657) |

| Disposal / (acquisition) of non-controlling interests |

- |

(17) |

- |

- |

- |

| Other financing activities (net) |

(20) |

(26) |

(13) |

(11) |

(15) |

| Net cash provided by (used in) financing activities |

313 |

(1,926) |

294 |

(1,675) |

557 |

| Net (decrease) increase in cash and cash equivalents |

(1,058) |

(126) |

(93) |

(734) |

(1,004) |

| Cash and cash equivalents transferred to assets held for sale |

1 |

- |

1 |

38 |

(31) |

| Effect of exchange rate changes on cash |

(180) |

(32) |

(71) |

9 |

(136) |

| Change in cash and cash equivalents |

(1,237) |

(158) |

(163) |

(687) |

(1,171) |

Appendix 1: Product shipments by region

| (000'kt) |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| Flat |

4,459 |

4,844 |

4,836 |

4,699 |

4,528 |

| Long |

1,158 |

1,094 |

1,171 |

1,193 |

1,212 |

| NAFTA |

5,463 |

5,805 |

5,866 |

5,790 |

5,613 |

| Flat |

1,514 |

1,643 |

1,452 |

948 |

899 |

| Long |

1,169 |

1,229 |

1,379 |

1,336 |

1,419 |

| Brazil |

2,707 |

2,895 |

2,844 |

2,312 |

2,325 |

| Flat |

7,544 |

6,680 |

6,881 |

7,039 |

6,992 |

| Long |

3,074 |

2,890 |

2,938 |

3,123 |

2,997 |

| Europe |

10,662 |

9,610 |

9,829 |

10,191 |

10,009 |

| CIS |

1,925 |

2,099 |

2,183 |

2,243 |

2,053 |

| Africa |

1,063 |

982 |

1,026 |

1,037 |

1,112 |

| ACIS |

3,006 |

3,111 |

3,229 |

3,306 |

3,187 |

Note: Others and eliminations line are not presented in the table

Appendix 2: Capital expenditures

| (USDm) |

1Q 15 |

4Q 14 |

3Q 14 |

2Q 14 |

1Q 14 |

| NAFTA |

90 |

127 |

152 |

116 |

110 |

| Brazil |

143 |

138 |

118 |

106 |

135 |

| Europe |

250 |

303 |

231 |

209 |

309 |

| ACIS |

93 |

188 |

170 |

110 |

105 |

| Mining |

173 |

290 |

274 |

220 |

209 |

| Total |

745 |

1,067 |

949 |

774 |

875 |

Note: Others and eliminations line are not presented

in the table

Appendix 3: Debt repayment schedule as of

March 31, 2015

| Debt repayment schedule (USD billion) |

2015 |

2016 |

2017 |

2018 |

2019 |

>2019 |

Total |

| Bonds |

1.0 |

1.5 |

2.5 |

2.1 |

2.3 |

7.4 |

16.8 |

| LT revolving credit lines |

|

|

|

|

|

|

|

| - $3.6bn syndicated credit facility |

- |

- |

- |

- |

- |

- |

- |

| - $2.4bn syndicated credit facility |

- |

- |

- |

- |

- |

- |

- |

| Commercial paper |

0.1 |

- |

- |

- |

- |

- |

0.1 |

| Other loans |

0.7 |

0.9 |

0.2 |

0.1 |

0.2 |

0.4 |

2.5 |

| Total gross debt |

1.8 |

2.4 |

2.7 |

2.2 |

2.5 |

7.8 |

19.4 |

Appendix

4: Credit lines available as of March 31, 201511

| Credit lines available (USD billion) |

|

|

|

Maturity |

Commitment |

Drawn |

Available |

| - $3.6bn syndicated credit facility |

|

|

|

18/03/2016 |

3.6 |

0.0 |

3.6 |

| - $2.4bn syndicated credit facility |

|

|

|

06/11/2018 |

2.4 |

0.0 |

2.4 |

| Total committed lines |

|

|

|

|

6.0 |

0.0 |

6.0 |

Appendix 5: EBITDA bridge from 4Q 2014

to 1Q 2015

| USD millions |

|

EBITDA 4Q 14 |

Volume & Mix - Steel (a) |

Volume & Mix - Mining (a) |

Price-cost - Steel (b) |

Price-cost - Mining (b) |

Other (c) |

EBITDA 1Q 15 |

| Group |

|

1,815 |

165 |

(9) |

(365) |

(31) |

(197) |

1,378 |

| a) | The volume variance indicates the sales value gain/loss through selling a higher/lower

volume compared to the reference period, valued at reference period contribution (selling price–variable cost). The mix variance

indicates sales value gain/loss through selling different proportions of mix (product, choice, customer, market including domestic/export),

compared to the reference period contribution. |

| b) | The price-cost variance is a combination of the selling price and cost variance.

The selling price variance indicates the sales value gain/loss through selling at a higher/lower price compared to the reference

period after adjustment for mix, valued with the current period volumes sold. The cost variance indicates increase/decrease in

cost (after adjustment for mix, one-time items and others) compared to the reference period cost. Cost variance includes the gain/loss

through consumptions of input materials at a higher price/lower price, movement in fixed cost, changes in valuation of inventory

due to movement in capacity utilization etc. |

| c) | “Other” includes a $69 million provision primarily related to onerous

hot rolled and cold rolled contracts in the US and foreign exchange translation impact. |

Appendix 6: Terms and definitions

Unless indicated otherwise, or the context otherwise requires, references

in this earnings release report to the following terms have the meanings set out next to them below:

LTIF: Lost time injury frequency rate equals lost time injuries

per 1,000,000 worked hours, based on own personnel and contractors.

EBITDA: operating income plus depreciation, impairment expenses

and exceptional items.

Free cash flow: net cash provided by operating activities less purchases

of property, plant and equipment and intangibles.

Net debt: long-term debt, plus short term debt, less cash and cash

equivalents, restricted cash and short-term investments (including those held as part of assets/liabilities held for sale).

Market priced tonnes: represent amounts of iron ore and coal from ArcelorMittal

mines that could be sold to third parties on the open market. Market priced tonnes that are not sold to third parties are transferred

from the Mining segment to the Company’s steel producing segments and reported at the prevailing market price. Shipments

of raw materials that do not constitute market priced tonnes are transferred internally and reported on a cost-plus basis.

Foreign exchange and other net financing costs: include foreign currency

swaps, bank fees, interest on pensions, impairments of financial instruments and revaluation of derivative instruments, and other

charges that cannot be directly linked to operating results.

Average steel selling prices: calculated as steel sales divided by

steel shipments.

Mining segment sales: i) “External sales”: mined product

sold to third parties at market price; ii) “Market-priced tonnes”: internal sales of mined product to ArcelorMittal

facilities and reported at prevailing market prices; iii) “Cost-plus tonnes” - internal sales of mined product to ArcelorMittal

facilities on a cost-plus basis. The determinant of whether internal sales are reported at market price or cost-plus is whether

the raw material could practically be sold to third parties (i.e. there is a potential market for the product and logistics exist

to access that market).

Rotation days: days of accounts receivable plus days of inventory minus

days of accounts payable. Days of accounts payable and inventory are a function of cost of goods sold of the quarter on an annualized

basis. Days of accounts receivable are a function of sales of the quarter on an annualized basis.

Operating working capital: trade accounts receivable plus inventories

less trade accounts payable.

Capex: includes the acquisition of intangible assets (such as concessions

for mining and IT support) and includes payments to fixed asset suppliers.

Seaborne iron ore reference prices: refers to iron ore prices for 62%

Fe CFR China.

Own iron ore production: Includes total of all finished production

of fines, concentrate, pellets and lumps (excludes share of production and strategic long-term contracts).

On-going projects: Refer to projects for which construction has begun

(excluding various projects that are under development), even if such projects have been placed on hold pending improved operating

conditions.

EBITDA/tonne: calculated as EBITDA divided by total steel

shipments.

Steel-only EBITDA: calculated as EBITDA less Mining segment

EBITDA.

Steel-only EBITDA/tonne: calculated as steel-only EBITDA

divided by total shipments

Iron ore unit cash cost: includes weighted average pellet and concentrate

cost of goods sold across all mines

Liquidity: includes back-up lines for the commercial paper program.

Shipments information at the Group level was previously based on a

simple aggregation, eliminating intra-segment shipments and excluding shipments of the Distribution Solutions segment. The

new presentation of shipments information eliminates both inter- and intra–segment shipments which are primarily between

Flat/Long plants and Tubular plants and continues to exclude the shipments of Distribution Solutions.

1 The financial information in this

press release has been prepared consistently with International Financial Reporting Standards (“IFRS”) as issued by

the International Accounting Standards Board (“IASB”). While the interim financial information included in this announcement

has been prepared in accordance with IFRS applicable to interim periods, this announcement does not contain sufficient information

to constitute an interim financial report as defined in International Accounting Standards 34, “Interim Financial Reporting”.

The numbers in this press release have not been audited. The financial information and certain other information presented in a

number of tables in this press release have been rounded to the nearest whole number or the nearest decimal. Therefore, the sum

of the numbers in a column may not conform exactly to the total figure given for that column. In addition, certain percentages

presented in the tables in this press release reflect calculations based upon the underlying information prior to rounding and,

accordingly, may not conform exactly to the percentages that would be derived if the relevant calculations were based upon the

rounded numbers. This press release also includes certain non-GAAP financial measures.

2 EBITDA in 1Q 2015 of $1,378 million

was negatively impacted by a $69 million provision primarily related to onerous hot rolled and cold rolled in the US. EBITDA in

4Q 2014 of $1,815 million was negatively impacted by a $76 million provision related to onerous annual tin plate contracts at Weirton

in the US, offset by the positive impact from the $79 million gain on disposal of Kuzbass coal mines in Russia.

3 Underlying steel-only EBITDA in 1Q

2015 of $1,333 million is calculated as EBITDA of $1,378 million plus $69 million provision for onerous contracts in the US less

$114 million Mining EBITDA. Steel-only EBITDA in 1Q 2014 of $1,321 million is calculated as EBITDA of 1,754 million less $433 million

Mining EBITDA.

4 Effective from January 1, 2015, the

functional currency of Kryvyi Rih was changed to the Ukrainian Hryvnia due to changes in the regulatory and economic environment

and transaction currencies of the operations.

5 Following the sale of a 5% stake

to Valin Group as a result of the exercise of the third put option on February 8, 2014, the Company’s interest in Hunan Valin

decreased from 20% to 15%. On August 6, 2014, the Company exercised the fourth and final instalment, which subsequently led to

the decrease in its stake in Hunan Valin from 15% to 10%. The Company received cash from the third and fourth installment of $108

million both in the fourth quarter of 2014 and first quarter of 2015, respectively.

6 On December 9, 2013, ArcelorMittal

signed an agreement with Kiswire Ltd. for the sale of its 50% stake in the joint venture Kiswire ArcelorMittal Ltd in South Korea

and certain other entities of its steel cord business in the US, Europe and Asia for a total consideration of $169 million. The

net proceeds received in 2Q 2014 are $39 million being $55 million received in cash during the quarter minus cash held by steel

cord business. Additionally, $28 million of gross debt held by the steel cord business has been transferred. During 1Q 2015, the

Company received $45 million with the remainder due in 2Q 2015.

7 On February 26, 2014, ArcelorMittal,

together with Nippon Steel & Sumitomo Metal Corporation (“NSSMC”), announced that it has completed the acquisition

of ThyssenKrupp Steel USA (“TK Steel USA”), a steel processing plant in Calvert, Alabama, having received all necessary

regulatory approvals. The transaction – a 50/50 joint venture with NSSMC – was completed for an agreed price of $1,550

million plus working capital and net debt adjustment. ArcelorMittal paid $258 million cash for the acquisition in 1Q 2014. The

Calvert plant has a total capacity of 5.3 million tons including hot rolling, cold rolling, coating and finishing lines.

8 As at December 31, 2014 net debt

included $0.1 billion relating to distribution centers in Europe held for sale.

9 During the first quarter of 2015,

the Company generated cash proceeds totalling $0.3 billion from the proceeds from the exercise of the fourth put option on Hunan

Valin shares of $108 million, cash received from Kiswire divestment and proceeds from the sale of tangible assets.

10 Assets and liabilities held for

sale as of December 31, 2014 included assets and liabilities held for sale related to distribution centers in Europe and the disposal

of tangible assets. As of March 31, 2014, assets and liabilities subject to disposal primarily relate to steel cord business and

ATIC classified as asset/liabilities held for sale.

11 In April 2015, the Company refinanced

and extended $6 billion lines of credit (two tranches: $2.5 billion 3Yr and $3.5 billion 5Yr) with 4.25x Net debt / EBITDA covenant

ArcelorMittal Europe reports operating profit of €281

million for

Q1 2015

Luxembourg, 07 May 2015 - ArcelorMittal Europe today

announced its results for the first quarter ended 31 March 2015. The segment recorded an operating profit of €281m, compared

with €58m for Q1 2014.

First quarter 2015 Ebitda increased by 23.3 per cent, to €546m

compared with €443m in the last quarter of 2014. Ebitda in Q1 2015 was also 40 per cent higher than in the corresponding quarter

of 2014, reflecting improved demand dynamics and the ongoing realisation of the benefits of cost optimisation efforts.

Steel shipments in the first quarter increased by 10.9 per cent

to 10.7 million tonnes, compared with Q4 2014, as both flat and long product shipment volumes benefitted from seasonal impacts

and improved underlying demand.

Sales in the ArcelorMittal Europe segment increased by 5.9 per

cent to €7.6bn this quarter compared to Q4 2014. This was primarily due to higher steel shipments partly offset by lower average

steel selling prices.

Commenting, Aditya Mittal, CEO ArcelorMittal Europe, said: “Ebitda

improved again this quarter proving further evidence that the actions taken to improve the competitive position of our European

operations were the right ones, and are delivering results. It’s important to note that we have achieved this in a European

market where demand remains significantly below pre-crisis levels. Looking ahead, we expect to see continued pick-up in European

manufacturing activity to support our apparent steel consumption growth forecast for Europe of around 2 per cent this

year, and are very well placed to capture our share of improving demand.”

Confidence has picked up in the European market and is expected

to slowly gain momentum. Factors such as quantitative easing, the weak Euro, low oil prices and reduced fiscal headwinds are expected

to drive a recovery in growth for the Eurozone in 2015 and 2016. In addition, manufacturing output for the EU28 has reached its

highest level since 2008.

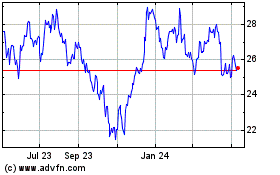

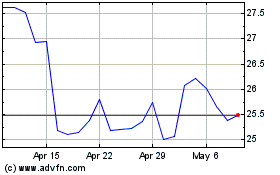

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024